Post content & earn content mining yield

placeholder

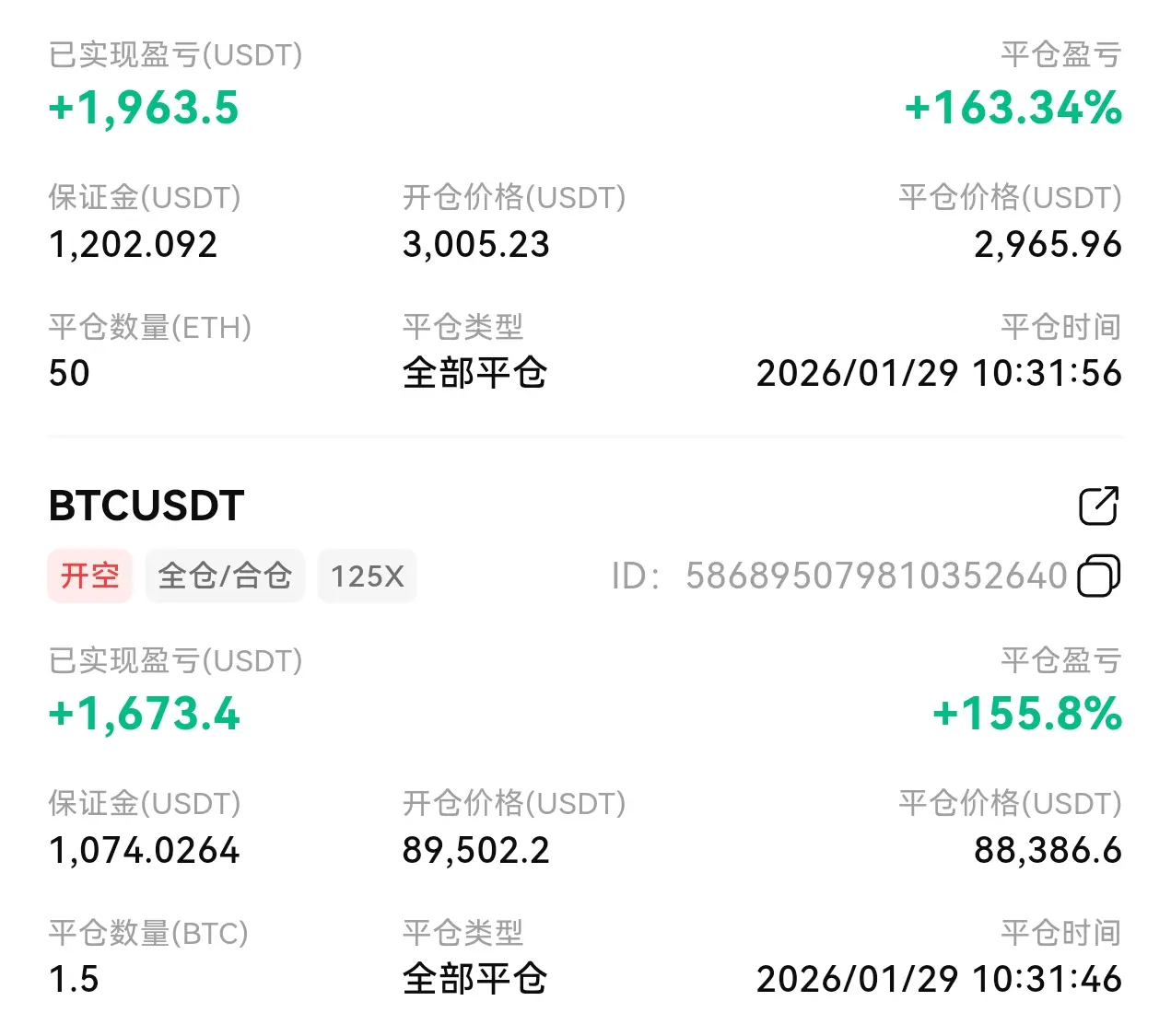

Allin熬鹰资本

Got it, brothers. See you in the US stocks tonight.

