BH

Gate FunGo to Trade

MC:$2.43KHolders:1

0.00%

Before00zero

0

0

- Bitcoin Price Expectations: Bitcoin drops below $68,000 amid a defensive stance for recovery

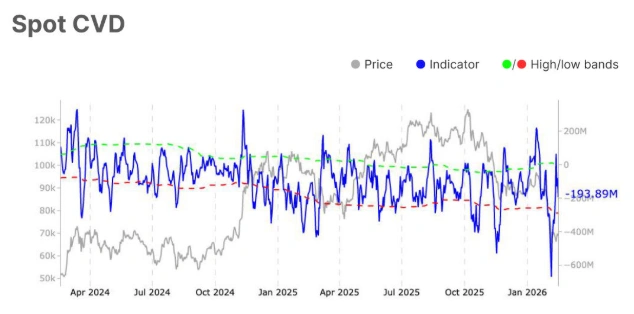

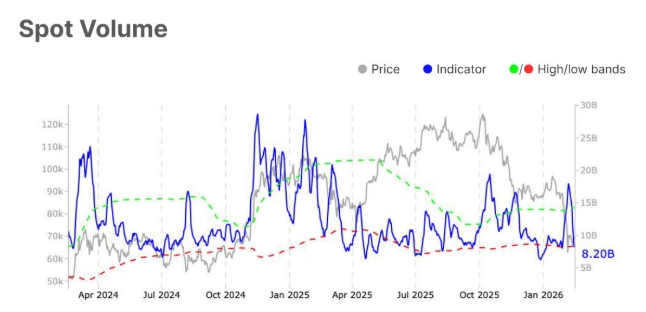

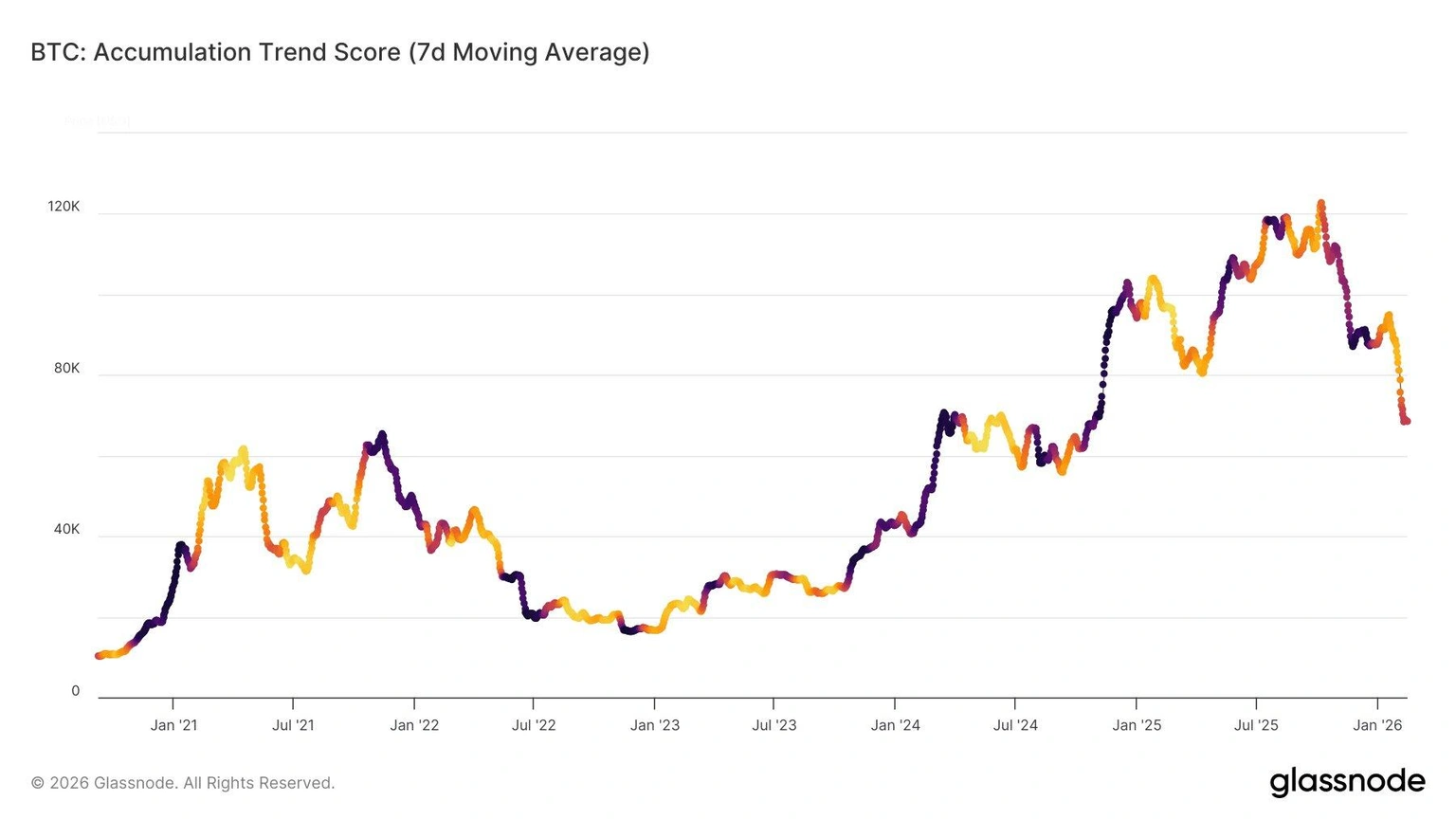

Bitcoin (BTC) is trading below $68,000 as of the time of writing this report on Tuesday after facing resistance near the upper boundary of accumulation. A Glassnode report indicates that market conditions remain defensive for the king of cryptocurrencies, maintaining a sideways market stability, while sustainable recovery depends on renewed spot demand. Meanwhile, technical forecasts suggest that Bitcoin could fall further toward the $60,000 level if it breaks below the lower boundary of accumulation

Bitcoin (BTC) is trading below $68,000 as of the time of writing this report on Tuesday after facing resistance near the upper boundary of accumulation. A Glassnode report indicates that market conditions remain defensive for the king of cryptocurrencies, maintaining a sideways market stability, while sustainable recovery depends on renewed spot demand. Meanwhile, technical forecasts suggest that Bitcoin could fall further toward the $60,000 level if it breaks below the lower boundary of accumulation

BTC-2,37%

- Reward

- 3

- Comment

- Repost

- Share

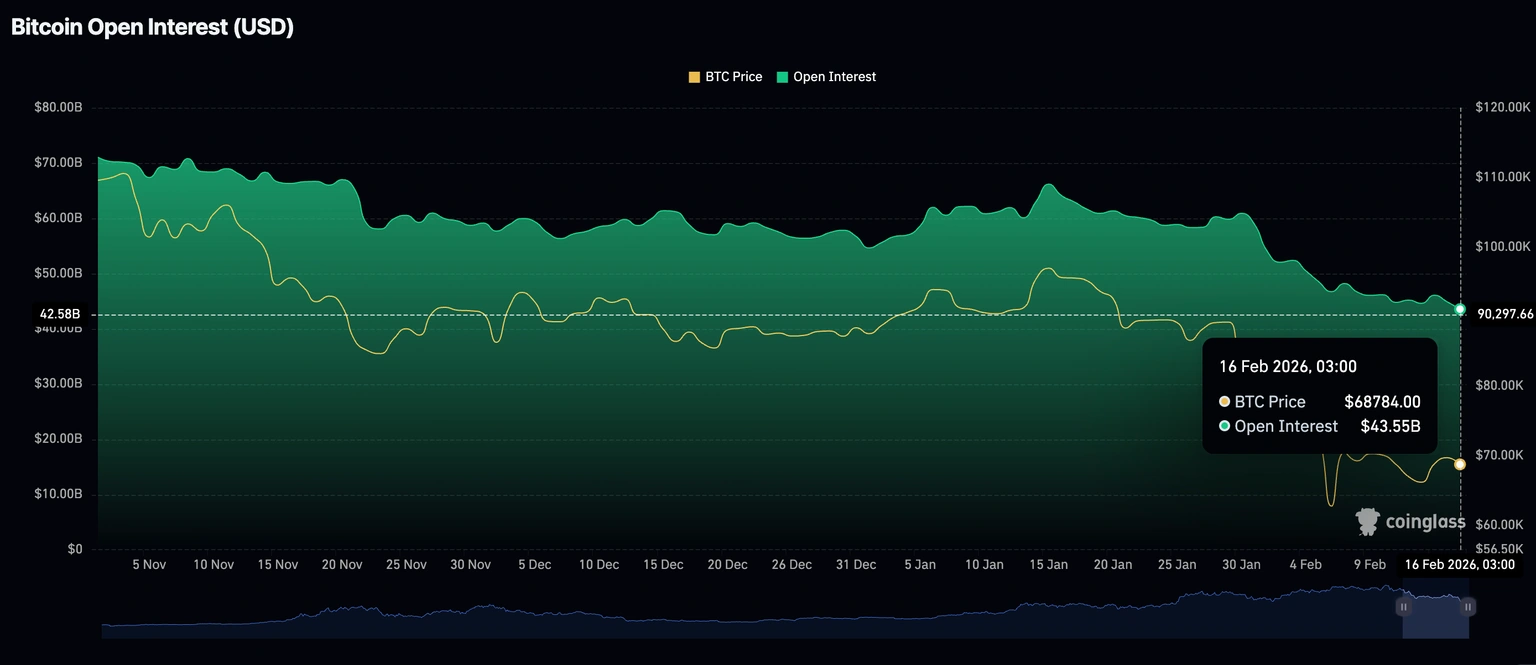

- Limited Rise in Bitcoin and Ethereum Value Amid Weak Derivatives:

Bitcoin is trading in a weak environment in the derivatives market, with open futures contracts decreasing to $43.55 billion on Monday from $44.87 billion. Since Bitcoin reached an all-time high of $126,199 in October, with open contracts totaling $94.12 billion, retail investors have gradually lost interest, leading to a continuous decline in price.

The decline in retail investor activity indicates their lack of confidence in Bitcoin's ability to sustain gains or extend its bullish trend. Therefore, they tend to close their p

View OriginalBitcoin is trading in a weak environment in the derivatives market, with open futures contracts decreasing to $43.55 billion on Monday from $44.87 billion. Since Bitcoin reached an all-time high of $126,199 in October, with open contracts totaling $94.12 billion, retail investors have gradually lost interest, leading to a continuous decline in price.

The decline in retail investor activity indicates their lack of confidence in Bitcoin's ability to sustain gains or extend its bullish trend. Therefore, they tend to close their p

