Search results for "FRONT"

XRP Breaking News: Veteran Transition, ETF Progress, Policy Catalysts, Is the $3 Target in Place?

At the beginning of 2026, the XRP ecosystem ushered in a dual key catalyst. On the technical front, David Schwartz, the Chief Technology Officer of Ripple and co-creator of the XRP Ledger, who has served for over 13 years, officially stepped down, transitioning to Honorary CTO and remaining on the board, marking a smooth transition of an era. On the market front, the XRP spot ETF has accumulated a net inflow of $1.18 billion since its launch, defying market pressure in December 2025 to attract $499.9 million, forming a stark contrast to the outflows from Bitcoin and Ethereum ETFs.

Meanwhile, the U.S. Senate Banking Committee will review the key "Market Structure Act" on January 15, paving the way for clearer regulation of digital assets. The strategic handover of technical veterans, surging institutional funds, and potential regulatory benefits have collectively brought XRP into the market spotlight, with analysts generally optimistic about a mid-term price increase to $3.

MarketWhisper·01-04 07:51

Battle for the Fed Chair Intensifies: Hassett Loses Front-Runner Status as Trump’s Decision Nears

The race to lead the U.S. central bank is becoming increasingly competitive. According to the latest market-based forecasts, the probability that Kevin Hassett will become the next chair of the Federal Reserve has fallen below 50%. The decline reflects growing uncertainty and mounting competition as

Moon5labs·2025-12-30 13:01

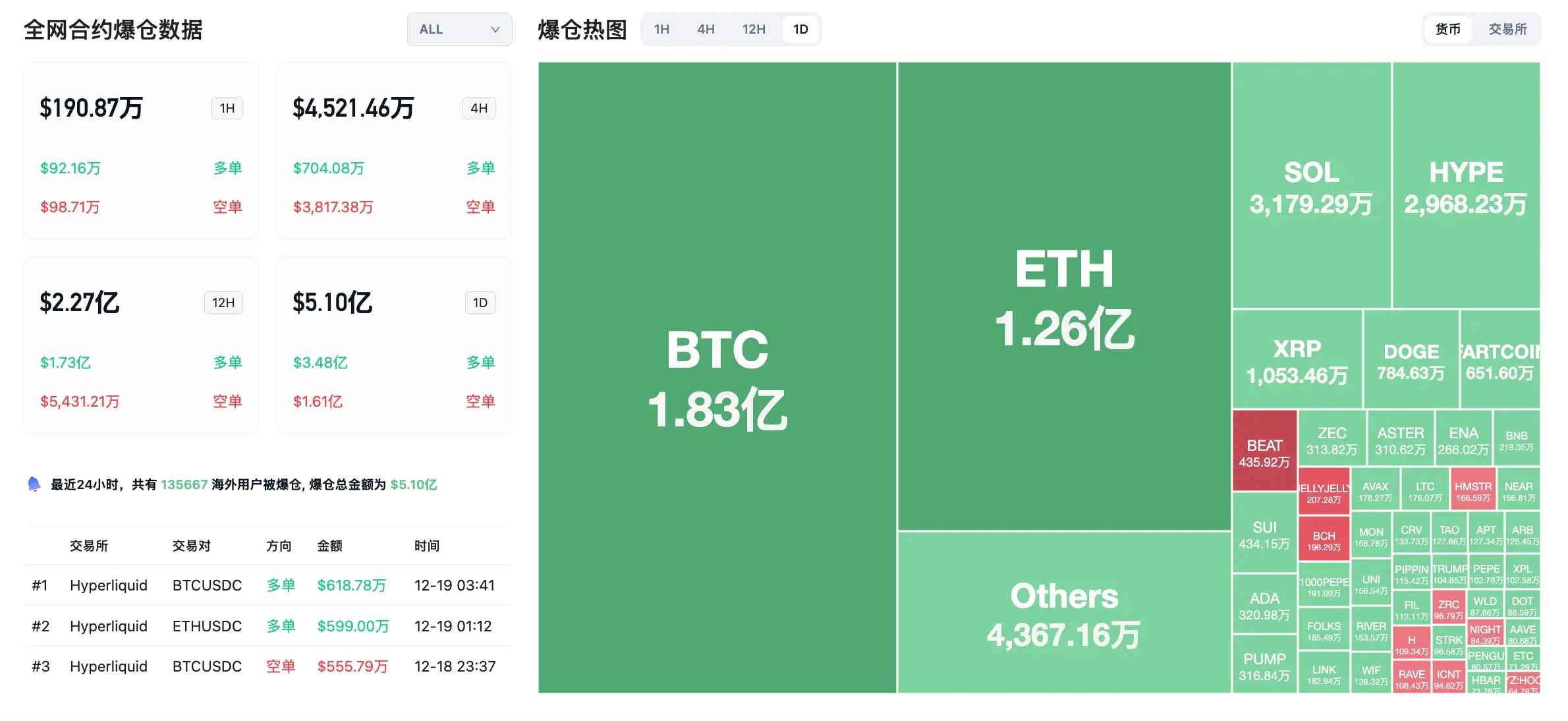

A Review of the 2025 Cryptocurrency Market: $290 Billion Market Cap Evaporated, Privacy Coins Soar 12 Times

The cryptocurrency market in 2025 shrank from 3.26 trillion to 2.97 trillion, evaporating 290 billion USD. The sector is highly polarized: privacy coins ZEC surged 1,200%, DASH increased 6 times; Bitcoin-related stocks MicroStrategy's stock price dropped 47%. On the policy front, the 《GENIUS Act》 was implemented, and Circle's IPO surged 9 times. October saw the largest liquidation in history with 19 billion USD in leveraged margin calls, and December entered a silent bear market.

MarketWhisper·2025-12-29 09:17

Why has Russia's cryptocurrency policy shifted from "total denial" to "positive entry"?

What can turn a country from "total ban" to "cryptocurrency listed on the stock exchange"?

In 2021, the Governor of the Russian Central Bank, Nabiullina, stood in front of the camera and said with an undeniable tone: Our attitude towards cryptocurrencies is, quite simply, a position of complete denial.

In December 2025, the same Russia, the same national financial institution.

The largest Moscow and Saint Petersburg exchanges publicly announced: technology is ready, just waiting for the regulations to take effect on July 1, 2026.

Since then, retail investors and institutions can trade cryptocurrencies on the stock exchange. And it is a positive acceptance by the stock exchange, not a gray area compromise.

In four years, Russia has gone from "total ban" to "how to manage."

01. What happened?

In March 2025, Russia launched an "experimental legal system" allowing the use of cryptocurrencies in cross-border payments.

In December 2025, the central bank released a comprehensive regulatory framework.

BTC2,98%

PANews·2025-12-26 13:10

2025 Cryptocurrency Major Events Recap: Trump Policies, 1.4 Billion Hackers, Bitcoin New High

2025 will be the most turbulent year in cryptocurrency history, with the Trump administration promoting Bitcoin strategic reserves, pardoning Silk Road founder, and signing stablecoin legislation. On the market front, Bitcoin reached a historic high of $126,000 before experiencing $20 billion in liquidations, a record $14 billion hack on CEXs, and MicroStrategy accumulating over 3% of the Bitcoin supply. These major events mark a critical turning point for the crypto industry as it transitions from the fringe to the mainstream.

MarketWhisper·2025-12-26 01:02

Price decline, massive whales dumping and leaving the market—A look at the DeFi governance dilemma through the battle for control of Aave

Author: Jae, PANews

When the governance benchmark of the DeFi market collides with real-world commercial interests, a brutal game of "who is the master" is unfolding inside the top lending protocol Aave.

