2025 MIDNIGHT Price Prediction: Expert Analysis and Market Outlook for the Next Generation Cryptocurrency Token

Introduction: MIDNIGHT's Market Position and Investment Value

MIDNIGHT (NIGHT) is a gaming infrastructure token designed to interconnect MMORPG ecosystems through the Evergreen platform, enabling character and economic progress portability across multiple games. Since its launch, MIDNIGHT has emerged as a solution to the fragmentation challenge in the gaming world. As of January 2026, MIDNIGHT's fully diluted market capitalization stands at $588,900, with a circulating supply of approximately 201.96 million tokens and a current price around $0.0001963. This innovative gaming-focused asset is playing an increasingly pivotal role in bridging disparate MMORPG communities and creating a unified ecosystem for global gaming.

This article will comprehensively analyze MIDNIGHT's price trends from 2026 through 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. MIDNIGHT Price History Review and Market Status

MIDNIGHT Historical Price Evolution Trajectory

- 2024: Project launch with initial offering price of $0.03, representing the entry point for early participants in the Evergreen gaming ecosystem initiative.

- November 2024: All-time high price of $0.04333 reached on November 29, 2024, marking peak market valuation for the MIDNIGHT token.

- 2025: Extended downtrend period with significant price depreciation of 88.1% over the one-year timeframe, declining from historical highs to current trading levels near $0.0001963.

MIDNIGHT Current Market Status

As of January 6, 2026, MIDNIGHT is trading at $0.0001963, reflecting a 24-hour increase of 2.61% with daily trading volume reaching $12,053.60. The token demonstrates short-term bullish momentum with a 1-hour gain of 1.069%, though longer-term performance reveals substantial headwinds with a 30-day decline of -56.98%.

The current market capitalization stands at $39,644.748 with a fully diluted valuation of $588,900. Circulating supply comprises 201,960,000 tokens out of a total supply of 3,000,000,000, representing 6.732% circulation ratio. The token maintains a ranking of 6,009 by market capitalization and exhibits limited exchange presence with availability on a single trading venue. Token holder count reaches 1,120, indicating a nascent but developing community base.

Click to view current MIDNIGHT market price

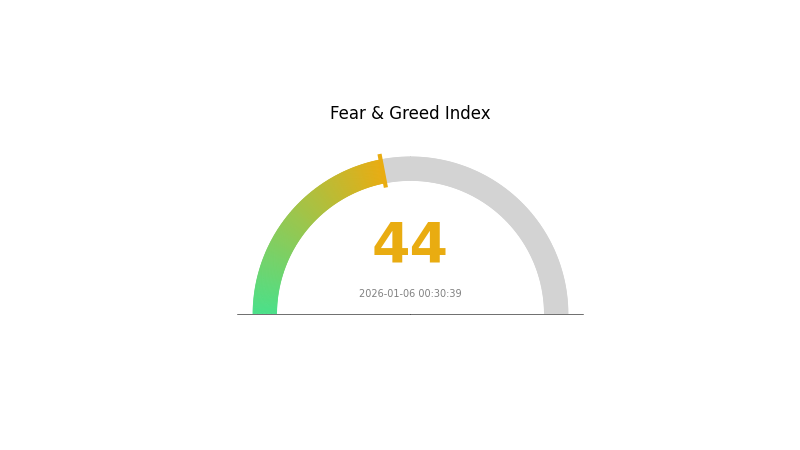

MIDNIGHT Market Sentiment Index

2026-01-06 Fear & Greed Index: 44 (Fear)

Click to view current Fear & Greed Index

Market Analysis:

The crypto market is currently experiencing a fear sentiment with an index reading of 44. This indicates heightened market anxiety and cautious investor behavior. When fear dominates, market participants tend to be risk-averse, leading to potential selling pressure and increased volatility. This environment typically presents contrarian opportunities for long-term investors who can identify quality assets at lower valuations. Monitor key support levels and consider dollar-cost averaging strategies during fearful periods. Stay informed through Gate.com's comprehensive market data tools to navigate current market conditions effectively.