View Original

- Reward

- 3

- 1

- Repost

- Share

StopWhenYou'veEarnedEnoughU :

:

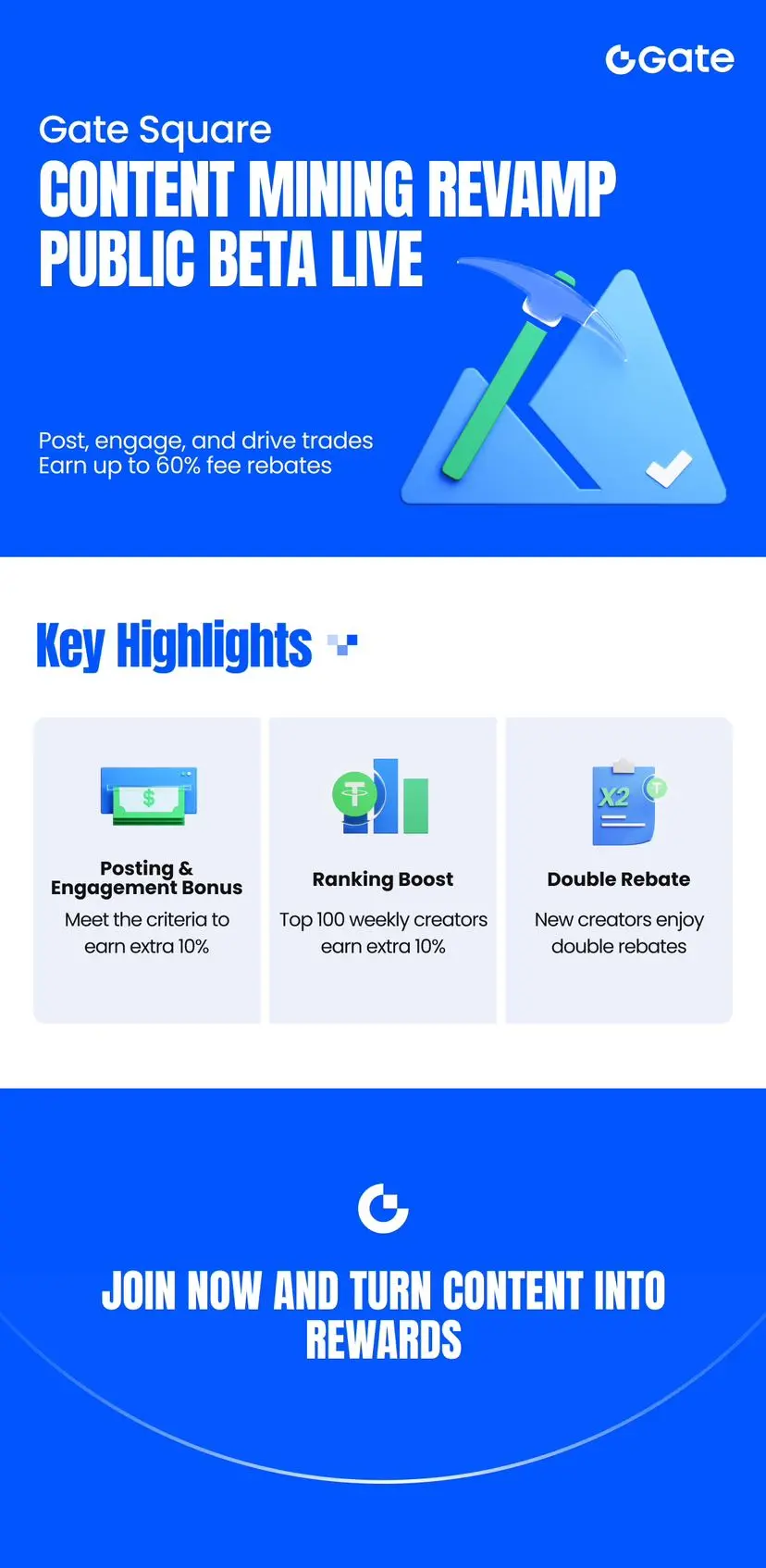

Eating meat is awesomeThe Gate Square Content Mining Revamp is live, and this one actually changes the game for creators who know how to move attention and liquidity together.

This is not just about posting anymore. It is about turning influence into measurable trading impact, and getting paid for it in a structured, transparent way.

During the public beta, Gate Square is pushing aggressive incentives to onboard serious creators. You are looking at double rebates with total trading fee rebates going up to 60%, which is massive for anyone building consistent engagement.

Here is how the reward engine works.

