2025 LOFI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: LOFI's Market Position and Investment Value

LOFI (LOFI), a decentralized finance token built on the Sui blockchain, has emerged as a notable asset in the cryptocurrency ecosystem. Since its launch in April 2023, LOFI has established itself with a current market capitalization of approximately $5,988,000 USD and a circulating supply of 1 billion tokens, with prices hovering around $0.005988. This asset, which represents a collective mission to build a thriving and forward-thinking ecosystem on the Sui blockchain, continues to play an increasingly significant role in the decentralized finance landscape.

This article will provide a comprehensive analysis of LOFI's price trajectory from 2025 to 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging digital asset.

I. LOFI Price History Review and Market Status

LOFI Historical Price Movement Trajectory

- 2023 (April): LOFI launched with an initial price of $0.008

- 2025 (January): LOFI reached its all-time high of $0.1845

- 2025 (December): LOFI declined to its all-time low of $0.00532, representing a year-to-date decline of -95.61%

LOFI Current Market Situation

As of December 23, 2025, LOFI is trading at $0.005988 with a 24-hour trading volume of $26,936.58. The token has experienced significant volatility in recent trading periods, declining -7.05% over the past 24 hours and -3.61% over the past 7 days. The hourly trend shows a modest recovery of +0.59%, indicating some short-term price stabilization attempts.

The market capitalization stands at $5,988,000, with a fully diluted valuation of $5,988,000. LOFI maintains a circulating supply of 1,000,000,000 tokens, representing 100% of its total and maximum supply. The token is currently ranked 1435 by market capitalization with a market dominance of 0.00018%.

The 30-day performance shows a -10.33% decline, reflecting broader market pressure on the asset. The trading range over the past 24 hours spans from $0.005769 (low) to $0.006423 (high), indicating relatively tight price consolidation at depressed levels. With 10,482 token holders and trading activity across 5 exchanges, LOFI maintains modest liquidity in the market.

Click to view current LOFI market price

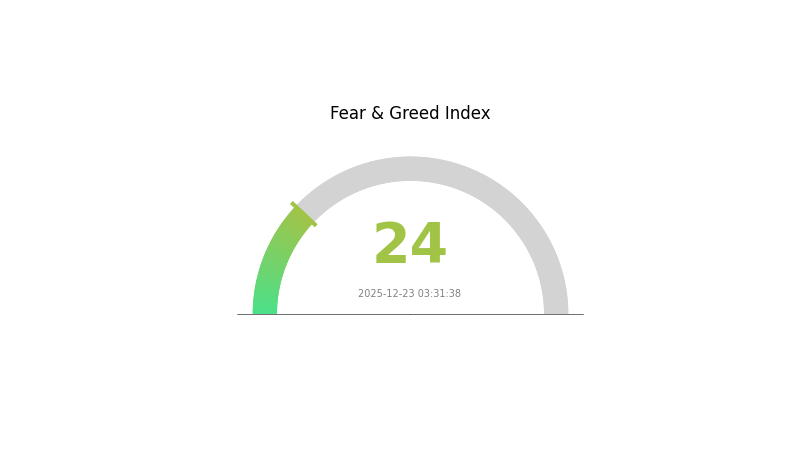

LOFI Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, market volatility typically increases, and asset prices often face downward pressure. However, extreme fear can also present opportunities for long-term investors to accumulate positions at lower valuations. Traders should exercise caution, manage risk carefully, and avoid making impulsive decisions driven by emotion. Consider reviewing your portfolio strategy and risk management protocols on Gate.com to navigate this challenging market environment effectively.

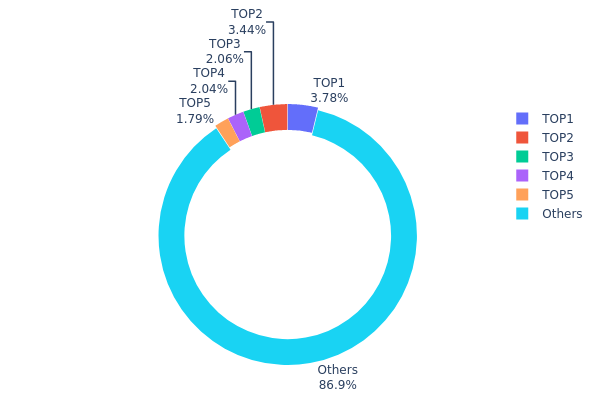

LOFI Holdings Distribution

The address holdings distribution represents the concentration of LOFI tokens across different wallet addresses on the blockchain. This metric provides critical insight into token ownership patterns, helping analysts assess the degree of decentralization, potential market concentration risks, and the distribution of voting power or governance influence among holders.

Current analysis of LOFI's address distribution reveals a relatively healthy decentralization structure. The top five addresses collectively hold approximately 13.09% of total token supply, with the largest holder controlling only 3.77%. This distribution pattern indicates that no single entity maintains overwhelming control over the token supply. The remaining 86.91% of tokens are dispersed among thousands of other addresses, suggesting a broad-based holder ecosystem that mitigates concentration risks. The gradual decline in holdings from rank one to rank five demonstrates an absence of extreme oligopolistic control, which is a positive indicator for market stability.

From a market structure perspective, LOFI's current holdings distribution suggests limited potential for severe price manipulation by any individual actor. The fragmented ownership across numerous addresses reduces the likelihood of coordinated pump-and-dump schemes or sudden large-scale liquidations that could destabilize the price discovery mechanism. This decentralized holder base contributes to improved market resilience and supports more organic price formation. Overall, LOFI demonstrates robust on-chain distribution characteristics that reflect a mature, decentralized community structure rather than speculative concentration among whales.

Click to view current LOFI holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb0c4...f305a0 | 37792.15K | 3.77% |

| 2 | 0x62f3...fa53ad | 34378.13K | 3.43% |

| 3 | 0xf8b7...c2d43f | 20611.85K | 2.06% |

| 4 | 0xc38e...f15f32 | 20403.02K | 2.04% |

| 5 | 0x443c...dba79a | 17945.08K | 1.79% |

| - | Others | 868869.77K | 86.91% |

II. Core Factors Influencing LOFI's Future Price

Market Sentiment and Overall Crypto Trends

-

Market Dynamics: LOFI's price is influenced by broader cryptocurrency market sentiment and overall industry trends. As Bitcoin maintains stable upward momentum, altcoins like LOFI have become focal points in market discussions.

-

Trading Volume and Liquidity: Exchange trading volume and liquidity are key price drivers. Increased trading activity on major platforms directly impacts price discovery and market accessibility for investors.

-

Exchange Listings: LOFI has gained significant traction through exchange expansions, which enhance market visibility and accessibility. Recent listing announcements have contributed to breaking records and attracting increased trader attention.

Project Development Progress

-

Project Milestones: LOFI's price movements are closely tied to development progress and project achievements. Investors' optimism is driven by successful implementation of planned features and technical advances.

-

Community Engagement: Active community participation and support strengthen investor confidence, creating positive price momentum. Strong community involvement contributes to sustained market interest in the token.

III. 2025-2030 LOFI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00414 - $0.00591

- Neutral Forecast: $0.00591

- Bearish Forecast: $0.0084 (Requires market recovery and positive sentiment shift)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Transition from consolidation to gradual recovery phase, with increasing market interest and gradual price appreciation momentum.

- Price Range Forecast:

- 2026: $0.0058 - $0.01038

- 2027: $0.00491 - $0.01105

- Key Catalysts: Ecosystem development progress, increased adoption metrics, positive regulatory developments, and growing institutional interest in the project.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00921 - $0.01278 (Assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.01043 - $0.01214 (Assumes accelerated adoption and strategic partnership announcements)

- Transformational Scenario: $0.01092 - $0.01714 (Assumes breakthrough technological advancement and mainstream integration)

- 2030-12-31: LOFI targets $0.01714 as potential peak (Based on cumulative 96% appreciation over the forecast period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0084 | 0.00591 | 0.00414 | -1 |

| 2026 | 0.01038 | 0.00716 | 0.0058 | 19 |

| 2027 | 0.01105 | 0.00877 | 0.00491 | 46 |

| 2028 | 0.01278 | 0.00991 | 0.00921 | 65 |

| 2029 | 0.01214 | 0.01134 | 0.01043 | 89 |

| 2030 | 0.01714 | 0.01174 | 0.01092 | 96 |

LOFI Investment Analysis Report

IV. LOFI Professional Investment Strategy and Risk Management

LOFI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Community-driven investors aligned with Sui ecosystem development

- Operational Recommendations:

- Accumulate during market downturns when LOFI trades significantly below historical highs (current price $0.005988 vs. ATH of $0.1845)

- Maintain positions through ecosystem development phases on Sui blockchain

- Dollar-cost averaging approach to mitigate volatility given the -95.61% one-year decline

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor 24-hour volatility range ($0.005769 - $0.006423) for swing opportunities

- Track momentum indicators given recent -7.05% 24-hour decline

- Wave Trading Considerations:

- Watch support levels near $0.00532 (historical low)

- Identify resistance near $0.006423 (24-hour high)

- Execute trades during high volume periods (current 24h volume: $26,936.58)

LOFI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 2% of portfolio

- Active Investors: 2% - 5% of portfolio

- Professional Investors: 5% - 10% of portfolio

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance LOFI holdings with established Sui ecosystem tokens

- Position Sizing: Limit individual trades to 1-2% of total capital given extreme historical volatility

(3) Secure Storage Solutions

- Self-Custody Option: Gate Web3 wallet for direct LOFI management on Sui blockchain

- Exchange Storage: Gate.com platform for active trading purposes

- Security Considerations: Enable multi-factor authentication, verify contract address before transfers (0xf22da9a24ad027cccb5f2d496cbe91de953d363513db08a3a734d361c7c17503::LOFI::LOFI on Sui), never share private keys

V. LOFI Potential Risks and Challenges

LOFI Market Risks

- Extreme Price Volatility: -95.61% annual decline indicates severe market instability and speculative nature

- Low Liquidity Depth: 24-hour volume of only $26,936.58 may result in significant slippage on large orders

- Small Market Capitalization: $5.988M market cap creates susceptibility to manipulation and sudden price movements

LOFI Regulatory Risks

- Sui Blockchain Compliance: Regulatory clarity surrounding Sui-based tokens remains evolving

- Jurisdictional Restrictions: Token may face varying regulatory treatment across different regions

- Community-Driven Governance: Movement-oriented structure may face future regulatory scrutiny

LOFI Technology Risks

- Sui Network Dependency: Project success entirely dependent on Sui blockchain stability and adoption

- Smart Contract Vulnerabilities: Early-stage ecosystem tokens carry inherent smart contract risks

- Ecosystem Development: Limited historical track record relative to established blockchain projects

VI. Conclusion and Action Recommendations

LOFI Investment Value Assessment

LOFI represents a speculative, community-oriented token built on the Sui blockchain with significant downside risk history. The 95.61% annual decline, combined with minimal market liquidity and capitalization, indicates this is an extremely high-risk asset suitable only for speculative positioning. The project's value proposition centers on building a forward-thinking ecosystem on Sui rather than established financial utility, making it suitable only for risk-tolerant participants with deep conviction in Sui's long-term growth.

LOFI Investment Recommendations

✅ Beginners: Avoid or limit to microcap allocations (<0.5%) only after extensive research into Sui ecosystem fundamentals

✅ Experienced Traders: Consider contrarian positions during extreme downturns with strict stop-loss discipline at -20% below entry

✅ Institutional Investors: Monitor ecosystem developments but maintain minimal exposure given illiquidity and regulatory uncertainties

LOFI Trading Participation Methods

- Gate.com Spot Trading: Direct LOFI/USDT pair trading with real-time price discovery

- Gate.com Web3 Wallet: Self-custody option for long-term holding and direct ecosystem participation

- Community Engagement: Participate in LOFI ecosystem development on Sui blockchain through official channels (https://lofitheyeti.com/, https://x.com/lofitheyeti)

Cryptocurrency investment carries extreme risk. This analysis is for informational purposes only and does not constitute investment advice. Investors must conduct independent research and consult qualified financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

What is the price prediction for LOFI?

LOFI is predicted to reach $0.0063 within a week and $0.00552 within four weeks, based on current analytical trends and market momentum.

What is LOFI token and what are its use cases?

LOFI token is a cryptocurrency rooted in lo-fi music culture on blockchain. Use cases include ecosystem transactions, community engagement, and serving as a utility token within the LOFI platform ecosystem.

What factors influence LOFI price movements?

LOFI price movements are driven by market sentiment, trading volume, user adoption rates, and technological developments. Macroeconomic conditions and broader crypto market trends also significantly impact price fluctuations.

Is LOFI a good investment opportunity based on current analysis?

LOFI shows strong potential as an investment opportunity. Technical analysis indicates positive momentum with solid trading volume metrics. Current market conditions suggest favorable entry points for investors conducting proper research.

What are the risks associated with investing in LOFI?

LOFI carries market volatility risks, potential capital loss, and regulatory uncertainty. Conduct thorough research and only invest what you can afford to lose.

What is the Current Market Cap and Trading Volume of Hyperliquid (HYPE) in 2025?

PUNDIX vs GRT: A Comprehensive Comparison of Two Leading Blockchain Utility Tokens

ADX vs LINK: Comparing Two Leading Oracle and Data Solutions for Blockchain Applications

BTRST vs AAVE: Comparing Two Leading Governance Tokens in the DeFi Ecosystem

ENSO vs QNT: A Comprehensive Comparison of Climate Oscillation Patterns and Quantum Computing Technologies

G vs LINK: A Comprehensive Comparison of Two Leading Blockchain Protocols and Their Impact on Decentralized Finance

2025 CLORE Price Prediction: Expert Analysis and Market Forecast for Distributed Cloud Computing Token

2025 OSHI Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 STOS Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

2025 VON Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Exploring Cardano: Future Prospects and Investment Potential