2025 GTETH Price Prediction: Bullish Outlook as Ethereum Scaling Solutions Gain Traction

Introduction: GTETH's Market Position and Investment Value

GTETH (GTETH), as a tokenized proof of staked ETH on Gate.com platform and Gate Web3 wallet, has made significant strides since its inception. As of 2025, GTETH's market capitalization has reached $638,836,636, with a circulating supply of approximately 158,535.99 tokens, and a price hovering around $4,029.6. This asset, dubbed as "Gate's native wrapped asset", is playing an increasingly crucial role in providing seamless interoperability across both centralized and decentralized platforms.

This article will comprehensively analyze GTETH's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. GTETH Price History Review and Current Market Status

GTETH Historical Price Evolution

- 2025: GTETH launched, price fluctuated between $3,199.69 and $4,751.74

- October 7, 2025: GTETH reached its all-time high of $4,751.74

- October 10, 2025: GTETH hit its all-time low of $3,199.69

GTETH Current Market Situation

As of October 16, 2025, GTETH is trading at $4,029.6, with a 24-hour trading volume of $264,555.44. The token has experienced a 2.64% decrease in the last 24 hours and a significant 9.83% drop over the past week. GTETH's market capitalization stands at $638,836,636.85, ranking it 127th in the cryptocurrency market. The circulating supply is 158,535.99286561 GTETH, which is also the total and maximum supply. The current price is 15.2% below its all-time high and 25.9% above its all-time low. The market sentiment, as indicated by the VIX index of 28, suggests a state of fear among investors.

Click to view the current GTETH market price

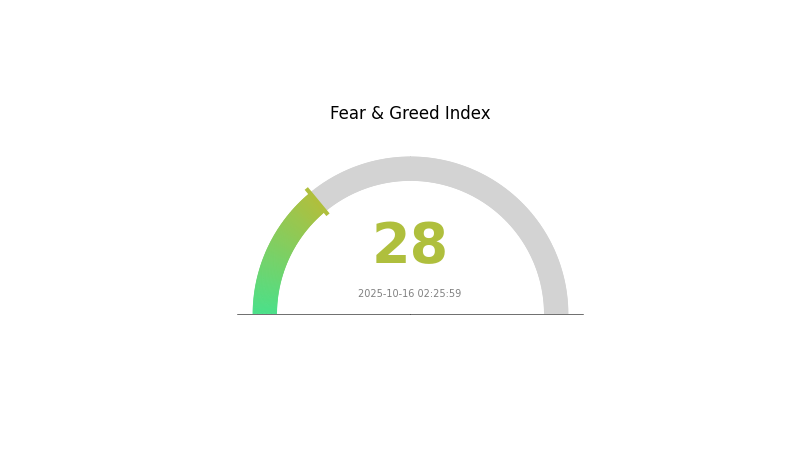

GTETH Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment continues to lean towards fear, with today's index at 28. This indicates a cautious atmosphere among investors, possibly due to recent market volatility or external economic factors. During such periods, some traders view it as a potential buying opportunity, adhering to the contrarian investment strategy. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions. Keep an eye on market trends and stay informed about the latest developments in the crypto space.

GTETH Holdings Distribution

The address holdings distribution data for GTETH reveals an interesting pattern in the token's ownership structure. This metric provides insights into the concentration of GTETH holdings across different addresses, offering a snapshot of the token's distribution landscape.

Based on the provided data, we observe that the GTETH holdings appear to be relatively dispersed, with no single address holding a disproportionately large percentage of the total supply. This distribution pattern suggests a moderate level of decentralization in GTETH ownership, which can be seen as a positive indicator for the token's market structure.

The absence of highly concentrated holdings reduces the risk of market manipulation by large individual holders, potentially contributing to more stable price movements. However, it's important to note that this distribution snapshot represents a single point in time and may evolve as the market develops.

