Search results for "EURC"

USDT negative premium, holding stablecoins still losing money, how should we interpret this?

Under the RMB appreciation channel, USDT exhibits negative premiums, and investors do not need to panic excessively. It is recommended to maintain an appropriate proportion of stablecoin assets, which can be hedged through on-chain exchange rate strategies, such as allocating to Euro stablecoins or gold RWA, to moderately avoid exchange rate losses. This article is based on an article by @Web3Mario, organized, compiled, and written by Foresight News.

(Previous context: USDT exits the market, EURC fills the gap, Euro stablecoins surge over 170% against the trend)

(Additional background: Chinese crypto circles panic selling USDT "at a 1.5% negative premium against RMB," bear market, regulatory flight?)

Table of Contents

Why does the RMB enter an appreciation channel, and why does USDT show a negative premium

Should we convert USD stablecoins back to RMB

How to hedge exchange rate losses through on-chain strategies, gold, and euro stablecoins

動區BlockTempo·2025-12-31 15:10

Circle’s 2025 Review Details Stablecoin Growth and Rules

Circle's 2025 Year in Review highlights significant growth in digital currencies USDC, EURC, and USYC due to improved regulatory frameworks. Key developments include a rise in USDC’s market cap, the launch of the Arc blockchain testnet, and Circle's IPO and banking approval.

USDC-0,03%

CryptoFrontNews·2025-12-24 15:41

Circle Announces €300M Milestone for Euro Stablecoin EURC

_Circle reports stablecoin EURC reaching €300 million circulation, highlighting MiCA compliance, rising euro stablecoin demand, and expanding global digital finance use._

Circle has announced a major milestone for its euro-backed stablecoin, EURC. The company confirmed that circulation

LiveBTCNews·2025-12-24 07:50

USDT exits, EURC fills the gap, Euro stablecoin surges over 170% against the trend

The total market capitalization of Euro stablecoins has surpassed $400 million, with growth of over 170% since the beginning of this year. This growth is mainly driven by the regulation of the EU's Markets in Crypto-Assets (MiCA) legislation and the demand for market diversification, indicating that the Eurozone's crypto ecosystem is undergoing a profound liquidity reshaping.

(Background: France's Paris Bank and 10 other European banks are launching Qivalis Euro stablecoin, planning to go live in the second half of 2026)

(Additional background: Deutsche Bank's "EURAU" Euro stablecoin launched: certified by MiCA and German authorities, will the European payment landscape be rewritten?)

Table of Contents

- Providing compliant entry tickets, regulatory certainty as a growth driver

- From risk hedging to arbitrage allocation, another catalyst for scale growth

- Multi-chain deployment and application strategies combined, EURC accounts for 70% of the market share

- Entry of mainstream banks, CBDC

動區BlockTempo·2025-12-20 17:00

USDT exits, EURC fills the gap, Euro stablecoin surges over 170% against the trend

The total market capitalization of Euro stablecoins has surpassed $400 million, with growth of over 170% since the beginning of this year. This growth is mainly driven by the regulation of the EU's Markets in Crypto-Assets (MiCA) legislation and the demand for market diversification, indicating that the Eurozone's crypto ecosystem is undergoing a profound liquidity reshaping.

(Background: France's Paris Bank and 10 other European banks are launching Qivalis Euro stablecoin, planning to go live in the second half of 2026)

(Additional background: Deutsche Bank's "EURAU" Euro stablecoin launched: certified by MiCA and German authorities, will the European payment landscape be rewritten?)

Table of Contents

- Providing compliant entry tickets, regulatory certainty as a growth driver

- From risk hedging to arbitrage allocation, another catalyst for scale growth

- Multi-chain deployment and application strategies combined, EURC accounts for 70% of the market share

- Entry of mainstream banks, CBDC

動區BlockTempo·2025-12-19 17:00

USDT exits the market, EURC fills the gap, Euro stablecoin surges over 170% against the trend

Author: Jae, PANews

In the global stablecoin landscape exceeding $300 billion, where US dollar assets dominate with a 99% share, a non-mainstream category is quietly making a comeback.

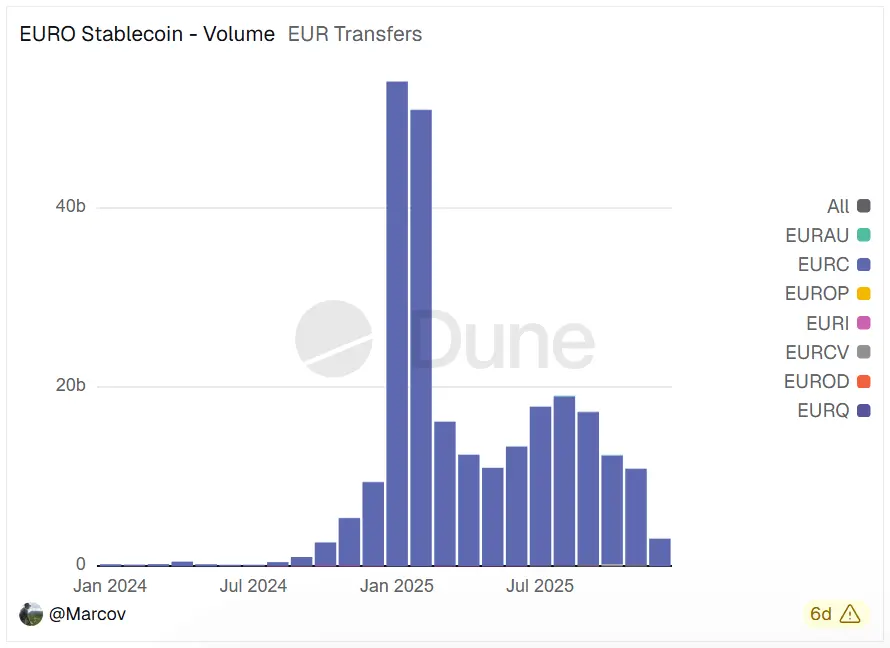

Dune data shows that the total market capitalization of euro stablecoins recently broke through $400 million for the first time in history, with a growth rate of over 170% since the beginning of this year.

In the face of the massive size of US dollar stablecoins, although euro stablecoins account for only 0.14% of the global market, this force should not be underestimated. Against the backdrop of increasingly stringent requirements of the EU's Markets in Crypto-Assets (MiCA) Regulation and tightening regulatory walls, this counter-trend surge in data indicates that the crypto ecosystem in the Eurozone is undergoing a profound liquidity reshaping.

A silent on-chain euro war may have already begun, and this could be the turning point for euro stablecoins moving from the fringes to the mainstream market.

Providing compliant entry

PANews·2025-12-19 08:37

Circle Secures Key Regulatory License in UAE, Expands MEA Presence

Circle secures ADGM license, boosting UAE presence and making USDC and EURC easier to use in the MEA region.

Dr. Saeeda Jaffar joins Circle MEA to guide strategy, build partnerships, and speed up digital dollar adoption.

Clear rules in Abu Dhabi let Circle safely offer digital money services to bu

USDC-0,03%

CryptoFrontNews·2025-12-09 14:47

The market cap of euro stablecoins has doubled since MiCA came into effect, but there is still a huge gap compared to dollar stablecoins.

According to TechFlow on December 6, citing Coingecko data, the market capitalization of euro stablecoins has doubled in the year since the EU’s Markets in Crypto-Assets Regulation (MiCA) came into effect, currently reaching around $683 million. However, there is still a large gap compared to the over $30 billion market capitalization of USD stablecoins.

