Gate Ventures Weekly Crypto Recap (September 15, 2025)

Gate Ventures

TL;DR

- US CPI and core CPI were in line with market expectations last week, but core goods prices were driven higher due to the pass-through effects from auto tariffs.

- The big event of the week is Thursday’s FOMC meeting, while a 25 bps cut is almost priced in, there are chances for other meeting results.

- BTC ETFs saw $2.34B inflows with stable prices, while ETH rebounded ~7% with $640M inflows as ETFs reversed outflows. ETH validator exits (~$2.6M) spiked after Kiln made precautionary withdrawals following a $41M SOL hack. ETH/BTC rose to 0.04.

- Top movers: MNT +40% (buyback speculation), DOGE +20% (ETF news), AVAX +19% (DeFi surge from sUSDe + Benqi).

- New launches: AVNT (perps DEX on Base) surged ~10x after Bithumb/Upbit listings; LINEA (a Layer 2 by Consensys) has been gradually gaining market attention.

- Galaxy Digital, Jump Crypto and Multicoin Capital lead $1.65B PIPE to launch Forward Industries’ Solana treasury strategy.

- Tether launches USAT, a U.S.-compliant stablecoin, challenging Circle’s USDC.

- MegaETH launches USDm, a yield-bearing stablecoin to subsidize protocol fees.

Macro Overview

US CPI and core CPI were in line with market expectations last week, but core goods prices were driven higher due to the pass-through effects from auto tariffs.

U.S. CPI rose 0.4% MoM in August and 2.9% YoY, core CPI rose 0.3% MoM and 3.1% YoY, in line with market expectations. By component, core goods prices increased 1.5% YoY, the highest since May 2023, signaling a shift in core goods from 2023–2024 deflation to inflation. Within autos, used car prices rose 1.0%, new cars 0.3%, and non‑tire motor vehicle parts 1.7%, indicating the pass-through effects of auto tariffs.

While August inflation did not exceed expectations, the trend is not converging toward the Fed’s 2% target — rather it’s drifting farther away. This is occurring against the background of sharply weaker employment data and a stalled labor market. Because employment data continue to deteriorate, the Fed will likely have to cut rates first; however, amid supply contraction, stagflation risks are worth attention. Recent data show US job growth has nearly stalled, whereas inflationary pressures are still accumulating — this hints that in the near term, the “stagnation” pressure outweighs the “inflation” pressure.