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

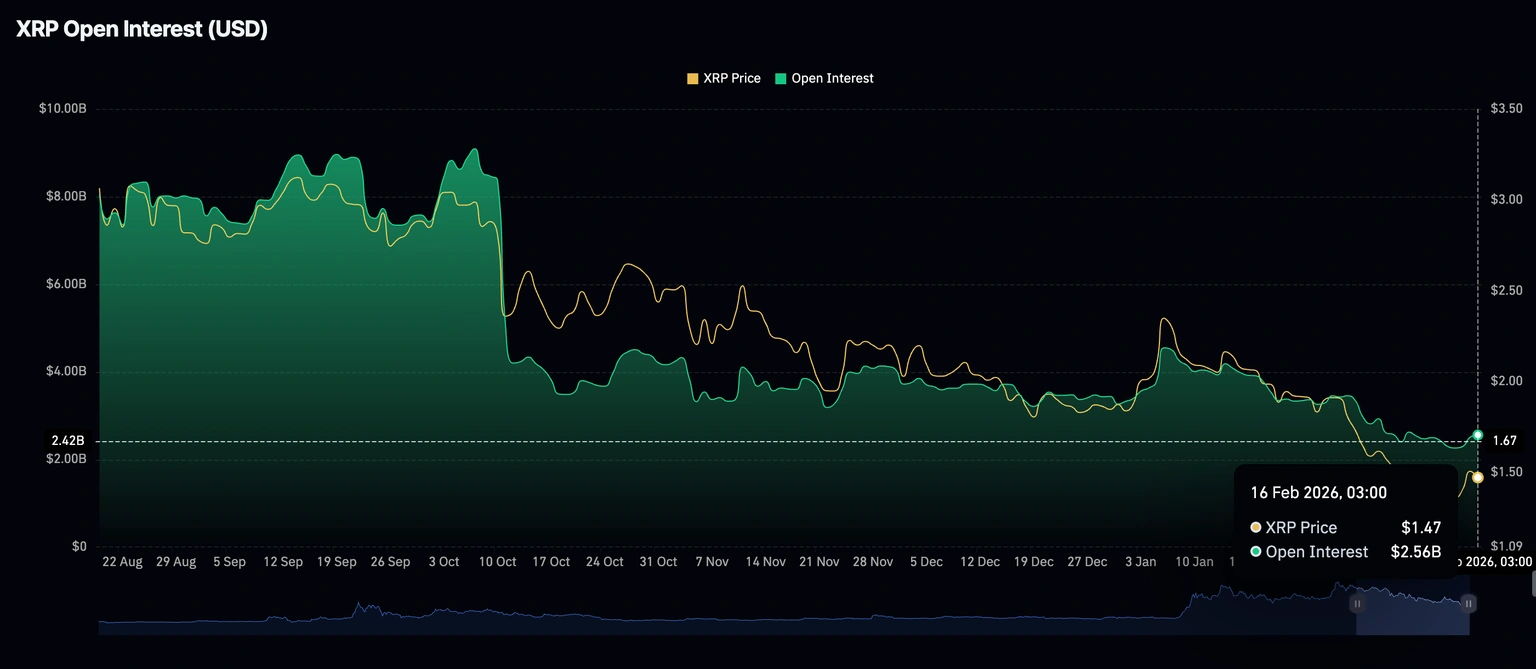

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) still show limited volatility, remaining within narrow ranges at the time of writing this report on Monday. The chances of sustained price increases are limited by low retail investor participation and weak technical fundamentals.- Technical Outlook: Can XRP Sustain Its Recovery?

XRP price is fluctuating around $1.36, well below the 50-day exponential moving average of $1.76, the 100-day EMA of $1.97, and the 200-day EMA of $2.16. All three moving averages are trending downward, reinforcing the bearish trend.

The Moving Average Convergence Divergence (MACD) remains below the signal line and under zero. Meanwhile, the red histogram bars are shrinking, indicating a slowdown in bearish momentum. However, the Relative Strength Index (RSI) at 32, close to oversold territory, suggests weakening market strength, while the dow

XRP price is fluctuating around $1.36, well below the 50-day exponential moving average of $1.76, the 100-day EMA of $1.97, and the 200-day EMA of $2.16. All three moving averages are trending downward, reinforcing the bearish trend.

The Moving Average Convergence Divergence (MACD) remains below the signal line and under zero. Meanwhile, the red histogram bars are shrinking, indicating a slowdown in bearish momentum. However, the Relative Strength Index (RSI) at 32, close to oversold territory, suggests weakening market strength, while the dow

