New Version, Worth Being Seen! #GateAPPRefreshExperience

🎁 Gate APP has been updated to the latest version v8.0.5. Share your authentic experience on Gate Square for a chance to win Gate-exclusive Christmas gift boxes and position experience vouchers.

How to Participate:

1. Download and update the Gate APP to version v8.0.5

2. Publish a post on Gate Square and include the hashtag: #GateAPPRefreshExperience

3. Share your real experience with the new version, such as:

Key new features and optimizations

App smoothness and UI/UX changes

Improvements in trading or market data experience

Your fa

Bitcoin remains around $92,000 after the Federal Reserve rate cut; the market needs new momentum

Source: DecenterKorea Original Title: US Federal Reserve Cuts Interest Rates but Bitcoin Remains in the $92,000 Range [Decenter Market Overview] Original Link: https://www.decenter.kr/NewsView/2H1OSC29IB/GZ03

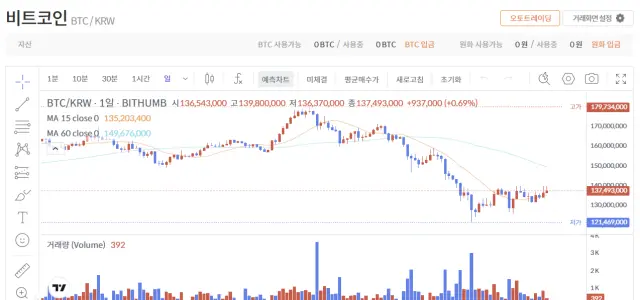

At 8 a.m. on the 11th, according to data from a major exchange, BTC increased by 0.69% compared to the previous day, trading at 13.749 billion Korean won.

The US Federal Reserve(Fed) announced a 25 basis point rate cut, but Bitcoin(BTC) remains volatile around $92,000.

According to data from a global cryptocurrency data website at 8 a.m. on the 11th, BTC fell 0.34% from the previous day, trading at $92,538.38. Ethereum(ETH) rose 0.35% to $3,347.95. Ripple(XRP) dropped 2.90% to $2.055. Binance Coin(BNB) fell 0.72% to $898.78, and Solana(SOL) decreased 1.42% to $137.00.

The domestic market shows mixed performance. At the same time, data from a major exchange indicates that BTC increased by 0.69% from the previous day, trading at 1.3749 billion Korean won. ETH rose 0.77% to 4.676 million Korean won, XRP decreased 0.46% to 3,056 Korean won, and SOL increased 0.39% to 204,800 Korean won.

After the Federal Open Market Committee (FOMC) meeting on the 10th, the Federal Reserve announced a rate cut from 3.75%-4.00% to 3.50%-3.75%. This is the third rate cut this year and the third consecutive cut. Federal Reserve Chair Jerome Powell stated after the meeting, “The labor market may be weaker than expected,” causing BTC to surge to the $94,000 range. However, he also said, “The fight against high inflation is not over,” leading BTC to retreat most of its gains. Industry analysts interpret this as a signal that the monetary policy tone has not been significantly loosened.

Industry experts believe that for BTC to break through the upper bound of the box, additional momentum is needed. An investment expert in crypto assets said, “New momentum is needed to push down the concentrated short positions near the $94,500 resistance level.” He pointed out that, “In an environment of declining capital costs, increased inflows into Bitcoin spot ETFs could become an opportunity for BTC to regain the $100,000 mark.” The fear and greed index from a crypto data analytics firm rose 4 points from the previous day to 26, indicating a ‘fear’ state. The closer the index is to 0, the more pessimistic investor sentiment; the closer to 100, the more overheated the market.