2025 ILV Price Prediction: Expert Analysis and Market Forecast for Illuvium Token

Introduction: ILV's Market Position and Investment Value

Illuvium (ILV), an open-world GameFi game built on the Ethereum network, has emerged as a distinctive asset in the crypto gaming ecosystem since its inception in 2021. As of December 2025, ILV boasts a market capitalization of approximately $53.82 million with a circulating supply of 9.48 million tokens, currently trading at $5.61. This innovative gaming token, which serves dual purposes as both a player reward mechanism and governance token, is establishing itself as a key player in the intersection of decentralized gaming and blockchain finance.

Leveraging Ethereum's Layer 2 scaling solution Immutable X, Illuvium enables cost-effective NFT transactions while offering gamers full ownership of in-game assets. This unique value proposition provides players and investors with opportunities to collect, trade, battle, and acquire rare digital assets within a decentralized ecosystem.

This comprehensive analysis will examine ILV's price trajectories through 2030, integrating historical performance data, market supply-demand dynamics, ecosystem development, and broader macroeconomic conditions to deliver professional price forecasts and actionable investment strategies for stakeholders.

I. ILV Price History Review and Current Market Status

ILV Historical Price Evolution

- November 2021: ILV reached its all-time high (ATH) of $1,911.26, marking the peak of market enthusiasm during the GameFi boom period.

- 2022-2025: Significant market correction phase, with ILV experiencing a sustained downtrend as market conditions shifted and the broader crypto market faced headwinds.

- December 18, 2025: ILV hit a new all-time low (ATL) of $5.52, representing an 89.01% decline over the past year.

ILV Current Market Position

As of December 18, 2025, Illuvium (ILV) is trading at $5.608 with a 24-hour trading volume of $34,863.05. The token has experienced notable short-term volatility, declining 7.19% in the last 24 hours while gaining 0.84% in the past hour. Over longer timeframes, the bearish trend intensifies, with a 17.82% decline over 7 days and a 26.25% decline over the past 30 days.

The current market capitalization stands at $53,191,220.74, with a fully diluted valuation of $53,821,959.49. With 9,484,882.44 ILV tokens in circulation out of a total supply of 9,597,353.69, the circulating supply represents approximately 94.85% of the total supply. The token maintains a market dominance of 0.0017% and is listed on 34 exchanges globally.

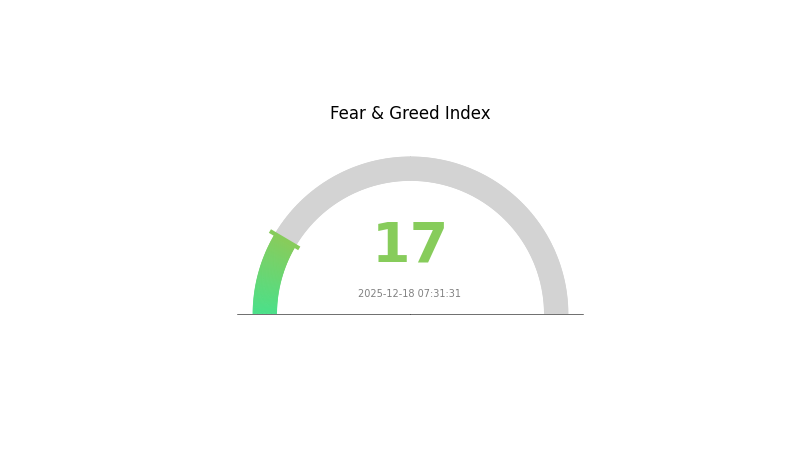

Market sentiment currently reflects extreme fear, with the Crypto Fear & Greed Index at 17, indicating pessimistic market conditions.

Click to view current ILV market price

ILV Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index at 17. This indicates heightened market pessimism and significant selling pressure among investors. During such periods, risk-averse traders typically reduce positions, while contrarian investors may view this as a potential buying opportunity. Market volatility tends to increase under extreme fear conditions. Investors should exercise caution, conduct thorough research, and consider their risk tolerance before making trading decisions. Monitor market developments closely for potential trend reversals.

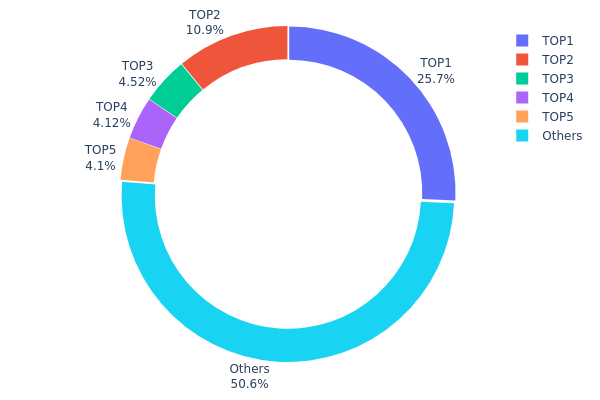

ILV Holding Distribution

The address holding distribution map illustrates the concentration of ILV tokens across on-chain addresses, revealing the degree of token centralization and market structural characteristics. By analyzing the distribution of the top holders relative to the total supply, we can assess market concentration risk, potential price manipulation vulnerabilities, and the overall decentralization level of the token ecosystem.

