The trader is buying 3 low market cap Perp DEX tokens at the beginning of October.

The market has recorded a series of impressive milestones in the Perp DEX field ( decentralized exchange specializing in perpetual futures ) in October. Many altcoins from Perp DEX platforms, such as Hyperliquid (HYPE), Aster (ASTER), and Avantis (AVNT), have achieved significant growth. If this trend continues, capital is likely to continue shifting into smaller market cap altcoins.

On-chain data shows that some low-cap altcoin Perp DEXs are experiencing strong accumulation, as evidenced by the wallet balances of whales and reserves on exchanges.

Perp DEX boosts interest in low-cap Altcoins

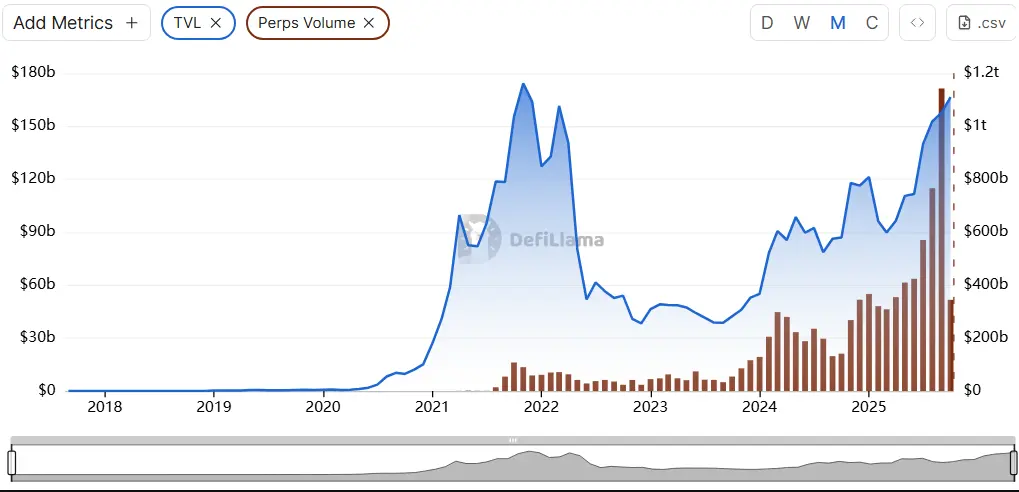

According to data from DefiLlama, the trading volume of Perps has surpassed 1.1 trillion USD in September, marking the highest level in DeFi history. The volume increased by more than 340 billion USD in just the first three days of October, indicating the potential to set a new record this month.

TVL DeFi and Total trading volume | Source: DefiLlama. A large wave of investors has flocked to trade derivatives on DEX, attracted by airdrop programs and incentives from industry leaders. If this trend continues, many low market cap altcoins may witness a strong price increase. These tokens have a market cap of under 50 million USD and have begun to show early signs of accumulation.

TVL DeFi and Total trading volume | Source: DefiLlama. A large wave of investors has flocked to trade derivatives on DEX, attracted by airdrop programs and incentives from industry leaders. If this trend continues, many low market cap altcoins may witness a strong price increase. These tokens have a market cap of under 50 million USD and have begun to show early signs of accumulation.

Adrena (ADX)

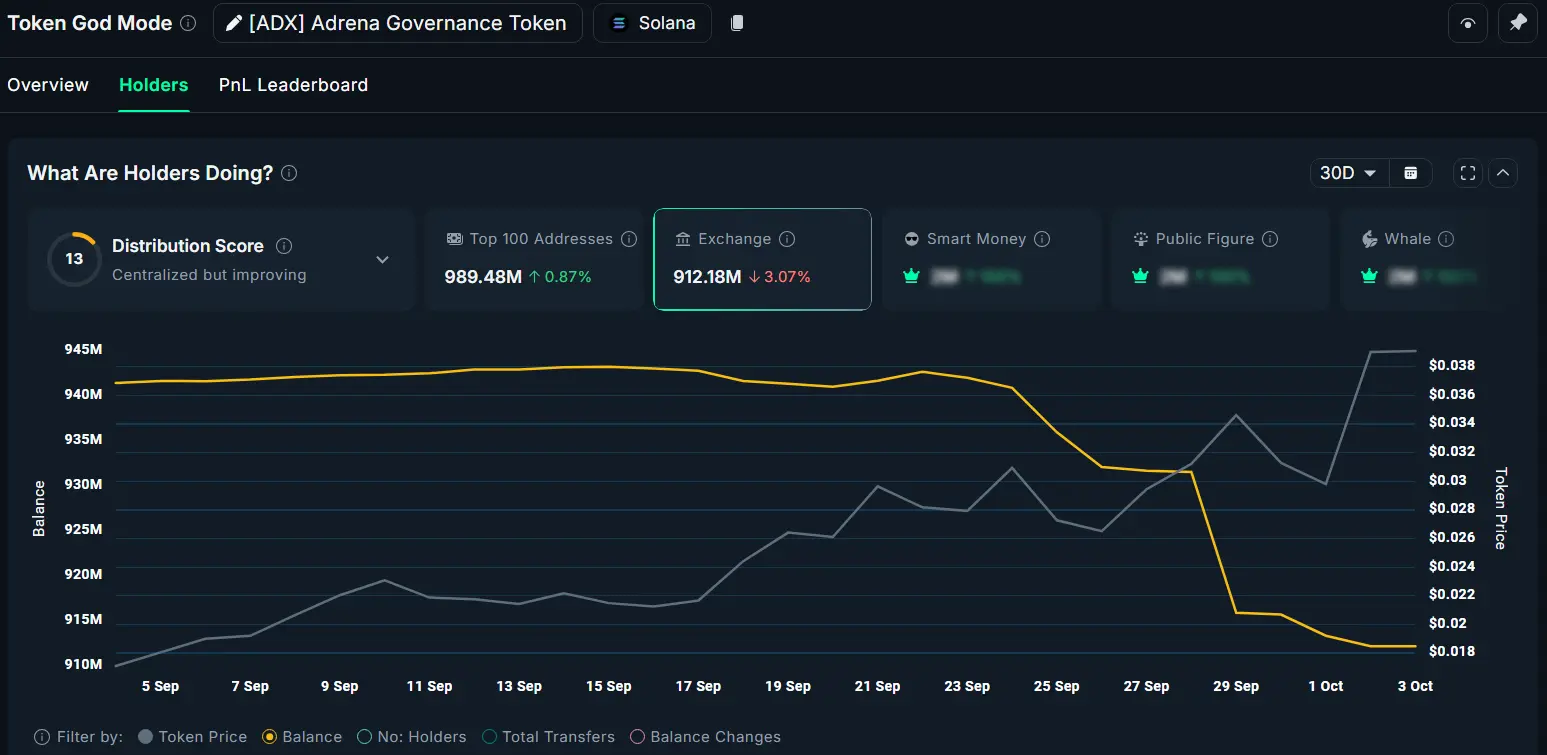

Adrena is a decentralized, open-source exchange built on the Solana platform. Currently, ADX has a market capitalization of under 40 million USD. Data from Nansen shows that reserves on the exchange have decreased by more than 3% in the last week of September, while the price of ADX rose from 0.028 USD to 0.038 USD. At the same time, the balances of the top whale wallets have increased by 0.87%.

Source: NansenAlthough these changes are somewhat modest, several factors may support further growth potential for ADX. First, data from DefiLlama shows that the trading volume of Perps on the exchange has recovered to over 600 million USD last month, reaching its highest level since June. Second, as of October 3rd, Adrena ranks second in daily trading fees among the derivative DEXs on Solana, only behind Jupiter. Third, the project has appeared in Coingecko's trending list, indicating that Adrena is attracting attention from new traders.

Source: NansenAlthough these changes are somewhat modest, several factors may support further growth potential for ADX. First, data from DefiLlama shows that the trading volume of Perps on the exchange has recovered to over 600 million USD last month, reaching its highest level since June. Second, as of October 3rd, Adrena ranks second in daily trading fees among the derivative DEXs on Solana, only behind Jupiter. Third, the project has appeared in Coingecko's trending list, indicating that Adrena is attracting attention from new traders.

Perpetual Protocol (PERP)

Perpetual Protocol is a decentralized futures exchange built on Ethereum. PERP has been listed on Binance since 2020, but its price has dropped nearly 99%, leaving its market capitalization at around 22 million USD. The resurgence of interest from investors in the stories about Perp DEX has brought attention back to this token.

Source: NansenData from Nansen shows that reserves on the exchange of PERP have decreased by more than 15.6% in the past month, while balances in top wallets have increased by 7.8%. Some technical analysts have pointed out the price structure of PERP for 2025, indicating that this token is no longer making lower lows and is forming a bullish pattern, forecasting a potential growth of over 130% by the end of the year. The combination of accumulation signals on-chain and technical structure may support a bullish scenario for PERP.

Source: NansenData from Nansen shows that reserves on the exchange of PERP have decreased by more than 15.6% in the past month, while balances in top wallets have increased by 7.8%. Some technical analysts have pointed out the price structure of PERP for 2025, indicating that this token is no longer making lower lows and is forming a bullish pattern, forecasting a potential growth of over 130% by the end of the year. The combination of accumulation signals on-chain and technical structure may support a bullish scenario for PERP.

Bluefin (BLUE)

Bluefin is currently the leading derivatives platform on Sui. A recent report from BeInCrypto has indicated positive signs that the project could attract further interest from investors in October. The market capitalization of BLUE is currently around 39 million USD. Data from DefiLlama shows that this DEX generates over 13.6 million USD in annual revenue. Bluefin has committed to using 25% of that revenue, approximately 3.4 million USD, to implement the BLUE buyback program.

The estimated buyback amount is equivalent to nearly 10% of the market capitalization, which could act as a strong price catalyst and encourage more investors to accumulate BLUE. Notably, the buyback program began in October, and many analysts expect the price of BLUE to exceed $0.20 this month.

Low market cap altcoins can provide significant profit opportunities but also carry two main risks. The first is liquidity risk. These tokens often have low trading volumes and poor market depth, making them prone to large fluctuations. The second is psychological risk. If the Perp DEX trend weakens, projects lacking real utility may fail to retain users, leading to a decline in token prices.

Mr. Teacher