# WeekendMarketAnalysis

8.5K

YingYue

#WeekendMarketAnalysis #WeekendMarketAnalysis

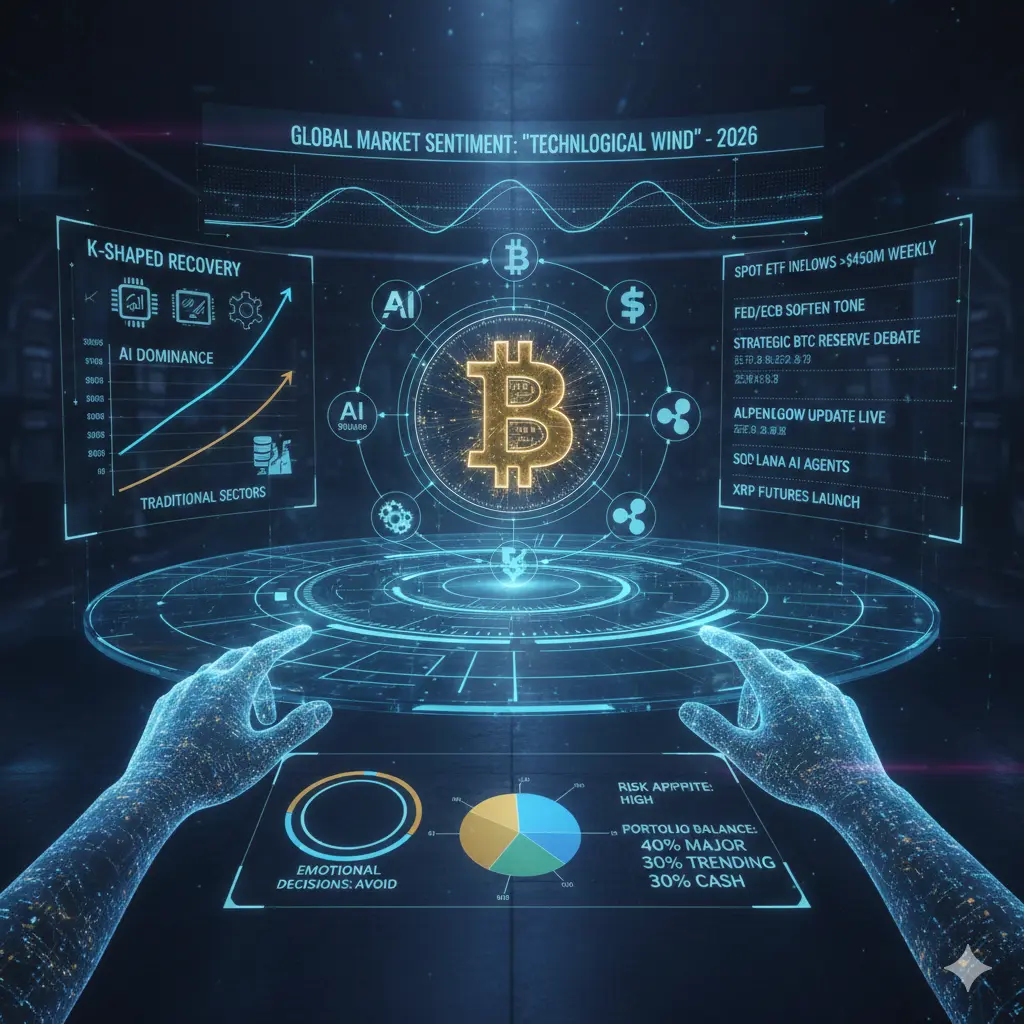

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

- Reward

- 2

- 1

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊#WeekendMarketAnalysis

📊 Core Takeaways

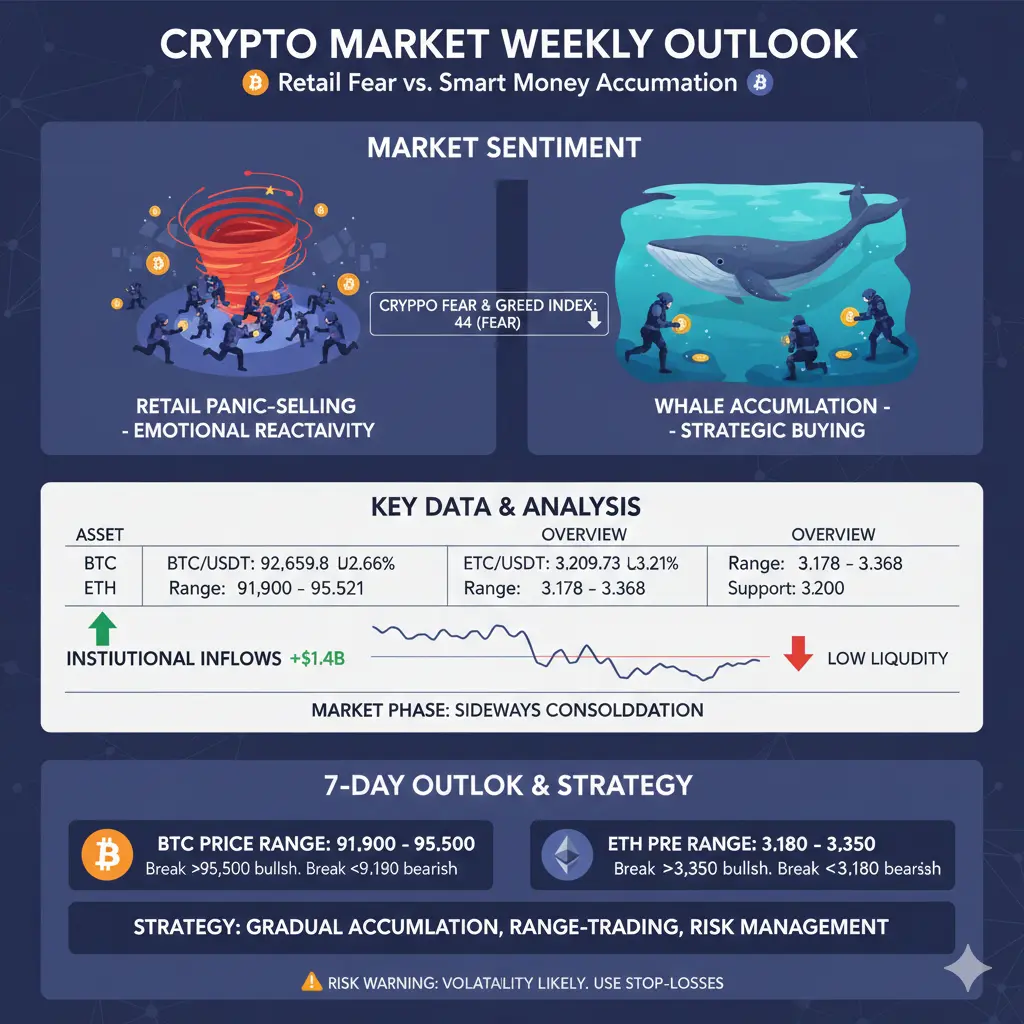

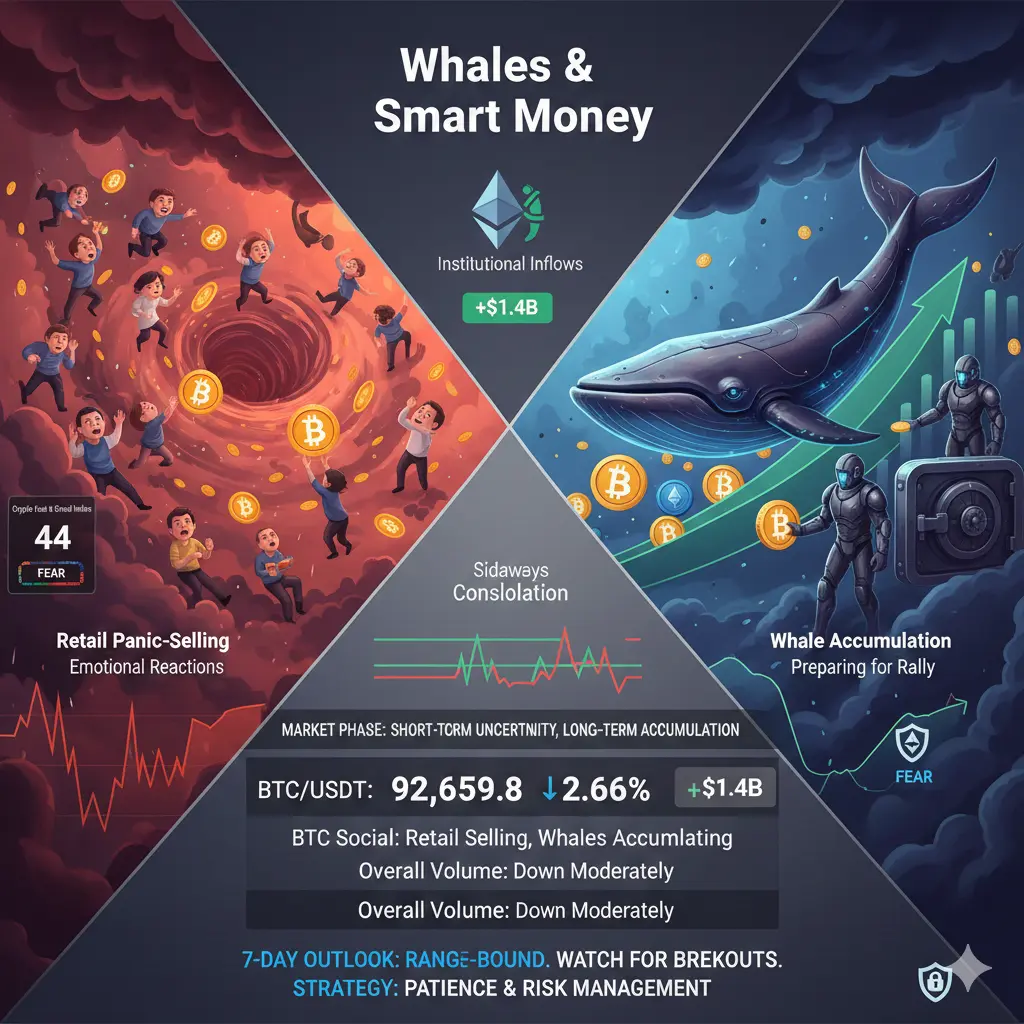

Crypto markets went through a cautious and choppy weekend, with both Bitcoin (BTC) and Ethereum (ETH) seeing moderate pullbacks amid macro uncertainty, political developments, and low weekend liquidity.

While retail traders reacted emotionally, selling into short-term weakness, large holders (“whales”) and institutional players quietly accumulated. This divergence between retail fear and smart money buying is often a signal that the market is preparing for the next significant move.

In short:

Retail: Panic-selling, short-term reactive behavior

Whales /

📊 Core Takeaways

Crypto markets went through a cautious and choppy weekend, with both Bitcoin (BTC) and Ethereum (ETH) seeing moderate pullbacks amid macro uncertainty, political developments, and low weekend liquidity.

While retail traders reacted emotionally, selling into short-term weakness, large holders (“whales”) and institutional players quietly accumulated. This divergence between retail fear and smart money buying is often a signal that the market is preparing for the next significant move.

In short:

Retail: Panic-selling, short-term reactive behavior

Whales /

- Reward

- 1

- Comment

- Repost

- Share

#WeekendMarketAnalysis #WeekendMarketAnalysis

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

Global Market Sentiment: "Technological Wind"

Global markets began 2026 amidst geopolitical risks but were buoyed by a technological revolution. The prominence of AI is evident as the S&P 500 and Nasdaq set records with robust earnings in the AI and semiconductor sectors. The concept of "K-Shaped Recovery" highlights the contrast between tech-driven growth and traditional sectors that struggle with high costs.

The Fed and ECB's softer tones are easing global liquidity conditions, thereby fueling risk appetite. Spot ETF inflows in the US, surpassing

- Reward

- 1

- Comment

- Repost

- Share

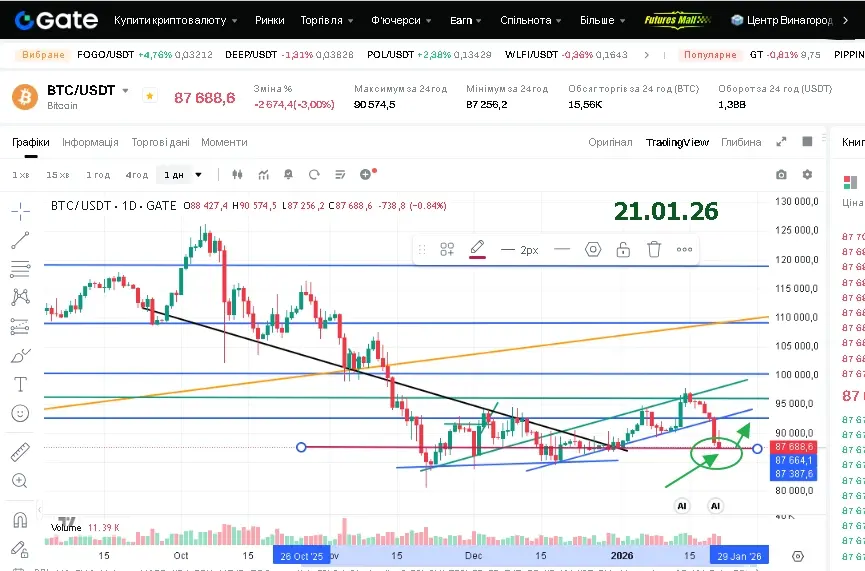

#WeekendMarketAnalysis #BTC

This weekend is over and we really saw some easing of pressure from sellers, but over the last two days the sellers have been pushing hard and we all saw the results. On Tuesday my short order worked successfully and I'm happy. Regarding favorite assets, my favorite coin is Dogecoin and BERA.

This weekend is over and we really saw some easing of pressure from sellers, but over the last two days the sellers have been pushing hard and we all saw the results. On Tuesday my short order worked successfully and I'm happy. Regarding favorite assets, my favorite coin is Dogecoin and BERA.

- Reward

- 5

- 2

- Repost

- Share

AnnaCryptoWriter :

:

Vibe at 1000x 🤑View More

#WeekendMarketAnalysis

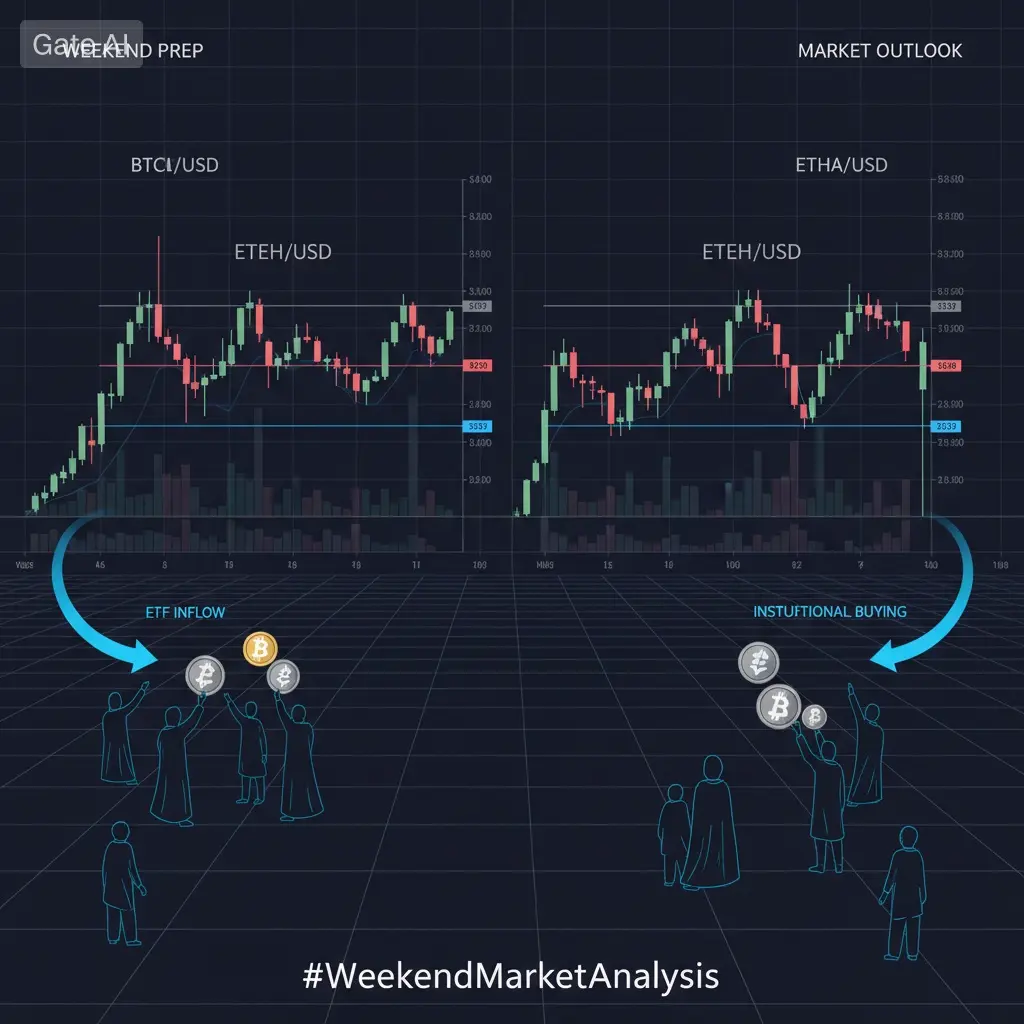

A Deep Dive into Market Sentiment, Trends, and What Lies Ahead

As the global financial markets move into the weekend, traders and investors shift their focus from fast-paced execution to strategic evaluation. Weekend market analysis plays a crucial role in understanding broader trends, assessing risk, and preparing for the week ahead. With reduced liquidity and limited institutional participation, weekend price action often reflects pure market sentiment—making it a valuable period for analysis rather than aggressive trading.

Market Overview

This week, markets showed a

A Deep Dive into Market Sentiment, Trends, and What Lies Ahead

As the global financial markets move into the weekend, traders and investors shift their focus from fast-paced execution to strategic evaluation. Weekend market analysis plays a crucial role in understanding broader trends, assessing risk, and preparing for the week ahead. With reduced liquidity and limited institutional participation, weekend price action often reflects pure market sentiment—making it a valuable period for analysis rather than aggressive trading.

Market Overview

This week, markets showed a

BTC-0,22%

- Reward

- 2

- Comment

- Repost

- Share

#WeekendMarketAnalysis

$ETH For the asset, it is now important to break through the key resistance level at 3100 and hold above it. Otherwise, a retest and further price decline may occur at this level. Indicators on the 2H timeframe signal a reversal to LONG.

$ETH For the asset, it is now important to break through the key resistance level at 3100 and hold above it. Otherwise, a retest and further price decline may occur at this level. Indicators on the 2H timeframe signal a reversal to LONG.

ETH-1,61%

- Reward

- like

- 1

- Repost

- Share

UuuUpUpUp :

:

Hold on tight, we're about to take off 🛫#WeekendMarketAnalysis

This weekend’s crypto market reflects a classic preparation phase rather than a clear directional move. Both Bitcoin and Ethereum are consolidating near critical levels, while volume contraction and neutral sentiment signal hesitation on the surface—but growing institutional activity suggests something is building underneath.

Bitcoin has traded between $94,293 and $97,188 over the past few days, currently hovering near the mid-range. Momentum is weak, with RSI around 35 and trading volume down over 50%, making short-term trend confirmation difficult. However, this calm

This weekend’s crypto market reflects a classic preparation phase rather than a clear directional move. Both Bitcoin and Ethereum are consolidating near critical levels, while volume contraction and neutral sentiment signal hesitation on the surface—but growing institutional activity suggests something is building underneath.

Bitcoin has traded between $94,293 and $97,188 over the past few days, currently hovering near the mid-range. Momentum is weak, with RSI around 35 and trading volume down over 50%, making short-term trend confirmation difficult. However, this calm

- Reward

- 64

- 106

- Repost

- Share

alex19x :

:

2026 GOGOGO 👊View More

#WeekendMarketAnalysis

Weekend Strategy: Discipline Before Direction

The market enters the weekend in a familiar but dangerous phase: quiet on the surface, decisive underneath.

Bitcoin is consolidating around the $95K zone. Despite strong fundamentals — including $1.8B in weekly spot ETF inflows and continued institutional accumulation — short-term momentum remains weak. Declining volume and low RSI suggest a technical bounce is possible, but without confirmation, this area also carries classic weekend trap risk. This is not a breakout zone; it’s a decision zone.

Ethereum shows relative stren

Weekend Strategy: Discipline Before Direction

The market enters the weekend in a familiar but dangerous phase: quiet on the surface, decisive underneath.

Bitcoin is consolidating around the $95K zone. Despite strong fundamentals — including $1.8B in weekly spot ETF inflows and continued institutional accumulation — short-term momentum remains weak. Declining volume and low RSI suggest a technical bounce is possible, but without confirmation, this area also carries classic weekend trap risk. This is not a breakout zone; it’s a decision zone.

Ethereum shows relative stren

- Reward

- 56

- 83

- Repost

- Share

CryptoSelf :

:

Happy New Year! 🤑View More

#WeekendMarketAnalysis

Despite Bitcoin recording a 21% rebound since November 2025, climbing from $80,500 to around $97,900, this move still appears to be a bear market rally rather than the start of a sustainable recovery. The broader market structure does not yet support the idea of a confirmed long-term trend reversal.

A similar pattern played out during the 2022 bear market. After Bitcoin crossed above the 365-day moving average from below, the price first declined by approximately 27%, then surged nearly 47%, only to be rejected precisely at the 365-day moving average. The current price

Despite Bitcoin recording a 21% rebound since November 2025, climbing from $80,500 to around $97,900, this move still appears to be a bear market rally rather than the start of a sustainable recovery. The broader market structure does not yet support the idea of a confirmed long-term trend reversal.

A similar pattern played out during the 2022 bear market. After Bitcoin crossed above the 365-day moving average from below, the price first declined by approximately 27%, then surged nearly 47%, only to be rejected precisely at the 365-day moving average. The current price

BTC-0,22%

- Reward

- 8

- 13

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#WeekendMarketAnalysis

Global Market Sentiment: "Technological Wind"

Global markets began 2026 under the shadow of geopolitical risks but with a technological revolution.

AI Dominance: The S&P 500 and Nasdaq are breaking records with strong earnings in the AI and semiconductor sectors. The key word for investors is "K-Shaped Recovery": On one side, those growing with technology, on the other, traditional sectors struggling with high costs.

The Fed and ECB adopting a softer tone is easing global liquidity conditions and fueling risk appetite. Spot ETF inflows in the US exceeding $450

Global Market Sentiment: "Technological Wind"

Global markets began 2026 under the shadow of geopolitical risks but with a technological revolution.

AI Dominance: The S&P 500 and Nasdaq are breaking records with strong earnings in the AI and semiconductor sectors. The key word for investors is "K-Shaped Recovery": On one side, those growing with technology, on the other, traditional sectors struggling with high costs.

The Fed and ECB adopting a softer tone is easing global liquidity conditions and fueling risk appetite. Spot ETF inflows in the US exceeding $450

- Reward

- 103

- 151

- Repost

- Share

Asiftahsin :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

18.73K Popularity

1.5K Popularity

29.09K Popularity

788 Popularity

204 Popularity

283 Popularity

105 Popularity

66.04K Popularity

349.14K Popularity

16K Popularity

89 Popularity

50.77K Popularity

207.73K Popularity

18K Popularity

158.28K Popularity

News

View MoreRevolut abandons US acquisition plans and shifts focus to pursuing independent licensing applications

8 m

"Victory War God" 40x long position with 25.12 BTC, average entry price $89,550.8

10 m

CryptoQuant: Bitcoin realized profit and loss indicate a market shift to loss confirmation, or a confirmed market bear trend

14 m

Japan 2-year government bond yield hits highest since 1996

24 m

Hardware wallet manufacturer Ledger plans to go public in the United States, with a valuation potentially exceeding $4 billion

31 m

Pin