2025 LKY Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: LKY's Market Position and Investment Value

Luckycoin (LKY), recognized as the oldest and first memecoin in the cryptocurrency space, has made significant strides since its inception in 2013. By 2025, Luckycoin's market capitalization has reached $3,821,130, with a circulating supply of approximately 19,153,537 tokens and a price hovering around $0.1995. This asset, hailed as the "pioneer of meme coins," is playing an increasingly crucial role in the realm of blockchain innovation and community-driven cryptocurrencies.

This article will provide a comprehensive analysis of Luckycoin's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LKY Price History Review and Current Market Status

LKY Historical Price Evolution

- 2013: Luckycoin launched as the first memecoin, price not available

- 2024: Bitcoin developers revived Luckycoin in August, price began to fluctuate

- 2024-2025: Market cycle, price reached an all-time high of $7.599 on December 21, 2024, and dropped to an all-time low of $0.139 on March 4, 2025

LKY Current Market Situation

As of October 12, 2025, LKY is trading at $0.1995. The token has experienced a 1.52% decrease in the last 24 hours, with a trading volume of $22,174.92. LKY's market capitalization stands at $3,821,130.71, ranking it at 1886 in the cryptocurrency market. The circulating supply is 19,153,537.37 LKY, which represents 95.77% of the total supply. The fully diluted market cap is $3,990,000.00. Over the past week, LKY has seen a significant decline of 15.5%, while the 30-day and 1-year price changes show decreases of 19.48% and 47.40% respectively.

Click to view the current LKY market price

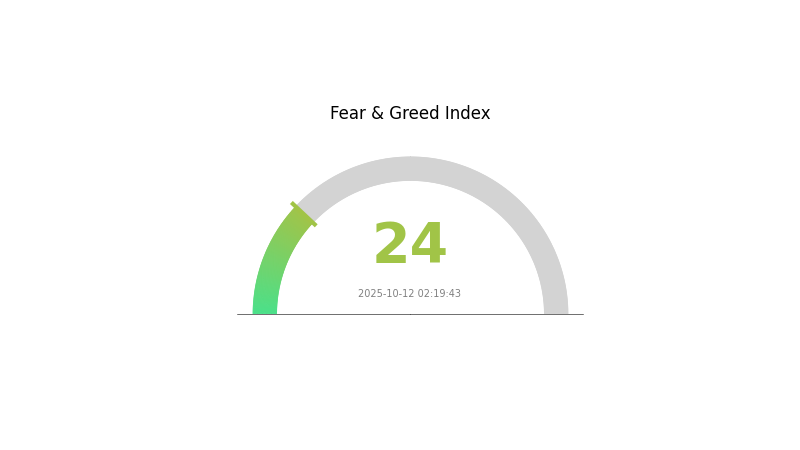

LKY Market Sentiment Indicator

2025-10-12 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the sentiment index plummeting to 24. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider dollar-cost averaging and diversifying their portfolios to mitigate risks. Remember, while fear prevails, it's crucial to conduct thorough research and avoid making impulsive decisions based solely on market sentiment.

LKY Holdings Distribution

The address holdings distribution chart provides valuable insights into the concentration of LKY tokens among different wallet addresses. Based on the provided data, it appears that there are currently no addresses holding significant amounts of LKY tokens, as the table is empty.

This unusual situation could indicate a highly decentralized distribution of LKY tokens, with no single address or entity controlling a large portion of the supply. Such a distribution pattern may suggest a reduced risk of market manipulation or price volatility caused by large holders. However, it could also potentially indicate a lack of major institutional or long-term holders, which might impact market stability and liquidity.

The absence of large holders may reflect a more democratic and widely distributed token ecosystem. This could be seen as a positive factor for LKY's decentralization efforts, potentially leading to a more resilient and fair market structure. Nevertheless, further investigation into smaller holdings and overall token distribution would be necessary to form a comprehensive understanding of LKY's on-chain dynamics and market characteristics.

