Gate Research: Post-CPI Gains Retraced | De-Risking and Caution Dominate Market

Crypto Market Overview

- BTC (-0.91% | Current Price: 85,356.6 USDT): Over the past 24 hours, BTC surged briefly above $89,000 following the CPI data release but failed to hold those gains. It encountered clear selling pressure in the $89,000–90,000 range, triggering a rapid pullback that took prices as low as $84,460. Overall, the price action reflects a classic failed rally, followed by weak retracement and low-level oscillation. The moving average structure remains firmly bearish, with MA5 < MA10 < MA30, and price continuing to trade below the MA30. The short- to medium-term trend stays tilted toward weakness. In the near term, focus on the $86,000–86,500 resistance zone. If BTC cannot reclaim and hold above this level convincingly, the market is likely to see continued choppy oscillation or even fresh downside probes.

- ETH (-0.2% | Current Price: 2,822.53 USDT): Following a brief warming in risk sentiment driven by the CPI data, ETH rallied close to the $3,000 level but failed to establish a firm foothold. It subsequently pulled back, dipping as low as $2,775, reflecting an overall pattern of weak rebound momentum followed by range-bound consolidation under pressure. The moving average structure shows short-term lines repeatedly tangling below the MA30 without a clear upward inflection, with price action still suppressed by the prevailing trend. In the near term, monitor support around $2,800—a break below could open the door to further downside tests. The $3,000 level remains a key psychological and technical resistance overhead. In the medium term, ETH is expected to continue oscillating within the $2,800–3,000 range.

- Altcoins: The Fear & Greed Index remains at 16, firmly in the “Extreme Fear” zone, signaling sustained cooling in risk appetite. The market continues to operate in a predominantly defensive mode, characterized by proactive de-risking and caution.

- Macro: On December 18, the S&P 500 rose 0.79% to close at 6,774.76 points; the Dow Jones Industrial Average gained 0.14% to 47,951.85 points; and the Nasdaq Composite advanced 1.38% to 23,006.36 points.As of 12:45 AM on December 19 (UTC+8), spot gold is temporarily quoted at $4,348 per ounce, down 0.39% over the past 24 hours.

Trending Tokens

JELLYJELLY jelly-my-jelly (+45.19%, Circulating Market Cap: $131M)

According to Gate.com market data, the JELLYJELLY token is currently trading at around $0.13, with a surge of over 45% in the past 24 hours. Jelly-My-Jelly (JELLYJELLY) is a Solana-based meme coin launched in early 2025 via the pump.fun platform. While it started with heavy reliance on community hype and meme culture rather than strong inherent utility, it has since tied into an upcoming AI-powered video-sharing app (similar to a podcast-focused TikTok), offering potential features like micropayments and rewards for token holders.

Recently, some established Solana meme coins have regained traction, and JELLYJELLY has benefited from capital rotation out of other tokens (such as PIPPIN and similar plays). In a broadly weak market environment, its appearance on Gate.com’s 24-hour gainers leaderboard has drawn additional attention and buying interest, further driving the price higher.

NBLU NuriTopia (+39.45%, Circulating Market Cap: $5.57M)

According to Gate.com market data, the NBLU token is currently quoted at $0.0025, with a gain of nearly 40% over the past 24 hours. NuriTopia (NBLU) is a blockchain-based metaverse social platform, with core features including “FRIENDS & HANGOUTS,” virtual dating, an NFT marketplace, health consulting, community clubs, virtual office spaces, and more. Users can create personalized avatars and pets, engage in interactions, content creation, and trading, while earning rewards through participation in various activities.

The recent surge in NBLU appears tied to speculation around low-market-cap tokens. As a long-dormant small-cap project with no clear fundamental catalysts, its volatility is likely driven primarily by low liquidity, leveraged trading, and hype in group chats or communities. Historically, the token has experienced multiple sharp pumps and dumps, making it particularly susceptible to manipulation.

IR AI Infrared (+24.65%, Circulating Market Cap: $54.82M)

According to Gate.com market data, the IR token is currently quoted at $0.2589, with a gain of nearly 25% over the past 24 hours. Infrared Finance (IR) is the core infrastructure protocol on the Berachain blockchain, centered around Berachain’s Proof of Liquidity (PoL) mechanism. It is the first system to integrate liquid staking, validator infrastructure, and automated yield vaults into a unified platform, serving as a pillar of Berachain’s yield economy.

