2025 ELIZA Price Prediction: Analyzing Market Trends and Technological Advancements in AI Chatbots

Introduction: ELIZA's Market Position and Investment Value

ELIZA (ELIZA), as a community-driven memecoin on the Solana blockchain, has been making waves in the cryptocurrency space since its inception. As of 2025, ELIZA's market capitalization stands at $279,477.20, with a circulating supply of approximately 961,063,259 tokens, and a price hovering around $0.0002908. This asset, often referred to as a "community-driven meme token," is playing an increasingly significant role in the realm of social tokens and community engagement on the Solana ecosystem.

This article will provide a comprehensive analysis of ELIZA's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment, offering investors professional price predictions and practical investment strategies.

I. ELIZA Price History Review and Current Market Status

ELIZA Historical Price Evolution

- 2024: Project launch, price reached all-time high of $0.04998 on November 20

- 2025: Market correction, price dropped to all-time low of $0.0002641 on October 10

ELIZA Current Market Situation

As of October 31, 2025, ELIZA is trading at $0.0002908, with a 24-hour trading volume of $10,141.46. The token has experienced a 5.41% decrease in the last 24 hours. ELIZA's market cap currently stands at $279,477.20, ranking it at position 4000 in the overall cryptocurrency market.

The token has shown negative performance across various timeframes, with a 1-hour decline of 0.27%, a 7-day drop of 3.42%, and a 30-day decrease of 17.84%. The current price is significantly lower than its all-time high, indicating a substantial market correction since its peak in November 2024.

ELIZA has a circulating supply of 961,063,259 tokens, which is equal to its total and maximum supply, suggesting no further token issuance is planned. The project's fully diluted valuation matches its current market cap, implying all tokens are in circulation.

The token's market dominance is relatively low at 0.0000071%, reflecting its position as a smaller player in the cryptocurrency ecosystem. ELIZA is currently listed on 6 exchanges, with Gate.com being one of the platforms where it can be traded.

Click to view the current ELIZA market price

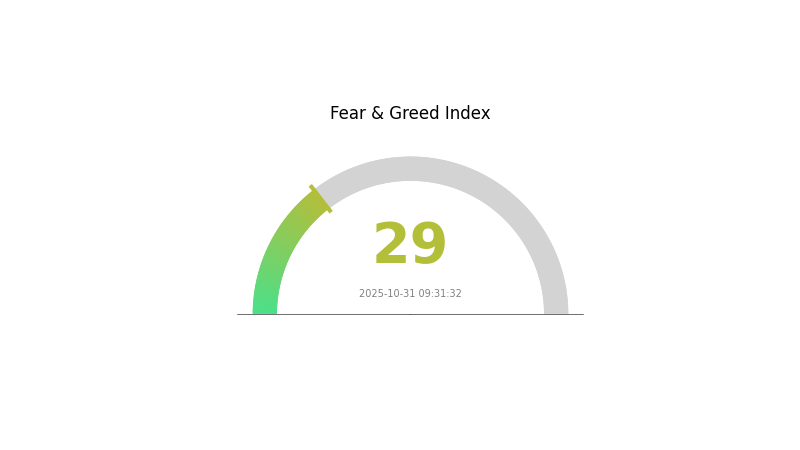

ELIZA Market Sentiment Indicator

2025-10-31 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the sentiment index at 29. This suggests investors are cautious and potentially seeking safe-haven assets. Such periods of fear often present buying opportunities for contrarian investors. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and trade responsibly on Gate.com.

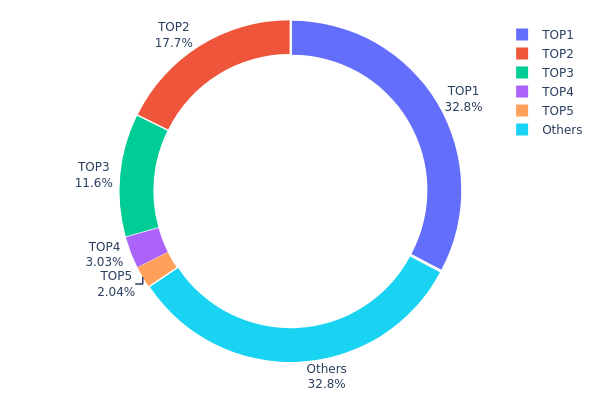

ELIZA Holdings Distribution

The address holdings distribution data for ELIZA reveals a significant concentration of tokens among a few top addresses. The top address holds 32.79% of the total supply, while the top 5 addresses collectively control 67.16% of ELIZA tokens. This high concentration suggests a potentially centralized ownership structure, which could have implications for market dynamics and price volatility.

Such a concentrated distribution raises concerns about market manipulation risks and the overall decentralization of the ELIZA ecosystem. The top holder, with nearly one-third of the supply, has substantial influence over token circulation and potential price movements. This concentration could lead to increased price volatility if large holders decide to sell or accumulate more tokens.

However, it's worth noting that 32.84% of the tokens are distributed among "Others," indicating some level of broader participation. While this provides a degree of decentralization, the dominance of top holders still poses challenges to the token's market structure and stability. Monitoring these large addresses and their transaction patterns will be crucial for understanding ELIZA's future market behavior and assessing its long-term viability as a decentralized asset.

