2025 DRESS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: DRESS Market Position and Investment Value

DRESS (DRESSdio), a pioneering Web3-native fashion-tech platform integrating artificial intelligence and blockchain technology, has emerged as a transformative force in the decentralized fashion ecosystem. Since its public launch, DRESS has established itself as a unique bridge between creators, consumers, and digital assets within the fashion industry. As of January 2026, DRESS maintains a market capitalization of approximately $23.58 million with a circulating supply of 10 million tokens, currently trading at $0.011791 per token.

This innovative asset, recognized as a "fashion-tech pioneer," is gaining increasing importance in revolutionizing how fashion is created, owned, and experienced through AI-powered design agents and blockchain-enabled asset trading. The platform has secured significant backing, including a $2.76M research and development grant from the Korean government and strategic investments from established IT enterprises, validating its technological potential and market vision.

This comprehensive analysis will examine DRESS price trends through 2026-2030, incorporating historical market patterns, supply-demand dynamics, ecosystem development milestones, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for stakeholders seeking exposure to the Web3 fashion-tech sector.

DRESSdio (DRESS) Market Analysis Report

I. DRESS Price History Review and Current Market Status

DRESS Historical Price Trajectory

- October 2025: Project reached all-time high (ATH) of $0.15297, reflecting strong market momentum and investor confidence during the initial phases of platform development and promotional activities.

- December 2025: Price declined significantly to an all-time low (ATL) of $0.005493 on December 22, 2025, marking a sharp correction from peak valuations as market sentiment shifted.

- January 2026: Price recovered to $0.011791 as of January 3, 2026, indicating a potential stabilization phase following the previous month's downturn.

DRESS Current Market Performance

As of January 3, 2026, DRESS is trading at $0.011791 with a 24-hour trading volume of $13,342.19. The token exhibits moderate volatility with the following price movements:

- 1-hour change: +0.18%

- 24-hour change: +0.43%

- 7-day change: +27.85%

- 30-day change: +68.23%

- 1-year change: -79.77%

The token's current market capitalization stands at $23.58 million with a fully diluted valuation (FDV) matching this figure, reflecting a circulating supply of 10 million DRESS tokens out of a total supply of 2 billion tokens. The market dominance of DRESS is minimal at 0.00072%, and the token ranks at position 4,724 in the overall cryptocurrency market. The holder base comprises approximately 10,841 addresses, indicating a distributed community of stakeholders.

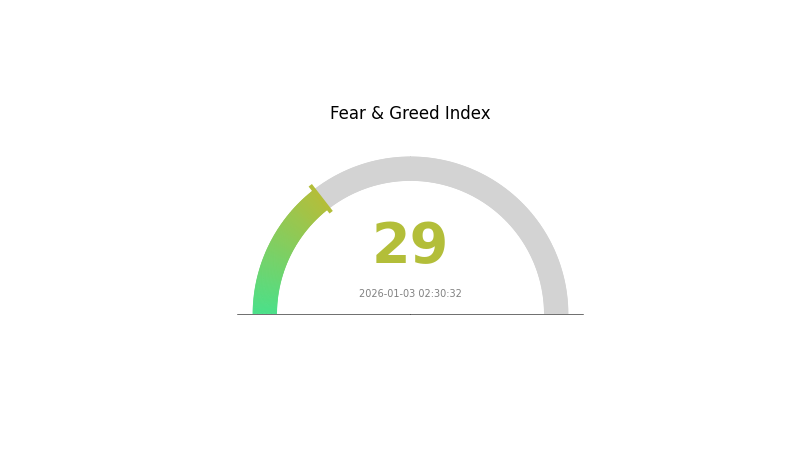

Recent price action shows strong recovery over the past month with a 68.23% gain in the 30-day period, though the asset remains significantly below its October 2025 peak, representing an approximately -79.77% decline from yearly highs. Current market sentiment reflects a "Fear" emotion index (VIX: 29), suggesting cautious investor positioning.

Click to view current DRESS market price

DRESS Market Sentiment Indicator

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear phase with the Fear and Greed Index at 29, indicating heightened market anxiety and risk aversion. This sentiment reflects investor concerns about market volatility and potential downside risks. During fear periods, experienced traders often view this as a potential accumulation opportunity, as extreme fear can precede market reversals. However, cautious positioning and risk management remain essential. Monitor key support levels and consider dollar-cost averaging strategies on Gate.com to navigate this uncertain market environment effectively.

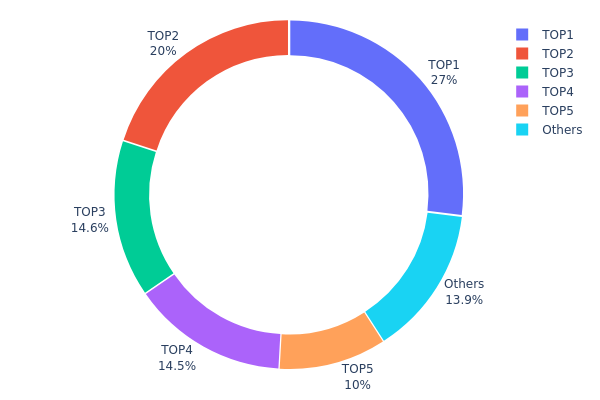

DRESS Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the top wallet addresses within the DRESS ecosystem. This metric serves as a crucial indicator for assessing the decentralization level, market structure stability, and potential vulnerability to price manipulation. By examining how token supply is distributed among major holders, investors and analysts can evaluate the health and robustness of the project's tokenomics.

DRESS currently exhibits moderate to elevated concentration risk, with the top five addresses controlling 86.1% of the total token supply. The leading address (0x377c...af98ba) alone accounts for 27.00% of holdings, while the second-largest holder (0xb76a...05eb6e) maintains a 20.00% stake. This concentration pattern indicates that decision-making power and market influence are concentrated among a limited number of stakeholders. The remaining 13.9% distribution among other addresses suggests a long tail of smaller holders, which partially offsets the dominance of major holders but does not fundamentally alter the overall concentration dynamics.

The current address distribution structure presents both opportunities and risks for market participants. The significant holdings by top addresses create potential liquidity concerns and increase susceptibility to coordinated selling pressure or price manipulation through large-scale transactions. However, the presence of multiple major holders rather than a single dominant address provides some degree of checks and balances. To better understand the evolution of DRESS's decentralization profile and monitor potential shifts in holder concentration, comprehensive tracking of these metrics over time is essential for stakeholders seeking to assess long-term ecosystem stability.

Click to view current DRESS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x377c...af98ba | 540000.00K | 27.00% |

| 2 | 0xb76a...05eb6e | 400000.00K | 20.00% |

| 3 | 0x8330...c56f6b | 292000.00K | 14.60% |

| 4 | 0xa2cb...92e8ad | 290000.00K | 14.50% |

| 5 | 0x5f67...c248a2 | 200000.00K | 10.00% |

| - | Others | 278000.00K | 13.9% |

II. Core Factors Influencing DRESS's Future Price

Supply Mechanism

-

Token Distribution Structure: DRESS has a total supply of 2 billion tokens with a circulating supply of 10 million tokens as of November 2025. The fully diluted market cap stands at $17.94 million.

-

Current Impact: The token exhibits an extremely concentrated holder distribution, with the top five addresses controlling 86.1% of total supply. The largest holder possesses 27% of all tokens, while the second-largest holds 20%. This high degree of concentration presents significant risks for price volatility, as concentrated large holders could trigger substantial price fluctuations through coordinated selling or token transfers. The concentrated distribution also negatively impacts market liquidity and stability.

Institutions and Whale Dynamics

- Whale Holdings: DRESS demonstrates a highly centralized ownership structure. The top five addresses collectively hold 86.1% of the total supply, with the largest address holding 540,000K DRESS (27%) and the second-largest holding 400,000K DRESS (20%). This concentration creates potential manipulation risks and centralization vulnerabilities that could significantly impact price movements.

Market Sentiment Indicators

-

Current Market Fear Index: As of late November 2025, the cryptocurrency market Fear and Greed Index stands at 28, indicating fear dominance in the market. This suggests investors are exercising caution and may anticipate further market declines. During such periods, some traders attempt to "buy the dip," while others remain on the sidelines. Market sentiment in the cryptocurrency space changes rapidly, requiring thorough research before making investment decisions.

-

Price Performance Context: DRESS experienced a 72.72% decline over the past 30 days, though it showed a 0.55% increase in the past 24 hours. Over the past week, the token declined 9.91%. This sharp downward trend reflects broader market pessimism affecting the digital fashion token sector.

III. 2026-2031 DRESS Price Forecast

2026 Outlook

- Conservative Forecast: $0.00638 - $0.00900

- Neutral Forecast: $0.00900 - $0.01181

- Optimistic Forecast: $0.01181 - $0.01264 (requires sustained market interest and positive ecosystem development)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery trajectory, characterized by incremental adoption and expanding use cases within the DRESS ecosystem.

- Price Range Predictions:

- 2027: $0.01051 - $0.01455

- 2028: $0.00910 - $0.01405

- 2029: $0.01303 - $0.01605

- Key Catalysts: Enhanced protocol functionality, strategic partnerships, increased institutional participation, and broader market recovery momentum.

2030-2031 Long-term Outlook

- Base Case: $0.01206 - $0.02025 (assumes stable market conditions and moderate adoption growth)

- Optimistic Case: $0.01634 - $0.02073 (assumes accelerated ecosystem expansion and positive macroeconomic sentiment)

- Transformative Case: $0.02073+ (contingent on breakthrough technological innovations, significant regulatory clarity, and mass market adoption)

- 2026-01-03: DRESS trading at current reference levels (stabilization phase initiated)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.01264 | 0.01181 | 0.00638 | 0 |

| 2027 | 0.01455 | 0.01222 | 0.01051 | 3 |

| 2028 | 0.01405 | 0.01339 | 0.0091 | 13 |

| 2029 | 0.01605 | 0.01372 | 0.01303 | 16 |

| 2030 | 0.02025 | 0.01489 | 0.01206 | 26 |

| 2031 | 0.02073 | 0.01757 | 0.01634 | 48 |

DRESSdio (DRESS) Professional Investment Strategy and Risk Management Report

IV. DRESS Professional Investment Strategy and Risk Management

DRESS Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Technology-forward investors interested in Web3 fashion innovation, early-stage blockchain project supporters, and risk-tolerant individuals with 3+ year investment horizons

- Operational Recommendations:

- Accumulate during market downturns when DRESS trades below 0.01 USD, leveraging the 68.23% monthly gains to identify entry points

- Maintain positions through market cycles, recognizing that projects in active funding discussions (such as ongoing negotiations with Hashed) may experience significant appreciation

- Dollar-cost averaging approach: invest fixed amounts monthly to mitigate volatility impact, given the 79.77% year-over-year decline

(2) Active Trading Strategy

- Price Action Analysis Tools:

- Support and Resistance Levels: Monitor the all-time low of 0.005493 USD (established December 22, 2025) as major support and the all-time high of 0.15297 USD (established October 1, 2025) as resistance for swing trading opportunities

- Volatility Tracking: Utilize the 24-hour trading volume of 13,342.19 DRESS to identify liquidity windows; execute orders during higher volume periods to minimize slippage

- Key Trading Points:

- Capitalize on the 27.85% weekly gains by taking profits at 20-30% above entry points during bullish phases

- Set stop-losses at 8-12% below entry to protect against sudden reversals in this volatile micro-cap asset

DRESS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5%-1% of total portfolio allocation recommended, given DRESS's micro-cap status (ranking 4,724) and experimental nature

- Active Investors: 1%-3% allocation appropriate for investors with higher risk tolerance and ability to monitor market developments

- Professional Investors: Up to 5% allocation permissible for specialized blockchain funds focused on Web3 fashion technology with comprehensive risk monitoring systems

(2) Risk Hedging Solutions

- Stablecoin Reserve Strategy: Maintain 40-50% of DRESS allocation in stablecoins to capitalize on price dips and rebalance positions during volatility spikes

- Portfolio Diversification: Combine DRESS holdings with established Layer-1 blockchain assets to offset concentration risk from early-stage project exposure

(3) Secure Storage Solutions

- Cold Storage Option: Hardware wallet solutions with strong security protocols are essential for long-term DRESS holdings, particularly given the token's residence on Polygon network

- Exchange Custody: For active traders, Gate.com provides secure DRESS trading and storage capabilities with institutional-grade security infrastructure

- Security Considerations: Enable multi-signature authentication, regularly audit wallet addresses on PolygonScan (https://polygonscan.com/address/0xe6800cf598015a3ec5dd534f328f349da239bc78), and maintain private key backups in geographically distributed secure locations

V. DRESS Potential Risks and Challenges

DRESS Market Risk

- Extreme Volatility and Liquidity Constraints: With a 24-hour volume of only 13,342.19 DRESS and 10,841 token holders, large trades may experience substantial slippage; the 79.77% year-over-year decline demonstrates extreme price vulnerability

- Micro-Cap Market Manipulation Risk: As a rank 4,724 asset with 0.00072% market dominance, DRESS is susceptible to pump-and-dump schemes and sudden capitulation events

- Thin Order Book Risk: Limited trading pairs and narrow bid-ask spreads on Gate.com may prevent efficient position exits during rapid market downturns

DRESS Regulatory Risk

- Unclear Classification Status: Fashion-focused blockchain projects operate in evolving regulatory territories; future classification of DRESS tokens as securities could impose trading restrictions

- Geographic Compliance Uncertainty: Korean government backing (2.76M USD R&D grant) creates potential dependency on Korean regulatory approval for continued operations

- Cross-Border Enforcement Risk: International regulatory crackdowns on speculative crypto assets could impact DRESS accessibility on global trading platforms

DRESS Technology Risk

- Smart Contract Vulnerability Exposure: As a Polygon-based token, DRESS inherits technical risks from both the project's proprietary contracts and the underlying Polygon network infrastructure

- AI Fashion Agent Reliability: The platform's core innovation—AI-driven fashion design—lacks proven track record; potential system failures could undermine the project's unique value proposition

- Ecosystem Development Dependency: Project success relies on adoption by designers, artists, influencers, and producers; failure to build network effects could render the platform obsolete

VI. Conclusion and Action Recommendations

DRESS Investment Value Assessment

DRESSdio presents a high-risk, high-potential-reward investment opportunity targeting the nascent intersection of Web3, artificial intelligence, and fashion technology. The project demonstrates legitimate institutional backing through $3.48M in funding (including Korean government support) and engagement with reputable venture firms like Hashed. However, its micro-cap status (market cap: $23.58M), extreme volatility (ranging from $0.005493 to $0.15297), and minimal trading liquidity (13,342.19 DRESS daily volume) position it firmly in the speculative category. The technology remains unproven in real-world fashion commerce, and ecosystem adoption remains uncertain. DRESS is fundamentally a bet on the long-term viability of AI-powered fashion democratization rather than a near-term revenue-generating asset.

DRESS Investment Recommendations

✅ Newcomers: Limited exploratory allocation only—invest 0.5%-1% of portfolio as a moonshot bet with full acceptance of potential total loss; prioritize education on DRESS whitepaper and project roadmap before committing capital

✅ Experienced Investors: Position sizing of 1%-3% with disciplined dollar-cost averaging strategy; set clear exit rules at either +100% profit targets or -50% stop-loss levels; actively monitor Hashed negotiation progress and adoption metrics from the official website (dressdio.io)

✅ Institutional Investors: Consider 2%-5% allocation within dedicated emerging Web3 technology funds; require comprehensive audits of smart contracts on PolygonScan before institutional deployment; establish advisory board engagement with DRESSdio's development team

DRESS Trading Participation Methods

- Gate.com Spot Trading: Execute buy/sell orders directly on Gate.com's DRESS/USDT trading pair with transparent pricing and institutional custody options

- Dollar-Cost Averaging Programs: Establish automated recurring purchases through Gate.com to systematically accumulate DRESS while reducing timing risk

- Polygon Network Direct Purchase: Advanced users can acquire DRESS through decentralized mechanisms by interacting with the contract address (0xe6800cf598015a3ec5dd534f328f349da239bc78) on Polygon, though Gate.com remains the recommended route for security and liquidity

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and are strongly advised to consult qualified financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is DRESS token? What are its main uses and application scenarios?

DRESS token powers the metaverse fashion ecosystem, enabling virtual clothing transactions, digital wardrobe management, and immersive fashion experiences. It facilitates creator monetization, NFT-based fashion asset ownership, and decentralized fashion commerce within virtual environments.

What are the main factors affecting DRESS price?

DRESS price is primarily influenced by market sentiment, technological developments, and adoption demand. Investor confidence and bullish news drive price movements upward, while negative market conditions can trigger corrections. Trading volume and broader crypto market trends also play significant roles in price fluctuations.

How to conduct DRESS price prediction? What are the analysis methods?

Analyze DRESS using technical analysis of historical price trends, fundamental analysis of market capitalization and circulation supply, on-chain metrics like holder distribution, trading volume changes, market sentiment indicators, and macroeconomic factors. Monitor ecosystem development and community activity for comprehensive price forecasting.

DRESS代币的历史价格表现如何?

DRESS代币经历了多个周期,从早期低点逐步上升,历经市场波动后呈现恢复趋势。整体表现受市场情绪与项目发展驱动,未来增长潜力值得关注。

What are the main risks of investing in DRESS tokens?

Main risks include: extreme volatility with annual decline of 79.77%, low liquidity with 24-hour trading volume of 14,400 USD causing high slippage risk, and concentrated token holder distribution.

What are the advantages and disadvantages of DRESS compared to other similar tokens?

DRESS offers innovative tokenomics with strong community governance and deflationary mechanics. Its advantages include efficient smart contracts and transparent operations. Disadvantages may include lower initial liquidity and emerging market recognition compared to established competitors. DRESS focuses on sustainable growth rather than rapid price inflation.

What is the future development prospects and roadmap for DRESS?

DRESS is positioned to lead digital transformation in fashion retail through blockchain integration, enhancing supply chain transparency and consumer experience. The 2026 roadmap focuses on platform expansion, NFT fashion ecosystem development, and strategic partnerships to drive adoption and transaction volume growth in the Web3 fashion space.

Is NFPrompt (NFP) a good investment?: Analyzing the potential and risks of this emerging crypto asset

Is Artificial Liquid Intelligence (ALI) a good investment?: Exploring the Potential Returns, Risks, and Future Market Outlook for Emerging AI Technologies

2025 AWE Price Prediction: Comprehensive Analysis of Market Trends and Future Growth Potential

What is AITECH: Exploring the Cutting-Edge Technology Revolutionizing Artificial Intelligence Applications

Is Sleepless AI (AI) a good investment?: Analyzing the Long-Term Growth Potential and Risks in the Emerging AI Market

Is Adventure Gold (AGLD) a Good Investment?: Analyzing the Long-Term Potential of this Gaming Token in the NFT Ecosystem

What is USDC?

What Country Is This Leading Cryptocurrency Exchange From?

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?