Search results for "BAL"

Balancer announces an $8 million compensation plan: the bail-in after the $110 million vulnerability incident.

After suffering a massive vulnerability attack of $110 million, Balancer DAO has officially launched an $8 million asset refund plan, covering multi-chain assets such as Ethereum, Polygon, Base, and Arbitrum. This incident caused the total value locked (TVL) in the protocol to plummet from $775 million to $258 million, and the price of BAL Token dropped by about 30%. This is the third major security incident in Balancer's history and ranks among the top five security incidents in the DeFi sector in terms of loss scale for 2024, exposing the ongoing vulnerability of smart contracts in centralized exchanges.

MarketWhisper·2025-11-28 04:02

Weekly Preview | The UK Supreme Court holds a hearing on the disposal of 60,000 Bitcoins in the case of Qian Zhimin; Ethereum Devconnect opens.

News Forecast:

Coinbase launches an end-to-end token sale platform and will hold its first public sale of Monad tokens from November 17 to 22;

The UK High Court will hold another hearing on November 17 regarding the disposal of 60,000 bitcoins in the case of Qian Zhiming.

Ethereum Devconnect will be held on November 17 in Buenos Aires, Argentina;

The American Accounting Committee will discuss on November 19 whether to add an accounting treatment item for "cryptocurrency transfers";

OKX will delist the spot trading pairs BAL, PERP, FLM, DEP, NC, and LOOKS from November 19 to 22.

The Federal Reserve will release the minutes of its monetary policy meeting at 3:00 AM Beijing time on November 20.

November 17

Policy Regulation:

The UK High Court will hold another hearing on November 17 regarding the disposal of 60,000 bitcoins in the case of Qian Zhimin.

PANews·2025-11-16 12:30

Venus: Measures have been taken to prevent the Balancer attack incident until system stability is confirmed.

According to Mars Finance, Venus Protocol posted on the X platform stating: "Reports indicate that Balancer has encountered a hacker attack. As a precaution, Venus Protocol has set the loan-to-value (LTV) ratio for the BAL market on Ethereum to 0, suspending all new lending with BAL as collateral until system stability is confirmed. The liquidation threshold remains at 59%, so existing positions are unaffected. Users still need to closely monitor their positions and health factors, and consider repaying loans or adding collateral to ensure safety."

MarsBitNews·2025-11-03 12:03

Aura Finance: Why Driving LST Liquidity Growth on Optimism

Author: Beethoven X; Compiler: Deep Tide TechFlow

What is Aura?

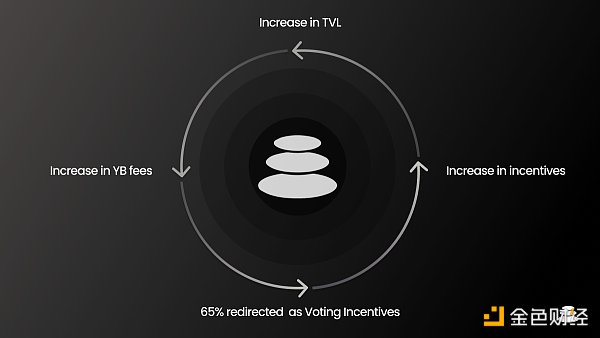

Aura Finance is a liquidity layer connected and built on top of the Balancer protocol. Much like Convex did for Curve, Aura Finance acquires Balancer's native governance token, veBAL, and plays a key role in providing an additional layer for network participants to build and incentivize liquidity.

Liquidity providers can stake Balancer Pool Tokens (BPT) to get incentives for AURA and BAL; AURA holders can stake and participate in the veBAL voting market, and the protocol can provide voting incentives to effectively incentivize BAL (and AURA) issuance pool. ...

金色财经_·2023-07-13 01:19

Load More