2025 SWELL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SWELL's Market Position and Investment Value

Swell Network (SWELL) is a non-custodial staking protocol dedicated to delivering the world's best liquid staking and restaking experience while simplifying access to DeFi and securing the future of Ethereum and restaking services. Since its launch in November 2024, the token has garnered significant attention within the Web3 staking ecosystem. As of December 23, 2025, SWELL's market capitalization stands at approximately $6.61 million with a circulating supply of 3.98 billion tokens, currently trading at $0.00166. This innovative staking solution is increasingly playing a critical role in the decentralized finance sector.

This article will comprehensively analyze SWELL's price trends and market dynamics, incorporating historical performance data, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies for the period ahead.

SWELL Market Analysis Report

I. SWELL Price History Review and Current Market Status

SWELL Historical Price Evolution Trajectory

-

September 2024: SWELL token reached its all-time high of $0.19992 on September 29, 2024, marking the peak of initial market enthusiasm following the protocol's launch.

-

December 2024 to Present: The token experienced a significant downtrend, declining over 94.61% year-over-year, with prices falling from the historical high to current levels around $0.00166 as of December 23, 2025.

SWELL Current Market Conditions

As of December 23, 2025, SWELL is trading at $0.00166, reflecting a substantial correction from its historical highs. The token's 24-hour trading volume stands at approximately $54,134.57, with a fully diluted market capitalization of $16.6 million. The circulating supply comprises 3.98 billion SWELL tokens out of a total maximum supply of 10 billion tokens, representing a circulation ratio of approximately 39.84%.

Recent price movements show mixed signals: the token gained 2.21% in the last 24 hours and 0.12% in the past hour, but faces headwinds with a 4.43% decline over the past 7 days and a 40.29% drop over the past 30 days. Within the past 24 hours, SWELL traded between a low of $0.001589 and a high of $0.001679.

The token maintains a market rank of 1,372 among all tracked cryptocurrency assets, with a market dominance of 0.0051%. SWELL currently has 41,772 token holders, indicating a distributed holder base. The project operates primarily on the Ethereum blockchain and maintains its native SWELL chain, with contract addresses available on both networks.

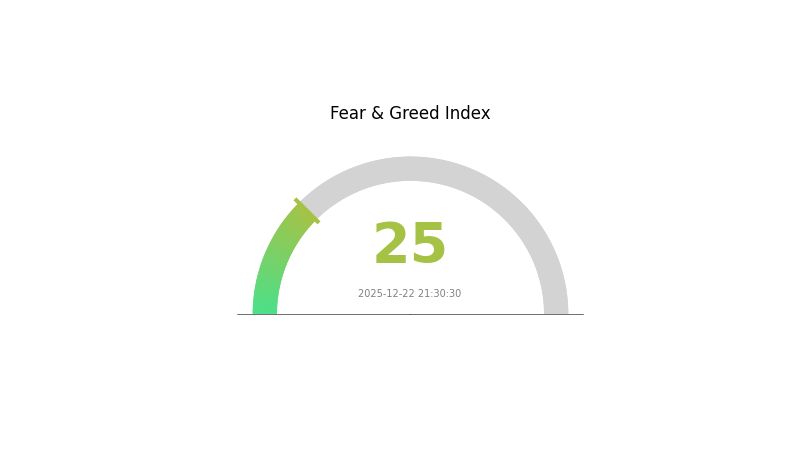

From a market sentiment perspective, the broader cryptocurrency market is experiencing "Extreme Fear" conditions as of December 22, 2025, with a VIX reading of 25, which typically correlates with heightened volatility and risk-averse positioning across digital assets.

Visit SWELL Market Price on Gate.com for real-time updates

SWELL Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, market volatility typically increases as sentiment reaches critical lows. Experienced traders may view this as a potential accumulation opportunity, while risk-averse investors should exercise caution. Market participants are encouraged to monitor sentiment shifts closely and adjust their strategies accordingly on Gate.com's market data platform.

