2025 DIS Price Prediction: Expert Analysis and Market Forecast for Disney Stock

Introduction: Market Position and Investment Value of DIS

TosDis (DIS) stands as a decentralized deposit protocol providing a variety of white-label DeFi products, designed to deliver an efficient and systematic environment for the DeFi industry. Since its launch in 2021, TosDis has established itself as "The One Stop DeFi Interoperable Solution," offering a comprehensive suite of services including staking-as-a-service mining, yield farming services, peer-to-peer lending platforms, and advanced decentralized trading solutions with minimal fees.

As of January 2026, DIS maintains a market capitalization of approximately $42,111.38, with a circulating supply of 74,998 tokens trading at $0.5615. The token has demonstrated notable recovery momentum, posting a 5.78% gain over the past 24 hours and an 8.97% increase over the past 7 days, reflecting renewed market interest in DeFi infrastructure solutions.

This report provides a comprehensive analysis of DIS price dynamics and market trends through 2026-2031, incorporating historical performance patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

I. DIS Price History Review and Market Status

DIS Historical Price Evolution

-

February 2021: Project launch period, DIS reached its all-time high of $253.52 on February 6, 2021, representing the peak of early market enthusiasm for the protocol.

-

May 2023: Market correction phase, DIS hit its all-time low of $0.0094393 on May 13, 2023, reflecting a significant decline from historical peaks.

-

2024-2026: Recovery and stabilization period, DIS has shown gradual recovery momentum, with price appreciation of 33.03% over the past 30 days.

DIS Current Market Dynamics

As of January 6, 2026, DIS is trading at $0.5615 with a 24-hour trading volume of $12,642.13. The token demonstrates short-term positive momentum with a 24-hour price increase of 5.78%, while the 1-hour change reflects marginal gains of 0.25%. Over the 7-day period, DIS has appreciated 8.97%, and the 30-day performance shows a stronger rally of 33.03%. However, the annual performance indicates a significant decline of -61.63% from the previous year.

The fully diluted valuation stands at $56,071.67, with a circulating supply of 74,998 DIS tokens out of a maximum supply of 100,000 tokens (representing 74.998% circulation). The token maintains a market cap of $42,111.38 and holds a ranking of 5,947 by market capitalization. Trading data shows a 24-hour high of $0.6045 and a low of $0.5268, indicating moderate volatility within the daily trading range.

The token is actively traded on Gate.com, with a total of 1 exchange listing and 1,536 unique token holders, reflecting a distributed holder base within the ecosystem.

Click to view current DIS market price

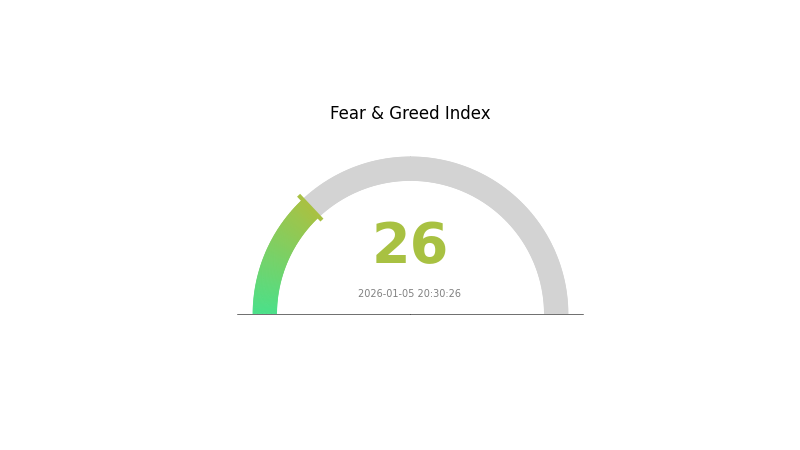

DIS Market Sentiment Index

2026-01-05 Fear and Greed Index: 26 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a fear sentiment with an index reading of 26. This indicates investors are exhibiting cautious behavior and risk aversion. Market participants should exercise prudence during periods of heightened fear, as they often present both challenges and potential opportunities. Consider reviewing your portfolio strategy and risk management approach on Gate.com to navigate the current market conditions effectively.

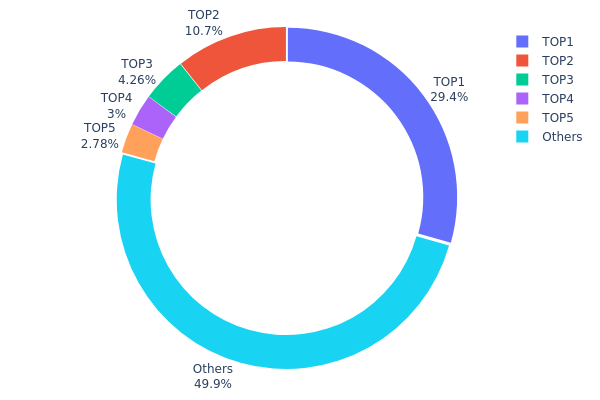

DIS Holdings Distribution

The address holdings distribution chart illustrates the concentration of DIS tokens across the blockchain network by displaying the top individual wallet addresses and their respective token quantities and percentages. This metric serves as a critical indicator for assessing token centralization, market structure stability, and potential vulnerability to large-scale liquidations or market manipulation.

Current analysis of DIS reveals a moderate concentration pattern with notable structural characteristics. The top holder commands 29.35% of total supply, while the second-largest address holds 10.65%, and the top five addresses collectively account for approximately 50.02% of all circulating tokens. This distribution suggests that half of the token supply is dispersed among a broader base of smaller holders represented in the "Others" category at 49.98%. While the leading address represents a significant position, the relatively substantial portion held by remaining stakeholders indicates that complete supply concentration does not exist at extreme levels.

From a market dynamics perspective, this distribution pattern presents moderate centralization risks. The concentration of roughly one-third of tokens in a single address could theoretically facilitate considerable price volatility if such holdings were rapidly deployed into or withdrawn from liquidity pools. However, the presence of a substantial "Others" segment suggests reasonable decentralization, which may provide countervailing market forces and resilience against extreme price manipulation. The distribution reflects a market structure where significant token concentration exists alongside meaningful distributed ownership, creating a balanced but monitored environment for price stability and market integrity.

For detailed information on DIS holdings distribution, visit DIS Holdings Data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3c5e...584c9f | 29.32K | 29.35% |

| 2 | 0x0d07...b492fe | 10.64K | 10.65% |

| 3 | 0xad5b...cff7a3 | 4.25K | 4.25% |

| 4 | 0xd48f...57ea92 | 3.00K | 3.00% |

| 5 | 0xb774...e6458f | 2.77K | 2.77% |

| - | Others | 49.88K | 49.98% |

II. Core Factors Affecting DIS Future Price

Supply Mechanism

- Halving Mechanism: DIS undergoes periodic halving, resulting in reduced block rewards.

- Historical Pattern: Previous halving events have typically driven long-term price appreciation.

Macroeconomic Environment

- Monetary Policy Impact: Higher interest rates or reduced consumer spending could negatively impact the entertainment industry. Interest rate volatility has historically influenced Disney stock performance, particularly during periods of high inflation and economic uncertainty in 2021-2022.

- Inflation Hedge Characteristics: During inflationary environments combined with high interest rates, the entertainment sector experiences pressure on consumer discretionary spending, which directly affects Disney's revenue streams and stock valuation.

III. 2026-2031 DIS Price Forecast

2026 Outlook

- Conservative Forecast: $0.39-$0.50

- Neutral Forecast: $0.50-$0.60

- Optimistic Forecast: $0.60+ (requires sustained market momentum and ecosystem expansion)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental growth trajectory, characterized by stabilization of price floor and expansion of trading activity on major platforms like Gate.com

- Price Range Forecast:

- 2027: $0.48-$0.77

- 2028: $0.49-$0.95

- 2029: $0.62-$0.89

- Key Catalysts: Increased institutional adoption, integration with decentralized finance protocols, expansion of utility cases within the ecosystem, and general market sentiment improvement

