Search results for "MODE"

MicroStrategy's "Unlimited Coin Purchase" mode ends! MSCI freezes the flywheel effect clause

MSCI maintains MicroStrategy but freezes the number of shares, cutting off the link between new share issuance and passive buying, ending the flywheel effect. Bull Theory quantitative analysis shows that every 20 million newly issued shares result in a $600 million loss from passive buying. MicroStrategy plans to issue over $15 billion in new shares by 2025. Under the new regulations, the dilution effect is unsupported, increasing the risk of price correction.

MarketWhisper·21h ago

Overview of the three proxy deployment mechanisms for Virtuals: Pegasus, Unicorn, and Titan

Virtuals Protocol aims to support builders by introducing three release mechanisms—Pegasus, Unicorn, and Titan—to meet the needs of teams at different stages. Pegasus focuses on distribution, Unicorn emphasizes belief and accountability, and Titan provides scalable support for mature teams. As the market evolves, Virtuals will continue to adapt, ensuring the right release mode is available at the right time.

PANews·01-06 11:33

Aster Token Surpasses 200K On-Chain Holders After Shield Mode Launch

_ASTER token holders crossed 200k following Shield Mode launch, highlighting strong adoption, rising activity, and growing confidence in Aster’s trading ecosystem._

Aster, an on-chain trading platform, reported over 200,000 on-chain holders of its native ASTER token. The milestone followed the

ASTER-2,96%

LiveBTCNews·01-06 06:05

Grok Ani Affinity Guide! 10-Minute Hypnosis for Rapid Level Up, Doctor Warns About AI Addiction Risks

Grok AI launches the Companions feature, with the blonde twin-tailed Grok Ani sparking heated discussions. The affinity system ranges from Lv 0-5, with Lv 3 unlocking NSFW mode, and Lv 5 unlocking clothing changes. Netizens share that hypnosis and JSON modification can quickly level up, but a NTU doctor warns about the risks of AI addiction.

MarketWhisper·01-06 03:55

Maji Big Brother "Bull King Does Not Surrender" gains $1.53 million in a single week! Heavy positions shift to Ethereum and HYPE

Last year, Brother Ma, who aggressively went long but suffered a huge loss of over 10 million USD, achieved a long-awaited victory in early 2026. Now, is he planning to add to his position while the momentum is high?

(Background: Brother Ma previously faced setbacks with his long positions, and Bitcoin OG whale floated a loss of 56 million USD)

(Additional context: In November, Brother Ma was liquidated 71 times by Hyperliquid, earning the title of "Liquidation King"! Aster is opening Brother Ma mode next week)

The bull didn't return, but well-known trader Brother Ma made a profit from the rebound in early 2026! Today, he closed a 40x leveraged Bitcoin (BTC) long position and realized approximately 1.53 million USD profit, then quickly shifted funds into Ethereum (ETH) and HYPE tokens within the Hyperliquid ecosystem, continuing to go long while the trend is favorable.

40x BTC position fully closed

According to Hyperliq

動區BlockTempo·01-04 06:05

New Patent Positions Chainlink as Core Infrastructure for Hostile Cross-Chain Systems

Patent treats chains as hostile by default, using Chainlink RMN to validate intent before deterministic execution across chains.

RMN nodes reconstruct Merkle roots and bless matches, while curse mode pauses processing after finality or execution violations.

A U.S. patent application tied to

CryptoNewsFlash·01-03 10:40

New Patent Positions Chainlink as Core Infrastructure for Hostile Cross-Chain Systems

Patent treats chains as hostile by default, using Chainlink RMN to validate intent before deterministic execution across chains.

RMN nodes reconstruct Merkle roots and bless matches, while curse mode pauses processing after finality or execution violations.