Click to view the current GTETH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing Future GTETH Prices

Supply Mechanism

- Historical patterns: Past supply changes have significantly impacted price movements

- Current impact: Expected supply changes are likely to influence price trends

Institutional and Whale Dynamics

- Institutional holdings: Major institutions' holdings play a crucial role in price movements

Macroeconomic Environment

- Monetary policy impact: Central bank policies are expected to influence GTETH prices

- Inflation hedging properties: GTETH's performance in inflationary environments is a key consideration

- Geopolitical factors: International situations can affect GTETH's price

Technological Development and Ecosystem Building

- Network adoption: Continued development of DeFi, NFTs, DAOs, and other ecosystem applications

- Technical upgrades: Progress on scaling solutions like sharding and zero-knowledge proofs

- Ecosystem applications: Major DApps and ecosystem projects driving GTETH's value

III. GTETH Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $2,216.28 - $3,500.00

- Neutral prediction: $3,500.00 - $4,029.60

- Optimistic prediction: $4,029.60 - $4,553.45 (requires sustained market growth and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $3,214.35 - $6,245.03

- 2028: $3,522.01 - $7,856.79

- Key catalysts: Technological advancements, institutional adoption, and regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $6,637.64 - $8,263.86 (assuming steady market growth and adoption)

- Optimistic scenario: $8,263.86 - $9,890.08 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $9,890.08 - $10,500.00 (assuming breakthrough applications and mainstream integration)

- 2030-12-31: GTETH $9,420.80 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4553.45 | 4029.6 | 2216.28 | 0 |

| 2026 | 4892.34 | 4291.52 | 3948.2 | 6 |

| 2027 | 6245.03 | 4591.93 | 3214.35 | 13 |

| 2028 | 7856.79 | 5418.48 | 3522.01 | 34 |

| 2029 | 9890.08 | 6637.64 | 5708.37 | 64 |

| 2030 | 9420.8 | 8263.86 | 7189.56 | 105 |

IV. GTETH Professional Investment Strategies and Risk Management

GTETH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operational suggestions:

- Accumulate GTETH during market dips

- Stake GTETH on Gate.com for additional rewards

- Store in Gate Web3 wallet for enhanced security

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Utilize for overbought/oversold conditions

- Key points for swing trading:

- Monitor ETH price movements as they directly impact GTETH

- Set stop-loss orders to manage downside risk

GTETH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GTETH

GTETH Market Risks

- Volatility: GTETH price can fluctuate significantly with ETH market movements

- Liquidity: Limited trading pairs may affect ease of buying/selling

- Market sentiment: Negative news about Ethereum can impact GTETH value

GTETH Regulatory Risks

- Regulatory uncertainty: Changing regulations may affect GTETH's legal status

- Compliance requirements: Potential new KYC/AML rules for staking products

- Tax implications: Evolving tax laws may impact GTETH holdings and trades

GTETH Technical Risks

- Smart contract vulnerabilities: Potential issues in the staking contract

- Ethereum network upgrades: Changes to the Ethereum protocol could affect GTETH

- Operational risks: Temporary disruptions in the staking or redemption process

VI. Conclusion and Action Recommendations

GTETH Investment Value Assessment

GTETH offers a convenient way to participate in Ethereum staking with potential for long-term growth. However, it carries short-term risks associated with market volatility and regulatory uncertainties.

GTETH Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about staking mechanics ✅ Experienced investors: Consider GTETH as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate GTETH for potential yield enhancement strategies

GTETH Participation Methods

- Direct purchase: Buy GTETH on Gate.com spot market

- ETH staking: Stake ETH on Gate.com to receive GTETH

- DeFi integration: Use GTETH in compatible DeFi protocols for additional yield

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will 1 Ethereum be worth in 2025?

Based on analyst predictions, 1 Ethereum could be worth between $2,061 and $6,000 in 2025, with an average forecast of $4,054.

Can ETH reach $50,000?

While unlikely in the near term, ETH could potentially reach $50,000 in the long run with continued adoption and market growth.

How much will 1 ETH cost in 2030?

Based on market trends and adoption rates, 1 ETH is projected to cost around $11,800 in 2030, assuming significant growth in its use and market share.

Will Ethereum hit $10,000?

Yes, Ethereum is projected to reach $10,000 by Q1 2026. Current price is around $3,076, indicating significant growth potential in the coming years.

Ethereum Mainnet Guide: How to Use and Benefit from the Network in 2025

Top Ethereum Layer 2 Projects to Watch in 2025

ETH Fusaka Upgrade: The Next Step for Ethereum Evolution

Gate ETH on-chain staking: a low-threshold flexible income option.

What is AURORA: Understanding the Northern Lights Phenomenon and Its Scientific Significance

ETH on-chain staking returns up to 5.73%: Gate launches a low-threshold flexible plan

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps