# BitcoinAndETFNetInflows

34

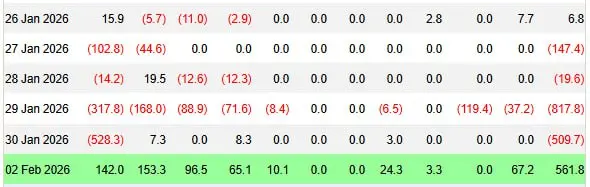

Bitcoin spot ETFs recorded $561.9M net inflows, ending 4 consecutive days of outflows. All ETFs saw positive flows, led by Fidelity ($153M) and BlackRock ($142M). February's first inflow day surpassed January's total, signaling renewed investor confidence.

Shenron1226

MASUKAN ETF BITCOIN KEMBALI

ETF spot Bitcoin mencatatkan masuk bersih sebesar $561,9M kemarin, mengakhiri 4 hari berturut-turut keluar dana.

Tidak ada satu ETF pun yang mengalami keluar dana.

Fidelity memimpin dengan $153M, diikuti oleh BlackRock dengan $142M.

Hari masuk pertama bulan Februari sudah melampaui SEMUA bulan Januari.

TENDER ITU KEMBALI.

ETF spot Bitcoin mencatatkan masuk bersih sebesar $561,9M kemarin, mengakhiri 4 hari berturut-turut keluar dana.

Tidak ada satu ETF pun yang mengalami keluar dana.

Fidelity memimpin dengan $153M, diikuti oleh BlackRock dengan $142M.

Hari masuk pertama bulan Februari sudah melampaui SEMUA bulan Januari.

TENDER ITU KEMBALI.

BTC-12,1%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

Fatema12 :

:

yeapppppppppppppppppppppppppppppppppppp🔼 #BITCOIN #KEMBALI MASUKAN ETF#Bitcoin spot ETFs recorded $561.9M in net inflows yesterday, ending 4 straight days of outflows. Not a single #ETF mengalami arus keluar. Fidelity memimpin dengan $153M, diikuti oleh BlackRock dengan $142M. Hari masuk pertama bulan Februari sudah melampaui SEMUA bulan Januari. #PemulihanCrypto $BTC

BTC-12,1%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Bitcoin (BTC) Menatap $100.000 Saat Harga Menemukan Dukungan di Atas Level Krusial

Michaël van de Poppe optimis terhadap Bitcoin, memprediksi potensi kenaikan menuju $100K karena tetap di atas level support utama. Dengan arus masuk ETF yang kuat dan permintaan institusional, pasar siap untuk bergerak, meskipun kehati-hatian tetap penting karena volatilitas mungkin mengikuti.

BTC-12,1%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

ETF spot Bitcoin menyaksikan arus masuk modal besar minggu ini—kita berbicara tentang lebih dari $1.8 miliar dalam dana segar hanya dalam 4 hari perdagangan. Itu hampir mencapai tanda $2B .

Ini dia: pemain institusional tidak kehilangan tidur atas apa yang dikatakan oleh para bearish. Pedagang teknikal yang terobsesi dengan moving averages? Analis siklus yang memprediksi kehancuran? Tidak satu pun dari itu mempengaruhi aliran uang serius ke produk ini.

Ketika Anda memiliki kecepatan seperti itu dalam arus masuk ETF, itu memberi tahu Anda sesuatu yang sederhana—ada keyakinan nyata di balik perm

Ini dia: pemain institusional tidak kehilangan tidur atas apa yang dikatakan oleh para bearish. Pedagang teknikal yang terobsesi dengan moving averages? Analis siklus yang memprediksi kehancuran? Tidak satu pun dari itu mempengaruhi aliran uang serius ke produk ini.

Ketika Anda memiliki kecepatan seperti itu dalam arus masuk ETF, itu memberi tahu Anda sesuatu yang sederhana—ada keyakinan nyata di balik perm

BTC-12,1%

- Hadiah

- 13

- 9

- Posting ulang

- Bagikan

SneakyFlashloan :

:

Lembaga menggelontorkan uang, investor ritel masih melihat grafik K, jaraknya jauh sekali.Lihat Lebih Banyak

🚨Breaking: BlackRock Memimpin Masif $840M Arus Masuk ke ETF Bitcoin saat $BTC Melampaui $97K! 🛫

Hai semuanya, keluarga crypto!🌞

Jika Anda mengikuti pasar, Anda tahu semuanya sedang memanas.

