Bitcoin Falls Below $110K — Who’s Losing Money This Time?

After the October 11 black swan event, widespread concerns about a “second dip” emerged in the market, and only a few days later, another steep drop followed. On October 17, Bitcoin fell for four straight days from its rebound high of $116,000, hitting a low of approximately $104,500 around 8:00 UTC, nearly matching the October 11 crash low of $102,000. ETH also suffered, dropping to $3,706, while SOL slipped to around $175, and most altcoins saw broad declines.

Coinglass reported $1.189 billion in liquidations of open interest positions across the network over the past 24 hours, with $935 million from long positions. The largest single liquidation occurred on Hyperliquid: ETH-USD, totaling $20.4274 million. Alternative data shows the fear index has fallen to 22, indicating extreme fear.

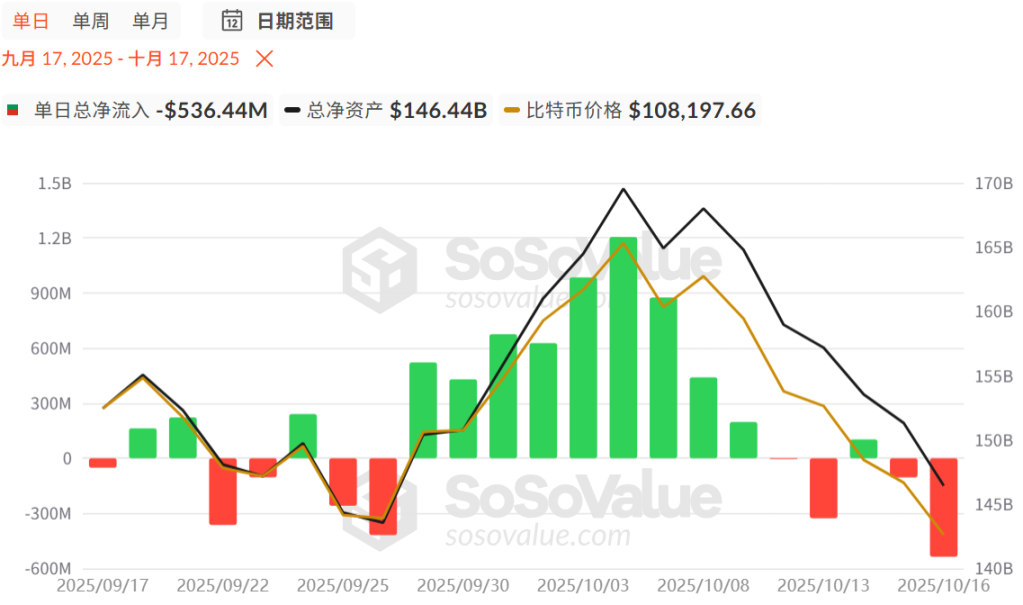

Significant Net Outflows from U.S. BTC and ETH Spot ETFs

Following the crash, U.S. BTC spot ETFs saw substantial net outflows. From October 10 to October 16, only October 14 recorded a net inflow of $102.58 million; all other days posted net outflows. On October 1, net outflows exceeded $536 million, marking the lowest point since August.

Ethereum spot ETFs also faced a negative outlook, with large net outflows continuing since October 9. On October 13, net outflows surpassed $428 million, the highest since September.

Crash Event Shakes Market Confidence

DeFiance Capital, which rose to prominence in the last cycle by backing multiple DeFi projects, suffered losses in the recent crash. On October 14, founder Arthur posted on social media: “We’re fine. The fund has experienced some losses, but it doesn’t rank among our top five biggest P&L swings. I’m just extremely angry and disappointed. This crash set the entire crypto sector back significantly, especially for altcoins, since most price discovery happens on offshore CEXs.”

He went so far as to suggest that this crash could mark the end of the crypto era.

The trend of DAT treasuries has also diminished. Tom Lee, Chairman of BitMine, the largest Ethereum holder, stated that this bubble may have burst.

Previously, U.S.-listed QMMM Holdings announced on September 9, 2025 that it intended to allocate $100 million to establish a cryptocurrency reserve, causing its stock price to surge 9.6 times in three weeks. The U.S. Securities and Exchange Commission (SEC) suspected the company of stock price manipulation via social media and ordered a halt to trading from September 29, which remains in effect. On October 16, Caixin visited the company’s Hong Kong headquarters and found it deserted. An employee from a neighboring company said QMMM had moved out in September and its new location is unknown.

Changpeng Zhao commented, “All crypto treasury (DAT) companies should use third-party custody solutions and have accounts audited by investors.”

U.S. Regional Banks Hit Turbulence, Market Rushes to Sell

On Thursday, U.S. regional banks Zions Bancorp and Western Alliance Bancorp reported losses due to fraudulent activity related to commercial mortgage loan investment funds. Although the losses were relatively modest—just tens of millions of dollars compared to other recent credit events—the market reaction was exceptionally sharp.

The German DAX fell 2.13%, the UK FTSE 100 dropped 1.6%, the Nikkei 225 declined 1.44%, the Australian S&P/ASX 200 slid 0.81%, and futures for all three major U.S. stock indexes were down.

Panic spread rapidly, causing a decline in the entire banking sector. The combined market cap of 74 major U.S. banks lost over $100 billion in a single day.

This “sell first, ask questions later” mentality quickly took hold. JPMorgan analysts Anthony Elian and Michael Pietrini noted in a report that they too were questioning “why all these credit ‘isolated incidents’ seem to be happening in such a short span.” Large banks weren’t spared either—shares of Citigroup and Bank of America both fell more than 3%.

The 2023 U.S. banking crisis previously triggered a major correction in the crypto market as well.

Is the Market Turning Bearish?

Chris Burniske, Partner at Placeholder VC, posted: “I’m increasingly convinced last Friday’s crash has stalled the crypto market in the short-term. After such a collapse, it’s tough to see sustained buying. This cycle has disappointed most, which may limit action as everyone waits for a recovery or previous highs. It’s easy to get lost in chart details, but if you look at BTC and ETH monthly charts, we’re still in a high range (though cracks are showing), if you’re considering locking in profits.”

MSTR is declining, gold is issuing warning signals, and credit markets are also affected; stocks are likely to react last. There’s always a weak rebound, but I’ve already acted (remember, profit-taking is never all or nothing). I’ll be watching BTC at $100,000, but if it falls to $75,000 or lower, I may be interested in re-entering the market. This bull market is different, and the next bear market will be too.”

Arete Capital Partner McKenna said the market is in the process of forming a bottom, which could take 40–60 days to establish. All price action in this window is just volatility and shakeout. “By mid-November, we should begin to see positive results, leading to a positive December and Q1 2026.”

glassnode tweeted that Bitcoin is currently at a critical support range, trading below its 200-day moving average ($107,400) but just above the 365-day moving average ($99,900), with overhead resistance at the 111-day moving average ($114,700).

If the 365-day moving average holds, the trend may stabilize; if it breaks, deeper corrections may follow.

Weiss Crypto stated that around October 17 could mark the beginning of a rebound from market lows. By December, Bitcoin may reach a new high near $135,000.

Statement

- This article is reprinted from [Foresight News] and the copyright belongs to the original author [1912212.eth, Foresight News]. If you have objections to this reprint, please contact the Gate Learn team for prompt handling in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article represent the author’s own and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is cited, reproduction, distribution, or plagiarism of the translated article is not permitted.

Related Articles

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Dogecoin Nears Critical Breakout Window as Market Tensions Build

Gate Research: Polymarket Builders — New Paradigm and Ecosystem

Is This the Real Reason Behind the $20 Billion Crypto Liquidation?

Gate Research: Implied Volatility Remains Elevated, Favoring Neutral-to-Bullish Structural Trades