At the ba

This is not just about posting anymore. It is about turning influence into measurable trading impact, and getting paid for it in a structured, transparent way.

During the public beta, Gate Square is pushing aggressive incentives to onboard serious creators. You are looking at double rebates with total trading fee rebates going up to 60%, which is massive for anyone building consistent engagement.

Here is how the reward engine works.

At the ba

- Reward

- 2

- 2

- Repost

- Share

EagleEye :

:

This post is truly impressive! I really appreciate the effort and creativity behind it.View More

$BTC is pulling back after a clear rejection from the 90,600 zone, and I’m seeing this move as a healthy correction, not a trend break. The market took liquidity above recent highs, failed to hold, and now price is reacting back into a key intraday demand area. Momentum cooled down, weak longs are flushed, and this is exactly where I start paying attention.

I’m looking at the 1H structure and I can see price moving below short-term moving averages, with selling pressure slowing down near previous support. This zone already acted as a reaction area before, and volume is stabilizing. I’m not cha

I’m looking at the 1H structure and I can see price moving below short-term moving averages, with selling pressure slowing down near previous support. This zone already acted as a reaction area before, and volume is stabilizing. I’m not cha

BTC-0,75%

- Reward

- like

- Comment

- Repost

- Share

招财猫

Maneki-neko

Created By@ChainStrategyStudyGroup-Uncle

Listing Progress

0.00%

MC:

$3.37K

Create My Token

Now, the grandma who buys gold has won, the dad who invests in stocks has won, the mom who likes buying silver has won, even the younger brother who loves playing on the computer has won—all except you, because you play in the crypto circle.

View Original

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 1

- 13

- Repost

- Share

ox_Alan :

:

join the live and claim the redpocket 🧧🧧🧧 fastView More

Subscribe to updates: btc 87800, sol 122.4, both long. btc gained 500 points, profit-taking; sol gained 1 point, profit-taking. Precisely targeted and caught the lowest point.

View Original

- Reward

- 2

- Comment

- Repost

- Share

🤖 Clawdbot Goes Viral — CLAWD Token Rockets

The AI tool Clawdbot has taken the crypto world by storm, sparking renewed hype around CLAWD and related meme coins. Prices are climbing sharply, and traders are asking: Is this the start of another GOAT/ACT-style rally, or just short-term FOMO?

🔍 Market Drivers

Viral hype: Social media buzz and AI trends driving attention and speculative buying.

FOMO rotations: Traders moving quickly into high-beta meme/utility coins.

AI + blockchain narrative: Investors are reacting to perceived innovation and “next big thing” sentiment.

Short-term liquidity surg

The AI tool Clawdbot has taken the crypto world by storm, sparking renewed hype around CLAWD and related meme coins. Prices are climbing sharply, and traders are asking: Is this the start of another GOAT/ACT-style rally, or just short-term FOMO?

🔍 Market Drivers

Viral hype: Social media buzz and AI trends driving attention and speculative buying.

FOMO rotations: Traders moving quickly into high-beta meme/utility coins.

AI + blockchain narrative: Investors are reacting to perceived innovation and “next big thing” sentiment.

Short-term liquidity surg

- Reward

- 3

- 3

- Repost

- Share

EagleEye :

:

This post is truly impressive! I really appreciate the effort and creativity behind it.View More

#CryptoMarketWatch

Recent volatility across the crypto market has highlighted a clear and growing divergence between bullish conviction and defensive caution, and this split itself is becoming one of the most important signals to watch. On one side, long-term holders continue to accumulate selectively, narratives like ETFs, infrastructure, and AI-driven use cases remain intact, and on-chain data shows that panic selling is still relatively contained. On the other side, macro uncertainty, geopolitical risk, and tightening liquidity conditions are keeping short-term traders cautious, leading to

Recent volatility across the crypto market has highlighted a clear and growing divergence between bullish conviction and defensive caution, and this split itself is becoming one of the most important signals to watch. On one side, long-term holders continue to accumulate selectively, narratives like ETFs, infrastructure, and AI-driven use cases remain intact, and on-chain data shows that panic selling is still relatively contained. On the other side, macro uncertainty, geopolitical risk, and tightening liquidity conditions are keeping short-term traders cautious, leading to

BTC-0,75%

- Reward

- 3

- 3

- Repost

- Share

CryptoChampion :

:

HODL Tight 💪View More

$SOL showing controlled weakness after a steady intraday selloff.

Price is reacting at demand with sellers losing momentum.

EP

122.80–123.40

TP

TP1 124.80

TP2 126.00

TP3 128.30

SL

121.90

Liquidity was swept below 122.70 before a clear reaction, signaling short term sell side exhaustion. Price is stabilizing near the reaction zone, and if structure holds, a bounce toward overhead liquidity and moving average resistance is favored.

Let’s go $SOL

Price is reacting at demand with sellers losing momentum.

EP

122.80–123.40

TP

TP1 124.80

TP2 126.00

TP3 128.30

SL

121.90

Liquidity was swept below 122.70 before a clear reaction, signaling short term sell side exhaustion. Price is stabilizing near the reaction zone, and if structure holds, a bounce toward overhead liquidity and moving average resistance is favored.

Let’s go $SOL

SOL-2,68%

- Reward

- like

- Comment

- Repost

- Share

#SolanaMemeHypeReturns

The Solana blockchain is once again at the center of attention as meme coin hype returns with renewed intensity. The hashtag #SolanaMemeHypeReturns captures the growing excitement across the crypto community as trading activity surges and new meme tokens gain rapid visibility. After a period of relative calm, Solana-based meme coins are experiencing heightened interest, reflecting the network’s ability to attract speculative capital during bullish market phases. This revival highlights how meme-driven narratives continue to play a powerful role in shaping short-term tre

The Solana blockchain is once again at the center of attention as meme coin hype returns with renewed intensity. The hashtag #SolanaMemeHypeReturns captures the growing excitement across the crypto community as trading activity surges and new meme tokens gain rapid visibility. After a period of relative calm, Solana-based meme coins are experiencing heightened interest, reflecting the network’s ability to attract speculative capital during bullish market phases. This revival highlights how meme-driven narratives continue to play a powerful role in shaping short-term tre

- Reward

- 2

- 4

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

🔘 Worldcoin spikes 40% as OpenAI reportedly plans biometric X rival

OpenAI-linked token Worldcoin spiked 40% on Wednesday following a report that the artificial intelligence firm is working on a bot-free social media platform that requires “proof of personhood.”

According to a Tuesday Forbes report citing sources familiar with the matter, OpenAI is aiming to develop a “humans-only platform” as a point of difference from other social media services on the market.

Still in its early stages, sources state that a small team of around 10 people is building the platform to compete with X, and that

OpenAI-linked token Worldcoin spiked 40% on Wednesday following a report that the artificial intelligence firm is working on a bot-free social media platform that requires “proof of personhood.”

According to a Tuesday Forbes report citing sources familiar with the matter, OpenAI is aiming to develop a “humans-only platform” as a point of difference from other social media services on the market.

Still in its early stages, sources state that a small team of around 10 people is building the platform to compete with X, and that

WLD14,08%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

射了马

射了马

Created By@0x6666...2345

Listing Progress

2.68%

MC:

$3.93K

Create My Token

vyygyggyggygg aku ga bisa di ajak ngobrol dengan teman PP no kyc no kyc no kyc no kyc no kyc no kyc no kyc no kyc no kyc no kyc no kyc no

- Reward

- like

- Comment

- Repost

- Share

As Expected - We can see to grab lower Liq if price unable to hold 87k

We can see 85.5 - 84 - or 82k - shakeout.

Why lower side liq , This manipulation can happen due to Gov Shutdown news by 31sth Jan.

Still im expecting atleast 93.5 - 94k should visit there to grab about 3b Liq + That is imp retest resistance on daily , Or i maybe could be prove wrong.

Things are uncertain little bit yet — Price is Chopped between heavy resistance & Support. $BTC $KITE $STABLE

We can see 85.5 - 84 - or 82k - shakeout.

Why lower side liq , This manipulation can happen due to Gov Shutdown news by 31sth Jan.

Still im expecting atleast 93.5 - 94k should visit there to grab about 3b Liq + That is imp retest resistance on daily , Or i maybe could be prove wrong.

Things are uncertain little bit yet — Price is Chopped between heavy resistance & Support. $BTC $KITE $STABLE

- Reward

- 1

- 1

- Repost

- Share

EagleEye :

:

This post is truly impressive! I really appreciate the effort and creativity behind it.$GT showing controlled weakness after a steady intraday pullback.

Price is reacting at demand with sellers losing momentum.

EP

9.75–9.85

TP

TP1 9.95

TP2 10.01

TP3 10.30

SL

9.60

Liquidity was swept below 9.76 before a clear reaction, signaling short term sell side exhaustion. Price is stabilizing near the reaction zone, and if structure holds, a bounce toward overhead liquidity and moving average resistance is favored.

Let’s go $GT

Price is reacting at demand with sellers losing momentum.

EP

9.75–9.85

TP

TP1 9.95

TP2 10.01

TP3 10.30

SL

9.60

Liquidity was swept below 9.76 before a clear reaction, signaling short term sell side exhaustion. Price is stabilizing near the reaction zone, and if structure holds, a bounce toward overhead liquidity and moving average resistance is favored.

Let’s go $GT

GT-1,4%

- Reward

- 1

- Comment

- Repost

- Share

#MiddleEastTensionsEscalate

Rising tensions between Iran, Israel, Gaza-based groups, Lebanon’s Hezbollah, and the involvement of regional powers such as Saudi Arabia and the United States are intensifying instability in the Middle East, increasing geopolitical risks with global consequences.

Middle East Tensions Escalate Between Key Regional Powers

The escalation of tensions in the Middle East is primarily unfolding between Iran and Israel, with Gaza-based Palestinian groups, Lebanon’s Hezbollah, and indirect involvement from the United States and Saudi Arabia. The hashtag #MiddleEastTensions

Rising tensions between Iran, Israel, Gaza-based groups, Lebanon’s Hezbollah, and the involvement of regional powers such as Saudi Arabia and the United States are intensifying instability in the Middle East, increasing geopolitical risks with global consequences.

Middle East Tensions Escalate Between Key Regional Powers

The escalation of tensions in the Middle East is primarily unfolding between Iran and Israel, with Gaza-based Palestinian groups, Lebanon’s Hezbollah, and indirect involvement from the United States and Saudi Arabia. The hashtag #MiddleEastTensions

- Reward

- 3

- 4

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

BTC 1-Hour Market Analysis — Weak Consolidation After Sharp Drop

Resistance Levels

• First Resistance: $88,540-$88,950 (MA5 + recent rebound high, short-term selling pressure zone)

• Strong Resistance: $89,300-$89,500 (MA20 + previous consolidation platform, medium-term key resistance)

Support Levels

• First Support: $87,250-$87,350 (previous correction low, short-term bullish defense line)

• Strong Support: $86,900-$87,000 (previous consolidation low, critical defense level)

Technical Indicator Interpretation

1. Moving Averages: Short- and medium-term moving averages (MA5/MA10/MA20/MA30) are

Resistance Levels

• First Resistance: $88,540-$88,950 (MA5 + recent rebound high, short-term selling pressure zone)

• Strong Resistance: $89,300-$89,500 (MA20 + previous consolidation platform, medium-term key resistance)

Support Levels

• First Support: $87,250-$87,350 (previous correction low, short-term bullish defense line)

• Strong Support: $86,900-$87,000 (previous consolidation low, critical defense level)

Technical Indicator Interpretation

1. Moving Averages: Short- and medium-term moving averages (MA5/MA10/MA20/MA30) are

BTC-0,75%

- Reward

- 1

- Comment

- Repost

- Share

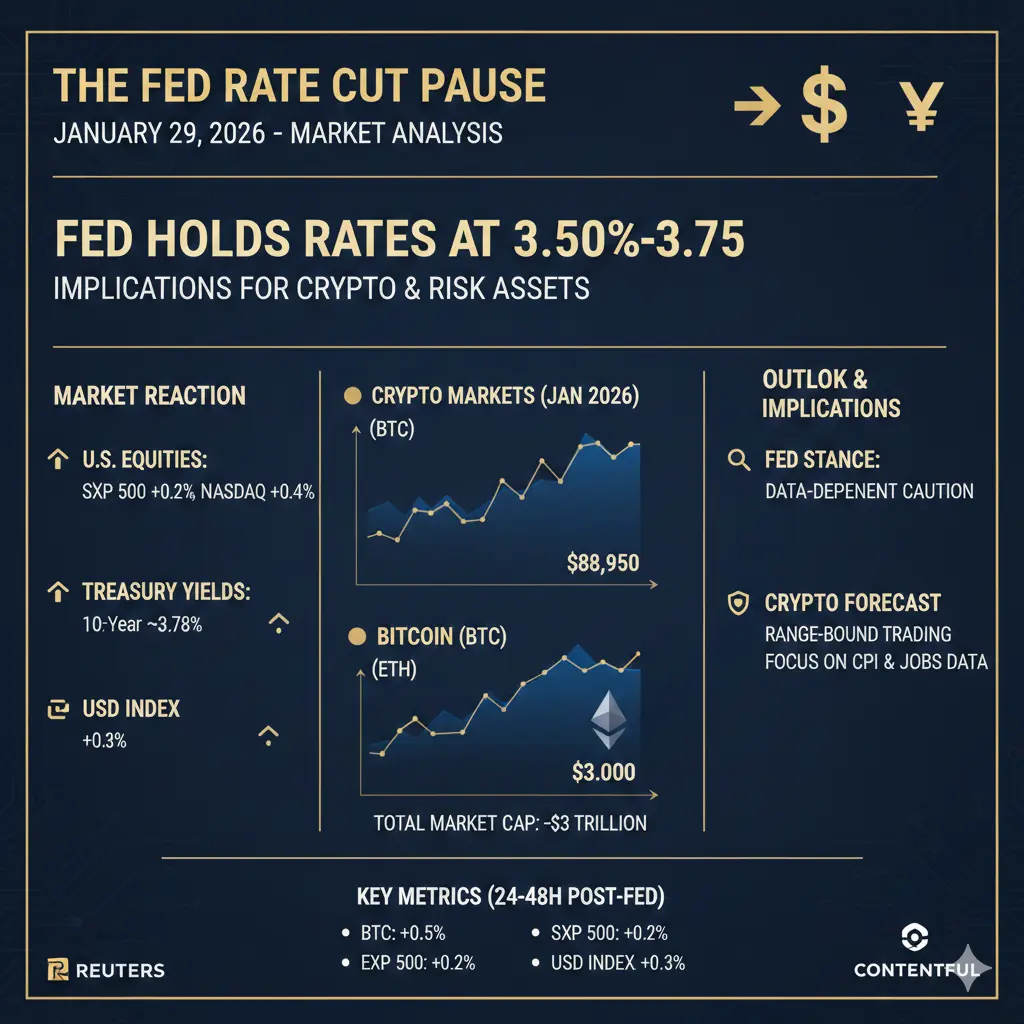

#FedRateDecisionApproaches: Markets on Edge as the Federal Reserve Prepares Its Next Move

As the hashtag #FedRateDecisionApproaches trends across financial and crypto communities, global markets are entering a critical phase of uncertainty and anticipation. Investors, traders, and institutions alike are closely watching the U.S. Federal Reserve as it prepares to announce its next interest rate decision — a move that could significantly shape the direction of stocks, crypto assets, commodities, and global currencies.

The Federal Reserve’s interest rate policy is one of the most powerful tools i

As the hashtag #FedRateDecisionApproaches trends across financial and crypto communities, global markets are entering a critical phase of uncertainty and anticipation. Investors, traders, and institutions alike are closely watching the U.S. Federal Reserve as it prepares to announce its next interest rate decision — a move that could significantly shape the direction of stocks, crypto assets, commodities, and global currencies.

The Federal Reserve’s interest rate policy is one of the most powerful tools i

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More25.2K Popularity

89.66K Popularity

38.05K Popularity

13.4K Popularity

14.62K Popularity

Hot Gate Fun

View More- MC:$3.42KHolders:20.04%

- MC:$3.38KHolders:10.00%

- MC:$3.89KHolders:32.48%

- MC:$3.45KHolders:20.00%

- MC:$3.45KHolders:20.15%

News

View MoreHOLO (Holoworld AI) increased by 21.45% in the last 24 hours

5 m

The probability of a US government shutdown this Saturday on Polymarket has significantly decreased

5 m

Ethereum spot ETF had a total net inflow of $28,095,100 yesterday, with BlackRock ETHA leading with a net inflow of $27,343,100.

6 m

Bitcoin spot ETF saw a total net outflow of $19,644,900 yesterday, with BlackRock IBIT experiencing the largest net outflow of $14,179,200.

8 m

A certain whale shorted 71.31 BTC at 40x leverage, with an average entry price of $88,120.6.

12 m

Pin