Baru saja dari Cointelegraph: ETF Bitcoin Spot mencatat arus masuk sebesar $843,6 juta pada hari Rabu – pengumpulan terbesar dalam satu hari sejak 2026.

Dan yang memimpin? Tidak lain adalah BlackRock dengan ETF Bitcoin iShares mereka ( $IBIT) menyedot lebih dari $648 juta saja.

Ini bukan sekadar angka; ini sinyal bahwa uang institusional kembali mengalir ke Bitcoin seperti belum pernah sebelumnya.

$

Lihat AsliHai semuanya, keluarga crypto!🌞

Jika Anda mengikuti pasar, Anda tahu semuanya sedang memanas.

Baru saja dari Cointelegraph: ETF Bitcoin Spot mencatat arus masuk sebesar $843,6 juta pada hari Rabu – pengumpulan terbesar dalam satu hari sejak 2026.

Dan yang memimpin? Tidak lain adalah BlackRock dengan ETF Bitcoin iShares mereka ( $IBIT) menyedot lebih dari $648 juta saja.

Ini bukan sekadar angka; ini sinyal bahwa uang institusional kembali mengalir ke Bitcoin seperti belum pernah sebelumnya.

$

- Hadiah

- 2

- 3

- Posting ulang

- Bagikan

MIlhamAbdulR :

:

Antrian keluar validator Ethereum turun menjadi nol karena permintaan staking melonjakLihat Lebih Banyak

Apakah Bitcoin Menuju ke $100K? Permintaan Institusional Baru Dorong Dorongan Besar

_Bitcoin mendekati $100K saat arus masuk ETF melebihi $1,5Miliar, menandakan permintaan institusional yang kuat dan potensi fase pasar baru._

Harga Bitcoin baru-baru ini melonjak di atas $97.000, memicu diskusi tentang apakah itu akan segera mencapai tanda $100K . Kenaikan harga ini terjadi setelah aliran yang berkelanjutan

Harga Bitcoin baru-baru ini melonjak di atas $97.000, memicu diskusi tentang apakah itu akan segera mencapai tanda $100K . Kenaikan harga ini terjadi setelah aliran yang berkelanjutan

BTC-12,1%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

ETF Ethereum menarik dana sebesar 110 juta dolar AS melawan tren pasar, ETH bertahan di atas 3000 dolar AS, sementara dana institusi justru menarik diri

1月27日消息,2026年1月下旬以来,以太坊(ETH)在剧烈震荡中迎来关键考验。上周ETH价格一度跌破3000美元,最低下探至2796美元附近,引发市场对中期趋势的激烈分歧。一边是机构资金持续撤离,另一边却是现货以太坊ETF出现罕见的强势回流,使ETH价格走势充满张力。

从机构资金动向来看,截至1月23日当周,以太坊遭遇超过6.3亿美元的机构资金净流出,直接抹去了此前的反弹成果,并将1月以来的累计资金流动拉至负7740万美元,成为主流加密资产中资金表现最弱的品种之一。这类资金 biasanya mewakili dana besar dan manajemen aset, tindakan pengurangan posisi mereka seringkali terkait dengan lingkungan makro global, volatilitas aset risiko, dan penurunan pengembalian relatif Ethereum. Jika sikap defensif ini berlanjut, ETH dalam jangka menengah mungkin masih akan mengalami tekanan jual tambahan.

从机构资金动向来看,截至1月23日当周,以太坊遭遇超过6.3亿美元的机构资金净流出,直接抹去了此前的反弹成果,并将1月以来的累计资金流动拉至负7740万美元,成为主流加密资产中资金表现最弱的品种之一。这类资金 biasanya mewakili dana besar dan manajemen aset, tindakan pengurangan posisi mereka seringkali terkait dengan lingkungan makro global, volatilitas aset risiko, dan penurunan pengembalian relatif Ethereum. Jika sikap defensif ini berlanjut, ETH dalam jangka menengah mungkin masih akan mengalami tekanan jual tambahan.

ETH-12,44%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Pesan dari Coinjie.com, 27 Januari, menurut pemantauan Farside, kemarin ETF spot Ethereum AS mengakhiri 4 hari berturut-turut keluar masuk bersih dengan masuk bersih sebesar 1,17 miliar dolar AS, termasuk masuk bersih Fidelity FETH sebesar 137,2 juta dolar AS.

Lihat Asli- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Dalam satu minggu terakhir, aktivitas dana institusional sangat aktif. ETF spot Bitcoin mencatat aliran masuk bersih selama seminggu lebih dari 1,4 miliar dolar AS, di mana satu perusahaan saja, BlackRock, menarik masuk 1 miliar dolar AS—angka ini sudah cukup untuk menjelaskan segalanya.