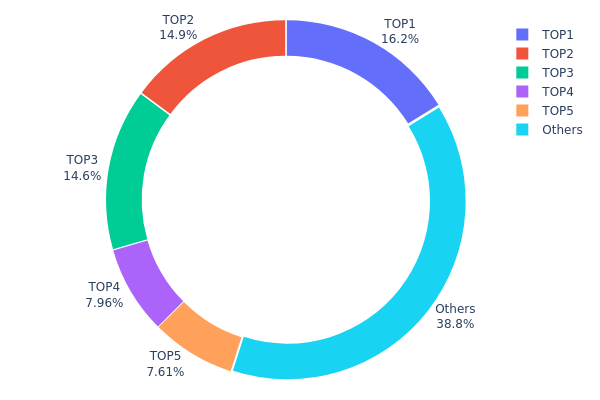

SWELL Holdings Distribution

Address holdings distribution refers to the allocation of token ownership across different wallet addresses on the blockchain. This metric provides critical insights into token concentration levels, market structure, and the degree of decentralization within a project's ecosystem. By analyzing how SWELL tokens are distributed among top holders versus the broader community, we can assess potential risks related to market manipulation, price volatility, and governance centralization.

The current SWELL holdings distribution exhibits moderate concentration characteristics. The top five addresses collectively control approximately 61.22% of total token supply, with the largest holder accounting for 16.19% and the second-largest at 14.89%. While this concentration level is not extreme, it represents a notable centralization point within the token's on-chain structure. The remaining 38.78% distributed among other addresses indicates a substantial community presence, yet the dominance of the top five holders suggests that significant price movements or liquidity decisions could be influenced by a relatively small number of stakeholders.

This distribution pattern carries important implications for market dynamics and ecosystem stability. The concentration of ownership in the top addresses creates potential vulnerability to sudden selling pressure or coordinated movements that could significantly impact SWELL's price stability. However, the fact that more than one-third of tokens remain in distributed hands provides some resilience against extreme manipulation scenarios. Investors should monitor these top addresses for movement patterns and consider the balance between institutional accumulation and community participation as key indicators of the project's long-term sustainability and governance health.

Click to view current SWELL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4b9c...6a2bef | 1619253.11K | 16.19% |

| 2 | 0x2019...a6dc1a | 1490000.00K | 14.89% |

| 3 | 0x7815...c36a6d | 1457735.93K | 14.57% |

| 4 | 0x0934...9d85b7 | 796367.19K | 7.96% |

| 5 | 0x9ae3...df875e | 761184.59K | 7.61% |

| - | Others | 3875459.19K | 38.78% |

II. Core Factors Affecting SWELL's Future Price

Technology Development and Ecosystem Construction

-

Liquidity Management: Swell must maintain sufficient liquidity to sustain the 1:1 price peg between rswETH and its fair value. The protocol has undergone multiple security audits by reputable audit firms to identify and mitigate risks within the Ethereum ecosystem.

-

Security and Scalability Improvements: Major upgrades, scalability enhancements, and security improvements can significantly influence investor sentiment and price movements. Technical developments in the restaking infrastructure may attract more participants to the ecosystem.

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve rate decisions affect the broader cryptocurrency market. The U.S. Federal Reserve's recent 25 basis point rate cut and projected rate cuts in 2026 and 2027 can influence market sentiment and capital allocation toward DeFi protocols like Swell.

-

Market Sentiment and Volatility: The cryptocurrency market experiences significant volatility driven by macroeconomic factors and broader market sentiment. Ethereum and rswETH prices are particularly susceptible to market emotions and overall economic conditions, which subsequently impact staking yields and user participation.

Risk Factors

-

Market Risk: Cryptocurrency market volatility can substantially affect ETH and rswETH prices. Market sentiment swings and macroeconomic headwinds may influence users' staking returns and participation rates.

-

Compliance Risk: DeFi projects face evolving regulatory challenges that could impact operations, user adoption, and token price performance.

III. 2025-2030 SWELL Price Forecast

2025 Outlook

- Conservative Forecast: $0.00138 - $0.00166

- Neutral Forecast: $0.00166

- Optimistic Forecast: $0.00221 (requires sustained ecosystem development and increased adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Forecast:

- 2026: $0.00116 - $0.00252

- 2027: $0.00189 - $0.00258

- 2028: $0.00200 - $0.00274

- Key Catalysts: Enhanced protocol functionality, expanding liquidity pools on Gate.com and other major platforms, growing institutional interest in liquid staking derivatives, and broader adoption within the decentralized finance ecosystem

2029-2030 Long-term Outlook

- Base Case: $0.00165 - $0.00294 (assumes steady market conditions and consistent protocol development)

- Optimistic Case: $0.00256 - $0.00391 (assumes accelerated mainstream adoption and significant network expansion)

- Transformative Case: $0.00391+ (extreme favorable conditions including breakthrough partnerships, major protocol upgrades, and substantial increase in total value locked)

- 2030-12-31: SWELL projected to reach $0.00391 maximum (cumulative growth of approximately 65% from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00221 | 0.00166 | 0.00138 | 0 |

| 2026 | 0.00252 | 0.00194 | 0.00116 | 16 |

| 2027 | 0.00258 | 0.00223 | 0.00189 | 34 |

| 2028 | 0.00274 | 0.00241 | 0.002 | 44 |

| 2029 | 0.00294 | 0.00257 | 0.00165 | 55 |

| 2030 | 0.00391 | 0.00275 | 0.00256 | 65 |

Swell Network (SWELL) Professional Investment Strategy and Risk Management Report

IV. SWELL Professional Investment Strategy and Risk Management

SWELL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: DeFi enthusiasts and Ethereum ecosystem believers seeking liquid staking exposure

- Operation Recommendations:

- Accumulate SWELL during market downturns, particularly when prices deviate significantly from long-term trends

- Participate in Swell's liquid staking and restaking services to generate additional yield while maintaining token exposure

- Dollar-cost averaging (DCA) strategy to reduce timing risk given current market volatility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key levels at $0.001589 (24H low) and $0.001679 (24H high) for entry and exit points

- Moving Averages: Monitor 7-day and 30-day trends to confirm directional bias; note the -4.43% 7-day decline and -40.29% 30-day decline indicate downward pressure

- Wave Trading Key Points:

- Monitor volatility patterns around DeFi protocol updates and Ethereum restaking developments

- Track trading volume (currently $54,134.57 in 24H volume) for confirmation signals before position adjustments

SWELL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 1% of portfolio maximum allocation

- Aggressive Investors: 2% - 5% of portfolio allocation

- Professional Investors: Up to 10% for strategic protocol participation, with hedging strategies in place

(2) Risk Hedging Solutions

- Position Sizing Control: Limit individual trades to 1-2% of total portfolio to manage extreme volatility exposure

- Diversification Strategy: Balance SWELL holdings with established Ethereum staking alternatives and blue-chip DeFi protocols

(3) Secure Storage Solutions

- Hot Wallet Options: Gate Web3 Wallet for active trading and frequent transactions with seamless Gate.com integration

- Cold Storage Approach: Transfer long-term holdings to secure self-custody solutions; consider multi-signature security for larger positions

- Security Considerations: Never share private keys, enable two-factor authentication on all exchange accounts, regularly audit wallet permissions, and verify smart contract interactions before approving transactions

V. SWELL Potential Risks and Challenges

SWELL Market Risk

- Extreme Price Volatility: SWELL has declined 94.61% over one year and 40.29% in the past month, indicating severe price instability and limited historical price stability reference

- Low Trading Liquidity: Daily volume of approximately $54,134 suggests potential slippage for larger trades and limited exit liquidity during market stress

- High Concentration Risk: With only 41,772 token holders and 39.84% market cap to fully diluted valuation ratio, significant distribution concentration exists among early holders

SWELL Regulatory Risk

- Emerging Protocol Status: As a non-custodial staking protocol operating in rapidly evolving regulatory environments, changing DeFi and staking regulations could impact token utility

- Jurisdictional Uncertainty: Different regulatory treatments across jurisdictions regarding staking rewards, restaking mechanisms, and protocol governance could affect SWELL adoption

- Compliance Evolution: Potential regulatory crackdowns on staking derivatives or liquid staking protocols could directly impact Swell Network's business model

SWELL Technical Risk

- Protocol Execution Risk: As a relatively new liquid staking and restaking protocol, technical vulnerabilities or smart contract bugs could threaten user funds and protocol credibility