Additionally, the "2025 Euro Stablecoin Trend Report" released by London-based payments company Decta points out that recent growth in euro stablecoins is mainly concentrated among a few leading tokens. For example, the market capitalization of EURS grew by 6.44%; Circle’s EURC and Société Générale’s EURCV also saw significant growth, with trading volumes increasing by 1,139% and 343%, respectively. Decta’s survey also shows that search activity for euro stablecoins has surged across the EU, with Finland increasing by 400%, Ita

DeepFlowTech·2025-12-06 13:22

CryptoProcessing By CoinsPaid Launches EURC Support on Ethereum, Solana, and Base

CryptoProcessing by CoinsPaid has integrated EURC, Circle’s fully euro-backed stablecoin, expanding its portfolio of crypto payment options for European businesses. The addition strengthens the company’s position in the market for euro-denominated crypto payments, addressing growing demand for

USDC-0,03%

CryptoDaily·2025-12-05 16:53

Bit2Me Pushes Stablecoins as the Safest Entry Into Crypto

Crypto exchange Bit2Me has launched a new educational push highlighting stablecoins as the most secure and volatility-free entry point for newcomers entering the crypto ecosystem. In a post shared on X, the company emphasized that stablecoins such as USDC, EURC, EURR, USDR, EUROP, and EURQ provide u

Coinfomania·2025-11-29 10:53

German exchange locks in third euro stablecoin amid broader EU adoption

Market infrastructure provider Deutsche exchange plans to integrate the EURAU euro-pegged stablecoin issued by AllUnity, expanding the exchange group’s digital-asset strategy following earlier work with Circle’s Euro Coin (EURC) and Societe Generale-Forge’s EUR CoinVertible (EURCV).

According to a

AAVE5,07%

Cointelegraph·2025-11-26 09:28

New collateral currency available for margin and futures trading: EURC!

We have increased our selection of margin and futures collateral currencies to now include EURC.

We’re committed to providing traders with greater flexibility and control, and are excited to announce a significant expansion in our collateral opportunities for Kraken Pro traders

Margin

BitcoinInsider·2025-11-24 14:50

Deutsche Börse Teams With Circle as Stablecoins Push Into Core Euro Markets

Europe is taking a massive leap toward regulated digital finance as Circle and Deutsche exchange join forces to embed stablecoins into core market infrastructure.

Circle’s USDC and EURC Take Aim at Legacy Systems Via Deutsche exchange

Global integration of digital assets into regulated markets is

USDC-0,03%

Coinpedia·2025-11-13 17:40

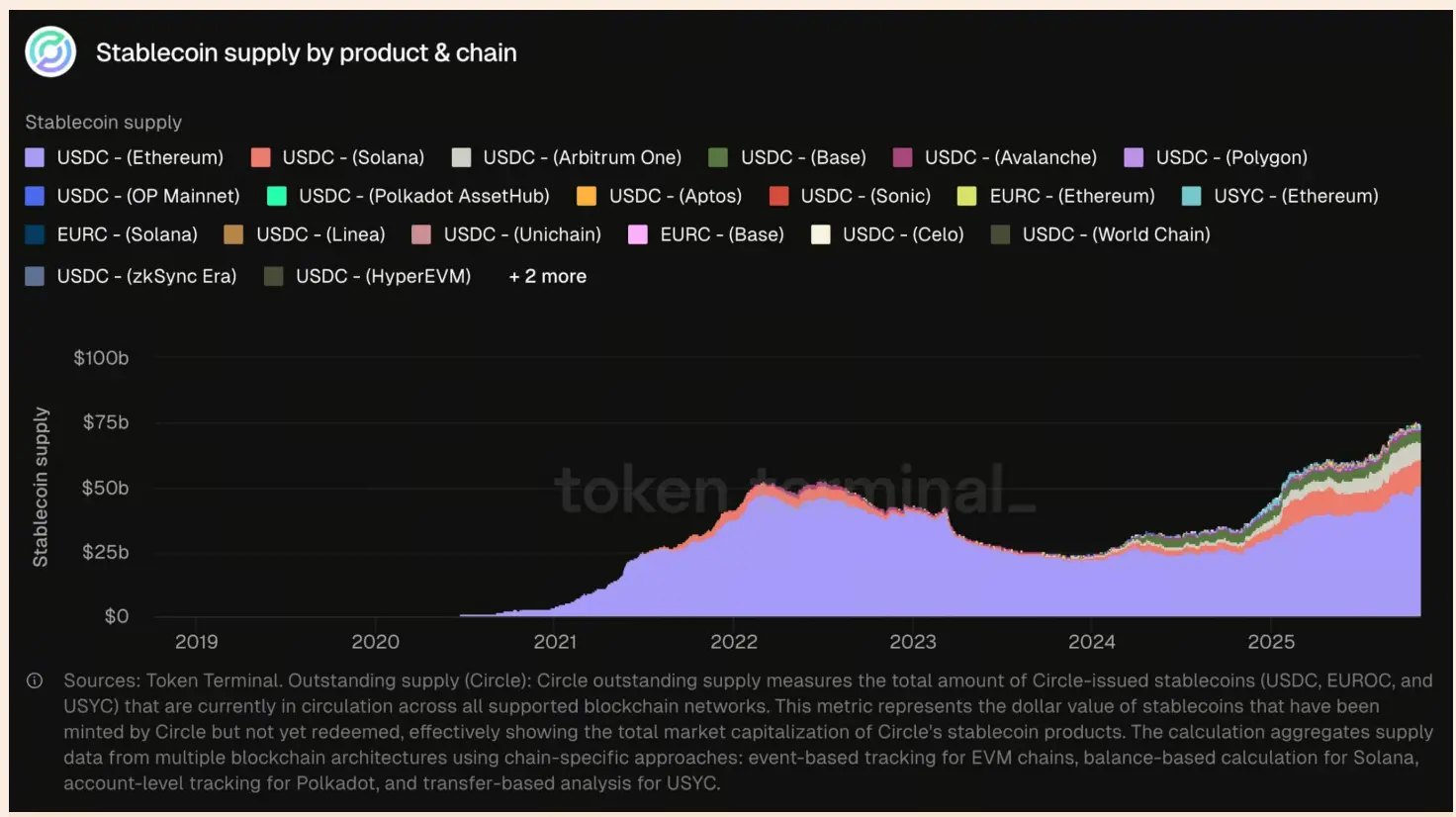

Circle stablecoin users surged to 35 million, with $75 billion in supply flowing into L2 networks such as Solana, Base, and Arbitrum.

Circle's issuance of USDC and EURC stablecoins is expected to experience explosive growth in 2025, with the number of holders reaching 35 million, double that of early 2025. Circle's total supply (including USDC, EURC, and interest-bearing products) has reached a record 75 billion USD. Notably, this expansion of 75 billion USD is no longer confined to Ethereum, but is pouring into Layer 2 and alternative Layer 1 networks such as Solana, Base, Arbitrum, and Polygon. Although the total amount of stablecoins on Ethereum has reached 184 billion USD, the simultaneous acceleration of volume indicates that capital is circulating and being utilized on a large scale and efficiently.

USDC-0,03%

MarketWhisper·2025-11-03 09:47

ClearBank to Join Circle’s Payments Network and Expand Stablecoin Access

ClearBank has entered a strategic agreement with Circle Internet Group, aiming to enhance digital finance in Europe by providing access to MiCA-compliant stablecoins USDC and EURC and joining Circle's Payment Network.

USDC-0,03%

BitcoincomNews·2025-10-27 14:59

ClearBank and Circle Partner to Bring Stablecoin Payments

The European financial technology scene is changing quickly, and a major shift has just taken place. ClearBank in the UK has teamed up with Circle, the issuer of USDC and EURC, to offer smooth stablecoin payments in Europe. This collaboration is a significant step in the expansion of crypto-backed p

USDC-0,03%

Coinfomania·2025-10-27 11:47

What have payment giants done in the past month?

If you haven't followed the payment industry in the past month, you may have missed some important news.

On September 29th, Stripe and OpenAI jointly announced that ChatGPT users can shop directly in the chat window without needing to navigate to the merchant's website. The next day, Visa launched a pilot program for stablecoin preloading, allowing financial institutions to conduct cross-border settlements using USDC and EURC. One day later, Stripe made another move by releasing a platform called "Open Issuance", enabling any business to issue its own stablecoin.

On October 9, the market reported that Mastercard and Coinbase are bidding for a stablecoin infrastructure company.

金色财经_·2025-10-13 08:27

Circle partners with Deutsche Börse as Europe shapes the future of stablecoin

Circle is collaborating with Deutsche Börse to introduce regulated stablecoins in Europe's financial infrastructure, focusing on EURC and USDC. This partnership aims to streamline cross-border payments and reduce risks, positioning Circle as the first global compliant issuer under MiCA regulations.

USDC-0,03%

TapChiBitcoin·2025-10-02 02:37

Visa tests using stablecoin for cross-border payments via Visa Direct

Visa is testing the integration of stablecoins into the Visa Direct platform, allowing businesses to deposit stablecoins instead of fiat to make international payments faster.

Circle's pilot program using USDC and EURC helps shorten payment times from several days to just a few minutes, coin

USDC-0,03%

TapChiBitcoin·2025-09-30 07:44

Kraken and Circle partner to accelerate global access to USDC and EURC

Kraken partners with Circle to enhance USDC and introduce EURC, expanding stablecoin liquidity and infrastructure. This collaboration aims to foster the growth of stablecoins within the new internet financial system, benefiting clients with better access and reduced fees.

USDC-0,03%

BitcoinInsider·2025-09-17 14:24

Kraken launches Circle Euro stablecoin EURC service

According to Jin10, Mars Finance reports that the cryptocurrency exchange Kraken will launch services for the Euro stablecoin EURC of Circle (CRCL.N).

MarsBitNews·2025-09-17 13:33

Circle partners with Mastercard and Finastra! USDC stablecoin accelerates integration into the global Payment Network.

Stablecoins are moving towards the mainstream financial stage. American stablecoin issuer Circle announced a strategic partnership with payment giant Mastercard and fintech company Finastra to directly integrate USD Coin (USDC) and Euro stablecoin (EURC) into the global payment and banking system, covering Eastern Europe, the Middle East, Africa, and over 50 countries. This move marks a new phase of USDC's penetration into cross-border settlement and international business payment fields.

USDC-0,03%

MarketWhisper·2025-08-28 01:42

Mastercard Boosts Circle Partnership For USDC And EURC Stablecoin Payments In EEMEA Region

Mastercard and Circle expanded their partnership to provide merchants and users across the EEMA region with options to process transactions in USDC and EURC stablecoins.

Stablecoins are no longer just a

Blockzeit·2025-08-27 14:11

Bullish IPO raised $1.15 billion in stablecoin subscriptions, marking the first large-scale use of stablecoin for settlement in a US IPO.

Bullish raised approximately $1.15 billion in its IPO in the United States using stablecoins USDC and EURC, demonstrating the potential of stablecoins in global capital transfers.

TechubNews·2025-08-20 01:56

Bullish sets a record with a $1.15 billion IPO: All stablecoin settlement disrupts traditional practices, strong validation for the Solana ecosystem | Wall Street welcomes a milestone moment

Bullish (stock code: BLSH) has completed an $1.15 billion IPO in a new model, becoming the first NYSE-listed company to raise funds entirely using blockchain stablecoins, hailed by market analysts as a "watershed moment." This IPO relies on stablecoins such as USDC and EURC, and primarily settles through the Solana blockchain, strongly validating its position as a mainstream settlement layer. Meanwhile, various stablecoins including Paxos and PayPal participate, and the GENIUS Act provides regulatory clarity, together promoting a new phase for stablecoin B2B payments and capital market applications.

SOL3,53%

MarketWhisper·2025-08-20 01:08

Coinbase restarts stablecoin guidance fund! Investing in Aave, Morpho, Kamino, Jupiter to promote USDC/EURC DeFi liquidity | Stablecoin competition intensifies

Coinbase announced the restart of its stablecoin Bootstrap Fund ( Stablecoin Bootstrap Fund ) on August 12, injecting funds into the Decentralized Finance ( DeFi ) ecosystem for the first time in four years, aiming to significantly enhance the on-chain liquidity of its issued USD stablecoin USDC and Euro stablecoin EURC. The first round of funding will be directed towards Aave and Morpho on Ethereum to optimize lending efficiency, as well as Kamino and Jupiter ( JUP ) in the Solana ( SOL ) ecosystem to expand trading and liquidity routing. This move comes at a time when the total value locked ( TVL ) in DeFi is nearly $160 billion, and with clearer regulations on stablecoins, Coinbase aims to establish USDC (with an annual on-chain settlement volume of $2.7 trillion) as a core multi-chain settlement tool.

MarketWhisper·2025-08-13 05:24

CRCL to Report Q2 Earnings: What's in Store for the Stock?

Circle CRCL is set to report its second-quarter 2025 results on Aug. 12. This will be the stablecoin provider’s first-ever earnings call since its initial public offering on June 5, 2025

Circle offers USDC, which is redeemable on a one-for-one basis for US dollars. USDC, along with EURC, are d

IN0,76%

YahooFinance·2025-08-11 18:31

VISA expands its multi-chain territory as payment giants engage in a heated competition for "on-chain infrastructure".

Jessy, Golden Finance

Recently, Visa announced the expansion of its stablecoin settlement capabilities, adding support for the Global Dollar (USDG) issued by Paxos, PayPal USD (PYUSD) launched by PayPal, and the Euro Coin (EURC) stablecoin launched by Circle. At the same time, Visa will also expand the blockchain networks supported for settlements from the original Ethereum and Solana to include Stellar and Avalanche, further enhancing the "multi-chain compatibility" of its on-chain infrastructure.

This move by Visa undoubtedly aims to solidify its dominant position in the global payment infrastructure while accelerating its transformation towards the "on-chain settlement layer." Not only Visa, but major payment giants are also speeding up their efforts in areas they excel in.

金色财经_·2025-08-05 11:24

Important updates in the crypto market: DeFi TVL returns to pre-UST crash highs; IMF officially incorporates crypto assets into national accounts; Visa expands the stablecoin landscape across multiple chains.

The dynamics of the crypto market focus on three core developments: The total value locked (TVL) in DeFi has strongly risen to USD 138 billion, reaching levels before the Terra crash, led by AAVE and Lido; The IMF has historically revised the national accounting system, classifying Bitcoin and other crypto assets as "non-productive non-financial assets," with El Salvador being a direct beneficiary; Visa is accelerating its layout in the stablecoin ecosystem, adding multi-chain support for PYUSD, EURC, and other currencies, as traditional finance giants compete for opportunities in the USD 256 billion stablecoin market.

DEFI-0,47%

MarketWhisper·2025-08-01 03:34

Visa expands support for stablecoins, adding PYUSD, USDG, EURC, and the Stellar blockchain, Avalanche.

Visa has expanded its stablecoin payment platform, adding support for three new stablecoins — PayPal's PYUSD, Paxos-issued USDG, and Circle's EURC — along with two blockchains, Stellar and Avalanche.

This move raises the total number of supported stablecoins to 4 (USDC, PYUSD, USDG, EURC) and expands the multi-infrastructure.

TapChiBitcoin·2025-07-31 19:00

Visa Expands Stablecoin Integration With RLUSD Rivals - Coinspeaker

Key Notes

Visa has partnered with Paxos to add USDG and PYUSD stablecoins for settlement.

Stellar and Avalanche blockchains now support Visa’s stablecoin payments.

Visa has introduced EURC, its first euro-backed stablecoin on the platform.

American tech giant Visa Inc. is pushing further

Coinspeaker·2025-07-31 07:26

Circle Mints $250M USDC on Solana as Demand Soars

Circle mints $250M USDC on Solana as institutional demand surges for faster, low-cost cross-border blockchain settlements.

Circle Mint's FX service enables near-instant euro-to-USDC conversion for EEA institutions, boosting liquidity and payment speed.

Ivy integrates USDC and EURC APIs for

CryptoFrontNews·2025-07-03 15:46

German Fintech Ivy Unleashes Seamless USDC EURC Integration

The world of finance is constantly evolving, with digital currencies and blockchain technology at the forefront of innovation. For businesses and consumers alike, the promise of faster, cheaper, and more transparent transactions is becoming a reality. At the heart of this transformation are

USDC-0,03%

BitcoinWorldMedia·2025-07-02 16:56

Ivy and Circle revolutionize global payments: the borderless account for Web3 businesses is born

Ivy, the global instant payments platform, announces a strategic partnership with Circle, one of the leading fintech operators and creator of USDC and EURC.

Thanks to this collaboration, businesses operating in the Web3 sector will be able to access borderless bank accounts, with the ability to

USDC-0,03%

TheCryptonomist·2025-07-02 16:31

Instant Payments Fintech Ivy Adds Circle’s USDC, EURC Stablecoins

Ivy, a Berlin-based fintech, has integrated Circle's USDC and EURC stablecoins into its instant payment platform, enabling seamless bank payments and conversions for crypto firms and merchants. This positions Ivy as a key player in utilizing stablecoins for rapid settlements.

USDC-0,03%

YahooFinance·2025-07-02 12:49

Criptan partners with OpenTrade to enhance EURC and USDC yield offerings

Criptan, a leading Spanish fintech platform specializing in digital asset access, has announced a strategic partnership with OpenTrade to power its enhanced Earn product suite, as per the information shared with Finbold on July 1

The collaboration enables users to generate passive income on

USDC-0,03%

TheBitTimesCom·2025-07-01 14:34

Market Cap of Euro Stablecoins Surges to Nearly $500M as EUR/USD Rivals Bitcoin's H1 Gains

The EUR/USD exchange rate has surged 12.88% in the first half of the year, driving interest in euro-pegged stablecoins, particularly Circle's EURC, which has seen significant growth in market cap, though still less than dollar-pegged stablecoins.

YahooFinance·2025-06-27 10:20

Alchemy Pay: The Alchemy Chain is scheduled to launch in Q4 2025 and issue its own stablecoin.

According to Mars Finance, on June 19, Alchemy Pay officially announced that Alchemy Chain is scheduled to officially launch in the fourth quarter of 2025. As a blockchain built specifically for stablecoin payments, Alchemy Chain will support seamless exchanges between global stablecoins (such as USDT, USDC) and local stablecoins (such as EURC, MBRL), and its own stablecoin is also planned to be issued shortly thereafter.

ACH2,14%

MarsBitNews·2025-06-19 17:58

Circle (CRCL) stocks can pump more than Crypto Assets! Soaring nearly 4 times on the 2nd day of listing.

The stablecoin USDC issuer Circle saw its stock price soar on the second day of its listing on the New York Stock Exchange, reaching a high of over $120. The market holds an optimistic outlook on stablecoins. (Background: Analyzing the power dynamics behind USDC: Is the only challenge for Coinbase's acquisition of Circle the price?) (Background Supplement: Circle Payments Network Mainnet launched: Providing global institutions with USDC and EURC instant settlement) The stablecoin USDC issuer Circle Internet Financial (CRCL) performed exceptionally well on the New York Stock Exchange (NYSE) during its initial public offering (IPO), with the stock price peaking at $123.51 on the second day, nearly four times the issuance price of $31. This IPO marks a significant milestone for Cir.

USDC-0,03%

動區BlockTempo·2025-06-07 03:59

Nobel Prize in Economics winners boycott Trump: The Great American Rescue Plan impacts low-income households, and the reform of national debt will ultimately benefit the wealthy and must collapse.

Six Nobel Prize economists issued an open letter to boycott Trump's Great Beauty Act, warning that the impact on people's livelihood and national debt should be considered by the Senate. (Summary: Circle officially launches IPO: stock code CRCL target valuation of $6.7 billion, JPMorgan Chase, Citi and Goldman Sachs as main distributors) (Background supplement: Circle Payments Network mainnet launch: provide global institutional USDC, EURC real-time settlement) The Big Beautiful Bill promoted by President Trump (One Big Beautiful Bill

TRUMP3,96%

動區BlockTempo·2025-06-04 11:45

According to a report by The Block on May 16, Bitstamp exchange announced a strategic partnership with Circle to significantly expand its USDC and EURC stablecoin trading pair services. This cooperation is a positive response to the new "Regulation on Markets in Crypto-Assets" (MiCA) introduced by the European Union.

