Post content & earn content mining yield

placeholder

SamDoors

Guys sending more Power. Love your Postions

- Reward

- like

- Comment

- Repost

- Share

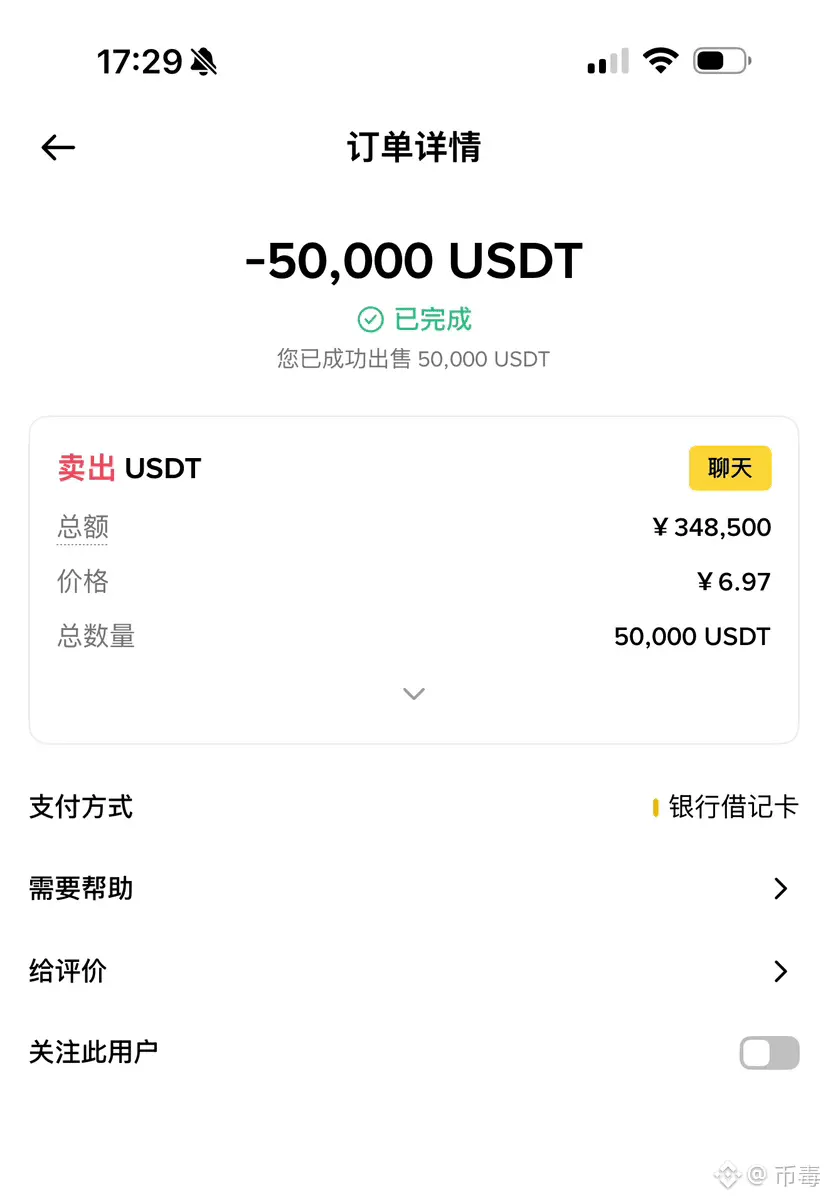

$I'm coming,牛, and comparing myself to it. I want to see if my 10u can make money.

我踏马来了40.2%

- Reward

- like

- Comment

- Repost

- Share

#我的周末交易计划

In mid-2009, Satoshi Nakamoto launched Bitcoin, the first decentralized blockchain digital currency. With a fixed total supply of 21 million coins, it verifies transactions through the PoW consensus mechanism. It features anonymity, transparency, and global circulation, and is regarded as "digital gold." Its development has several milestones: the first physical payment in 2010, and in 2024, the US approved a spot ETF, attracting giants like BlackRock and billions of dollars in compliant capital. Bitcoin's core value lies in anti-inflation and decentralization, but it also faces con

In mid-2009, Satoshi Nakamoto launched Bitcoin, the first decentralized blockchain digital currency. With a fixed total supply of 21 million coins, it verifies transactions through the PoW consensus mechanism. It features anonymity, transparency, and global circulation, and is regarded as "digital gold." Its development has several milestones: the first physical payment in 2010, and in 2024, the US approved a spot ETF, attracting giants like BlackRock and billions of dollars in compliant capital. Bitcoin's core value lies in anti-inflation and decentralization, but it also faces con

BTC-5.25%

- Reward

- 2

- 3

- Repost

- Share

HaonanChen :

:

Hold on tight, we're about to take off 🛫View More

WMRS

外卖人生

Created By@TravelingTheWorldWithCoins

Listing Progress

0.00%

MC:

$2.9K

Create My Token

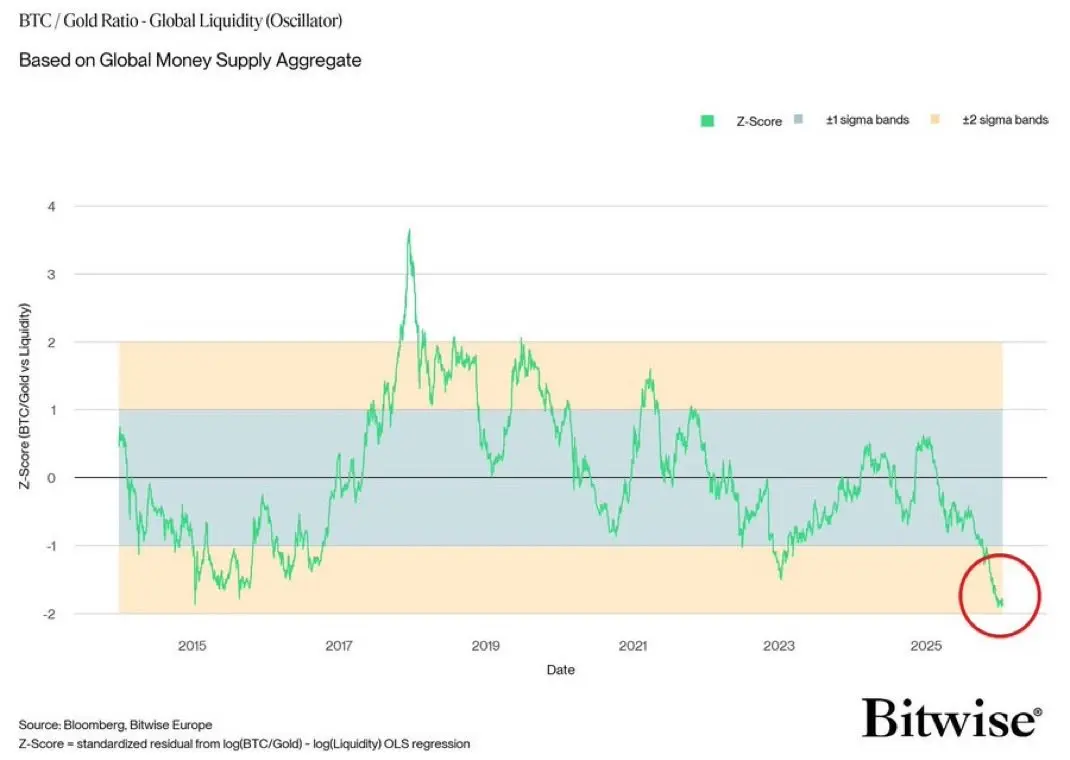

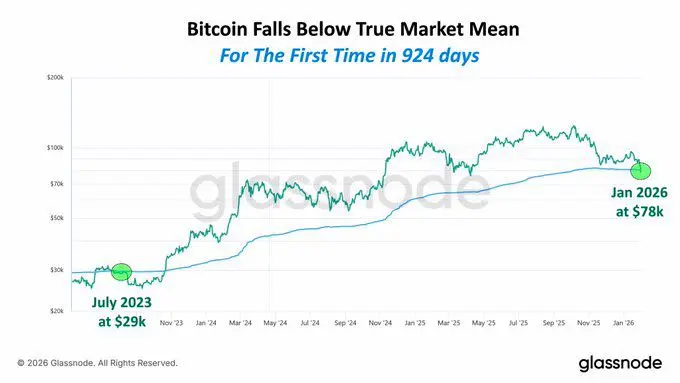

$BTC The local bottom of Bitcoin was recorded at just above $75 000 — such values have not been observed since April 2025. As of now, the asset has recovered and is trading close to $78 000.

