2025 TOSHI Price Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Ecosystem

Introduction: TOSHI's Market Position and Investment Value

Toshi (TOSHI), positioned as the largest community takeover project in crypto history, has emerged as a purely community-oriented meme token since its inception. As of 2025, TOSHI's market capitalization has reached $371,721,684, with a circulating supply of 420,690,000,000 tokens, and a price hovering around $0.0008836. This asset, hailed as "the most community-centric meme token in crypto," is playing an increasingly crucial role in decentralized community governance and social token ecosystems.

This article will comprehensively analyze TOSHI's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. TOSHI Price History Review and Current Market Status

TOSHI Historical Price Evolution

- 2024: Project launch, price started at $0.0001403

- 2024: Reached all-time low of $0.0000738 on September 6

- 2025: Achieved all-time high of $0.002325 on January 26

TOSHI Current Market Situation

TOSHI is currently trading at $0.0008836, with a 24-hour trading volume of $7,716,858. The token has experienced significant growth over the past year, with a 783.19% increase. In the last 24 hours, TOSHI has shown strong performance with a 9.73% price increase. The token's market capitalization stands at $371,721,684, ranking it 215th in the overall cryptocurrency market. TOSHI's circulating supply matches its total and maximum supply at 420,690,000,000 tokens, indicating full circulation. The current price represents a 62% decrease from its all-time high and a 1,097% increase from its all-time low.

Click to view the current TOSHI market price

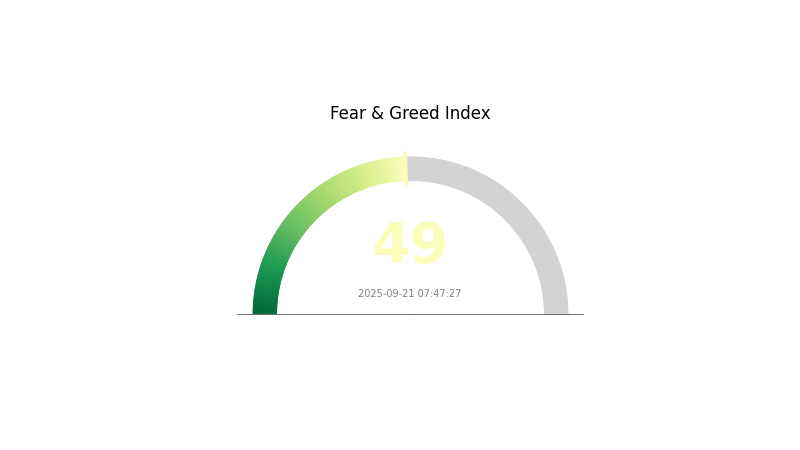

TOSHI Market Sentiment Indicator

2025-09-21 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced as the Fear and Greed Index hovers at 49, indicating a neutral stance. This equilibrium suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. Traders should remain vigilant, as this neutral position could potentially shift in either direction based on upcoming market developments or news. It's an opportune time for investors to reassess their strategies and maintain a balanced portfolio approach.

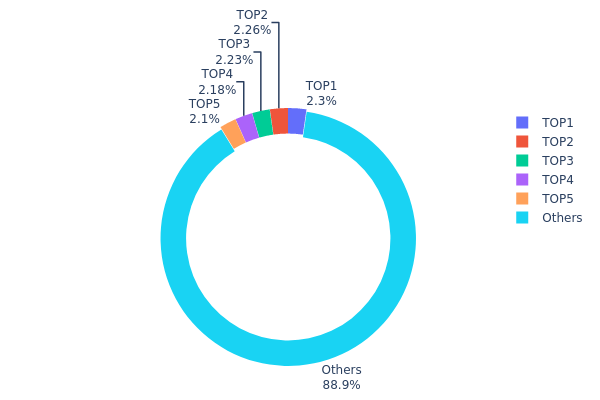

TOSHI Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of TOSHI tokens among various wallet addresses. Based on the provided data, the top 5 addresses collectively hold approximately 11.06% of the total TOSHI supply, with individual holdings ranging from 2.10% to 2.30%. This distribution pattern suggests a relatively moderate level of concentration, as no single address controls an overwhelmingly large portion of the supply.

The fact that 88.94% of TOSHI tokens are held by addresses outside the top 5 indicates a fairly distributed ownership structure. This distribution pattern is generally favorable for market stability and resilience against potential price manipulation attempts. It also reflects a decent level of decentralization, which aligns with the ethos of many cryptocurrency projects.

However, it's important to note that while the current distribution appears balanced, any significant changes in the holdings of these top addresses could potentially impact market dynamics. Traders and investors should continue to monitor these holdings for any substantial shifts that might affect TOSHI's price action or overall market structure.

Click to view the current TOSHI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3c60...d7e7b4 | 9681892.12K | 2.30% |

| 2 | 0x941e...44898a | 9509783.66K | 2.26% |

| 3 | 0xd3e0...20cd97 | 9377691.12K | 2.22% |

| 4 | 0x8caa...e96fc0 | 9184561.67K | 2.18% |

| 5 | 0xdc2b...6a27c9 | 8850350.24K | 2.10% |

| - | Others | 374085721.18K | 88.94% |

II. Key Factors Influencing TOSHI's Future Price

Supply Mechanism

- Total Supply: 420,690,000,000 TOSHI

- Circulating Supply: 420,678,883,162.58 TOSHI

- Current Impact: The fixed total supply and near-full circulation may lead to increased scarcity, potentially supporting price stability or growth.