XRP-1,27%

- Reward

- 1

- Comment

- Repost

- Share

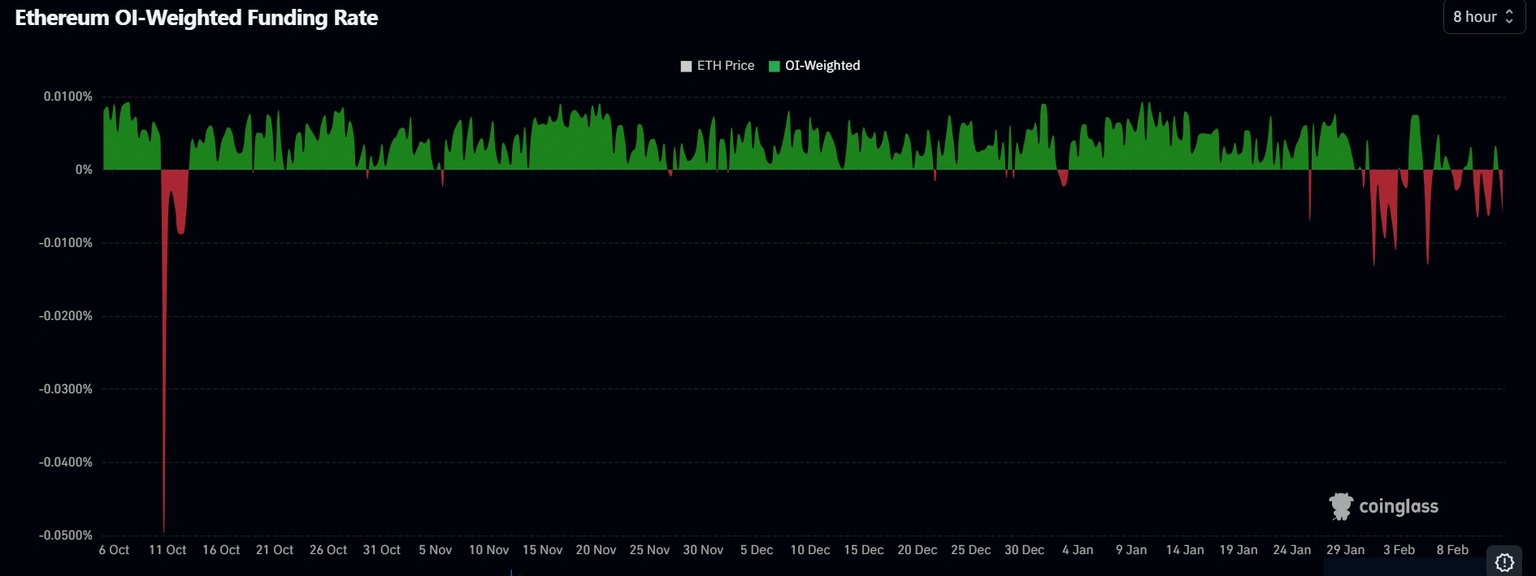

- Ethereum Price Outlook: Ethereum recovers to $2000, but the downtrend remains

Ethereum network experienced liquidations worth $70 million over the past 24 hours, with the most notable being long positions totaling $58 million as of this report, according to CoinGlass data. Since the beginning of the week, total liquidations have reached $456 million.

On the weekly chart, the ETH/USDT pair is trading at $2055. The price remains below the 20-week exponential moving average (EMA) at $2999, and the moving average is trending downward, limiting any rebounds. The continued gap below this indicator

Ethereum network experienced liquidations worth $70 million over the past 24 hours, with the most notable being long positions totaling $58 million as of this report, according to CoinGlass data. Since the beginning of the week, total liquidations have reached $456 million.

On the weekly chart, the ETH/USDT pair is trading at $2055. The price remains below the 20-week exponential moving average (EMA) at $2999, and the moving average is trending downward, limiting any rebounds. The continued gap below this indicator

ETH-0,97%

- Reward

- 3

- 1

- Repost

- Share

100UsdBravelyVentureIntoThe :

:

Volatility is an opportunity 📊- Daily Chart: Technical Outlook for Bitcoin:

Bitcoin is attempting to recover above the support level at $65,118, supported by the Relative Strength Index (RSI) which has stabilized at 31 on the daily chart after recently rising from the oversold region. Continued RSI recovery toward the midline will confirm a new bullish dominance, with bearish momentum waning.

Meanwhile, the Moving Average Convergence Divergence (MACD) is narrowing the gap with the signal line on the same chart. Additionally, the red histogram bars are steadily decreasing, indicating that sellers may have overextended their

Bitcoin is attempting to recover above the support level at $65,118, supported by the Relative Strength Index (RSI) which has stabilized at 31 on the daily chart after recently rising from the oversold region. Continued RSI recovery toward the midline will confirm a new bullish dominance, with bearish momentum waning.

Meanwhile, the Moving Average Convergence Divergence (MACD) is narrowing the gap with the signal line on the same chart. Additionally, the red histogram bars are steadily decreasing, indicating that sellers may have overextended their

BTC-2,37%

- Reward

- 1

- Comment

- Repost

- Share

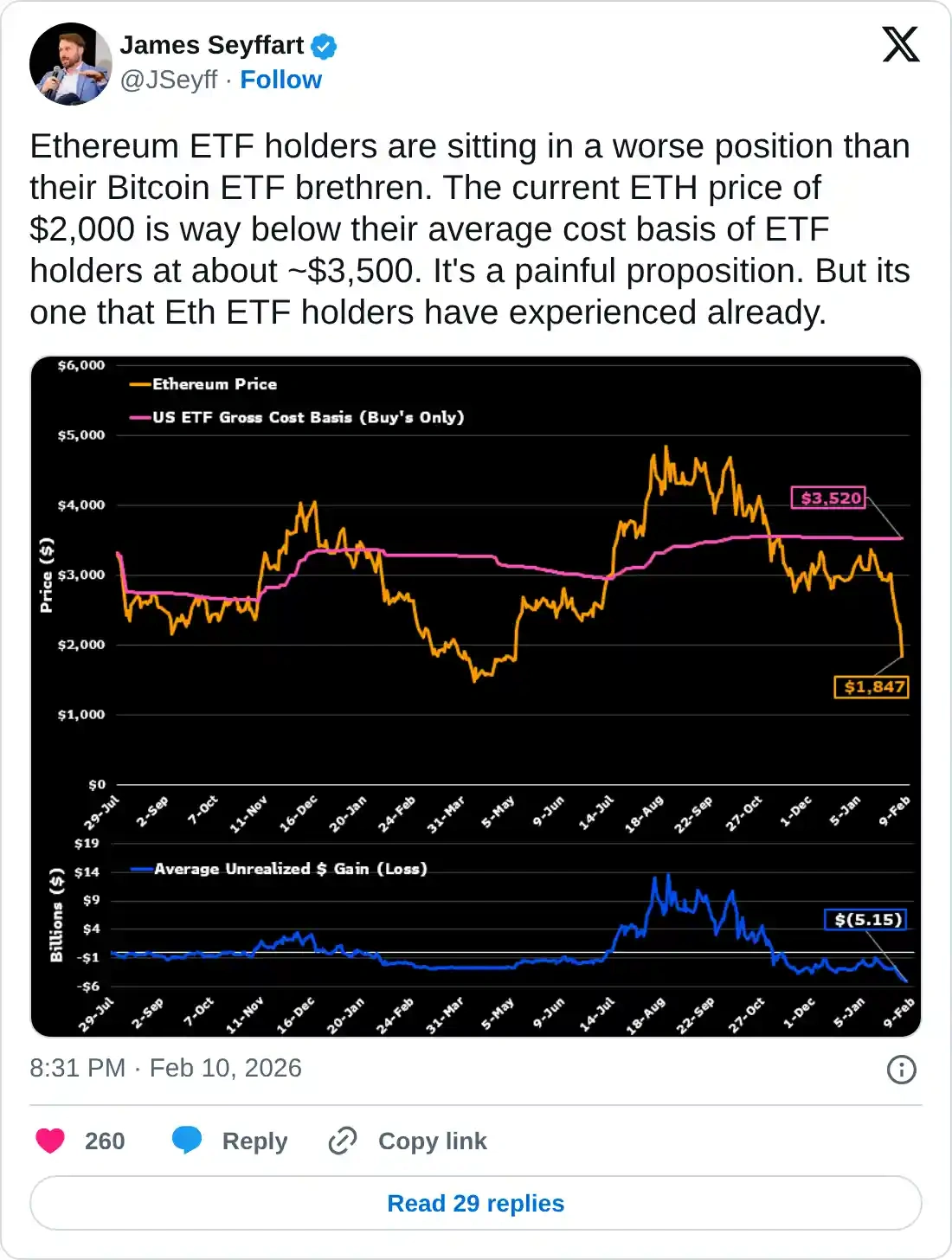

- Ethereum Price Expectations: Investors in Ethereum ETFs face significant unrealized losses following a price decline:

Ethereum Price Today: $1920

Ethereum ETF investors are experiencing unrealized losses of approximately $5.15 billion after a 60% price drop over the past four months.

Net inflows decreased from around $15 billion to just under $12 billion during that period.

Ethereum continues its downward trend, aiming for the support level of $1740.

Ethereum ETF funds (ETH) in the U.S. spot market turned negative again on Wednesday after recording net outflows of $129.1 million, reversing t

Ethereum Price Today: $1920

Ethereum ETF investors are experiencing unrealized losses of approximately $5.15 billion after a 60% price drop over the past four months.

Net inflows decreased from around $15 billion to just under $12 billion during that period.

Ethereum continues its downward trend, aiming for the support level of $1740.

Ethereum ETF funds (ETH) in the U.S. spot market turned negative again on Wednesday after recording net outflows of $129.1 million, reversing t

ETH-0,97%

- Reward

- 1

- Comment

- Repost

- Share

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

News

View MoreCoinShares: Asset management scale will reach $7.4 billion by the end of 2025, with a $21.5 million dividend payout

1 m

TradFi上涨提醒:GBPNZD上涨超0.5%

7 m

Investment bank TD Cowen: If Trump agrees to fill the Democratic vacancies at the SEC and CFTC, the progress of the "CLARITY Act" could be effectively advanced.

7 m

Federal Reserve officials debate the script for rate cuts and reopening, with inflation risk becoming the biggest obstacle

10 m

Crypto Fear Index drops to 8, market "extreme fear" sentiment intensifies

24 m

Pin