2025 ROOST Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of ROOST

ROOST (ROOST) is the champion of the Base ecosystem, dedicated to protecting, vibing and growing the ROOST community. Since its launch in April 2024, the token has established itself within the Base network ecosystem. As of January 2026, ROOST maintains a market capitalization of $215,400 with a circulating supply of 1,000,000,000 tokens, trading at approximately $0.0002154 per token.

This asset, which serves as a community-driven token within the Base ecosystem, is playing an increasingly important role in decentralized community building and ecosystem development.

This article will provide a comprehensive analysis of ROOST's price trends from 2026 to 2031, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environmental factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this Base ecosystem token.

ROOST Market Analysis Report

I. ROOST Price History Review and Market Status

ROOST Historical Price Evolution

-

April 2024: ROOST reached its all-time high (ATH) of $0.09382, marking the peak of its market valuation during the early phase of the project's trading history.

-

December 2025: ROOST hit its all-time low (ATL) of $0.0001957, representing a significant decline from historical peaks and reflecting substantial market correction.

-

Project Launch to Present: Since its publication date in March 2024 at an initial price of $0.025, ROOST has experienced considerable volatility, declining approximately 99.14% from its ATH to current levels.

ROOST Current Market Status

As of January 1, 2026, ROOST is trading at $0.0002154, reflecting a 24-hour price increase of 1.26% and a 7-day gain of 2.57%. However, the token displays significant downward pressure on longer timeframes, with a 30-day decline of -30.72% and a 1-year loss of -83.30%.

The token commands a market capitalization of $215,400, with a fully diluted valuation (FDV) equivalent to its market cap, indicating that all 1 billion ROOST tokens are currently in circulation (100% circulating supply). The 24-hour trading volume stands at $12,284.13, demonstrating modest trading activity relative to the market cap.

With a current market dominance of 0.0000068% and ranking at position 4,060 among all cryptocurrencies, ROOST maintains a relatively small position in the broader digital asset ecosystem. The token is held by approximately 86,136 addresses, indicating a distributed but limited holder base.

The current market sentiment reflects "Extreme Fear" with a VIX reading of 20, suggesting elevated volatility and bearish market conditions. The 24-hour trading range spans from $0.0002127 to $0.0002291, representing the ongoing price consolidation amid broader market uncertainty.

View current ROOST market price

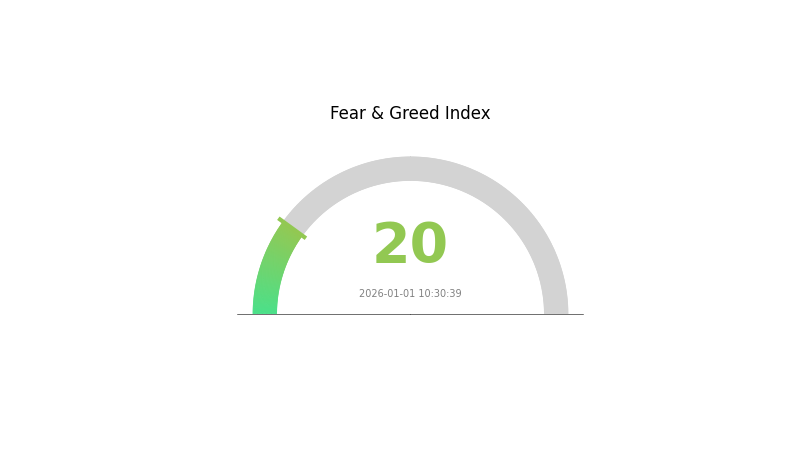

ROOST Market Sentiment Index

2026-01-01 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 20. This indicates significant market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors. However, caution remains warranted as market volatility may persist. Monitor key support levels and consider dollar-cost averaging strategies. Visit Gate.com to track real-time market sentiment and make informed trading decisions during this period of uncertainty.

