Search results for "OHM"

Chainlink Powers OlympusDAO Cross Chain Expansion with CCIP Integration | BSCN (fka BSC News)

OlympusDAO has officially implemented Chainlink’s Cross-Chain Interoperability Protocol (CCIP) as its canonical cross-chain infrastructure. This upgrade aims to enable seamless and secure token transfers of its native OHM token, beginning with Solana.

The decision follows a unanimous governance

LINK4,47%

BSCN·2025-06-17 08:14

Best DeFi 2.0 Projects to Invest for 100% Growth in Q1: The Future of Algorithmic Stability & DeF...

Olympus (OHM) provides stability through a unique reserve-backed model, Kadena (KDA) combines PoW security with scalability, and Spell Token (SPELL) enhances DeFi lending. These cryptocurrencies showcase blockchain technology's advancement in achieving financial innovation.

CryptoFrontNews·2025-03-17 02:14

Large Investors catch the bottom list, besides AAVE and UNI, what else?

This article points out the significant fluctuations in the BTC market recently may be related to global trade tensions and mentions an increase in market participation. Based on transaction data on the ETH blockchain, which shows single swaps exceeding $200,000, a large number of whale buy-ins have been compiled for multiple tokens, including LINK, AAVE, UNI, FRAX, ONDO, PEPE, MKR, BOLD, SPX, TEST, ENA, LDO, OHM, USUAL, SKY, GHO, and other tokens.

TechubNews·2025-02-12 10:44

Taking stock of 3 new protocols for on-chain lending that deserve attention

Original author: AARON XIE

Original compilation: Deep Chao TechFlow

Introducing: The beginning of permissionless lending on the chain

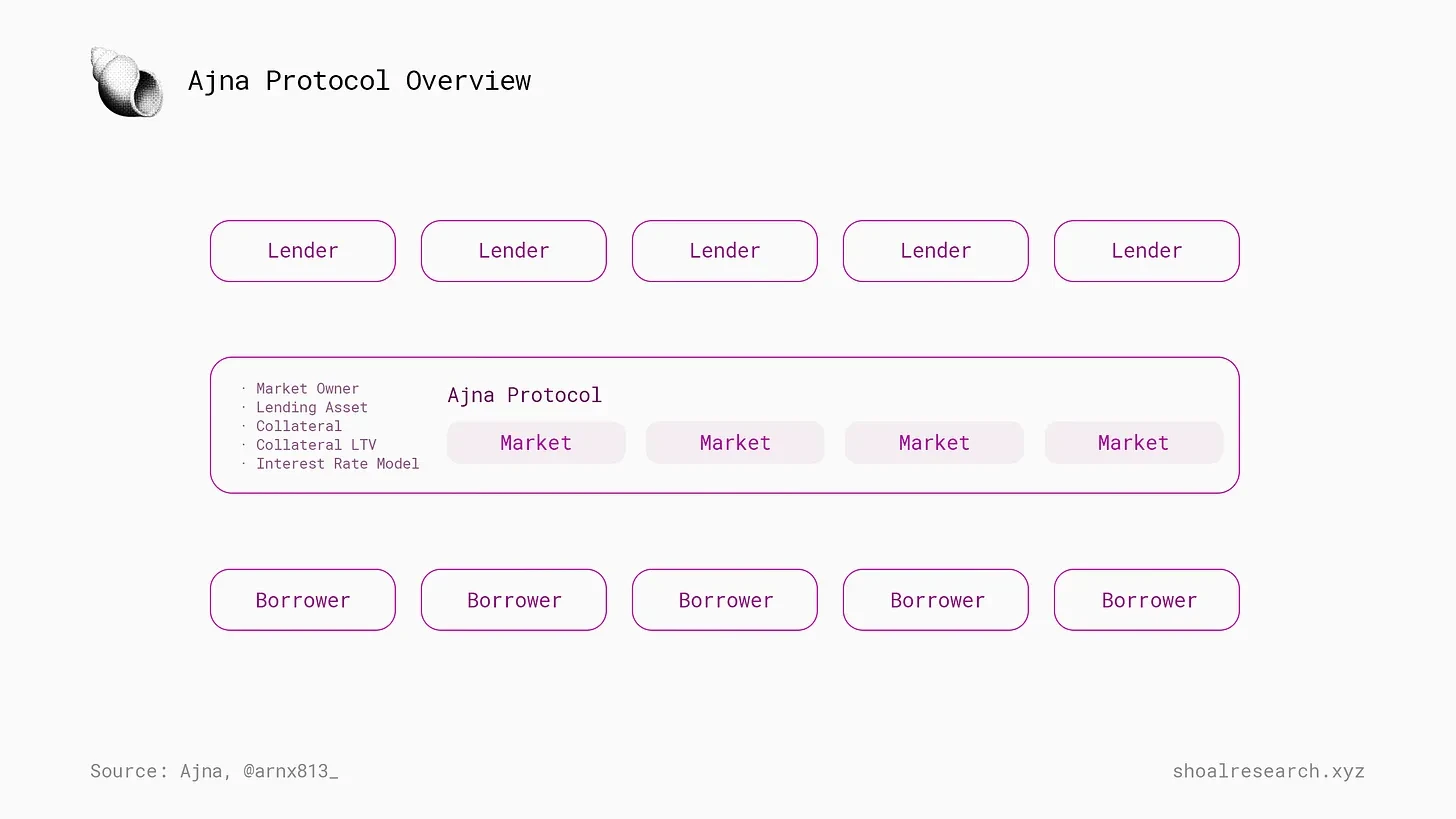

The story of on-chain permissionless lending platforms begins with Rari Capital and its Fuse platform. Released in the first half of 2021, Fuse quickly gained traction after launching during the DeFi summer boom, a period that marked DeFi's explosive growth. The brainchild of Rari Capital, this platform revolutionizes the DeFi space by enabling users to create and manage their own permissionless loan pools, in line with the emerging trend of yield optimization.

During its rise, Rari Capital adopted the (9, 9) narrative popularized by the Olympus DAO, a platform designed to exploit OHM

星球日报·2024-03-08 11:10

Ponzi is making a comeback after the collapse. Can the OHM team still bring the code of wealth?

Market enthusiasm is still surrounding memes. In just one weekend, the new meme currency YES on Blast triggered FOMO in the community. Even Cinneamhain Ventures partner Adam Cochran (AC) discussed with the community on Discord and read Baseline’s All code.

After Baseline's predecessor, Jimbos protocol, changed its name last year, it announced that it would be a permissionless algorithmic market maker protocol. The protocol extends POL (Protocol Owned Liquidity) and uses smart contracts to manage token liquidity within a centralized liquidity pool. And this market-making mechanism also allows YES to

星球日报·2024-03-08 06:34

Bankless: How long can TIA’s strong performance last under the expectation of airdrops?

> Although TIA may face headwinds, it still represents a good opportunity to outperform, driven by Celestia's momentum.

Original title: "It's TIA Time"

Written by Jack Inabinet, Bankless

Compiled by: Yvonne, Mars Finance

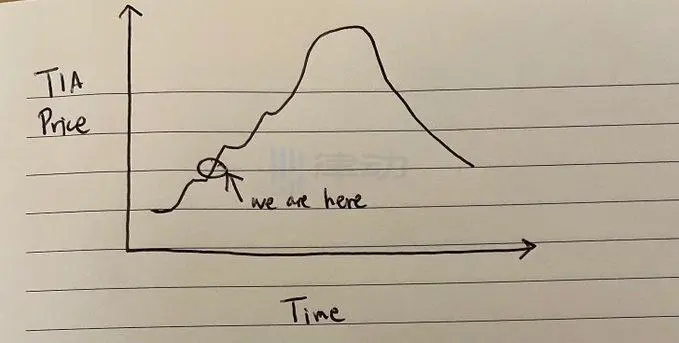

Despite a lackluster week for cryptocurrency markets, modular data availability layer Celestia continues to rise; TIA is up 39% this week! What's driving this explosive growth?

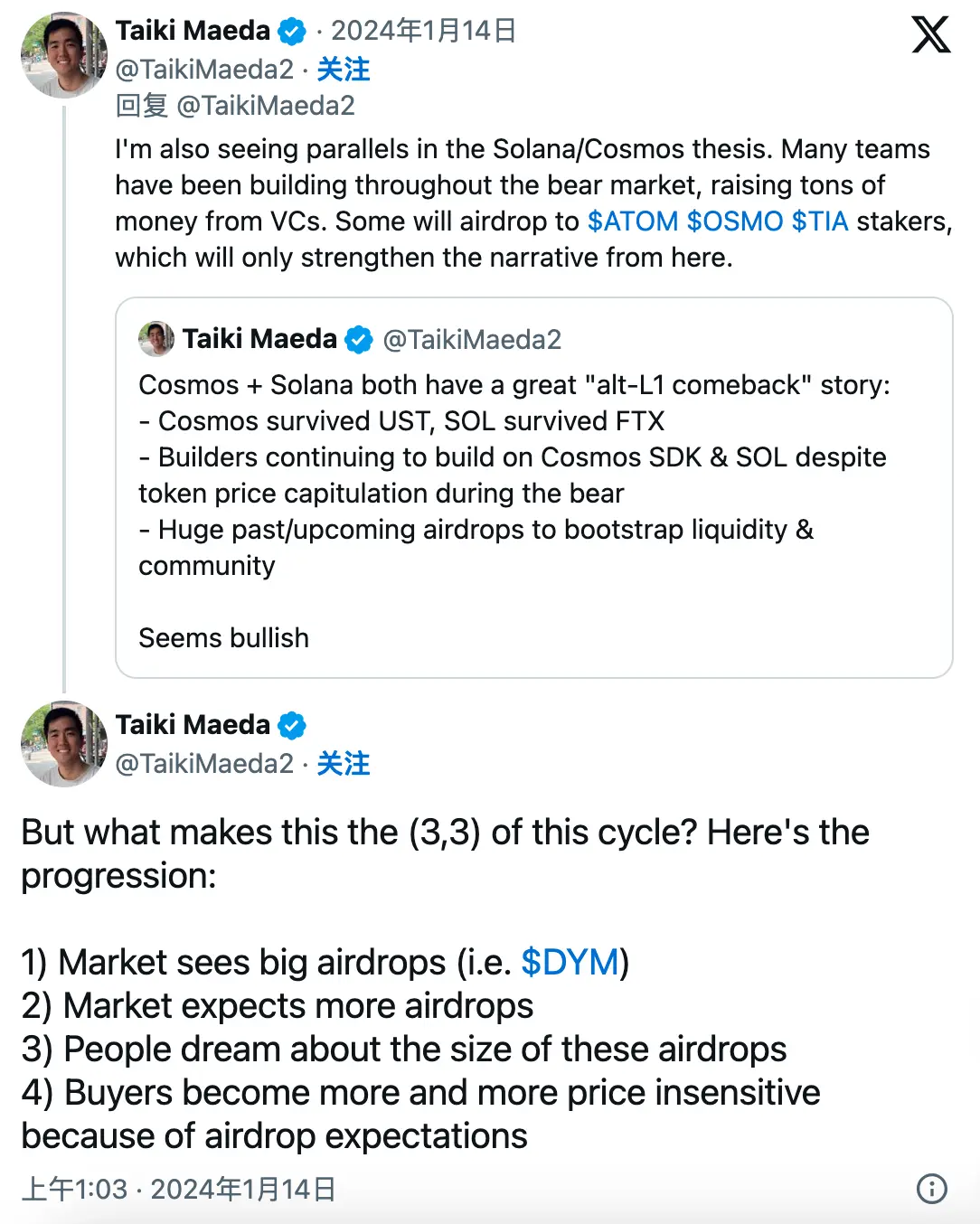

Many compare staking TIA with the intention of obtaining airdrops, arguing that versions of this cycle, like (3,3), are game theory-based memes that encourage permanent staking of OHM as the best for all ecosystem participants Strategy.

ForesightNews·2024-01-16 09:50

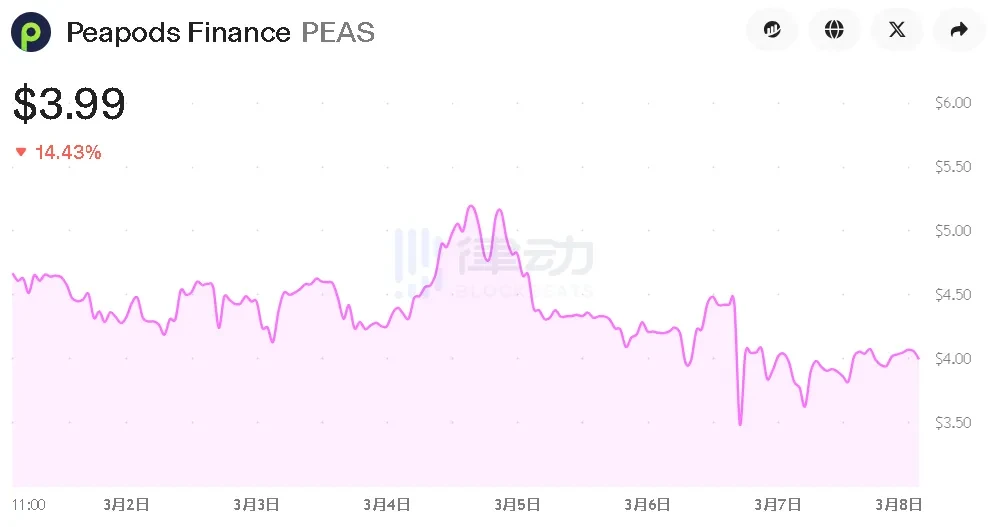

(3,3) of the new cycle? The “Ponzi expectation” of TIA’s pledge airdrop model

> “The price of TIA doesn’t matter because airdrops make up for it.”

Written by: @TaikiMaeda2

Compiled by: Luccy, BlockBeats

Editor's note:

TIA's re-staking and DYM's airdrop are undoubtedly one of the hottest topics in this bull market, and various re-staking track projects have also received attention. People who missed DYM are eager to search for re-pledge projects to obtain potential airdrops in addition to FOMO. In response, @TaikiMaeda2, founder and CEO of cryptocurrency research company HFAresearch, posted a long post on the social media platform expressing his thoughts on TIA.

@TaikiMaeda2 believes that TIA’s rehypothecation narrative and short-term expected development are related to OHM

ForesightNews·2024-01-15 14:40

Syncus, a zkSync-based stablecoin protocol, will launch a new paradigm DeFi lending platform

On December 19, zkSync ecosystem project Syncus announced the upcoming launch of a new paradigm DeFi lending platform, where users can borrow USDC or ETH at a rate of 85% after staking $SYNC to regain liquidity.

Syncus (\_Fi) is a decentralized, stablecoin ecosystem protocol that distributes dividends to staking users through transaction tax revenue, aiming to fix and improve the sustainability of Olumpus and build a self-growing treasury system through positive incentives.

Different from the traditional lending model of platforms such as MakerDAO and AAVE that pledge mainstream coins to borrow stablecoins, Syncus realizes that it can obtain liquidity by staking its DAO governance token $SYNC, which is due to the fact that Syncus adopts a similar (3) similar to Olympus (OHM).

星球日报·2023-12-19 11:36

What happened to the once-DeFi star protocol Olympus DAO?

> Seeing him raise the Zhu Tower, seeing him feast on guests, seeing his building collapse.

>

> ——《桃花扇》

>

>

Go2Mars has two hobbies in doing research, one is to search for high-quality and high-potential early alpha projects, looking for high-quality innovation points to position them, which is learning, and the other is to find those outdated projects with the ebb and flow of TVL, and analyze how they "build high-rise buildings", "feast guests" and finally "collapse buildings", which is reflection.

The "guest" we are going to talk about today is called Olympus DAO, although its price has not returned to zero, but compared to the highest point of over $1000U in 21 years, it still seems a little down. The ups and downs of 100-fold TVL, what made it brilliant, and what doomed it to plummet?

且听patience慢道来~

Preface

During an in-depth analysis of OlympusDAO and its native token, OHM, a...

金色财经_·2023-11-23 07:39

How to make a Ponzi on friend.tech?

Author: Sukie.eth

The fundamental way to trap users is to improve the efficiency of establishing interest relationships.

The long-term existence of a social product is to give users a reason to be trapped in your system.

Before the specific operation, let us first review how the (3,3) and ve (3,3) flywheels used by the large Ponzi fly:

The first is (3,3). OHM uses a very classic case in game theory, the prisoner’s dilemma, which is a type of non-zero-sum game in game theory. Simply put, when users both choose (stake, stake) or (bond, bond) Then the bubble will get bigger and bigger.

Then there is ve(3,3), which is a combination of Curve’s ve (vote escrow) model and OlympusDao(3,3) model, ve refers to the user’s CRV token...

金色财经_·2023-09-13 05:27

Load More