The surge in IR is primarily driven by the new listing effect and exchange promotional activities. IR was recently listed on major platforms like Gate.com, where events such as CandyBomb and trading competitions have drawn significant user participation in trading and mining, amplifying volume and price momentum. As a new project, IR is in the typical post-listing premium phase, but its long-term performance will depend on the broader development of the Berachain ecosystem.

Alpha Insights

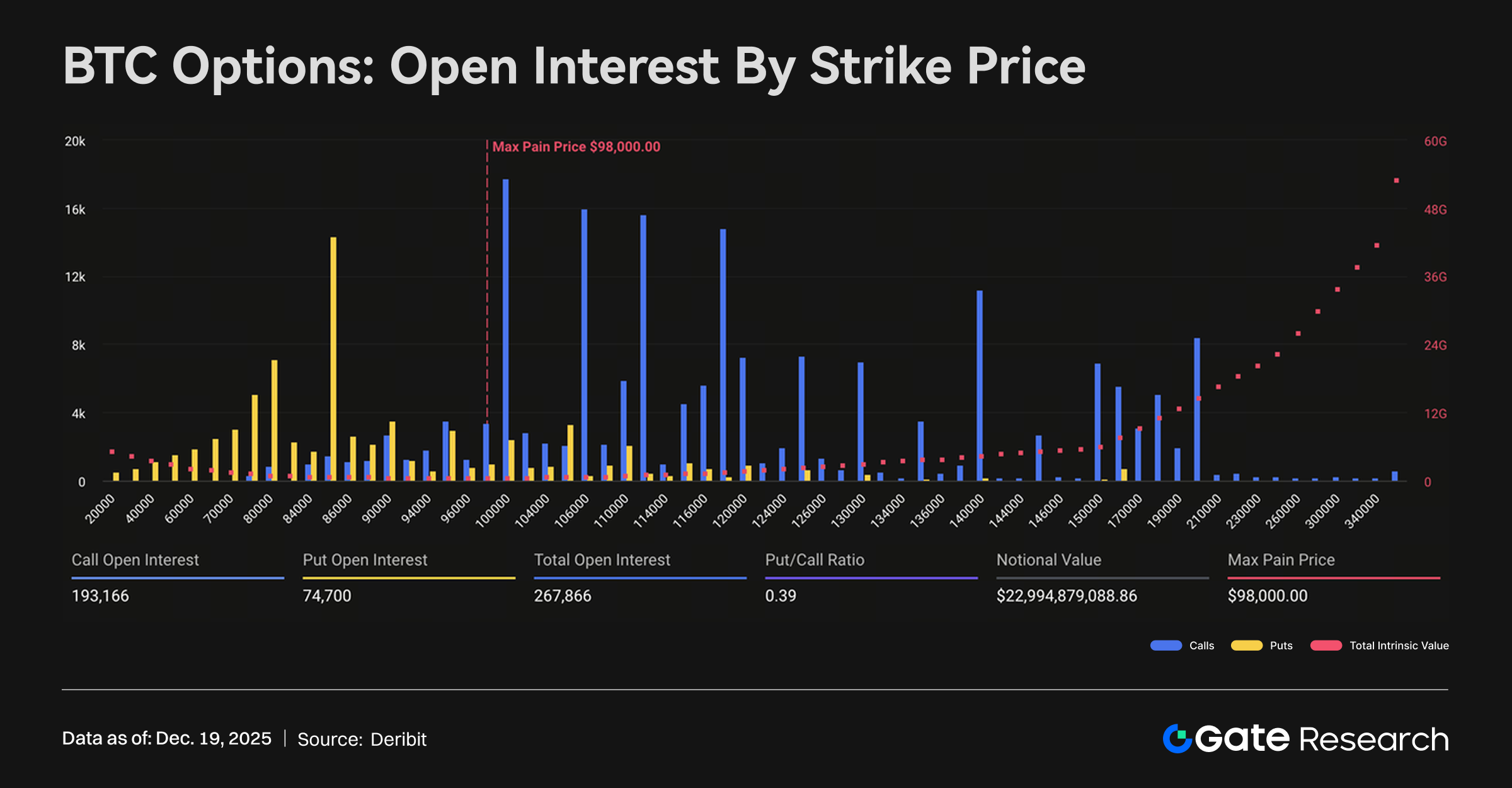

$23 Billion Options Expiry Emerges as BTC’s Biggest Near-Term Risk

Approximately $23 billion in BTC options contracts are set to expire on December 26, 2025 (next Friday), representing more than half of the total open interest—a massive scale. Options expiries of this magnitude often amplify volatility as traders adjust positions ahead of the deadline, particularly when a large volume concentrates on a single date.

Meanwhile, 30-day implied volatility has climbed back toward 45%, and the skew stands at around -5%. The negative skew signals stronger demand for put options, making downside protection more expensive. This pattern isn’t limited to the short term; similar dynamics are seen in Q1 and Q2 2026 contracts, indicating traders are aggressively buying puts to hedge against downside risks, with bearish positioning dominating the market.

Notably, BTC has already fallen about 30% from its all-time high above $126k in early October 2025, putting the current quarter on track for its worst performance since the Q2 2022 Terra/LUNA collapse.

Lido DAO Accelerates Diversification with $60 Million Ecosystem Budget Proposal

Lido DAO is seeking approval for a $60 million ecosystem grant budget for 2026, aimed at executing the third phase of its GOOSE (Guided Open Objective Setting Exercise) strategy. The proposal seeks to evolve Lido from a single-product Ethereum liquid staking token (LST) protocol into a multi-product innovative organization.

Key priorities include expanding the product lineup, developing new revenue streams, and strengthening long-term protocol resilience, moving beyond its core ETH staking operations—where Lido currently controls nearly 24% of all staked Ethereum. In DeFi TVL rankings, Lido holds second place with approximately $25.7 billion, trailing only Aave at $33.2 billion. This diversification effort addresses potential risks, such as past community concerns over staking centralization, while building on prior GOOSE and reGOOSE initiatives (e.g., Staking Router development, Dual Governance, L2 integrations, and restaking support).

The budget, if approved via LDO holder vote, will provide ongoing funding to contributor groups, the foundation, and related projects for R&D, audits, deployment, and new product exploration. Community forum feedback has been relatively calm so far, with no major controversies emerging.

Overall, this shift from LST dominance to a broader DeFi ecosystem layout signals Lido’s accelerated push toward diversification and expansion in 2026, though future success will hinge on efficient fund allocation and execution risks.

JPMorgan Forecasts Stablecoin Market Cap at $500–600 Billion by 2028

JPMorgan analysts have recently reiterated a conservative outlook for the stablecoin market, projecting a total market capitalization of approximately $500–600 billion by 2028—well below the trillion-dollar mark and far short of more optimistic forecasts from peers like Citi (base case of $1.9 trillion by 2030, bull case up to $4 trillion) or Standard Chartered (up to $2 trillion by 2028).

Since the start of 2025, the stablecoin market has grown by around $100 billion, pushing the total beyond $300 billion (with recent figures hovering near $310 billion). This expansion has been largely driven by the two dominant issuers: Tether (USDT) and Circle (USDC). However, demand remains heavily concentrated in crypto-native activities, such as trading, derivatives collateral, DeFi lending, and idle fund holding for yield—rather than widespread real-world payment adoption.

JPMorgan expects stablecoin growth to track broadly in line with the overall crypto market capitalization, maintaining a stable share of around 7–8%. Key constraining factors include rising velocity of circulation in payment systems (reducing the need for larger stockpiles), competition from bank-tokenized deposits and CBDC, regulatory preferences for non-transferable designs to preserve financial stability, and strengthening of traditional systems like SWIFT through blockchain experiments.

Ultimately, stablecoins are unlikely to dramatically decouple from the broader crypto ecosystem, and expanded payment use cases may not trigger explosive market cap growth. Bank-led tokenization efforts could further encroach on space currently occupied by private stablecoins.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/crypto-market-data

- Investing, https://investing.com/indices/usa-indices

- Investing, https://investing.com/currencies/xau-usd

- CoinGecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Bloomberg, https://www.bloomberg.com/news/articles/2025-12-18/bitcoin-volatility-rises-ahead-of-23-billion-options-expiration?srnd=phx-crypto

- The Block, https://www.theblock.co/post/383236/jpmorgan-stablecoin-market-projections?utm_source=twitter&utm_medium=social

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

How to Do Your Own Research (DYOR)?

What Is Technical Analysis?

12 Best Sites to Hunt Crypto Airdrops in 2025