Search results for "FORM"

Web3 programmers urgently self-check: Technical circumvention infringement has been criminalized

Original author: Lawyer Li Xinyi, Mankun Blockchain

Introduction

A ruling by the Hangzhou Internet Court clearly demonstrates that "Fat Tiger Vaccination" NFT infringement case: decentralization does not mean no responsibility. Behind the technology, there are still clear legal boundaries.

Many people think that since they only develop technology, build platforms, and provide tools, and do not directly participate in infringement, they should be fine. But this ruling clearly states: technology itself cannot serve as a "shield" against infringement; if used improperly, it can still be illegal.

In this article, we will discuss a key but often overlooked concept: "Technological Evasion of Copyright Infringement."

What is it?

How can ordinary people avoid it?

And how should we find a balance between innovation and compliance?

Technological Evasion of Infringement: The Deadly Shortcut to Bypass "Digital Locks"

In the Web3 and digital creation fields, there is a form of infringement that is often underestimated: it is not direct theft.

PANews·48m ago

Bitcoin reclaims the 200-day moving average. If it stabilizes above 95K, a golden cross may be on the horizon.

Entering a new year, the Bitcoin market has seen a long-awaited turning point. Bitcoin prices have recently rebounded strongly, breaking above the 200-day moving average for the first time since October last year, bringing a glimmer of hope to long-term cautious bulls. As the price structure improves, the market is beginning to focus on whether Bitcoin has the chance to break free from the bearish "death cross" pattern formed in November last year and re-establish a medium- to long-term upward trend. The accumulated compression momentum over the past few weeks has already been released upward. The 200-day moving average has stabilized again. If Bitcoin's price can close above $95,000 for several consecutive trading days, and the average daily volatility (ADX) continues to rise, then Bitcoin may be able to escape the death cross dilemma and form a "golden cross." A golden cross refers to the 50-day moving average (50-day EMA) crossing upward through the 200-day (200-day) moving average.

BTC1,55%

ChainNewsAbmedia·5h ago

Payouts need to increase by over 1300% in 2026 to break even! If support is lost, it may collapse to $0.188.

PaiCoin experienced a 66.5% crash in March after launching in February 2025, with only two months of positive growth throughout the year. The CMF indicator has triggered the oversold threshold five times, indicating persistent selling pressure. To reach the peak of $2,994, it needs to increase by 1,376%, currently hovering at $0.199. This support has been tested three times; a break below could see it drop to $0.188. A recovery requires first breaking the $0.273 Fibonacci level, then holding above $0.662 to form an upward structure.

PI0,35%

MarketWhisper·01-05 03:52

How does Digital RMB, entering the era of digital deposit currency, ensure the rights and interests of users?

Written by: Zhang Feng

According to Lu Lei, Vice Governor of the People's Bank of China, in his article titled "Digital Renminbi Will Transition from the Digital Cash Era to the Digital Deposit Currency Era" published in the Financial Times, the new generation of the digital renminbi system will officially be implemented on January 1, 2026, marked by the "Action Plan for Further Strengthening the Digital Renminbi Management Service System and Related Financial Infrastructure Construction" (hereinafter referred to as the "Action Plan").

This evolution is not only a technological upgrade but also a profound transformation in the form of currency, operational mechanisms, and governance logic. During this process, how to build a privacy and security governance system that effectively serves the real economy, strengthens financial regulation, and fully respects and safeguards users' personal information rights has become a core issue for the healthy development of the digital renminbi.