Click to view the current LKY holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing LKY's Future Price

Supply Mechanism

- Historical Patterns: Past supply changes have influenced price movements

- Current Impact: Expected impact of current supply changes on price

Institutional and Whale Dynamics

- Corporate Adoption: Notable companies adopting LKY

Macroeconomic Environment

- Impact of Monetary Policy: Expected policies of major central banks

- Geopolitical Factors: Influence of international situations

Technological Development and Ecosystem Building

- Technical Upgrades: Content and impact of upgrades

- Ecosystem Applications: Major DApps/ecosystem projects

III. LKY Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.12569 - $0.15

- Neutral prediction: $0.18 - $0.22

- Optimistic prediction: $0.25 - $0.28728 (requires strong market momentum)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.13096 - $0.38003

- 2028: $0.17831 - $0.40119

- Key catalysts: Wider adoption of blockchain technology, favorable regulatory developments

2029-2030 Long-term Outlook

- Base scenario: $0.35 - $0.45 (assuming steady market growth)

- Optimistic scenario: $0.46414 - $0.50672 (assuming accelerated adoption and positive market conditions)

- Transformative scenario: Above $0.50 (given breakthrough use cases and mainstream acceptance)

- 2030-12-31: LKY $0.41197 (potential year-end average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.28728 | 0.1995 | 0.12569 | 0 |

| 2026 | 0.27016 | 0.24339 | 0.20201 | 22 |

| 2027 | 0.38003 | 0.25678 | 0.13096 | 28 |

| 2028 | 0.40119 | 0.3184 | 0.17831 | 59 |

| 2029 | 0.46414 | 0.3598 | 0.19069 | 80 |

| 2030 | 0.50672 | 0.41197 | 0.34605 | 106 |

IV. Professional Investment Strategies and Risk Management for LKY

LKY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and crypto enthusiasts

- Operation suggestions:

- Accumulate LKY during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to manage risk

LKY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Luckycoin wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for LKY

LKY Market Risks

- High volatility: Price can fluctuate dramatically in short periods

- Limited liquidity: May face challenges in executing large trades

- Correlation with broader crypto market: Vulnerable to overall market sentiment

LKY Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of meme coins

- Tax implications: Evolving tax laws may impact LKY holders

- Legal status: Risk of being classified as a security in some jurisdictions

LKY Technical Risks

- Network security: Potential vulnerabilities in the blockchain

- Smart contract risks: If implemented, bugs could lead to loss of funds

- Scalability challenges: May face issues with increased adoption

VI. Conclusion and Action Recommendations

LKY Investment Value Assessment

Luckycoin (LKY) presents a unique investment opportunity as the oldest memecoin in the crypto space. While it offers potential for significant returns, investors should be aware of its high volatility and speculative nature.

LKY Investment Recommendations

✅ Beginners: Allocate a small portion (1-2%) of your crypto portfolio to LKY

✅ Experienced investors: Consider a 3-5% allocation, actively manage position

✅ Institutional investors: Approach with caution, thorough due diligence required

LKY Trading Participation Methods

- Spot trading: Available on Gate.com

- Dollar-cost averaging: Set up recurring buys to accumulate over time

- Staking: Participate in staking programs if offered by the Luckycoin network

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for XRP in 2030?

By 2030, XRP is predicted to reach a price range of $90 to $120, based on current market trends and expected growth in the crypto sector.

What is lky crypto?

LKY (Luckycoin) is a cryptocurrency created in 2013, known for its 'flip the coin' mechanism. It has a unique place in crypto history.

Which AI can predict crypto prices?

Incite AI is a leading tool for crypto price predictions. It uses advanced algorithms to analyze market trends, offering precise insights through a user-friendly interface. Its reliability and accuracy make it a top choice for crypto forecasting.

What is the price prediction for crypto in 2025?

Bitcoin is expected to reach $60,000, Ethereum $4,000, and Solana $100 by 2025. These predictions suggest significant growth potential for major cryptocurrencies.

2025 BANANAS31Price Prediction: Market Trends and Investment Outlook for the Emerging Crypto Asset

Is cheems (CHEEMS) a good investment?: Analyzing the potential and risks of the meme-inspired cryptocurrency

2025 BEFE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 ANDYETH Price Prediction: Bullish Outlook Amid Blockchain Advancements and Market Expansion

What Does 'Stonks' Mean ?

Will Crypto Recover in 2025?

TechyPaper AI Academic Summary Platform

How Does Kaspa (KAS) Community Activity Compare to Mainstream Crypto Projects in 2025?

1011 Crypto Market Crash Analysis

What Is Regulatory and Compliance Risk in Cryptocurrency: SEC Legal Requirements and KYC/AML Policies Explained

What is AVNT: A Comprehensive Guide to Advanced Virtual Network Technology