#深度创作营 War is in full swing! 44 minutes evaporated 480 billion! The US-Israel-Iran conflict has completely ignited! What is the market worried about?

The US-Israel-Iran conflict has fully erupted! After 2:00 PM Beijing time today, Israel launched a surprise attack on Iran first, followed by the US military joining in, and the Middle East warfare is now fully ignited.

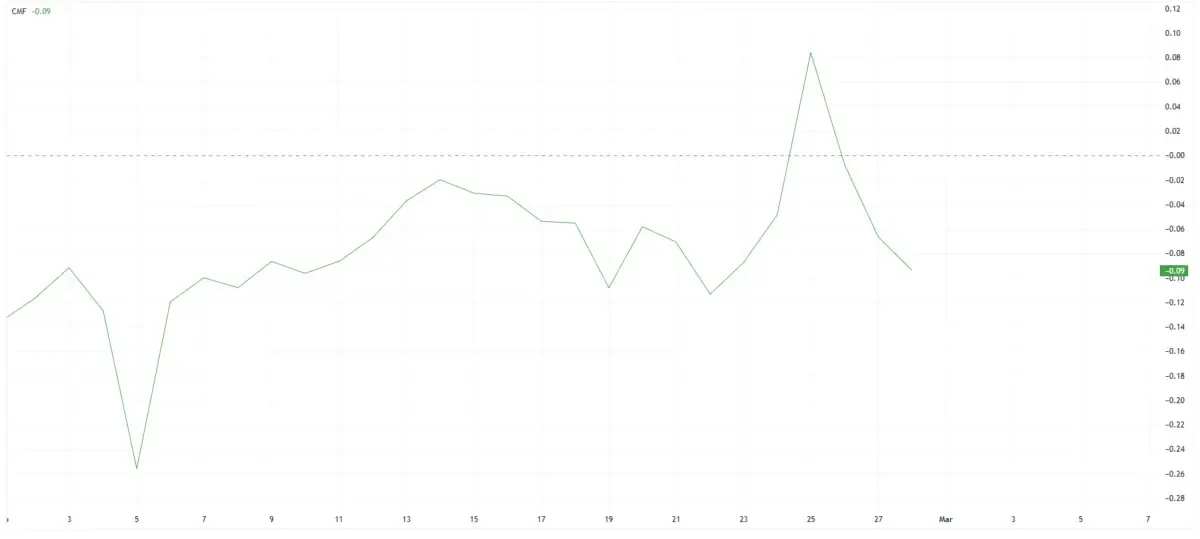

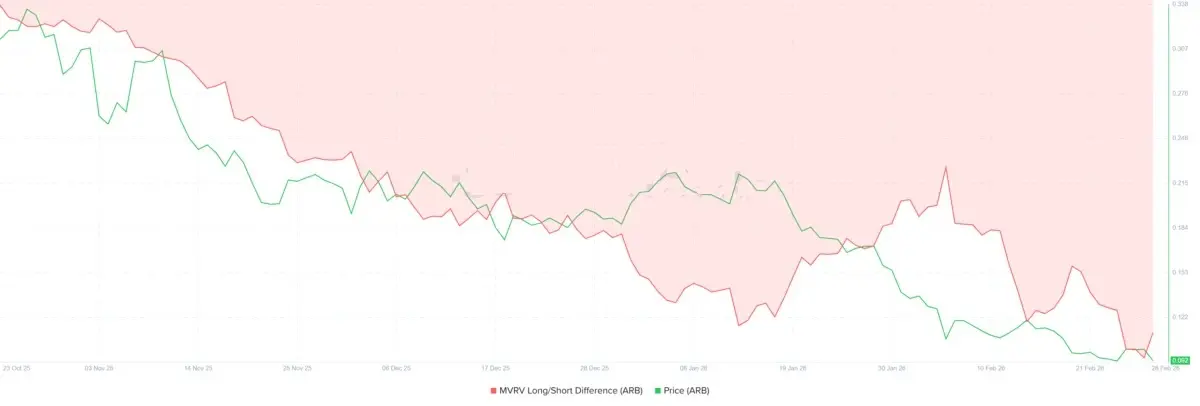

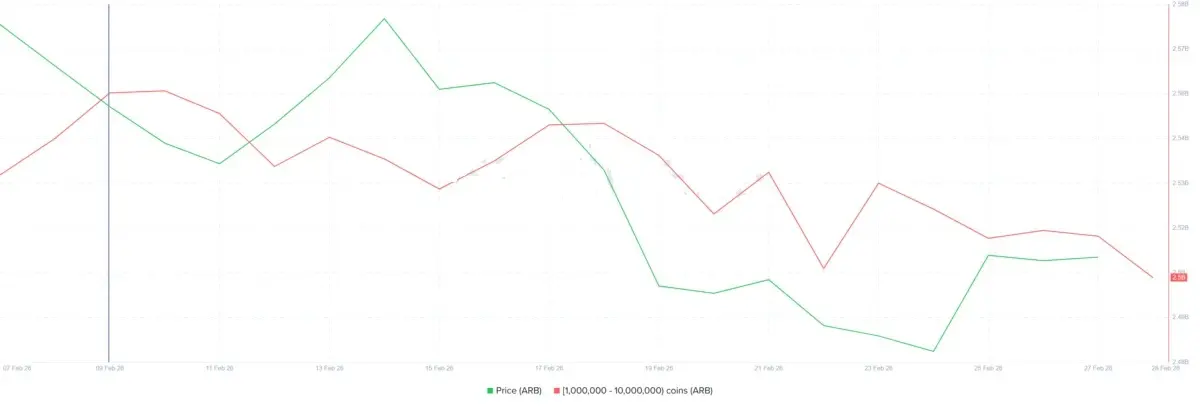

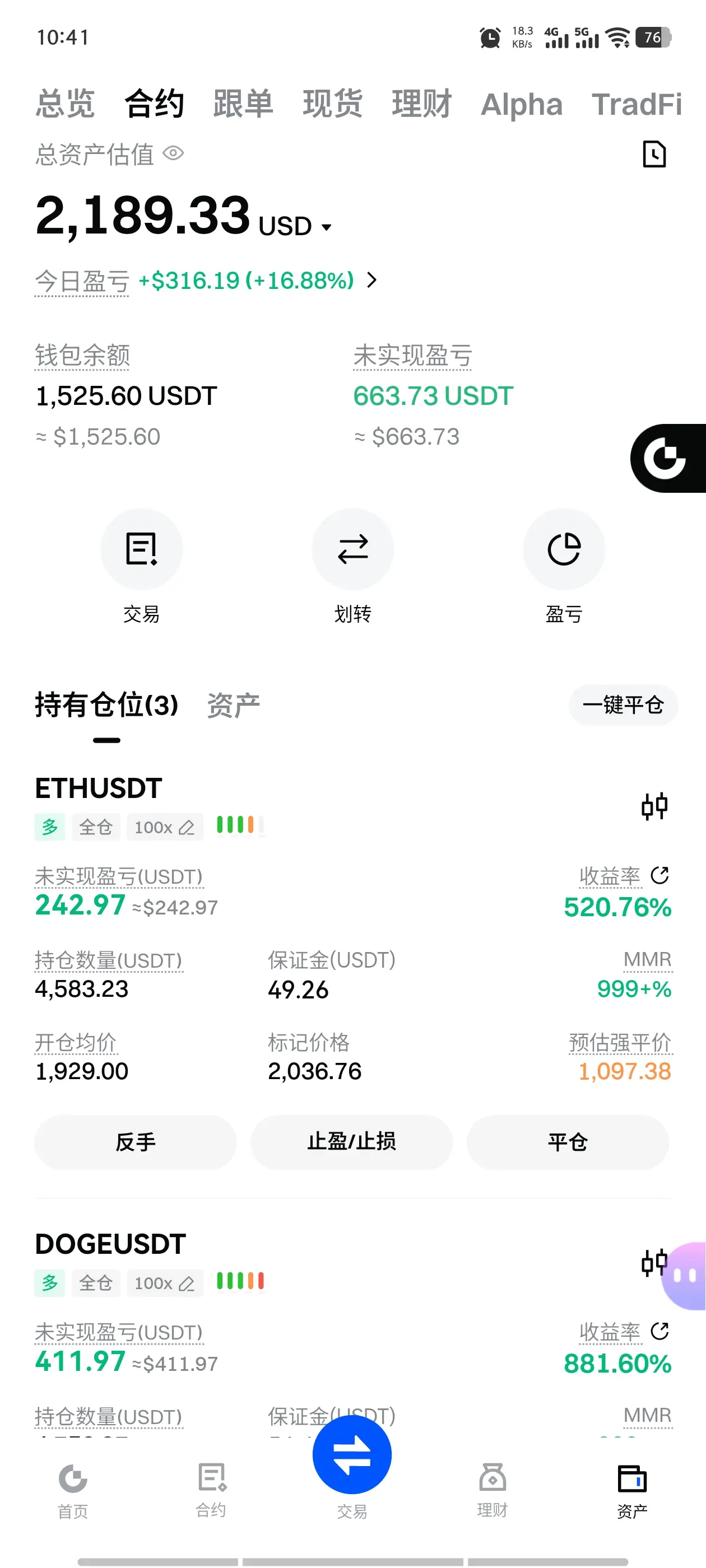

As investors, the most concern is undoubtedly the impact of this conflict on the market. From the virtual currency market perspective, 44 minutes after the outbreak of the conflict, the total market capitalization of virtual currencies dropped from $2.24 trillion to $2.17 trillion, evaporating about $70 billion (equivalent to nearly 480 billion RMB).

On the 28th local time, Israeli Prime Minister Netanyahu announced that the goal of the US and Israel's military actions is to overthrow the Iranian regime.

Some experts believe that if this is the goal, it will trigger sustained risk aversion and increased cross-asset volatility. Regime change is not a single event; on the contrary, it could be a long process involving a comprehensive reassessment of governance systems, security environments, and oil policies. However, compared to the two-week strike in June last year, this first wave of joint strikes lasted only four days. This may foster an expectation of “fighting while negotiating.” Moreover, after the war broke out, an OPEC+ representative revealed that after Israel launched airstrikes on targets inside Iran, OPEC+ will consider further production increase plans at the main member country meeting on Sunday (March 1). Analysts believe that the biggest variable affecting financial markets could be the “Strait of Hormuz.”

Implications for the Virtual Currency Market

At the moment the news of Israel launching attacks on Iran broke, the virtual currency market experienced a sharp drop. The market cap quickly fell from $2.24 trillion before the attack to $2.17 trillion, a decline of about 3.1%. Subsequently, the entire market did not accelerate its decline but instead rebounded somewhat. After Iran launched a counterattack, the market fell again, with the total market cap remaining around $2.17 trillion.

From the reaction of the virtual currency market, sudden shocks seem difficult to avoid. How it develops afterward largely depends on the intensity of the war. Based on current statements from various sides, the goals of the US and Israel seem somewhat different.

According to Xinhua News Agency, US President Trump stated that Iran is developing long-range missiles threatening the US. The current attack aims to destroy Iran’s missile industry, eliminate the Iranian navy, and ensure Iran cannot acquire nuclear weapons. Israeli Prime Minister Netanyahu announced that the goal of the US and Israel’s military actions is to overthrow the Iranian regime.

According to Futu Securities, renowned macro strategist Michael Ball said that if the US military’s goal is to overthrow the Iranian leadership, it will trigger sustained risk aversion and increased cross-asset volatility. Regime change could be a long process involving a comprehensive reassessment of governance, security, and oil policies. Even in a so-called orderly transition scenario, market sentiment would only recover once investors are confident that future oil supplies are relatively stable. Additionally, with inflation data likely to accompany rising energy prices, the global central bank situation will become more complicated. During the early stages of the 2003 Iraq war, oil volatility surged until the regime change phase settled and the global oil market adjusted (including the outbreak of the US shale revolution), after which prices stabilized again.

However, according to CCTV News, an Israeli government official stated that Israel is preparing for a four-day intensive joint strike in its first phase. Compared to last June’s operation, this is much shorter in duration. If this leads to an expectation of “fighting while negotiating,” the market trend could become quite complex.

Key Factors: Not Production, But Transportation

Iran’s conflict impacts the global market through oil prices, but what is the most critical factor affecting oil prices right now?

According to foreign media reports, an OPEC+ representative revealed that after Israel launched airstrikes on targets inside Iran, OPEC+ will consider further production increase plans at the main member country meeting on Sunday (March 1). As of the latest data released on February 25, U.S. EIA crude oil inventories increased by 15.989 million barrels last week, far exceeding market expectations of a 1.925 million barrel increase, with the previous value being a decrease of 9.014 million barrels. From this perspective, production and supply are not the main issues; the biggest concern may be transportation. Analysts believe that only when the Strait of Hormuz’s oil production and shipping suffer significant disruptions can this negative market sentiment persist long-term. As the Strait of Hormuz (a critical choke point for 20% of global oil supply) has now become a war zone, analysts expect that oil prices will be heavily priced in “war premiums” at the market open on Monday (March 2). Strong risk aversion will also appear in the first 1-3 days, with rises in oil prices, gold prices, and the VIX, while stock markets come under pressure. So, what will be the future direction of the Strait of Hormuz?

According to Tencent News, the well-known research institution Oxford Economics stated that the difference in this situation is that the risk of escalation in the external situation is intertwined with domestic turmoil in Iran. This increases the possibility that the Iranian regime may feel its survival is threatened, and thus Iran might be willing to take costly actions, including severely disrupting traffic through the Strait of Hormuz, even if it damages its own exports and relations with neighboring countries and major trading partners. Currently, severe trade disruptions are unlikely to last because Iran would need to maintain unprecedented naval forces to carry out blockades. According to Trump’s latest statements, the US military has already begun military strikes against Iran and will completely destroy the “Iranian Navy.” This means any Iranian naval actions in the Strait of Hormuz will be heavily constrained.

Oxford Economics’ energy forecast chief Payne said that compared to a complete closure, the Strait is more likely to experience targeted attacks and disruptions, leading to reduced energy flows rather than a total stoppage. Alternative supplies, pipelines, and storage facilities could buffer some of the disruptions.

Research from the Dallas Fed on the potential impact of the “Midnight Hammer” operation also shows that even under severe impacts on the Strait of Hormuz, the initial surge in oil prices is far less significant than its sustained upward trend.

The US-Israel-Iran conflict has fully erupted! After 2:00 PM Beijing time today, Israel launched a surprise attack on Iran first, followed by the US military joining in, and the Middle East warfare is now fully ignited.

As investors, the most concern is undoubtedly the impact of this conflict on the market. From the virtual currency market perspective, 44 minutes after the outbreak of the conflict, the total market capitalization of virtual currencies dropped from $2.24 trillion to $2.17 trillion, evaporating about $70 billion (equivalent to nearly 480 billion RMB).

On the 28th local time, Israeli Prime Minister Netanyahu announced that the goal of the US and Israel's military actions is to overthrow the Iranian regime.

Some experts believe that if this is the goal, it will trigger sustained risk aversion and increased cross-asset volatility. Regime change is not a single event; on the contrary, it could be a long process involving a comprehensive reassessment of governance systems, security environments, and oil policies. However, compared to the two-week strike in June last year, this first wave of joint strikes lasted only four days. This may foster an expectation of “fighting while negotiating.” Moreover, after the war broke out, an OPEC+ representative revealed that after Israel launched airstrikes on targets inside Iran, OPEC+ will consider further production increase plans at the main member country meeting on Sunday (March 1). Analysts believe that the biggest variable affecting financial markets could be the “Strait of Hormuz.”

Implications for the Virtual Currency Market

At the moment the news of Israel launching attacks on Iran broke, the virtual currency market experienced a sharp drop. The market cap quickly fell from $2.24 trillion before the attack to $2.17 trillion, a decline of about 3.1%. Subsequently, the entire market did not accelerate its decline but instead rebounded somewhat. After Iran launched a counterattack, the market fell again, with the total market cap remaining around $2.17 trillion.

From the reaction of the virtual currency market, sudden shocks seem difficult to avoid. How it develops afterward largely depends on the intensity of the war. Based on current statements from various sides, the goals of the US and Israel seem somewhat different.

According to Xinhua News Agency, US President Trump stated that Iran is developing long-range missiles threatening the US. The current attack aims to destroy Iran’s missile industry, eliminate the Iranian navy, and ensure Iran cannot acquire nuclear weapons. Israeli Prime Minister Netanyahu announced that the goal of the US and Israel’s military actions is to overthrow the Iranian regime.

According to Futu Securities, renowned macro strategist Michael Ball said that if the US military’s goal is to overthrow the Iranian leadership, it will trigger sustained risk aversion and increased cross-asset volatility. Regime change could be a long process involving a comprehensive reassessment of governance, security, and oil policies. Even in a so-called orderly transition scenario, market sentiment would only recover once investors are confident that future oil supplies are relatively stable. Additionally, with inflation data likely to accompany rising energy prices, the global central bank situation will become more complicated. During the early stages of the 2003 Iraq war, oil volatility surged until the regime change phase settled and the global oil market adjusted (including the outbreak of the US shale revolution), after which prices stabilized again.

However, according to CCTV News, an Israeli government official stated that Israel is preparing for a four-day intensive joint strike in its first phase. Compared to last June’s operation, this is much shorter in duration. If this leads to an expectation of “fighting while negotiating,” the market trend could become quite complex.

Key Factors: Not Production, But Transportation

Iran’s conflict impacts the global market through oil prices, but what is the most critical factor affecting oil prices right now?

According to foreign media reports, an OPEC+ representative revealed that after Israel launched airstrikes on targets inside Iran, OPEC+ will consider further production increase plans at the main member country meeting on Sunday (March 1). As of the latest data released on February 25, U.S. EIA crude oil inventories increased by 15.989 million barrels last week, far exceeding market expectations of a 1.925 million barrel increase, with the previous value being a decrease of 9.014 million barrels. From this perspective, production and supply are not the main issues; the biggest concern may be transportation. Analysts believe that only when the Strait of Hormuz’s oil production and shipping suffer significant disruptions can this negative market sentiment persist long-term. As the Strait of Hormuz (a critical choke point for 20% of global oil supply) has now become a war zone, analysts expect that oil prices will be heavily priced in “war premiums” at the market open on Monday (March 2). Strong risk aversion will also appear in the first 1-3 days, with rises in oil prices, gold prices, and the VIX, while stock markets come under pressure. So, what will be the future direction of the Strait of Hormuz?

According to Tencent News, the well-known research institution Oxford Economics stated that the difference in this situation is that the risk of escalation in the external situation is intertwined with domestic turmoil in Iran. This increases the possibility that the Iranian regime may feel its survival is threatened, and thus Iran might be willing to take costly actions, including severely disrupting traffic through the Strait of Hormuz, even if it damages its own exports and relations with neighboring countries and major trading partners. Currently, severe trade disruptions are unlikely to last because Iran would need to maintain unprecedented naval forces to carry out blockades. According to Trump’s latest statements, the US military has already begun military strikes against Iran and will completely destroy the “Iranian Navy.” This means any Iranian naval actions in the Strait of Hormuz will be heavily constrained.

Oxford Economics’ energy forecast chief Payne said that compared to a complete closure, the Strait is more likely to experience targeted attacks and disruptions, leading to reduced energy flows rather than a total stoppage. Alternative supplies, pipelines, and storage facilities could buffer some of the disruptions.

Research from the Dallas Fed on the potential impact of the “Midnight Hammer” operation also shows that even under severe impacts on the Strait of Hormuz, the initial surge in oil prices is far less significant than its sustained upward trend.