# DecemberRateCutForecast

166.34K

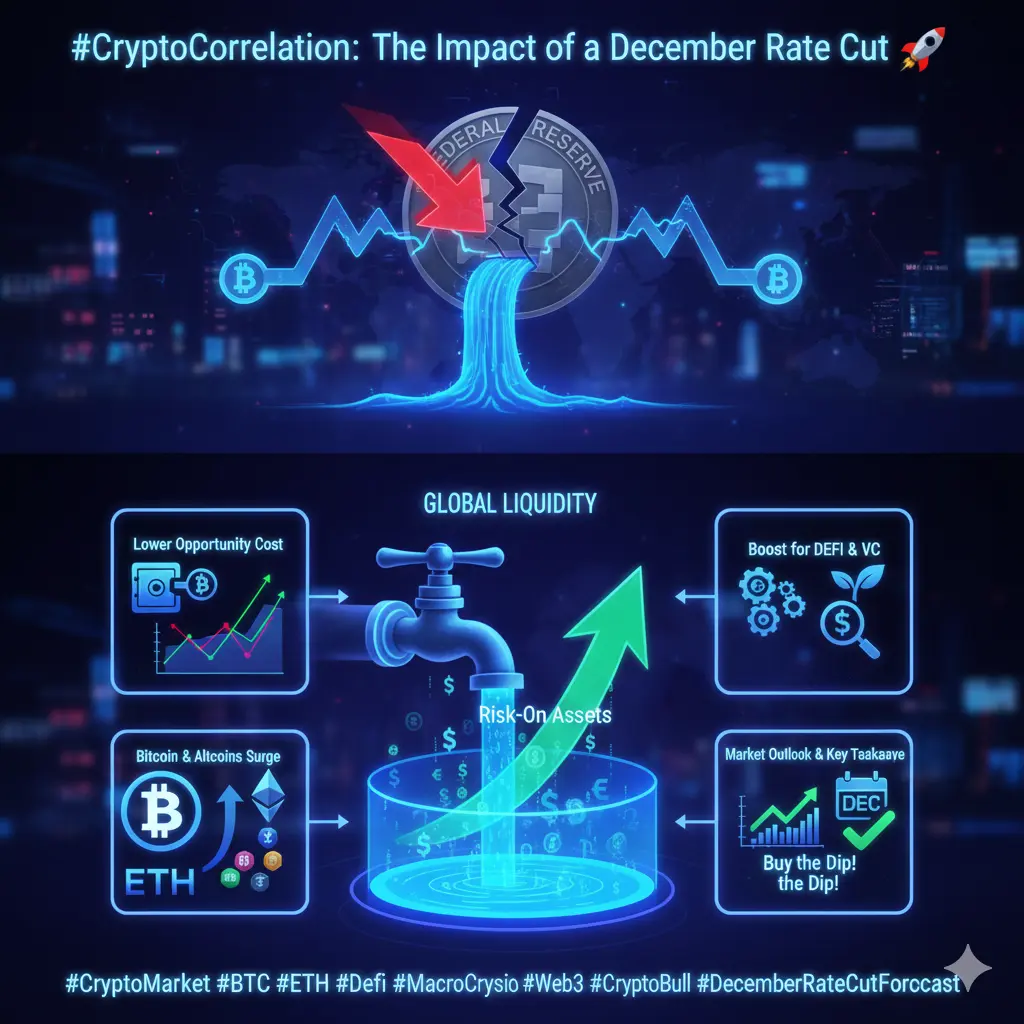

The Fed may cut rates again in December, sparking discussions about liquidity and a rebound in risk assets. How likely do you think a rate cut is? Could it trigger the next bull run?

Mahbubsimon

Don’t Miss Exclusive Rewards! Draw With Growth Points.

Nov 27, 04:00 (UTC) – Dec 7, 16:00 (UTC)

https://www.gate.com/activities/pointprize?now_period=14&refUid=18022746

The “Draw With Growth Points” campaign lets you turn your earned points into real rewards. Simply redeem your Growth Points during the event period to enter the prize draw each point equals one entry, giving you more chances to win.

Enjoy a clean, simple, and rewarding

experience with:

• 🎁 Exclusive vouchers & bonuses

• 💳 Cashback perks

• ⭐ Special campaign rewards

No cost, no complexity — just use the points you alrea

Nov 27, 04:00 (UTC) – Dec 7, 16:00 (UTC)

https://www.gate.com/activities/pointprize?now_period=14&refUid=18022746

The “Draw With Growth Points” campaign lets you turn your earned points into real rewards. Simply redeem your Growth Points during the event period to enter the prize draw each point equals one entry, giving you more chances to win.

Enjoy a clean, simple, and rewarding

experience with:

• 🎁 Exclusive vouchers & bonuses

• 💳 Cashback perks

• ⭐ Special campaign rewards

No cost, no complexity — just use the points you alrea

- Reward

- 6

- 5

- Repost

- Share

Mahbubsimon :

:

Earn rewards by just repost! & Boost your Active participation (viewing, liking, posting, reposting) is the key driver for significantly increasing your account's visibility and growth rate.View More

$DOGE /USDT

$DOGE is currently trading around $0.14001, down -5.36% in the last 24 hours. After yesterday’s sharp sell-off from the $0.148 area, price action has attempted multiple recoveries but remains weak under the intraday resistance. On the lower timeframes, we are seeing bearish pressure creeping in again, especially as candles repeatedly fail to break above $0.1406–$0.1410.

Trade Setup (Short Bias)

> Based on current visible structure, not financial advice — just chart behavior.

Entry Zone (Short):

$0.1405 – $0.1412

(If price retests this resistance and fails)

Targets

• Target 1 🎯:

$DOGE is currently trading around $0.14001, down -5.36% in the last 24 hours. After yesterday’s sharp sell-off from the $0.148 area, price action has attempted multiple recoveries but remains weak under the intraday resistance. On the lower timeframes, we are seeing bearish pressure creeping in again, especially as candles repeatedly fail to break above $0.1406–$0.1410.

Trade Setup (Short Bias)

> Based on current visible structure, not financial advice — just chart behavior.

Entry Zone (Short):

$0.1405 – $0.1412

(If price retests this resistance and fails)

Targets

• Target 1 🎯:

DOGE0,66%

- Reward

- 6

- 3

- Repost

- Share

Mehedihasan99 :

:

djkds. njjhxxbbnbv ftnmbfdcbbbView More

$DOGE is deep in a bearish slide right now, dropping from $0.15096 down to the low of $0.13714, and now it's trying to stabilize around $0.13921. The 1h chart still shows a clear downtrend — MA5, MA10, and MA30 are all angled sharply downward, meaning sellers still have momentum on their side.

The bounce off $0.13714 shows buyers are defending that support, but recovery is slow, and price is hovering right under the moving averages, signaling hesitation. This tight consolidation is usually the calm before the next wave.

If bulls hold the $0.138–$0.140 zone, $DOGE may attempt a short-term push

The bounce off $0.13714 shows buyers are defending that support, but recovery is slow, and price is hovering right under the moving averages, signaling hesitation. This tight consolidation is usually the calm before the next wave.

If bulls hold the $0.138–$0.140 zone, $DOGE may attempt a short-term push

DOGE0,66%

- Reward

- 3

- Comment

- Repost

- Share

#ETHEREUM WEEKLY UPDATE

$ETH has broken below 3000 exactly as expected. I mentioned earlier that losing this level clears the path toward 2800 to 2600, and the chart shows price already dipping into the green box. The move has played out the same way as Bitcoin, with both charts hitting their downside targets perfectly. I’m still looking for further weakness.

ETH is trading near 3000, but the 1W50 EMA is sitting above as a clear resistance. A retest toward 3300 looks likely, and I’ve already placed my limit orders in that zone. I shared the same setup in the free group. If we reject from 3300

$ETH has broken below 3000 exactly as expected. I mentioned earlier that losing this level clears the path toward 2800 to 2600, and the chart shows price already dipping into the green box. The move has played out the same way as Bitcoin, with both charts hitting their downside targets perfectly. I’m still looking for further weakness.

ETH is trading near 3000, but the 1W50 EMA is sitting above as a clear resistance. A retest toward 3300 looks likely, and I’ve already placed my limit orders in that zone. I shared the same setup in the free group. If we reject from 3300

ETH-1,58%

- Reward

- 5

- 2

- Repost

- Share

CryptoCalling :

:

$USDT The U price has dropped quite a bit,

This is a huge risk

There's an inexplicable sense of tension$USDT

View More

$ETH USDT Trade Setup

ETH just flushed into 2911 liquidity and snapped back with a strong reaction candle, showing buyers defending a key intraday level. I’m seeing a possible bounce continuation if price holds above the reclaim zone.

Entry zone

2938 to 2952

TP1

2978

TP2

3008

TP3

3055

Stop loss

2910

This setup rides the recovery from the liquidity sweep while keeping the invalidation clean and tight under the 2911 wick.

Let’s go and train now 🚀🔥

$ETH #DecemberRateCutForecast #SharingMy100xToken #LINKETFToLaunch #PostonSquaretoEarn$50 #DecemberMarketOutlook

ETH just flushed into 2911 liquidity and snapped back with a strong reaction candle, showing buyers defending a key intraday level. I’m seeing a possible bounce continuation if price holds above the reclaim zone.

Entry zone

2938 to 2952

TP1

2978

TP2

3008

TP3

3055

Stop loss

2910

This setup rides the recovery from the liquidity sweep while keeping the invalidation clean and tight under the 2911 wick.

Let’s go and train now 🚀🔥

$ETH #DecemberRateCutForecast #SharingMy100xToken #LINKETFToLaunch #PostonSquaretoEarn$50 #DecemberMarketOutlook

ETH-1,58%

- Reward

- like

- Comment

- Repost

- Share

#DecemberRateCutForecast

December at a Monetary Turning Point: Will a Potential Fed Rate Cut Unlock a New Wave of Global Liquidity and Ignite the Next Crypto and Risk-Asset Bull Run, or Is the Market Ahead of Itself?

As speculation intensifies around the possibility of another Federal Reserve rate cut in December, global markets are once again shifting into anticipation mode, with traders and investors debating whether easing monetary policy could act as the catalyst that reignites risk appetite across equities, crypto, and alternative assets, because at its core, a rate cut is not just a sym

December at a Monetary Turning Point: Will a Potential Fed Rate Cut Unlock a New Wave of Global Liquidity and Ignite the Next Crypto and Risk-Asset Bull Run, or Is the Market Ahead of Itself?

As speculation intensifies around the possibility of another Federal Reserve rate cut in December, global markets are once again shifting into anticipation mode, with traders and investors debating whether easing monetary policy could act as the catalyst that reignites risk appetite across equities, crypto, and alternative assets, because at its core, a rate cut is not just a sym

BTC1,87%

- Reward

- 4

- 5

- Repost

- Share

BabaJi :

:

HODL Tight 💪View More

$BTC /USDT

Multi-Timeframe Technical Analysis -7 December 2025 06:10 Am

Analyst: Leeshah

This analysis provides a clean, structure-based view of the current Bitcoin (BTC/USDT) market, identifying critical liquidity zones and potential turning points based on institutional trading concepts (Order Blocks, Demand/Supply Zones).

I. Monthly Timeframe (Macro Perspective)

The Monthly chart dictates the long-term trend and identifies the strongest structural zones.

Level Type Price Zone (USDT) Interpretation

Major Resistance $112,000−$115,000 A strong psychological and structural ceiling. Conclusive

Multi-Timeframe Technical Analysis -7 December 2025 06:10 Am

Analyst: Leeshah

This analysis provides a clean, structure-based view of the current Bitcoin (BTC/USDT) market, identifying critical liquidity zones and potential turning points based on institutional trading concepts (Order Blocks, Demand/Supply Zones).

I. Monthly Timeframe (Macro Perspective)

The Monthly chart dictates the long-term trend and identifies the strongest structural zones.

Level Type Price Zone (USDT) Interpretation

Major Resistance $112,000−$115,000 A strong psychological and structural ceiling. Conclusive

MC:$117.46KHolders:77596

100.00%

- Reward

- 3

- Comment

- Repost

- Share

#DecemberRateCutForecast

The crypto market, led by Bitcoin (BTC) and Ethereum (ETH), operates as a risk-on asset class. This means its performance is inversely correlated with the cost of capital and global liquidity. When the Federal Reserve pivots from tightening (raising rates) to easing (cutting rates), it fundamentally changes the incentive structure for investors, creating a powerful tailwind for digital assets.

1. Lower Opportunity Cost of Holding Crypto

High interest rates make cash and Treasury bills attractive, offering “risk-free” yields (e.g., 5%). This creates a high opportunity

The crypto market, led by Bitcoin (BTC) and Ethereum (ETH), operates as a risk-on asset class. This means its performance is inversely correlated with the cost of capital and global liquidity. When the Federal Reserve pivots from tightening (raising rates) to easing (cutting rates), it fundamentally changes the incentive structure for investors, creating a powerful tailwind for digital assets.

1. Lower Opportunity Cost of Holding Crypto

High interest rates make cash and Treasury bills attractive, offering “risk-free” yields (e.g., 5%). This creates a high opportunity

- Reward

- 25

- 11

- Repost

- Share

BeautifulDay :

:

1000x Vibes 🤑View More

#Bitcoin Sunday Update

Nothing has really changed. Everything is moving exactly the way we planned. $BTC is still holding above 88k, and as long as it stays above that level, the upside liquidity grab remains likely. First target for that sweep is around 95–96k. If price can hold there, the move can stretch toward 99k at most.

As I said before, a clean break above 99k is where I’ll add more short positions. I’m still holding my original shorts from 118k, and I’m in no rush to close them. If BTC gives a fake pump into 99k or beyond, I’ll simply scale in heavier.

With FOMC dropping on December 1

Nothing has really changed. Everything is moving exactly the way we planned. $BTC is still holding above 88k, and as long as it stays above that level, the upside liquidity grab remains likely. First target for that sweep is around 95–96k. If price can hold there, the move can stretch toward 99k at most.

As I said before, a clean break above 99k is where I’ll add more short positions. I’m still holding my original shorts from 118k, and I’m in no rush to close them. If BTC gives a fake pump into 99k or beyond, I’ll simply scale in heavier.

With FOMC dropping on December 1

BTC1,87%

- Reward

- 13

- 21

- Repost

- Share

AngelEye :

:

Bull Run 🐂View More

Powell's dovish stance could boost liquidity flows into risk assets, especially cryptocurrencies, as investors shift away from fixed income. Historically, Bitcoin rises within 30 to 60 days following the first confirmed Fed easing. Similar data from 2024 showed BTC rising 42% within six weeks of stabilizing.$BTC #DecemberMarketOutlook #DecemberRateCutForecast #ReboundTokenstoWatch #BitcoinPriceWatch #AreYouBullishOrBearishToday?

BTC1,87%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

24.5K Popularity

37.8K Popularity

357.68K Popularity

35.13K Popularity

52.5K Popularity

7.08K Popularity

21.09K Popularity

11.39K Popularity

85.55K Popularity

31.22K Popularity

26.41K Popularity

25.3K Popularity

11.72K Popularity

17.98K Popularity

207.8K Popularity

News

View MoreNomura's European Business Division has turned to losses due to the decline in crypto assets and has tightened management of holdings and risk exposure.

12 m

Jupiter "CatLumpurr 2026" event officially opens

21 m

Trump announces nomination of Brett Sampson as the new director of the Bureau of Labor Statistics

24 m

Data: In the past 24 hours, the entire network has liquidated 1.382 billion USD, with long positions liquidated at 1.226 billion USD and short positions at 157 million USD.

25 m

JPMorgan: Bitcoin futures are oversold, while silver has turned overbought. The long-term target price for gold is $8,500.

45 m

Pin