1. Basic Principles: Seeking a Dynamic Balance Between Strengthening Regulation and Respecting Rights

TechubNews·01-04 08:53

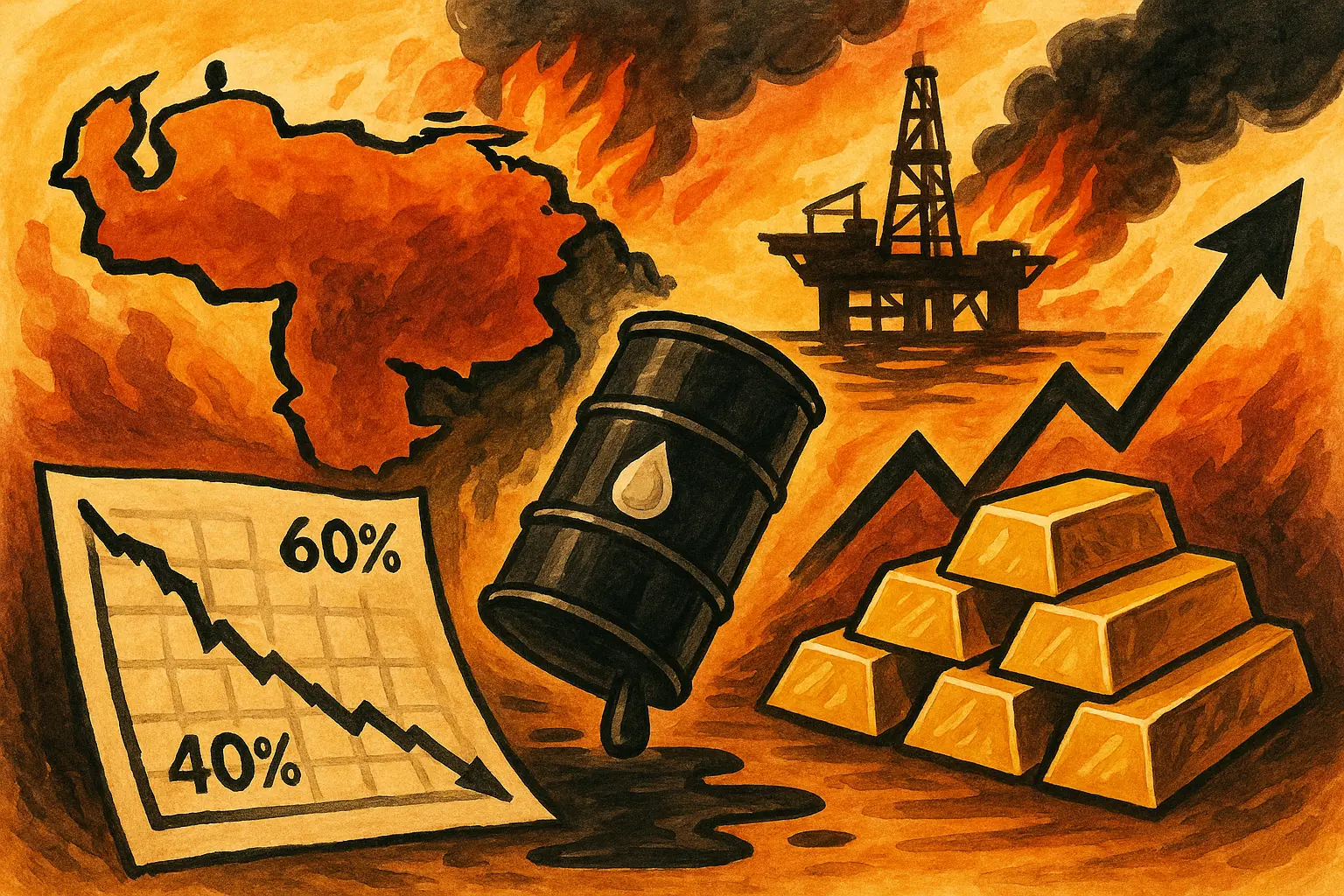

Venezuela's upheaval impacts the world: oil supply cuts, gold surges, 60/40 model collapses

On January 3, 2026, in the early morning, the U.S. military successfully captured Venezuelan President Maduro in an operation codenamed "Southern Spear Operation," triggering the most intense geopolitical upheaval in Latin America since the U.S. invasion of Panama in 1989. This 30-minute targeted strike not only marked the return of Monroe Doctrine in a highly militarized form but also triggered a chain reaction across the global oil markets, financial systems, and safe-haven asset allocations, with impacts expected to last throughout 2026.

MarketWhisper·01-04 06:24

Looking back at the 2025 TGE, what did the tokens that haven't "returned to their original form" do right?

Author: Stacy Muur

Translation: Deep Tide TechFlow

If you participated in the 2025 Token Generation Event (TGE) trading, you might be familiar with this default script: a lively first week, followed by a slow decline, and finally having to accept the fact that the "issue price is the highest point."

Most newly launched tokens not only perform poorly but even crash outright because the market finally begins to treat tokenomics and liquidity as fundamentals rather than optional add-ons.

Nevertheless, a few tokens achieved significant growth by the end of 2025 compared to their TGE prices. The rise of these tokens is not a fleeting phenomenon nor due to buying at extreme lows for profit, but indicates genuine market demand.

Below are the tokens I summarized as performing strongly in 2025: $ASTER, $FOLK

ASTER2,38%

PANews·01-04 00:38

Traditional Finance's On-Chain "Conspiracy": Why the Crypto Embraced by Giants Is Destined to Fail?

The so-called "on-chain" activities of traditional financial institutions often betray the spirit of decentralization. The more they enthusiastically embrace a particular form of the crypto world, the less likely that form is to succeed.

(Background: Cryptocurrency Popularization vs. Decentralization: An Unsolvable Paradox?)

(Additional context: Blockchain "decentralization" challenges global regulation; are the two destined to conflict? Can they coexist?)

This is a warning: as traditional finance gradually embraces blockchain, the actions of the largest financial intermediaries are very likely to foreshadow future failure. The more they enthusiastically adopt a specific form of the crypto world, the less likely that form is to truly succeed.

Those giant exchanges, clearinghouses, banks, brokerages, and payment providers. These well-known names will frequently make headlines in the coming year due to their "cautious" embrace of blockchain.

How these institutions "go on-chain" mainly reflects that they

動區BlockTempo·01-03 10:35

Traditional Finance's On-Chain "Conspiracy": Why the Crypto Embraced by Giants Is Destined to Fail?

The so-called "on-chain" activities of traditional financial institutions often betray the spirit of decentralization. The more they enthusiastically embrace a particular form of the crypto world, the less likely that form is to succeed.

(Background: Cryptocurrency Popularization vs. Decentralization: An Unsolvable Paradox?)

(Additional context: Blockchain "decentralization" challenges global regulation; are the two destined to conflict? Can they coexist?)

This is a warning: as traditional finance gradually embraces blockchain, the actions of the largest financial intermediaries are very likely to foreshadow future failure. The more they enthusiastically adopt a specific form of the crypto world, the less likely that form is to truly succeed.

Those giant exchanges, clearinghouses, banks, brokerages, and payment providers. These well-known names will frequently make headlines in the coming year due to their "cautious" embrace of blockchain.

How these institutions "go on-chain" mainly reflects that they

動區BlockTempo·01-02 10:30

Traditional Finance's On-Chain "Conspiracy": Why the Crypto Embraced by Giants Is Destined to Fail?

The so-called "on-chain" activities of traditional financial institutions often betray the spirit of decentralization. The more they enthusiastically embrace a particular form of the crypto world, the less likely that form is to succeed.

(Background: Cryptocurrency Popularization vs. Decentralization: An Unsolvable Paradox?)

(Additional context: Blockchain "decentralization" challenges global regulation; are the two destined to conflict? Can they coexist?)

This is a warning: as traditional finance gradually embraces blockchain, the actions of the largest financial intermediaries are very likely to foreshadow future failure. The more they enthusiastically adopt a specific form of the crypto world, the less likely that form is to truly succeed.

Those giant exchanges, clearinghouses, banks, brokerages, and payment providers. These well-known names will frequently make headlines in the coming year due to their "cautious" embrace of blockchain.

