# SolanaLiquidityAndPrice

65

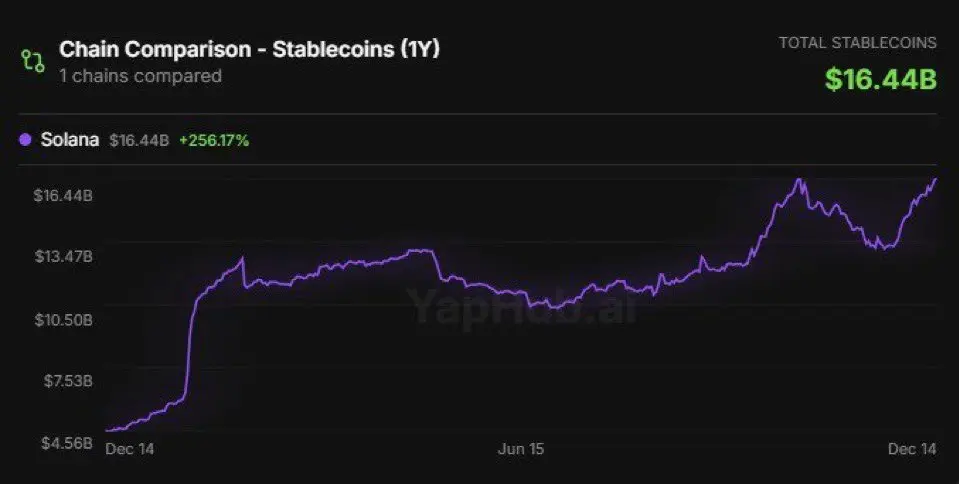

Solana recorded $1.3 billion in stablecoin net inflows over 7 days, ranking first among major blockchains. This liquidity concentration provides substantial support for SOL price. Despite short-term pressure, increased trading volume suggests intensifying market activity and potential positioning for a rebound.

CryptoSelf

#MiddleEastTensionsEscalate

news reports indicate that Solana price predictions are showing new on-chain signals. According to data released by Artemis, Solana recorded approximately $1.3 billion in stablecoin net inflows over the past 7 days, ranking first among major blockchain networks and being the only public chain to reach this scale during the same period. This capital flow suggests that a large amount of liquidity is converging into the Solana ecosystem, providing substantial support for the price of SOL.

From a market performance perspective, after experiencing a phased correction, S

news reports indicate that Solana price predictions are showing new on-chain signals. According to data released by Artemis, Solana recorded approximately $1.3 billion in stablecoin net inflows over the past 7 days, ranking first among major blockchain networks and being the only public chain to reach this scale during the same period. This capital flow suggests that a large amount of liquidity is converging into the Solana ecosystem, providing substantial support for the price of SOL.

From a market performance perspective, after experiencing a phased correction, S

SOL-0.54%

- Reward

- 58

- 25

- Repost

- Share

GateUser-7f5f8a27 :

:

Happy New Year! 🤑View More

#MiddleEastTensionsEscalate

news reports indicate that Solana price predictions are showing new on-chain signals. According to data released by Artemis, Solana recorded approximately $1.3 billion in stablecoin net inflows over the past 7 days, ranking first among major blockchain networks and being the only public chain to reach this scale during the same period. This capital flow suggests that a large amount of liquidity is converging into the Solana ecosystem, providing substantial support for the price of SOL.

From a market performance perspective, after experiencing a phased correction, S

news reports indicate that Solana price predictions are showing new on-chain signals. According to data released by Artemis, Solana recorded approximately $1.3 billion in stablecoin net inflows over the past 7 days, ranking first among major blockchain networks and being the only public chain to reach this scale during the same period. This capital flow suggests that a large amount of liquidity is converging into the Solana ecosystem, providing substantial support for the price of SOL.

From a market performance perspective, after experiencing a phased correction, S

SOL-0.54%

- Reward

- 8

- 6

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

- Reward

- 15

- 9

- Repost

- Share

SerumSquirter :

:

Haha, 828M a day? SOL is really about to take off, it seems my previous doubts were all for nothing.View More

Just spotted an interesting token movement on Solana - $HODL showing some activity worth tracking. Here's what the data reveals:

Contract address: 66nquDrwBEM8NavNYmb4UNa9p17Qv2frZmjAdwBfpump

The 24-hour trading volume tells a story here - buy volume hitting $48,687 while sell volume came in at $40,143, showing more buying pressure. Current liquidity sits at $0, and the market cap is valued at $36,454.

These are still early-stage metrics typical of newer Solana tokens. The buy-sell volume ratio suggests some accumulation happening, though the limited liquidity is something to monitor closely.

Contract address: 66nquDrwBEM8NavNYmb4UNa9p17Qv2frZmjAdwBfpump

The 24-hour trading volume tells a story here - buy volume hitting $48,687 while sell volume came in at $40,143, showing more buying pressure. Current liquidity sits at $0, and the market cap is valued at $36,454.

These are still early-stage metrics typical of newer Solana tokens. The buy-sell volume ratio suggests some accumulation happening, though the limited liquidity is something to monitor closely.

- Reward

- 10

- 5

- Repost

- Share

DarkPoolWatcher :

:

Liquidity is zero, and you're still boasting? I wouldn't dare touch this liquidity at all.View More

- Reward

- 2

- Comment

- Repost

- Share

Day trading momentum/setup/new meme coins on Solana remains, in my view, the best approach into January for experienced and active traders. Emotionless capital protection with the rest. No need to add stress by managing more positions (yet). Stay safe. There will always be

- Reward

- like

- Comment

- Repost

- Share

Solana Price Prediction: $1.3 Billion Stablecoins Flood Onto the Chain, SOL Holds Key Range Aiming for $130

On January 27, news reports indicate that Solana price predictions are showing new on-chain signals. According to data released by Artemis, Solana recorded approximately $1.3 billion in stablecoin net inflows over the past 7 days, ranking first among major blockchain networks and being the only public chain to reach this scale during the same period. This capital flow suggests that a large amount of liquidity is converging into the Solana ecosystem, providing substantial support for the price of SOL.

From a market performance perspective, after experiencing a phased correction, SOL is currently oscillating around an important technical support zone. Although short-term prices are under pressure, the 24-hour trading volume has significantly increased, indicating that the battle between bulls and bears is intensifying near the current price levels, and some funds are beginning to position themselves in anticipation of a rebound. Several on-chain analysts believe that a key variable in Solana price predictions is the inflow of stablecoins, as this often signifies that potential buying momentum is gathering.

From a market performance perspective, after experiencing a phased correction, SOL is currently oscillating around an important technical support zone. Although short-term prices are under pressure, the 24-hour trading volume has significantly increased, indicating that the battle between bulls and bears is intensifying near the current price levels, and some funds are beginning to position themselves in anticipation of a rebound. Several on-chain analysts believe that a key variable in Solana price predictions is the inflow of stablecoins, as this often signifies that potential buying momentum is gathering.

- Reward

- 1

- Comment

- Repost

- Share

#数字资产市场动态 Looking at the recent flow of funds can reveal the market sentiment. ETH has directly experienced a net outflow of $182 million, becoming the most heavily outflowed asset, with BTC following closely behind with a net outflow of $163 million. Even XRP hasn't escaped, with a net outflow of $41.41 million. What does this reflect? The capital sentiment for mainstream coins is clearly cautious, with large funds choosing to temporarily exit the market, just watching from the sidelines.

But what's interesting is the other side—where is the capital quietly flowing to? AIN comfortably takes t

View OriginalBut what's interesting is the other side—where is the capital quietly flowing to? AIN comfortably takes t

- Reward

- 12

- 5

- Repost

- Share

StableNomad :

:

lmao, smart money just casually yeeting $1.82B out of ETH and we're supposed to believe this is "tactical repositioning"... statistically speaking, this usually ends one way. been here since UST imploded, so yeah, i'm watching where AIN money's flowing with maximum skepticism rn.View More

#Strategy加仓BTC In the past 24 hours, I observed an interesting phenomenon: Ethereum net outflow of $182 million, Bitcoin net outflow of $163 million, Ripple net outflow of $41.14 million. Mainstream cryptocurrencies are all bleeding. But the key here is—there's no panic sell-off; instead, there is an orderly transfer of funds.

Some funds are quietly flowing into smaller-cap assets. What does this indicate? It doesn't mean everyone is clearing out and running away, but rather that they are adjusting risk at high levels. In simple terms, some are timing their shifts in direction.

The market temp

View OriginalSome funds are quietly flowing into smaller-cap assets. What does this indicate? It doesn't mean everyone is clearing out and running away, but rather that they are adjusting risk at high levels. In simple terms, some are timing their shifts in direction.

The market temp

- Reward

- 14

- 7

- Repost

- Share

VitaliksTwin :

:

Ordered outflow ≠ panic, this is the key... indicating smart money is quietly repositioning ---

Mainstream coins are bleeding but no one is fleeing? Isn't this a sign of looking for the next hot spot?

---

Funds moving to smaller tokens? A game of capital in a bear market, so exciting

---

The hesitation phase tests people's mentality the most, let's see who can hold on this time

---

Well said, orderly adjustment is a professional attitude, not a reckless dump

---

The next move of funds determines everything, it's time to prepare in advance

---

Small-cap assets are flooding in? This is the real opportunity

---

Market temperature is dropping... feels like divergence is about to begin, ready to cut losses or buy the dip?

---

Not clearing out and fleeing, but reshuffling, those who understand, understand

---

I love the phrase "timing the switch," it means the market is looking for a new story

View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

196.15K Popularity

52.78K Popularity

27.9K Popularity

9.11K Popularity

3.86K Popularity

3.97K Popularity

7.81K Popularity

3.7K Popularity

16.61K Popularity

8.41K Popularity

4.96K Popularity

4.6K Popularity

10.7K Popularity

1.2K Popularity

38.58K Popularity

News

View MorePhantom will launch social feature Phantom Chat

6 m

BONK.fun: In BONKERS mode, creator fees will be automatically used to buy back tokens.

10 m

Tom Lee: Market pullbacks are "highly attractive" entry points. BitMine has invested $84 million this week to purchase Ethereum.

13 m

Gate will disable lending functions for 15 tokens including BLUM and HAPPY on February 11th. Users must repay their loans by February 12th.

15 m

Data: The total net inflow of the US XRP spot ETF today is 6.31 million USD.

17 m

Pin