Search results for "RATIO"

Alt/BTC MACD Flips Bullish for the First Time in 22 Months - Coinspeaker

Key Notes

OTHERS/BTC appears to have bottomed in Q4 2025.

Similar setups were seen before the 2017 and 2021 alt cycles.

The monthly MACD has flipped bullish for the first time in 22 months.

The Altcoin-to-Bitcoin ratio (OTHERS/BTC) could be setting a major bottom in Q4 2025, as per market

BTC-1,77%

Coinspeaker·01-06 10:06

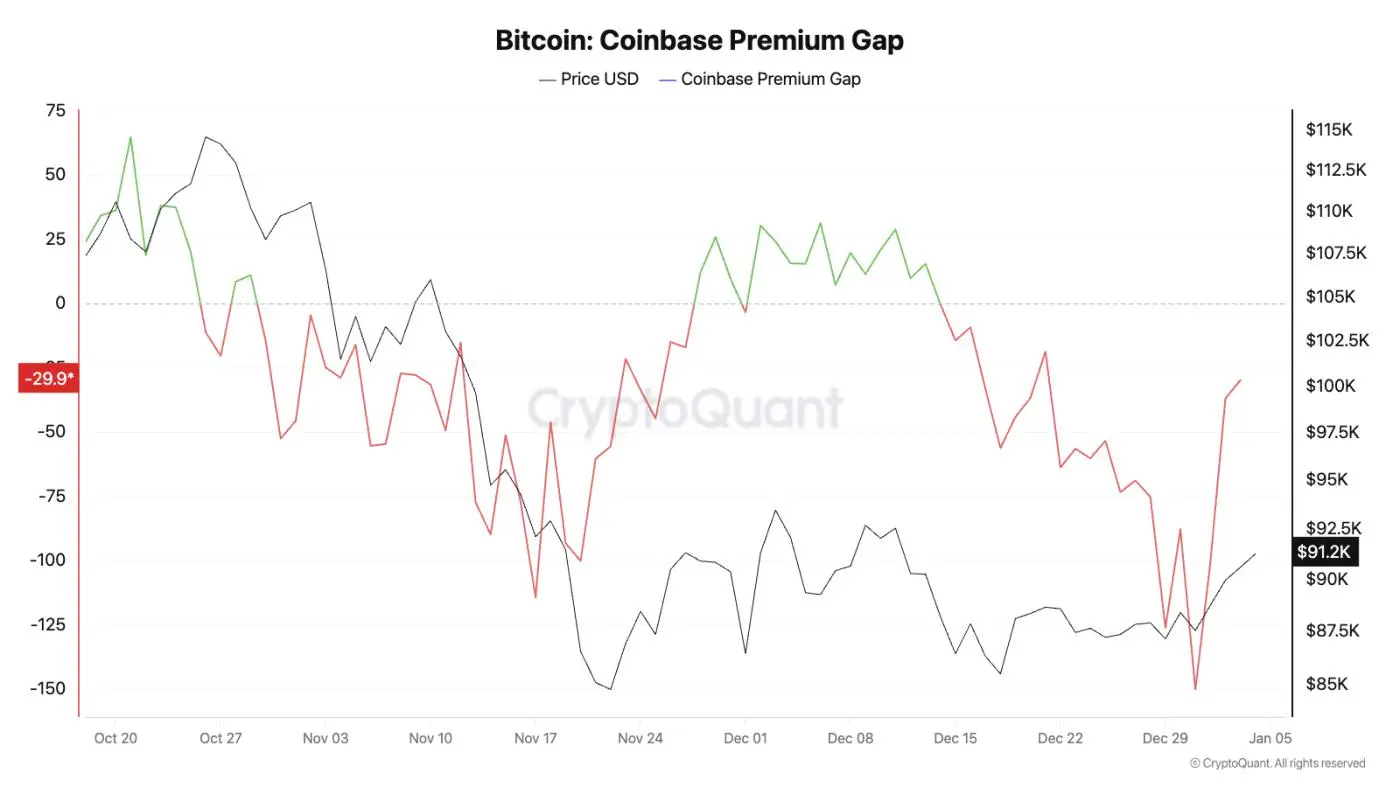

Bitcoin soars past $94,000! Coinbase premium turns positive, institutional giants return to the market

In early 2026, Bitcoin surged to a high of $94,789, clearing the shadow of falling below $87,000 in December. The three major indicators turned bullish: Coinbase premium rebounded from -150 to approach the zero line, the Fear and Greed Index bounced from 29 to 40, and the bullish-to-bearish ratio remained above 1.0. Analysts warn that it is currently more suitable to accumulate cautiously rather than blindly chase higher.

MarketWhisper·01-06 05:14

Is TSMC still worth investing in? By 2026, holding 500 billion in orders, with a 72% market share dominating the global market

TSMC's stock price is expected to rise over 50% by 2025, with Wall Street forecasting a 21% revenue growth in 2026. Key catalysts: NVIDIA's $500 billion order, global foundry market share at 72%, far surpassing Samsung, and a P/E ratio of 24 times making the valuation reasonable. The Motley Fool analysts believe the future outlook remains optimistic.

MarketWhisper·01-05 10:10

In-depth analysis: The illusion of Polymarket whales having an extremely high win rate; hedging arbitrage is much more complex than you think

In-depth analysis of Polymarket: 27,000 trades by the top ten profit whales in December reveal the truth behind "smart money": the extremely high win rate is masked by a large number of open "zombie orders," with actual win rates only slightly above random; hedging arbitrage is far more complex than imagined, and blind imitation can lead to losses.

(Background summary: Heaven, Earth, Humanity—why did the prediction market only explode after nearly 40 years?)

(Additional background: 26 predictions about the development of prediction markets in 2026)

Table of Contents

1. SeriouslySirius: 73% win rate masked by "zombie orders," and the complex quantitative hedging network

2. DrPufferfish: Turning small probabilities into large ones, the ultimate "profit-loss ratio" management art

3. gmanas: High-frequency automated assembly line operations

4. Hunter sim

動區BlockTempo·01-05 05:25

MicroStrategy's persistent struggles: Why does the Bitcoin whale holding $59 billion get rejected by the S&P 500?

Despite holding Bitcoin worth up to $59 billion, far exceeding its $4.5 billion market capitalization, MicroStrategy's stock plummeted nearly 50% in 2025, making it the worst-performing component of the Nasdaq 100 index. This brutal decline not only triggered fierce criticism of its "Bitcoin-backed" corporate strategy from economists including Peter Schiff but also clearly highlighted the "high wall" between MicroStrategy and the S&P 500 index.

This article delves into the underlying reasons for the severe divergence between MicroStrategy's stock price and its Bitcoin assets, revealing the essence of its business model as a "Bitcoin proxy" and the perilous situation where its market value-to-net asset ratio falls below 1.0, providing a comprehensive perspective on the unique position of this world's largest publicly listed Bitcoin holder.

BTC-1,77%

MarketWhisper·01-04 03:40

DOGE Trades Near $0.1244 Resistance Amid Controlled Market Action

Dogecoin (DOGE) maintained its price at $0.1239, up 1.3% in a limited trading range, supported at $0.1222. The market showed stability against Bitcoin, with the DOGE/BTC ratio rising slightly, highlighting a balanced market environment.

CryptoNewsLand·01-03 18:51

Filecoin Users Gain USD-Backed Stablecoin With USDFC Launch

USDFC is overcollateralized with FIL, maintaining a 110% ratio and fully on-chain issuance and redemption via FVM smart contracts.

The stablecoin supports DeFi use, storage payments, and cross-chain bridges, expanding Filecoin ecosystem liquidity and utility.

USDFC’s open-source design an

CryptoFrontNews·01-03 10:31

DOGE Trades Near $0.1244 Resistance Amid Controlled Market Action

Dogecoin (DOGE) maintained its price at $0.1239, up 1.3% in a limited trading range, supported at $0.1222. The market showed stability against Bitcoin, with the DOGE/BTC ratio rising slightly, highlighting a balanced market environment.

CryptoNewsLand·01-02 18:46

MSTR open interest far exceeds Tesla, Saylor: Bitcoin makes MicroStrategy more interesting

Bitcoin reserve strategy pioneer MicroStrategy Strategy founder Michael Saylor states that compared to other tech giants, the market value of MSTR's open contracts shows that Bitcoin makes MSTR interesting! However, MSTR's stock price is projected to fall by 50% within 2025, far worse than Bitcoin's -6%, leading some netizens to question: Isn't this just because it's being "shorted"?

Bitcoin makes $MSTR interesting. pic.twitter.com/XF80ngHGlt

— Michael Saylor (@saylor) January 2, 2026

Open interest surges: Clarifying leverage speculation and shorting indicators

Michael Saylor states that MSTR's open contract market value ratio with

BTC-1,77%

ChainNewsAbmedia·01-02 05:04

DOGE Trades Near $0.1244 Resistance Amid Controlled Market Action

Dogecoin (DOGE) maintained its price at $0.1239, up 1.3% in a limited trading range, supported at $0.1222. The market showed stability against Bitcoin, with the DOGE/BTC ratio rising slightly, highlighting a balanced market environment.

CryptoNewsLand·01-01 18:41

Bitcoin eyes copper-gold signal as whales ease selling into 2026 uncertainty

Analysts are tracking potential recovery signals for Bitcoin linked to the copper-gold ratio, despite ongoing whale selling and fears of a crypto winter extending into 2026. Market sentiment remains cautious as investors await clearer trends.

BTC-1,77%

Cryptonews·01-01 15:24

Metaplanet increases its Bitcoin holdings by 4,000 coins after three months, with the stock price sluggish and facing challenges from MNAV

Japanese listed company Metaplanet announced a large-scale accumulation action at the end of 2025, after a three-month hiatus, investing nearly 70 billion yen to purchase 4,279 Bitcoins, solidifying its position as the fourth-largest Bitcoin reserve publicly traded company globally. The acquisition was mainly financed through Bitcoin-backed loans and the issuance of preferred shares, demonstrating the company's continued commitment to a "Bitcoin-backed" financial strategy. However, the purchase cost significantly differs from the current market price, and coupled with a substantial correction in the company's stock price from its peak, the market is closely watching its financial leverage and asset net value ratio (mNAV) for stability.

Metaplanet Buys Bitcoin Again After Three Months

Japanese microstrategy Metaplanet, after a three-month break, finally announced at the end of the year that it has repurchased Bitcoin. Metaplanet purchased 4,279 Bitcoins this time, totaling

BTC-1,77%

ChainNewsAbmedia·2025-12-31 02:34

Cryptocurrency market, $96.85 million in leveraged positions liquidated within 24 hours... Long positions account for 67%

In the past 24 hours, approximately $96.85 million (about 1.34 trillion KRW) of leveraged positions have been liquidated in the cryptocurrency market.

According to current aggregated data, long positions account for 67% of the liquidated positions, while short positions make up 33%.

4-hour liquidation data by exchange / CoinGlass

In the past 4 hours, the exchange with the most liquidations was Binance, with a total of $6.4 million (27.35% of the total) liquidated. Among these, long positions account for 71.9%.

The second-highest liquidations occurred on Bybit, with $6.09 million (26.03%) of positions liquidated, of which 70.47% were long positions.

OKX experienced approximately $2.27 million (9.7%) in liquidations, with a long position ratio of 58.81%.

It is worth noting that on Hyperliquid exchange, compared to other exchanges

TechubNews·2025-12-30 20:20

DOGE Trades Near $0.1244 Resistance Amid Controlled Market Action

Dogecoin (DOGE) maintained its price at $0.1239, up 1.3% in a limited trading range, supported at $0.1222. The market showed stability against Bitcoin, with the DOGE/BTC ratio rising slightly, highlighting a balanced market environment.

CryptoNewsLand·2025-12-30 18:39

South Korea plans to limit the shareholding of major shareholders in the four major virtual asset exchanges, and Upbit, Bithumb may face significant governance structure reforms.

The Korean government plans to overhaul the governance structure of cryptocurrency exchanges, with financial regulators proposing to limit the shareholding ratio of major shareholders in the four largest virtual asset exchanges, sparking significant industry concern over operational control and market stability.

(Background recap: Korea's stablecoin internal conflict: central bank and Financial Services Commission clash draft, Seoul missing the initial launch opportunity)

(Additional background: Korea plans to implement "super strict anti-money laundering" measures to close small loopholes: transactions below $680 require KYC and personal data collection)

According to the latest report by Korea's public broadcasting media "KBS," the Financial Services Commission (FSC) has proposed a major regulatory recommendation in the "Digital Asset Basic Act" submitted to the National Assembly, suggesting to limit the shareholding ratio of major shareholders in the four domestic virtual asset exchanges Upbit, Bithumb, Coinone, and Korbit, with a proposed cap set between 15% and 20%.

Financial Commission

ATS-2,4%

動區BlockTempo·2025-12-30 14:20

In the cryptocurrency market, approximately $5 million in leveraged positions were liquidated within 24 hours... Short positions account for 55%

In the past 24 hours, over $5 million in leveraged positions have been liquidated in the cryptocurrency market.

According to current aggregated data, the liquidation ratio of long and short positions across all exchanges is approximately 45:55, with more short positions being liquidated.

4-Hour Exchange Liquidation Data / CoinGlass

In the past 4 hours, the exchange with the highest liquidation volume is Binance, with a total of $2.76 million liquidated. Among them, short positions account for 55.58%, reflecting a bullish market trend.

The second-highest liquidation exchange is Bybit, with $781,600 liquidated, of which 61.65% are long positions.

OKX experienced approximately $749,600 in liquidations, with long positions making up 55.65%.

Notably, on Hyperliquid exchange, almost all liquidations come from short positions, with 99.93% recorded as short liquidations.

TechubNews·2025-12-28 15:39

Bitcoin Rental Strategy: Analyzing Options Seller Strategies and Risk Management

In traditional financial frameworks, options seller strategies are regarded as effective ways to generate scalable returns and manage market volatility. Their core lies in risk transfer and the realization of time value. By breaking down three strategies—selling puts (Sell Put), vertical credit spreads, and ratio credit spreads—we will conduct quantitative analysis of their win rates, margin efficiency, and risk thresholds under extreme market conditions. This helps market participants establish a rigorous risk management system in the highly volatile crypto markets, enabling you to shift from a gambler to a bookmaker, collecting steady rent through options.

Risk and Volatility Transfer: The Profit Logic of Options Sellers

In the derivatives market, options sellers essentially serve as "volatility insurance" providers. According to historical data, about 80% of options

ChainNewsAbmedia·2025-12-28 07:44

[Evening News Brief] BTC long positions face massive forced liquidations within 24 hours Outside

24-Hour Cryptocurrency Perpetual Contract Forced Liquidation Scale

The recent 24-hour forced liquidation scale and liquidation ratio for cryptocurrencies are as follows.

BTC liquidation scale: $47.32 million, liquidation ratio: Longs 91.39%

ETH liquidation scale: $21.18 million, liquidation ratio: Longs 74.9%

ZEC liquidation scale: $5.52 million, liquidation ratio: Shorts 94.88%

Top 3 Futures Exchanges BTC Perpetual Contract Long/Short Ratio

Based on open interest, the recent 24-hour long and short positions for BTC perpetual contracts across the world's top three cryptocurrency futures exchanges are as follows.

All exchanges: Long 49.49% / Short 50.51%

1. Binance: Long 50.34% / Short 49.66%

2. OKX: Long 48.15% / Short 51.85%

3. Bybit: Long

BTC-1,77%

TechubNews·2025-12-27 07:14

Solana ecosystem stablecoin USX temporarily de-pegs

Techub News reports that Solana ecosystem DeFi protocol Solstice tweeted that the secondary market for the stablecoin USX will experience significant fluctuations, but the net asset value of the underlying assets and Solstice custody assets remain unaffected, with a collateralization ratio exceeding 100%. The team has requested a third-party to immediately provide an additional certification report, which will be released as soon as it is completed. Solstice stated that this is purely a liquidity issue in the secondary market, and the team and market makers are taking immediate steps to address it. They will continue to inject liquidity into the secondary market to ensure market stability. The 1:1 redemption in the primary market remains fully available.

According to PeckShield monitoring, the stablecoin USX briefly de-pegged and, due to liquidity exhaustion, fell to $0.10 in the secondary market. After Solstice injected liquidity, the exchange rate gradually

TechubNews·2025-12-26 06:02

Gate Research Institute: BTC and ETH remain in low-range consolidation, with moving average breakout strategies capturing structural market trends

Market Overview

To systematically present the current cryptocurrency market's capital flow behavior and trading structure changes, this report approaches from five key dimensions: Bitcoin and Ethereum price volatility, long-short trading ratio (LSR), contract holdings, funding rates, and market liquidation data. These five indicators cover price trends, market sentiment, and risk conditions, providing a comprehensive reflection of the current market's trading intensity and structural features. The following will sequentially analyze the latest changes in each indicator since December 9:

1. Bitcoin and Ethereum Price Volatility Analysis

According to CoinGecko data, from December 9 to December 22, BTC and ETH generally showed a pattern of weak recovery after oscillating downward, with price centers significantly lower than previous highs, and market sentiment remained cautious. BTC experienced a rapid pullback after a temporary surge, followed by repeated oscillations.

GateResearch·2025-12-26 04:41

XRP Holders Capitulate in Q4 as Realized Losses Spike Sharply

XRP holders faced significant losses in Q4 2025, with many selling below their initial investment. The realized profit/loss ratio dropped below 0.5, suggesting capitulation and emotional selling. Historical trends indicate potential market recovery, as large holders accumulate despite overall selling.

Coinfomania·2025-12-25 12:40

Toncoin Price Prediction: Whale Orders Surge, TON Bullish Breakout Confirmed, Surging Past $1.70

Toncoin (TON) price rebounds above $1.51, successfully breaking through the descending wedge pattern, opening an upward channel for the bulls. CryptoQuant data shows a significant increase in whale bulk orders, while CoinGlass's long-short ratio reaches 1.14, approaching the monthly high, indicating traders' growing confidence in a price increase.

TON-3,23%

MarketWhisper·2025-12-25 05:52

Stablecoin ETF is here! Amplify's asset tokenization dual product targets the trillion-dollar market

Amplify ETFs launches two innovative ETF products, namely the Amplify Stablecoin Technology ETF and the Amplify Tokenization Technology ETF, marking institutional capital's entry into the stablecoin and asset tokenization sectors. Both ETFs have an expense ratio of 0.69% and are listed on the NYSE Arca exchange.

MarketWhisper·2025-12-24 06:15

Gold breaks through $4500 is just the starting point! Mining stocks have a tenfold growth opportunity coming.

Gold prices have skyrocketed by 119% in the past two years, breaking through $4,500 to reach a historic high, but relative to stocks and bonds, gold is still lower than its peak in 1980. The Dow/Gold ratio remains at 10:1, indicating that there is still significant appreciation potential for physical assets relative to financial assets. More critically, gold mining stocks are showing a "crocodile mouth" effect, with most miners maintaining sustainable costs of only $2,200, and the current price difference exceeding $2,300, creating a windfall profit space.

MarketWhisper·2025-12-24 04:00

The Bitcoin market is in trouble! Leverage liquidity has vanished, and IBIT has withdrawn 523 million in a single day.

Bitcoin stabilized at 80,000 USD, but the market atmosphere is completely different from early October. After Trump’s tariffs triggered a $19 billion liquidation event on October 10, the order book depth disappeared, $3.6 billion in ETF outflows in November set a record, BlackRock's IBIT saw a single-day withdrawal of $523 million, and the leverage ratio dropped to a historic low. Traders intuitively sensed that "something went wrong" as data validated this.

MarketWhisper·2025-12-24 02:50

$27 billion in cryptocurrency options will expire on Christmas Day! Traders are betting on a "Christmas Rebound," can BTC rise to $96,000?

As the year-end approaches, the crypto derivatives market is undergoing an unprecedented "structural reset." On December 26 (Boxing Day), the world's largest crypto assets options exchange Deribit will have Bitcoin and Ether options contracts with a total value of up to $27 billion expiring, with Bitcoin options accounting for $23.6 billion and Ether options for $3.8 billion. This expiration involves more than 50% of Deribit's total open contract volume, and the market shows a clear bullish bias, with the put-to-call ratio dropping to as low as 0.38.

At the same time, data from institutions like Matrixport shows that the sentiment among options traders has shifted from extreme bearishness to "slightly bullish" for the first time since the sharp drop in October, with the key indicator 25-Delta skew starting to rebound. This series of signs, combined with the characteristics of thin liquidity at year-end, sets the stage for the long-awaited "Santa Claus rally" in the market, while the $96,000 "maximum pain point" price for Bitcoin will become the focus of today's long and short battle.

MarketWhisper·2025-12-23 03:07

DY is carrying out a paid capital increase of 60 billion KRW... seeking to stabilize management rights by expanding the shareholding ratio of the largest shareholder.

The KOSDAQ-listed company DY has decided to implement a paid capital increase through a third-party placement to raise approximately 60 billion Korean Won. The company plans to use the raised funds to supplement its operating capital and improve its financial structure.

According to the electronic announcement from the Financial Supervisory Service on the 22nd, DY will issue 6,437,769 shares (common stock) at a price of 932 KRW per share. The subscribers are the company's largest shareholder, Leg Tech Co., Ltd. (2,145,923 shares), and Mr. Kim Young-bae (4,291,846 shares). The two subscribers will jointly hold all the newly issued shares.

Third-party placement for paid capital increase refers to the method of issuing new shares to specific investors to directly obtain capital investment, which has the advantage of raising funds more quickly compared to public offerings. Analysis suggests that DY adopts this method to achieve the dual strategic goals of raising operational funds and reducing financial burdens.

Through this capital increase, the largest shareholder's equity ratio will be increased.

TechubNews·2025-12-22 14:45

Bridgewater Fund's Ray Dalio: Bitcoin is inferior to gold, Central Banks will not choose it.

Ray Dalio, the founder of the world's largest hedge fund Bridgewater Associates, once again discussed the comparison between Bitcoin and gold. He admitted to holding a small amount of Bitcoin but pointed out that Bitcoin has structural flaws, making it less reliable than gold and more difficult to become the preferred reserve asset for central banks.

(Previous summary: Bridgewater's Dalio: My Bitcoin holding ratio has remained unchanged! Stablecoins are "not worth it" for preserving wealth)

(Background Supplement: Bridgewater's Dalio calls for dollar decline "Gold is indeed safer": I feel the market is in a bubble)

Global renowned hedge fund Bridgewater Associates founder Ray Dalio recently appeared on the podcast "WTF is" hosted by Nikhil Kamath, founder of the Indian online brokerage Zerodha.

BTC-1,77%

動區BlockTempo·2025-12-22 13:00

Lighter Airdrop is coming: Is a valuation of 3.7 billion reasonable? Is now a chance to get in or catch a falling knife?

The on-chain Perpetual Futures exchange Lighter has opened its Airdrop registration. The current premarket price is around 3.75, corresponding to a FDV of 3.75 billion USD, while the latest valuation in the last round was 1.5 billion USD. The author has organized Hyperliquid's market capitalization to revenue ratio (PS Ratio), as well as the Lighter PS Ratio calculated using VC valuation and premarket valuation, suggesting that the current Lighter premarket price may not be a good entry point. On the other hand, the trading volume of Lighter divided by the open interest ratio is far higher than that of Hyperliquid, indicating that there may be some wash trading involved.

Lighter has opened the Airdrop submission page

Click on Points in Lighter, then proceed to

HYPE2,46%

ChainNewsAbmedia·2025-12-22 04:24

Weekly Preview | Approximately $23 billion in Bitcoin Options will expire on December 26; Aster launches the fifth phase Airdrop activity.

News Preview:

Aster will launch the fifth phase of the airdrop on December 22, allocating 1.2% of the total supply.

MetaPlanet will hold an extraordinary general meeting of shareholders on December 22 to discuss important proposals regarding the future issuance of preferred shares.

The Bureau of Economic Analysis will release the third quarter GDP data on December 23.

Due to the Christmas holiday in the United States, the US stock market will be closed for one day on December 25th (Wednesday);

Plasma (XPL) will unlock approximately 88.89 million tokens at 8 PM Beijing time on December 25, with a circulation ratio of 4.5%, valued at about 11.7 million USD.

Approximately $23 billion in Bitcoin options will expire on December 26, which may exacerbate the already high volatility.

December 22

Project Updates:

Binance Wallet will launch Bitway on December 22.

PANews·2025-12-21 12:57

PA Daily | As of this year, the proportion of 118 TGE falling below the issue price is 84.7%; Tether is developing a mobile encryption Wallet with integrated AI features.

Today's News Highlights:

1. Bipartisan members of the U.S. House of Representatives draft a cryptocurrency tax proposal, involving tax exemption for stablecoins and deferral of taxes on staking rewards.

2. Tom Lee responds to the conflicting discussions with Fundstrat, emphasizing that different analysts have different responsibilities and time horizons.

3. Arthur Hayes: The season of copycats always exists, it's just that some traders do not hold the rising currencies.

4. Tether CEO confirms the development of a mobile cryptocurrency wallet integrated with AI.

5. Data: So far this year, 118 TGEs have a break-even ratio of 84.7%, with only 15% of projects showing an upward trend.

6. F2Pool co-founder Wang Chun once lost 490 bitcoins after testing private key security by transferring 500 bitcoins to a suspicious address.

macroeconomic

Members of both parties in the U.S. House of Representatives are drafting a cryptocurrency tax bill that includes tax exemptions for stablecoins and deferral of taxes on staking rewards.

Representative Max

PANews·2025-12-21 09:17

Ethereum Eyes Major Upside Against Nasdaq Amid Bottoming Signal

ETH/Nasdaq ratio bottoms at 0.11, signaling potential rebound and mean reversion against tech stocks.

Macro factors like QE restart and cash stimulus may accelerate Ethereum’s outperformance vs Nasdaq.

SEC’s push for on-chain U.S. equities adds structural support, boosting ETH’s upside po

ETH-0,46%

CryptoFrontNews·2025-12-19 16:11

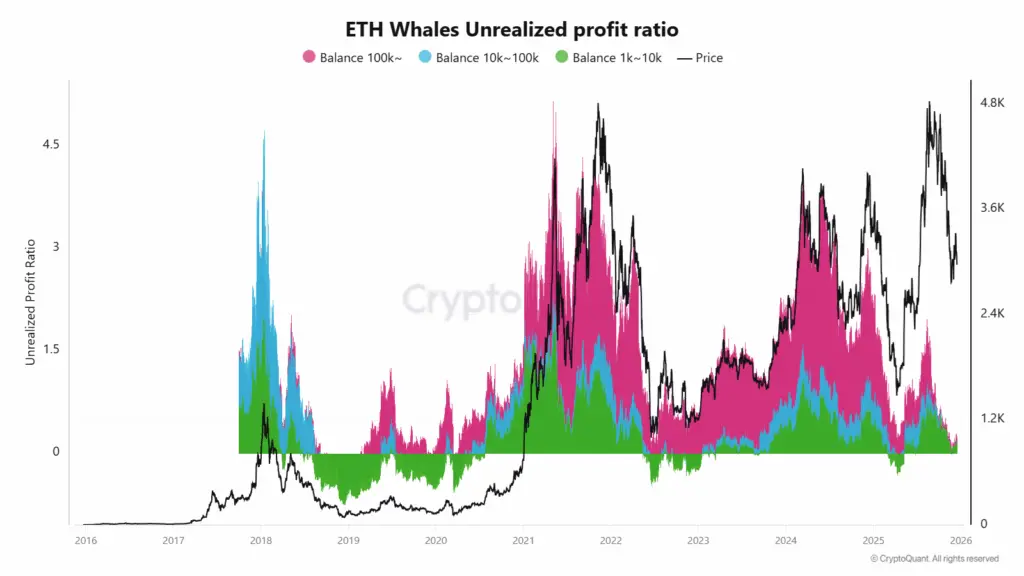

Ethereum Faces Whale Panic Fears as Coinbase Premium Turns Negative

Ethereum Coinbase Premium Index remains negative indicating US investor selling pressure

Whale Unrealized Profit Ratio approaches zero as large holders near breakeven levels

Active sending addresses reach yearly low reflecting weak retail market participation

Ethereum appears headed toward a

ETH-0,46%

TheNewsCrypto·2025-12-18 14:39

How big is the bubble in the AI market?

The article discusses the level of the AI market bubble and estimates the market size using data from ChatGPT. The author projects the C-end market at $33.75 billion, while the seven major tech giants have a combined AI market value of approximately $8.25 trillion, resulting in a price-to-sales ratio (P/S) of 244 times. The article points out that AI is currently mainly used as a productivity tool, and the capital market's valuation of it is overly high, which may lead to adjustments. The emergence of AGI in the future could change the current situation, but caution is still necessary.

金色财经_·2025-12-18 08:03

Gold to Bitcoin exchange rate hits a peak! Repeating signals before explosive growth in 2017 and 2021

The gold-to-Bitcoin exchange rate has reached a historically rare resistance level. This technical signal has previously triggered parabolic rallies in Bitcoin during the 2017 and 2021 bull cycles. In 2025, a sharp surge in gold prices has pushed the gold price back near the resistance level, while Bitcoin remains sideways. This divergence is a precursor to capital rotation. Traders are closely watching this ratio because it reflects the market's choice between safety and growth potential.

MarketWhisper·2025-12-17 05:41

Gold vs Bitcoin Ratio Hits Historic Resistance as Rally Signals Emerge

The essay discusses the historical significance of the Gold to Bitcoin ratio, highlighting how shifts in this ratio signal capital movements from gold to Bitcoin and increased risk appetite among investors. It analyzes past trends and patterns, suggesting that as confidence grows in Bitcoin, it leads to higher volatility and potential rallies, marking a shift in market dynamics.

BTC-1,77%

Coinfomania·2025-12-16 09:11

Small-cap tokens fall to a four-year low, is the "Shanzhai Bull" completely hopeless?

Despite a correlation of up to 0.9 with major Crypto market tokens, small-cap tokens have failed to provide any diversification value. In the first quarter of 2025, they plummeted by 46.4%, with an annual decline of approximately 38%, while the major US stock market index achieved double-digit growth with controlled pullbacks. This article is based on an article by Gino Matos, organized, translated, and written by ForesightNews.

(Background: Current situation of the altcoin ETF market: XRP as the biggest winner, LTC and DOGE abandoned by the market)

(Additional context: We earned $50 million in one year by targeting altcoins on DEX)

Table of Contents

Choose a reliable altcoin index

Sharpe Ratio and Drawdown

Bitcoin Investors and Crypto Liquidity

What does this mean for liquidity in the next market cycle

動區BlockTempo·2025-12-15 09:15

Aave V4: From Fragmented Markets to Modular Liquidity

Written by: Tia, Techub News

In the DeFi lending space, Aave has long been a benchmark for innovation and industry standards. As the user base and asset types have grown, Aave V3 has gradually revealed issues such as liquidity fragmentation, risk management, and relatively coarse liquidation mechanisms. To address these challenges, Aave V4 has undergone a systematic upgrade: the liquidity organization has been redesigned into a unified Hub and modular Spoke architecture, enabling multi-asset and multi-strategy shared liquidity while maintaining risk isolation; the accounting system has been upgraded to an ERC-4626-style share model, making the overall liquidity status clear and controllable; the liquidation mechanism has shifted from a fixed ratio model to a dynamic, health factor-centric, minimal necessary liquidation logic. Overall, V4 is not just a parameter optimization but a co-evolution of architecture and mechanisms that will elevate Aave from

AAVE-2,07%

金色财经_·2025-12-15 03:50

Artificial intelligence saves the US economy! Anthropic: TFP increases by 1.1% and reduces $2 trillion in debt

The National Bureau of Economic Research (NBER) study indicates that if the debt-to-GDP ratio can be stabilized, an additional annual growth of just 0.5 percentage points in total factor productivity (TFP) is sufficient to achieve fiscal stability. If productivity growth continues for ten years, the debt forecast decreases by $2 trillion. AI company Anthropic's analysis suggests that AI-assisted productivity could potentially increase TFP by approximately 1.1 percentage points, which is twice the amount needed for fiscal stability.

MarketWhisper·2025-12-15 01:35

Can Artificial Intelligence Save the US Finances? Anthropic's analysis indicates that AI can enhance TFP total factor productivity to stabilize finances

The article discusses the importance of total factor productivity (TFP) in economic growth, pointing out that if the U.S. government can maintain a stable debt-to-GDP ratio, a 0.5% annual increase in TFP can promote fiscal sustainability. The study shows that artificial intelligence has the potential to boost TFP by about 1.1%, which could disrupt the economy and public finances, but caution is needed in facing model assumptions and structural changes.

ChainNewsAbmedia·2025-12-14 06:44

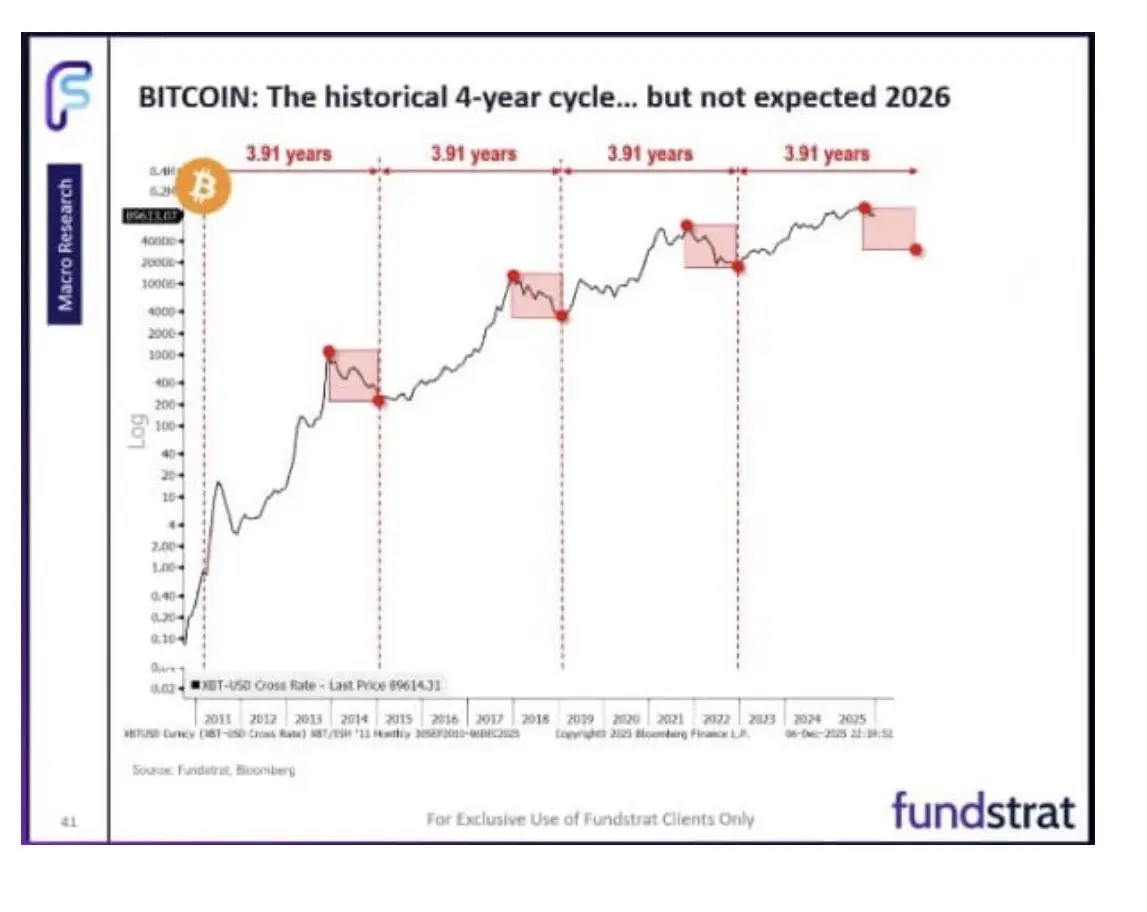

Wall Street Bull Tom Lee: U.S. stocks will rise another 10% next year, Bitcoin has not yet peaked

Fundstrat Global Advisors Co-Founder Tom Lee stated that the bull market still exists, and by the end of 2026, the US stock market S&P 500 index is expected to reach 7,700 points, about a 10% increase from the current level. He believes that Bitcoin will break the four-year cycle in 2026, with the ISM Manufacturing Index remaining below 50 for three consecutive years and the copper-gold ratio showing no signs of peaking, indicating that Bitcoin has not yet reached the cycle top.

ETH-0,46%

MarketWhisper·2025-12-12 00:46

Bitcoin Looks Cheap Against Gold: Analyst Says This Cycle Has “Much More Room to Run”

Crypto analyst Michaël van de Poppe shared a striking chart comparing Bitcoin’s valuation to gold, and the message behind it is clear: Bitcoin may be far cheaper than many think when viewed through this lens. With gold recently pumping and BTC undergoing a sharp correction, the BTC/Gold ratio has

CaptainAltcoin·2025-12-10 17:03

SpaceX is pushing forward with its IPO! Musk aims for a valuation of $1.5 trillion with a fundraising goal of over $30 billion

SpaceX plans to IPO in 2026 with a valuation of 1.5 trillion USD, and the market is evaluating the legitimacy of the space data center narrative, along with a potential market cap-to-sales ratio of up to 60 times. (Background recap: Elon Musk's space company SpaceX reportedly plans to IPO next year! Valuation expected to reach 800 billion USD, surpassing OpenAI) (Additional background: OpenAI space war begins? Sam Altman allegedly plots to acquire rocket company Stoke Space, targeting Musk's SpaceX) According to sources from Cailian Press, Musk's SpaceX is evaluating an IPO as early as 2026, with a valuation of up to 1.5 trillion USD and a fundraising goal of over 30 billion USD. If true, this will surpass Saudi Arabia's listing record and propel the aerospace rocket manufacturer to a level comparable with Microsoft, Apple,

動區BlockTempo·2025-12-10 09:54

BiyaPay Analyst: Ten Years of Volatility Ends, Silver Breaks Through $60 Strongly, Expected to Enter a Main Bull Market in 2026

Silver prices have increased nearly 110% this year, far surpassing gold, with the gold-silver ratio falling below 70 times, driven by increased demand. Analysts recommend investors gradually allocate funds to silver mining stocks and commodity assets, while also paying attention to Fed rate cuts and changes in industrial demand.

DeepFlowTech·2025-12-10 09:51

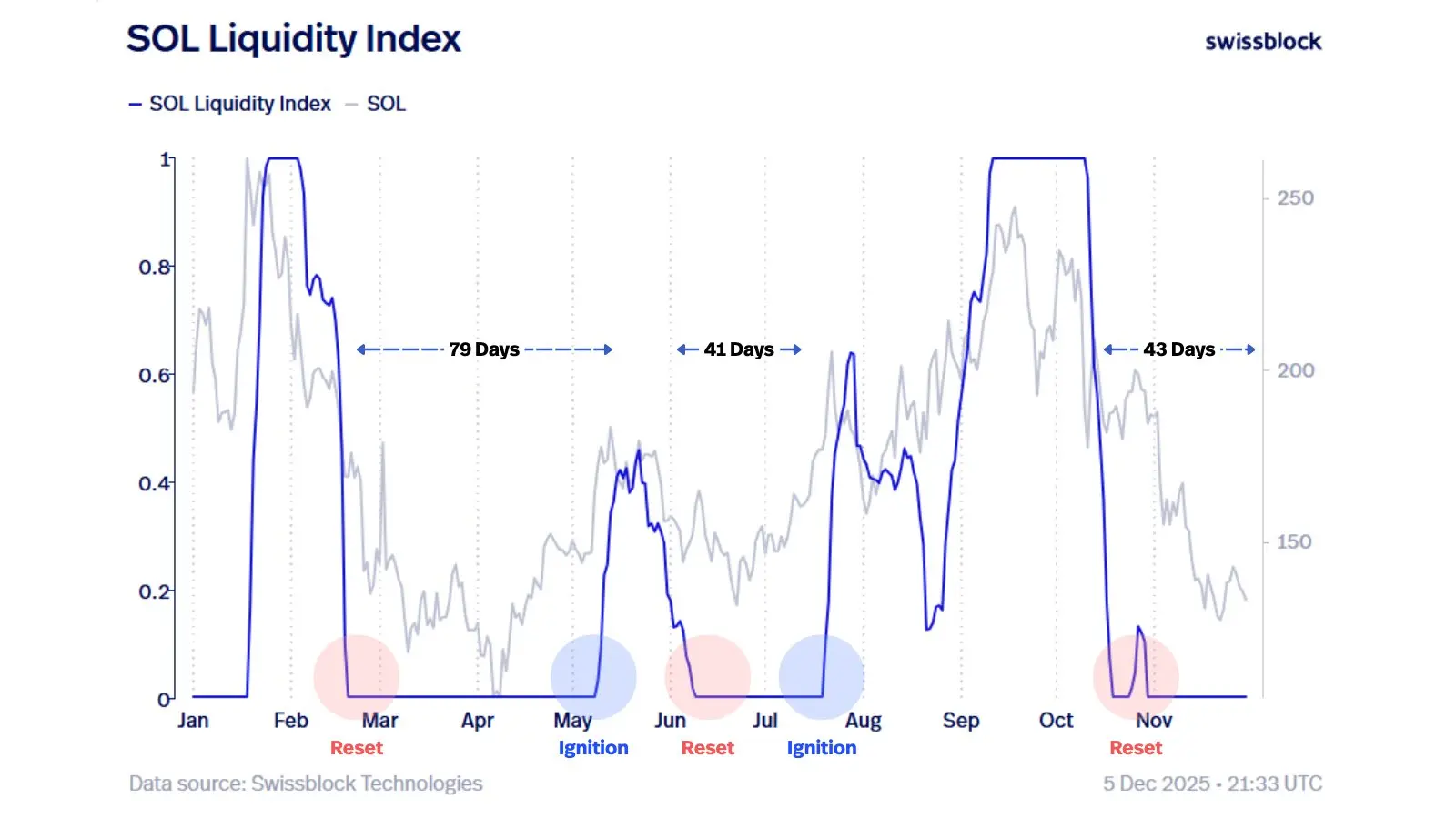

Solana's profit and loss ratio fell below 1! The 1560 liquidation wave is coming, and the bear market signal is flashing

In the past 24 hours, Solana liquidations have reached a whopping $1560K. According to Glassnode data, Solana's 30-day average real profit and loss ratio has been consistently below 1 since mid-November, a level often associated with bear market behavior. A reading below 1 indicates that traders are losing more than they are profiting, indicating deteriorating market sentiment and reduced liquidity.

MarketWhisper·2025-12-10 07:27

Trading moment: The FOMC decision is imminent, Bitcoin is at $91,500 as a key support, and Ethereum is aiming for the $3,500 mark

Daily market key data review and trend analysis, produced by PANews.

1. Market observation

In a complex macroeconomic environment, the Fed's policy decision this week has become the focus of the market. The market generally expects the Fed to cut interest rates by 25 basis points, with a probability of 88.6% to 95%, but Bank of America and other institutions believe that given the structural cooling of the labor market with "low hiring, low turnover, and rising layoffs", the Fed may send a "hawkish rate cut" signal, that is, cut interest rates but hint at the possibility of future policy tightening. This uncertainty has led to fluctuations in U.S. Treasury yields, while Goldman Sachs has warned of early signs of a recession through indicators such as Las Vegas consumption data.

In the commodity market, spot silver performed well, breaking through $60 per ounce for the first time to hit a record high, with an increase of more than 100% during the year, significantly outperforming gold, and the gold-silver ratio fell to its lowest level since 2021. However, ARK In

PANews·2025-12-10 07:16

Solana Liquidity Plummets to Bear Level Territory Amid $500M Liquidation Overhang

In brief

Solana's 30-day profit/loss ratio has been below one since mid-November, signaling more losses are being realized than profits.

The major altcoin is in a "full liquidity reset," a pattern that has historically preceded bottoming phases, according to on-chain analysts.

Roughly $500

SOL-0,48%

Decrypt·2025-12-10 05:06

Dalio warns: The global economy is "on the brink" in the next two years; don't rush to exit due to AI overvaluation

Ray Dalio, founder of Bridgewater Associates, warns that the global economy will face dangerous conditions over the next one to two years due to the combined impact of debt, political conflict, and geopolitical cycles. He advises investors not to rush out of AI investments solely because of overvaluation, but to pay attention to substantial signals of a bubble bursting. This article is sourced from Wallstreetcn and compiled, translated, and written by ForesightNews. (Previous background: Bridgewater’s Dalio: I own Bitcoin, but it only accounts for 1% of my portfolio; BTC will never become a sovereign reserve currency.) (Additional background: Bridgewater’s Dalio: My Bitcoin holdings ratio has never changed! Stablecoins are “not cost-effective” for preserving wealth.) Dalio believes that although there are already signs of a bubble in the AI industry, it is important to focus on the catalysts that could burst the bubble—such as monetary tightening or forced asset sales to meet debt obligations. Dalio warns that in the next one to two years, the global economy

BTC-1,77%

動區BlockTempo·2025-12-09 01:59

Wind vane undergoes drastic change! Harvard University bets 2-to-1 on Bitcoin over gold, institutional demand ushers in a new era

Harvard University, one of the world’s top academic institutions with an endowment fund worth tens of billions of dollars, is causing market tremors with even subtle shifts in its investment strategy. On December 8, Bitwise Chief Investment Officer Matt Hougan revealed that Harvard Management Company (HMC) significantly increased its Bitcoin investment exposure in the third quarter from $117 million to nearly $443 million. At the same time, its allocation to gold ETFs also grew from $102 million to $235 million.

Key data show that Harvard’s allocation ratio to Bitcoin has reached 2-to-1 compared to gold, clearly indicating that, against the backdrop of the “fiat devaluation trade,” this Ivy League school’s preference for “digital gold” has significantly surpassed that of traditional gold. This landmark event may serve as a crucial catalyst, prompting other large institutions that have been on the sidelines to enter the market.

BTC-1,77%

MarketWhisper·2025-12-08 08:06

Load More