EagleEye

No content yet

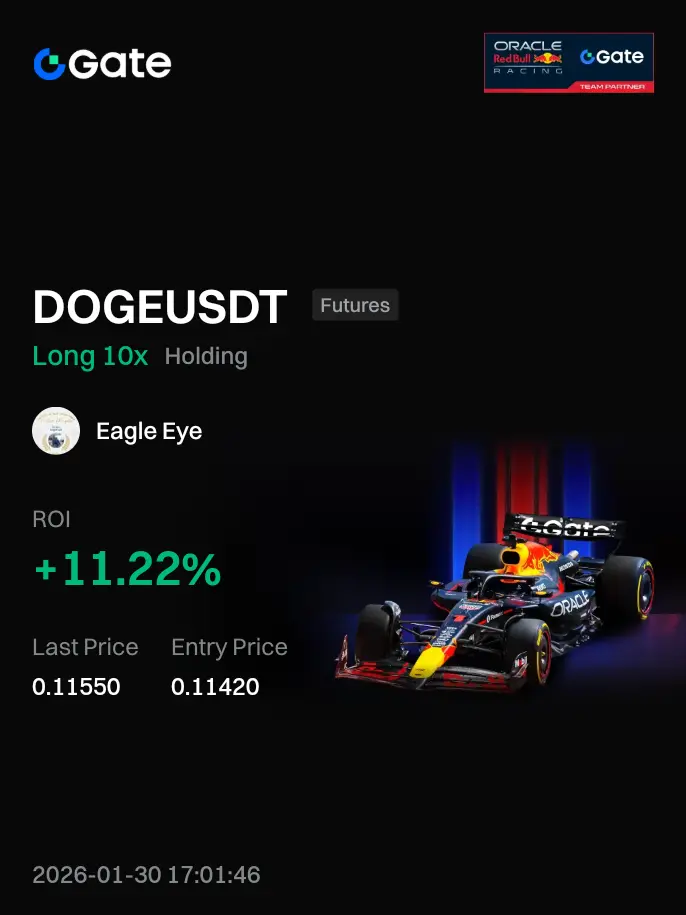

EagleEye

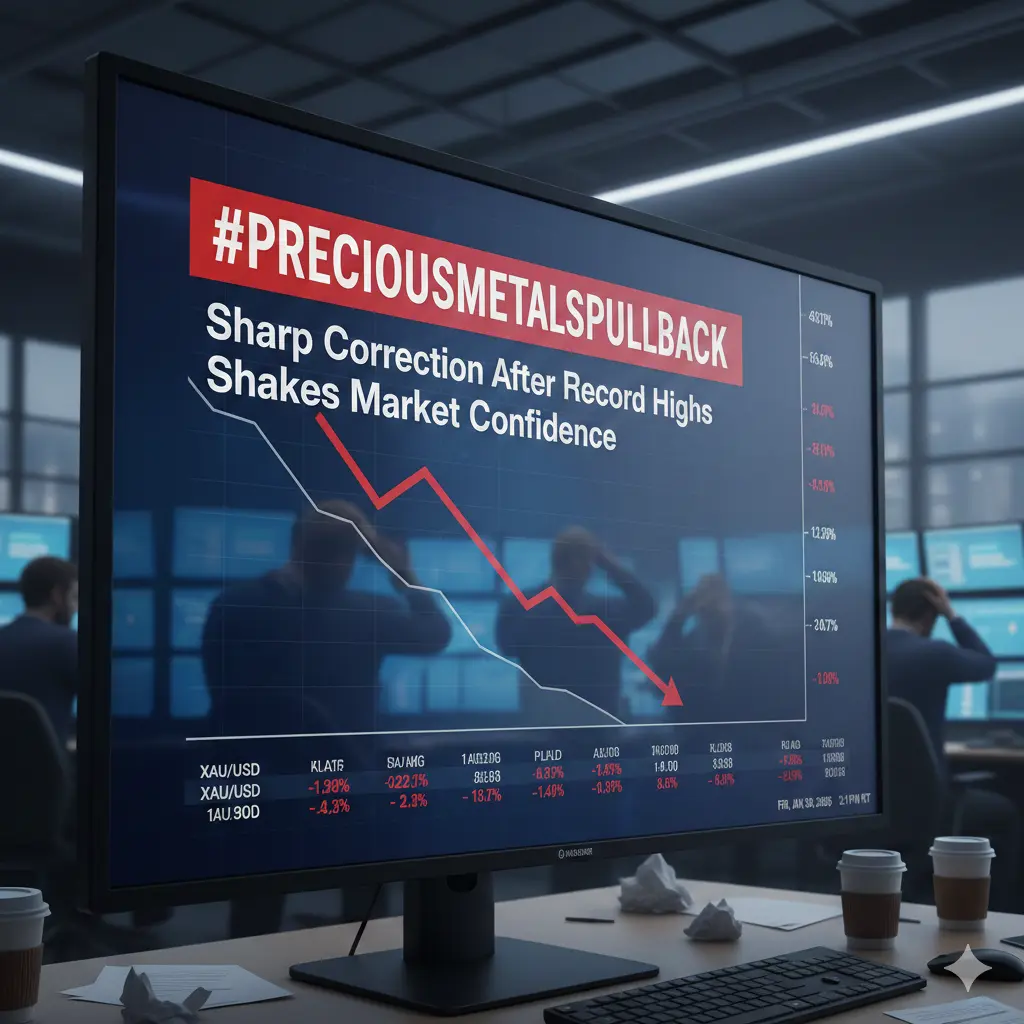

#PreciousMetalsPullBack

Gold and Silver Dip Amid Market Volatility: Strategic Insights and My Perspective

Overnight, the crypto and financial markets experienced heightened volatility, and precious metals were no exception. Gold fell $300 to $5,155/oz, while silver dropped nearly 8% to $108.23/oz. For many investors, such declines can trigger uncertainty or fear, but I view this differently as a strategic opportunity to assess market positioning and accumulate key safe-haven assets at attractive levels. While short-term volatility can be unsettling, it’s important to remember that metals lik

Gold and Silver Dip Amid Market Volatility: Strategic Insights and My Perspective

Overnight, the crypto and financial markets experienced heightened volatility, and precious metals were no exception. Gold fell $300 to $5,155/oz, while silver dropped nearly 8% to $108.23/oz. For many investors, such declines can trigger uncertainty or fear, but I view this differently as a strategic opportunity to assess market positioning and accumulate key safe-haven assets at attractive levels. While short-term volatility can be unsettling, it’s important to remember that metals lik

BTC2,07%

- Reward

- 5

- 10

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

#GateLiveMiningProgramPublicBeta

Gate Live Mining Plan Upgrade Public Test Begins APP V8.6.0 Now Available

Gate Live has officially launched the public test of its upgraded Live Mining Plan with APP V8.6.0, marking a significant enhancement to the host earnings structure and overall platform dynamics.

This upgrade is designed to provide hosts with more transparent, scalable, and rewarding ways to monetize their streaming activity, while simultaneously incentivizing viewer engagement and trading activity.

At its core, the plan introduces a fully upgraded commission and rebate system, with h

Gate Live Mining Plan Upgrade Public Test Begins APP V8.6.0 Now Available

Gate Live has officially launched the public test of its upgraded Live Mining Plan with APP V8.6.0, marking a significant enhancement to the host earnings structure and overall platform dynamics.

This upgrade is designed to provide hosts with more transparent, scalable, and rewarding ways to monetize their streaming activity, while simultaneously incentivizing viewer engagement and trading activity.

At its core, the plan introduces a fully upgraded commission and rebate system, with h

TOKEN0,39%

- Reward

- 5

- 5

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

BTC and ETH Weaken, Total Market Cap Falls Below $3 Trillion: Is This the Dip-Buying Opportunity Traders Have Been Waiting For?

The crypto market experienced a broad pullback overnight, with Bitcoin (BTC) and Ethereum (ETH) both weakening, and the total market capitalization slipping below $3 trillion. After a period of relative optimism, this sudden loss of momentum has brought market sentiment back to cautious territory. Traders and investors are now facing a classic dilemma: should one stay on the sidelines until stability returns, or use this as a strategic opportuni

BTC and ETH Weaken, Total Market Cap Falls Below $3 Trillion: Is This the Dip-Buying Opportunity Traders Have Been Waiting For?

The crypto market experienced a broad pullback overnight, with Bitcoin (BTC) and Ethereum (ETH) both weakening, and the total market capitalization slipping below $3 trillion. After a period of relative optimism, this sudden loss of momentum has brought market sentiment back to cautious territory. Traders and investors are now facing a classic dilemma: should one stay on the sidelines until stability returns, or use this as a strategic opportuni

- Reward

- 5

- 10

- Repost

- Share

Yusfirah :

:

Watching Closely 🔍️View More

Trump Expected to Announce Hawkish Kevin Warsh as Fed Chair: Deep Dive into Macro Implications and Crypto Market Impact

Tonight, the markets are watching closely as Trump is expected to announce the next Federal Reserve Chair, with speculation pointing toward hawkish candidate Kevin Warsh.

This decision carries immense weight across traditional finance, impacting equities, bonds, and the U.S. dollar, but the ripple effects extend to the crypto ecosystem as well. For crypto investors, this is a critical inflection point: how will a hawkish Fed influence BTC, altcoins, stablecoins, and broader

Tonight, the markets are watching closely as Trump is expected to announce the next Federal Reserve Chair, with speculation pointing toward hawkish candidate Kevin Warsh.

This decision carries immense weight across traditional finance, impacting equities, bonds, and the U.S. dollar, but the ripple effects extend to the crypto ecosystem as well. For crypto investors, this is a critical inflection point: how will a hawkish Fed influence BTC, altcoins, stablecoins, and broader

- Reward

- 5

- 6

- Repost

- Share

Yusfirah :

:

HODL Tight 💪View More

#MiddleEastTensionsEscalate

Gold Hits $5,000 as Geopolitical Risk Spikes, Bitcoin Pulls Back: Where Are You Allocating Now?

Rising U.S.–Iran tensions are rattling markets. Gold has surged above $5,000/oz, reflecting a classic flight-to-safety, while Bitcoin and other risk assets are pulling back as traders digest uncertainty. This is one of those rare moments where macro events intersect directly with crypto and traditional markets, creating both risk and opportunity.

Gold as the Safe Haven

Gold’s move above $5,000 is no coincidence. Investors are flocking to safety amid geopolitical uncerta

Gold Hits $5,000 as Geopolitical Risk Spikes, Bitcoin Pulls Back: Where Are You Allocating Now?

Rising U.S.–Iran tensions are rattling markets. Gold has surged above $5,000/oz, reflecting a classic flight-to-safety, while Bitcoin and other risk assets are pulling back as traders digest uncertainty. This is one of those rare moments where macro events intersect directly with crypto and traditional markets, creating both risk and opportunity.

Gold as the Safe Haven

Gold’s move above $5,000 is no coincidence. Investors are flocking to safety amid geopolitical uncerta

BTC2,07%

- Reward

- 8

- 9

- 3

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

Rising Risk of a Partial U.S. Government Shutdown and What It Could Mean for Crypto Markets

After the Senate failed to pass a funding bill on January 29, the risk of a partial U.S. government shutdown has increased, raising questions across financial markets and digital assets. While government shutdowns are not unprecedented, the political gridlock this time highlights the fragility of fiscal policy in a polarized environment. For crypto investors, this event is particularly interesting because it intersects macro uncertainty, liquidity, and market sentiment in ways that could directly influe

After the Senate failed to pass a funding bill on January 29, the risk of a partial U.S. government shutdown has increased, raising questions across financial markets and digital assets. While government shutdowns are not unprecedented, the political gridlock this time highlights the fragility of fiscal policy in a polarized environment. For crypto investors, this event is particularly interesting because it intersects macro uncertainty, liquidity, and market sentiment in ways that could directly influe

- Reward

- 5

- 6

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

CLAWD Surges Amid FOMO, Meme Coin Mania Reignites, and Could This Mirror the Explosive GOAT or ACT Rallies?

The AI tool Clawdbot has officially gone viral, and the market reaction is immediate. Meme coins like CLAWD are seeing sharp price movements as FOMO takes hold, reigniting excitement reminiscent of earlier rallies like GOAT and ACT. But while the hype is strong, it’s important to step back and ask: how much is narrative driving this, and how should we strategically approach it?

Understanding the Viral Effect

Clawdbot’s virality illustrates the immense power of AI-driven narratives in tod

The AI tool Clawdbot has officially gone viral, and the market reaction is immediate. Meme coins like CLAWD are seeing sharp price movements as FOMO takes hold, reigniting excitement reminiscent of earlier rallies like GOAT and ACT. But while the hype is strong, it’s important to step back and ask: how much is narrative driving this, and how should we strategically approach it?

Understanding the Viral Effect

Clawdbot’s virality illustrates the immense power of AI-driven narratives in tod

- Reward

- 5

- 6

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

A New Era for Precious Metals on the Blockchain

Silver is stepping into the digital age. With tokenized silver now on-chain, we’re witnessing a fundamental shift in how investors can access, trade, and integrate this historically undervalued metal into portfolios. This isn’t just about novelty or hype it’s about unlocking liquidity, fractional ownership, and programmable finance for a metal that has long been overshadowed by gold.

From my perspective, tokenized silver creates two simultaneous opportunities:

Catch-Up Potential vs Gold

Historically, silver has lagged gold in both price performa

Silver is stepping into the digital age. With tokenized silver now on-chain, we’re witnessing a fundamental shift in how investors can access, trade, and integrate this historically undervalued metal into portfolios. This isn’t just about novelty or hype it’s about unlocking liquidity, fractional ownership, and programmable finance for a metal that has long been overshadowed by gold.

From my perspective, tokenized silver creates two simultaneous opportunities:

Catch-Up Potential vs Gold

Historically, silver has lagged gold in both price performa

- Reward

- 6

- 5

- 1

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

#GrowthPointsDrawRound16

Celebrate the Year of the Horse with Exciting Prizes!

The 16th edition of the Growth Value New Year Lottery is officially live! This is your chance to start the Year of the Horse with some extraordinary luck and win prizes ranging from the brand-new iPhone 17 to exclusive New Year merchandise, tokens, and other exciting gifts. Whether you’re a long-time participant or joining for the first time, this round promises more opportunities and more rewards than ever before.

How to Participate:

Engage with the community by posting, commenting, and liking content on the plaza

Celebrate the Year of the Horse with Exciting Prizes!

The 16th edition of the Growth Value New Year Lottery is officially live! This is your chance to start the Year of the Horse with some extraordinary luck and win prizes ranging from the brand-new iPhone 17 to exclusive New Year merchandise, tokens, and other exciting gifts. Whether you’re a long-time participant or joining for the first time, this round promises more opportunities and more rewards than ever before.

How to Participate:

Engage with the community by posting, commenting, and liking content on the plaza

- Reward

- 5

- 5

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

Renewed U.S. Legislative Efforts and Their Market Implications

U.S. crypto legislation discussions are back on track, with Democratic lawmakers signaling a return to negotiations. This development is a significant milestone for the industry, as regulatory uncertainty has long been one of the primary obstacles to broader institutional adoption, innovation, and market stability. While the precise details of any forthcoming bill remain unclear, the resumption of talks demonstrates that Congress recognizes the importance of a coherent, forward-looking framework for digital assets rather than relyi

U.S. crypto legislation discussions are back on track, with Democratic lawmakers signaling a return to negotiations. This development is a significant milestone for the industry, as regulatory uncertainty has long been one of the primary obstacles to broader institutional adoption, innovation, and market stability. While the precise details of any forthcoming bill remain unclear, the resumption of talks demonstrates that Congress recognizes the importance of a coherent, forward-looking framework for digital assets rather than relyi

DEFI2,76%

- Reward

- 9

- 8

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

My View on “Higher for Longer” and How I’m Positioning Across Crypto

The Fed keeping rates unchanged, while continuing to signal a “higher for longer” stance, doesn’t feel like a shockbut it does feel like a confirmation. To me, this meeting wasn’t about new information; it was about locking in expectations. Markets have largely priced in the idea that rate cuts won’t come quickly or easily, and the Fed’s tone reinforces that monetary conditions will remain restrictive for longer than many risk assets would prefer. The real impact now comes from how investors respond after the uncertainty is r

The Fed keeping rates unchanged, while continuing to signal a “higher for longer” stance, doesn’t feel like a shockbut it does feel like a confirmation. To me, this meeting wasn’t about new information; it was about locking in expectations. Markets have largely priced in the idea that rate cuts won’t come quickly or easily, and the Fed’s tone reinforces that monetary conditions will remain restrictive for longer than many risk assets would prefer. The real impact now comes from how investors respond after the uncertainty is r