- Ethereum Dependency: Complete reliance on Ethereum's security and network health means any Ethereum-level issues directly impact Swell's functionality and value proposition

- Integration Risk: Success depends on broad adoption by Ethereum validators and DeFi protocols; failure to achieve sufficient integration could limit token utility

VI. Conclusion and Action Recommendations

SWELL Investment Value Assessment

Swell Network operates in the strategically important liquid staking and restaking segment of the Ethereum ecosystem, addressing genuine infrastructure needs. However, current market dynamics present significant challenges: the token has experienced a 94.61% annual decline and trades far below its all-time high of $0.19992, reflecting market pessimism about protocol adoption or broader DeFi conditions. The project's non-custodial approach and mission to enhance Ethereum security carry long-term merit, but the extremely limited trading liquidity ($54,134 daily volume), concentrated holder distribution, and unproven protocol adoption present near-term risks. SWELL represents a speculative position with meaningful technological upside but substantial downside risk exposure.

SWELL Investment Recommendations

✅ Beginners: Start with minimal positions (0.1% - 0.5% of portfolio) through Gate.com, prioritizing learning about liquid staking mechanics over aggressive accumulation. Use primarily to understand the protocol rather than speculate on price appreciation.

✅ Experienced Investors: Implement scaled entry strategies using technical support levels around $0.001589, combining small position sizes with active engagement in Swell's protocol ecosystem. Consider this part of broader Ethereum infrastructure exposure rather than a standalone bet.

✅ Institutional Investors: Conduct thorough due diligence on Swell's restaking validator set and protocol security audits before any meaningful allocation. Structure positions with clear risk management frameworks given market volatility, and maintain diversified staking exposure across multiple protocols.

SWELL Participation Methods

- Gate.com Spot Trading: Purchase and trade SWELL directly against multiple trading pairs with institutional-grade infrastructure and security standards

- Protocol Participation: Engage directly with Swell's liquid staking services to earn protocol yields while maintaining token exposure through active participation

- Strategic Accumulation: Use extreme price weakness as accumulation opportunities, particularly when global risk sentiment stabilizes and DeFi protocols demonstrate renewed adoption momentum

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are advised to consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the future of the Swell coin?

Swell has strong potential driven by its liquid staking protocol innovation and growing DeFi adoption. With increasing institutional interest and ecosystem expansion, SWELL could see significant growth trajectory through 2025-2027. Market fundamentals suggest positive long-term prospects for the project.

How much is swell crypto worth?

Swell crypto is currently worth $0.00165 as of December 22, 2025, showing a 1.81% increase over the past 24 hours. The all-time high reached $0.0695 in November 2024.

What factors influence SWELL price movements?

SWELL price movements are driven by market sentiment, trading volume, technological developments, user adoption rates, and broader cryptocurrency market trends.

What is SWELL token and what is its use case?

SWELL is the native token of Swell, an Ethereum L2 chain enabling native restaking. It powers protocol governance, transaction fees, and rewards users who restake ETH for additional yields through the Swell ecosystem.

What are the risks of investing in SWELL?

SWELL carries market volatility risk, liquidity risk, and regulatory uncertainty. Price fluctuations may lead to substantial losses. Market conditions and adoption rates significantly impact token value performance.

2025 REZ Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

What is REZ: A Comprehensive Guide to Understanding Real Estate Investment Zones and Their Impact on Property Markets

# How Much SOL Are Institutions Currently Holding: 2025 Holdings & Fund Flow Analysis

Exploring LSDFi: Unlocking the Potential of Liquid Staking in DeFi

What is SWELL: A Comprehensive Guide to Understanding Liquid Staking and Ethereum's Future

Is Swell Network (SWELL) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

What is MAVIA: A Comprehensive Guide to Mobile Augmented Visual Intelligence Architecture

What is DAOLITY: A Comprehensive Guide to Decentralized Autonomous Organization Liquidity Infrastructure

What is GMMT: A Comprehensive Guide to Global Market Making Technology

What is TRADE: A Comprehensive Guide to Understanding International Commerce and Economic Exchange

What is SUPRA: A Comprehensive Guide to the Decentralized Oracle Network Revolutionizing Blockchain Data