As the leader in the DeFi market, Aave manages approximately $34 billion in assets and is regarded as a model of on-chain governance. However, by December 2025, Aave found itself in its most severe trust crisis since its founding 8 years ago.

This controversy was not accidental. The initial spark was a seemingly minor front-end fee distribution, but it unexpectedly triggered a domino effect. Through a series of key events and layers of catalysis, the lending giant Aave was ultimately thrust into the spotlight.

This is not just a simple dispute over profit sharing; it has torn open a gap, exposing the most fundamental and sensitive dispute in the DeFi space: in decentralization

区块客·2025-12-25 15:58

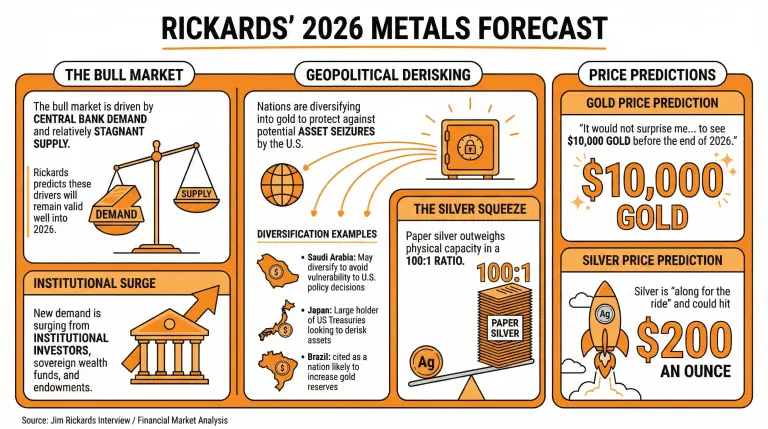

Jim Rickards' Explosive Predictions: Gold to $10,000, Silver to $200 in 2026

The legendary economist and best-selling author states that the elements driving up the whole metals market, with gold at its front, will continue next year. In a recent interview, Rickards explained that he would not be surprised if gold reaches prices of $10,000 and silver follows with $200 in 202

Coinpedia·2025-12-25 10:36

Price decline, massive whales dumping and leaving the market—A look at the DeFi governance dilemma through the battle for control of Aave

Author: Jae, PANews

When the governance benchmark of the DeFi market collides with real-world commercial interests, a brutal game to determine "who is the master" is unfolding within the top lending protocol Aave.

As the leader in the DeFi market, Aave manages approximately $34 billion in assets and is regarded as a model of on-chain governance. However, by December 2025, Aave found itself in its most severe trust crisis since its founding 8 years ago.

This controversy was not accidental. The spark initially was a relatively insignificant front-end fee distribution, but it unexpectedly triggered a domino effect. Through a series of key events and layers of catalysis, the lending giant Aave was ultimately pushed into the spotlight.

This is not merely a dispute over profit sharing; it has torn open a gap, exposing the most fundamental and sensitive conflicts within the DeFi space.

区块客·2025-12-24 15:57

The coin price is falling, and the Whale is dumping and leaving the market. Observing the governance dilemma of DeFi from the power struggle in Aave.

Author: Jae, PANews

When the governance benchmark of the DeFi market collides with the realities of commercial interests, a brutal game deciding "who is the master" is unfolding within the top lending protocol Aave.

As a leader in the DeFi market, Aave not only manages approximately $34 billion in assets but is also regarded as a model of on-chain governance. However, in December 2025, Aave found itself in the most severe trust crisis it has faced in its 8-year history.

This controversy was not accidental. The initial flashpoint was merely a relatively inconspicuous allocation of front-end fees, but it unexpectedly triggered a domino effect, culminating in a series of key events that ultimately pushed Aave, the lending giant, into the spotlight.

This is not just a simple dispute over profit distribution; it has opened a rift, exposing the most fundamental and sensitive conflicts in the DeFi space.

区块客·2025-12-23 15:56

Is the Tom Lee team still trustworthy despite aggressively promoting ETH externally while being bearish internally?

Author: Aki, Wu talks about Blockchain

If we had to choose the most representative figure for the Ethereum bull narrative in 2025, Tom Lee, the chairman of BitMine and co-founder and chief investment officer of Fundstrat, would often be placed in the most prominent position. He has repeatedly emphasized in several public speeches that ETH is undervalued, and during the Binance Blockchain Week on December 4, he stated that Ethereum at $3000 is "seriously undervalued," and has given a high target price judgment of "ETH at $15,000 by the end of 2025." As a Wall Street veteran known as the "Wall Street Oracle" and a strategist actively involved in media and institutional roadshows, Tom Lee's views are often regarded by the market as a sentiment barometer.

However, when the market shifts its focus from the front of the lens to internal documents, the situation reverses: in To

ETH2,93%

金色财经_·2025-12-23 03:37

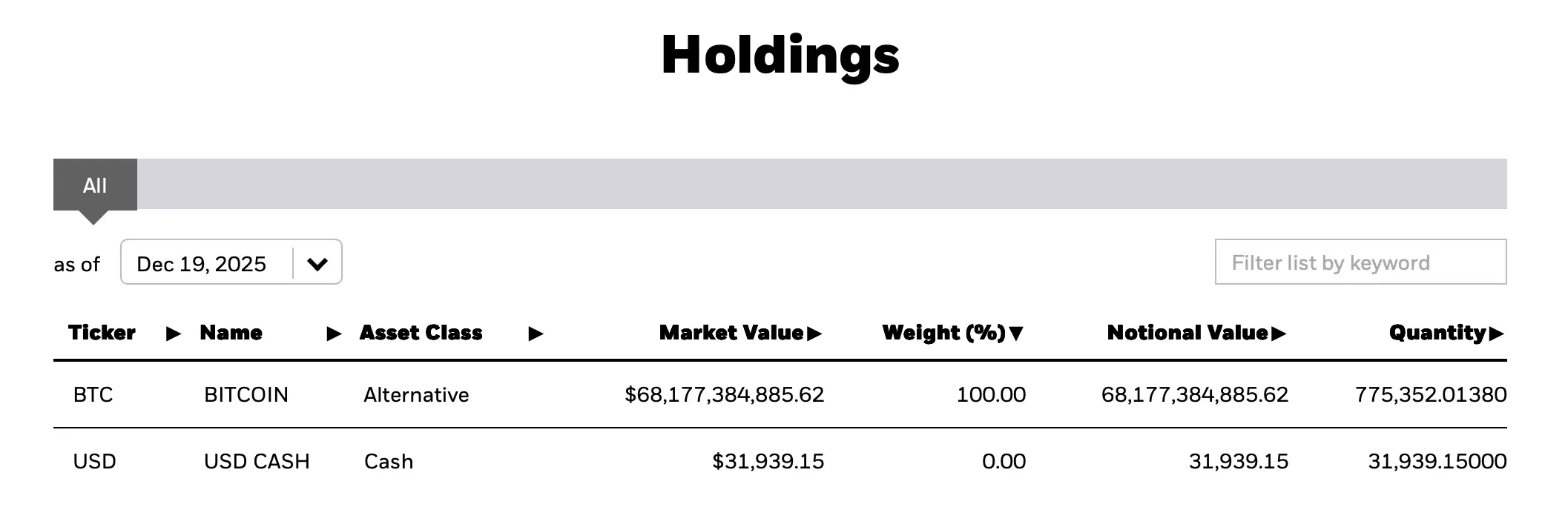

Blackrock’s 2025 Investment Themes Put Bitcoin and IBIT Front and Center

Blackrock has placed bitcoin alongside Treasury bills and mega-cap U.S. equities as one of the defining investment themes of 2025, spotlighting its Ishares Bitcoin Trust (IBIT) directly on the firm’s website.