ILV currently exhibits moderate concentration characteristics with notable centralization among large holders. The top five addresses collectively control approximately 49.38% of the token supply, with the largest address alone accounting for 25.73% of holdings. The second-largest holder maintains a significant 10.93% stake, while addresses ranked third through fifth each hold between 4-5% of the total supply. This distribution pattern indicates that while no single entity exercises overwhelming dominance, substantial concentration remains among a limited number of accounts, suggesting potential vulnerability to coordinated actions by major stakeholders.

The current holding structure presents measurable implications for market dynamics and price stability. With the top holder maintaining over one-quarter of the circulating supply, any large liquidation or accumulation activity from this address could exert considerable pressure on market pricing and liquidity conditions. The remaining 50.62% distribution among other addresses provides some counterbalance to concentration risk, yet the asymmetric positioning of the top five holders indicates that retail and smaller institutional participants hold relatively limited token quantities. This structural composition suggests moderate centralization rather than severe concentration, though price volatility could remain susceptible to decisions made by a handful of major stakeholders.

Access current ILV holding distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6bd2...57adc6 | 2352.13K | 25.73% |

| 2 | 0xf977...41acec | 1000.00K | 10.93% |

| 3 | 0x7f5f...34291d | 413.31K | 4.52% |

| 4 | 0x28c6...f21d60 | 376.15K | 4.11% |

| 5 | 0xe66d...8527a1 | 374.70K | 4.09% |

| - | Others | 4624.64K | 50.62% |

II. Core Factors Affecting ILV's Future Price

Supply and Demand Dynamics

-

Token Scarcity Mechanism: As a blockchain-based asset, ILV token's scarcity is a fundamental factor that may drive up demand, particularly considering its role within the Illuvium gaming ecosystem. The limited supply of ILV creates natural price support through supply and demand principles inherent to DeFi markets.

-

Current Market Impact: ILV's value is significantly influenced by fundamental supply-demand principles in the DeFi sector. The token's integration into the Illuvium game economy establishes utility-based demand from players and ecosystem participants, which serves as a foundational price driver.

Technology Development and Ecosystem Building

-

Gaming Ecosystem Development: Illuvium's future price movements are closely tied to its game ecosystem maturation and market adoption. The project represents a AAA-grade blockchain game initiative, with ongoing development that influences investor sentiment and token utility expectations.

-

Ecosystem Applications: The primary application of ILV exists within the Illuvium gaming platform, where the token functions as a core economic component. The platform's ability to attract users and maintain engagement directly correlates with token demand and price dynamics.

Key Consideration: Multiple factors influence ILV token price beyond project fundamentals alone, including overall blockchain performance, competitive pressures within the GameFi sector, and broader investor sentiment in the cryptocurrency market.

Three、2025-2030 ILV Price Forecast

2025 Outlook

- Conservative Forecast: $2.97 - $4.50

- Neutral Forecast: $4.50 - $6.00

- Optimistic Forecast: $6.00 - $6.85 (requires sustained platform adoption and ecosystem expansion)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, driven by protocol improvements and increased developer activity within the Illuvium ecosystem

- Price Range Forecast:

- 2026: $4.92 - $8.03

- 2027: $5.06 - $7.70

- Key Catalysts: Gaming platform upgrades, strategic partnerships, increased in-game utility, and broader NFT market recovery

2028-2030 Long-term Outlook

- Base Case: $5.78 - $10.61 (assumes steady ecosystem growth and mainstream adoption of play-to-earn mechanics)

- Optimistic Case: $10.61 - $11.98 (assumes accelerated blockchain gaming adoption and successful tournament launches)

- Transformative Case: $13.54+ (requires paradigm shift in Web3 gaming adoption, institutional involvement, and Illuvium becoming the leading gaming protocol across multiple networks)

Based on the projection data, ILV demonstrates an expected cumulative appreciation of approximately 87% by 2030, reflecting confidence in the protocol's long-term value generation potential. Investors should monitor platform milestones and trading activity on regulated platforms such as Gate.com for real-time market developments.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 6.84542 | 5.611 | 2.97383 | 0 |

| 2026 | 8.03439 | 6.22821 | 4.92029 | 11 |

| 2027 | 7.7018 | 7.1313 | 5.06322 | 27 |

| 2028 | 10.60567 | 7.41655 | 5.78491 | 32 |

| 2029 | 11.98478 | 9.01111 | 5.49678 | 60 |

| 2030 | 13.54235 | 10.49794 | 5.66889 | 87 |

Illuvium (ILV) Professional Investment Strategy and Risk Management Report

I. Market Overview

ILV Current Market Position

Illuvium (ILV) is an open-world GameFi game built on the Ethereum network, currently ranked #487 in the cryptocurrency market by market capitalization. As of December 18, 2025:

- Current Price: $5.608

- 24-Hour Change: -7.19%

- Market Capitalization: $53.82 million

- Circulating Supply: 9,484,882 ILV (94.85% of total supply)

- 24-Hour Trading Volume: $34,863.05

- All-Time High: $1,911.26 (November 30, 2021)

- All-Time Low: $5.52 (December 18, 2025)

Project Fundamentals

ILV serves as the native utility and governance token for the Illuvium ecosystem. Key features include:

- Play-to-Earn Mechanism: Players earn ILV rewards through gameplay activities

- Governance Rights: Token holders participate in project governance decisions

- Layer 2 Integration: Utilizes Immutable X (Ethereum Layer 2) to reduce NFT transaction gas fees

- NFT Ownership: Players fully own their Illuvials NFTs and can trade them on secondary markets

- Market Accessibility: Available on 34 cryptocurrency exchanges

II. ILV Professional Investment Strategies

Investment Approach (1): Long-Term Holding Strategy

Suitable Investors:

- GameFi ecosystem believers with 2+ year investment horizons

- Investors seeking exposure to gaming and NFT technology

- Portfolio diversifiers in blockchain gaming sector

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Given the extreme volatility (89% decline over 1 year), implement monthly purchases of fixed amounts to reduce timing risk

- Accumulation During Downturns: Current low price levels may represent oversold conditions; consider increasing position size during further market weakness

- Staking Participation: Engage with Illuvium's governance mechanisms to earn additional rewards while holding ILV

Storage Solutions:

- Utilize Gate Web3 Wallet for secure self-custody of ILV tokens

- Maintain private keys in cold storage for positions exceeding $5,000 in value

- Consider multi-signature wallet configurations for larger holdings

Investment Approach (2): Active Trading Strategy

Technical Analysis Tools:

- RSI (Relative Strength Index): Current extreme weakness suggests potential oversold bounce opportunities; monitor for readings below 30

- Moving Averages: Track 50-day and 200-day MAs to identify trend reversals and resistance levels

- Volume Analysis: Watch for capitulation volume at price lows as potential reversal signals

Swing Trading Key Points:

- Resistance Levels: Monitor historical resistance at $8-12 range based on recent price action

- Support Identification: Current support established near all-time low of $5.52; breaks below this level indicate further downside risk

- Risk-Reward Ratios: Maintain minimum 1:3 risk-reward ratios; avoid trading with unfavorable odds

III. ILV Risk Management Framework

Asset Allocation Principles

Given ILV's high volatility and speculative nature:

- Conservative Investors: 0-1% portfolio allocation maximum

- Active Investors: 2-5% portfolio allocation suitable for risk-tolerant participants

- Aggressive Investors: 5-10% allocation only for experienced traders with high risk tolerance

Risk Mitigation Strategies

Hedging Approach 1: Position Sizing Limits

- Implement strict maximum loss per trade at 2% of total portfolio

- Scale positions gradually rather than concentrating holdings

Hedging Approach 2: Diversification

- Balance ILV holdings with stable positions in established cryptocurrencies

- Avoid over-concentration in single GameFi projects

Secure Storage Solutions

Hot Wallet Approach:

- Gate Web3 Wallet recommended for active trading amounts (typically <$500)

- Provides optimal balance between accessibility and security

Cold Storage Method:

- Hardware wallet solutions for holdings exceeding $1,000

- Offline storage eliminates exchange counterparty risk

Critical Security Considerations:

- Never share private keys or seed phrases with any individual or service

- Enable all available security features on Gate.com accounts

- Verify website URLs before entering credentials (phishing risk is significant)

- Regularly audit wallet access logs and transaction history

IV. ILV Potential Risks and Challenges

Market Risks

Extreme Volatility Risk: ILV experienced a 89% price decline over 12 months and 7.19% decline in 24 hours. This extreme volatility can result in substantial losses for unprepared investors.

Low Liquidity Risk: Daily trading volume of $34,863 represents thin liquidity. Large buy or sell orders may experience significant slippage, disadvantaging retail traders.

Speculative Valuation Risk: Current price remains 99.7% below all-time high, indicating potential overvaluation during peak optimism and vulnerability to sentiment shifts.

Regulatory Risks

Gaming Regulation Uncertainty: Jurisdictions worldwide are developing frameworks for play-to-earn games. Potential restrictions could limit player growth and token demand.

Token Classification Risk: Regulatory agencies may reclassify ILV as a security, triggering compliance requirements and potential delisting from certain exchanges.

Cross-Border Compliance: Gaming platforms operating globally face complex compliance requirements across multiple jurisdictions simultaneously.

Technology Risks

Smart Contract Vulnerability: Like all Ethereum-based protocols, Illuvium remains subject to potential smart contract bugs or exploits that could compromise token holders.

Immutable X Dependency: Reliance on Immutable X for scaling introduces counterparty risk; platform issues would directly impact Illuvium's functionality and user experience.

Gaming Adoption Risk: Success depends on sustained player engagement. Declining user metrics or competitive pressure from superior gaming experiences could reduce token demand.

V. Conclusions and Action Recommendations

ILV Investment Value Assessment

Illuvium represents a high-risk, high-reward speculative position within the GameFi sector. The 89% annual decline reflects broader challenges in convincing users that gaming tokenomics create sustainable value. However, the current low price may present contrarian opportunities for risk-tolerant investors willing to endure continued volatility. Long-term viability depends critically on game adoption rates and genuine utility development beyond token speculation.

Investment Recommendations by Investor Profile

✅ Beginners: Avoid concentrated ILV positions. If interested in GameFi exposure, allocate maximum 1% of portfolio and use Gate.com platform for safe purchasing and storage through Gate Web3 Wallet. Prioritize learning about token mechanics before deploying capital.

✅ Experienced Investors: Consider 2-5% allocation as portfolio diversifier. Implement technical analysis-based swing trading for 25% of position; hold remaining 75% for long-term upside. Maintain strict stop-loss discipline at 10-15% below entry points.

✅ Institutional Investors: Evaluate ILV within broader GameFi sector allocation. Conduct detailed due diligence on game adoption metrics and competitive positioning. Consider structured investment approach with quarterly rebalancing and risk-adjusted position sizing.

Trading Participation Methods

Method 1 - Gate.com Spot Trading: Purchase ILV directly using fiat currency or cryptocurrency pairs. Provides immediate access to liquidity and transparent price discovery. Suitable for all investor types.

Method 2 - Dollar-Cost Averaging: Execute systematic monthly purchases regardless of price. Reduces timing risk and psychological factors in decision-making. Ideal for long-term accumulators.

Method 3 - Technical Trading: Combine support/resistance analysis with volume indicators for swing trades lasting 1-4 weeks. Requires active monitoring but maximizes returns during volatile price action.

Cryptocurrency investment carries extreme risk of total capital loss. This report does not constitute financial advice. Investors must conduct independent research and consult qualified financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely. Market conditions, regulatory environment, and project fundamentals can change rapidly and unexpectedly.

FAQ

What will Illuvium be worth in 2025?

Based on expert forecasts, Illuvium is projected to trade between $16 and $40 in 2025. The valuation depends on market adoption, gaming ecosystem growth, and overall crypto market conditions during the year.

Can Illuvium reach $1000?

While reaching $1000 is theoretically possible with major market shifts and increased adoption, current forecasts remain conservative. ILV would need significant ecosystem growth and broader market expansion to achieve such valuations.

Is ILV a good investment?

ILV may be a good investment for those who believe in blockchain gaming and long-term adoption. With strong ecosystem development and gaming potential, ILV shows promising growth opportunities in the Web3 sector.

Does Illuvium have a future?

Yes, Illuvium has a promising future. The project continues active development, regular updates, and strong community engagement. With ongoing game expansion and technological innovations, ILV is positioned for sustained growth and adoption in the gaming sector.

Is Illuvium (ILV) a good investment?: A Comprehensive Analysis of Tokenomics, Market Performance, and Future Potential in the Gaming Metaverse Sector

What is XAI: Understanding Explainable Artificial Intelligence and Its Impact on Modern Decision-Making Systems

Is ALICE (ALICE) a good investment?: Analyzing the Potential and Risks of This Gaming Token in Today's Crypto Market

What is SLIMEX ($SLX)? An in-depth exploration of the game-driven L2 network.

MF vs IMX: Comparing Investment Strategies for Long-Term Growth

MV vs IMX: Comparing Marine Vessel and Intermodal Exchange Technologies in Modern Logistics

Comprehensive Guide on the DRC 20 Token Standard

What are satoshis in the Bitcoin ecosystem

Exploring DRC20 Platforms for Dogecoin Transactions

Must-See NFT Collections Launching in 2024

NFT App Mysteriously Removed from Apple Store: Why It Happened