Search results for "PNL"

Holding XRP Got Painful: Treasury Data Shows Heavy Losses

XRP holders have had another rough stretch, and the latest on-chain view makes that pain easy to see. XRP is down around 3% this week and still trades below $1.90. Price action has stayed heavy, and every bounce has struggled to stick.

A CryptoQuant chart tracking Evernorth’s unrealized PnL adds

XRP-6,46%

CaptainAltcoin·2025-12-24 16:35

Data: Hyperliquid platform Whale current Holdings 4.167 billion USD, long-short position ratio is 0.89

According to Mars Finance, data from Coinglass shows that the whale on the Hyperliquid platform currently has Holdings of 4.167 billion USD, with long order Holdings of 1.964 billion USD, accounting for 47.13% of total Holdings, and short order Holdings of 2.203 billion USD, accounting for 52.87%. The unrealized PNL for long orders is -204 million USD, while for short orders it is 351 million USD. Among them, the Whale Address 0x9eec..ab has gone long on ETH with 15x leverage at a price of 3201.03 USD, currently experiencing an unrealized PNL of -20.8178 million USD.

ETH-3,33%

MarsBitNews·2025-12-02 08:20

Data: Hyperliquid platform Whale current Holdings 4.395 billion USD, long-short Holdings ratio is 0.9

According to Mars Finance news, data from Coinglass shows that the whale on the Hyperliquid platform currently has Holdings of 4.395 billion USD, with long orders amounting to 2.085 billion USD, accounting for 47.43% of the Holdings, and short orders amounting to 2.31 billion USD, accounting for 52.57% of the Holdings. The unrealized PNL of long orders is -112 million USD, and the unrealized PNL of short orders is 242 million USD. Among them, the Whale Address 0x9eec..ab has gone long on ETH with a 15x full position at a price of 3201.03 USD, currently having an unrealized PNL of -8.5827 million USD.

ETH-3,33%

MarsBitNews·2025-11-29 02:44

Bitcoin Whale Places $84M Leveraged Long After Posting $10M PnL

A major Bitcoin whale has stunned the market with a bold $84.19 million leveraged long position on Hyperliquid. The trade uses 3x cross leverage and came just hours after the same wallet reportedly locked in over $10 million in realized profit.

On-chain data shows the position entered near the $91,

BTC-2,45%

Coinfomania·2025-11-28 08:23

Data: Hyperliquid platform Whale current Holdings 4.355 billion USD, long-short Holdings ratio is 0.91

According to Mars Finance, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of $4.355 billion, with long order Holdings of $2.08 billion, accounting for 47.77% of the total, and short order Holdings of $2.275 billion, accounting for 52.23%. The unrealized PNL for long orders is -$120 million, and for short orders, it is $256 million. Among them, the Whale Address 0x9eec..ab has gone long on ETH with a 15x full position at a price of $3,201.03, currently having an unrealized PNL of -$10.6298 million.

ETH-3,33%

MarsBitNews·2025-11-28 02:34

Data: Hyperliquid platform Whale current Holdings 4.321 billion USD, long-short Holdings ratio is 0.9

The Whale on the Hyperliquid platform currently has holdings of $4.321 billion, with long orders accounting for 47.31% and an unrealized PNL of -$144 million, while short orders account for 52.69% with a profit of $275 million. Among them, Whale Address 0x9eec..ab has a 15x full position go long on ETH at a price of $3201.03, with an unrealized PNL of -$13.4359 million.

ETH-3,33%

MarsBitNews·2025-11-26 08:03

Data: Hyperliquid platform Whale current Holdings 5.35 billion USD, long to short ratio is 0.89

According to Mars Finance news and Coinglass data, the Whale on the Hyperliquid platform currently has Holdings of 5.35 billion USD, with a long order of 2.521 billion USD, accounting for 47.12% of Holdings, and a short order of 2.829 billion USD, accounting for 52.88%. The unrealized PNL for long orders is -181 million USD, while for short orders, it is 274 million USD. Among them, the Whale Address 0x9eec..ab has a 15x full position go long on ETH at a price of 3219.98 USD, with current unrealized PNL of -7.1365 million USD.

ETH-3,33%

MarsBitNews·2025-11-19 13:04

Data: Hyperliquid platform Whale current Holdings 5.595 billion USD, long-short position ratio is 0.88

According to Mars Finance news, Coinglass data shows that the Whale on the Hyperliquid platform currently has Holdings of $5.595 billion, with long orders amounting to $2.615 billion, accounting for 46.75% of the holdings, and short orders amounting to $2.979 billion, accounting for 53.25%. The unrealized PNL for long orders is -$144 million, while for short orders it is $213 million. Among them, the Whale address 0x9eec..ab has a 15x full margin long order on ETH at a price of $3,243.65, currently with an unrealized PNL of -$3.9619 million.

ETH-3,33%

MarsBitNews·2025-11-16 14:16

Data: Hyperliquid platform Whale current Holdings 5.319 billion USD, long to short position ratio is 0.86

According to Mars Finance news and Coinglass data, the whale's current holdings on the Hyperliquid platform amount to 5.319 billion USD, with long orders at 2.455 billion USD, accounting for 46.15% of the holdings, and short orders at 2.864 billion USD, accounting for 53.85% of the holdings. The unrealized PNL for long orders is -183 million USD, while for short orders it is 275 million USD. Among them, the whale address 0x5b5d..60 is shorting ETH with a 10x leverage at a price of 3533.74 USD, currently having an unrealized PNL of 15.7825 million USD.

ETH-3,33%

MarsBitNews·2025-11-14 07:41

Data: Hyperliquid platform Whale current Holdings 5.377 billion USD, long-short Holdings ratio is 0.81

According to Mars Finance news, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of $5.377 billion, with long orders of $2.413 billion, accounting for 44.87% of Holdings, and short orders of $2.964 billion, accounting for 55.13%. The unrealized PNL for long orders is -$109 million, and for short orders, it is $197 million. Among them, the Whale Address 0x5b5d..60 is shorting ETH with a 10x full position at a price of $3533.75, currently with an unrealized PNL of $5.7019 million.

ETH-3,33%

MarsBitNews·2025-11-13 02:29

Data: Hyperliquid platform Whale current Holdings 5.336 billion USD, long-short position ratio is 0.81

According to Mars Finance, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of $5.336 billion, with long order Holdings of $2.382 billion, accounting for 44.64% of the total Holdings, and short order Holdings of $2.954 billion, accounting for 55.36%. The unrealized PNL for long orders is -$89.0541 million, while for short orders it is $17.5 million. Among them, the Whale Address 0x5b5d..60 is shorting ETH at a price of $3533.78 with 10x leverage, currently having an unrealized PNL of $5.0451 million.

ETH-3,33%

MarsBitNews·2025-11-12 07:44

Data: Hyperliquid platform Whale current Holdings 6.001 billion USD, long-short position ratio is 0.86

According to Coinglass data, the total Whale Holdings on the Hyperliquid platform amount to $6.001 billion, with long orders and short orders accounting for 46.29% and 53.71%, respectively. The profit and loss for long orders is $12.8721 million, while for short orders it is $59.4238 million. A certain Whale Address has shorted ETH with a full position at a price of $3,532.98, and the current unrealized PNL is -$2.6664 million.

ETH-3,33%

MarsBitNews·2025-11-11 02:23

Data: Hyperliquid platform Whale current Holdings 5.868 billion USD, long-short position ratio is 0.87

According to Coinglass data, the Whale Holdings on the Hyperliquid platform reached $5.868 billion, with long orders accounting for 46.44% and short orders accounting for 53.56%. The Whale is shorting ETH at a price of $3530.47, currently having an unrealized PNL of -$5.4089 million.

ETH-3,33%

MarsBitNews·2025-11-10 03:04

Data: Hyperliquid platform Whale current Holdings 5.365 billion USD, long-short position ratio is 0.82

According to Coinglass data, the whale holdings on the Hyperliquid platform reached $5.365 billion, with long orders accounting for 44.94% and short orders accounting for 55.06%. Long orders are currently at a loss of $81.6222 million, while short orders are profitable by $194 million. Whale address 0x5b5d..60 shorted ETH with full margin at the price of $3527.73, with unrealized PNL of $9.4268 million.

ETH-3,33%

MarsBitNews·2025-11-07 07:39

Data: Hyperliquid platform Whale current Holdings 5.88 billion USD, long-short position ratio is 0.88

According to Mars Finance, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of $5.88 billion, with long orders totaling $2.75 billion, accounting for 46.77% of the Holdings, and short orders totaling $3.13 billion, accounting for 53.23%. The unrealized PNL for long orders is -$64.1953 million, while the unrealized PNL for short orders is $16.6 million. Among them, Whale Address 0x5b5d..60 shorted ETH with 10x leverage at a price of $3527.78, currently having an unrealized PNL of $625.81 thousand.

ETH-3,33%

MarsBitNews·2025-11-06 02:24

Data: Hyperliquid platform Whale current Holdings 5.5 billion USD, long to short position ratio is 0.82

According to Mars Finance news and Coinglass data, the Whale on the Hyperliquid platform currently has Holdings of 5.5 billion USD, with long order Holdings of 2.48 billion USD, accounting for 45.09% of the Holdings, and short order Holdings of 3.02 billion USD, accounting for 54.91%. The unrealized PNL for long orders is -210 million USD, while for short orders it is 300 million USD. Among them, the Whale Address 0x5b5d..60 has shorted ETH with a 10x full margin at a price of 3531.53 USD, currently having an unrealized PNL of 2.6602 million USD.

ETH-3,33%

MarsBitNews·2025-11-04 07:47

Data: Hyperliquid platform Whale current Holdings 6.409 billion USD, long-short Holdings ratio is 0.83

According to Coinglass data, the total Whale Holdings on the Hyperliquid platform is $6.409 billion, with long orders accounting for 45.26% and short orders accounting for 54.74%. The current unrealized PNL for long orders is -$136 million, while for short orders it is $157 million. The Whale Address 0x5b5d..60 shorted the entire position when the ETH price was $3531.51, with an unrealized PNL of -$11.9588 million.

ETH-3,33%

MarsBitNews·2025-11-03 07:40

Data: Hyperliquid platform Whale current Holdings 6.722 billion USD, long to short position ratio is 0.83

According to Coinglass data, the Whale holdings on the Hyperliquid platform amount to $6.722 billion, with long orders accounting for 45.49% and short orders accounting for 54.51%. The Whale has shorted ETH with a full position at $3,531.45, with an unrealized PNL of -$20.4575 million.

ETH-3,33%

MarsBitNews·2025-11-01 08:56

Data: Hyperliquid platform Whale current Holdings 7.377 billion USD, long-short Holdings ratio is 0.85

According to Mars Finance, data from Coinglass shows that the current Whale Holdings on the Hyperliquid platform is $7.377 billion, with long orders amounting to $3.386 billion, accounting for 45.89% of the holdings, and short orders amounting to $3.992 billion, accounting for 54.11%. The unrealized PNL for long orders is $51.8305 million, while for short orders it is -$80.7957 million. Among them, the Whale Address 0x5b5d..60 has shorted ETH with 10x leverage at a price of $3,455.27, currently having an unrealized PNL of -$23.6881 million.

ETH-3,33%

MarsBitNews·2025-10-30 08:05

Data: Hyperliquid platform Whale current Holdings 6.847 billion USD, long-short ratio is 0.84

According to Mars Finance, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of 6.847 billion USD, with long order Holdings of 3.134 billion USD, accounting for 45.77% of the Holdings, and short order Holdings of 3.713 billion USD, accounting for 54.23%. The unrealized PNL for long orders is 56.9048 million USD, and for short orders, it is -98.2945 million USD. Among them, the Whale Address 0x5b5d..60 is shorting ETH with a 10x full margin at a price of 3455.17 USD, currently having an unrealized PNL of -29.0546 million USD.

ETH-3,33%

MarsBitNews·2025-10-29 08:14

Data: Hyperliquid platform Whale current Holdings 7.013 billion USD, long-short ratio is 0.89

According to Mars Finance news and Coinglass data, the current whale holdings on the Hyperliquid platform are 7.013 billion USD, with long order holdings of 3.294 billion USD, accounting for 46.97% of the total, and short order holdings of 3.719 billion USD, accounting for 53.03%. The profit and loss for long orders is 153 million USD, while for short orders it is -193 million USD. Among them, the whale address 0x5b5d..60 shorted ETH with 10x leverage at a price of 3453.45 USD, currently having an unrealized PNL of -38.1502 million USD.

ETH-3,33%

MarsBitNews·2025-10-27 08:09

Data: Hyperliquid platform Whale current Holdings 6.34 billion USD, long-short position ratio is 0.86

Mars Finance reports that the Hyperliquid platform's Whale Holdings amount to $6.34 billion, with long orders accounting for 46.29% and short orders for 53.71%. The profit and loss for long orders is $25.0791 million, while the profit and loss for short orders is -$40.4472 million. Whale address 0x5b5d..60 shorted ETH at $3453.36, currently having an unrealized PNL of -$23.9042 million.

ETH-3,33%

MarsBitNews·2025-10-26 03:23

Data: Hyperliquid platform Whale current Holdings 5.709 billion USD, long to short position ratio is 0.85

According to Mars Finance, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of 5.709 billion USD, with long order Holdings of 2.618 billion USD, accounting for 45.86% of the Holdings, and short order Holdings of 3.091 billion USD, accounting for 54.14%. The unrealized PNL for long orders is -8.2549 million USD, and for short orders, it is 2.8154 million USD. Among them, the Whale Address 0x5b5d..60 has made a 10x full-margin shorting of ETH at a price of 3453.36 USD, currently with unrealized PNL of -25.2692 million USD.

ETH-3,33%

MarsBitNews·2025-10-24 08:26

Data: Hyperliquid platform Whale current Holdings 4.971 billion USD, long to short position ratio is 0.83

According to Mars Finance, data from Coinglass shows that the Hyperliquid platform's Whales currently have Holdings of 4.971 billion USD, with long orders of 2.25 billion USD, accounting for 45.26% of the Holdings, and short orders of 2.722 billion USD, accounting for 54.74%. The PNL for long orders is -54.3168 million USD, while the PNL for short orders is 68.0892 million USD. Among them, Whale Address 0x5b5d..60 is shorting ETH with a 10x full position at a price of 3442.49 USD, currently having an unrealized PNL of -21.6497 million USD.

ETH-3,33%

MarsBitNews·2025-10-23 08:53

Data: Hyperliquid platform Whale current Holdings 5.212 billion USD, long-short position ratio is 0.84

According to Mars Finance, the whale holdings on the Hyperliquid platform have reached 5.212 billion USD, with the ratio of long orders and short orders being close, at 45.63% and 54.37% respectively. Currently, the long orders are losing nearly 97 million USD, while the short orders are making a profit of 128 million USD. A whale address is shorting BTC with 10x leverage, and the current unrealized PNL is 6.02 million USD.

BTC-2,45%

MarsBitNews·2025-10-22 02:30

Data: Hyperliquid platform Whale current Holdings 5.023 billion USD, long-short position ratio is 0.84

Currently, the Whale Holdings on the Hyperliquid platform amount to $5.023 billion, with long orders accounting for 45.76% and short orders for 54.24%. The shorting PNL is $191 million, while the long order PNL is -$136 million. The Whale address 0x5b5d..60 is shorting ETH with a full position at a price of $3441.74, with unrealized PNL of -$17.5933 million.

ETH-3,33%

MarsBitNews·2025-10-17 13:18

Data: Hyperliquid platform Whale current Holdings 5.282 billion USD, long-short ratio is 0.81

According to Mars Finance, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of $5.282 billion, with long order Holdings of $2.366 billion, accounting for 44.79% of the Holdings, and short order Holdings of $2.916 billion, accounting for 55.21%. The unrealized PNL for long orders is -$18.3721 million, and for short orders it is $9.7955 million. Among them, the Whale address 0x5b5d..60 has shorted ETH with 10x leverage at a price of $3441.59, currently with an unrealized PNL of -$36.2282 million.

ETH-3,33%

MarsBitNews·2025-10-16 13:23

Data: Hyperliquid platform Whale current Holdings 5.289 billion USD, long-short Holdings ratio is 0.81

According to Mars Finance news and Coinglass data, the Whale on the Hyperliquid platform currently has Holdings of 5.289 billion USD, with long order Holdings of 2.361 billion USD, accounting for 44.64% of the total Holdings, and short order Holdings of 2.928 billion USD, accounting for 55.36%. The unrealized PNL for long orders is 1.3236 million USD, while the unrealized PNL for short orders is -18.6134 million USD. Among them, Whale Address 0x5b5d..60 has shorted ETH at a price of 3441.59 USD with 10x leverage, currently with an unrealized PNL of -40.1658 million USD.

ETH-3,33%

MarsBitNews·2025-10-15 13:26

You treat Polymarket as a casino, but smart money is crazily arbitraging with it.

For those who know how to really make money on Polymarket, this is a golden age. Most people treat Polymarket like a casino, while smart money sees it as an arbitrage tool. (Background: The parent company of the NYSE invested $2 billion in Polymarket, what is the real intention?) (Context: Swinging between losses and gains, Polymarket has taught me a lesson) After securing a $2 billion investment, Polymarket is valued at $9 billion, which is one of the highest funding amounts obtained by projects in the Crypto space in recent years. In the context of increasing rumors about IPO + IDO + Airdrop, let's first take a look at an interesting piece of data: If your PNL exceeds $1,000, you can enter the TOP 0.51% of Wallets;

動區BlockTempo·2025-10-15 09:32

Data: Hyperliquid platform Whale current Holdings 5.365 billion USD, long-short Holdings ratio is 0.81

According to Mars Finance news, Coinglass data shows that the Hyperliquid platform Whale currently has Holdings of 5.365 billion USD, with long order Holdings of 2.399 billion USD, accounting for 44.71% of Holdings, and short order Holdings of 2.966 billion USD, accounting for 55.29%. The unrealized PNL for long orders is -64.468 million USD, while the unrealized PNL for short orders is 94.3514 million USD. Among them, Whale Address 0xb317..ae has shorted BTC with a 10x full margin at a price of 115288.4 USD, currently having an unrealized PNL of 19.6466 million USD.

BTC-2,45%

MarsBitNews·2025-10-14 13:19

Data: Hyperliquid platform Whale current Holdings 5.539 billion USD, long-short position ratio is 0.84

According to Mars Finance news and Coinglass data, the current whale holdings on the Hyperliquid platform amount to 5.539 billion USD, with long order holdings of 2.53 billion USD, accounting for 45.67% of the holdings, and short order holdings of 3.01 billion USD, accounting for 54.33%. The unrealized PNL for long orders is 29.3439 million USD, while for short orders it is -18.6032 million USD. Among them, the whale address 0x5b5d..60 shorted ETH at a price of 3441.35 USD with 10x leverage, currently having an unrealized PNL of -40.5379 million USD.

ETH-3,33%

MarsBitNews·2025-10-13 13:35

Top Hyperliquid Trader Shorts Bitcoin at $110K, Betting on Market Reversal

One of the highest-ranking traders by profit and loss (PnL) on Hyperliquid, one of the fastest-growing decentralized perpetual futures exchanges, has gone short of 1163K USD of Bitcoin (BTC) at a price of 110,297.00. The total short of the trader currently is of 11.93K and the average entry price of

Coinfomania·2025-10-11 09:44

Data: Hyperliquid platform Whale current Holdings 10.951 billion USD, long to short position ratio is 0.83

According to Mars Finance, data from Coinglass shows that the current holdings of whales on the Hyperliquid platform amount to 10.951 billion USD, with long order holdings at 4.98 billion USD, accounting for 45.47% of the total holdings, and short order holdings at 5.971 billion USD, accounting for 54.53%. The unrealized PNL for long orders is -55.75 million USD, and for short orders it is -12 million USD. Among them, the whale address 0xb317..ae has shorted BTC with 6 times leverage at a price of 120689.3 USD, currently having an unrealized PNL of -3.3971 million USD.

BTC-2,45%

MarsBitNews·2025-10-10 02:09

Data: Hyperliquid platform Whale current Holdings 11.053 billion USD, long-short Holdings ratio is 0.85

According to Mars Finance, Coinglass data shows that the Whale on the Hyperliquid platform currently has Holdings of $11.053 billion, with long order Holdings of $5.089 billion, accounting for 46.05% of the total Holdings, and short order Holdings of $5.963 billion, accounting for 53.95%. The unrealized PNL for long orders is $159 million, while for short orders it is -$434 million. Among them, the Whale Address 0x5b5d..60 has shorted ETH with a 10x full margin at a price of $3439.28, currently having an unrealized PNL of -$87.8913 million.

ETH-3,33%

MarsBitNews·2025-10-07 08:54

Data: Hyperliquid platform Whale current Holdings 11.094 billion USD, long-short position ratio is 0.85

Hyperliquid platform Whale Holdings reach 11.094 billion USD, of which long orders account for 46.06% and short orders account for 53.94%. The profit and loss of long orders is 143 million, the profit and loss of short orders is -394 million, and a specific Whale shorted the entire position at a BTC price of 111,465.4 USD, with unrealized PNL of -32.9708 million USD.

BTC-2,45%

MarsBitNews·2025-10-06 03:07

Data: Hyperliquid platform Whale current Holdings 10.441 billion USD, long-short Holdings ratio is 0.86

The Hyperliquid platform shows that the Whale Holdings are $10.441 billion, with long order and short order ratios of 46.36% and 53.64%, respectively. The long order PNL is $172 million, and the short order PNL is -$419 million, with one Address fully shorting ETH at a price of $3439.28, resulting in an unrealized PNL of -$74.9419 million.

ETH-3,33%

MarsBitNews·2025-10-04 09:04

Data: Hyperliquid platform Whale current Holdings 10.076 billion USD, long-short Holdings ratio is 0.87

According to Coinglass data, the Whale Holdings on the Hyperliquid platform reached $10.076 billion, with long orders and short orders accounting for 46.59% and 53.41%, respectively. The unrealized PNL for long orders is $127 million, while the unrealized PNL for short orders is -$359 million, and the Whale Address is shorting ETH with 10x leverage, currently having an unrealized PNL of -$72.1366 million.

ETH-3,33%

MarsBitNews·2025-10-03 08:16

Whale Trader Confirms $1.24M ETH Short on Hyperliquid, Liquidation Set at $7,964.80

One of the leading Profit-and-Loss traders in Hyperliquid had placed a new short on Ethereum in the amount of 10,350 at 4,144.20. This increased the overall exposure of the trader to a short of 1.24 million dollars, and an average entry of 4,147.87. The trade is so noticeable due to the PnL

ETH-3,33%

Coinfomania·2025-10-01 06:59

Data: Hyperliquid platform Whale current Holdings is 9.681 billion USD, with a long-short ratio of 0.87.

The Whale's current total Holdings on the Hyperliquid platform is $9.681 billion, with long orders and short orders amounting to $4.514 billion and $5.167 billion respectively. The profit and loss situation shows a loss of $143 million on long orders and a loss of $58.3843 million on short orders. The Whale Address shorted when the BTC price was $111,465.4, and the current unrealized PNL is $5.2672 million.

BTC-2,45%

MarsBitNews·2025-09-28 08:18

Data: Hyperliquid platform Whale current Holdings 9.518 billion USD, long-short Holdings ratio is 0.87

According to Mars Finance, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of 9.518 billion USD, with long order Holdings of 4.43 billion USD, accounting for 46.54% of the Holdings, and short order Holdings of 5.089 billion USD, accounting for 53.46%. The unrealized PNL for the long order is -222 million USD, and for the short order, it is 32.9301 million USD. Among them, Whale address 0x5b5d..60 made a 10x full position shorting BTC at a price of 111,465.4 USD, currently having an unrealized PNL of 4.8117 million USD.