How these institutions "go on-chain" mainly reflects that they

動區BlockTempo·2025-12-31 10:30

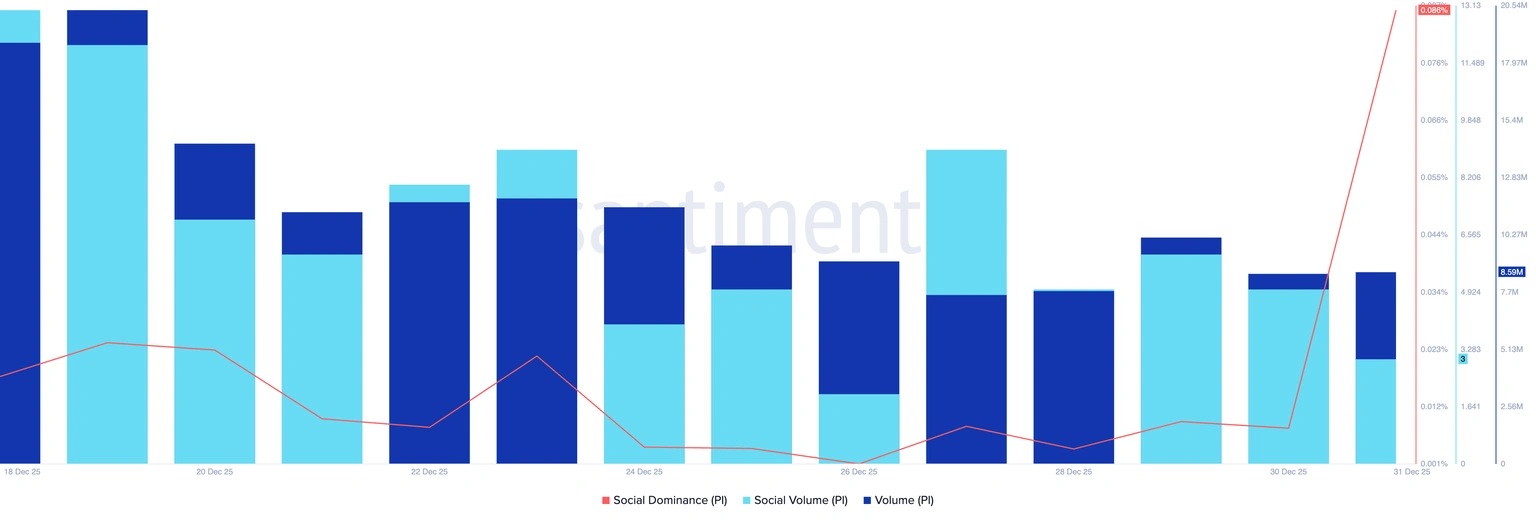

Pi coin revives on New Year's Eve! Social buzz skyrockets 10 times, Morning Star pattern pushes to $0.22

Pi Network rose nearly 1% on Wednesday, continuing its rebound momentum. Santiment data shows social media influence increased to 0.086%, and retail investor expectations are warming. On the technical side, PI held the $0.20 support level to form a morning star pattern, with a target of the 50-day EMA at $0.2191. Although the daily trading volume decreased from 38.65 million coins to 8.58 million coins, the rising MACD histogram indicates strengthening bullish momentum.

PI0,35%

MarketWhisper·2025-12-31 07:38

Cryptocurrency Exchange for Forex Conviction: 6 Years! 245 Million Illegal Transactions Fully Exposed

The Intermediate People's Court of Leshan City, Sichuan Province, concluded a case involving the use of virtual currency to conduct illegal foreign exchange transactions, with a involved amount of 245 million yuan. The main offender, Wan Mouyuan, was sentenced to 6 years in prison and fined 740,000 yuan. His wife, Chen Mouwen, received a sentence of 2 years and 6 months. Upstream supplier Huang Mouyuan was sentenced to 5 years and 6 months. The court's first ruling recognized that using virtual currencies such as USDT as a medium to realize the exchange rate conversion between RMB and foreign currencies constitutes a disguised form of foreign exchange trading, and should be prosecuted as illegal business operations.

MarketWhisper·2025-12-31 07:04

Grayscale applies for the first Bittensor spot ETF: Can TAO price break $300 in one month?

Grayscale Investments, the world's largest digital asset management company, has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission for the Grayscale Bittensor Trust, planning to convert it into a spot exchange-traded fund listed on NYSE Arca with the ticker symbol GTAO. This will be the first investment product in the U.S. to offer direct exposure to Bittensor's native token TAO, marking the first time the AI + crypto frontier narrative enters the traditional capital markets in the form of a mainstream compliant financial product.

Buoyed by this news, the TAO price surged above $223 within 24 hours, and the market is now buzzing about whether it can leverage this momentum to challenge the $300 mark by January 2026. The application coincides with the Bittensor network's first "halving" in mid-December, reducing the daily issuance from 7,200 TAO to 3,600 TAO. The contraction on the supply side, combined with potential demand driven by the influx of large funds from the ETF, creates a resonance that adds a new dimension to TAO's long-term value narrative.

MarketWhisper·2025-12-31 06:51

Vitalik may not have realized that transitioning Ethereum to PoS actually planted a financial "landmine"

After shifting consensus from PoW to PoS, $ETH now has staking yields, creating an "maturity mismatch" arbitrage opportunity between one's own LST liquid staking tokens and LRT liquidity re-mortgage tokens.

As a result, leveraging, cyclic lending, and maturity arbitrage of ETH staking yields have become the largest application scenarios for lending protocols like Aave, and also form one of the foundations of current on-chain DeFi.

That's right, the biggest application scenario for DeFi today is "arbitrage."

But don't panic, and don't be discouraged; traditional finance is the same.

The problem is, ETH's maturity mismatch hasn't brought additional liquidity or other value to the blockchain industry, or even to the Ethereum ecosystem itself, but only ongoing selling pressure. After all, institutions earning ETH staking yields will eventually cash out.

