2025 KTON Price Prediction: Expert Analysis and Future Market Outlook for Kusama's Treasury Token

Introduction: KTON's Market Position and Investment Value

KTON, a derivative token of Darwinia Network's native RING token, functions as a commitment token designed to incentivize long-term staking and liquidity provision. As of January 2026, KTON has established itself with a market capitalization of approximately $213,616, a circulating supply of 149,696 tokens, and a current price hovering around $1.427. This token, recognized for its role in the cross-chain ecosystem, is increasingly playing a vital role in decentralized governance and staking mechanisms within the Darwinia Network infrastructure.

This article will provide a comprehensive analysis of KTON's price trajectory and market dynamics, combining historical performance patterns, supply-demand factors, and ecosystem development to deliver professional price forecasts and practical investment guidance for the period from 2026 onwards.

KTON Market Analysis Report

I. KTON Price History Review and Market Status

KTON Historical Price Evolution

KTON reached its all-time high of $416.09 on September 1, 2020, reflecting the peak of market enthusiasm during the earlier cryptocurrency cycle. Since that peak, the token has experienced a significant long-term decline. Over the one-year period, KTON has depreciated by 67.28%, indicating sustained downward pressure on valuations.

As of January 21, 2025, KTON reached its all-time low of $1.28, marking a dramatic 99.69% decline from its historical peak.

KTON Current Market Position

Price Performance:

- Current Price: $1.427

- 24-Hour High: $1.547

- 24-Hour Low: $1.407

- 24-Hour Change: -1.65%

Recent Price Momentum:

- 1-Hour Change: +0.27%

- 7-Day Change: -3.25%

- 30-Day Change: -4.22%

- 1-Year Change: -67.28%

Market Metrics:

- Market Capitalization: $213,616.19

- Circulating Supply: 149,696 KTON

- Total Supply: 149,696 KTON

- Maximum Supply: Unlimited

- Market Dominance: 0.0000067%

- 24-Hour Trading Volume: $11,849.21

- Active Token Holders: 2,274

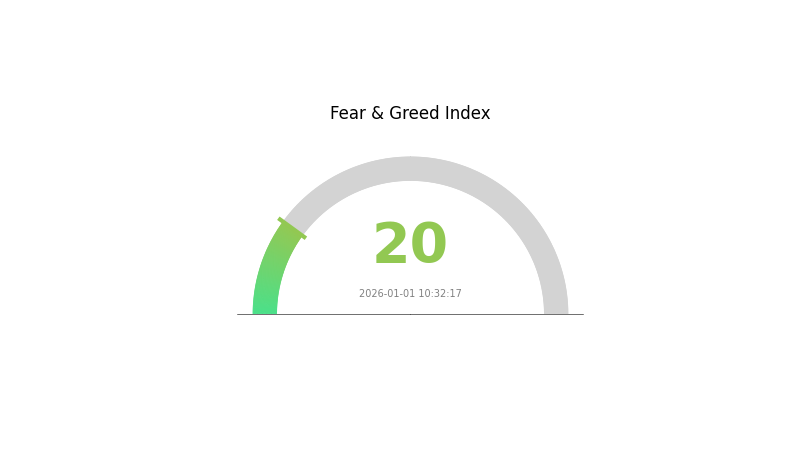

Market Sentiment: The current market sentiment indicates "Extreme Fear" (VIX score of 20), suggesting prevailing risk aversion across the broader cryptocurrency market.

Click to view current KTON market price

KTON Market Sentiment Index

2026-01-01 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The market is currently experiencing extreme fear, with the Fear and Greed Index standing at 20. This indicates heightened anxiety among investors and significant pessimism in the crypto market. When fear reaches such extreme levels, it typically presents contrarian investment opportunities for experienced traders. Market downturns often create favorable entry points for long-term investors. However, proceed with caution and conduct thorough research before making any investment decisions. Monitor market developments closely on Gate.com for real-time data and analysis to guide your trading strategy during this volatile period.

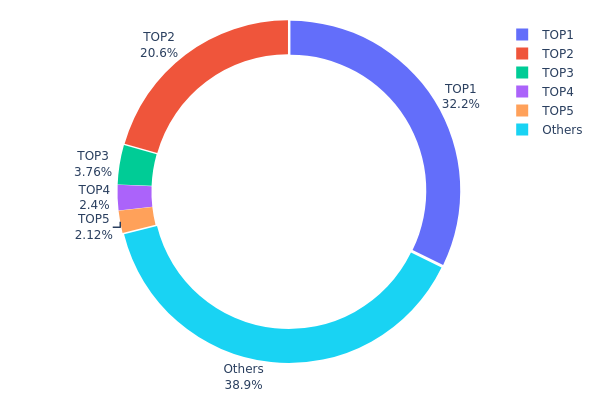

KTON Holdings Distribution

The address holdings distribution map illustrates the concentration of KTON tokens across the top wallet addresses on the blockchain. This metric provides critical insight into token ownership structure, revealing the degree of centralization and potential market control dynamics. By analyzing the distribution of holdings among the largest addresses, stakeholders can assess liquidity concentration, governance risks, and the overall decentralization characteristics of the token ecosystem.

KTON's current holdings distribution exhibits significant concentration among the top holders. The largest address commands 32.20% of total holdings with 16.58K tokens, while the second-largest holds 20.60% with 10.61K tokens. Combined, these two addresses control over 52% of the circulating supply, indicating pronounced token concentration at the apex of the distribution hierarchy. The top five addresses collectively represent 61.07% of holdings, whereas the remaining addresses account for only 38.93%, demonstrating a marked concentration pattern typical of tokens in relatively early development phases or with substantial institutional allocation.

This concentration structure presents both opportunities and risks for market participants. On one hand, such concentrated holdings may reflect early investor or institutional stakeholder positions, potentially lending credibility and long-term commitment to the project. Conversely, the elevated concentration raises considerations regarding liquidity fragmentation, price volatility susceptibility, and potential for large-scale liquidation events should major holders alter their positions. The distribution indicates moderate centralization pressure; however, with approximately 39% of tokens dispersed across numerous smaller addresses, there exists a meaningful distributed base that partially mitigates extreme concentration concerns. This structure suggests KTON maintains a relatively balanced market architecture, with sufficient decentralized participation to support sustainable ecosystem development while retaining concentrated stakeholder involvement in project governance and strategic direction.

View current KTON holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2d97...40d5fc | 16.58K | 32.20% |

| 2 | 0x0d07...b492fe | 10.61K | 20.60% |

| 3 | 0x75e8...1dcb88 | 1.94K | 3.76% |

| 4 | 0x40ec...5bbbdf | 1.24K | 2.40% |

| 5 | 0x67e7...18c0cc | 1.09K | 2.11% |

| - | Others | 20.03K | 38.93% |

II. Core Factors Affecting KTON Future Price

Supply Mechanism

-

Transaction Fee Model: KTON serves as the primary utility token for processing blockchain transactions on the TON network. Due to the network's sharding capabilities, KTON can also be utilized for cross-chain transaction fees and creation of new workchains.

-

Current Impact: As the TON ecosystem continues to expand and attract more developers and users, transaction volume is expected to increase, which would drive demand for KTON as the primary fee-bearing asset on the network.

Wallet Adoption and Network Utility

-

Telegram Integration: Users can conveniently purchase and transfer KTON through the Telegram wallet (@wallet bot) using credit cards. This integration significantly lowers barriers to entry for mainstream users.

-

Ecosystem Expansion: The TON ecosystem comprises 792 applications as of May 2024, with 14 projects recorded on DefiLlama spanning liquidity staking, DeFi, privacy, SocialFi, and gaming sectors. This diversification increases KTON's practical utility across multiple use cases.

Technology Development and Ecosystem Building

-

Infinite Sharding Architecture: The network's unlimited sharding technology solves scalability challenges, enabling TON to support billions of users globally while maintaining high transaction efficiency.

-

Hypercube Instant Routing: This mechanism ensures low-latency cross-chain interactions regardless of system scale, improving overall network efficiency and KTON's utility value.

-

Self-Healing Vertical Blockchain: TON's unique design corrects invalid blocks without network forks, maintaining system consistency and reliability while reducing transaction failures that would otherwise increase fee demands.

-

High-Performance Virtual Machine: Provides robust infrastructure for smart contract execution, supporting diverse DeFi, gaming, and SocialFi applications that increase on-chain activity and KTON demand.

Market Dynamics and Investor Sentiment

-

Price Volatility Patterns: KTON has historically traded within a 0.9-2.6 USD range over recent years, indicating significant retail accumulation at these price levels. Since February 2024, elevated trading volumes and higher prices reflect strong capital inflow and positive market expectations.

-

Community Growth: Ongoing Telegram channel interactions and community engagement drive awareness and adoption, influencing investor sentiment and price trajectories.

III. 2026-2031 KTON Price Forecast

2026 Outlook

- Conservative Forecast: $1.32 - $1.43

- Neutral Forecast: $1.43 - $1.82

- Optimistic Forecast: $1.82+ (requiring sustained network adoption and ecosystem expansion)

2027-2029 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with increasing institutional interest and protocol upgrades driving value proposition

- Price Range Predictions:

- 2027: $1.38 - $2.06 (13% upside potential)

- 2028: $1.07 - $2.60 (29% upside potential)

- 2029: $1.47 - $3.27 (55% upside potential)

- Key Catalysts: Cross-chain interoperability enhancements, strategic partnerships with major platforms, ecosystem developer growth, and mainstream DeFi adoption acceleration

2030-2031 Long-term Outlook

- Base Case: $1.81 - $3.37 (92% appreciation from 2026 levels, assuming steady ecosystem maturation and market cyclicality)

- Optimistic Case: $2.20 - $3.46 (114% appreciation by 2031, assuming breakthrough protocol innovations and significant institutional capital inflows)

- Transformative Case: $3.46+ (assuming KTON becomes foundational infrastructure for emerging Web3 financial systems with enterprise-level adoption)

- 2031-12-31: KTON projected at $3.46 average (potential accumulation phase entry point for long-term holders)

Note: All price forecasts are derived from market analysis models and should be verified through Gate.com's real-time data feeds before making investment decisions. Past performance does not guarantee future results.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 1.81737 | 1.431 | 1.31652 | 0 |

| 2027 | 2.06271 | 1.62419 | 1.38056 | 13 |

| 2028 | 2.59926 | 1.84345 | 1.0692 | 29 |

| 2029 | 3.2654 | 2.22136 | 1.4661 | 55 |

| 2030 | 3.37435 | 2.74338 | 1.81063 | 92 |

| 2031 | 3.45652 | 3.05886 | 2.20238 | 114 |

KTON Professional Investment Strategy and Risk Management Report

IV. KTON Professional Investment Strategy and Risk Management

KTON Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Crypto enthusiasts interested in cross-chain infrastructure and decentralized governance participation

- Operational Recommendations:

- Acquire KTON through Gate.com and hold for extended periods to benefit from staking rewards and governance participation

- Participate in network staking to earn influence and governance rights on the Darwinia Network mainnet

- Monitor project developments related to cross-chain infrastructure and NFT market expansion

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Track the 24-hour, 7-day, and 30-day price movements to identify trend reversals and support/resistance levels

- Volume Analysis: Monitor trading volume patterns on Gate.com to confirm price breakouts and market sentiment shifts

- Wave Trading Key Points:

- Capitalize on short-term volatility, noting the 24-hour price change of -1.65% and 7-day decline of -3.25%

- Execute entry positions during local support levels and exit during resistance zones

KTON Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Aggressive Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Balance KTON holdings with other layer-1 blockchain tokens and stablecoins to reduce concentration risk

- Position Sizing: Implement stop-loss orders at 10-15% below entry price to protect against sudden market downturns

(3) Secure Storage Solution

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and staking participation on Darwinia Network

- Self-custody Approach: Transfer KTON to secure wallets for long-term holdings when not actively participating in staking

- Security Precautions: Enable two-factor authentication, use hardware verification for all transactions, never share private keys, and regularly update security protocols

V. KTON Potential Risks and Challenges

KTON Market Risk

- Extreme Price Volatility: KTON has experienced significant historical volatility, with an all-time high of $416.09 (September 2020) and a recent low of $1.28 (November 2025), representing a 99.7% decline. Current price of $1.427 reflects ongoing market pressure

- Low Trading Liquidity: 24-hour trading volume of $11,849.21 is relatively low, which may result in significant slippage during large transactions

- Market Cap Concentration: With a market share of 0.0000067%, KTON is highly susceptible to market sentiment shifts and lacks established institutional demand

KTON Regulatory Risk

- Uncertain Regulatory Framework: Cross-chain protocols and their native tokens face evolving regulatory scrutiny across different jurisdictions

- Token Classification Ambiguity: Regulatory authorities may reclassify KTON as a security in certain markets, potentially restricting trading and staking activities

- Compliance Challenges: Changes in DeFi and staking regulations could impact KTON's utility and value proposition