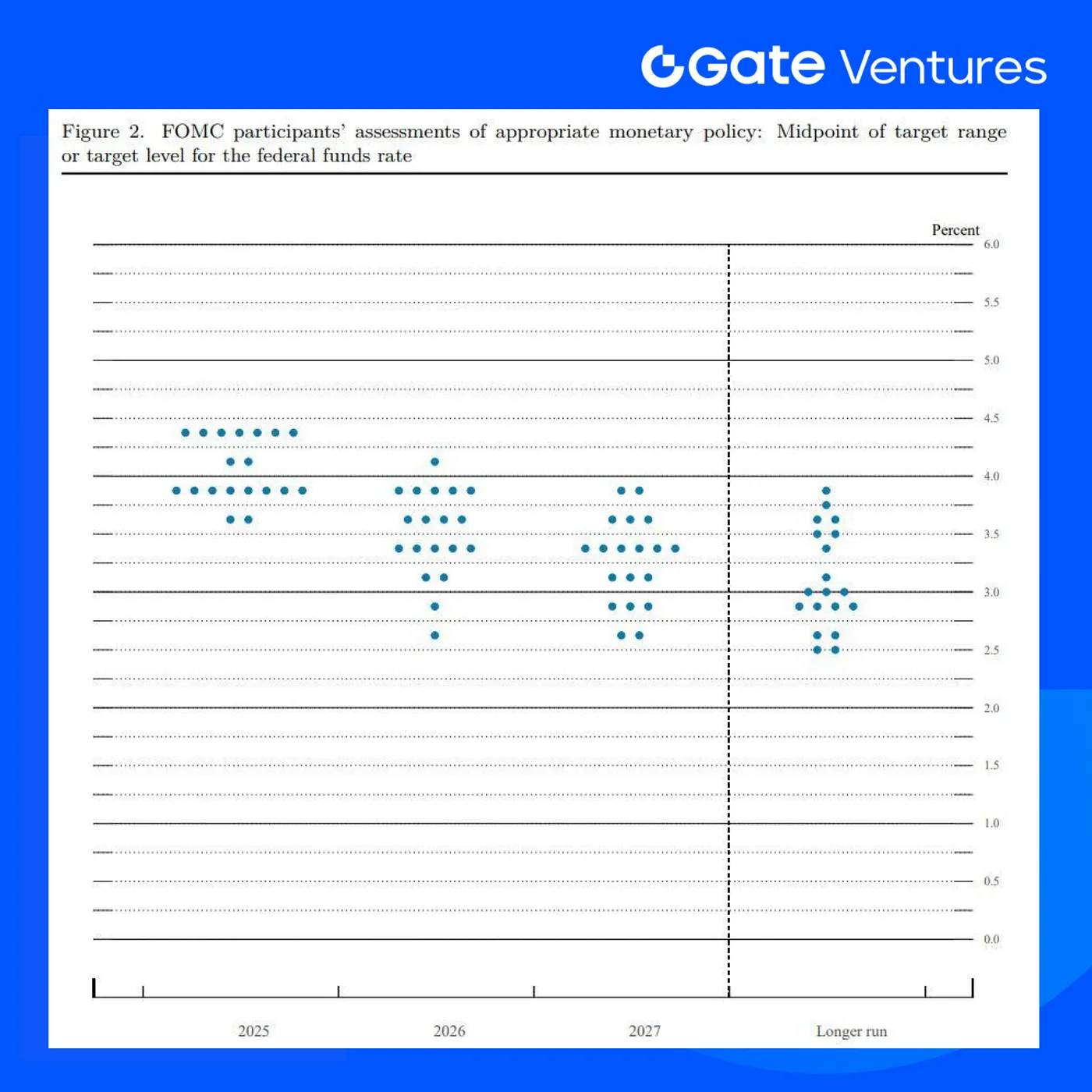

The big event of the week is Thursday’s FOMC meeting, where an interest rate cut is widely expected. The market believes in a near certainty of 25 bps cut this time, but there’s also a smaller chance for a 50 bps cut. The meeting also sees the FOMC members’ projections for future interest rates updated in the dot plot, which will provide an important guideline on how policymakers see the rates path evolving over the next few years. The last set of projections showed the FOMC’s median expectation was for a federal funds rate of 3.6% in 2026 and 3.4% in 2027, dropping to 3.0% in the longer run. (1, 2)

FOMC Meeting Dot Plot on June 18th

DXY

The US dollar index drifted higher for a bit last Friday, but still stayed on track for a weekly fall of 0.1%, and it has been the second consecutive weekly decline, due to the weak economic data and potential rate cut. (3)

US 10 Year Bond Yield

The US 10 year bond yield has seen a relatively stable turbulence between 4.00% and 4.10%, showcasing the market is reaching a consensus on asset pricing before the actual rate cut is announced. (4)

Gold

Gold prices rose slightly last Friday, holding close to the record high of $3,673.95 achieved last Tuesday, as signs of weakening US labour market reinforced the market expectation of first Fed rate cut this year. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

Last week, U.S. Bitcoin ETFs recorded strong inflows of $2.34B, with BTC prices holding steady around previous week levels. Ethereum rebounded, posting a ~7% gain as U.S. ETH ETFs recovered from the prior week’s record outflows and recorded about $640M in net inflows.

On-chain, ETH validator exit queues spiked to $2.6M on September 11, which is largely driven by Kiln, a major staking provider taking precautionary measures. Days earlier, hackers compromised the API of SwissBorg’s Solana validator (operated via Kiln), causing a $41M SOL loss. While ETH assets remained safe, Kiln proactively withdrew over a million ETH from staking to mitigate potential risks. (6)

Given ETH’s stronger performance relative to BTC, the ETH/BTC ratio edged up slightly to 0.04.

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap climbed ~5% to $3.98T, while the altcoin market (ex-BTC & ETH) rose ~7% to $1.13T, driven by strong performances from SOL, DOGE, AVAX, and MNT.

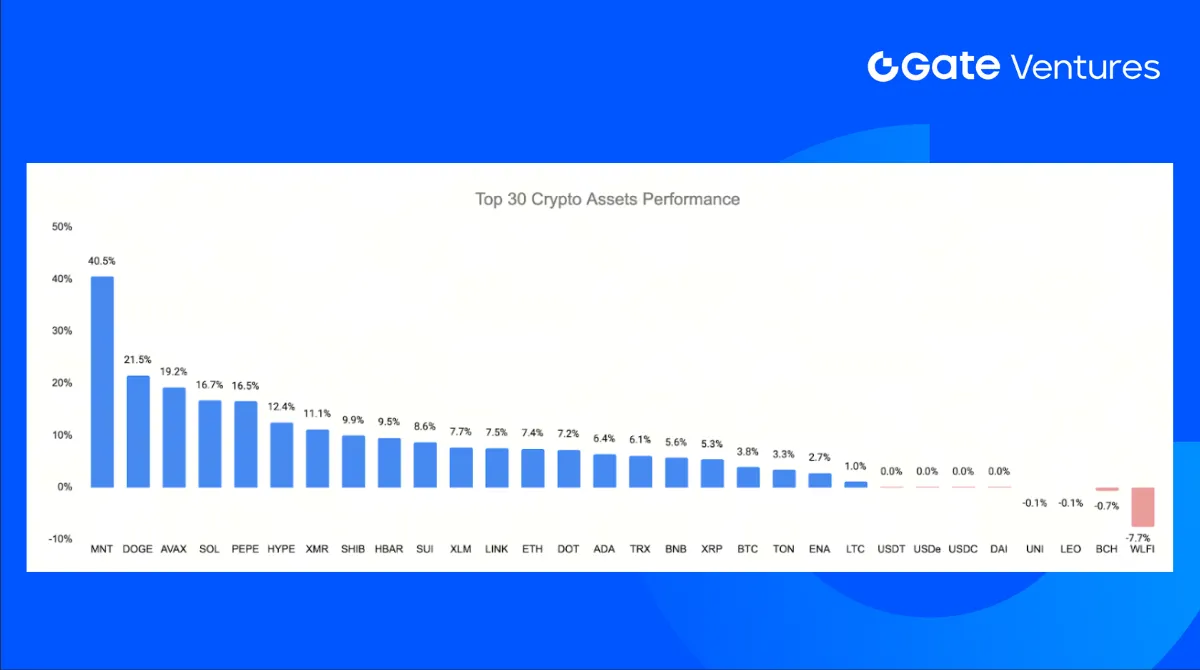

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Sept 15th 2025

The altcoin market has sustained its strength this week, led by Mantle (MNT) with a surge of over 40%.

MNT’s rally has been underpinned by strong fundamentals: Bybit’s deep integration (fee discounts, collateral usage, payment), prospects of a buyback-and-burn program, relative undervaluation versus peers, and broader ecosystem growth. The key narrative remains the market assigning a premium to MNT over other CEX tokens such as BNB and OKB, with speculation building that Mantle may follow OKB’s precedent in initiating buybacks.

Dogecoin (DOGE) ranked second with ~20% gains, fueled by renewed headlines around the launch of a DOGE ETF, despite the approval process being delayed once again. (7, 8)

Avalanche (AVAX) followed with a ~19% increase, supported by robust DeFi activity. Last week, Avalanche DEXs recorded ~$3.8B in trading volume, the highest since March 2024. The surge was driven primarily by

- the launch of sUSDe from Ethena Labs together with Pendle, which enables both fixed and variable yield markets on Avalanche.

- Benqi, Avalanche’s largest lending protocol, which saw TVL climb ~18%.(9)

4. New Token Launched

Avantis (AVNT) is a perps DEX built on Base, backed by the Base Foundation and Pantera Capital, enabling leveraged trading across crypto, commodities, forex, and equities. AVNT debuted on Binance Alpha and Binance Futures on September 9, with a simultaneous spot listing on Coinbase. The token has since gained momentum, and its price surged nearly 10x following today’s listings on the major Korean exchanges Bithumb and Upbit.

Linea (LINEA) is a Layer-2 rollup built on Ethereum, developed by Consensys and backed by major ecosystem partners, designed to provide low-cost, high-throughput execution with full EVM equivalence. LINEA debuted with its TGE and listings on major exchanges including Binance and Bybit, alongside a simultaneous integration push across DeFi protocols. The token has since gained momentum, supported by its recent appearance on OKX Boost Launch, which further expanded liquidity and retail access.

The Key Crypto Highlights

1. Galaxy Digital, Jump Crypto and Multicoin Capital lead $1.65B PIPE to launch Forward Industries’ Solana treasury strategy

Forward Industries (FORD) announced it has entered into a $1.65B private investment in public equity (PIPE) intended to build a Solana-focused digital asset treasury, led by Galaxy Digital, Jump Crypto, and Multicoin Capital, with participation from C/M Capital Partners. The firms will provide capital and strategic support to position Forward as the foremost publicly traded institutional participant in the Solana ecosystem. As part of the transaction, Multicoin co-founder Kyle Samani is expected to become Chairman of the Board, while representatives from Galaxy and Jump are slated to join the board as observers. Cantor Fitzgerald & Co. was named lead placement agent, and Galaxy Investment Banking is serving as co-placement agent and financial advisor.

Management characterized Solana as a high-conviction bet, citing its developer pace, adoption, and performance, while partners bring deep ecosystem expertise: Galaxy will advise on trading, lending, staking, and risk, and Jump continues to bolster Solana’s infrastructure via its Firedancer validator client. If executed at scale, the treasury initiative would place Forward among the largest public digital-asset treasuries, elevating Solana alongside established corporate BTC/ETH holdings. The PIPE proceeds are intended to fund active SOL treasury operations, reinforcing Forward’s shift from legacy product design to a crypto-native balance sheet strategy, aligned with institutional infrastructure on Solana. (10, 11)

2. Tether launches USAT, a U.S.-compliant stablecoin, challenging Circle’s USDC

Tether has introduced USAT, its first U.S.-compliant stablecoin, marking a formal push into the American market, which has long been dominated by Circle’s USDC. The token will be issued by Anchorage Digital Bank, with Cantor Fitzgerald managing reserves. Bo Hines, a former White House crypto policy adviser, will lead Tether’s new U.S. arm as CEO.

Built to comply with the GENIUS Act standard, USAT runs on regulated rails: balances and flows are transparent and traceable, and the token is non-yielding by design. Tether frames this as a “hedge and expand” move: USDT continues as the offshore, permissionless workhorse, while USAT gives banks, corporates, and fintechs a compliant on-ramp to the same brand. Tether says Anchorage and Cantor will also take equity stakes in the U.S. entity and share reserve revenues, with terms to be finalized. U.S. operations will be based in Charlotte, North Carolina; the international HQ remains in El Salvador.

The competitive stakes are high. USDT’s supply stands at nearly $170B, compared with about $73B for USDC, and a U.S.-regulated Tether product could blunt USDC’s positioning as the default “compliant” dollar. Pressure may grow where USDC is entrenched (e.g., Hyperliquid activity), as distribution and integrations become the real battleground. USAT could help stablecoins go mainstream by making payments faster, liquidity deeper, and access easier for big institutions. Critics warn that it carries a privacy cost, as the network is permissioned and every transaction traceable — unlike crypto’s earlier, more open model (12, 13)

3. MegaETH launches USDm, a yield-bearing stablecoin to subsidize protocol fees

MegaETH, an Ethereum-secured L2, is introducing USDm, a native stablecoin built with Ethena to replace traditional sequencer margins by directing reserve yield to cover network operating costs. The first iteration of USDm will be issued on Ethena’s USDtb rails, whose reserves are held primarily in BlackRock’s tokenized U.S. Treasury fund (BUIDL) via Securitize, alongside liquid stables for redemptions, providing institutional-grade backing and transparent accounting. USDtb, for example, has ≈$1.5B outstanding, with GENIUS Act compliance via Anchorage Digital Bank.

USDm will be deeply integrated across MegaETH wallets, paymasters, Dapps, and services; existing options (USDT0, cUSD) remain first-class. MegaETH’s public testnet is live, demonstrating ~10 ms block times and 20k+ TPS, with a roadmap targeting up to 100k TPS while preserving Ethereum composability, enabling real-time, streaming, and interactive apps at sub-cent fees.

On economics, USDm’s reserve income is programmatically routed to sequencer OPEX, not chain profit. MegaETH said MEV and other revenue details will be shared closer to mainnet. Alternatives like user yield sharing are constrained by the GENIUS Act, making OPEX coverage the first step; allocation may evolve as the network matures.(14, 15, 16)

Key Ventures Deals

1. Ethena Labs invests in Based to drive USDEe stablecoin growth on Hyperliquid

Ethena Labs has made a strategic investment in Based, the largest builder codes platform on Hyperliquid, to accelerate adoption of its synthetic dollar USDe. Based currently accounts for nearly 7% of Hyperliquid’s 24-hour perpetuals volume, and the partnership is designed to deepen liquidity and expand stablecoin use cases across the exchange.

The collaboration establishes Based as a key partner for Ethena’s stablecoin suite, including USDe, USDtb, and upcoming products. Ethena said the initiative will integrate USDe not only into trading flows on Hyperliquid but also into Based’s debit card program, enabling users to spend stablecoins globally, with yield functionality embedded. sENA stakers will also gain exclusive eligibility for Based Points under the agreement.

Together, the firms aim to merge trading and payments, bridging onchain liquidity with real-world financial rails. Ethena continues to scale USDe as a core collateral and settlement asset across the digital economy. (17, 18)

2. Inversion secures $26.5M to acquire and upgrade Traditional firms with Blockchain infrastructure

Inversion has raised $26.5M in a seed round to pursue a private-equity approach to crypto adoption — acquiring traditional businesses and upgrading them with blockchain rails. The round drew backing from Dragonfly, Lightspeed Venture Partners, ParaFi Capital, Mirana Ventures, HashKey Capital, VanEck, Volt Capital, Race Capital, Moonrock Capital, Bodhi Ventures, among others.

Inversion is building Inversion L1, an Avalanche-powered Layer 1 designed specifically for crypto-native private equity strategies. Rather than chasing end-user speculation, the model targets cash-generating, off-chain businesses, embedding stablecoin payments and on-chain financial services to reduce costs, speed settlement, and unlock new revenue lines with a long-term, hold-forever mandate. Investors describe the strategy as distribution-first: acquire established customer bases and plug in crypto as invisible infrastructure, not ideology. VanEck framed the goal as shifting focus from speculative TVL to on-chain GDP, accruing network value from real economic activity on the Inversion chain. With stablecoin rails scaling globally, backers see Inversion positioned to capture trillions in payments volume as enterprises migrate to programmable money.

With seed capital in hand, Inversion plans to scout acquisitions and begin bridging real-world revenues on-chain, aiming to prove the thesis that blockchain upgrades streamline operations, improve liquidity, and standardize compliance across a portfolio of modernized, token-enabled businesses. (19, 20, 21)

3. Recoveris secures $1.26M to launch AI-Enhanced investigation management system

Recoveris, Switzerland company raised CHF 1M (~$1.26M) in a strategic seed round led by VerifyVASP to build an AI-enhanced Blockchain Investigation Management System (BIMS). The platform will automate complex casework, streamline workflows, and improve stakeholder communications across cross-chain investigations. The firm’s expert-led recovery services already serve exchanges, DeFi projects, banks, insurers, law firms, and individuals, leveraging deep technical forensics and hands-on case experience. The new capital is dedicated solely to product development.

VerifyVASP will contribute verified VASP/transactional datasets and Travel Rule expertise, strengthening BIMS with auditable counterparty context used by compliance teams, FIUs, and law enforcement worldwide. The company described the raise as “rocket fuel” for the product roadmap. Management added that AI-driven tooling is vital as digital-asset crime grows, supporting a safer, more compliant Web3 ecosystem. (22, 23)

Ventures Market Metrics

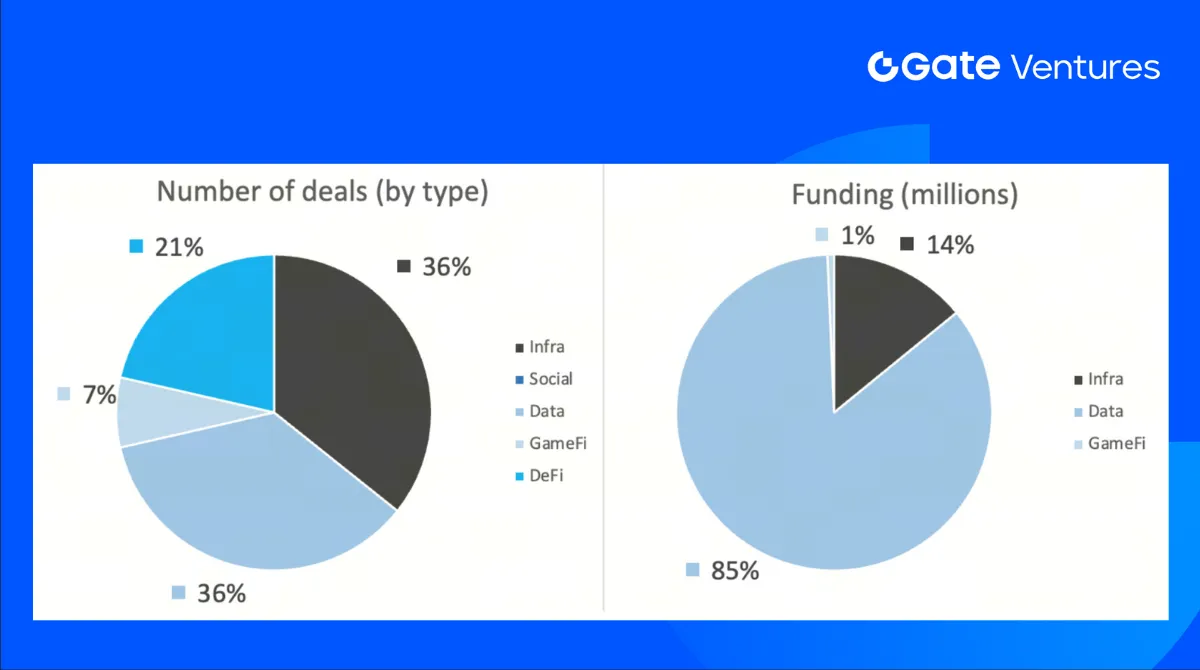

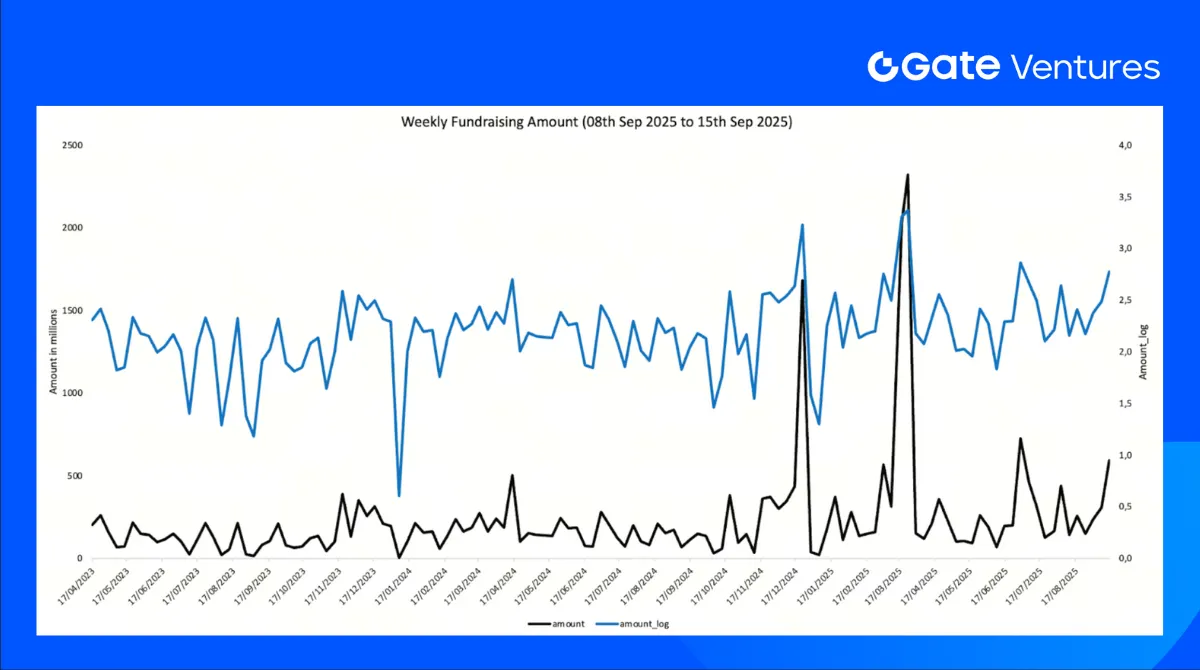

The number of deals closed in the previous week was 14, with Infra having 5 deals, representing 36% for each sector of the total number of deals. Meanwhile, Data had 5 (36%), Gamefi had 1(7%) and DeFi had 3 (21%) deals.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 15th Sep 2025

The total amount of disclosed funding raised in the previous week was $594M, 43% deals (6/14) in previous week didn’t public the raised amount. The top funding came from Data sector with $506M. Most funded deals: Rapyd $500M, Gemini $50M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 15th Sep 2025

Total weekly fundraising rose to $594M for the 2nd week of Sep-2025, an increase of +95% compared to the week prior. Weekly fundraising in the previous week was up +81% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://www.gate.com/ventures

Thanks for your attention.

Gate Ventures Weekly Crypto Assets Review (September 1, 2025)

Gate Ventures Weekly Crypto Recap (September 08, 2025)

Gate Ventures Weekly Crypto Recap (August 25, 2025)

Gate Ventures Weekly Crypto Recap (August 11, 2025)

Gate Ventures Weekly Crypto Assets Review (August 18, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Latest Terra Classic LUNC Price Update: Major Support for Parity Upgrade

L1TF Unveils Latest Strategy for Luna Classic Revival | Crypto News Insights

Recognizing and Avoiding Cryptocurrency Wallet Scams: Essential Warning Signs

2025 QORPO Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 RARI Price Prediction: Expert Analysis and Market Forecast for the Year Ahead