IBIT’s Capital Haul Helps Bitcoin Crack Blackrock’s 2025 Theme List

The feature

BTC2,98%

Coinpedia·2025-12-22 19:31

How Taiwan's AI startup Zeabur secured 64 million in funding, starting from the founder's graduation project.

At 24 years old, entrepreneur Lin Yuanlin from Taoyuan, Taiwan, graduated from the Computer Science Department of Zhejiang University in 2023 and previously interned as a front-end engineer at Ant Group. During his university years, he took on numerous outsourced development projects but found that the real time-consuming aspect was not coding, but deployment and delivery. This led him to transform what was originally regarded as a graduation project that would be shelved after completion into an AI startup that spans across Taiwan and the United States, gaining favor with Silicon Valley venture capitalists. Recently, he shared his insights on his journey in the YouTube channel Kelly Tsai.

The cloud deployment platform Zeabur (formerly known as Zeebird), founded by him, has recently completed a $2 million seed round financing led by the well-known American venture capital firm 500 Global. Currently, the registered users have exceeded 100,000, with about 5,000 paying users. The product has been featured in the world's largest product.

ChainNewsAbmedia·2025-12-22 10:24

Latest Aave community controversy: free asset swap becomes charged, DAO demands the recovery of revenue control.

The Decentralized Finance (DeFi) lending platform Aave is facing strong Rebound from the community. The controversy arises from Aave's recent introduction of a 0.15% to 0.25% fee on the originally free asset swap function in the official front-end interface, and this revenue does not flow into the DAO treasury but is retained by the development company Aave Labs.

This move has sparked widespread discussion in the community about whether "decentralized governance is being undermined," and has focused the entire Decentralized Finance community on a core question: who truly controls the value and revenue of the protocol?

From Free to Paid: Major Changes to Aave's Frontend Swap Functionality

In the past, Aave users could perform free asset swaps through its official front end (such as app.aave.com), such as swapping between USDC and DAI or ETH, only bearing the basic DEX slippage and

ChainNewsAbmedia·2025-12-22 09:04

Why Is Midnight (NIGHT) Price Pumping Hard?

The Midnight (NIGHT) price has jumped to the front of the market, climbing roughly 30% in a single session and changing hands around $0.0866 at writing. Activity has followed price higher, with trading volume up close to 70%, pointing to broad engagement rather than a brief liquidity gap.

The

CaptainAltcoin·2025-12-21 07:35

"Fat App" is dead, welcome to the era of "Fat Distribution".

Encryption applications are shifting from technological innovation to competition in distribution capabilities, and in the future, the focus will be on embedding backend services into other ecosystems rather than attracting individual users. Front-end platforms like Coinbase will capture a larger share of value, and competition will focus on distribution capabilities rather than liquidity.

動區BlockTempo·2025-12-21 05:15

Coinbase borrows Kalshi’s playbook, sues three states over prediction markets

Coinbase is taking three US states to court in a bid to lock in federal protection for its planned prediction markets, opening a new front in the battle over whether event contracts are finance or gambling.

The exchange has sued regulators in Connecticut, Illinois, and Michigan, asking federal

IN-0,28%

Cointelegraph·2025-12-19 08:39

Trading Moment: Japan's rate hike triggers, Bitcoin faces a critical test at $81,000, Ethereum's rebound is weak

Daily Market Highlights and Trend Analysis, produced by PANews.

1. Market Observation

Despite the US November CPI year-over-year unexpectedly dropping to 2.7%, with core CPI falling to 2.6%, hitting a new low since 2021, fueling market expectations of the Federal Reserve accelerating rate cuts, the reliability of this report has been widely questioned due to data collection disruptions caused by the government shutdown. The market wavers amid complex signals; on one hand, White House officials believe the Fed has "ample room to cut rates"; on the other hand, the Bank of Japan raised its benchmark interest rate to 0.75%, a 30-year high, continuing to tighten global liquidity. On the regulatory front, the CLARITY Act, aimed at clarifying rules for the crypto market, is expected to enter the Senate for review in January next year, bringing positive industry expectations. However, the financial markets are facing the largest-ever quarterly concentrated derivatives settlement, with approximately $7.1 trillion in risk exposure.

PANews·2025-12-19 06:32

Ripple Earns Front-Page Mention in The New York Times

The New York Times (NYT) spotlighted Ripple on its front page today, positioning the company at the center of a shift in U.S. crypto regulation under President Donald Trump.

Ripple featured in an NYT investigative report today titled “Trump Warmed to Crypto, and S.E.C. Eased Up,” authored by

IN-0,28%

TheCryptoBasic·2025-12-15 14:54

Brazil's largest bank Itaú advises clients: Allocate 3% to Bitcoin to hedge against US dollar depreciation.

Itaú Unibanco recommends clients to transfer 1% to 3% of their funds into Bitcoin, opening a new front for Brazilian investors to hedge against the depreciation of the Real.

(Background: The printing presses are running again! The US Federal Reserve has launched the "Reserve Management Purchase Program," starting 12/12, buying 40 billion USD worth of short-term government bonds over 30 days)

(Additional background: Silver breaks through $60 to hit a new all-time high! This year's increase exceeds 100%, ranking as the sixth-largest asset globally)

Table of Contents

The 3% Golden Rule: Low Correlation Results

"Digital Shield" in the Exchange Rate Storm

Institutional Consensus from Wall Street to São Paulo

Risks and Discipline: Warnings from Bankers

This is not a miracle about getting rich overnight, but Brazil's top private bank Itaú Unibanco in the face of a strong dollar and a plunging Real.

動區BlockTempo·2025-12-15 04:10

Aave erupts in internal community turmoil over "hidden privatization": fee revenue flows into Aave Labs address instead of DAO treasury

Aave DAO and Aave Labs recently clashed over front-end fee allocations, causing a weekly cash flow of $200,000 to be rerouted, prompting token holders to question governance failure.

(Background: An unhappy casino economy is taking shape, with young Americans feeling pessimistic and powerless about the future)

(Additional background: The US OCC has given the green light! Ripple, BitGo, Circle, and five other crypto giants received "conditional approval" for trust bank licenses)

Table of Contents

Weekly $200,000 flow to unknown addresses

Shareholder revolt: token holders strongly oppose

The boundary between Labs and DAO

Governance quizzes and future risks

On-chain detective and Aave DAO representatives

動區BlockTempo·2025-12-15 02:45

Top 3 Cryptos Set for 2025 Breakout: Ozak AI, Solana, and Ethereum Lead the Charge

Crypto market sentiment continues building as investors look ahead to the 2025 cycle, and three projects are emerging as clear front-runners: Ozak AI (OZ), Solana (SOL), and Ethereum (ETH). Each plays a very different role in the ecosystem, yet analysts agree that all three are positioned for

CaptainAltcoin·2025-12-12 20:05

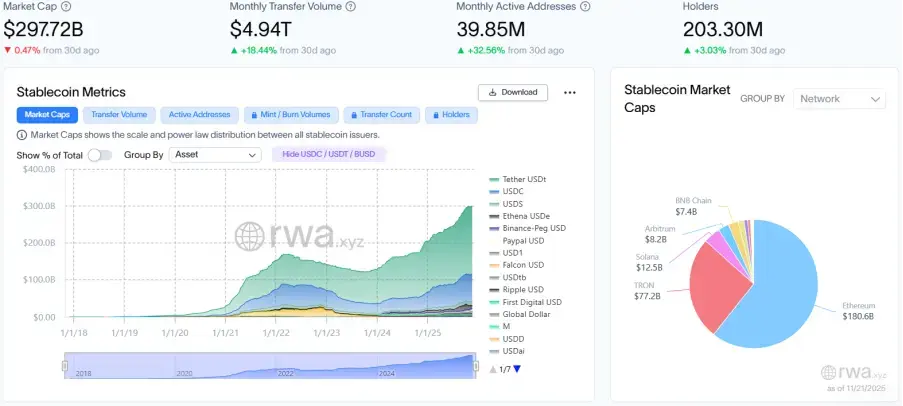

RWA Weekly: Mainland enterprises' consulting volume for RWA business in Hong Kong plummets by over 90%; US SEC permits DTCC to custody on blockchain and approves tokenized stocks and other RWA assets

Highlights of this Issue

The weekly coverage period for this issue spans from December 5, 2025, to December 11, 2025.