The decline coincided with the end of January: thus, the monthly chart of digital gold closed with a red candle for the third consecutive month.

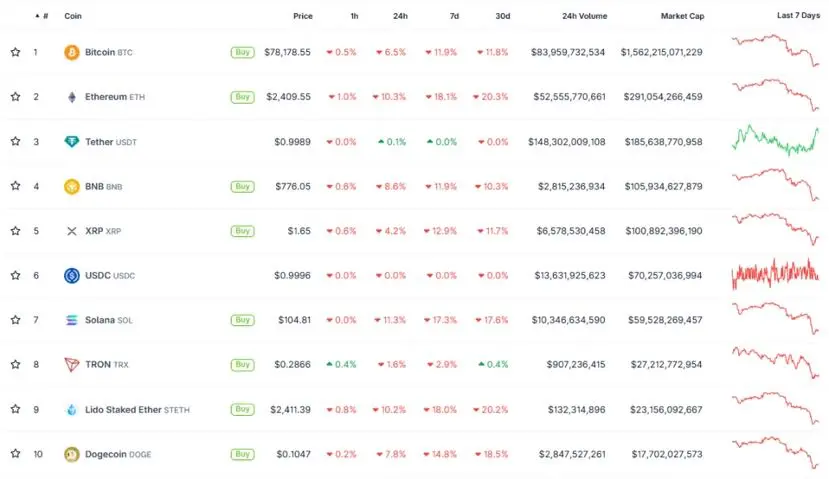

Other cryptocurrencies from the top 10 by market capitalization also declined, with some falling even further than the flagship.

**Bitcoin's logo**

**Monthly chart of

The decline coincided with the end of January: thus, the monthly chart of digital gold closed with a red candle for the third consecutive month.

Other cryptocurrencies from the top 10 by market capitalization also declined, with some falling even further than the flagship.

**Bitcoin's logo**

**Monthly chart of

BTC-5.25%

- Reward

- like

- Comment

- Repost

- Share

$DOGE

📌 Update on EGY Token – Gate Fun

In light of the ongoing fluctuations in the digital asset market, some emerging projects continue to record various movements that reflect the diversity of asset behaviors on decentralized platforms.

The EGY token has demonstrated relative stability in its performance on Gate Fun recently, with the community actively monitoring price movements and its ranking among other listed projects.

These movements highlight the importance of analyzing each project individually, following its data and development without relying solely on the overall market trend.

�

📌 Update on EGY Token – Gate Fun

In light of the ongoing fluctuations in the digital asset market, some emerging projects continue to record various movements that reflect the diversity of asset behaviors on decentralized platforms.

The EGY token has demonstrated relative stability in its performance on Gate Fun recently, with the community actively monitoring price movements and its ranking among other listed projects.

These movements highlight the importance of analyzing each project individually, following its data and development without relying solely on the overall market trend.

�

DOGE-5.6%

- Reward

- 3

- 4

- Repost

- Share

GateUser-c845622b :

:

Atmosphere 1000x coming 🤑View More

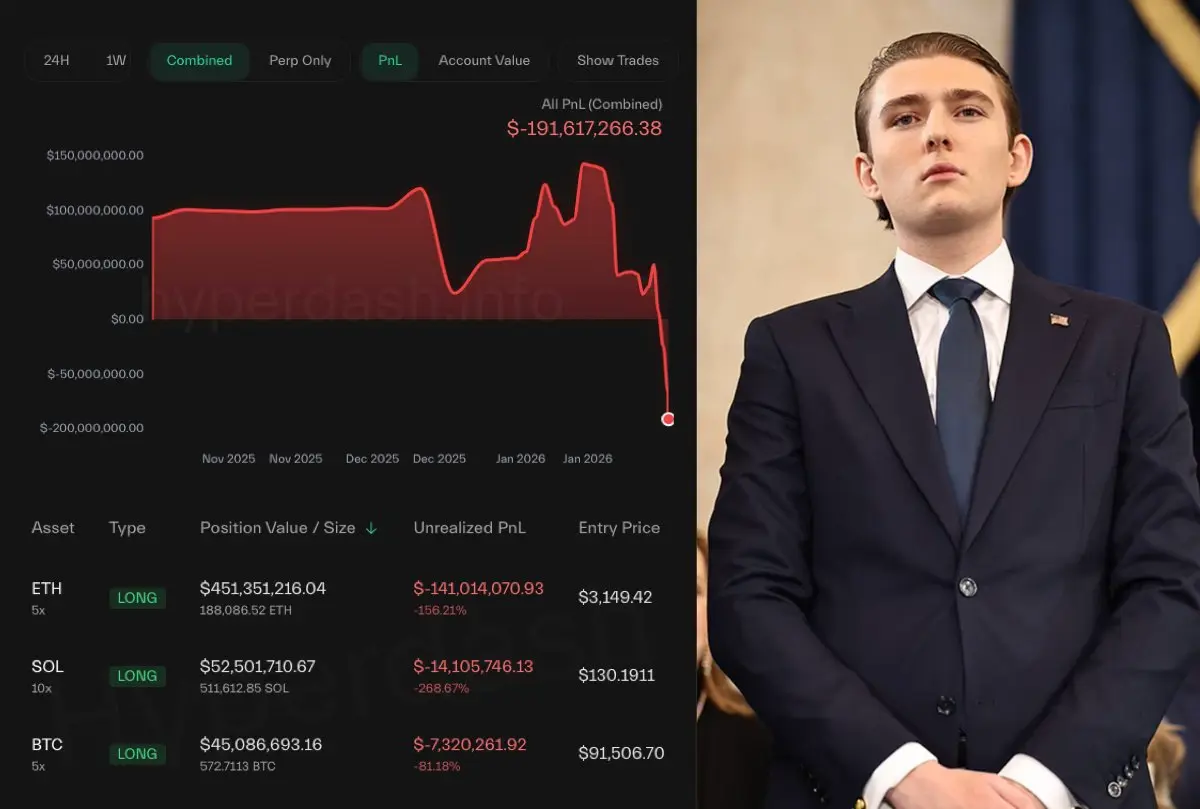

BREAKING

A SO-CALLED TRUMP INSIDER TRADER WITH A PERFECT TRACK RECORD JUST GOT COMPLETELY WIPED OUT — $800 MILLION LIQUIDATED.

HE WAS SITTING ON $125M IN PROFIT LAST WEEK, WENT ALL-IN ON ONE MOVE… AND LOST EVERYTHING IN A SINGLE TRADE.

CRYPTO DOESN’T FORGIVE MISTAKES. THIS MARKET IS ABSOLUTELY RUTHLESS. 🤯

A SO-CALLED TRUMP INSIDER TRADER WITH A PERFECT TRACK RECORD JUST GOT COMPLETELY WIPED OUT — $800 MILLION LIQUIDATED.

HE WAS SITTING ON $125M IN PROFIT LAST WEEK, WENT ALL-IN ON ONE MOVE… AND LOST EVERYTHING IN A SINGLE TRADE.

CRYPTO DOESN’T FORGIVE MISTAKES. THIS MARKET IS ABSOLUTELY RUTHLESS. 🤯

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

How to Read Candlesticks & Trend Lines in Crypto (Beginner Guide)”

- Reward

- like

- Comment

- Repost

- Share

How to Read Candlesticks & Trend Lines in Crypto (Beginner Guide)”

- Reward

- like

- Comment

- Repost

- Share

When I first entered the circle, I studied the purpose, direction, and vision of various project teams every day, actively participated in evaluations of different projects, and built a future outlook with group friends daily. Every token in hand was treasured. Now, in the ruins, I see corpses everywhere, a piece of shameful cloth torn off, and each makeshift team exposed. Every token in hand has become capital's mockery and trampling of me. I was once full of ambition and couldn't listen to anything. Now, I am silent and can't say anything. Everything has changed.

View Original

- Reward

- like

- Comment

- Repost

- Share

$SOSO /USDT is currently trading at $0.5457. Key levels to watch include support and resistance zones (to be determined based on chart analysis). A strategic entry zone can help optimize risk/reward, while defined targets 1, 2, and 3 guide profit-taking. Always set a stop loss to protect your capital and manage exposure. Proper risk management ensures positions are sized correctly relative to your portfolio. Stay disciplined and monitor market moves closely before acting.

SOSO-0.58%

- Reward

- like

- Comment

- Repost

- Share

馬币火

Malaysian Ringgit

Created By@TIANDAO

Listing Progress

100.00%

MC:

$12.82K

Create My Token

I used to frequently get liquidated to zero, earning more and more but eventually losing everything. Very little could be withdrawn. This also trained me to withdraw some funds to spend whenever I lose, which I see as a gift that poverty has given me.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

#USGovernmentShutdownRisk, written in a professional, premium tone suitable for crypto, finance, or macro-economic audiences:

USGovernmentShutdownRisk: Why Markets Are Watching Washington So Closely

The risk of a US government shutdown has once again moved to the forefront of global market discussions, raising concerns across equities, bonds, commodities, and the crypto space.

While government shutdowns are not new in American politics, the current environment of high interest rates, fragile economic growth, and geopolitical uncertainty makes this situation particularly sensitive. Investors a

USGovernmentShutdownRisk: Why Markets Are Watching Washington So Closely

The risk of a US government shutdown has once again moved to the forefront of global market discussions, raising concerns across equities, bonds, commodities, and the crypto space.

While government shutdowns are not new in American politics, the current environment of high interest rates, fragile economic growth, and geopolitical uncertainty makes this situation particularly sensitive. Investors a

BTC-5.25%

- Reward

- 1

- Comment

- Repost

- Share

All 8 traders once made huge profits on Hyperliquid, but every one of them ended up getting wiped out.Stay away from high leverage.

HYPE2.6%

- Reward

- like

- Comment

- Repost

- Share

#MyWeekendTradingPlan

Weekends in crypto are funny — low liquidity, surprise volatility, and random candles that move like they had too much coffee ☕📉📈

So this weekend, I’m entering the market with discipline first, emotions last.

Serious part first:

My main focus is risk management. No over-trading, no chasing green candles, and absolutely no revenge trades. I’ll stick to higher-timeframe support and resistance, wait for confirmation, and size my positions carefully. If the setup isn’t clear, I stay out — capital protection > quick profits.

Now the funny reality:

If the market pumps sudden

Weekends in crypto are funny — low liquidity, surprise volatility, and random candles that move like they had too much coffee ☕📉📈

So this weekend, I’m entering the market with discipline first, emotions last.

Serious part first:

My main focus is risk management. No over-trading, no chasing green candles, and absolutely no revenge trades. I’ll stick to higher-timeframe support and resistance, wait for confirmation, and size my positions carefully. If the setup isn’t clear, I stay out — capital protection > quick profits.

Now the funny reality:

If the market pumps sudden

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

#CryptoRegulationNewProgress

The cryptocurrency regulatory landscape has seen substantial progress in recent months, particularly as 2025 transitioned into 2026.

Across the globe, regulators are moving toward clearer frameworks, reduced enforcement-heavy approaches, and greater support for innovation, especially in stablecoins, market structure, compliance, and tokenization.

United States: The US has shifted dramatically toward pro-crypto regulation. The GENIUS Act (enacted July 2025) establishes the first federal framework for payment stablecoins, allowing banking integration and everyday u

The cryptocurrency regulatory landscape has seen substantial progress in recent months, particularly as 2025 transitioned into 2026.

Across the globe, regulators are moving toward clearer frameworks, reduced enforcement-heavy approaches, and greater support for innovation, especially in stablecoins, market structure, compliance, and tokenization.

United States: The US has shifted dramatically toward pro-crypto regulation. The GENIUS Act (enacted July 2025) establishes the first federal framework for payment stablecoins, allowing banking integration and everyday u

LINK-5.81%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More25.76K Popularity

62.7K Popularity

367.57K Popularity

45.75K Popularity

61.89K Popularity

Hot Gate Fun

View More- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.9KHolders:10.00%

- MC:$2.92KHolders:10.00%

News

View More“1011 Insider Whale” ranks first in the loss amount among Hyperliquid's top whales.

13 m

Cathie Wood: BTC, ETH, SOL, HYPE can be used as diversified investment options

18 m

Whale Deposits $3M USDC to Hyperliquid, Sets Buy Orders for HYPE

21 m

Ethereum's return rate for January 2026 is -17.52%, compared to Bitcoin's return rate of -10.17%.

21 m

Bitcoin has been surpassed by Tesla and has fallen to the 14th position in the global asset market capitalization ranking.

30 m

Pin