2025 HYPER Price Prediction: Analyzing Market Trends and Future Growth Potential for the Digital Asset

Introduction: HYPER's Market Position and Investment Value

Hyperlane (HYPER), as the first permissionless and universal interoperability protocol, has made significant strides since its inception. As of 2025, Hyperlane's market capitalization has reached $41,916,600, with a circulating supply of approximately 175,200,000 tokens, and a price hovering around $0.23925. This asset, dubbed "The Open Interoperability Framework," is playing an increasingly crucial role in cross-chain communication and decentralized infrastructure.

This article will comprehensively analyze Hyperlane's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. HYPER Price History Review and Current Market Status

HYPER Historical Price Evolution Trajectory

- 2025: Launch on major exchanges, price reached all-time high of $0.68762

- 2025: Market correction, price dropped to all-time low of $0.08647

- 2025: Gradual recovery and stabilization, price fluctuating between $0.20 and $0.30

HYPER Current Market Situation

As of October 1, 2025, HYPER is trading at $0.23925, with a 24-hour trading volume of $2,035,155. The token has seen a 2.07% increase in the last 24 hours, indicating short-term positive momentum. However, looking at longer time frames, HYPER has experienced a decline of 13.55% over the past week and 20.21% over the last 30 days, suggesting a broader downward trend.

The current market capitalization of HYPER stands at $41,916,600, ranking it 763rd among all cryptocurrencies. With a circulating supply of 175,200,000 HYPER tokens out of a total supply of 1,000,000,000, the token has a circulation ratio of 17.52%.

HYPER's price is currently well below its all-time high of $0.68762, recorded on July 11, 2025, but significantly above its all-time low of $0.08647, reached on June 22, 2025. This suggests that while the token has recovered from its lowest point, it still has considerable ground to cover to reach its previous peak.

The token is listed on 38 exchanges, providing ample liquidity and trading options for investors. The current market sentiment, as indicated by the VIX index of 49, is described as "Neutral," which aligns with the token's recent price stability around the $0.23-$0.25 range.

Click to view the current HYPER market price

HYPER Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains neutral today, with the Fear and Greed Index hovering at 49. This balanced state suggests investors are neither overly pessimistic nor excessively optimistic. While caution persists, there's a sense of stability in the market. Traders on Gate.com are advised to maintain a balanced approach, carefully assessing risks and opportunities. Remember, market conditions can change rapidly, so stay informed and adjust your strategies accordingly.

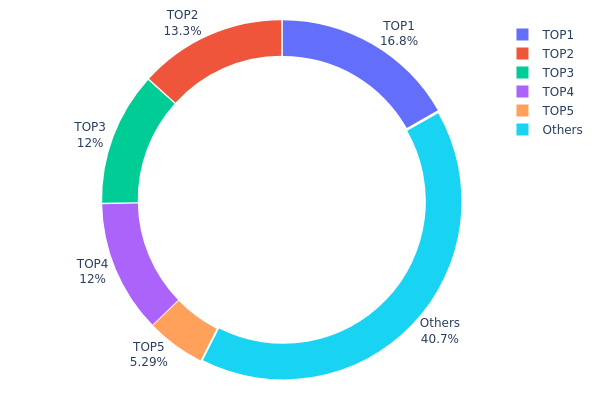

HYPER Holdings Distribution

The address holdings distribution data for HYPER reveals a relatively concentrated ownership structure. The top five addresses collectively hold 59.3% of the total supply, with the largest address controlling 16.77% of HYPER tokens. This concentration level indicates a potential centralization risk, as a small number of entities have significant influence over the token's supply.

Such a distribution pattern may have implications for market dynamics. The concentrated holdings could lead to increased volatility if large holders decide to sell or accumulate more tokens. It also raises concerns about potential market manipulation, as these major holders could potentially coordinate their actions to influence price movements.

From a structural perspective, the current distribution suggests that HYPER's on-chain ecosystem may be less decentralized than ideal. While 40.7% of tokens are held by addresses outside the top five, the significant concentration among a few large holders could impact governance decisions and overall token utility. Investors and analysts should monitor any changes in this distribution pattern, as shifts could signal important developments in HYPER's market structure and long-term stability.

Click to view the current HYPER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe1f2...b0de58 | 99720.55K | 16.77% |

| 2 | 0xbff1...dd675d | 79100.18K | 13.30% |

| 3 | 0xad5b...d43f22 | 71397.37K | 12.00% |

| 4 | 0x0102...c98f8f | 71059.36K | 11.95% |

| 5 | 0x7462...3b6ebf | 31446.20K | 5.28% |

| - | Others | 241846.06K | 40.7% |

II. Key Factors Influencing HYPER's Future Price

Supply Mechanism

- Presale Mechanism: The current price and market value of HYPER tokens are primarily influenced by the presale mechanism, with small incremental increases every few days.

- Current Impact: Once HYPER is officially released, its price will be subject to multiple factors, including broader market dynamics.

Institutional and Whale Dynamics

- Enterprise Adoption: In the Bitcoin Hyper ecosystem, HYPER serves as the core payment token and will have governance functionality in the future.

Macroeconomic Environment

- Monetary Policy Impact: While the current bull market differs slightly from previous cycles, monetary policy remains a core driving factor.

- Inflation Hedging Properties: As a Bitcoin Layer 2 solution, HYPER may inherit some of Bitcoin's inflation-hedging characteristics.

Technological Development and Ecosystem Building

- Solana Virtual Machine Integration: Bitcoin Hyper integrates the Solana Virtual Machine (SVM) into the Bitcoin system, enabling complex contract execution and support for decentralized applications (dApps) and smart contracts on Bitcoin for the first time.

- Ecosystem Applications: Bitcoin Hyper aims to unlock Web3 applications, including DeFi platforms, decentralized trading, and NFT markets, leveraging its unique technological architecture to enable faster, cheaper, and more efficient transfers of BTC.

III. HYPER Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.22983 - $0.23941

- Neutral forecast: $0.23941 - $0.27652

- Optimistic forecast: $0.27652 - $0.31363 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.26222 - $0.3647

- 2028: $0.29642 - $0.47293

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.40299 - $0.4171 (assuming steady market growth)

- Optimistic scenario: $0.43120 - $0.45881 (assuming strong market performance)

- Transformative scenario: $0.47293 - $0.50000 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: HYPER $0.45881 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.31363 | 0.23941 | 0.22983 | 0 |

| 2026 | 0.32629 | 0.27652 | 0.23228 | 15 |

| 2027 | 0.3647 | 0.30141 | 0.26222 | 25 |

| 2028 | 0.47293 | 0.33305 | 0.29642 | 39 |

| 2029 | 0.4312 | 0.40299 | 0.24986 | 68 |

| 2030 | 0.45881 | 0.4171 | 0.34202 | 74 |

IV. HYPER Professional Investment Strategies and Risk Management

HYPER Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in cross-chain technology

- Operation suggestions:

- Accumulate HYPER tokens during market dips

- Stay informed about Hyperlane's development and adoption

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Watch for news catalysts that may impact HYPER's price

- Set clear entry and exit points based on technical indicators

HYPER Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple interoperability projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for HYPER

HYPER Market Risks

- Volatility: Cryptocurrency market's inherent price fluctuations

- Competition: Emerging interoperability solutions may impact Hyperlane's market share

- Adoption rate: Slow integration by blockchain networks could affect growth

HYPER Regulatory Risks

- Unclear regulations: Potential for unfavorable regulatory decisions in key markets

- Cross-border compliance: Challenges in adhering to diverse international regulations

- Tax implications: Evolving tax laws may impact HYPER holders

HYPER Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol's code

- Scalability challenges: Issues in handling increased cross-chain traffic

- Interoperability failures: Risks associated with cross-chain communication errors

VI. Conclusion and Action Recommendations

HYPER Investment Value Assessment

HYPER presents a compelling long-term value proposition in the growing interoperability sector, but faces short-term risks from market volatility and competition. Its success hinges on continued adoption and technological advancement.

HYPER Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Explore strategic partnerships and substantial positions based on in-depth analysis

HYPER Trading Participation Methods

- Spot trading: Purchase HYPER tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Utilize HYPER in cross-chain DeFi applications

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can hyperliquid go?

Based on current projections, HyperLiquid could potentially reach $121.53 by 2028, a significant increase from its current price of around $26.83.

Should I stake my Bitcoin hyper?

Yes, staking HYPER offers rewards and governance rights. It's a good option for long-term holders who want to support the network.

What is Bitcoin hyper coin?

Bitcoin Hyper is a Layer-2 solution for Bitcoin, enhancing scalability and supporting advanced use cases like DeFi and NFTs. It's a promising new cryptocurrency project that raised significant funds in presales.

When was Hyper Coin launched?

Hyper Coin was launched in May 2025 with an initial price of $0.0115. The presale raised over $18 million.

2025 MLPrice Prediction: Navigating the Future of Machine Learning Costs in a Rapidly Evolving Tech Landscape

How Does On-Chain Data Reveal Merlin Chain's $3 Billion TVL Growth?

How Does MERL's Holding and Fund Flow Reflect Investor Confidence in Merlin Chain?

How Does Merlin Chain's On-Chain Data Reveal Bitcoin Layer 2 Adoption Trends?

How Does On-Chain Data Analysis Reveal Merlin Chain's Growth in 2025?

Exploring the Benefits of Bitcoin's Taproot Upgrade

GIGA Investor Loses $6M from Phishing: How to Protect Yourself from Fake Links

湯姆熊幣今日價格與走勢分析:即時TOM轉USD及購買指南

Unlocking EIP 4337: A Comprehensive Guide to Account Abstraction Implementation

Forecasting Jupiter's Value: Can JUP Reach $2 By 2030?

ARK Invest Divests $12.4 Million Position in Bitcoin ETF