Institutional and Whale Dynamics

- Corporate Adoption: Adoption by known enterprises is not explicitly mentioned, but could be a significant factor in future price movements.

Macroeconomic Environment

- Inflation Hedging Properties: As a meme coin, TOSHI's performance in inflationary environments is yet to be established, but cryptocurrency interest often increases during economic uncertainties.

Technological Development and Ecosystem Building

- Ecosystem Applications: TOSHI is part of the BNB Chain and Base ecosystems, which could provide opportunities for integration with DApps and other blockchain projects.

- Platform Diversity: TOSHI operates on both BNB Smart Chain (BEP20) and Base platforms, potentially increasing its accessibility and use cases.

III. TOSHI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00085 - $0.00088

- Neutral prediction: $0.00088 - $0.00100

- Optimistic prediction: $0.00100 - $0.00121 (requires significant market recovery)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00075 - $0.00160

- 2028: $0.00087 - $0.00209

- Key catalysts: Broader crypto market recovery, TOSHI ecosystem developments

2029-2030 Long-term Outlook

- Base scenario: $0.00175 - $0.00207 (assuming steady market growth)

- Optimistic scenario: $0.00239 - $0.00290 (assuming strong market conditions)

- Transformative scenario: Above $0.00290 (extreme favorable conditions and mass adoption)

- 2030-12-31: TOSHI $0.00207 (133% increase from 2025, potential for further growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00121 | 0.00088 | 0.00085 | -1 |

| 2026 | 0.00138 | 0.00104 | 0.00089 | 17 |

| 2027 | 0.0016 | 0.00121 | 0.00075 | 36 |

| 2028 | 0.00209 | 0.0014 | 0.00087 | 58 |

| 2029 | 0.00239 | 0.00175 | 0.00164 | 97 |

| 2030 | 0.0029 | 0.00207 | 0.00126 | 133 |

IV. TOSHI Professional Investment Strategies and Risk Management

TOSHI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with high risk tolerance

- Operational suggestions:

- Accumulate TOSHI tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend direction and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor TOSHI's correlation with major cryptocurrencies

- Set strict stop-loss orders to manage downside risk

TOSHI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for TOSHI

TOSHI Market Risks

- High volatility: Meme tokens are subject to extreme price swings

- Market sentiment: Heavily influenced by social media trends and celebrity endorsements

- Liquidity risk: Potential difficulty in selling large amounts during market stress

TOSHI Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on meme tokens

- Platform delisting: Risk of being removed from major exchanges due to regulatory concerns

- Tax implications: Evolving tax laws may impact TOSHI transactions and holdings

TOSHI Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: High transaction fees and delays during peak usage periods

- Technological obsolescence: Risk of being surpassed by more advanced meme token projects

VI. Conclusion and Action Recommendations

TOSHI Investment Value Assessment

TOSHI presents a high-risk, high-reward opportunity in the meme token space. While it offers potential for significant short-term gains, its long-term value proposition remains speculative and heavily dependent on community engagement and market sentiment.

TOSHI Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio, if any. Focus on education and risk management. ✅ Experienced investors: Consider small position sizes with strict risk controls. Monitor social media trends closely. ✅ Institutional investors: Approach with caution. Conduct thorough due diligence and consider TOSHI as part of a diversified crypto strategy.

TOSHI Participation Methods

- Spot trading: Buy and sell TOSHI tokens on Gate.com

- Staking: Explore potential staking opportunities if offered by the TOSHI ecosystem

- Community engagement: Participate in Meow DAO governance to stay informed and contribute to project development

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can toshi coin reach $1 dollar?

Based on current market trends, it's unlikely Toshi will reach $1. Projections suggest it may peak around $0.005 to $0.01 in the near future.

What is the toshi coin price prediction?

Toshi's short-term outlook is bearish. The 2026 price prediction is $0.00113. By 2030, it could reach $0.00341, a 6.13x increase from current price.

How much will the price of Toshi be in 2030?

Based on current trends, Toshi's price in 2030 is projected to be between $0.000122 and $0.000150, indicating significant potential growth for the token.

Is it worth buying toshi coin?

Yes, Toshi coin shows strong potential for 2025. With increasing adoption and market trends, it could be a valuable addition to your crypto portfolio.

2025 DOGPrice Prediction: Analyzing Market Trends and Key Factors Influencing the Future of DOG Tokens

2025 BABYDOGE Price Prediction: Will This Meme Coin Surge to New Heights in the Cryptocurrency Market?

2025 ELON Price Prediction: Analyzing Future Growth Potential and Market Trends for Dogelon Mars Token

2025 BANPrice Prediction: Analyzing Market Trends and Future Growth Potential for Banano Cryptocurrency

2025 DOGSPrice Prediction: Market Analysis and Forecast for the Coming Bull Run

2025 PEPE Price Prediction: Analyzing the Meme Coin's Potential in a Maturing Crypto Market

How to Purchase Bitcoin (BTC) in Turkey – A Simple Guide

What is PROPS: A Comprehensive Guide to Understanding React Component Properties

What is XL1: A Comprehensive Guide to Understanding This Powerful Bacterial Strain and Its Applications in Molecular Biology

Stellar (XLM) Price Forecasts for 2025-2030: Future Perspectives and Growth Potential

What Do Derivatives Market Signals Reveal About Crypto Price Movements: Open Interest, Funding Rates, and Liquidation Data Explained