# CryptoMarketPullback

371.19K

Overnight losses deepened across the crypto market, with BTC and ETH both weakening. Total crypto market cap fell below $3 trillion. Are you waiting on the sidelines or buying the dip? Share your recent trading ideas.

Blockwise

Why ~$83k–$87k acts as strong resistance for Bitcoin (psychological edition):

Many traders/investors bought BTC around or above this zone (e.g., near recent highs or during earlier pumps). Now they’re sitting on big unrealized losses.

When price rallies back toward $83k/$87k, those holders finally see a chance to break even → they dump to exit at ≈ no loss.

→ Massive sell orders flood in at/near that level → heavy supply pressure caps the upside or causes rejection/dips.

This creates a repeating cycle: buyers push up → sellers unload at breakeven → price gets rejected → dips again.

The level o

Many traders/investors bought BTC around or above this zone (e.g., near recent highs or during earlier pumps). Now they’re sitting on big unrealized losses.

When price rallies back toward $83k/$87k, those holders finally see a chance to break even → they dump to exit at ≈ no loss.

→ Massive sell orders flood in at/near that level → heavy supply pressure caps the upside or causes rejection/dips.

This creates a repeating cycle: buyers push up → sellers unload at breakeven → price gets rejected → dips again.

The level o

- Reward

- like

- Comment

- Repost

- Share

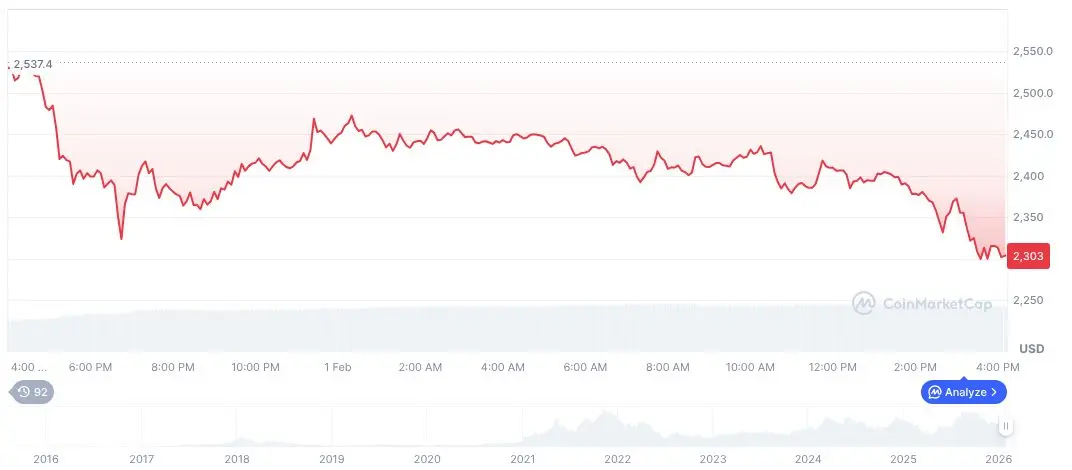

$ETH has hit the final target and is forming a potential double bottom on the 4H.

Now we wait for the daily candle close above support for confirmation.

Bullish divergence printing on the Oscillator.

If confirmation comes, we may get a solid long opportunity from here

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback

Now we wait for the daily candle close above support for confirmation.

Bullish divergence printing on the Oscillator.

If confirmation comes, we may get a solid long opportunity from here

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback

ETH-6,72%

- Reward

- 2

- 3

- Repost

- Share

GateUser-6857559e :

:

thanks for the useful information 😊View More

📊 #ExtremeFear — Crypto Market Sentiment Data

Sentiment Index

Crypto Fear & Greed Index: 14

Sentiment category: Extreme Fear

Typical occurrence: Post-sharp declines / high uncertainty phases

Observed Market Conditions

Elevated price volatility

Increased emotional trading activity

Higher frequency of panic-driven sell-offs

Reduced participation from risk-averse investors

Historical Context (Data-Based)

Extreme Fear levels have historically aligned with:

Periods of heightened market stress

Strong short-term price fluctuations

Potential sentiment exhaustion phases

No consistent confirmation of i

Sentiment Index

Crypto Fear & Greed Index: 14

Sentiment category: Extreme Fear

Typical occurrence: Post-sharp declines / high uncertainty phases

Observed Market Conditions

Elevated price volatility

Increased emotional trading activity

Higher frequency of panic-driven sell-offs

Reduced participation from risk-averse investors

Historical Context (Data-Based)

Extreme Fear levels have historically aligned with:

Periods of heightened market stress

Strong short-term price fluctuations

Potential sentiment exhaustion phases

No consistent confirmation of i

- Reward

- 17

- 16

- Repost

- Share

Shadow_Hunter :

:

2026 GOGOGO 👊View More

$CLANKER

General indicators

• Value: ~$37.06 (+2.7% in 24 hours)

• Market Cap: ~$36.6 million → medium market cap

• Volume: $17.0 million (+~60%) → active trading

• Liquidity: $2.98 million → quite solid from UAI

• Holders: 11,295 (+1.34%) → expanding base

• Risk Score: 73/100 → medium risk

• Sniper: 15/100 → early entrants present, but not excessive

📊 Technical (1D)

• After a sharp decline, the chart shows compression/consolidation.

• Recent candles show no continuation of panic, indicating stabilization.

• Volume increase → active trading within th

General indicators

• Value: ~$37.06 (+2.7% in 24 hours)

• Market Cap: ~$36.6 million → medium market cap

• Volume: $17.0 million (+~60%) → active trading

• Liquidity: $2.98 million → quite solid from UAI

• Holders: 11,295 (+1.34%) → expanding base

• Risk Score: 73/100 → medium risk

• Sniper: 15/100 → early entrants present, but not excessive

📊 Technical (1D)

• After a sharp decline, the chart shows compression/consolidation.

• Recent candles show no continuation of panic, indicating stabilization.

• Volume increase → active trading within th

CLANKER-28,03%

- Reward

- like

- 1

- Repost

- Share

Safa777 :

:

Total Supply: 1,000,000😃Ethereum Holdings Decline as Supply Lockup Increases

Key Points:

45% of Ethereum is now locked, impacting trade ease.

Over 6.1 million ETH held by publicly listed companies.

Exchange-traded funds account for about 10% of Ethereum supply.

Sygnum's Q1 2026 investment outlook highlights ETH supply dynamics with 45% locked and a 14.5% decrease in exchange-held $ETH , potentially affecting market volatility if demand increases.

Reduced ETH supply against potential demand rises could trigger price fluctuations, impacting investor strategies and market behavior in the cryptocurrency sector.

Key Devel

Key Points:

45% of Ethereum is now locked, impacting trade ease.

Over 6.1 million ETH held by publicly listed companies.

Exchange-traded funds account for about 10% of Ethereum supply.

Sygnum's Q1 2026 investment outlook highlights ETH supply dynamics with 45% locked and a 14.5% decrease in exchange-held $ETH , potentially affecting market volatility if demand increases.

Reduced ETH supply against potential demand rises could trigger price fluctuations, impacting investor strategies and market behavior in the cryptocurrency sector.

Key Devel

ETH-6,72%

- Reward

- 1

- Comment

- Repost

- Share

#CryptoMarketPullback

🔍 What This Pullback Really Is (And Isn’t)

The current crypto market pullback is not a trend failure — it’s a structural reset.

After an extended upside phase, markets naturally enter periods where:

Liquidity is rebalanced

Risk is repriced

Weak hands are flushed

This pullback reflects normal market digestion, not panic.

📉 Liquidity & Positioning Dynamics

During strong rallies, leverage builds quietly.

When momentum slows, markets don’t crash immediately — they pull back just enough to:

Liquidate overexposed long positions

Test genuine demand zones

Absorb sell pressure

🔍 What This Pullback Really Is (And Isn’t)

The current crypto market pullback is not a trend failure — it’s a structural reset.

After an extended upside phase, markets naturally enter periods where:

Liquidity is rebalanced

Risk is repriced

Weak hands are flushed

This pullback reflects normal market digestion, not panic.

📉 Liquidity & Positioning Dynamics

During strong rallies, leverage builds quietly.

When momentum slows, markets don’t crash immediately — they pull back just enough to:

Liquidate overexposed long positions

Test genuine demand zones

Absorb sell pressure

BTC-2,26%

- Reward

- 6

- 7

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

The crypto market has taken a sharp pullback overnight, with Bitcoin and Ethereum both weakening and total market capitalization dipping below $3 trillion. This decline reflects a mix of profit-taking, liquidity constraints, and macro-driven risk-off sentiment, rather than structural weakness in the market. Pullbacks like these often test key support levels and separate long-term holders from short-term speculators, creating both risk and opportunity for those who approach the market strategically.

Key Observations:

Bitcoin: BTC is testing critical support around $

The crypto market has taken a sharp pullback overnight, with Bitcoin and Ethereum both weakening and total market capitalization dipping below $3 trillion. This decline reflects a mix of profit-taking, liquidity constraints, and macro-driven risk-off sentiment, rather than structural weakness in the market. Pullbacks like these often test key support levels and separate long-term holders from short-term speculators, creating both risk and opportunity for those who approach the market strategically.

Key Observations:

Bitcoin: BTC is testing critical support around $

- Reward

- 7

- 12

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

$BTC #CryptoMarketPullback 🚨

The market just delivered a sharp reality check.

Bitcoin has officially broken the key $84,600 support and is now trading in the $77K–$78K range. That level was holding structure — and losing it triggered aggressive selling pressure.

BTC: ~$77,800 (-7%)

ETH: ~$2,370 (-13%)

Billions in liquidations flushed in 24 hours.

This isn’t random.

Macro tension, tech stock weakness, and renewed Fed uncertainty are pushing capital into “risk-off” mode. When liquidity tightens, crypto feels it first.

Now the real question:

Is this a market reset…

or a high-probability accu

The market just delivered a sharp reality check.

Bitcoin has officially broken the key $84,600 support and is now trading in the $77K–$78K range. That level was holding structure — and losing it triggered aggressive selling pressure.

BTC: ~$77,800 (-7%)

ETH: ~$2,370 (-13%)

Billions in liquidations flushed in 24 hours.

This isn’t random.

Macro tension, tech stock weakness, and renewed Fed uncertainty are pushing capital into “risk-off” mode. When liquidity tightens, crypto feels it first.

Now the real question:

Is this a market reset…

or a high-probability accu

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

#CryptoMarketPullback — A Healthy Reset, Not the End of the Cycle

The crypto market is once again facing a pullback, and as prices flash red across the charts, fear begins to dominate conversations. However, experienced market participants understand that a crypto market pullback is not a sign of failure it’s a sign of structure. In fact, pullbacks are a natural and necessary part of every sustainable market cycle.

A pullback occurs when prices temporarily decline after a strong upward move. In crypto, this can be triggered by multiple factors: profit-taking by short-term traders, shifts in gl

The crypto market is once again facing a pullback, and as prices flash red across the charts, fear begins to dominate conversations. However, experienced market participants understand that a crypto market pullback is not a sign of failure it’s a sign of structure. In fact, pullbacks are a natural and necessary part of every sustainable market cycle.

A pullback occurs when prices temporarily decline after a strong upward move. In crypto, this can be triggered by multiple factors: profit-taking by short-term traders, shifts in gl

- Reward

- 2

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

#MyWeekendTradingPlan

$ETH Weekly Update

Ethereum is trading around $2,600 after a clean rejection from the 1W 50 EMA. As mentioned earlier, this level was expected to act as strong resistance, and price reacted exactly as anticipated. I added more short exposure on the rejection, as this was not a reclaim attempt but a confirmed failure.

On the weekly timeframe, there is no structure supporting a sustained recovery. The market continues to print lower highs and lower closes, keeping the higher timeframe trend firmly bearish. More importantly, price is now pressuring the 1W 99 EMA (red line).

$ETH Weekly Update

Ethereum is trading around $2,600 after a clean rejection from the 1W 50 EMA. As mentioned earlier, this level was expected to act as strong resistance, and price reacted exactly as anticipated. I added more short exposure on the rejection, as this was not a reclaim attempt but a confirmed failure.

On the weekly timeframe, there is no structure supporting a sustained recovery. The market continues to print lower highs and lower closes, keeping the higher timeframe trend firmly bearish. More importantly, price is now pressuring the 1W 99 EMA (red line).

ETH-6,72%

- Reward

- 12

- 17

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

39.57K Popularity

73.73K Popularity

371.19K Popularity

50.95K Popularity

69.6K Popularity

23.2K Popularity

27.92K Popularity

22.45K Popularity

94.34K Popularity

40.7K Popularity

35.56K Popularity

29.23K Popularity

19.26K Popularity

25.51K Popularity

216.95K Popularity

News

View MoreGold, silver, oil, and stocks all declined on Monday, as market sentiment shifted to caution

11 m

In the past hour, the entire network has been liquidated by $114 million, with ETH liquidations reaching $43.28 million.

13 m

"Maqi" has closed all long positions, and the on-chain contract account now holds only $1,278.

18 m

ETH Breaks Through 2300 USDT

19 m

BTC breaks through 77,000 USDT

22 m

Pin