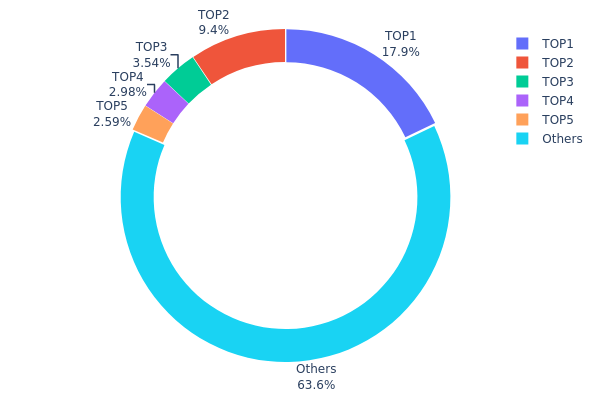

ROOST Holdings Distribution

The address holdings distribution chart illustrates the concentration of ROOST tokens across wallet addresses on the blockchain, revealing the decentralization degree and potential market structure risks. By analyzing the top holders and their proportional stakes, this metric provides critical insights into token ownership patterns and the overall health of the ecosystem.

ROOST currently exhibits moderate concentration characteristics. The top five addresses collectively control approximately 36.4% of the total token supply, with the largest holder (0xcdeb...87a432) commanding 17.90% and the second-largest (0x0d07...b492fe) holding 9.39%. While these figures indicate meaningful concentration among major holders, the remaining 63.6% distributed across other addresses suggests a reasonably diversified holder base. This distribution pattern falls within an acceptable range for established tokens, avoiding the extreme concentration risks typically associated with projects where top holders exceed 50% of circulating supply.

The current address distribution reflects a balanced market structure with controlled centralization risks. The concentration levels observed do not suggest imminent manipulation threats, as no single actor dominates the supply excessively. However, the combined holdings of the top five addresses warrant monitoring, particularly regarding coordinated selling pressure or governance decisions. The substantial proportion held by dispersed addresses indicates healthy ecosystem participation, supporting relatively stable on-chain dynamics. This distribution model demonstrates that ROOST maintains adequate decentralization while preserving the potential for meaningful influence by established stakeholders.

Click to view current ROOST holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcdeb...87a432 | 179034.17K | 17.90% |

| 2 | 0x0d07...b492fe | 93967.99K | 9.39% |

| 3 | 0x0bab...b3ac81 | 35398.84K | 3.54% |

| 4 | 0x5f36...d50f5c | 29822.31K | 2.98% |

| 5 | 0x4e3a...a31b60 | 25938.91K | 2.59% |

| - | Others | 635704.16K | 63.6% |

II. Core Factors Influencing ROOST's Future Price

Supply Mechanism

- Fixed Total Supply: ROOST has a total supply of 1,000,000,000 tokens with a circulating supply also at 1,000,000,000 tokens, directly impacting price and investment value.

- Historical Price Movement: ROOST reached its historical peak of $0.09382 USD on April 2, 2024, before experiencing a significant decline to $0.000348 USD by November 2025, representing a 99.6% decrease from its all-time high.

- Current Market Impact: The large supply combined with minimal trading volume (24-hour volume of $13,373.09 USD) suggests limited liquidity and high volatility typical of emerging cryptocurrencies.

Ecosystem Development

- Base Network Integration: ROOST is positioned as a "Base ecosystem champion," leveraging the growing Base network infrastructure to provide long-term value support and community protection.

- Market Demand Factors: Future price movement is primarily influenced by market demand, community support growth, and technological advancements within its ecosystem.

Macro-Economic Environment

- Cryptocurrency Market Volatility: As an emerging cryptocurrency, ROOST remains subject to high market volatility, with price movements reflecting broader crypto market sentiment and risk appetite among investors.

- Asset Accumulation Opportunity: The significant price decline from historical highs presents potential accumulation opportunities for risk-tolerant investors during bearish market conditions.

III. ROOST Price Forecast for 2026-2031

2026 Outlook

- Conservative Forecast: $0.0002 - $0.00022

- Neutral Forecast: $0.00022 - $0.00029

- Optimistic Forecast: $0.00029 (requires sustained market interest and ecosystem development)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual accumulation as the project establishes market presence

- Price Range Predictions:

- 2027: $0.00013 - $0.00032

- 2028: $0.00019 - $0.00031

- 2029: $0.00029 - $0.00043

- Key Catalysts: Ecosystem expansion, strategic partnerships, increased adoption on Gate.com and other platforms, positive regulatory developments, and growing institutional interest in emerging tokens

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00031 - $0.00053 (assumes steady market growth and continued project development)

- Optimistic Scenario: $0.00036 - $0.00060 (assumes accelerated adoption and favorable market conditions)

- Transformative Scenario: $0.00045+ (extreme favorable conditions including major exchange listings, significant protocol upgrades, and mainstream adoption)

- Cumulative Growth: ROOST demonstrates approximately 106% upside potential by 2031, reflecting strong appreciation trajectory across the forecast period

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00029 | 0.00022 | 0.0002 | 0 |

| 2027 | 0.00032 | 0.00025 | 0.00013 | 18 |

| 2028 | 0.00031 | 0.00029 | 0.00019 | 32 |

| 2029 | 0.00043 | 0.0003 | 0.00029 | 39 |

| 2030 | 0.00053 | 0.00036 | 0.00031 | 68 |

| 2031 | 0.0006 | 0.00045 | 0.00027 | 106 |

ROOST Investment Analysis Report

IV. ROOST Professional Investment Strategy and Risk Management

ROOST Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Community-focused investors and Base ecosystem supporters

- Operational recommendations:

- Accumulate during market downturns, as ROOST has experienced a -83.3% decline over the past year, potentially presenting entry opportunities for long-term believers

- Hold through community development phases, as ROOST aims to protect and grow the $ROOST community

- Monitor Base ecosystem developments, as ROOST's value is inherently tied to Base network adoption and growth

(2) Active Trading Strategy

- Market dynamics considerations:

- Current price volatility: 24-hour price range between $0.0002127 and $0.0002291

- Short-term momentum: +1.26% in 24-hour performance and +2.57% over 7 days, following a strong -30.72% monthly decline

- Wave operation focus points:

- Entry signals: Accumulate during price bounces from historical lows ($0.0001957 set on 2025-12-18)

- Exit considerations: Take profits during rallies above 24-hour highs, as liquidity remains limited with only $12,284.13 in 24-hour volume

ROOST Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0.5% - 1% maximum portfolio allocation

- Active investors: 1% - 3% portfolio allocation

- Professional investors: 3% - 5% with hedging strategies, considering the token's micro-cap status (market cap: $215,400)

(2) Risk Hedging Approaches

- Diversification strategy: Balance ROOST holdings with established Base ecosystem assets to reduce concentration risk

- Position sizing: Implement strict position limits given the low trading volume ($12,284.13 in 24-hour volume) and liquidity constraints

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 Wallet for frequent trading and community participation

- Security considerations: Given ROOST's focus on community, use non-custodial solutions to maintain token governance rights and community participation opportunities

- Primary risk alerts: Low liquidity may result in slippage; always verify contract addresses (0xeD899bfDB28c8ad65307Fa40f4acAB113AE2E14c on Base network) to avoid scams

V. ROOST Potential Risks and Challenges

ROOST Market Risk

- Extreme liquidity constraints: With only $12,284.13 in 24-hour trading volume and 1 billion circulating tokens, the token faces severe liquidity challenges that could result in significant slippage on large trades

- Price volatility: Historical price swing from $0.09382 (April 2024) to $0.0001957 (December 2025) demonstrates -79% depreciation, indicating extreme volatility unsuitable for risk-averse investors

- Limited trading venues: The token is listed on only 1 exchange, severely restricting accessibility and exit liquidity

ROOST Regulatory Risk

- Base network regulatory status: As a Base ecosystem token, ROOST faces potential regulatory challenges if Base network faces regulatory scrutiny

- Community token classification: Regulatory authorities may classify ROOST differently based on its community-focused positioning, potentially triggering compliance requirements

- Geographic restrictions: Some jurisdictions may restrict or prohibit trading of community tokens without proper registration

ROOST Technical Risk

- Smart contract audit status: No information available regarding security audits or code reviews

- Network dependency: ROOST's viability is entirely dependent on Base network's continued operation and adoption

- Token supply concentration: With a fixed supply of 1 billion tokens and circulating supply ratio of 100%, supply dynamics may impact price discovery and community distribution fairness

VI. Conclusion and Action Recommendations

ROOST Investment Value Assessment

ROOST positions itself as a community-driven champion of the Base ecosystem with an emphasis on protecting and growing its user base. However, the project presents significant challenges: extreme illiquidity ($12,284.13 daily volume), severe historical depreciation (-83.3% annually), and micro-cap status ($215,400 market cap). The token's value proposition remains primarily community-focused rather than fundamentally driven. For most investors, ROOST represents a highly speculative community token suitable only for those with deep Base ecosystem conviction and ability to absorb total loss.

ROOST Investment Recommendations

✅ Beginners: Avoid direct ROOST investment; instead, gain exposure through Base ecosystem diversification and learning about community token dynamics through research only.

✅ Experienced investors: Consider micro-allocations (0.5%-1% of portfolio) only if you have strong conviction in Base ecosystem growth and actively participate in the ROOST community; use Gate.com for any trading activities.

✅ Institutional investors: ROOST's micro-cap status, extreme illiquidity, and limited venue availability make it unsuitable for institutional allocation; focus on larger, more liquid Base ecosystem positions instead.

ROOST Trading Participation Methods

- Gate.com spot trading: Direct purchasing of ROOST through Gate.com's spot market at current prices; verify contract address (0xeD899bfDB28c8ad65307Fa40f4acAB113AE2E14c) before transactions

- Community participation: Engage with ROOST through official channels (https://roostcurrency.com/, https://x.com/RoostCurrency) to understand tokenomics and development roadmap before investing

- DCA strategy: If committed to long-term ROOST holdings, implement dollar-cost averaging over extended periods to reduce timing risk and average entry prices

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Consultation with professional financial advisors is recommended. Never invest funds you cannot afford to lose completely.

FAQ

What is the current price of ROOST token? How has its historical price trend been?

ROOST token is currently trading at ¥233.44. The token has shown varied price movements historically. For comprehensive historical price data and trend analysis, please visit the official ROOST website or community channels for real-time information.

What are the main factors affecting ROOST price?

ROOST price is primarily influenced by supply and demand dynamics, market sentiment driven by news and investor confidence, regulatory developments including policy changes, institutional adoption rates, and broader macroeconomic trends such as inflation and interest rates. These factors collectively determine ROOST's price movement and market outlook.

How to predict ROOST token price? What are the analysis methods?

Use technical analysis with moving averages and RSI indicators, analyze historical price trends, monitor trading volume and market sentiment, and track on-chain metrics to forecast ROOST price movements accurately.

What is the total supply and circulating supply of ROOST tokens?

ROOST has a total supply of 1 billion tokens with a maximum supply also capped at 1 billion. The circulating supply information is currently unavailable in public data sources.

ROOST代币在加密货币市场中的排名和市值如何?

ROOST代币在加密货币市场排名第2761位,市值为¥1,414,181 CNY,流通供给量为937,143,771 ROOST。

What are the risks of investing in ROOST tokens and what should I pay attention to?

ROOST token investment carries high market volatility and price fluctuation risks. Investors should conduct thorough research and bear full responsibility for investment decisions. Exercise caution and avoid over-leveraging positions.

YZY vs CHZ: The Battle of Streetwear Giants Shaping Urban Fashion Trends

Looking for new crypto assets to invest in

Is Moongate (MGT) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

ANIME vs BAT: The Epic Clash of Animation and Dark Knights

Is Skeb Coin (SKEB) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Nostra (NSTR) a good investment?: Evaluating the Potential and Risks of this Emerging Cryptocurrency

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps