2025 TET Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: TET's Market Position and Investment Value

Tectum (TET) is a Layer 2 scaling solution for Bitcoin and cryptocurrency built on the Tectum Layer 1 Blockchain, which operates as one of the fastest blockchains in the world with transaction speeds of 1.3 million TPS/BPS. Since its launch in June 2023, Tectum has developed the SoftNote™ protocol to provide instant, trustless, anonymous, and decentralized crypto payments at no cost. As of December 2025, TET's market capitalization has reached approximately $4,293,000, with a circulating supply of approximately 9,934,576 tokens, currently trading around $0.4293 per token.

This innovative Layer 2 solution is playing an increasingly pivotal role in addressing the scalability challenges that have plagued blockchain networks, offering a compelling alternative to existing scaling solutions by overcoming the limitations of conventional approaches. Available for trading on Gate.com and other major platforms, TET represents a unique positioned asset in the cryptocurrency ecosystem.

This article will comprehensively analyze TET's price trajectory through 2025-2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and actionable investment strategies.

Tectum (TET) Market Analysis Report

I. TET Price History Review and Current Market Status

TET Historical Price Evolution

- June 2023: TET was launched at an initial price of $7.178, marking the beginning of its market presence.

- March 2024: TET reached its all-time high (ATH) of $39.79 on March 14, 2024, representing a significant peak in the token's valuation.

- July 2025 to Present: TET experienced a sharp decline, reaching its all-time low (ATL) of $0.3434 on July 4, 2025, followed by a partial recovery to current trading levels.

TET Current Market Status

As of December 24, 2025, TET is trading at $0.4293, reflecting significant losses from its historical highs. The token has experienced a -92.53% decline over the past year, illustrating substantial downward pressure in the long-term trend. Over the 24-hour period, TET declined by -5.61%, with an intraday range between $0.4192 and $0.4662.

TET's market capitalization stands at approximately $4.29 million, with a fully diluted valuation (FDV) of $4,293,000. The circulating supply comprises 9,934,576.14 TET tokens out of a maximum supply of 10,000,000 tokens, representing a circulation ratio of 99.35%. The 24-hour trading volume is $25,699.71, indicating moderate liquidity levels.

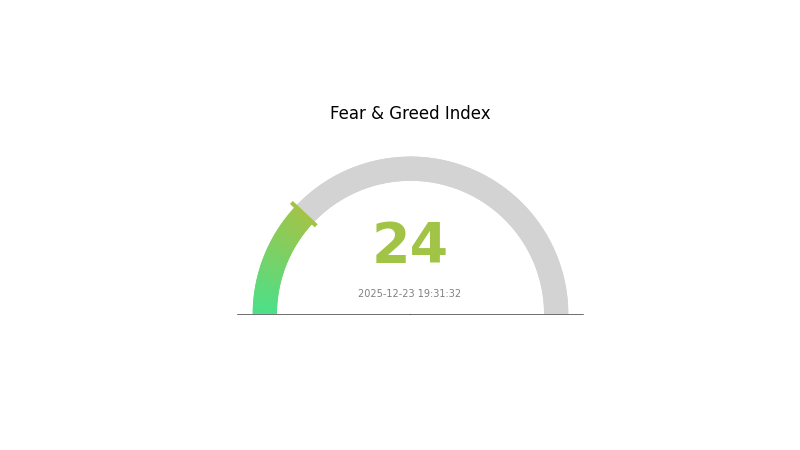

The token maintains a market dominance of 0.00013%, reflecting its relatively small position within the broader cryptocurrency ecosystem. With 14,047 token holders and availability across 6 exchanges, TET maintains limited but existing market accessibility. Current market sentiment indicators suggest extreme fear conditions, with a VIX rating of 24 as of December 23, 2025.

In terms of price momentum, TET showed short-term resilience with a +1.35% gain in the past hour, though this appears insufficient to reverse the broader downtrend. Weekly and monthly declines of -7.58% and -11.82% respectively indicate sustained selling pressure.

Visit current TET market price

TET Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 24. This historically low sentiment suggests investors are highly pessimistic and risk-averse. Market participants are showing significant concern about price declines and potential further downturns. During such periods of extreme fear, contrarian investors often view this as a potential buying opportunity, as excessive pessimism can signal market bottoms. However, cautious risk management remains essential. Monitor market developments closely and consider your investment strategy carefully on Gate.com.

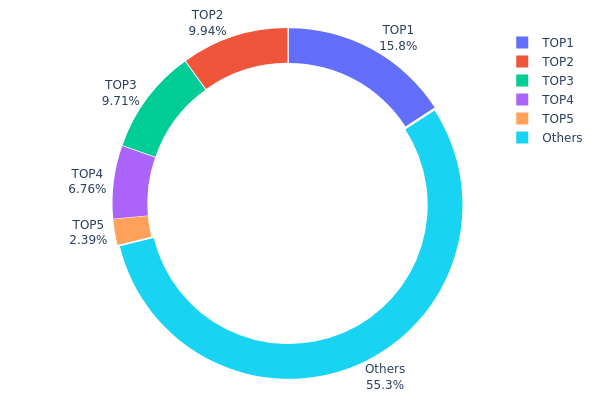

TET Holdings Distribution

The address holdings distribution chart illustrates the concentration of TET tokens across blockchain addresses, revealing the ownership structure and decentralization characteristics of the token. By analyzing the distribution of top holders relative to the overall supply, this metric provides crucial insights into potential market risks, governance concentration, and price stability dynamics.

Current data demonstrates moderate concentration patterns in TET's holder base. The top five addresses collectively control approximately 44.62% of the total token supply, with the largest holder commanding 15.84%. While this level of concentration warrants attention, the significant remaining allocation of 55.38% distributed among other addresses indicates a relatively dispersed secondary holder base. The distribution exhibits a gradual decline pattern rather than extreme centralization, suggesting a more balanced structure compared to highly concentrated tokens dominated by single entities.

This holdings architecture presents meaningful implications for market structure and price dynamics. The presence of multiple substantial holders reduces the risk of sudden price manipulation through coordinated token dumps, though the top five addresses retain sufficient capital to influence short-term price movements. The majority stake held by dispersed addresses enhances market resilience and supports organic price discovery mechanisms. However, the concentration level remains sufficiently high to warrant monitoring for potential governance implications and insider selling pressure, particularly if top holders coordinate their activities or respond to significant market catalysts simultaneously.

Click to view current TET holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8f6b...2a672d | 1584.92K | 15.84% |

| 2 | 0x3cc9...aecf18 | 994.15K | 9.94% |

| 3 | 0x9642...2f5d4e | 971.23K | 9.71% |

| 4 | 0xefdf...b18b24 | 675.94K | 6.75% |

| 5 | 0x968f...dbb86a | 238.94K | 2.38% |

| - | Others | 5534.83K | 55.38% |

II. Core Factors Impacting TET's Future Price

Supply Mechanism

-

Supply and Demand Dynamics: TET's future price is fundamentally influenced by supply-demand equilibrium. Changes in token supply directly impact market value and investor confidence in the asset's scarcity and long-term appreciation potential.

-

Current Market Impact: The interplay between circulating supply and market demand continues to shape price volatility and investor positioning in TET holdings.

Macroeconomic Environment

-

Monetary Policy Influence: Interest rate fluctuations and broader macroeconomic factors significantly affect cryptocurrency valuations. Changes in central bank policies and interest rate expectations can either support or constrain demand for alternative assets like TET.

-

Market Sentiment and Trading Activity: Overall cryptocurrency market sentiment, trading volumes, and investor confidence play crucial roles in determining TET's price movements. Periods of market euphoria typically drive prices higher, while risk-averse sentiment creates downward pressure.

Technology Development and Ecosystem Building

-

Blockchain Network Activity: The vibrancy and adoption levels of the underlying blockchain network directly influence TET's utility and value proposition. Active development and increased network usage strengthen the fundamental case for token appreciation.

-

Community and Governance Role: Utility tokens like TET derive value from their roles in community building and decentralized autonomous organization (DAO) governance. Enhanced participation in governance mechanisms and community engagement can reinforce long-term value creation.

III. 2025-2030 TET Price Forecast

2025 Outlook

- Conservative Forecast: $0.31746 - $0.39873

- Base Case Forecast: $0.429

- Optimistic Forecast: $0.45045 (requires sustained market interest and positive sentiment)

2026-2027 Mid-term Outlook

- Market Stage Expectations: Recovery and consolidation phase with gradual price appreciation

- Price Range Forecasts:

- 2026: $0.36937 - $0.53207

- 2027: $0.44217 - $0.68511

- Key Catalysts: Increased adoption, ecosystem development, market recovery cycles, and improved liquidity on platforms like Gate.com

2028-2030 Long-term Outlook

- Base Scenario: $0.5855 - $0.70846 (assumes steady market conditions and moderate adoption growth)

- Optimistic Scenario: $0.64698 - $0.76033 (assumes accelerated ecosystem expansion and broader market penetration)

- Transformative Scenario: $0.76033+ (extreme favorable conditions including mainstream institutional adoption and significant utility expansion)

- Price Trajectory: TET demonstrates consistent upward momentum with a cumulative gain of approximately 56% by 2030 from 2025 levels

Note: All price forecasts are subject to market volatility, regulatory developments, and macroeconomic conditions. Investors should conduct thorough due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.45045 | 0.429 | 0.31746 | 0 |

| 2026 | 0.53207 | 0.43973 | 0.36937 | 2 |

| 2027 | 0.68511 | 0.4859 | 0.44217 | 13 |

| 2028 | 0.70846 | 0.5855 | 0.31617 | 36 |

| 2029 | 0.69874 | 0.64698 | 0.40113 | 50 |

| 2030 | 0.76033 | 0.67286 | 0.43063 | 56 |

Tectum (TET) Professional Investment Strategy and Risk Management Report

IV. TET Professional Investment Strategy and Risk Management

TET Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Early-stage blockchain technology adopters and cryptocurrency believers who understand Layer 2 scaling solutions

- Operational suggestions:

- Accumulate TET during price dips, particularly when the asset experiences significant corrections from all-time highs

- Hold positions through market cycles, recognizing that Layer 2 solutions may have extended adoption periods

- Implement dollar-cost averaging (DCA) to reduce the impact of volatility on average purchase price

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Utilize key price points at $0.3434 (all-time low) and historical resistance areas to identify entry and exit opportunities

- Moving Averages: Apply both short-term (20-day) and long-term (200-day) moving averages to confirm trend direction and momentum shifts

- Wave trading key points:

- Monitor 24-hour price volatility ranges (current range: $0.4192-$0.4662) for short-term trading opportunities

- Track volume patterns during price movements to confirm breakout validity before establishing positions

TET Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio allocation

- Active investors: 2-5% of portfolio allocation

- Professional investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Portfolio diversification: Balance TET holdings with established cryptocurrencies and traditional assets to reduce concentration risk

- Position sizing: Establish clear maximum loss limits per trade and maintain strict position sizing discipline regardless of market sentiment

(3) Secure Storage Solution

- Cold storage method: Store the majority of long-term holdings in secure offline wallets to protect against exchange-related risks and cyber threats

- Trading allocation: Maintain only necessary working capital on Gate.com for active trading purposes

- Security considerations: Enable two-factor authentication (2FA) on all exchange accounts, use strong and unique passwords, and never share private keys or recovery phrases with any third parties

V. TET Potential Risks and Challenges

TET Market Risk

- Extreme price volatility: TET has experienced a 92.53% decline over one year (from approximately $5.75 to $0.4293), indicating significant market risk and potential continued downward pressure

- Low trading volume: 24-hour volume of $25,699.71 suggests limited liquidity, which can result in wider bid-ask spreads and difficulty executing large orders

- Market capitalization challenges: At $4.26 million, TET has a relatively small market cap with low market dominance (0.00013%), making it vulnerable to manipulation and rapid price swings

TET Regulatory Risk

- Cryptocurrency regulatory uncertainty: Evolving global regulatory frameworks targeting Layer 2 solutions and blockchain technology could impact TET's operational viability and adoption

- Compliance requirements: Potential changes in securities regulations or stablecoin regulations could affect TET's use cases and market demand

- Jurisdiction-specific restrictions: Different countries may impose varying restrictions on cryptocurrency trading and use, limiting TET's addressable market

TET Technology Risk

- Layer 2 solution competition: Tectum faces intense competition from established Layer 2 solutions with larger communities, more liquidity, and proven track records

- Blockchain scalability limitations: While claiming 1.3 million TPS/BPS, the network must demonstrate consistent uptime, security, and practical adoption in real-world conditions

- Smart contract vulnerabilities: Any vulnerabilities or bugs in the SoftNote™ implementation or supporting infrastructure could result in fund loss and loss of user confidence

VI. Conclusions and Action Recommendations

TET Investment Value Assessment

Tectum presents a high-risk, speculative investment opportunity centered on its Layer 2 scaling solution for Bitcoin and cryptocurrencies. While the technological proposition of instant, trustless, and anonymous payments is compelling, the significant price decline (92.53% annually), limited market capitalization, and low trading volume indicate substantial execution risk. The project's success depends on achieving meaningful adoption of its SoftNote™ platform and differentiating itself in a competitive Layer 2 landscape. Current market conditions suggest Tectum remains in an early developmental stage with uncertain commercial viability.

TET Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of portfolio) only after thoroughly understanding Layer 2 scaling solutions and accepting potential total loss scenarios. Use Gate.com for secure trading and storage of small positions.

✅ Experienced investors: Consider opportunistic accumulation during significant price dips, implement strict risk management with predetermined stop-loss levels, and maintain positions only as speculative portfolio components rather than core holdings.

✅ Institutional investors: Conduct comprehensive due diligence on the project's technical architecture, team credentials, and commercial partnerships before considering allocation. Evaluate the competitive positioning of SoftNote™ against established Layer 2 solutions.

TET Trading Participation Methods

- Exchange trading: Execute buy and sell orders on Gate.com, which supports TET trading pairs and provides secure custody solutions for active traders

- Spot purchases: Accumulate TET during price corrections using limit orders to achieve better entry prices

- Strategic allocation: Maintain TET as a small speculative position within a diversified cryptocurrency portfolio, reviewing holdings quarterly for continued viability

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial situation. Consult with professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

Is tectum crypto a good investment today?

Tectum's current bearish trend suggests limited upside potential. Price predictions indicate continued decline through 2025. Monitor market developments and technical indicators before considering entry points.

What is the price prediction for TET token in 2024-2025?

Based on current market analysis, TET token is predicted to reach approximately $3.573 by December 2025. This projection reflects technical and fundamental analysis of the token's market performance and growth trajectory during this period.

What factors could drive TET price up or down in the future?

TET price could rise from protocol updates, increased adoption, and ecosystem growth, or fall due to regulatory changes, market competition, and block reward adjustments.

How does Tectum compare to other blockchain projects in terms of adoption and utility?

Tectum prioritizes energy efficiency and practical utility through its Proof of Utility consensus mechanism. While growing in adoption, it maintains a smaller footprint than major platforms, focusing on sustainable and functional blockchain solutions for real-world applications.

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 KAS Price Prediction: Analyzing Key Factors Driving the Future Value of Kaspa

2025 MOVE Price Prediction: Analyzing Growth Factors and Market Trends in the Evolving Cryptocurrency Landscape

2025 SAGA Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Blockchain Ecosystem

Is Kaspa (KAS) a good investment?: Analyzing the potential of this high-throughput blockchain project

FOXY vs APT: Comparing Modern Threat Detection Systems in Enterprise Security Environments

2025 PROPS Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

2025 DEGOD Price Prediction: Expert Analysis and Market Forecast for the Coming Year

How Does LUNC Exchange Net Inflow and Holding Concentration Impact Terra Classic's Market Dynamics in 2025?

2025 INTER Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 COOK Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year