BTC-2,45%

MarsBitNews·2025-09-26 02:15

Data: Hyperliquid platform Whale current Holdings 10.04 billion USD, long-short position ratio is 0.87

According to Mars Finance and Coinglass data, the total holdings of whales on the Hyperliquid platform amount to 10.04 billion USD, with long orders and short orders at 4.677 billion and 5.363 billion USD respectively. Both sides' profits and losses are close, and the whale address has an unrealized PNL of 2.9992 million USD from high-leverage shorting of BTC.

BTC-2,45%

MarsBitNews·2025-09-25 02:11

Data: Hyperliquid platform Whale current Holdings 9.592 billion USD, long-short position ratio is 0.86

According to Mars Finance, data from Coinglass shows that the Whale on the Hyperliquid platform currently has Holdings of $9.592 billion, with long order Holdings of $4.43 billion, accounting for 46.19% of the total, and short order Holdings of $5.162 billion, accounting for 53.81%. The unrealized PNL for long orders is -$161 million, and for short orders, it is -$107 million. Among them, the Whale address 0x5b5d..60 is shorting BTC with 10x leverage at a price of $111,459.6, currently with an unrealized PNL of -$1.8336 million.

BTC-2,45%

MarsBitNews·2025-09-23 02:34

Data: Hyperliquid platform Whale current Holdings 11.052 billion USD, long-short position ratio is 0.88

According to Mars Finance, the Whale Holdings on the Hyperliquid platform has reached $11.052 billion, with long orders and short orders accounting for 46.76% and 53.24% respectively. The Whale Address shorted when the ETH price was $3417.32, with an unrealized PNL of -$74.733 million.

ETH-3,33%

MarsBitNews·2025-09-20 08:49

Data: Hyperliquid platform Whale current Holdings 11.203 billion USD, long to short position ratio is 0.88

The Hyperliquid platform shows that the current Whale Holdings are $11.203 billion, with long orders accounting for 46.94% and a loss of $185 million, while short orders account for 53.06% with a loss of $604 million. A Whale shorted BTC at $111,459.6, with an unrealized PNL of -$14.7288 million.

BTC-2,45%

MarsBitNews·2025-09-19 08:24

Data: Hyperliquid platform Whale current Holdings 10.91 billion USD, long-short position ratio is 0.88

According to Mars Finance, data from Coinglass shows that the whale on the Hyperliquid platform currently holds 10.91 billion USD, with long orders at 5.122 billion USD, accounting for 46.94% of the holdings, and short orders at 5.789 billion USD, accounting for 53.06%. The unrealized PNL for long orders is 245 million USD, while for short orders it is -670 million USD. Among them, the whale address 0x5b5d..60 is shorting BTC with a 10x leverage at a price of 111459.6 USD, currently with an unrealized PNL of -15.2708 million USD.

BTC-2,45%

MarsBitNews·2025-09-18 13:24

Data: Hyperliquid platform Whale current Holdings 10.36 billion USD, long and short position ratio is 0.88

According to Mars Finance, as per Coinglass data, the Whale on the Hyperliquid platform currently has Holdings of 10.36 billion USD, with long order Holdings of 4.836 billion USD, accounting for 46.67% of the total Holdings, and short order Holdings of 5.525 billion USD, accounting for 53.33%. The unrealized PNL for long orders is 162 million USD, while for short orders it is -559 million USD. Among them, the Whale Address 0x5b5d..60 shorted BTC with a 10x leverage at a price of 111,459.6 USD, currently having an unrealized PNL of -12.7191 million USD.