The selling pressure, ETH buying, and deflation form a micro

PANews·2025-12-31 04:17

Concentrated Liquidity Market Making in DeFi

Introduction

The advent of decentralized finance (DeFi) in 2008 in the form of Bitcoin ($BTC) started a new era in the world of economy. It was a heaven for those who sought anonymous transactions and disliked the interference and watchkeeping of banks. Appreciation of $BTC’s price attracted

BlockChainReporter·2025-12-30 13:03

After the victory of transparency: the DeFi transformation of financial crimes and the next battleground for regulation

Law enforcement agencies successfully tracking Bitcoin ransom funds are often depicted as a victory of blockchain transparency over the underground economy. However, this triumphant picture may conceal a more critical turning point: the victory only sweeps the surface of technological innovation, forcing dark activities to undergo a brutal evolutionary filter. Low-tech crimes are pushed out of the cryptocurrency space, as mentioned in the dialogue, they retreat back into the gift card and cash worlds. What truly remains and upgrades are new participants capable of encoding illegal intentions into complex financial protocol logic. What we are witnessing is not the end of crime, but a fundamental shift in its form from “avoiding surveillance” to “manipulating rules.” When every transaction is exposed to the sunlight, the focus of the game shifts from how to hide to how to construct an indeterminate financial behavior under the watchful eyes of all. The next battlefield will move from blockchain explorers to intelligent systems.

BTC1,55%

TechubNews·2025-12-30 05:27

Computing Power as Strategy: Analyzing the AI Infrastructure Challenges Behind the WanKa GPU Cluster

By the end of 2025, news about ByteDance's plan to spend billions on purchasing tens of thousands of top-tier NVIDIA AI chips has become a hot topic in the tech industry. Media perspectives focus on narratives of capital competition and geopolitical considerations. However, behind this billion-dollar procurement order, a much larger and more complex engineering challenge is quietly being overlooked: transforming these chips into usable, efficient, and stable computing power is far more difficult than acquiring them. When the number of chips jumps from hundreds in the laboratory to tens of thousands at an industrial scale, the complexity of system design does not grow linearly but undergoes a qualitative change. The floating-point computing capacity of a single GPU is no longer the bottleneck; how to achieve ultra-high-speed communication between chips, how to supply massive training data with millisecond-level latency, how to efficiently allocate and cool enormous amounts of power, and how to intelligently schedule thousands of computing tasks—these series of system-level problems form an engineering abyss that lies between raw hardware and AI productivity.

TechubNews·2025-12-30 03:26

Lighter Airdrop: What to Expect?

Article by: thedefinvestor

Compiled by: Plain Blockchain

According to Polymarket data, the largest perpetual contract DEX without a token—Lighter—is expected to launch its Token on December 29. Although its team has not publicly confirmed the specific date of the TGE (Token Generation Event), Polymarket indicates a 73% probability of an airdrop on December 29, possibly based on insider bets.

Additionally, Lighter's user interface recently added an airdrop registration form, which will expire on December 26. Lighter founder Vladimir Novakovski and his wife have hinted that the TGE will take place during the holiday season, and he recently posted on his X (formerly

LIT15,57%

TechubNews·2025-12-29 06:01

Trust Wallet has opened a claim channel, with over 2,600 people applying in a short period of time.

Trust Wallet was subjected to a supply chain attack this week, with losses totaling at least $7 million. The official team has now officially initiated the compensation process.

(Background: CZ: Trust Wallet will compensate users for asset losses, with stolen funds reaching $7 million)

(Additional context: SlowMist: Trust Wallet's code repository suspected of being compromised, users are advised to disconnect from the internet and transfer assets)

The self-custody crypto wallet Trust Wallet has officially opened the official claim form for full compensation. Applicants must prepare: 1) contact email and residence; 2) stolen wallet address; 3) attacker’s receiving address; 4) relevant transaction hashes

TWT2,62%

動區BlockTempo·2025-12-28 03:35

5 Best Crypto Investments Right Now: BlockchainFX Trading App Presale Gains Heat as Large Caps Hold Steady

Market pauses tend to expose a critical divide. Large-cap assets consolidate, narratives cool, and attention quietly shifts toward projects still in their acceleration phase. This is often when the best crypto investment opportunities begin to form, before price expansion makes the move

CaptainAltcoin·2025-12-26 15:35

From Safe-Haven Assets to Financial Building Blocks: The Structural Rise and Investment Logic of Gold RWA

1. Behind the New High in Gold Prices, Asset Forms Are Changing

On December 22, 2025, the domestic gold price once again broke through 1,000 yuan/gram, setting a new high for the year. In traditional financial markets, gold price increases are usually interpreted as a rise in risk aversion; but in the digital asset world, changes in gold go beyond just price levels.

CoinFound (a data technology company specializing in TradFi × Crypto) recently released the "Gold RWA Trend Insights" report, which systematically reviews the market size, ecological landscape, and application scenarios of gold RWA in 2025. Data shows that the market capitalization of gold RWA grew from less than $1 billion at the beginning of the year to over $3 billion in 2025, nearly tripling.

In Starbase's view, this growth is not simply a reflection of rising gold prices, but rather a transformation in the asset form of gold.

TechubNews·2025-12-26 10:00

Where did the funds go after the meme craze subsided? An in-depth analysis of the predicted market tracks and the top 5 dark horses lurking on the BNB Chain

Summary: This article will deeply explore how prediction markets are gradually consuming the attention left by Meme, becoming a new form of speculative platform; as well as a panoramic interpretation of the BNB ecosystem prediction market.

Author: Changan, Amelia I Biteye Content Team

Meme is waning, and prediction markets are taking over. This is not speculation; it is a major capital migration happening right now.

When Polymarket obtained full US licensing and received a $2 billion investment from the NYSE parent company, you should understand:

The Meme era of trading cats and dogs is over, and the era of trading "truth" has officially begun.

This article will guide you:

Understand why prediction markets suddenly exploded; review the promising black horse projects on the BNB chain; and teach you step-by-step how to position early and reap the initial benefits.

1️⃣ Why have prediction markets suddenly become popular?

The moment market sentiment truly shifted,

Biteye·2025-12-26 02:46

Sprint towards 100 million TPS: Ethereum 2026 technical roadmap fully explained, how will the two major forks reshape the blockchain landscape?

Ethereum will迎来 the critical year for determining its long-term scalability in 2026. According to the core developers' plan, the Glamsterdam hard fork launched mid-year will introduce two core upgrades: "block access list" and "built-in proposer-builder separation," achieving perfect parallel transaction processing and significantly increasing the Gas cap from the current 60 million to 200 million.

Meanwhile, it is expected that about 10% of validators will shift from re-executing transactions to verifying zero-knowledge proofs, paving the way for Ethereum mainnet to reach thousands of transactions per second. Later in the same year, the Heze-Bogota fork will focus on enhancing the network's censorship resistance. These systemic upgrades, along with the increase in Layer 2 data block targets and the construction of interoperability layers, together form a grand blueprint for Ethereum's comprehensive evolution from a "world computer" to a "global settlement layer."

MarketWhisper·2025-12-26 01:25

Empowering AI, paving the way for value: How will Crypto position itself in the infrastructure battle before 2027?

In fact, the act of "empowering" humanity is being done by both Crypto and AI, but the ways and depths of their empowerment are completely different. Consider the following:

1) Crypto empowerment emphasizes the so-called "decentralized financial sovereignty," allowing individuals to manage their assets and conduct value exchanges without relying on traditional centralized institutions like banks. This form of empowerment is "defensive" in nature, meaning that there is no better alternative, and as long as decentralized empowerment is maintained, the Crypto industry will never be disproven;

2) AI empowerment, on the other hand, focuses on "exponentially amplifying productivity," enabling people to do things that were previously impossible. This is why internet giants continue to invest heavily in AI, driving the continuous growth of AI-related stocks. This form of empowerment is "offensive," meaning that the growth of the AI industry has already followed a trajectory similar to a "Moore's Law" industry growth curve.

AGI9,13%

PANews·2025-12-25 08:01

Bitcoin Beats Gold, Says Coinbase CEO Brian Armstrong

Brian Armstrong, CEO of Coinbase, asserts that Bitcoin surpasses gold as a form of money due to its portability, divisibility, and transparency. His comments reflect a growing trend in finance, where Bitcoin is gaining recognition as a serious financial instrument and potential global standard despite existing challenges.

BTC1,55%

Coinfomania·2025-12-25 06:48

XRP Today News: ETF Draws $1.13 Billion, XRP Drops for Four Consecutive Days, Can the Bull Market Restart in 2026?

Recently, XRP price movement has entered a technical weakness, recording a fourth consecutive trading day decline on December 24, closing near $1.86, a significant retracement from the July all-time high of $3.66. In stark contrast to the price weakness, its spot ETF has demonstrated remarkable institutional absorption capacity, with 28 consecutive days of net capital inflows since its listing in November, totaling $1.13 billion. This divergence of "price falling, funds flowing in" reveals a deep contradiction between short-term profit-taking pressure and medium- to long-term structural optimism in the market. Looking ahead to 2026, the advancement of crypto-friendly regulatory bills, the potential Fed interest rate cut cycle, and the deepening utility of XRP in cross-border payments collectively form a positive narrative for its price recovery.

XRP12,15%

MarketWhisper·2025-12-25 05:34

Is Bitcoin Cash (BCH) Coiling Up For a Bullish Breakout? This Key Pattern Formation Suggests So!

Meanwhile, Bitcoin Cash (BCH) has managed to hold its ground, posting over 11% gains over the same period. More importantly, its price action is beginning to form a structure that often precedes larger

BCH-2,51%

CoinsProbe·2025-12-24 09:05

Notion CEO Ivan Zhao: AI is the next miracle material, and "Infinite Mind" will reshape the entire knowledge economy

Every era is defined by a "miracle material"(miracle material). The gilded age of the 19th century belonged to steel, the digital revolution of the 20th century came from semiconductors, and now, artificial intelligence is emerging in the form of "Infinite Minds." Notion co-founder and CEO Ivan Zhao (趙伊凡) pointed out in his latest article that history repeatedly proves one thing: those who truly master the key materials will define the shape of the entire era.

This long article titled "Steam, Steel, and Infinite Minds" was recently published on social media platforms.

ChainNewsAbmedia·2025-12-24 07:13

Whoever controls the "ranking" holds the key to the project's lifeline.

I'll be more direct.

Binance is the best entry point for project teams to exit liquidity after issuing tokens, no doubt about it. $MON 's initial launch caused Coinbase to plummet, which should have completely dispelled other project teams' ideas of bypassing Binance.

When the market consensus is that BNB Chain projects will receive priority in launching Alpha, BNB Chain projects will naturally form scale.

There's no way around it; liquidity is the absolute lifeline of assets, and Binance is the liquidity center, which also determines and controls the "fate" of the majority of projects.

Next, there might only be one area to watch—edge innovation. Edge innovation is not about replacing Kodak with a better Kodak, but about replacing it with a mobile phone. From "Qiqin Jinchu" to the US and Japan, they all originated from fringe cultural groups and continuously absorbed external cultural innovations.

Large companies encountering this kind of potential "edge innovation"

PANews·2025-12-24 06:07

Don't waste every loss, the "Sisyphus Revelation" of the crypto market.

In 2025, the crypto market experienced severe fluctuations, causing many to incur heavy losses. This article explores how to turn losses into growth opportunities, establish a strict risk management system to avoid repeating past mistakes, and ultimately build one's own moat in the market. This article is derived from a piece written by thiccy and organized, translated, and authored by PANews.

(Previous summary: Michael Saylor is once again calling for Bitcoin to reach a million or ten million dollars: waiting for the day when Strategy controls 5% or 7% of the total BTC supply)

(Background information: Arthur Hayes predicts Bitcoin will bottom out and rebound in January: The Fed will implement a form of QE, I have

BTC1,55%

動區BlockTempo·2025-12-24 02:00

CFTC and SEC Chairs Form Powerhouse Crypto Regulation Dream Team

The Biden administration is advancing crypto regulation with Michael Selig confirmed as CFTC chair, forming a regulatory "dream team" with SEC Chair Paul Atkins. Key legislation aims to clarify digital asset oversight, signaling significant upcoming changes.

BTC1,55%

CryptoDaily·2025-12-23 18:35

Earn 250 million dollars a year! How did Joe Rogan create the world's largest podcast, and even Luo Yonghao is learning from him?

American podcast host Joe Rogan has built a media empire with annual revenues of $250 million through "The Joe Rogan Experience," with episode view counts reaching 50 million. From Elon Musk smoking marijuana to Trump’s campaign rallies, this long-form conversation show that "talks about anything" is redefining the boundaries of media influence.

(Previous Summary: Huang Renxun also praised! What makes "Acquired" a must-listen podcast for Silicon Valley and Wall Street elites?)

(Background information: Trump's full victory speech: I love Musk, he is a superstar, make America great again)

Table of Contents

From comedian to podcast king, the show's value is $250 million

Podcast Chat, Precise Campaigning: Trump's Three Hours

China Mirror: The Attempts of Luo Yonghao and Others

Controversy and

動區BlockTempo·2025-12-23 11:21

Japan Plans to Issue Local Government Bonds as Digital Securities

Japan is preparing a major shift in how local governments raise funds. According to a report by Nikkei, the Japanese government plans to promote the issuance of local government bonds in digital form. The team would issue these instruments as digital securities, also known as security tokens. The go

Coinfomania·2025-12-23 09:10

Taiwan's Central Bank: The US Dollar stablecoin may become a shadow forex market, impacting the New Taiwan Dollar exchange rate.

The Central Bank of Taiwan recently issued a stern warning regarding the US dollar stablecoin, pointing out that if widely circulated, it would form a "shadow forex market," allowing businesses or individuals to circumvent the current Exchange Settlement reporting mechanism, weakening the Central Bank's control over cross-border capital movements, and thus impacting the stability of the New Taiwan Dollar Exchange Rate. In a recent speech, Central Bank Governor Yang Jinlong compared stablecoins to a modern version of "wildcat banking," implying their private issuance, regulatory Arbitrage, and potential instability.

MarketWhisper·2025-12-23 07:50

Gate Research Institute: LazAI Alpha Mainnet officially launched|Velo partners with WLFI to bring USD1 into the ecosystem

crypto market panorama

BTC (-0.73% | Current Price 88,500 USDT): Currently, Bitcoin is still in a stage of fluctuating rebound. The 4-hour chart shows that BTC began a mild rebound after stabilizing around 84,000 USD, but after briefly breaking through the 90,000 USD mark on Monday, it fell back again. The MACD green bars continue to converge and form a death cross around 88,000 USD, indicating that buying momentum is still insufficient. From the daily structure, Bitcoin has not effectively broken away from the bottom range formed since late November, and is currently still operating within the stabilization range of 84,000–94,000 USD, mainly focusing on fluctuating repair.

ETH (-0.84% | Current Price 2,994 USDT): In the past 24 hours, the price of Ethereum has oscillated around the $3,000 threshold, with low trading volume.

GateResearch·2025-12-23 06:38

Spotify suffers a massive data breach! 86 million audio files were stolen, unexpectedly revealing the phenomenon of music graveyards?

Spotify was hacked by a piracy organization that stole 300 TB of data, including 86 million audio files. The organization plans to make it public in the form of torrents, which not only impacts musicians' income but also reveals that the platform has a large amount of low-quality AI-generated music.

Spotify data breach case, piracy organization claims to have stolen 300 TB of data.

----------------------------------------

The global streaming music leader Spotify has recently been reported to have experienced a massive data leakage incident. The piracy organization known as "Anna's Archive," referred to as the "secret library," claims to have successfully backed up Spotify's music library and plans to make the data public.

Anna's Archive claims in a blog post that it has captured Sp

CryptoCity·2025-12-23 03:26

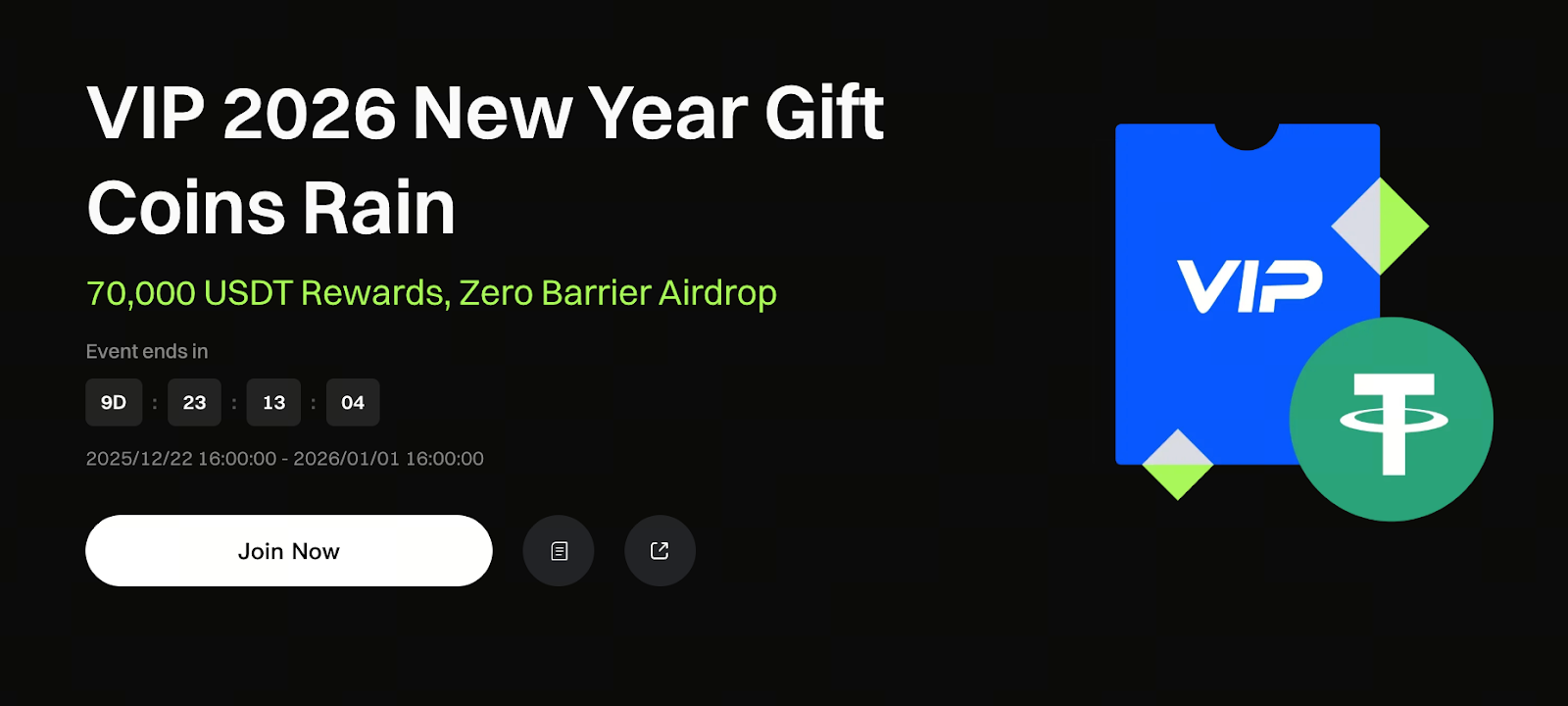

Gate VIP 2026 New Year gift coins rain detailed explanation: 70,000 USDT Airdrop is coming, full analysis of New Year financial benefits for VIP users.

What is the Gate VIP 2026 New Year gift coins rain?

Image: [https://www.gate.com/campaigns/3625](https://www.gate.com/campaigns/3625)

Gate VIP 2026 New Year Gift Coin Rain is one of the important VIP exclusive benefit activities launched by the platform at the New Year transition. This event distributes rewards in the form of an airdrop, with a total prize pool valued at approximately 70,000 USDT, and the reward tokens are KDK and CYS. Users do not need to incur additional costs to participate; they only need to meet the VIP level requirements to participate in the reward distribution according to the rules.

Unlike common random lotteries, this gift coin rain emphasizes VIP levels and participation quality. The reward distribution adopts a weighting mechanism, which favors long-term users and active VIPs.

GateLearn·2025-12-23 01:36

Pro Crypto US Regulators Form 'Dream Team' as SEC–CFTC Alignment Builds Breakout Pressure

Crypto market optimism is surging as unified SEC and CFTC leadership points to clear rules, lighter friction, and stronger U.S. backing, accelerating expectations for institutional adoption and a decisive regulatory turning point for digital assets.

Digital Asset Sentiment Rises With SEC and CFTC

Coinpedia·2025-12-23 00:24

Top Crypto Performers: SAROS, FORM, VELO, GUN, G, and Others Enter Accumulation Phase As Prices G...

Today, the market analyst Phoenix Group pointed out crypto assets that are in the accumulation phase. This is a period that happens when investors consistently buy certain tokens over time, normally after prices have declined or when they are moving sideways. During this period, volatility drops,

BlockChainReporter·2025-12-22 20:03

CFTC and SEC Chairs Form Powerhouse Crypto Regulation Dream Team

The Biden administration is advancing crypto regulation with Michael Selig confirmed as CFTC chair, forming a regulatory "dream team" with SEC Chair Paul Atkins. Key legislation aims to clarify digital asset oversight, signaling significant upcoming changes.

BTC1,55%

CryptoDaily·2025-12-22 18:30

DRTECH, implementing a paid-in capital increase of 80 billion won... starting strategic cooperation with Neo Solutions.

The KOSDAQ-listed company DRTec is raising funds through a third-party directed paid-in capital increase of 80 billion won. This move is interpreted as an effort to secure future operating funds and stabilize operations.

On the 22nd, DRTec officially announced this paid-in capital increase plan through the electronic disclosure system of the Financial Supervisory Service. The newly issued shares amount to 3,738,317 common stocks, with an issue price set at 2,140 KRW per share. All shares will be allocated to Neo Solutions Co., Ltd., and DRTec will raise a total of 7.99 billion KRW through this capital increase.

The compensated capital increase through a third-party directed approach differs from the general public offering method; it is a form of issuing shares to specific enterprises or investors. It is typically chosen when there is an urgent need for funds or a need for cooperation at the strategic alliance level. This situation appears to be DRTec focusing on consolidating its medium- to long-term financial stability and the foundation for business expansion.

D

TechubNews·2025-12-22 14:19

2025 Six Major AI Paradigm Shifts: From RLVR Training, Vibe Coding to Nano Banana

Author: Andrej Karpathy

Compiled by: Tim, PANews

2025 is a year of rapid development and full of uncertainties for large language models, and we have achieved fruitful results. Below are what I personally consider noteworthy and somewhat surprising "paradigm shifts" that have changed the landscape and left a deep impression on me, at least on a conceptual level.

1. Reinforcement Learning with Verifiable Rewards (RLVR)

At the beginning of 2025, the LLM production stack of all AI laboratories will roughly present the following form:

Pre-training (GPT-2/3 from 2020);

Supervised fine-tuning (InstructGPT from 2022);

and Reinforcement Learning from Human Feedback (RLHF, 2022)

For a long time, this has been a stable and mature technology stack for training production-level large language models. By 2025, reinforcement based on verifiable rewards

PANews·2025-12-22 09:29

Prediction market: An extended form of binary options

After following the prediction market, I increasingly find that it resembles binary options in many ways. Although not exactly the same, from a certain perspective, the prediction market can be seen as an extended form of binary options.

Prediction markets, such as Polymarket/kalshi/Opinion, utilize yes/no binary contracts. Prices reflect the market consensus on the probability of an event occurring, for example, predicting "Will BTC break $100,000 in January 2025?" The price fluctuates between 0 and 1, reflecting the market consensus on the probability of the event occurring in real-time; if the price is 0.7, it means that people in the market believe there is a 70% chance it will happen. At expiration, the settlement is based on the outcome: if it occurs, it's worth 1, and if it doesn't, it's worth 0. Doesn't this seem very similar to binary options?

The core of binary Options is also based on "yes/no"

BTC1,55%

金色财经_·2025-12-22 07:27

Why does Vitalik Buterin support prediction markets? More reliable than social media as a "truth discovery tool".

Recently, Ethereum co-founder Vitalik Buterin publicly posted on Farcaster, defending the ethical value of prediction markets. He pointed out that compared to social media, which fuels sensationalist rhetoric, prediction markets built on economic incentives are a superior "truth discovery tool." This statement immediately sparked intense ethical clashes with Quilibrium founder Cassie Heart and others, who criticized the act of betting on human life and death as the root of the "industry's disdain." Meanwhile, prediction market platforms like Polymarket and Kalshi are accelerating mainstream adoption, with data being included by Google Finance, and regulatory approval from the Commodity Futures Trading Commission in the form of a "no-action" exemption, signaling that this sector will continue to expand amid controversy.

MarketWhisper·2025-12-22 03:08

Bitcoin community warns: Quantum defense upgrade may take five to ten years to implement

Bitcoin reached a high of $88,000, but the threat of quantum computers has made the upgrade timeline of 5 to 10 years a new focus for the market, exposing the vulnerabilities and costs of decentralization governance.

(Background: Fidelity analyst: Bitcoin will be a "fallow year" in 2026, support range of $65,000 to $75,000)

(Background Supplement: Arthur Hayes predicts Bitcoin will hit bottom and rebound in January: The Federal Reserve will implement a form of QE, I have gone all-in with 90% of my assets)

Table of Contents

The Cost of Decentralization: Collective Action Across a Decade

The technocrats are calm, while the capitalists are anxious.

25% "Sleeping Coin" Reveals Security Flaw

Betting under Quantum Countdown

The price of Bitcoin remains at a high of $88,000 by the end of 2025, and the first year of the Trump administration can be described as calm. However, the seemingly stable situation...

動區BlockTempo·2025-12-22 02:25

AA Proficient in BTC 3rd Edition Intensive Reading 03

The second and third paragraphs of the "Introduction" chapter provide a concise introduction to Bitcoin (i.e., bitcoin with a lowercase 'b') as a unit of currency. The author AA writes as follows:

> Users can transfer Bitcoin over the network, achieving nearly all the functions of traditional currencies, including buying and selling goods, remitting to individuals or institutions, and providing credit services. Users can buy and sell Bitcoin on professional currency exchanges or exchange it for other currencies. It can be said that Bitcoin is the ideal form of currency in the internet era - it has fast transaction speeds, high security, and is not restricted by national borders.

It can be seen that the author AA mainly discusses the practicality of BTC as a value transfer medium here, without mentioning its ability as a value store. This actually deviates from the core value proposition that currently supports the value consensus of BTC.

Of course, considering that this book mainly presents BTC as a type of

BTC1,55%

金色财经_·2025-12-21 09:41

The era of Web3 super individuals has arrived: How to let AI be your auxiliary brain and make Wallet your sovereignty?

The intersection of AI and encryption technology allows individuals to form a closed loop through content, transactions, and entrepreneurship, with super individuals replacing institutions and becoming the core driving force of Web3.

CryptoCity·2025-12-21 04:55

Arthur Hayes Warns Fed’s New Liquidity Tool Is Basically QE in Disguise

Crypto Expert Argues Fed’s New Program is a Form of Quantitative Easing

Arthur Hayes, co-founder and former CEO of the cryptocurrency exchange BitMEX, has highlighted concerns over the Federal Reserve’s latest monetary policy initiative, labeling it a disguised form of quantitative easing (QE).

IN3,4%

CryptoDaily·2025-12-20 19:55

Argo Blockchain slides after technical breakdown Despite a Form 6-K filing

Argo Blockchain collapsed after losing a multi-month trading range, triggering aggressive downside price discovery.

A widely shared technical assessment framed the decline as a structural breakdown rather than short-term volatility.

A subsequent regulatory

CryptoFrontNews·2025-12-20 00:16

TikTok Becomes American and Bitcoin and Stocks Are Loving It

The cryptocurrency had recently stalled, but news of a TikTok U.S. joint venture buoyed equity markets and perhaps boosted bitcoin as well.

Bitcoin and Stocks Surge with TikTok’s U.S. Pivot

More than two billion users have now downloaded what was once an obscure Chinese short-form

BTC1,55%

Coinpedia·2025-12-19 23:07

Arthur Hayes Warns Fed’s New Liquidity Tool Is Basically QE in Disguise

Crypto Expert Argues Fed’s New Program is a Form of Quantitative Easing

Arthur Hayes, co-founder and former CEO of the cryptocurrency exchange BitMEX, has highlighted concerns over the Federal Reserve’s latest monetary policy initiative, labeling it a disguised form of quantitative easing (QE).

IN3,4%

CryptoDaily·2025-12-19 19:50

Load More