KTON Technical Risk

- Substrate-based Implementation Risk: Dependencies on Substrate framework updates may introduce unforeseen vulnerabilities or compatibility issues

- Cross-chain Bridge Security: As Darwinia Network operates as a cross-chain bridge, smart contract bugs or exploits on connected networks could affect KTON value

- Network Adoption Risk: Limited mainstream adoption of Darwinia Network's infrastructure could restrict demand for KTON tokens

VI. Conclusion and Action Recommendations

KTON Investment Value Assessment

KTON serves as a commitment token within the Darwinia Network ecosystem, offering staking rewards and governance participation incentives. However, the token faces significant headwinds: massive historical price depreciation (-67.28% year-over-year), extremely low market capitalization ($213,616.19), minimal trading liquidity, and limited ecosystem adoption. While the underlying Darwinia Network concept of cross-chain infrastructure and NFT markets presents long-term potential, KTON's current valuation reflects deep skepticism from the market. Investors should recognize this as a highly speculative position suitable only for those with substantial risk tolerance and deep conviction in the project's cross-chain vision.

KTON Investment Recommendations

✅ Beginners: Avoid or allocate only a negligible portion (0.1-0.5%) of a portfolio as a speculative position; prioritize understanding the Darwinia Network ecosystem before committing capital

✅ Experienced Investors: Consider limited positions for speculative purposes only; conduct thorough due diligence on Darwinia Network's technical roadmap and market traction; use Gate.com for trading with strict position sizing discipline

✅ Institutional Investors: Monitor project developments and market sentiment before considering allocation; assess cross-chain infrastructure adoption trends and regulatory clarity; implement comprehensive risk frameworks if participation is warranted

KTON Trading Participation Methods

- Spot Trading on Gate.com: Purchase and hold KTON directly for medium to long-term positions with active staking participation

- Staking on Darwinia Network: Lock KTON mainnet holdings to gain network influence and participate in governance while earning rewards

- Liquidity Provision: Supply KTON to DEX pools on supported networks for yield generation, understanding the associated impermanent loss risks

Cryptocurrency investment carries extreme risk and this report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and consult professional financial advisors. Never invest more capital than you can afford to lose. Always conduct independent research before making investment decisions.

FAQ

What is KTON? What is its role in Darwinia Network?

KTON is Darwinia Network's commitment token designed to incentivize long-term participation. Linked to the native RING token, KTON plays a crucial role in securing user commitments and rewarding ecosystem participants within the Darwinia network.

What are the main factors affecting KTON price?

KTON price is influenced by market demand, supply volume, regulatory policies, and overall market trends. Large investor activities and news events also significantly impact its price movements.

What is the KTON price prediction for 2024-2025? What are the optimistic and pessimistic views?

Optimistic forecasts suggest KTON could reach $15.58, while pessimistic estimates project $4.97. These predictions are based on market analysis and on-chain metrics evaluation.

What are the advantages and disadvantages of KTON compared to other Layer 2 governance tokens such as ARB and OP?

KTON offers unique profit-sharing governance structure with higher intrinsic value per token. ARB and OP have larger circulating supplies but lower individual token utility. KTON provides stronger governance influence through its economic model design.

What risks should I consider when investing in KTON?

KTON investment risks include price volatility, market uncertainty, and potential regulatory changes. Crypto assets experience significant price fluctuations, and market adoption remains unpredictable. Monitor liquidity and network development closely.

How to predict KTON price trends through technical and fundamental analysis?

Technical analysis identifies support and resistance levels to determine price targets. Fundamental analysis evaluates project development and market demand. Combining both approaches helps predict KTON price movements and trading opportunities effectively.

What is VELODROME: The Revolutionary Cycling Track Transforming Professional Racing and Urban Recreation

What Is the Token Economic Model and How Does It Impact Crypto Projects?

How Does a Token Economic Model Balance Inflation and Governance?

How Does the Token Economic Model of Polkadot Balance Inflation and Staking Rewards?

How Does SUI's Token Economic Model Incentivize Network Participation?

What is the AVAX token economic model and how does it compare to other Layer 1 blockchains?

How to Trace Bitcoin Address Owners: A Comprehensive Guide for Financial Institutions

Understanding PNL in the Crypto Space

Does Shiba Inu Coin (SHIB) Reach 1 Cent? Discover How Many Millionaires Would Be Created

Why China is Banning Crypto?

What Are Altcoins? Essential Cryptocurrency Investment Fundamentals for Beginners