2030-2031 Long-term Outlook

- Base Case Scenario: $0.45-$0.98 (assumes steady market conditions and moderate adoption growth)

- Optimistic Scenario: $0.68-$1.23 (assumes accelerated mainstream adoption and positive macroeconomic conditions)

- Transformative Scenario: $1.23+ (assumes breakthrough technological developments and significant institutional inflows)

- 2031-12-31: DIS reaching $1.23 (peak valuation under favorable market conditions)

Note: All price forecasts are speculative estimates based on historical data patterns and market analysis. Actual market performance may vary significantly based on regulatory changes, technological developments, and broader cryptocurrency market dynamics. Investors should conduct thorough due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.60316 | 0.5637 | 0.39459 | 0 |

| 2027 | 0.77013 | 0.58343 | 0.48425 | 3 |

| 2028 | 0.94749 | 0.67678 | 0.48728 | 20 |

| 2029 | 0.89335 | 0.81213 | 0.61722 | 44 |

| 2030 | 0.98065 | 0.85274 | 0.45195 | 51 |

| 2031 | 1.22837 | 0.9167 | 0.68752 | 63 |

TosDis (DIS) Professional Investment Strategy and Risk Management Report

IV. DIS Professional Investment Strategy and Risk Management

DIS Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: DeFi protocol believers and decentralized finance advocates with medium to long-term investment horizons

- Operational Recommendations:

- Accumulate DIS tokens during market downturns to average down entry costs, leveraging the protocol's positioning as a one-stop DeFi interoperable solution

- Monitor TosDis ecosystem developments including staking services, yield farming, and peer-to-peer lending platform updates

- Participate in staking mining opportunities to generate passive income while holding positions

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor the 24-hour price range ($0.5268 - $0.6045) to identify support and resistance levels

- Track volume patterns against the 24-hour volume baseline of $12,642.13 to confirm breakout signals

- Wave Trading Considerations:

- Capitalize on the recent 33.03% monthly gain momentum while managing overbought conditions

- Note the extreme historical volatility (all-time high of $253.52 versus current $0.5615) when setting stop-loss levels

DIS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 1% of portfolio

- Aggressive Investors: 2% - 3% of portfolio

- Professional Investors: 3% - 5% of portfolio

(2) Risk Hedging Strategies

- Position Sizing: Limit individual DIS positions to prevent catastrophic losses given the token's history of 99.63% decline from all-time highs

- Stop-Loss Orders: Set strict stop-loss levels at 15-20% below entry points to manage downside exposure

(3) Secure Storage Solutions

- Hardware Wallet Approach: Consider self-custody solutions for medium to long-term holdings to maintain full control over DIS tokens on the Ethereum network

- Exchange Storage: Use Gate.com's secure custody for active trading positions to facilitate rapid execution

- Security Considerations: Protect your private keys and recovery phrases; never share them with third parties; verify contract addresses before token transfers to prevent phishing attacks

V. DIS Potential Risks and Challenges

DIS Market Risk

- Extreme Historical Volatility: The token has experienced a 99.63% decline from its all-time high of $253.52 (February 2021) to current levels, indicating severe price instability and potential for further corrections

- Low Trading Liquidity: With only $12,642 in 24-hour volume across a single exchange listing, DIS exhibits minimal liquidity, creating slippage risks for larger traders and potential difficulty exiting positions

- Market Capitalization Concentration: The fully diluted valuation of $56,071 represents an extremely small market cap relative to major DeFi protocols, suggesting limited institutional adoption and validation

DIS Regulatory Risk

- Decentralized Protocol Oversight: As a DeFi protocol offering staking, yield farming, and lending services, TosDis faces potential regulatory scrutiny regarding securities classification and financial services licensing

- Jurisdiction-Specific Restrictions: Different countries may impose varying regulations on decentralized deposit protocols and yield farming services, limiting geographic accessibility

- Compliance Uncertainty: Evolving global cryptocurrency regulations could impact the protocol's operational viability and token utility

DIS Technology Risk

- Smart Contract Vulnerability: Any bugs or vulnerabilities in TosDis' smart contracts could result in fund losses or protocol exploitation

