New Version, Worth Being Seen! #GateAPPRefreshExperience

🎁 Gate APP has been updated to the latest version v8.0.5. Share your authentic experience on Gate Square for a chance to win Gate-exclusive Christmas gift boxes and position experience vouchers.

How to Participate:

1. Download and update the Gate APP to version v8.0.5

2. Publish a post on Gate Square and include the hashtag: #GateAPPRefreshExperience

3. Share your real experience with the new version, such as:

Key new features and optimizations

App smoothness and UI/UX changes

Improvements in trading or market data experience

Your fa

Here’s How High Kaspa (KAS) Price Could Go This Week

Kaspa (KAS) is holding around the $0.044 level, close to a region that has consistently shrugged off selling pressure in recent days. The KAS price is range-bound even after months of fall, even as focus has drifted back to the development roadmap. The launch of Kaspa’s first global hackathon and preparations for the Crescendo hard fork have brought renewed focus to the project’s base layer. Builder incentives and upcoming protocol changes are now colliding with a chart that still favors caution. This tension between technical weakness and fundamental progress defines Kaspa’s short-term setup heading into the week ahead.

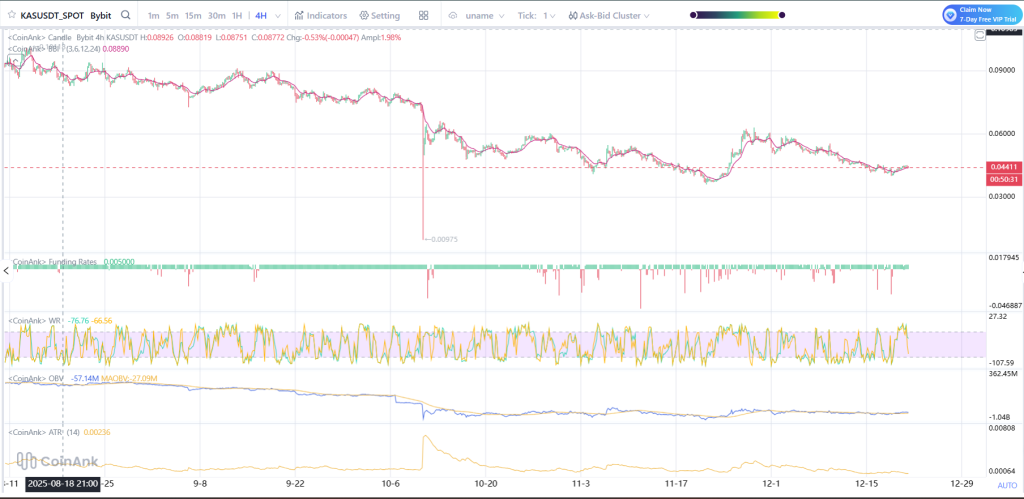

What the Kaspa Chart Is Showing On the 4H chart, the KAS price is bound within an evident downward channel since the early days of September. Price is continuing to make lower highs, identifying that the sellers are controlling the market. The sharp sell-off in early October marked a local capitulation point, after which KAS stabilized but failed to establish a higher low. Recent price action shows consolidation just above the $0.043–$0.044 support zone, an area that has held multiple times over the past two weeks. A clean break below this level would expose the KAS price to downside toward $0.038, while any bullish attempt needs a reclaim of $0.050 to weaken the bearish structure.

Source: Coinank

Market Indicators Signal Weak Momentum Momentum indicators are a mix and are overall lean bearish. The % R is on the verge of oversold, indicating a possible degression in selling pressure, but no change yet. On-Balance Volume remains in a sideways trend following a significant fall in October, showing that there is limited new demand coming into the market. This is consistent with a lack of follow-through from relief bounces. _Read Also: _****Why Is Starknet (STRK) Price Down Today? ATR has declined steadily, reflecting reduced volatility. This often precedes a larger directional move, though it does not indicate direction on its own. Funding rates remain slightly positive, showing leveraged traders are not aggressively short, but also not positioning for a strong upside breakout. KAS Price Short-Term Outlook for This Week For the current week, Kaspa price is likely to remain range-bound unless buyers reclaim key resistance. The $0.043–$0.044 area remains critical support. Holding above it keeps KAS in consolidation rather than breakdown mode. The positive news would be a breakout above $0.050, which would be the first harbinger of structural change, providing space to rise to $0.055-$0.058. Otherwise, any upsides could see selling pressures. Although there is hope in the long term due to upcoming network developments, caution still prevails in the short term. Until then, a cautious approach is also needed in trading the KAS price.