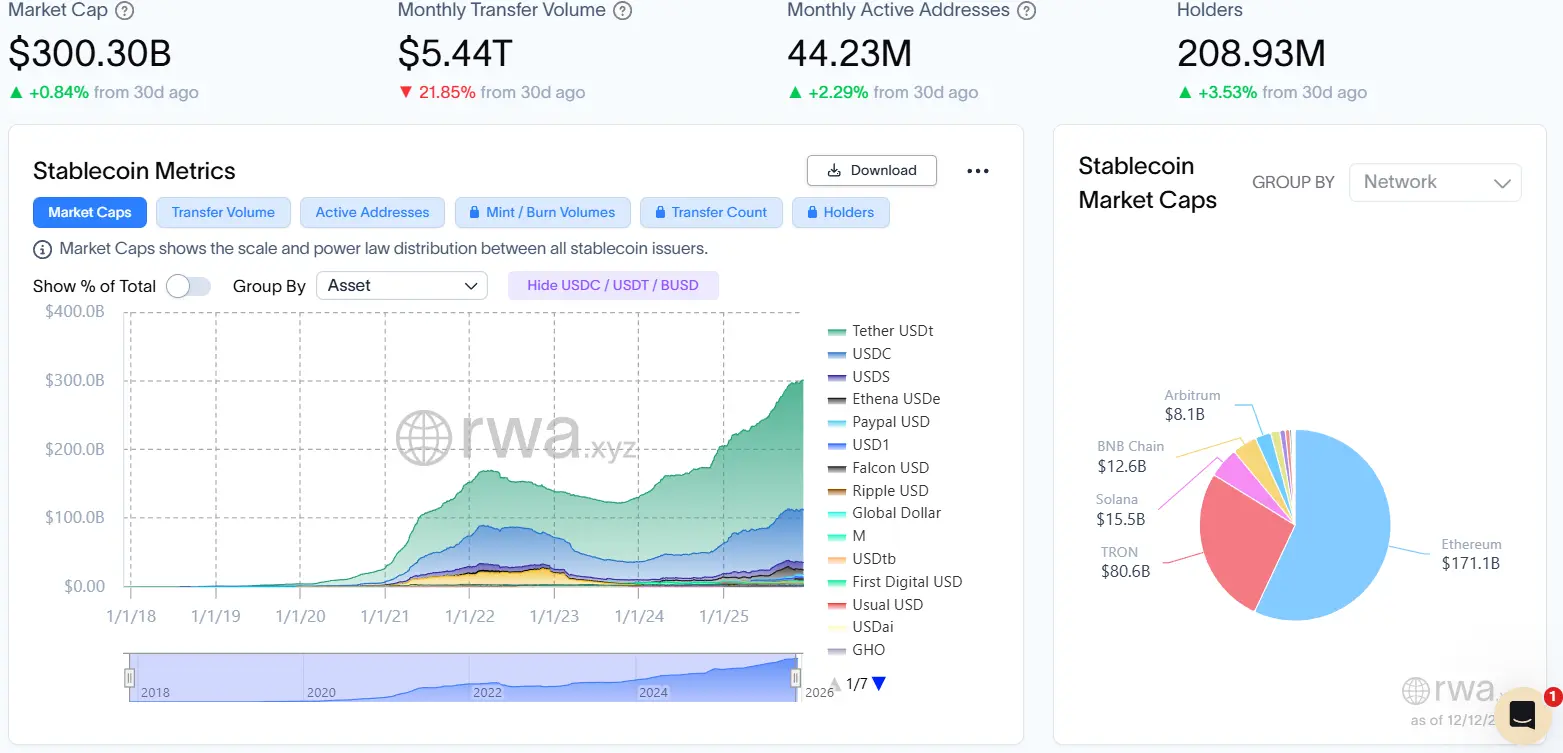

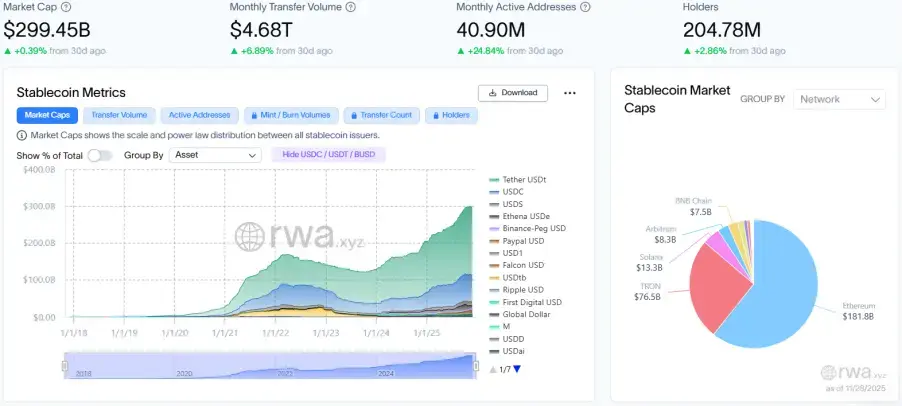

This week's RWA market data shows that the on-chain total market capitalization has nearly stagnated, but the number of holders has steadily increased, reflecting the market's entry into a deeper user penetration stage; the total market value of stablecoins has surpassed $300 billion, but the monthly transfer volume and active addresses have significantly declined, indicating a dual pressure of “liquidity contraction and user activity decline.”

On the regulatory front, some countries have made substantive progress in the issuance of tokenized assets. BRICS countries and Bhutan have launched digital currencies backed by gold, and the Crown stablecoin project in Brazil and the Ezeebit payment infrastructure in Africa have secured funding successively. YouTube has introduced a stablecoin payout option for U.S. creators.

A stark contrast emerges

RWA2%

PANews·2025-12-12 11:02

Stripe announces acquisition of crypto wallet Valora, aiming to promote the stablecoin network Tempo

Stripe acquires Valora team and launches the Tempo testnet, focusing on low-fee stablecoin payments, reshaping global cash flow rules under Trump policies

(Background: Stripe opened USDC payments on the 12th, with a 1.5% flat rate directly targeting Visa and Mastercard)

(Additional background: Will Stripe's dedicated payment chain Tempo threaten the status of ETH and SOL?)

Table of Contents

From API to full rail network: piecing together the final front-end piece

Tempo: a settlement layer built for high-frequency commercial use

Trump 2.0 policy expectations to boost stablecoin imagination

From toll booths to highways: strategic closed-loop formation

Silicon Valley payment company Stripe made two shocking moves yesterday (10): on one hand, in conjunction with

動區BlockTempo·2025-12-11 07:02

Did Polymarket Traders Front-Run a $1B Bitcoin Buy? Community Split After “Insider” Signals

A heated debate has taken over CoinMarketCap after several Polymarket participants appeared to position themselves perfectly ahead of a rumored $1B Bitcoin buy linked to MicroStrategy. What began as a few sharp trades on a prediction market has now turned into a full conversation about insider

BTC2,98%

CaptainAltcoin·2025-12-09 09:24

Stable TGE countdown! Insider pre-deposits spark controversy, bets placed on FDV surpassing $2 billion

On December 8, the Layer1 blockchain Stable mainnet will officially launch, with its core design centered on using USDT as the native gas fee, achieving sub-second settlement and gas-free peer-to-peer transfers. Previously, Stable’s pre-deposit campaign experienced front-running behavior, causing a trust crisis. According to Polymarket data, the market estimates an 85% probability that its FDV will exceed $2 billion on the day after launch.

MarketWhisper·2025-12-08 06:45

Retail Investors Are Dead, Institutions Rise: Understanding the Next Global Crypto Bull Market

Author: chelson Source: X, @chelsonw_

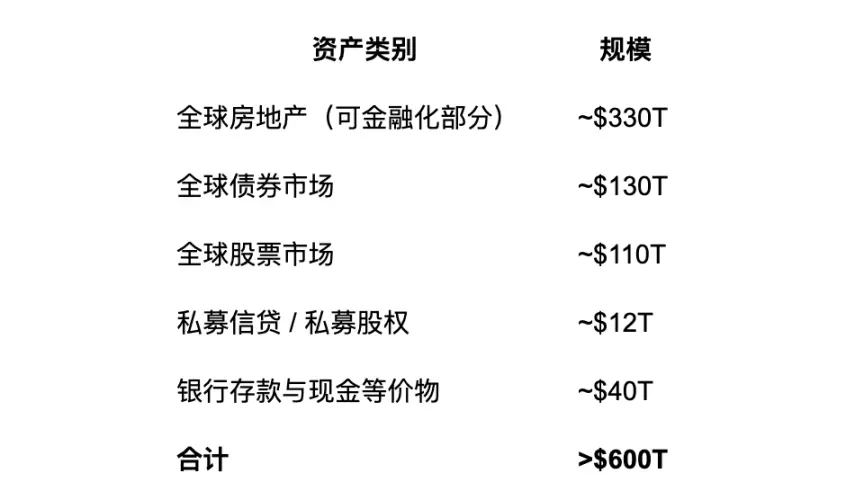

To start with the conclusion: The next three years will be a bull market led by institutions, marking the official entry of crypto and blockchain technology into Wall Street balance sheets, with mass adoption finally achieved through a top-down revolution.

Mass adoption of crypto will not be the anti-central bank revolution originally envisioned by Satoshi Nakamoto, but rather a top-down upgrade of global financial infrastructure.

Retail investors are the tide, institutions are the sea.

The tide may recede, but the sea remains.

Looking back at 2025: Why is this bull market the "dawn of the institutional era"?

Reason up front: Almost all BTC/ETH funds come from institutions, while retail investors are speculating on memes and altcoins.

In 2025, all major coins will hit new all-time highs:

金色财经_·2025-12-05 10:06

RWA Weekly: Stablecoin company First Digital plans to go public via SPAC merger; WLFI plans to launch RWA products next year

Highlights of this Issue

The statistical period for this issue covers November 28, 2025 to December 5, 2025. This week, due to adjustments in statistical methods, RWA market data showed some changes: the total on-chain market cap declined slightly, but the number of holders continued to grow, indicating a steadily strengthening user base. The total stablecoin market cap surpassed $300 billion, but both transfer volume and monthly active addresses decreased compared to the previous period, suggesting that the market may be transitioning from previous high-growth phases to a "new normal" focused on user penetration and ecosystem consolidation. On the regulatory front, the UK's FCA has opened a regulatory sandbox for stablecoin companies, the US FDIC plans to release an implementation draft of the GENIUS Act, and the Bank of Israel has signaled intentions to strengthen oversight—major global economies are accelerating efforts to bring stablecoins under prudent regulatory frameworks. On the project side, tokenized assets continue their global expansion trend: Europe's largest asset manager Amundi launched its first tokenized money market fund, and Japan Post Bank is advancing the application of DCJPY in real estate.

PANews·2025-12-05 07:34

Meme coin Pepe $PEPE official website hacked! Front end injected with "Inferno Drainer" malicious code—do NOT visit the site

Cybersecurity company Blockaid issued an urgent warning tonight (4th) on the X platform: the official website of the popular meme coin Pepe ($PEPE) has suffered a front-end attack, with the notorious "Inferno Drainer" malicious code implanted on the site.

(Previous context: DWF Labs reportedly hacked by North Korean attackers for $44 million but kept it secret! ZachXBT: Not surprising at all)

(Background supplement: Balancer issues "final ultimatum" to hacker, 96-hour countdown to return funds: Otherwise, we will use all means to find you)

Cybersecurity company Blockaid issued an urgent warning tonight (4th) on the X platform: the official website of the popular meme coin Pepe ($PEPE) has suffered a front-end attack, with the notorious "Inferno Drainer" malicious code implanted on the site. Blo

PEPE-2,75%

動區BlockTempo·2025-12-04 15:40

PIPPIN Faces Centralization Alarm as One Entity Amasses 73% Supply

Fresh on-chain analysis has set off alarms around the Solana meme coin PIPPIN. Data shared by Front Runners shows that a single coordinated entity now controls roughly 73% of the total token supply. It is valued near $155 million at current prices. The entity operates through around 50 linked

PIPPIN-29,7%

Coinfomania·2025-12-03 09:01

Who Will Lead the Fed? Hassett Moves to the Front as Markets Watch Nervously

The United States is entering one of the most consequential decision-making periods of the coming year — the selection of the next Chair of the Federal Reserve. This choice will shape the direction of U.S. monetary policy for years to come and influence global markets, interest rates, lending

Moon5labs·2025-11-28 20:02

RWA Weekly: Coinbase Ventures includes RWA Perptual Futures in its 2026 investment roadmap; multiple Central Banks warn about stablecoin regulatory risks.

Highlights of this issue

The statistical period for this week's newsletter covers November 21 to November 27, 2025. This week, the RWA market has entered a stage of existing stock optimization, with the total on-chain market capitalization growth further slowing to 1.10%. However, the number of holders continues to rise, indicating a shift in the market from scale expansion to user engagement. The total market capitalization of stablecoins is approaching zero growth, while the number of monthly active addresses has significantly increased by 24.84%, highlighting the strengthening of on-chain payment settlement functions and the activity of small high-frequency transactions. On the regulatory front, the G20, European Central Bank, and South African Reserve Bank have all warned about the regulatory risks of RWA and stablecoins. In contrast, South Korea's STO bill has passed preliminary review, and Bolivia plans to integrate stablecoins into its financial system, reflecting a trend of divergence in global regulation. At the project level, traditional finance and tech giants continue to integrate crypto projects to develop stablecoins: QCAD has been approved as Canada's first compliant Canadian dollar stablecoin, and Klarna plans to launch its stablecoin on the Tempo chain in 2026.

PANews·2025-11-28 09:31

Ark Investment: Google Nano Banana Pro is quite impressive, but its adoption rate is still not as high as ChatGPT.

ARK Invest (ARK Invest) The latest discussion points out that Google’s Gemini 3 has successfully returned to the top model ranks, but this update’s breakthrough is not in language capabilities, but in the brand new image and information generation model "Nano Banana Pro." The ARK team believes this update from Google signifies that its AI technology is back on the front lines, but it still faces challenges in user adoption and commercialization strategies.

Gemini 3 responds to criticism, Google emphasizes that the law of AI expansion has not failed.

ARK pointed out that Google's latest release, Gemini 3, has excelled in multiple benchmark tests, thereby refuting external doubts about the "diminishing returns of large models." The Google engineering team stated that scale expansion continues to bring visible benefits, demonstrating a significant increase in training capacity.