- Ethereum Network Dependency: As an ERC-20 token, DIS relies on Ethereum's security and operational stability; network congestion could impact transaction efficiency

- Limited Market Validation: The protocol's small holder base (1,536 addresses) and low exchange presence suggest insufficient network effects and adoption validation compared to established DeFi alternatives

VI. Conclusion and Action Recommendations

DIS Investment Value Assessment

TosDis presents a highly speculative investment opportunity characterized by extreme volatility and limited adoption. The protocol's positioning as a one-stop DeFi interoperable solution offers conceptual merit through its comprehensive suite of services (staking, yield farming, lending, and DEX functionality). However, the token's 99.63% decline from historical highs, minimal trading liquidity, and small holder base indicate significant implementation challenges and market skepticism. The recent 33.03% monthly price recovery provides cautious optimism, yet the overall risk-reward profile remains heavily skewed toward downside risk for most investors.

DIS Investment Recommendations

✅ Beginners: Avoid direct DIS exposure until demonstrating proficiency with established DeFi protocols; if interested, allocate only trivial capital (< $500) for educational purposes within a diversified portfolio

✅ Experienced Investors: Consider small-scale accumulation (1-2% portfolio allocation) during significant price corrections if you hold strong conviction in TosDis' technical development and ecosystem expansion

✅ Institutional Investors: Conduct comprehensive due diligence on TosDis' development team, security audits, and protocol performance metrics before considering any allocation; the limited trading infrastructure and market depth make meaningful positions impractical

DIS Trading Participation Methods

- Gate.com Spot Trading: Execute buy/sell orders for DIS tokens directly through Gate.com's spot market interface with competitive fees

- Limit Orders: Utilize Gate.com's advanced order types to establish entry points at predetermined price levels, mitigating emotional decision-making

- Dollar-Cost Averaging: Implement systematic purchases across multiple time periods to reduce timing risk in this high-volatility market

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Always consult with professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

DIS stock price will rise or fall in the future?

DIS stock price may decline to 70 USD or rebound to 90 USD, depending on company performance and macroeconomic factors. Specific trends are difficult to predict precisely.

How to analyze Disney (DIS) stock price trends?

Analyze DIS by tracking quarterly performance, analyst forecasts, and trading volume. DIS declined 10.24% last quarter but analysts predict 12.99% growth next quarter, with 2026 projected at 11.40% increase. Monitor earnings trends and revenue estimates for comprehensive analysis.

What are the main factors affecting DIS stock price?

DIS stock price is primarily influenced by content quality, franchise revenues, streaming subscriber growth, economic conditions, and operational performance. Market sentiment and competitive dynamics in entertainment also play significant roles in price movements.

How does DIS stock compare in investment value to other entertainment and media companies?

DIS stock shows strong fundamentals with streaming subscriber growth surpassing Netflix. Despite recent volatility, its diversified entertainment portfolio and improving operational metrics position it competitively within the media sector for long-term value investors.

What is the price prediction for DIS stock in 2024-2025?

DIS stock price prediction for 2025 ranges between $64.32 to $138.54, with an estimated average price of $101.43. The forecast is influenced by multiple factors and actual performance should be monitored.

What risks should I pay attention to when investing in DIS stock?

DIS stock investments involve market volatility, liquidity risk, and exchange rate fluctuations. Monitor price movements, trading volume, and market conditions. Conduct thorough research before investing to understand potential losses.

VINU vs STX: Comparing Two Emerging Cryptocurrencies in the Digital Asset Ecosystem

RVN vs AAVE: Which Crypto Asset Offers Better Long-Term Growth Potential?

CLORE vs RUNE: The Battle for Dominance in the Emerging Crypto Asset Management Space

Is Aerodrome Finance (AERO) a good investment?: Analyzing the potential of this DeFi protocol in the volatile crypto market

SDEX vs CRO: Comparing Two Leading Cryptocurrency Exchange Platforms

Is Hyperion (RION) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

What Country Is This Leading Cryptocurrency Exchange From?

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years