Dilihat dari sudut pandang lain, ini bukan sekadar aliran dana biasa. Pembelian berkelanjutan oleh institusi biasanya mencerminkan penilaian mereka terhadap pasar ke depan. Sebagai jalur utama masuk yang sesuai regulasi, setiap transaksi dana besar mencerminkan sikap nyata dari lembaga profesional. Raksasa sep

Lihat AsliDilihat dari sudut pandang lain, ini bukan sekadar aliran dana biasa. Pembelian berkelanjutan oleh institusi biasanya mencerminkan penilaian mereka terhadap pasar ke depan. Sebagai jalur utama masuk yang sesuai regulasi, setiap transaksi dana besar mencerminkan sikap nyata dari lembaga profesional. Raksasa sep

- Hadiah

- 17

- 6

- Posting ulang

- Bagikan

RugPullProphet :

:

BlackRock masuk dengan investasi sebesar 1 miliar dolar, saatnya investor ritel bangun sekarang, kan?Lihat Lebih Banyak

Data pasar 15 Januari mengirimkan sinyal yang jelas: dana institusional terus bertambah. ETF spot Ethereum hari itu mencatatkan arus masuk bersih sebesar 164 juta dolar AS, ini adalah hari perdagangan keempat berturut-turut dengan arus masuk positif, menunjukkan kepercayaan besar institusi terhadap ekosistem Ethereum tidak berkurang. Performa ETF Bitcoin juga stabil, dengan arus masuk bersih sebesar 100 juta dolar AS pada hari perdagangan sebelumnya, dan mempertahankan tren kenaikan selama empat hari berturut-turut.

Yang menarik, gelombang dana kali ini tidak hanya tertuju pada BTC dan ETH. ET

Lihat AsliYang menarik, gelombang dana kali ini tidak hanya tertuju pada BTC dan ETH. ET

- Hadiah

- 13

- 9

- Posting ulang

- Bagikan

SignatureVerifier :

:

hmm, empat hari berturut-turut aliran positif secara statistik tidak mungkin tanpa adanya koordinasi institusional yang serius di balik layar. angka-angkanya secara teknis cocok tetapi... pernahkah Anda bertanya-tanya apa yang *benar-benar* mendorong ini? percaya tetapi verifikasi, seperti yang mereka katakan.Lihat Lebih Banyak

Muat Lebih Banyak

Bergabung dengan 40M pengguna dalam komunitas yang terus berkembang

⚡️ Bergabung dengan 40M pengguna dalam diskusi tren kripto yang sedang ramai

💬 Berinteraksi dengan kreator top favorit Anda

👍 Lihat apa yang menarik minat Anda

Topik Trending

88.35K Popularitas

10.44K Popularitas

2.91K Popularitas

4.62K Popularitas

9.68K Popularitas

7.91K Popularitas

5.47K Popularitas

5.67K Popularitas

17.51K Popularitas

6.46K Popularitas

34.18K Popularitas

15.21K Popularitas

25.45K Popularitas

12.62K Popularitas

237.13K Popularitas

Berita

Lihat Lebih BanyakHYPE naik melawan tren, kinerja harga tetap stabil selama pasar jatuh tajam

4 men

J.P. Morgan: Bitcoin berpotensi mencapai $266.000 dalam jangka panjang, daya tarik relatif terhadap emas meningkat

19 men

ETH menembus 1900 USDT, menunjukkan kenaikan yang signifikan dalam harga cryptocurrency. Para trader dan investor memperhatikan pergerakan ini dengan antusiasme tinggi, menunggu apakah tren ini akan berlanjut ke level yang lebih tinggi. Analisis pasar menunjukkan bahwa faktor-faktor tertentu sedang mendukung kenaikan ini, termasuk adopsi institusional dan perkembangan teknologi blockchain terbaru. Tetaplah mengikuti berita terbaru untuk mendapatkan informasi terkini tentang pergerakan ETH dan pasar crypto secara umum.

20 men

BTC menembus 64.000 USDT, menandai pencapaian baru dalam pasar cryptocurrency. Investor dan trader memperhatikan dengan seksama pergerakan harga ini, yang menunjukkan tren bullish yang kuat dan potensi kenaikan lebih lanjut di masa depan.

21 men

Analisis: Penarikan Bitcoin lebih dari 40%, aliran dana ETF spot hanya 6,6%

24 men

Sematkan