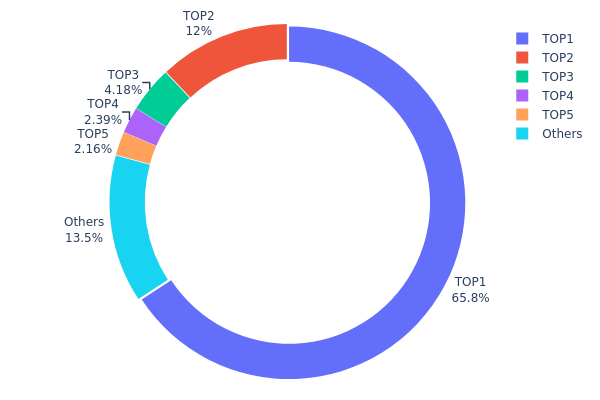

MIDNIGHT Holdings Distribution

The address holdings distribution chart represents the concentration of token ownership across the blockchain network, illustrating how MIDNIGHT tokens are distributed among different wallet addresses. This metric serves as a critical indicator of tokenomic health, market structure, and potential systemic risks. By analyzing the top holders and their proportional stakes, investors and analysts can assess the degree of decentralization and evaluate vulnerability to price manipulation or coordinated selling pressure.

MIDNIGHT exhibits pronounced concentration risk, with the top holder commanding 65.75% of total supply—a substantially elevated level that raises significant concerns regarding centralization. The top five addresses collectively control 86.49% of circulating tokens, leaving only 13.51% distributed among remaining holders. This extreme concentration pattern suggests that the token's price dynamics and network governance are heavily influenced by a limited number of stakeholders. The substantial gap between the largest holder and secondary positions indicates asymmetric control, where a single entity wields disproportionate influence over market movements and protocol decisions.

This distribution architecture carries material implications for market structure and price stability. The dominant position of the primary holder creates an inherent imbalance that could facilitate large-scale sell-side pressure if tokens enter circulation, potentially triggering cascading liquidations or volatility spikes. Additionally, such extreme concentration limits the token's utility as a decentralized governance instrument and raises questions about long-term sustainability and organic market participation. The current holdings structure reflects a centralized foundation that fundamentally constrains MIDNIGHT's progression toward genuine decentralization, presenting a structural challenge that must be addressed through deliberate token distribution initiatives and stakeholder diversification strategies.

Click to view current MIDNIGHT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3465...959a7f | 1972645.92K | 65.75% |

| 2 | 0x5ceb...87e848 | 360000.00K | 12.00% |

| 3 | 0xd04e...41b88f | 125550.00K | 4.19% |

| 4 | 0xcf86...99012a | 71571.16K | 2.39% |

| 5 | 0xf208...88b22a | 64687.50K | 2.16% |

| - | Others | 405545.42K | 13.51% |

II. Core Factors Influencing MIDNIGHT's Future Price

Supply Mechanism

-

Dual Token Model: MIDNIGHT operates with two resources. NIGHT is a tradable utility token with a circulating supply of 16.6 billion tokens and a maximum supply of 24 billion tokens. DUST is a protected, non-transferable resource that decays over time and is passively generated by NIGHT holders. DUST supports metadata-protected transactions and resets over time, ensuring privacy requires continued participation rather than token accumulation.

-

Historical Performance: NIGHT experienced explosive price movement following its listing on November 28, 2024, with prices surging over 180% during initial trading before profit-taking resulted in structural pullback. The token subsequently traded near $0.049, with a historical high of $0.04333 reached on November 29, 2024.

-

Current Impact: The large-scale cross-chain airdrop covering 8 million wallets created significant selling pressure. Initial circulating supply represents 69% of total tokens, with gradual token emission scheduled over multiple years, potentially constraining rapid price appreciation in the near term.

Institutional and Whale Dynamics

-

Enterprise Backing: The project was developed by Input Output Global (IOG) and receives endorsement from Charles Hoskinson, founder of Cardano, positioning it as a significant infrastructure initiative within the Cardano ecosystem.

-

Liquidity Events: NIGHT achieved premium liquidity upon launch through simultaneous listing on major platforms, which accelerated initial price discovery but also concentrated selling pressure from airdrop recipients.

Technical Development and Ecosystem Building

-

Zero-Knowledge Proof Architecture: Midnight implements ZK-SNARKs technology for privacy protection, enabling programmable privacy features on a compliant basis. This distinguishes it from privacy solutions that prioritize anonymity over regulatory compliance.

-

Mainnet Launch Timeline: The mainnet is scheduled for Q1 2026 launch, representing a critical catalyst for token valuation. This milestone will transition the protocol from testnet phase to production deployment.

-

Cross-Chain Integration: The protocol targets integration with major blockchain ecosystems including Bitcoin, Ethereum, and Cardano, positioning itself as a multi-chain privacy layer rather than a single-chain solution.

-

Ecosystem Applications: Target use cases span financial services, enterprise applications, and healthcare sectors, with focus on privacy-preserving decentralized applications that maintain regulatory compliance.