A U.S. patent application tied to

CryptoNewsFlash·01-02 10:31

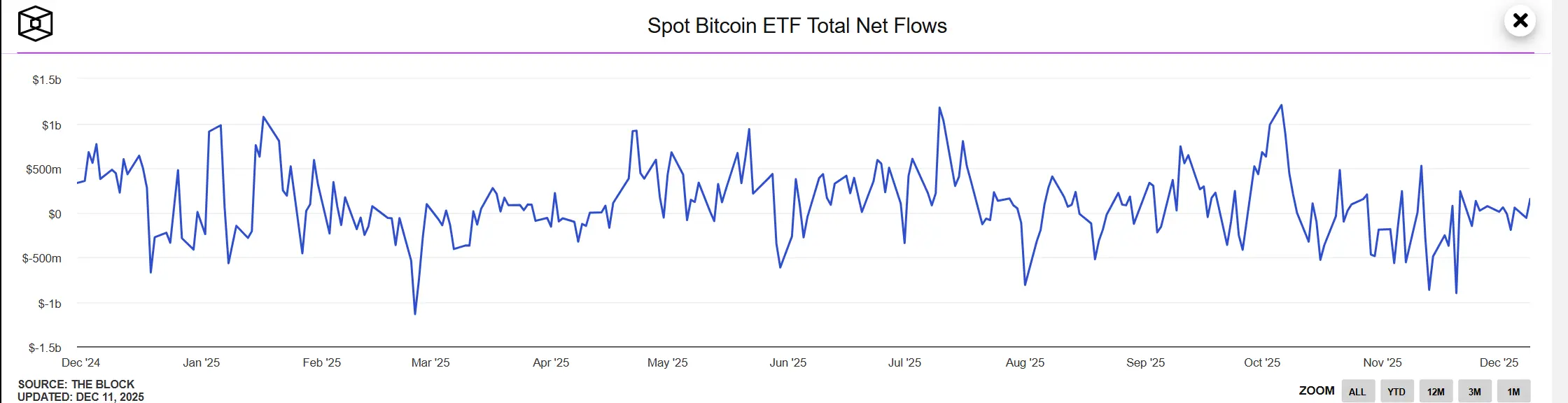

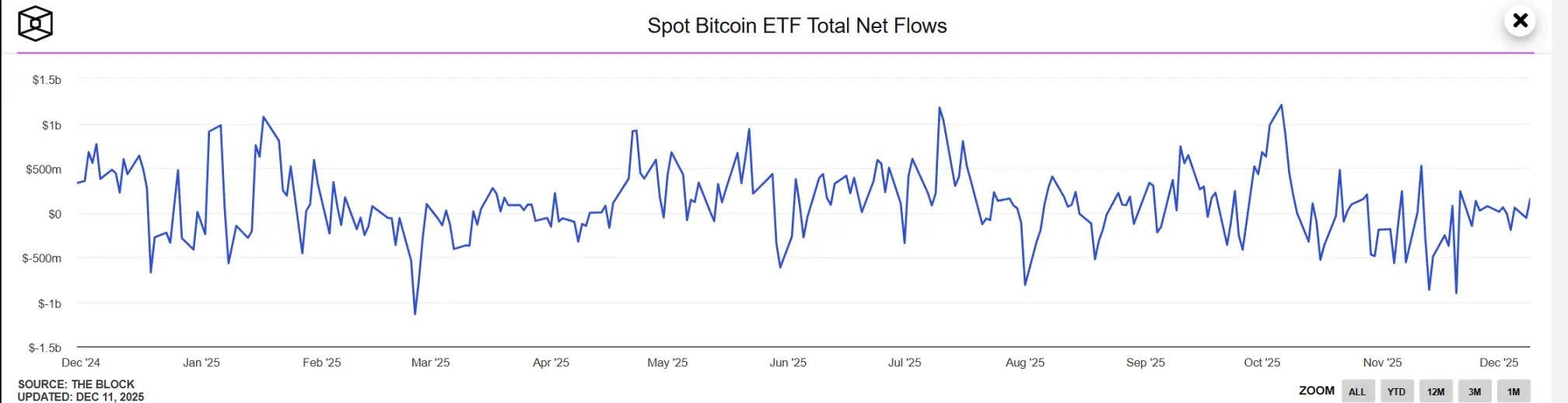

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·01-01 14:36

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-31 14:34

Cardano's Hoskinson Breaks Down 'New ADA' as NIGHT Jumps 23.89% This Week - U.Today

Midnight is officially in "price discovery" mode, and that alone is changing how people talk about Cardano's next chapter. With the early numbers being big enough to get people's attention — not just the Cardano loyalists, but anyone who sees new liquidity pop up fast — it is going to be hard to

UToday·2025-12-31 13:33

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-30 14:26

Can't beat the stock market, can't outperform precious metals, has Crypto truly become an outsider in the bull market?

Author: Nancy, PANews

Last night (December 29), Bitcoin once again experienced a "breakout" pattern. Faced with this oscillating and tug-of-war trend, the market's nerves seem to have long been numb.

Since Bitcoin's peak and its subsequent decline, it has been no more than three months, but investors seem to have been in the depths of winter for a long time. This psychological breakdown is not solely due to the decline in on-paper assets but also stems from shaken confidence, with stocks soaring, indices reaching new highs, and gold and silver surging...

Traditional assets are celebrating wildly, while crypto assets unexpectedly fall behind. Under this huge disparity, players are starting to vote with their feet—pessimism, cutting losses, and exiting en masse. The crypto market is falling into unprecedented survival anxiety.

Entering Purgatory Mode, trading activity drops to freezing point

Waiting and defensive strategies are becoming the main themes at the end of the year in the crypto market.

In fact, the market cap of stablecoins has quietly risen to an astonishing $300 billion.

BTC0,04%

PANews·2025-12-30 08:48

MICA Daily|Is the bullish trend just a shakeout before a rise? Last night, both bulls and bears were wiped out, with $150 million in positions liquidated

Yesterday was generally the first active trading day after the European and American Christmas holidays. Although market liquidity was still in holiday mode close to New Year's Eve, the cryptocurrency market at least broke out of the narrow range of USD, which had been oscillating around 88,000 USD. In the afternoon, it once surged past 90,000 USD, triggering nearly 110 million USD in short position liquidations. However, the rally didn't last long. Similar to the multiple ups and downs in December, the market fell back to 87,000 USD during the US market open, liquidating nearly 40 million USD in long positions, resulting in a classic long-short squeeze.

This strange pattern has been discussed several times before. Since the second half of the year, the crypto market has been dominated by this kind of "liquidation trend." As December progressed, this pattern became even more apparent. Due to the proximity to Christmas, some jokingly referred to this candlestick pattern as a "Christmas tree structure," which appeared frequently during the holiday period. However, due to the liquidity drying up in the crypto market,

区块客·2025-12-30 05:50

Will the 2026 crypto reserve winter arrive? The hoarding mode faces elimination, and most DAT companies may not survive.

After the market correction, the structural weaknesses of the DAT model have fully emerged. Relying solely on token accumulation is no longer sufficient to support valuation. Profitability, governance, and compliance standards have become critical tests for the industry's survival.

After the market downturn, the aftermath surfaces, and the DAT model shifts from a hot trend to an elimination race

------------------------

As the crypto market retreated from its 2025 peak, the rapidly expanding "Digital Asset Treasury" (DAT) companies are facing severe challenges. Several industry insiders point out that before 2026, the DAT industry is likely to undergo significant reshuffling, and most companies lacking substantial operational capabilities may struggle to survive.

Altan Tutar, co-founder and CEO of MoreMarkets, stated that in 2025, a large number of DAT companies emerged

CryptoCity·2025-12-30 02:05

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year’s double festival are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." U.S. Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the U.S. Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock’s IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity’s FBTC and Grayscale’s GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net inflow of $84.6 million the previous day.

区块客·2025-12-29 14:17

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-28 14:13

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-28 14:10

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-27 14:04

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-26 14:04

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-25 13:59

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

The Christmas and New Year holidays are approaching, and the crypto market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, following a previous day with $84.6 million

区块客·2025-12-24 13:47

Hyperliquid's Perfect PR Response to FUD: A Counterattack on Competitors' Centralization

In a high-stakes moment for decentralized perpetuals, Hyperliquid faced a technical exposé on December 20, 2025, via a blog post titled "Reverse Engineering Hyperliquid" on blog.can.ac. The article accused the platform of nine serious issues, from "insolvency" to a "God mode backdoor," labeling it a "centralized exchange masquerading as a blockchain."

CryptopulseElite·2025-12-24 05:54

TaskOn Brings White Label Services and CEX Mode in Latest Update

TaskOn v2.7 introduces a customizable White Label service for Web3 projects, allowing brands full control under their own domains. The update enhances user experience, integrates CEX competitions, and includes improved Boost and Quest systems for better engagement.

BlockChainReporter·2025-12-23 23:04

Bitcoin Falls Below $89K As Investors Turn to Coin Staking to Manage Risks

As the year comes to a close, Bitcoin slipping under the US$89,000 mark has put many investors back into waiting mode. Price swings are still happening, but a clear direction is harder to pin down, and taking big bets right now feels less convincing than it did earlier in the cycle. When markets

BlockChainReporter·2025-12-23 08:24

ASTER Slides Toward Yearly Low Amid New DEX Feature

ASTER trades below $0.91 support, signaling potential decline toward the $0.81 yearly low.

Shield Mode allows private, high-leverage trades, protecting users from frontrunning and MEV attacks.

Market outlook remains weak, with low demand and structural bearish pressure dominating

CryptoNewsLand·2025-12-23 07:41

Bitcoin Market Signals Bearish Calm Before Volatility Surge

Fewer active addresses and lower transactions suggest traders are in a wait-and-watch mode.

Early-week price moves can mislead traders, often reversing by week’s end.

Rising global liquidity may fuel Bitcoin’s next big rebound once market pressures ease.

Bitcoin traders face renewed

BTC0,04%

CryptoFrontNews·2025-12-22 22:13

Pi Network Service Suspended! Testnet2 Upgrade Freezes Wallets and Exchange Activities

Pi Network is upgrading Testnet2 to protocol v23, integrating Stellar Core v23 to support on-chain smart contracts, moving towards full mainnet functionality. During the upgrade, wallets will enter temporary maintenance mode, causing the entire ecosystem and exchange services to be temporarily suspended, and multiple CEXs have paused Pi-related operations. The core team has issued an early warning that this upgrade may temporarily impact services, including wallet access and trading activities.

PI0,02%

MarketWhisper·2025-12-18 07:54

In 2026, can the Meme King Pump.fun still tell a new story?

Despite the uncertainty, Pump remains one of the most resilient consumer applications in this cycle. This article is based on a piece by Simon, compiled, translated, and written by Deep潮 TechFlow.

(Background: The most profitable applications in the crypto world are starting to slack off, is there still hope for Pump.fun?)

(Additional context: Pump.fun's $170 million buyback and "chaos mode" still struggle to dominate the entire Meme market)

The following content is excerpted from Delphi's upcoming "2026 Application Outlook Report," focusing on Pump (.) fun — one of the consumer applications we are most interested in next year.

Since we released the initial Pump report (before its funding), many things have changed. Many of the dynamics we predicted have been validated, but some areas have not yet reached

動區BlockTempo·2025-12-17 18:25

The three major storms in the crypto world are coming at the end of 2025

By the end of 2025, the crypto world enters a "stormy mode": Bitcoin plummets, institutions buy more against the trend, major breakthroughs in US regulation, Asian exchanges successfully go public, and even some countries start using cryptocurrencies to fund national income. This series of events has changed market expectations and also laid a huge foundation for the crypto market in 2026.

1. Bitcoin falls below $90,000: Market sentiment rapidly shifts to "panic"

In the past two weeks, Bitcoin has been declining to below $90,000, and investor sentiment has deteriorated sharply. Many traders believe the market may remain sluggish until the end of the year, but several analysis agencies point out:

- This decline is not caused by an industry crisis

- Mainly due to a decrease in global macro market risk appetite

- Large funds are still on the sidelines watching low-price opportunities

Some institutions even predict: 2025 may become the fourth "annual decline" in BTC history.

2. However, institutions are starting to "quietly buy in" at this time

Market

BTC0,04%

金色财经_·2025-12-17 13:40

Taiwan Multi-Chain Wallet Blocto Announces Shutdown: Users Must Withdraw Liquidity and Export Private Keys by 12/19

Taiwan Multi-Chain Wallet, Blocto, founded by "Portto," announced that due to operational funding exhaustion, it will cease operations on Taiwan time 12/19 (Friday).

(Background: The Blocto wallet completed Series A funding with a valuation of 80 million USD, led by Mark Cuban)

(Additional background: Flow has shifted to DeFi, the former NFT top-tier's confidence and dilemma)

Table of Contents

An end of an era: Important announcement about Blocto's future

Difficult realities

Service changes and necessary actions

⚠️ Necessary actions before December 18, 2025, 7:00 PM PST:

⚠️ Custodial mode (Custodial

FLOW2,54%

動區BlockTempo·2025-12-17 01:50

Aster rolls out Shield Mode focused on private high-leverage trades

Aster has introduced a new trading feature aimed at traders who want speed and leverage without exposing their positions to the market.

Summary

Aster launched Shield Mode on Dec. 15, offering private BTC and ETH perp trading with leverage up to 1001x.

Trades execute instantly with zero

Cryptonews·2025-12-16 04:06

2025 Bitcoin Market Forecast Highlights: Why Are Institutions Collapsing Collectively

At the beginning of 2025, the Bitcoin (BTC) market was filled with rampant optimism, with institutions and analysts collectively betting that the year-end price would surge to over $150,000, or even head towards $200,000+ or higher. However, reality unfolded a different story: BTC plummeted more than 33% from its peak of approximately $126,000 in early October, entered a "bloodbath" mode in November (a monthly decline of 28%), and as of December 10th, the current price stabilized in the $92,000 range.

This collective crash warrants an in-depth review: Why was the early-year prediction so unanimously optimistic? Why did almost all mainstream institutions get it wrong?

1. Early-Year Predictions vs. Current Situation Comparison

1.1 The Three Pillars of Market Consensus

At the beginning of 2025, the Bitcoin market was engulfed in unprecedented optimism. Almost all mainstream institutions set a year-end target price of over $150,000, with some...

BTC0,04%

PANews·2025-12-15 12:06

2025 Bitcoin Market Forecast Highlights: Why Are Institutions Collapsing Collectively

Author: Nikka, WolfDAO

At the beginning of 2025, the Bitcoin (BTC) market was filled with wild optimism, with institutions and analysts collectively betting that the year-end price would soar above $150,000, possibly heading towards $200,000+ or higher. However, reality played out a "counter" drama: BTC plummeted over 33% from its peak of approximately $126,000 in early October, entered a "bloodbath" mode in November (a 28% decline in a single month), and as of December 10th, the current price stabilizes around the $92,000 range.

This collective crash warrants an in-depth review: Why were the early predictions so consistent? Why did almost all mainstream institutions get it wrong?

1. Early Predictions vs. Current Situation

1.1 The Three Pillars of Market Consensus

At the beginning of 2025, the Bitcoin market was infused with unprecedented optimism. Almost all mainstream institutions

金色财经_·2025-12-15 11:27

Hassett insists on Fed’s independence as Trump backs “two Kevins” for top job

Kevin Hassett defends Fed independence as Trump weighs him and Kevin Warsh for chair, prediction markets shift, and fresh rate cuts keep crypto in wait-and-see mode.

Summary

Kevin Hassett, now a leading Fed chair contender, says Trump's views would only matter if backed by data, stressing

Cryptonews·2025-12-15 07:36

Sorry Gooners: OpenAI's Erotic ChatGPT Delayed Into 2026

In brief

OpenAI has delayed its adult content mode to early 2026, missing a December launch target set by CEO Sam Altman.

The holdup centers on an AI age-prediction system meant to protect minors without misclassifying adults.

The delay frustrates users as rivals already allow NSFW

Decrypt·2025-12-12 17:42

Tangem Wallet integrates Aave for stablecoin yield

Tangem Wallet now lets users earn Aave yield on USDT, USDC and DAI inside the app, with hardware security, simple setup and no need for external dApps.

Summary

Tangem Wallet now offers Aave-backed yield through Yield Mode.

Users can earn on USDT, USDC and DAI without leaving the app.

Cryptonews·2025-12-12 04:30

Aster DEX Accelerates $ASTER Buybacks Amid Rising Trading Volume and Growth

Aster completed a 155.72M $ASTER buyback, burning half and allocating the rest to long-term rewards for traders.

The exchange recorded $5.79 billion in 24-hour perpetual trading, securing second place among top decentralized exchanges.

Upcoming updates include Shield Mode, TWAP orders, Aster

ASTER-2,96%

CryptoFrontNews·2025-12-09 21:46

Google Galaxy XR Ecosystem Debuts: Device Updates, AI Glasses, and Project Aura at a Glance

At "The Android Show: XR Edition" held by Google on 12/9, new features for the Galaxy XR headset were announced, including PC Connect, Travel Mode, and Likeness, enhancing the daily user experience. Additionally, AI glasses developed in partnership with collaborators were introduced, as well as XREAL's Project Aura wired XR glasses. Developer tools were also updated to promote richer XR application development.

ChainNewsAbmedia·2025-12-09 08:54

Binance Futures will launch the POWERUSDT perpetual contract with up to 20x leverage.

Mars Finance News: According to the official announcement, Binance Futures will launch the POWERUSDT perpetual contract at 09:00 (UTC) on December 6, 2025, with up to 20x leverage. This contract supports the Multi-Asset Mode and will be included in Binance Futures’ new listing fee promotion. Futures copy trading will be available within 24 hours of the contract launch.

MarsBitNews·2025-12-06 08:17

In-depth Analysis of How Aztec Achieves "Programmable Privacy"

Author: Zhixiong Pan

In the second decade of blockchain technology development, the industry is facing a fundamental philosophical and technical paradox: while Ethereum has successfully established itself as a trustless value settlement layer as the "World Computer," its radical transparency is evolving into an obstacle to mass adoption. Currently, every on-chain user interaction, asset allocation, payroll flow, and even social relationship is exposed in a permanent, immutable public panopticon. This "glass house" mode of existence not only infringes on individual sovereignty but also excludes the vast majority of institutional capital due to the lack of protection for trade secrets.

The year 2025 marks a decisive turning point in industry consensus. Ethereum co-founder Vitalik Buterin has explicitly stated that "privacy is not a feature, but a hygiene factor," defining it as the foundation of freedom and a necessary condition for social order. Just as the internet evolved from plaintext transmis

金色财经_·2025-12-05 08:50

Nof1 AI Trading Competition: Mysterious Model Profits Exceed 46.48%, GROK 4 Situational Awareness Model Losses Widen to 92.23%

According to Mars Finance, data from Alpha Arena shows that 7 models are currently profitable in the new season of the nof1 trading competition. They are: MYSTERY-MODEL - 3: SITUATIONAL AWARENESS (46.48%), DEEPSEEK-CHAT-V3.1 - 2: MONK MODE (24.7%), GPT-5.1 - 4: MAX LEVERAGE (19.69%), MYSTERY-MODEL - 1: NEW BASELINE (16.7%), MYSTERY-MODEL - 4: MAX LEVERAGE (6.21%), GEMINI-3-PRO - 2: MONK MODE (2.52%), and MYSTER

MarsBitNews·2025-12-05 07:56

Carry trade approaches "the eve before the final chapter": abnormal fluctuations in Japanese interest rates trigger global rebalancing

On December 4, 2025, Japan's government bond market suddenly entered an abnormal state. The 30-year yield broke through its all-time high of 3.445% in one fell swoop, the 20-year government bond returned to levels last seen at the end of the last century, and the 10-year yield, which serves as the policy anchor, also rose to 1.905%, marking the first time it has reached this range since 2007.

Surprisingly, this loss of control over long-term rates was not triggered by a sudden change in macro data, but rather by the market's accelerated pricing of a rate hike at the Bank of Japan's meeting on the 18th to 19th of this month.

Currently, the implied probability of a rate hike in interest rate derivatives has climbed to over 80%, with market sentiment entering a "countdown mode" ahead of the official policy statements.

The Invisible Channel of YCC: The Yen Engine Behind Global Liquidity

To understand this round of turmoil, we still need to return to the Bank of Japan's core policy framework of the past decade—Yield Curve Control (YCC). Since 2016, the Bank of Japan has adopted an extremely

PANews·2025-12-05 01:07

Aster DEX Unveils Its 2026 H1 Roadmap - Coinspeaker

Key Notes

Key upcoming developments include Shield Mode, an RWA upgrade, and the Aster Chain testnet.

The DEX also plans to launch a Layer-1 chain along with developer tools, fiat on/off-ramps, staking, governance, and more features.

Analysts expect a potential ASTER price breakout, with the ne

ASTER-2,96%

Coinspeaker·2025-12-04 14:15

From Sahara to Tradoor: A Look at Recent "Creative Downtrend" Tactics in Altcoins

Airdrops turn into "shorts," with project benefits becoming cash machines for insiders. From Sahara AI and aPriori to Irys and Tradoor, newly launched altcoins have been crashing one after another—halving in a single day, dropping more than 80%, and airdrops being heavily dumped, casting a shadow of decline over the crypto space.

(Previous context: Meteora airdrop trust disaster: 4 whales grabbed 28.5%, over 60,000 retail investors only shared 7%)

(Background supplement: Why are ICOs dominating on-chain fundraising again? The three underlying logics defeating airdrops)

Airdrops turn into "shorts," with project benefits becoming cash machines for insiders. Although the market has warmed up somewhat recently, the crypto world has still been shrouded in a lingering gloom since the "1011 crash." What's particularly notable is that a batch of newly launched altcoins seem to have all been switched to "decline mode," repeatedly experiencing dramatic crashes: halving in a single day, dropping more than 8

動區BlockTempo·2025-12-04 06:35

CryptoQuant Observes MicroStrategy Shifting to Defense: Preparing for Bitcoin Bear Market, Potential Drop to $70,000 Range

On-chain data firm CryptoQuant believes that MicroStrategy's recent establishment of a $1.44 billion cash reserve indicates the company has entered defense mode, signaling that Bitcoin is shifting towards a bear market. As buying slows, analysts estimate that Bitcoin may trade in the $55,000 to $70,000 range over the next year. However, CEO Ki Young Ju emphasized that this downturn will not repeat the massive crash of 2022.

Is MicroStrategy switching from offense to defense? CryptoQuant: Establishing a USD reserve signals market downturn

A few days ago, MicroStrategy announced the establishment of a $1.44 billion USD reserve to pay preferred share dividends and debt interest.

CryptoQuant pointed out that this means the company is taking a more conservative outlook on the future market, no longer relying on continuous stock issuance to purchase Bitcoin, but instead prioritizing securing one to

BTC0,04%

ChainNewsAbmedia·2025-12-04 05:54

A History of Privacy Development in the Crypto Field

Written by: milian

Translated by: AididiaoJP, Foresight News

Every major technological wave begins with specialized or single-user groups, and only later develops into general-purpose or multi-user ones.

Early computers could only do one thing at a time: cracking codes, processing census data, calculating ballistic trajectories. It was much later that they became shareable, programmable machines.

The internet started off as a small peer-to-peer research network (ARPANET), and only later evolved into a global platform, enabling millions to collaborate in a shared environment.

Artificial intelligence follows the same path: early systems were narrow expert models, built for a single field (chess engines, recommendation systems, spam filters), and only later evolved into general-purpose models that could work across domains, be fine-tuned for new tasks, and serve as a shared foundation for others to build applications on.

Technology always begins in a narrow or single-user mode,

DeepFlowTech·2025-12-04 02:29

Mistral Unveils Mistral 3: Next-Gen Open-Source Models For Enterprise And Edge AI

In Brief

Mistral just released Mistral 3, a new family of 10 open-weight models, designed to run on everything from consumer cloud to laptops, drones, and robots.

AI startup Mistral has unveiled Mistral 3, the latest generation of its models, featuring three compact, high-performance dense mode

MpostMediaGroup·2025-12-03 13:46

Load More