BTC2,07%

- Reward

- 5

- 4

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

My Deeper View on the BTC/Gold Ratio, Market Psychology, and Positioning

The fact that Bitcoin’s gold ratio is now down roughly 55% from its peak and has decisively fallen below the 200-week moving average is not something I see as a minor technical detail. For me, this is one of the most important cross-asset signals in the market right now. It forces an honest reassessment of where Bitcoin sits in the current macro cycle, how investors are treating risk, and what kind of patience this phase may require. While many are quick to frame this as a simple “buy-the-dip” opportunity, I think the rea

The fact that Bitcoin’s gold ratio is now down roughly 55% from its peak and has decisively fallen below the 200-week moving average is not something I see as a minor technical detail. For me, this is one of the most important cross-asset signals in the market right now. It forces an honest reassessment of where Bitcoin sits in the current macro cycle, how investors are treating risk, and what kind of patience this phase may require. While many are quick to frame this as a simple “buy-the-dip” opportunity, I think the rea

BTC2,07%

- Reward

- 4

- 3

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

My Deeper Take on Why This Is a Turning Point for RWAs

The SEC’s confirmation that tokenization does not change the nature of securities regulation may sound simple on the surface, but in my view, it represents a critical inflection point for the real-world asset (RWA) narrative. Many people initially react to this kind of statement with disappointment, interpreting it as regulatory resistance or a lack of innovation-friendly thinking. I see it very differently. To me, this message signals that tokenization is no longer being treated as an experimental edge case it’s being absorbed into the co

The SEC’s confirmation that tokenization does not change the nature of securities regulation may sound simple on the surface, but in my view, it represents a critical inflection point for the real-world asset (RWA) narrative. Many people initially react to this kind of statement with disappointment, interpreting it as regulatory resistance or a lack of innovation-friendly thinking. I see it very differently. To me, this message signals that tokenization is no longer being treated as an experimental edge case it’s being absorbed into the co

RWA2,06%

- Reward

- 4

- 5

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

VanEckLaunchesAVAXSpotETF My Deep-Dive View on Why This Matters (and What It Doesn’t)

From my perspective, VanEck launching the first U.S. spot AVAX ETF is one of those developments that looks modest on the surface but carries serious long-term implications if you zoom out.

This isn’t just another ETF headline riding the coattails of Bitcoin and Ethereum success. T

o me, it signals a quiet but meaningful shift in how institutions are beginning to evaluate Layer-1 blockchains beyond the usual incumbents. Avalanche being chosen here is not accidental it reflects years of consistent infrastruct

From my perspective, VanEck launching the first U.S. spot AVAX ETF is one of those developments that looks modest on the surface but carries serious long-term implications if you zoom out.

This isn’t just another ETF headline riding the coattails of Bitcoin and Ethereum success. T

o me, it signals a quiet but meaningful shift in how institutions are beginning to evaluate Layer-1 blockchains beyond the usual incumbents. Avalanche being chosen here is not accidental it reflects years of consistent infrastruct

- Reward

- 4

- 3

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

#CryptoMarketWatch

CryptoMarketWatch Volatility Rises as Bulls and Bears Clash for Control

Recent market activity across the crypto space has been marked by intensifying volatility, reflecting a growing divergence in conviction between bullish and bearish participants. Price action has become increasingly uneven, with sharp intraday swings, failed breakouts, and sudden reversals signaling that the market is entering a phase where sentiment is far from unified. On one side, bulls continue to argue that broader adoption, long-term fundamentals, and macro tailwinds support higher valuations. On

CryptoMarketWatch Volatility Rises as Bulls and Bears Clash for Control

Recent market activity across the crypto space has been marked by intensifying volatility, reflecting a growing divergence in conviction between bullish and bearish participants. Price action has become increasingly uneven, with sharp intraday swings, failed breakouts, and sudden reversals signaling that the market is entering a phase where sentiment is far from unified. On one side, bulls continue to argue that broader adoption, long-term fundamentals, and macro tailwinds support higher valuations. On

- Reward

- 4

- 3

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

#PreciousMetalsPullBack

PreciousMetalsPullBack Sharp Correction After Record Highs Shakes Market Confidence

Global markets saw a sudden shift in sentiment overnight as risk assets broadly sold off, triggering a sharp correction in precious metals after their recent historic rally.

Gold, which had only days earlier been trading near record highs above the $5,400–$5,500 range, experienced a steep pullback of nearly $300, sliding to around $5,155 per ounce. Silver, known for amplifying both upside and downside moves, reacted even more aggressively, plunging by as much as 8% to approximately $10

PreciousMetalsPullBack Sharp Correction After Record Highs Shakes Market Confidence

Global markets saw a sudden shift in sentiment overnight as risk assets broadly sold off, triggering a sharp correction in precious metals after their recent historic rally.

Gold, which had only days earlier been trading near record highs above the $5,400–$5,500 range, experienced a steep pullback of nearly $300, sliding to around $5,155 per ounce. Silver, known for amplifying both upside and downside moves, reacted even more aggressively, plunging by as much as 8% to approximately $10

- Reward

- 8

- 22

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

#CryptoMarketWatch

Crypto Market Watch: Navigating Volatility, Diverging Sentiment, and Strategic Positioning Amid Growing Uncertainty

The crypto market is experiencing heightened volatility, with recent price swings amplifying the divergence between bullish and bearish sentiment. While some investors see this as an opportunity to accumulate high-quality assets at discounted levels, others are exercising caution, anticipating potential corrections or further turbulence.

From my perspective, the current environment is a pivotal moment for strategic positioning, as macroeconomic indicators, re

Crypto Market Watch: Navigating Volatility, Diverging Sentiment, and Strategic Positioning Amid Growing Uncertainty

The crypto market is experiencing heightened volatility, with recent price swings amplifying the divergence between bullish and bearish sentiment. While some investors see this as an opportunity to accumulate high-quality assets at discounted levels, others are exercising caution, anticipating potential corrections or further turbulence.

From my perspective, the current environment is a pivotal moment for strategic positioning, as macroeconomic indicators, re

- Reward

- 14

- 21

- 1

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

#VanEckLaunchesAVAXSpotETF

VanEck Launches First U.S. Spot AVAX ETF: Institutional Access, Staking Rewards, and What This Means for AVAX’s Long-Term Growth Potential

VanEck has officially introduced the first U.S. spot Avalanche (AVAX) ETF, a landmark development in the institutional adoption of crypto assets. Unlike futures-based ETFs, this product allows investors to hold actual AVAX tokens directly, providing both price exposure and staking rewards through a fully regulated framework. This move bridges the gap between traditional finance and blockchain ecosystems, enabling institutional in

VanEck Launches First U.S. Spot AVAX ETF: Institutional Access, Staking Rewards, and What This Means for AVAX’s Long-Term Growth Potential

VanEck has officially introduced the first U.S. spot Avalanche (AVAX) ETF, a landmark development in the institutional adoption of crypto assets. Unlike futures-based ETFs, this product allows investors to hold actual AVAX tokens directly, providing both price exposure and staking rewards through a fully regulated framework. This move bridges the gap between traditional finance and blockchain ecosystems, enabling institutional in

AVAX-0,18%

- Reward

- 13

- 20

- 1

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

#GameFiSeesaStrongRebound

GameFi Roars Back: AXS Surges 37% in 24 Hours – Is This the Sector’s True Reversal or Just a Short-Term Rotation?

The GameFi sector is showing a remarkable rebound, with Axie Infinity (AXS) skyrocketing nearly 37% in just 24 hours, clearly outperforming the broader crypto market. This sharp bounce has reignited excitement in the space, prompting questions about whether GameFi is entering a sustained recovery phase or experiencing a fleeting rotation driven by speculative inflows and market sentiment. From my perspective, this rally highlights the sector’s explosive p

GameFi Roars Back: AXS Surges 37% in 24 Hours – Is This the Sector’s True Reversal or Just a Short-Term Rotation?

The GameFi sector is showing a remarkable rebound, with Axie Infinity (AXS) skyrocketing nearly 37% in just 24 hours, clearly outperforming the broader crypto market. This sharp bounce has reignited excitement in the space, prompting questions about whether GameFi is entering a sustained recovery phase or experiencing a fleeting rotation driven by speculative inflows and market sentiment. From my perspective, this rally highlights the sector’s explosive p

- Reward

- 10

- 12

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

Trending Topics

View More29.86K Popularity

41.49K Popularity

359.12K Popularity

36.58K Popularity

57.89K Popularity

Pin