Click to view the current ELIZA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 315169.93K | 32.79% |

| 2 | u6PJ8D...ynXq2w | 170036.20K | 17.69% |

| 3 | A77HEr...oZ4RiR | 111835.74K | 11.63% |

| 4 | GuGr2Y...ZDvWYu | 29099.81K | 3.02% |

| 5 | ASTyfS...g7iaJZ | 19590.67K | 2.03% |

| - | Others | 315185.05K | 32.84% |

II. Key Factors Influencing ELIZA's Future Price

Supply Mechanism

- Token Feedback Mechanism: AI agents launched on ELIZA contribute a portion of their tokens back to the ai16z DAO, creating a sustainable value accumulation model.

- Current Impact: This innovative token economics ensures continuous value accrual for ELIZA, potentially driving up its price as the ecosystem grows.

Institutional and Whale Dynamics

- Institutional Holdings: AI16Z, an AI-driven venture capital fund, manages over $25 million in assets and has a market cap exceeding $2 billion, demonstrating significant institutional interest in ELIZA's ecosystem.

Macroeconomic Environment

- Inflation Hedge Properties: As the global asset management industry grows rapidly, with AUM expected to reach $171 trillion by 2028, ELIZA positions itself as a potential hedge against traditional market volatility.

Technological Development and Ecosystem Building

- ELIZA Framework: A multi-agent simulation platform that combines AI-driven analysis with decentralized community input, enhancing decision-making processes in the ecosystem.

- AI-Driven Decision Making: The autonomous agent Marc AIndreessen combines advanced AI with human-like intuition to optimize trades in meme-driven markets.

- Ecosystem Applications: ELIZA's modular design supports rapid prototyping for various applications including gaming, trading, customer service, and engagement, fostering a diverse and growing ecosystem.

III. ELIZA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00018 - $0.00025

- Neutral prediction: $0.00025 - $0.00033

- Optimistic prediction: $0.00033 - $0.0004 (requires favorable market conditions and increased adoption)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2026: $0.00027 - $0.00036

- 2027: $0.00025 - $0.0005

- Key catalysts: Technological advancements, wider industry partnerships, and improved market sentiment

2030 Long-term Outlook

- Base scenario: $0.00042 - $0.00049 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00049 - $0.00056 (with significant ecosystem expansion and use case development)

- Transformative scenario: $0.00056 - $0.00065 (with breakthrough technology implementation and mass adoption)

- 2030-12-31: ELIZA $0.00056 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0004 | 0.00029 | 0.00018 | 0 |

| 2026 | 0.00036 | 0.00034 | 0.00027 | 18 |

| 2027 | 0.0005 | 0.00035 | 0.00025 | 21 |

| 2028 | 0.00053 | 0.00043 | 0.00028 | 47 |

| 2029 | 0.0005 | 0.00048 | 0.00046 | 65 |

| 2030 | 0.00056 | 0.00049 | 0.00042 | 67 |

IV. ELIZA Professional Investment Strategies and Risk Management

ELIZA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate ELIZA tokens during price dips

- Set price targets for partial profit-taking

- Store tokens in a secure Solana-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor for overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Set stop-loss orders to manage downside risk

ELIZA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. ELIZA Potential Risks and Challenges

ELIZA Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Limited liquidity: May face challenges in large-volume trades

- Market sentiment: Heavily influenced by social media trends

ELIZA Regulatory Risks

- Regulatory uncertainty: Potential for increased scrutiny of meme coins

- Legal status: Risk of classification as a security in some jurisdictions

- Compliance requirements: May face challenges in meeting evolving regulations

ELIZA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Solana network issues could affect transactions

- Wallet security: Risk of theft or loss due to user error or hacks

VI. Conclusion and Action Recommendations

ELIZA Investment Value Assessment

ELIZA presents a high-risk, high-reward opportunity within the meme coin sector. While it offers potential for significant short-term gains, its long-term value proposition remains uncertain due to its reliance on community sentiment and lack of fundamental utility.

ELIZA Investment Recommendations

✅ Newcomers: Limit exposure to a small portion of portfolio; focus on education

✅ Experienced investors: Consider short-term trading opportunities with strict risk management

✅ Institutional investors: Approach with caution; consider as part of a diversified crypto portfolio

ELIZA Trading Participation Methods

- Spot trading: Buy and sell ELIZA tokens on Gate.com

- Limit orders: Set specific entry and exit points to manage risk

- Dollar-cost averaging: Gradually accumulate tokens over time to mitigate volatility

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Jasmy hit $1 in 2025?

Based on current predictions, Jasmy is unlikely to hit $1 in 2025. Forecasts suggest a price range of $0.17 to $0.20, showing growth but falling short of the $1 mark.

How much is Eliza crypto worth?

As of October 31, 2025, Eliza crypto is worth $0.0003022. The price has increased by 2.03% in the last 24 hours, with a trading volume of $167,573.

Is Eliza a meme coin?

Yes, Eliza is a meme coin on the Solana blockchain, created as part of the Solana Meme project to capitalize on meme culture.

Will SLP coin reach $1?

While possible, it's unlikely SLP will reach $1 soon. The game's economy relies on stable SLP prices. A $1 value could disrupt the breeding system and gameplay balance.

2025 GORK Price Prediction: Market Analysis and Future Growth Potential for Emerging Cryptocurrency

Is XAI gork (GORK) a good investment?: Analyzing the Potential Returns and Risks in the Emerging Explainable AI Token Market

2025 GORKPrice Prediction: Market Analysis and Future Outlook for Cryptocurrency Investors

2025 CATGPT Price Prediction: Explosive Growth Expected as AI Integration Revolutionizes Feline Care

Is XAI gork (GORK) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

2025 AIMONICA Price Prediction: Analyzing Growth Potential and Market Trends in the AI-Powered Music Industry

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps