Search results for "BUSD"

The migration path of Binance's stablecoin landscape

Author: danny; Source: X, @agintender

In the world of cryptocurrency, what truly determines victory or defeat is never the code, but the game of liquidity, power, and regulation. The rise and fall of BUSD is not a tragic tale of a stablecoin, but a financial war about how exchanges attempt to "unify the world."

When BUSD was pushed onto the historical stage, it carried not only a narrative of compliance, but also Binance's ambition to reshape the stablecoin order through high-pressure tactics — by enforcing exchange rates and merging trading pairs, directly swallowing the depth of its competitors into its own ledger.

The "automatic conversion" of 2022 was a textbook-level blitzkrieg; while the regulatory iron fist of Valentine's Day 2023 caused this seemingly impeccable empire to collapse in an instant. The dual nature of BUSD, the shadow-like Binance-Peg, and the misalignment of regulatory boundaries together constitute its downfall.

金色财经_·2025-12-22 02:38

Binance Hegemony Rise and Fall: From BUSD's "Unified" Approach to $U's "Conquest" in the Stablecoin War

In the crypto world, what truly determines victory or defeat is never the code, but the game of liquidity, power, and regulation. The rise and fall of BUSD is not just a tragic story of a stablecoin, but a financial war over how exchanges attempt to "unify the world."

When BUSD was brought onto the stage of history, it carried not only a compliance narrative but also Binance's ambition to reshape the stablecoin order through heavy-handed tactics—by enforcing exchange rates and merging trading pairs, directly swallowing competitors' depth into its own ledger.

The 2022 "automatic conversion" was a textbook-level blitzkrieg; meanwhile, the regulatory iron fist on Valentine's Day 2023 caused this seemingly invincible empire to collapse in an instant. The twin BUSD, the shadow-like Binance-Peg, and the misalignment of regulatory boundaries together form its Achilles' heel.

But the story is not over yet.

From FDUSD

PANews·2025-12-19 12:08

Dogecoin Price Prediction: Binance Adds Zero-Trading Pairs for Trump Family Stablecoin, DeepSnitc...

Binance included additional trading pairs for the WLFI’s USD1 stablecoin. In addition to introducing fee-free trading pairs for tokens such as SOL, BNB, BTC, and ETH, the exchange also plans to convert collateral assets backing the BUSD stablecoin into USD1

As traders search for affordable tokens,

CaptainAltcoin·2025-12-13 06:26

U.S. prosecutors recover nearly $1.7 million in cryptocurrency investment scam funds through “civil asset forfeiture proceedings”

The U.S. Department of Justice successfully recovered nearly $1.7 million in cryptocurrency in Virginia, primarily from investment scams and money laundering activities. The recovered USDT and BUSD will be returned to the victims. The scammers lured victims to invest on fake websites through text messages and social media.

MarsBitNews·2025-12-06 00:30

Tether Freezes $5M, Exposing Stablecoin Centralization Risks

Tether froze $5M in three wallets, highlighting centralization risks in stablecoins like USDT, USDC, and BUSD.

T3 FCU has frozen over $300M in criminal crypto assets, supporting 23 jurisdictions and strengthening global law enforcement.

S&P downgraded USDT to “weak” despite Tether

CryptoFrontNews·2025-11-28 17:31

3.23 AI Daily Report: IMF Incorporates Bitcoin into Global Statistics, Digital Asset Industry Welcomes New Opportunities and Challenges

AI today discovered 1. The IMF includes Bitcoin and other digital assets in the global economic statistical framework 2. Bitcoin ETF attracted $785 million in inflows this week 3. On-chain analyst: AUCTION whales have all transferred 4. Shiba Inu burn rate has significantly increased, with a 24-hour burn surge of 771,019% 5. CZ: BUSD being "strangled" is part of the government's liquidation of the encryption industry

GateUser-26c36996·2025-03-23 10:05

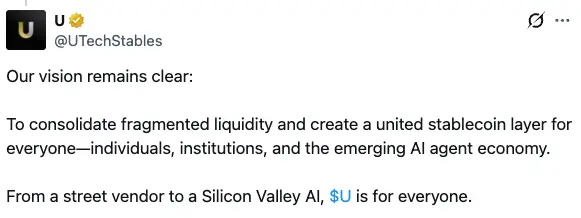

Bitcoin and Ethereum Lead Crypto Surge As $114 Billion Fuels Market Growth

Bitcoin increases above $40K signaling renewed confidence, with over $25B capital inflows improving the crypto market.

Stablecoins drive liquidity growth as USDT, USDC, and BUSD demand rises, with net positive inflows fueling activity.

Ethereum and Bitcoin gains align, showing coordinated

CryptoNewsLand·2024-12-06 16:54

The US government transferred 33.6 million US dollars in Cryptocurrency! FTX, Alameda detained funds flowing to a mysterious Address

The US government has transferred cryptocurrency worth $33.6 million seized from the closed Cryptocurrencyexchange FTX and its affiliated companies to two mysterious Addresses. These assets include Ether, stablecoin BUSD, Shiba Inu Token, and various other Tokens. Meanwhile, the cryptocurrency market is experiencing a comprehensive Rebound, with Ether's price rising by nearly 50% in the past month.

Blockee·2024-12-04 04:35

Paxos marries Solana ecosystem, USDP is ready for spring?

> Perhaps this is the beginning of the Nth stablecoin war.

Written by: Loopy, Odaily Planet Daily

Recently, a regulatory development of Paxos attracted our attention. Paxos received approval from the New York Department of Financial Services (NYDFS) to expand its stablecoin issuance operations to the Solana blockchain. It needs to be emphasized that even large-scale projects such as BUSD were still only allowed to be issued on the Ethereum network by regulatory authorities.

The move marks the first time Paxos has expanded its operations beyond Ethereum into the crypto world.

Paxos was once known for its BUSD business. In February 2023, BUSD suddenly came under NYDFS supervision. After BUSD was suspended by regulators, Paxos

ForesightNews·2023-12-26 00:33

Paxos marries Solana ecology, USDP spring?

Original | Odaily Planet Daily

Author | Loopy

! [Paxos marries Solana ecology, USDP spring?] (https://piccdn.0daily.com/202312/25134059/cmvxqdc8lxau4qrn.jpg!webp)

Recently, a regulatory development on Paxos has caught our attention. Paxos received approval from the New York Department of Financial Services (NYDFS) to expand its Stable Coin offering business to the Solana Blockchain. It should be emphasized that even if the previous volume is as large as BUSD, it is still only regulated and approved to be issued on the Ethereum network.

This move marks the first time Paxos has expanded its business beyond Ethereum into the crypto world.

Paxos used to be known for its BUSD

星球日报·2023-12-25 15:19

What is the safest stablecoin

What is a stablecoin?

A stablecoin is a type of digital asset whose goal is to maintain price stability by pegging its value to a traditional reserve asset. As an important part of the crypto financial ecosystem, stablecoins account for about 10% of the overall crypto market capitalization, or $124 billion out of $1.3 trillion in assets. More and more people are choosing to adopt stablecoins like USD Coin (USDC), Tether (USDT), and Binance USD (BUSD) because of their ability to effectively protect investors from the volatility associated with cryptocurrencies.

While the popularity of stablecoins has provided investors with a variety of options, it has also brought with it the challenge of identifying which stablecoins are safe and reliable. Among the growing number of stablecoin offerings, factors such as stablecoin-backed assets, regulatory compliance, and audit practices have become key indicators to assess the reliability of stablecoins. ...

币小白_·2023-11-27 07:38

PYUSD receives SEC subpoena, PayPal stablecoin will collapse again?

After Libra and BUSD, is it PYUSD's turn?

星球日报·2023-11-02 12:11

Case Study: Tranchess X BNB Chain X Chainlink

Below is an interview with Danny, co-founder of Tranchess.

What is unique about Tranchess as a platform?

Tranchess is a protocol on BNB Chain and Ethereum. It is an asset tracking management protocol that provides users with different risk returns. Users who hold BNB, BTC, ETH or stablecoins such as BUSD/USDC can find the most suitable products for them according to their risk appetite and expected returns. We have liquidity staking capabilities on both chains and aim to be the first in the offering of liquid staking services and structured products.

Our vision is to combine the best of traditional finance with the flexibility and efficiency of DeFi. We believe that our innovative products can not only provide sustainable long-term returns, but also provide users with the correct risk stratification and diversified...

金色财经_·2023-08-29 12:28

Business stagnation and regulatory relaxation. Is this the reason why Paypal entered the stable currency?

Author: Gyro Finance

From the perspective of the industry, many people have high hopes for Paypal, and believe that the entry of large institutions may lay the foundation for the relaxation of supervision. But behind the release, centralization myths and limited scenarios are also lingering.

Last week, Paypal, known as Alipay in the United States, announced the issuance of the stable currency PaypalUSD ("PYUSD" for short), and the encryption field was stirred up again.

As the largest third-party payment institution in the United States, Paypal released stablecoins at the juncture of intensified SEC supervision. An urgently delisted the stablecoin BUSD in cooperation with Paxos.

From the perspective of the industry, many people have high hopes for Paypal, and believe that the entry of large institutions may lay the foundation for the relaxation of supervision...

金色财经_·2023-08-16 05:18

American "Alipay" Paypal borrowed stable currency to survive and save the encryption circle?

Last week, Paypal, known as Alipay in the United States, announced the issuance of the stable currency PaypalUSD ("PYUSD" for short), and the encryption field was stirred up again.

As the largest third-party payment institution in the United States, Paypal released stablecoins at the juncture of intensified SEC supervision. An urgently delisted the stablecoin BUSD in cooperation with Paxos.

From the perspective of the industry, many people have high hopes for Paypal, and believe that the entry of large institutions may lay the foundation for the relaxation of supervision. But behind the release, centralization myths and limited scenarios are also lingering.

The speculation caused by Paypal is constantly fermenting.

Sending charcoal in the snow: the past and present of PYUSD

On August 8, 2023, the American payment giant Pa...

金色财经_·2023-08-15 11:45

Inventory of exciting changes in DeFi stablecoins

Author: Ignas, DeFi researcher; translation: Golden Finance xiaozou

Is the Golden Age of Decentralized Stablecoins Coming? Don’t be misled by the drop in the total market value of stablecoins from over $180 billion to $125 billion (DeFi stablecoins account for only 9%). Let's take a look at the exciting changes in DeFi stablecoins to meet the future bull market!

Safety first! The non-profit Bluechip has published its economic security ratings for major stablecoins. Which are the highest rated? BUSD, PAXG, GUSD and the safest DeFi stablecoin LUSD. Safer than USDC. LUSD served as a safe haven during the USDC decoupling event in March.

DeFi stablecoins like DAI and RAI received a B+, while USDD and Tron USDD received an F. These ratings are important because the ratings...

金色财经_·2023-08-07 05:10

Understand the opportunities and risks of TUSD

Author: jk

After BUSD encountered supervision, its market value has dropped by nearly 74% from the US$16.57 billion at the beginning of the year, and it is gradually withdrawing from the stage of history. The stablecoin market structure has also undergone significant changes. With the support, it has entered the mainstream field of vision, its share has grown rapidly, and news has continued.

TrueUSD, referred to as TUSD, because Binance transferred the previous zero-fee pending order activity of BUSD to TUSD, it is currently the largest trading pair of Bitcoin on Binance, and it is also an important part of the current stablecoin financial system in the encrypted world. Recently, TrueUSD has frequently appeared in the headlines of the encryption media due to events such as the suspension of automatic certification and the large-amount minting of Binance.

What is TrueUSD?

TrueUSD is a stable currency issued on Ethereum and Binance Smart Chain, the current market value...

金色财经_·2023-06-24 02:26

Several public chain projects are regarded as securities by the SEC. Why can DOT survive?

background

Due to the series of Crypto black swans triggered by FTX last year, existing countries have strengthened their supervision. This can be intuitively felt from the recent discussions and policies related to supervision in various countries, which often mention the need to avoid financial incidents similar to FTX.

Since the beginning of this year, the supervision in the United States has also changed its previous style and frequently attacked the Crypto industry. Previously, I have expressed sadness to stablecoins such as Kraken exchange and BUSD/USDC.

The frequency of policy and meeting releases on supervision is also increasing, and it is no longer just a wait-and-see or discussion atmosphere in the past, but tends to be more direct supervision.

In addition to such a trend in policy, this point has also been mentioned to Crypto practitioners in the United States. We have also had exchanges with some American teams in Hong Kong before. Many local teams are leaving the United States one after another. The United States is...

金色财经_·2023-06-12 05:29

What Cryptocurrencies Listed as Securities by the SEC Have in Common

Author: Miles Deutscher Compilation: PANews

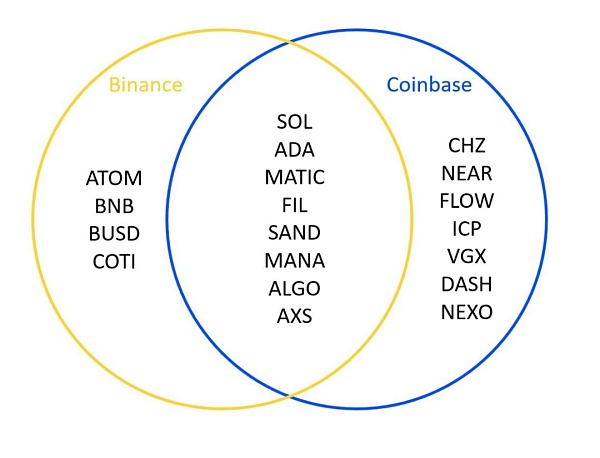

On the evening of June 5, Beijing time, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the cryptocurrency exchange Binance and its CEO Zhao Changpeng, and filed a lawsuit against the cryptocurrency exchange Coinbase a day later. In these two lawsuits, The U.S. Securities and Exchange Commission has designated 19 tokens as “securities,” a decision that could have huge ramifications for the tokens in question, and indeed the crypto industry as a whole.

This article will briefly sort out these tokens and explore what these tokens have in common.

First, crypto tokens identified as securities by the SEC include:

Listed on Binance: ATM, BNB, BUSD, COTI

Listed on Coinbase: CHZ, NEAR, FLOW, ICP, VGX, DASH, NEXO

...

金色财经_·2023-06-10 05:09

Why the Most Untrusted USDT Can Dominate Stablecoins

Author: Conor Ryder, CFA

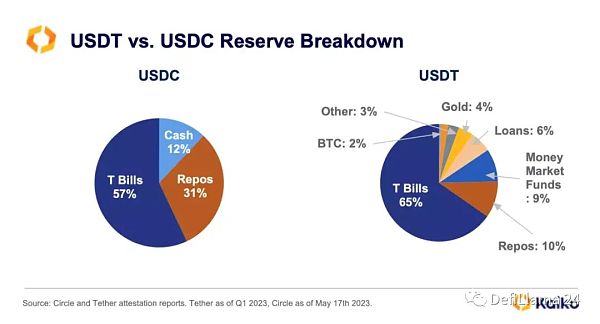

After all the events of 2023, Tether has become the dominant stablecoin despite being the least trusted. In this week's Deep Dive, we explore whether this proves that <trust> is less important for crypto investors, who seem to prefer the stability, liquidity, and versatility of pegs.

Although USDT is the least trusted, it has become the dominant stablecoin.

USDC and DAI suffered a decoupling during the banking crisis, while BUSD had an expiry date due to regulation.

CEX and DEX volume shares show different stablecoin preferences.

Investors seem to value the stability, liquidity, and versatility of the USDT peg more than its opaque reporting.

The stablecoin market...

金色财经_·2023-05-23 08:33

Load More