III. 2026-2031 MIDNIGHT Price Forecast

2026 Outlook

- Conservative Forecast: $0.00016 - $0.00020

- Neutral Forecast: $0.00020 (average price)

- Optimistic Forecast: $0.00023 (requires sustained market interest and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with emerging institutional interest and ecosystem expansion

- Price Range Forecasts:

- 2027: $0.00013 - $0.00026 (9% upside potential)

- 2028: $0.00021 - $0.00029 (20% upside potential)

- 2029: $0.00015 - $0.00040 (35% upside potential)

- Key Catalysts: Protocol upgrades, increased adoption by institutional investors through platforms like Gate.com, strategic partnerships, and growing DeFi integration

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00024 - $0.00035 (market achieves mainstream adoption with moderate network effects)

- Optimistic Scenario: $0.00033 - $0.00043 (strong ecosystem growth with 68-74% cumulative appreciation by 2031)

- Transformational Scenario: $0.00043+ (successful execution of major protocol milestones, significant institutional capital inflow, and breakthrough market penetration)

- January 6, 2026: MIDNIGHT $0.0002 (stable market entry point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00023 | 0.0002 | 0.00016 | 0 |

| 2027 | 0.00026 | 0.00021 | 0.00013 | 9 |

| 2028 | 0.00029 | 0.00024 | 0.00021 | 20 |

| 2029 | 0.0004 | 0.00027 | 0.00015 | 35 |

| 2030 | 0.00035 | 0.00033 | 0.00024 | 68 |

| 2031 | 0.00043 | 0.00034 | 0.00031 | 74 |

MIDNIGHT (MIDNIGHT) Professional Investment Strategy and Risk Management Report

IV. MIDNIGHT Professional Investment Strategy and Risk Management

MIDNIGHT Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: GameFi enthusiasts and Web3 gaming ecosystem believers

- Operational Recommendations:

- Dollar-cost averaging (DCA) approach with periodic purchases to reduce timing risk

- Hold MIDNIGHT tokens through market cycles to participate in potential ecosystem expansion across MMO gaming platforms

- Monitor Evergreen platform adoption milestones and gaming partnerships as triggers for rebalancing

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price floors at $0.0001873 (24H low) and resistance at historical highs; use for entry/exit signals

- Volume Analysis: Monitor the 24H trading volume of $12,053.60 to gauge market sentiment shifts and potential breakout opportunities

- Wave Trading Considerations:

- Track short-term volatility patterns given 24H positive momentum (2.61%) alongside 30-day decline (-56.98%)

- Set stop-loss orders below critical support levels to protect against adverse price movements

MIDNIGHT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% allocation (minimal exposure to early-stage gaming tokens)

- Active Investors: 5-10% allocation (moderate participation in ecosystem growth)

- Professional Investors: 10-15% allocation (strategic positioning in Web3 gaming infrastructure)

(2) Risk Hedging Strategies

- Diversification Across Gaming Ecosystems: Balance MIDNIGHT holdings with exposure to other established blockchain gaming platforms to reduce concentration risk

- Staggered Exit Plan: Pre-establish profit-taking targets at predetermined price levels to lock in gains during bullish phases

(3) Secure Storage Solutions

- Hardware Wallet Approach: Use cold storage solutions for long-term MIDNIGHT holdings to eliminate exchange counterparty risk

- Exchange Storage: Maintain trading portions on Gate.com for active trading while leveraging the platform's security infrastructure

- Security Precautions: Enable two-factor authentication, use unique passwords, regularly audit wallet activities, and never share private keys or seed phrases

V. MIDNIGHT Potential Risks and Challenges

MIDNIGHT Market Risks

- Price Volatility: MIDNIGHT has experienced severe drawdowns (-88.1% over one year) from its all-time high of $0.04333, indicating extreme price instability typical of early-stage gaming tokens

- Low Liquidity: With only one listed exchange and limited trading volume, MIDNIGHT may face significant slippage during large transactions, restricting market depth

- Market Sentiment Sensitivity: The token's value is highly dependent on Evergreen platform adoption announcements; negative developments could trigger sharp corrections

MIDNIGHT Regulatory Risks

- Gaming and Finance Intersection Uncertainty: Regulatory frameworks for blockchain-based gaming with in-game economy tokens remain unclear across major jurisdictions

- Changing Compliance Requirements: Future regulations on play-to-earn mechanics and tokenized in-game assets could impact MIDNIGHT's utility and value proposition

- Cross-Border Gaming Restrictions: Different countries may impose limitations on gaming platforms utilizing cryptocurrency, affecting Evergreen's global expansion

MIDNIGHT Technology Risks

- Aptos Network Dependency: MIDNIGHT's functionality is dependent on the Aptos blockchain; network congestion, security incidents, or protocol changes could impact token operations

- Smart Contract Vulnerabilities: Unaudited or partially audited smart contracts could contain bugs or exploits that compromise the security of MIDNIGHT holdings

- Ecosystem Scalability: Evergreen's ability to support multiple MMO games simultaneously without performance degradation remains unproven at scale

VI. Conclusion and Action Recommendations

MIDNIGHT Investment Value Assessment

MIDNIGHT presents a speculative opportunity within the Web3 gaming ecosystem, specifically targeting the MMO gaming vertical through its Evergreen platform. The project's value proposition centers on solving fragmentation in gaming economies by enabling character and progress portability across multiple games via the $MIDNIGHT token. However, the token faces significant headwinds including severe year-over-year depreciation (-88.1%), minimal market capitalization ($39,644.75), and extreme volatility. The project remains early-stage with limited exchange presence (only 1 listing), low trading liquidity, and unproven platform adoption. While the conceptual framework addresses real pain points in gaming interoperability, execution risk is substantial.

MIDNIGHT Investment Recommendations

✅ Beginners: Allocate only micro-positions (0.5-2% of gaming crypto portfolio) through Gate.com with strict stop-loss orders; avoid leverage or margin trading; prioritize understanding Evergreen's development roadmap before committing capital

✅ Experienced Investors: Consider tactical accumulation during oversold conditions (leveraging technical analysis) with pre-planned exit strategies; monitor quarterly partnership and adoption metrics; maintain position sizing discipline given extreme volatility

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security, team credentials, and regulatory compliance; establish position limits based on liquidity analysis; integrate into broader Web3 gaming exposure rather than standalone allocation

MIDNIGHT Trading Participation Methods

- On Gate.com Exchange: Direct spot trading of MIDNIGHT against major trading pairs; utilize platform's advanced charting tools and order types for active management

- Dollar-Cost Averaging: Schedule regular purchases at fixed intervals to reduce timing risk and benefit from average price reduction during market downturns

- Threshold-Based Trading: Execute predetermined buy orders at support levels and sell orders at resistance zones based on technical analysis; automate through Gate.com's order functionality

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and are strongly encouraged to consult qualified financial advisors. Never invest capital you cannot afford to lose entirely. MIDNIGHT remains a highly speculative early-stage token with unproven technology and limited market infrastructure.

FAQ

What is MIDNIGHT token? What are its main uses and technical features?

MIDNIGHT token is NIGHT, the core utility token of the Midnight network. It primarily generates DUST for privacy transactions and zero-knowledge execution. NIGHT holders automatically generate DUST proportionally to their holdings, enabling private on-chain operations.

What is the price prediction for MIDNIGHT in 2024-2025? What are the main factors affecting the price?

MIDNIGHT (NIGHT) is predicted to reach approximately $0.00061 by end of 2025. Key factors include project development progress, market trends, trading volume, and overall cryptocurrency market performance. The project's privacy technology and ecosystem adoption significantly influence price movements.

What risks does investing in MIDNIGHT carry? How to assess its investment potential?

MIDNIGHT faces market volatility and privacy coin competition risks. Assess potential through its zero-knowledge proof technology, Charles Hoskinson's backing, strong institutional support, and 2026 mainnet launch timeline. Strong long-term fundamentals suggest significant upside potential.

What are the advantages and disadvantages of MIDNIGHT compared to other privacy coins such as Monero and Zcash?

MIDNIGHT supports smart contracts and cross-chain capabilities with 30% higher user retention and lower fees than Monero and Zcash, making it ideal for emerging markets. However, it has smaller community adoption compared to established privacy coins.

How is MIDNIGHT's market liquidity? Which exchanges can trade it?

MIDNIGHT maintains moderate market liquidity with consistent trading activity. The token is available on major cryptocurrency exchanges, enabling users to buy and sell with reasonable trading volumes and competitive spreads for seamless transactions.

What is the background of Midnight's development team and what is the project's long-term roadmap?

Midnight is led by Cardano founder Charles Hoskinson. The roadmap includes launching a federated mainnet in Q1 2026, incentivized testnet in Q2 2026, and achieving full interoperability in Q3 2026, with focus on privacy-preserving blockchain technology and enterprise adoption.

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Is Sidus (SIDUS) a good investment?: Analyzing the Potential and Risks of this Gaming Cryptocurrency

MAVIA vs CHZ: A Comparative Analysis of Two Leading Blockchain Gaming Ecosystems

GOG vs LINK: The Battle for Digital Distribution Supremacy in the Gaming Industry

Is NEXPACE (NXPC) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps