Bitcoin "severely undervalued" but unable to rebound! Analyst: "Consolidation stalemate" is expected to continue

2m ago

It's already 2026. Who is still playing with NFTs?

6m ago

Trending Topics

View More4.62K Popularity

26.78K Popularity

4.24K Popularity

4.23K Popularity

30.98K Popularity

Hot Gate Fun

View More- MC:$3.52KHolders:10.00%

- MC:$3.57KHolders:20.04%

- MC:$3.52KHolders:10.00%

- MC:$3.62KHolders:20.04%

- MC:$3.53KHolders:20.00%

Pin

Arthur Hayes' latest article: Trump's "colonization" of Venezuela, how will Bitcoin prices move?

Original: Arthur Hayes

Translation: Yuliya, PANews

You can imagine a video call between US President Trump and Venezuelan President Pepe Maduro, at the time Maduro was flying from Caracas to New York.

Trump: “Pepe Maduro, you’re a bad guy. Your country’s oil is now mine. Long live America!”

Pepe Maduro: “Trump, you crazy!”

*Note: Arthur Hayes refers to the Venezuelan president as “Pepe Maduro” instead of his real name Nicolás Maduro. “Pepe” is a common nickname for “José” in Spanish. Although Maduro’s real name is Nicolás.

Regarding the historic, subversive, autocratic, and militarized event of the US “kidnapping” or “legally arresting” a sovereign national leader, people can attach various positive or negative labels. Countless AI-assisted writers will surely produce lengthy articles interpreting these events and predicting the future. They will judge these actions morally and suggest how other countries should respond. But this article is not about that. The core question is: Does the US “colonize” Venezuela, and is Bitcoin and cryptocurrencies ultimately bullish or bearish?

The only rule of politics: Re-election

To answer this question, we must understand a simple and brutal political reality: All elected politicians focus only on one thing at any time — winning re-election. As for grand narratives like God or the nation, they must come after winning votes. Because without power, you can’t bring change, so to some extent, this obsession with re-election is rational.

For Trump, two elections are crucial: the 2026 midterms and the 2028 presidential election. Although he doesn’t need to run in 2026 and cannot run for a third term in 2028, the loyalty and obedience of his political supporters depend on their respective re-election prospects. Those who diverge from the “Make America Great Again” (MAGA) camp do so because they believe that continuing to follow Trump’s directives will make their future election prospects bleak.

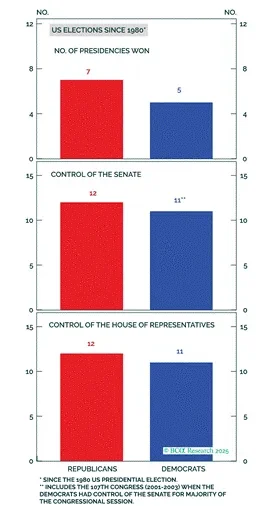

So, how does Trump ensure that undecided middle voters, whether they support the Democrats (blue camp) or Republicans (red camp), cast the “correct” vote in November 2026 and 2028?

Currently, it looks likely that the Democrats will retake the House of Representatives. If Trump wants to be a winner, he must act immediately. There is little time left for policy adjustments to change voter sentiment.

What do voters care about? The economy, especially oil prices

So, how to please middle voters? All flashy cultural wars are insignificant compared to voters’ wallets. The only thing voters care about is the economy — whether they feel wealthy or poor when voting.

For Trump, the simplest way to stimulate the economy is to turn on the printing press and boost nominal GDP. This can raise the prices of financial assets, rewarding the wealthy class that can use campaign donations to “pay back” him. However, in the US, it’s one person, one vote. If printing money causes severe inflation and the general public’s living costs soar, they will vote the ruling party out.

Trump and US Treasury Secretary Berset have stated they will keep the economy hot. The question is, how will they control inflation? The kind of inflation that would ruin re-election chances is in food and energy sectors.

For ordinary Americans, the most sensitive inflation indicator is gasoline prices. Because the US public transportation system is underdeveloped, almost everyone drives, and oil prices directly affect everyone’s living costs.

Therefore, Trump and his deputies “colonized” Venezuela for its oil.

When talking about Venezuela’s oil, many quickly point out that the country has the world’s largest proven reserves. But how much oil is underground is not important; the question is whether it can be profitably extracted. Trump clearly believes that developing Venezuela’s oil resources can supply oil to Gulf Coast refineries, and cheap gasoline will soothe the public by suppressing energy inflation.

Whether this strategy is correct will be answered by the markets for West Texas Intermediate (WTI) and Brent crude oil. As nominal GDP and dollar credit supply increase, will oil prices rise or fall? If GDP and oil prices rise together, the Democrats will win; if GDP rises but oil prices stay flat or fall, the Republicans will win.

The best part of this framework is that oil prices will reflect the reactions of other oil-producing and military powers (most importantly Saudi Arabia, Russia, and China) to the US “colonization” of Venezuela. Another advantage is market reflexivity. We know Trump will adjust policies based on stock prices, US Treasuries, and oil prices. As long as stocks keep rising and oil remains low, he will continue printing money and pursuing “colonial” policies to secure oil. As investors, we can react within the same timeframe as Trump, which is the best we can hope for. This reduces the need to predict complex geopolitical outcomes. Traders only need to read charts and adapt accordingly.

Below are some chart data and statistical analyses that clearly show why Trump must boost nominal GDP while suppressing oil prices to win the election:

These charts clearly indicate that, Trump must keep the economy hot without causing gasoline prices to rise.

Two scenarios for Bitcoin movement

We face two scenarios: one where nominal GDP/credit and oil prices both rise; and another where nominal GDP/credit rises but oil prices fall. How will Bitcoin react?

To understand this, we must first clarify a core point: the importance of oil prices is not because they affect mining costs, but because they have the power to force politicians to stop printing money.

Bitcoin, through proof-of-work (PoW) mining, consumes energy, making it a purely monetary abstraction. Therefore, energy prices themselves are unrelated to Bitcoin prices, as all miners’ costs change in sync, which does not alter Bitcoin’s intrinsic value logic.

The real power of oil prices lies in their ability to trigger political and financial disasters — acting as a “trigger” for chaos.

Chain reactions of runaway oil prices

If economic expansion causes oil prices to rise too fast or too high, it will trigger a series of destructive chain reactions:

Uncontrolled oil prices mean soaring living costs for the public, directly igniting voter anger and risking the ousting of the ruling party. To stay in power, they must do everything possible to lower oil prices (e.g., stealing oil from other countries or slowing credit creation). The 10-year US Treasury yield and the MOVE index, which measures US bond market volatility, will tell us when oil prices are too high.

Investors face a tough choice: invest in financial assets or real assets. When energy costs are low and stable, investing in government bonds and other financial assets makes sense. But when energy costs are high and volatile, investing in energy commodities is wiser. Therefore, when oil prices reach a certain level, investors will demand higher yields on government bonds (especially 10-year US Treasuries).

When the 10-year yield approaches 5%, market volatility may spike significantly, and the MOVE index could soar. Currently, US politics struggles to curb deficit spending, and “free benefits” often dominate elections. However, as oil prices rise and yields approach critical levels, markets may face pressure. Due to the large amount of leverage embedded in the current fiat financial system, when volatility rises, investors must sell assets or face total loss.

For example, the “Liberation Day” on April 2 last year and Trump’s “TACO” (tariff action) on April 9 are examples. Trump threatened to impose very high tariffs, which would reduce global trade and financial flows, creating a strong deflationary effect. The market plummeted, and the MOVE index briefly soared to 172. The next day, Trump “paused” the tariffs, and the market bottomed out and rebounded sharply.

MOVE index (white) vs. Nasdaq 100 (yellow)

In such issues, trying to precisely determine at what oil price and 10-year yield level Trump would tighten monetary policy based on historical data is pointless. We will naturally know when it happens. If oil and yields spike sharply, it’s time to reduce risk asset exposure.

The current baseline scenario is: oil prices remain stable or decline, while Trump and Berset will print money wildly like in 2020. The reason is that initially, the market will believe that US control of Venezuela’s oil will significantly increase daily crude output. Whether engineers can actually achieve millions of barrels per day in Venezuela is not important.

What truly matters is: Trump’s rate of money printing will be faster than Netanyahu’s constant changing of reasons to strike Iran. If these logics are still not enough to convince people to go long on all risk assets, just remember one thing: Trump is the most socialist US president since Roosevelt. In 2020, he printed trillions of dollars, and unlike previous presidents, he directly handed money to everyone. It’s safe to say he will never lose an election due to insufficient money printing.

Based on statements from Trump and his core team, we know credit will expand. Red camp Republican lawmakers will run deficits, Berset’s Treasury will issue debt to finance it, and the Federal Reserve (whether Powell or his successor) will print money to buy these bonds. As Lyn Alden said, “Nothing can stop this train.” As the dollar supply expands, Bitcoin and certain cryptocurrencies will soar.

Trading Strategy

Arthur Hayes’s biggest loss last year came from trading tokens after PUMP launched. Also, remember to stay away from meme coins; last year, his only profitable meme coin trade was TRUMP. On the bright side, most profits came from trading HYPE, BTC, PENDLE, and ETHFI. Although only 33% of trades were profitable, with proper position sizing, the average profit of winning trades was 8.5 times the average loss of losing trades.

Arthur Hayes’s plan for this year is: focus on his strengths, namely macro liquidity arguments combined with a credible “competitive coin” narrative, to deploy large medium-term positions. When trading “garbage coins” or meme coins for entertainment, he will reduce position sizes.

Looking ahead, this year’s dominant narrative will revolve around “privacy.” ZEC will become a bellwether in the privacy space. Maelstrom has already accumulated a large long position in this token in Q3 2025, planning to find at least one “competitive coin” in the privacy sector that can lead the trend and generate excess returns for the portfolio over the next few years. To achieve returns surpassing BTC and ETH, he plans to sell some Bitcoin and Ethereum to acquire privacy and “DeFi” projects with more influence.

Once oil prices rise and lead to credit expansion slowing, he will take profits opportunistically, accumulate more Bitcoin, and buy some mETH.