The Glory, the Downturn and Turmoil of DeFi

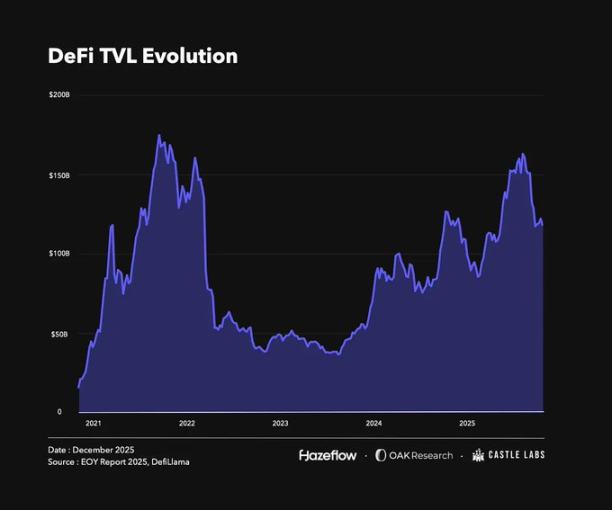

Reflecting on the past, DeFi has gone through cycles of boom, bust, and upheaval. Today, it stands on solid ground, with key metrics showing a consistent trend of “higher highs and higher lows.” It’s worth noting that many changes in TVL (Total Value Locked) closely track asset prices, since the assets locked in DeFi are typically volatile tokens whose price swings directly impact core data.

At the time of writing, TVL remains above its level at the start of the year. While the difference isn’t dramatic, a peak occurred in October when major crypto assets hit all-time highs. The subsequent “October liquidation event” resulted in $19 billion in liquidations, triggering protocol failures and a roughly 28% drop in total TVL, along with declines in related token prices.

Still, this report section isn’t just about protocol failures and cascading liquidations. It’s a thorough review of DeFi’s overall development, growth, and transformation over the past year.

DeFi in 2025: The New Landscape

This year, a number of protocols and sectors have captured market attention. While it’s impossible to cover every success story, we’ll focus on a few representative cases.

Leading Protocols

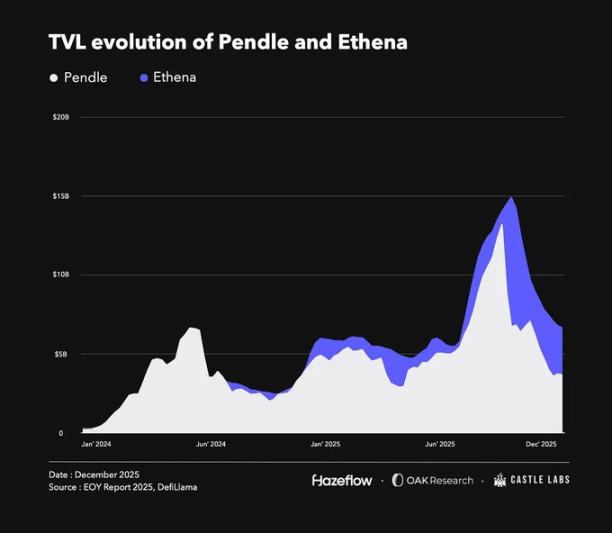

2025 is the “Year of Yield,” and @pendle_fi stands at the forefront. Pendle splits yield-bearing assets into principal (PT tokens) and yield (YT tokens). Yield can be traded independently, while principal is redeemable at maturity. This innovation, combined with partnerships with protocols like @ethena_labs and @aave, has fueled TVL growth.

It’s important to highlight that Pendle’s TVL is not at an all-time high and is currently below its level at the year’s start, with the peak in mid-September. This was mainly due to the launch of its Plasma chain, which incentivized users to migrate assets from other platforms, temporarily reducing TVL. Still, Pendle’s fundamentals remain strong, and it has solidified its role as a core yield distribution platform.

Pendle is also expanding yield services via the Boros protocol. Boros lets users long or short yield units (YU) to hedge or leverage funding rate risk. A YU represents the yield generated by one unit of collateral from issuance to maturity. For example, 1 YU-ETH equals the yield from 1 ETH until maturity—functionally similar to Pendle’s YT tokens.

@ethena_labs is another standout this year. Ethena introduced USDe, a synthetic dollar stablecoin that generates yield through basis trading. USDe is backed by volatile assets like BTC, ETH, and LSTs. To stay delta-neutral, Ethena hedges spot positions and opens perpetual shorts as margin. Although the position is delta-neutral, it earns yield from funding rates paid by longs to shorts in perpetual contracts.

Like Pendle, Ethena’s TVL declined in the second half, mainly after the October liquidation event while TVL was at its peak. The drop was triggered by a brief USDe depeg on @binance, which led to liquidations of USDe-based positions and a chain reaction in TVL. In reality, USDe itself remained secure; the Binance depeg resulted from oracle configuration and low liquidity in that pair. On platforms like Aave, where USDe/USDT prices are hardcoded, positions were unaffected.

Ethena’s moat is both robust and scalable. Recently, they’ve focused on “Stablecoin-as-a-Service,” issuing custom stablecoins for specific use cases in partnership with @megaeth, @JupiterExchange, @SuiNetwork, and others. This approach helps capture value that would otherwise flow out of the ecosystem (to Tether or Circle) and returns it on-chain. Tether and Circle each generate billions in annual revenue from stablecoins, but that value doesn’t flow back to the underlying chains and protocols that use them.

Ethena is also expanding token utility, recently launching USDe-margined perpetual DEX contracts on the Hyperliquid HIP-3 standard via @hyenatrade. Its key feature: traders can use USDe as margin and earn attractive APY, while using other stablecoins as margin yields nothing.

By broadening its core business and application scenarios, Ethena is well positioned to further grow its stablecoin market share in the coming years.

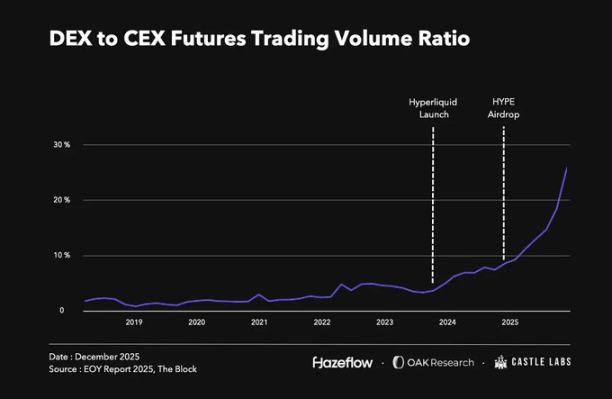

Among top-performing protocols, @HyperliquidX has led the pack across multiple metrics this year. After its token launch, it quickly became a premier venue for on-chain perpetual trading. The protocol generates substantial revenue and fees, all funneled into token buybacks, which has significantly boosted its market cap. Hyperliquid is building comprehensive financial infrastructure, advancing steadily with its HIP-3 upgrade and HyperEVM rollout.

Winning Sectors

Successful protocols often emerge from high-performing sectors. This year’s two biggest winners: perpetual contracts and stablecoins, both of which have found strong product-market fit and sustained demand.

Perpetual trading has long been a crypto market mainstay, with daily volumes in the tens of billions. Until this year, most of that volume was on centralized exchanges. This changed after Hyperliquid’s major airdrop at the end of 2024, which reignited interest in on-chain perpetuals and intensified competition. DEX perpetual volumes now account for a record 18% of CEX volumes. Protocols like @Lighter_xyz, @Aster_DEX, @extendedapp, and @pacifica_fi are all entering the space, competing for on-chain perpetual growth.

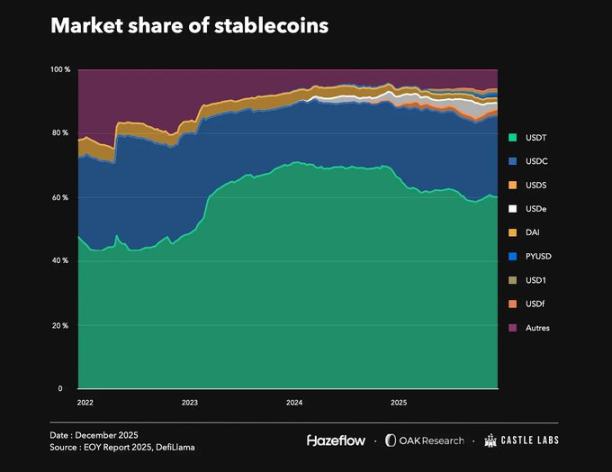

Stablecoins are the other breakout sector, with total market cap now around $309 billion—up over 50% from $200 billion at the year’s start. Demand for stablecoins has grown steadily for years, and with 300+ issuers, competition is fierce.

Despite the crowded field, @Tether_to (USDT) and @circle (USDC) still dominate, holding 85% market share, followed by Ethena (USDe) and @SkyEcosystem (USDS). Thanks to first-mover advantage and deep on-chain integration, Tether and Circle remain dominant even as new players enter.

This dominance creates a challenge: a massive value outflow from native ecosystems to external entities. In the past 30 days, Tether and Circle generated about $700 million and $240 million in revenue, respectively, thanks to their widespread use across chains and protocols. To address this, Ethena launched “Stablecoin-as-a-Service” to help blockchains retain value internally. Still, unseating Tether and Circle is extremely tough—they’re deeply embedded in the crypto infrastructure.

The October Liquidation Event

The October liquidation event—dubbed the “crypto stress test”—hit on October 10, wiping out over $19 billion in assets. The immediate trigger was Trump’s announcement of a 100% tariff hike on China in response to China’s rare earth export restrictions and expanded controls. Weeks later, a leaked JPMorgan memo suggested Strategy could be removed from the MSCI index, further fueling panic.

Asset prices plunged across the board. BTC and ETH fell 23% and 33% from their highs. The crypto market cap dropped from roughly $4.24 trillion on October 10 to $3.16 trillion as of this writing—a 25% decline.

On Binance and other platforms, Ethena’s yield-bearing stablecoin USDe depegged due to reliance on spot prices with low liquidity, resulting in unfair liquidations. Ultimately, the exchange compensated affected users with over $280 million, covering assets like BNSOL and WBETH.

DeFi lending protocols performed robustly, executing liquidations as designed and incurring virtually no bad debt. Protocols like @Aave, @Morpho, @0xFluid, and @eulerfinance collectively liquidated over $260 million in assets, with minimal bad debt.

While blue-chip DeFi and CeFi withstood the test, many other protocols and leveraged strategies—especially recursive borrowing on lending and perpetuals platforms—suffered major losses.

Recursive borrowing lets users gain leverage in lending protocols. With the rise of yield-bearing assets, this strategy became popular since it’s profitable when yields exceed borrowing costs. But in volatile markets, even minor depegs can crush leveraged positions. On October 10, as prices crashed, many users couldn’t close in time and were liquidated.

While leverage drove many losses, cases like Stream Finance stand out—they’re a stark warning against blindly chasing high yields. We’ll break this down in the next section.

Are Stablecoins Truly Stable? The Stream Finance Case

In Q4, several stablecoins with flawed mechanisms collapsed. They may have lasted longer, but the October liquidation event wiped out some over-leveraged stable assets. The largest and most far-reaching failures were xUSD (Stream Finance) and deUSD (Elixir), which were interlinked and crashed together.

Stream Finance, for example, essentially sold an over-leveraged, undercollateralized “stablecoin”—xUSD. When users deposited collateral, the protocol minted xUSD, swapped deposits for Elixir’s high-yield deUSD, and deposited it into lending protocols like Euler and Morpho.

Instead of simple looping, they minted even more xUSD, ballooning supply to seven times the actual collateral. Just $1.9 million in verifiable USDC collateral supported $14.5 million in xUSD.

The protocol also had off-chain risk exposures unknown to users. During the October 10 liquidation, its main off-chain positions were liquidated, leading to a $93 million loss and withdrawal shutdown. The closure triggered panic selling by xUSD holders in thin secondary markets, causing a rapid depeg. Elixir’s deUSD soon depegged as well, though most user redemptions were processed.

All vaults and managers exposed to these stablecoins in protocols like Euler and Morpho suffered losses. Some protocols even incurred bad debt by using fixed-price oracles that hardcoded these assets at $1 even after depegging. There’s no perfect pricing solution; proof-of-reserves oracles can help, but stablecoins like xUSD are often over-leveraged or lack collateral transparency. Ultimately, users chasing high APY in such trades must recognize the risks and do thorough due diligence.

Back to Basics: Revenue Rules

Revenue is the backbone of any business. If a protocol is profitable and has mechanisms to return value to token holders, everyone benefits. Of course, reality is more complex, and token holders often bear the downside. Before discussing value accrual, let’s examine crypto’s main revenue sources.

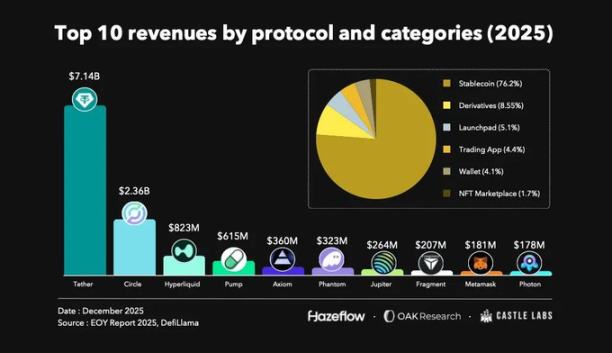

In the past year, the top ten protocols by revenue saw stablecoin issuers contribute about 76% of total revenue, followed by derivatives, launchpads, and trading apps.

Stablecoins remain crypto’s most profitable business, thanks to broad adoption. They’re DeFi’s foundation and the main entry and exit point for capital. Derivatives and launchpads also deliver strong revenue shares.

Over the past year, Tether and Circle generated a combined $9.8 billion in revenue, maintaining that scale. Next are derivatives leaders Hyperliquid and Jupiter, with combined revenue of $1.1 billion.

Beyond these established sectors, protocols like Pumpdotfun also generate sustainable revenue. Some top-earning protocols only launched last year, reflecting the market’s appetite for new alternatives. Incentives are crucial for early protocol growth and user acquisition, and unique features can help retain users.

Previously, Uniswap—one of DeFi’s largest protocols—couldn’t tie its token directly to protocol revenue due to regulatory constraints. The newest proposal burned 100 million UNI from the treasury, matching what would have been burned if protocol fees were enabled from inception. Now, protocol fees are live, used to burn UNI, and Uniswap has stopped charging for its frontend, wallet, and API.

This aligns protocol growth more directly with the governance token’s value. More projects are adopting value-aligned models to direct more value to token holders.

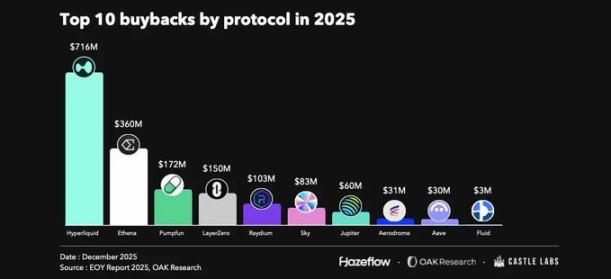

Buybacks Go Mainstream

In the past, token performance was driven largely by marketing, with little user focus on protocol economics. This may have favored short-term speculators, but it was unsustainable—many holders couldn’t exit. Today, protocol economics and real revenue are the core value drivers, not just hype.

The launch of the HYPE token and its value accrual mechanism was pivotal. The protocol injects 99% of revenue into an assistance fund for HYPE buybacks, reigniting perpetuals market interest—Hyperliquid set a high bar here. These buybacks provide strong price support and fuel value growth.

It’s not just Hyperliquid. Blue-chip protocols like Aave, Maple, and Fluid have also launched buyback programs. Buybacks are a compelling way to share revenue with token holders, but require sustainable protocol income. As a result, buybacks suit mature protocols, while early-stage projects should prioritize growth.

Since April, Aave has spent about $33 million on buybacks.

Likewise, Fluid has completed roughly $3 million in buybacks since October, returning revenue directly to token holders.

Disclaimer:

- This article is republished from [Foresight News], with copyright belonging to the original authors [Castle Labs, OAK Research, Hazeflow]. For concerns about this republication, contact the Gate Learn team, which will address it promptly per relevant procedures.

- Disclaimer: The views and opinions expressed are those of the author alone and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize without referencing Gate where applicable.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What Is a Yield Aggregator?

What is Stablecoin?