ChainNewsAbmedia·2025-11-28 09:14

Don't look at L1 with price-to-earnings ratio anymore! Dragonfly partner: Exponential growth covers everything.

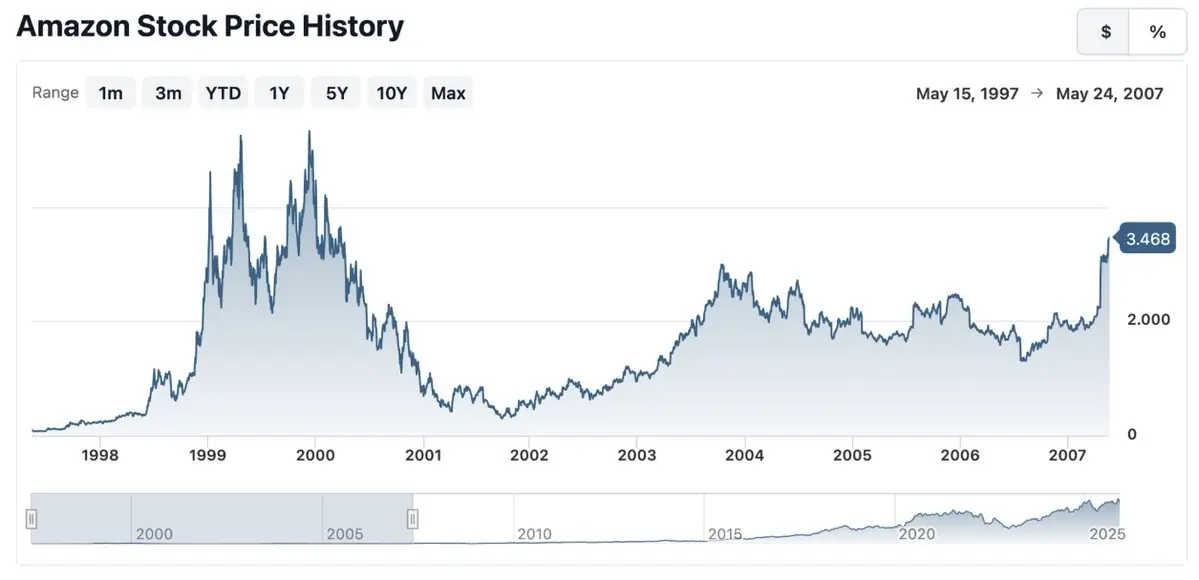

Dragonfly partner Haseeb Qureshi recently wrote an article criticizing the market's timid atmosphere, emphasizing that encryption is still in the early stages of exponential expansion and that the long-term value of L1 is severely underestimated. He used Amazon's early days as a metaphor: "When you are at the front end of an exponential curve, the price-to-earnings ratio and short-term revenue data are not the focus." Amazon had almost no net profit for 22 years before going public, and its stock price was sideways for ten years while being scorned by Wall Street, only to be recognized after the exponential curve surged upward.

MarketWhisper·2025-11-28 07:21

Encryption Morning Report: Hashkey and several other institutions donate to support Hong Kong, Upbit suffers a Hacker attack.

Author: Deep Tide TechFlow

Market Dynamics Yesterday

Multiple organizations donated to Hong Kong to support fire rescue and reconstruction efforts.

According to official news, HashKey Group announced an emergency donation of 10 million Hong Kong dollars to support the emergency assistance and resettlement of residents affected by the fire in Tai Po, Hong Kong. HashKey Group stated: "We pay our highest respect to the rescuers working on the front lines and will continue to monitor the disaster situation, doing our utmost to assist our affected compatriots in overcoming difficulties. We pray for safety."

OKX announced a donation of 10 million Hong Kong dollars to support local emergency rescue and post-disaster recovery efforts.

Binance announced that it will donate 10 million Hong Kong dollars to support disaster relief and subsequent reconstruction efforts in Hong Kong. Binance stated that it will donate to the disaster area through relevant channels to support the residents of Hong Fu Court in rebuilding their homes. Binance also expressed its support to all the affected residents in Tai Po.

DeepFlowTech·2025-11-28 01:30

Zero Knowledge Proof’s Presale Auction Activity Explodes As Traders Stop Waiting on Ethereum’s $3...

The market conversation around the top crypto coins is shifting quickly as traders chase real activity rather than passive speculation. Zero Knowledge Proof (ZKP) has risen to the front of the discussion due to its newly-launched presale auction and operational Proof Pods, both of which provide a re

CryptoNewsLand·2025-11-27 18:04

HashKey urgently donated HKD 10 million to support the fire rescue in Tai Po, Hong Kong.

According to Mars Finance, HashKey Group announced an emergency donation of 10 million HKD to support the emergency aid and resettlement work for residents affected by the fire in Tai Po, Hong Kong. HashKey Group expressed its highest respect to the rescue workers on the front lines and will continue to follow the disaster situation, fully assisting the affected compatriots in overcoming difficulties, and praying for their safety.

MarsBitNews·2025-11-27 08:04

4E: Ancient Whales are returning ETH, with regulation and institutions making a strong push, the sentiment for Bitcoin and Ethereum is resonating and warming up.

According to Mars Finance, 4E has observed that an "ancient whale that has interacted with the Ethereum Foundation" is flowing large amounts of funds back on-chain. This address has purchased 7,318 ETH at an average price of $3,016 since yesterday, amounting to approximately $22.07 million. The address previously sold 12,575 ETH at the peak last August, and its total holdings have now risen to 10,529 ETH, indicating that deep participants are repositioning themselves. On the regulatory front, the Nasdaq ISE in the U.S. has proposed to significantly raise the options position limit for BlackRock's IBIT from 250,000 to 1,000,000 contracts, reflecting strong expectations for demand for spot Bitcoin ETF derivatives; the SEC has released a revised 2025 plan, pointing towards clearer encryption regulations, safe harbor provisions, and exclusive rules for DLT, clearly promoting better integration of digital assets into traditional market structures. In terms of market sentiment, BitMine Director.

MarsBitNews·2025-11-27 03:57

The Russia-Ukraine war is dragging down the economy! Russia promotes the legalization of Bitcoin, and Putin attempts to bypass sanctions for survival.

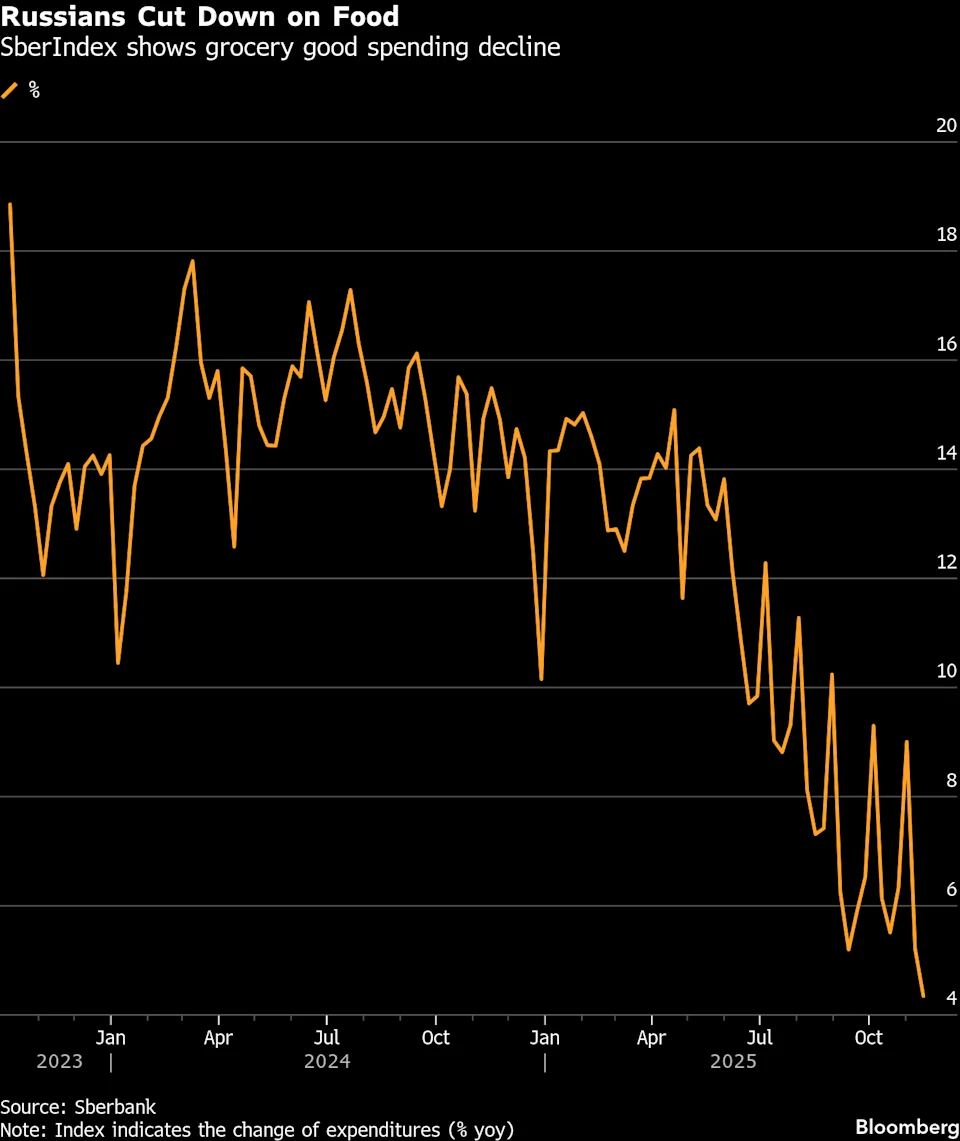

As President Putin's war in Ukraine enters its fourth winter, dozens of regions in central and southern Russia are feeling the proximity of war. Beyond the front lines, areas like Moscow are also beginning to feel the economic impact, with the Central Bank of Russia raising interest rates to a record 21%. Against this backdrop, Russia is pushing for the legalization of Bitcoin, allowing businesses to use crypto assets to replace traditional banking operations in order to bypass Western sanctions for cross-border transactions.

MarketWhisper·2025-11-27 02:41

Altman's ex-boyfriend? Investment genius? Who is the Groom that was robbed of ten million dollars?

Deng Tong, Golden Finance

On November 26, news reported that a tech investor, Lachy Groom, who had previously dated OpenAI co-founder Sam Altman, was the victim of an armed robbery at his residence in San Francisco last Saturday night, resulting in the loss of $11 million worth of cryptocurrency assets.

1. Armed robbers disguised as delivery personnel stole 11 million dollars.

In a family surveillance video posted on social media by Y Combinator CEO Garry Tan, the suspect is seen wearing dark clothing, sunglasses, a hoodie, and gloves, carrying a white box as he approaches the front door of the residence. As the suspect nears the door, he turns his head to the side, avoiding the surveillance camera, so his face is never fully visible throughout the video. He pressed the button for a value of 4.4 million.

金色财经_·2025-11-26 05:17

Bitunix Analyst: Core PCE may remain high, December Intrerest Rate battle clouds rise again

According to Mars Finance, on November 26, the latest PPI and CPI data show that the core PCE in the U.S. is expected to rise 0.2% month-on-month in September and fall to 2.8% year-on-year, only slightly lower than the previous month. Despite energy and food costs pushing up wholesale prices, several key items covered by the PCE may keep core inflation at recent levels, serving as the last available inflation assessment before the Fed's December meeting. The market generally believes that policymakers will engage in a heated debate between "the third rate cut" and "keeping interest rates unchanged." On the political front, Trump is fully intervening in the midterm elections 18 months in advance, strongly pushing for tax cuts and urging Republican candidates to focus on the issue of "affordability" to hedge against declining support due to rising living costs. His strategic layout is seen as both strengthening internal party mobilization and building a "Congress firewall" to avoid a third impeachment. However, polls show that

BTC2,98%

MarsBitNews·2025-11-26 03:20

Kevin Hassett Jumps to the Front of Trump’s Fed Chair Race

The frontrunner for a key unelected position in global finance is pro-rate cut, owns Coinbase stock, and contributed to the White House's crypto strategy, indicating significant shifts in financial policy.

TRUMP3,71%

BitcoinInsider·2025-11-26 02:37

Trump is expected to announce the new Fed chairman before Christmas, with White House chief economic advisor Hassett most likely to take over.

Trump is expected to announce the final candidate for the next Fed chairman before this Christmas, with Kevin Hassett, the director of the White House National Economic Council (NEC) and chief economic advisor, being seen as a "front-runner" by Trump's core staff and allies. (Background: The probability of a rate cut in December has jumped to 73%! The Federal Reserve's Williams is dovish: Fed still has room to cut rates soon) (Additional Context: U.S. non-farm payrolls in September far exceeded expectations! The probability of a rate cut by the Federal Reserve in December rebounded to 41%) As the current chairman Jerome Powell's term at the U.S. Federal Reserve will end in May 2026, the Trump administration is accelerating the selection of Powell's successor. The entire process is now in its final weeks, with several informed sources revealing that Trump could announce the final candidate before this Christmas.

動區BlockTempo·2025-11-25 20:15

Binance Charity Sends $200K to Support Flood Relief Across Vietnam’s Central Provinces

Key Takeaways:

Binance Charity has donated $200,000 to help communities in central Vietnam hit by severe flooding.

The group is working with the Vietnam Fatherland Front to deliver emergency supplies.

The effort reflects how major crypto organizations continue building a visible role in real-wor

CryptoNinjas·2025-11-25 12:34

The Fed is mired in "civil war," and a rate cut in December has become a "coin toss" gamble.

Written by: White55, Mars Finance

A fierce battle over policy divergence is currently unfolding within the Federal Reserve, one of the most intense in recent years. According to the latest statistics, among the 12 FOMC members with voting rights this year, 5 have clearly expressed their preference to remain on hold in December, while another faction, including influential New York Fed President Williams, supports continuing interest rate cuts.

Since the Federal Reserve's most recent interest rate decision on October 29, Chairman Powell has unexpectedly remained silent, while his colleagues have rushed to the media and public forums to express their respective positions, laying bare the internal conflicts in front of the public.

Polymarket data shows that the probability of interest rate cuts has risen to over 67%.

The depth of this divergence can be seen from the dramatic fluctuations in market expectations: within just a few weeks, the probability of a rate cut in December plummeted from a high of 95% to below 30%.

DeepFlowTech·2025-11-24 08:50

Avoid These Domains! Aerodrome Finance Warns Users After Front-End Breach

Story Highlights Aerodrome warns users over a suspected front-end security breach.

Centralized domains remain compromised; two decentralized mirrors still safe to access.

AERO3,97%

BitcoincomNews·2025-11-22 11:06

RWA Weekly: HSBC to Offer Tokenized Deposit Services to Select Clients; Ant International and UBS Cooperate in Blockchain Cross-Border Payment Settlement

Highlights of This Issue

The statistical period for this issue covers November 14-20, 2025. This week, the RWA market showed a phase of adjustment, with the total on-chain market value increasing slightly to $35.67 billion, and the growth rate slowing significantly. However, the number of holders grew against the trend, reflecting a market shift from scale expansion to deepening engagement with existing users. The total market value of stablecoins declined slightly, while transaction volume and monthly active addresses remained high, highlighting the rigid demand for on-chain payment and settlement. The market has entered the "stock optimization" phase. Regulatory frameworks continue to improve: The US FDIC is preparing guidelines for tokenized deposit insurance, and a Russian court will rule on the property rights of USDT, solidifying the legal foundation for stablecoins and RWAs from both judicial and insurance perspectives. On the project front, companies under Jack Ma have been active: Alibaba's cross-border division plans to launch a stablecoin-like payment system, Ant International and UBS will cooperate in cross-border payment settlements, and Ondo Finance has received EU approval.

PANews·2025-11-21 10:10

Encryption ETF enters a new stage: index funds become the new protagonists, with over 100 new ETFs expected to be launched in 2026.

The year 2025 is witnessing a structural turning point in digital asset investment, with industry attention shifting from "betting on a single token" to "laying out the overall track." Multiple asset management institutions predict that by 2026, there will be more than 100 new crypto ETFs and ETPs, with core competition focusing on broad market index funds rather than single asset products like Bitcoin, Ethereum, or Solana.

Despite Bitcoin recently pulling back below $90,000, institutional allocation demand remains strong, gradually displaying characteristics of long-term, indexed, and low preference in investment. On the policy front, the innovation-friendly approach implemented by the new US government may also accelerate the approval process for ETF products, pushing the crypto market into the indexed era.

MarketWhisper·2025-11-20 05:45

Vitalik Buterin warns that Bitcoin will be cracked by 2028: it needs to upgrade its quantum defense within four years before the US elections.

Vitalik Buterin predicted at the Devconnect developer conference held in Istanbul in November that Bitcoin is about to be cracked in 2028, possibly before the next U.S. presidential election, urging the community to participate in Ethereum's quantum defense upgrade (Background: Raoul Pal warned: The Federal Reserve (FED) will no longer print money under QE, "Liquidity will be short," or a repeat of the 2018 repurchase market financial crisis) (Context: The U.S. will release the non-farm payroll report for September next week, with the market closely watching the impact of the Federal Reserve (Fed) interest rate cuts) Ethereum co-founder Vitalik Buterin dropped a bombshell in front of a crowd of developers at the Devconnect developer conference in Istanbul in November: Quantum computers may crack elliptic curve cryptography before 2028.

ETH2,93%

動區BlockTempo·2025-11-19 10:48

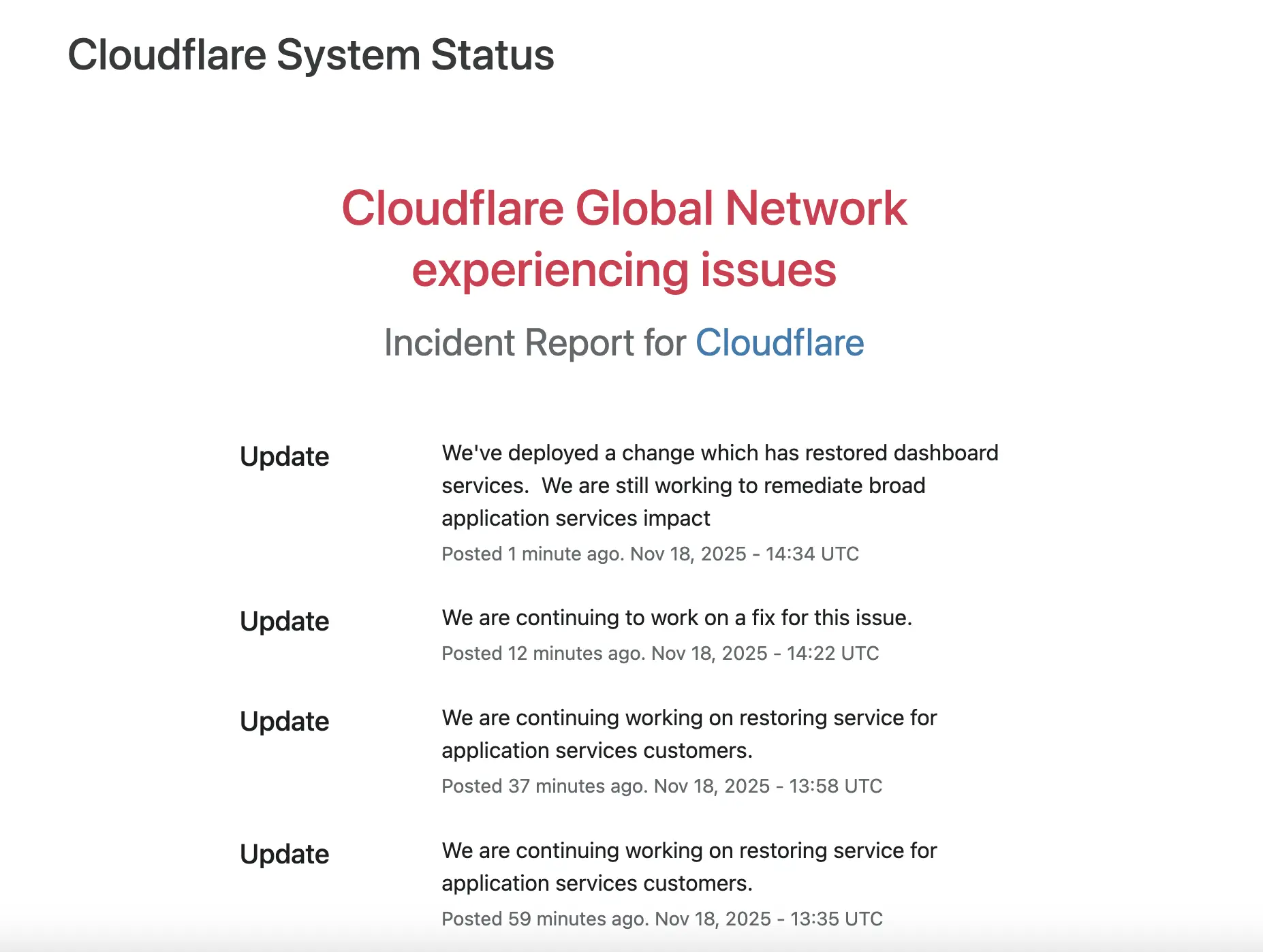

Cloudflare major outage! Dozens of websites including X, Truth Social are down, causing turbulence in the encryption circle.

After Cloudflare reported an "internal service degradation," access to the front end of several large CEXs, X (formerly Twitter), Truth Social, Ledger, Arbiscan, and dozens of other Crypto Assets websites and social media platforms was disrupted. Cloudflare officially stated that it has implemented a fix and announced in the latest progress report that the incident has been resolved.

MarketWhisper·2025-11-19 00:17

Decentralization Social "Collapse" Record: From High Hopes to Leaving in Disappointment

Deng Tong, Golden Finance

On November 16, 2025, the decentralized social media application Hey (formerly Lenster) will cease development due to limited funding. The official statement indicated that the annual profit of Hey Pro and Hey Names totals approximately $41,000, which is insufficient to support the team in operating the platform at the scale expected by users.

The decentralized social media sector was once very popular, with many star projects making a huge impact, but they could not escape a dismal fate.

This article reviews those fallen decentralized social media projects.

1. Hey

Hey originally named Lenster, Yogi Nth was created in March 2022. Yogi Nth is also a front-end engineer and has participated in work related to Aave and Lens Protocol.

Hey's initial positioning is similar to

金色财经_·2025-11-17 07:47

Load More