BTC-2,45%

MarsBitNews·2025-09-17 13:26

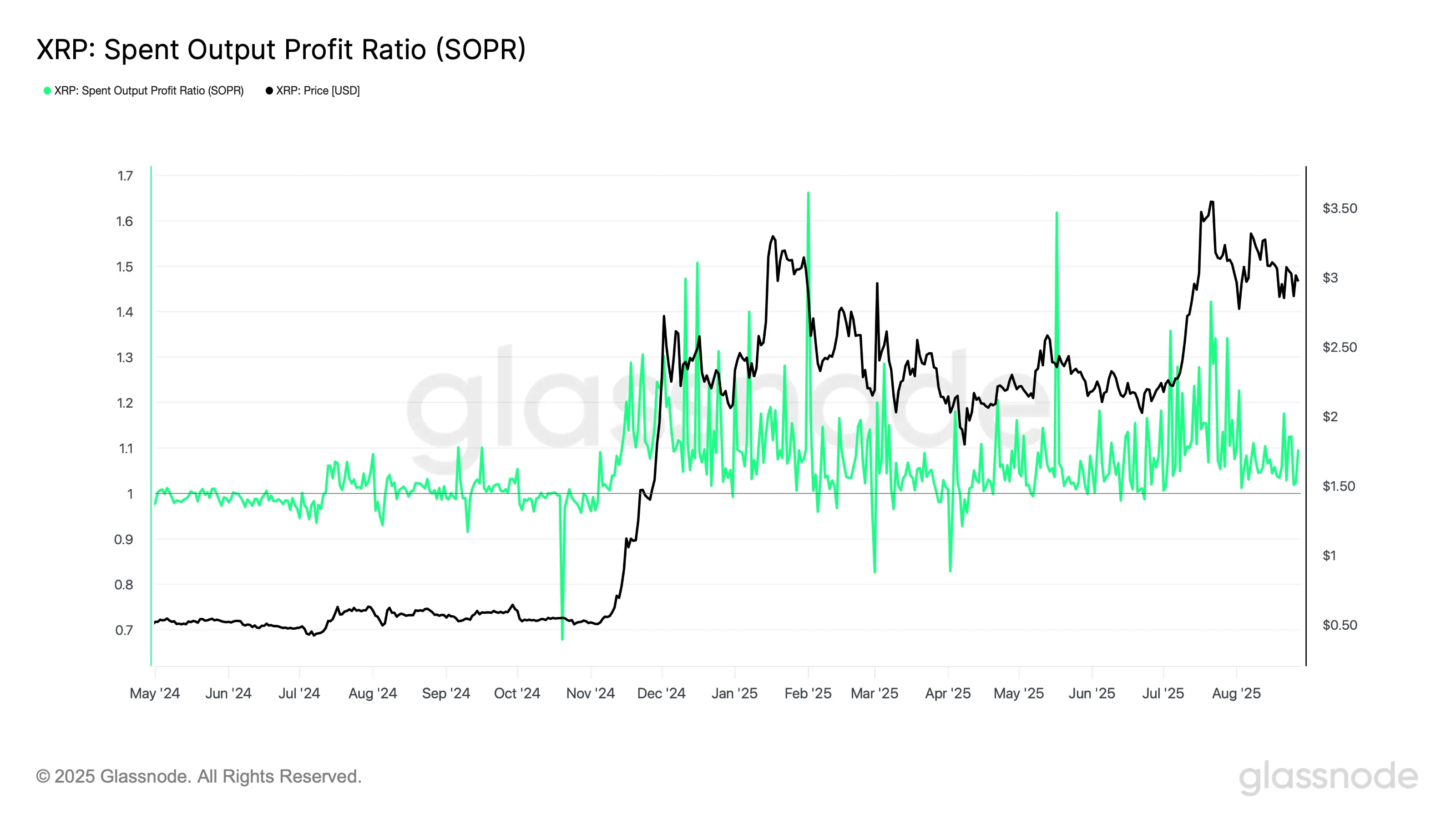

XRP Price Prediction: Key on-chain signals flash green, NUPL and SOPR indicators suggest a bullish breakout is imminent

Ripple (XRP) has recently stabilized above the $3.00 level and has maintained support from the 50-period EMA. On-chain data shows that the spent output profit ratio (SOPR) and the net unrealized PNL (NUPL) are both releasing bullish signals, indicating that investor sentiment is gradually shifting towards positive, which may lead to a technical breakout of 12% in the short term.

XRP-6,46%

MarketWhisper·2025-08-29 02:03

The new foundation for strategic assets: AIW3 connects Binance, OKX, and Hyperliquid, achieving execution closure and liquidity synergy.

In the eyes of most traders, a strategy is a form of logic, a model that iterates continuously on historical data, and a skill of "playing against others' expectations" during speculative cycles. However, from the systematic perspective of AIW3, a strategy is not merely a cognitive model, but an "asset unit" that is about to enter the main stage of trading — just like liquidity, order books, and PnL, it becomes an underlying module that can be executed, validated, utilized, and profited from.

The problem is that for a strategy to become a true asset, it is far from enough to rely solely on encapsulated logic; it must also be able to "execute", "operate in real markets", and "hang on high-quality Liquidity", leaving behind a verifiable performance track. Only in this way can the strategy meet the conditions for transformation from content to product and from model to asset.

And this is precisely the structural breakthrough achieved by the AIW3 in this round of integrated upgrades.

1. The core obstacle to the assetization of strategies is not "design", but "

HYPE-2,43%

KnowHereMediaOfficial·2025-08-18 09:09

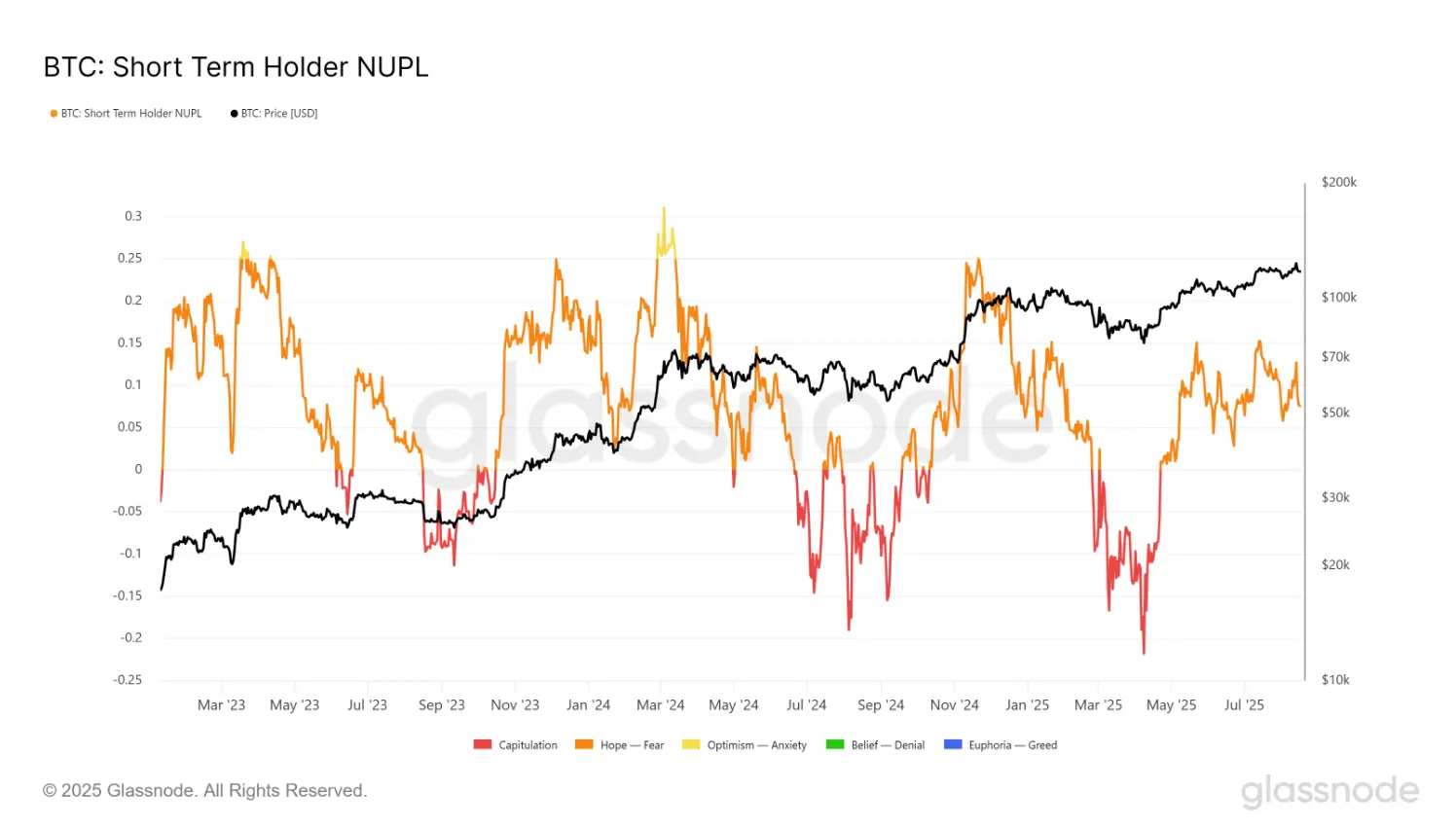

Bitcoin Price Prediction: Short-term holder cost model reveals limited selling pressure before breaking through $127,000.

Bitcoin has recently shown a mild pullback, but the price still holds above the key support level of $115,000. On-chain data analysis indicates that based on the short-term holder (STH) cost basis model, selling pressure may be relatively limited before the market reaches the first important target of $127,000. Meanwhile, the STH unrealized PNL ratio (NUPL) is currently only 0.07, far below the saturation threshold of 0.25, indicating a low willingness for short-term holders to take profits, leaving room for price upward movement. Analysts believe that if the support is maintained and the resistance of $117,261 is broken, Bitcoin is likely to restart its upward trend and challenge the previous high.

BTC-2,45%

MarketWhisper·2025-08-18 07:33

On-chain data reveals a qualitative change in the encryption bull run: Institutional funds getting on board promote a long-cycle slow bull, and the NUPL indicator shows a historic triple wave structure.

CryptoQuant on-chain analyst Yonsei_dent's latest research indicates that the current crypto bull run structure shows essential differences from historical cycles. The continuous inflow of institutional funds brought by Bitcoin Spot ETF is driving the market towards a more lasting but slower-rising long-term bull market. The key indicator Net Unrealized PNL (NUPL) has for the first time presented a "triple wave" pattern, breaking the single peak of 2017 and the double peak pattern of 2021. While institutional-led crypto asset allocation reduces market Fluctuation, it also means that a hundredfold big pump may be hard to replicate, and investors need to adjust their expectations for excess returns.

MarketWhisper·2025-08-14 02:14

Load More