USDC-0,03%

DeepFlowTech·2025-05-16 10:27

Circle launches the global payment network CPN, providing stablecoin cross-border payment services with USDC and EURC.

Circle launched the Circle Payments Network (CPN), utilizing stablecoins such as USDC and EURC to connect global Financial Institutions and provide low-cost, instant, and transparent cross-border payment services. CPN simplifies payment processes, gaining support from global banks, including cross-border payment efficiency, to meet the needs of global Financial Institutions, offering diverse applications in the developer ecosystem. Circle is actively moving towards an IPO, showcasing its core position and financial strength in the stablecoin business.

USDC-0,03%

ChainNewsAbmedia·2025-04-22 03:37

Circle launched a network based on stablecoin to drop global payment costs and latency.

Circle launched the infrastructure platform Circle Payment Network, allowing banks and financial institutions to use USDC and EURC stablecoins for 24/7 instant remittances, supporting cross-border payments and various Financial Services. Partners include dLocal, WorldRemit, BVNK, Yellow Card, and Coins.ph, with the platform focusing on emerging markets and large remittance channel operations.

USDC-0,03%

TechubNews·2025-04-22 03:16

EURC Hits New Record as Demand Grows Across Blockchains - Crypto News Flash

EURC supply surge 43%, reaching 217M tokens. Regulatory approval, DeFi adoption widen global utility. Circle's stablecoin EURC sees robust growth amid geopolitical tensions, expanding into major blockchains and financial markets.

CryptoNewsFlash·2025-04-15 09:52

Alchemy Pay plans to officially launch Alchemy Chain to build a global stablecoin payment ecosystem.

According to Mars Finance, the encryption payment company Alchemy Pay announced that it will officially launch its stablecoin payment public chain Alchemy Chain this year, which will integrate global mainstream stablecoins such as USDT, USDC, EURC, and local stablecoins anchored to regional fiat currencies, linking different Blockchain and fiat systems to build a Compliance stablecoin cross-border payment ecosystem, and will use ACH Token to pay gas fees.

MarsBitNews·2025-04-03 06:54

Dubai officially recognizes USDC and EURC stablecoins, developing a 'future finance' strategy!

Dubai officially recognizes USDC and EURC stablecoins, developing the 'future finance' strategy!

USDC-0,03%

LinkFocus·2025-03-11 10:04

3,100,000 Ripple USD (RLUSD) Minted on XRP Ledger: Details

American blockchain payments firm Ripple Labs Inc. minted 3.1 million RLUSD stablecoins, increasing its supply to 56 million. RLUSD has gained traction with growing utility and trading volume, outperforming competitors like Ethena USDe and Circle’s EURC. Ripple has expanded RLUSD partnerships to enhance its use case, aiming for deployment on the Cardano protocol.

XRP12,78%

UToday·2025-02-27 16:39

Circle becomes the first approved stablecoin in Dubai, and in the future, USDC and EURC can be used in the Dubai Financial Center, which has nearly 7,000 companies.

The Dubai Financial Services Authority (DFSA) recently announced its formal approval of Circle's issuance of USDC and EURC as the first recognized Stable Coins by the institution. This means that companies in the Dubai International Financial Centre (DIFC) can now integrate these two Stable Coins into a range of digital asset applications, including payments, fund management, and services.

Circle's stablecoin under the approval of the Dubai Financial Services Authority

In 2024, as the regulatory framework for blockchain in the UAE becomes clearer, the government introduced a series of regulatory frameworks, even piloting the implementation of DAO as a legal entity in the Hayma Corner Digital Oasis.

(The UAE will launch a DAO regulatory framework at the end of the month, which will allow remote registration to make DAOs legal entities)

The President of the Dubai International Financial Centre is none other than Sheikh, the Vice President, Prime Minister, and Minister of Finance of the United Arab Emirates.

USDC-0,03%

ChainNewsAbmedia·2025-02-26 08:51

Load More