Search results for "RWA"

Chainlink Investors Eye LINK Gains Ahead of Bitwise ETF Launch

Bitwise proposes its Chainlink ETF launch to February 1 after following the U.S. SEC approval for trading on the NYSE.

LINK price eyes further price rallies based on strong institutional interest, Chainlink partnerships, and position in RWA.

Bitwise Asset Management has received approval

LINK-0,9%

CryptoNewsFlash·8h ago

Hedera, Chainlink, AVAX and XLM Dominate RWA Development, Santiment Reports

Hedera led Santiment’s RWA GitHub development ranking, while Chainlink slipped as Avalanche and Stellar held their positions.

The top 10 list also featured upward moves for Chia and OriginTrail, with IOTA the biggest decliner.

Hedera, Chainlink, Avalanche, and Stellar led real-world asset c

CryptoNewsFlash·9h ago

Gate Research Institute: Cryptocurrency Market Fluctuations and Consolidation | Aave Horizon RWA Market Net Deposits Surpass $600 Million

Cryptocurrency Asset Overview

BTC (-2.13% | Current Price 90,887 USDT)

BTC entered a consolidation phase after a sharp rise and pullback on the 1-hour chart. The price found support around $91,000, with a short-term attempt to recover towards MA5 and MA10, but overall it remains trading around MA30.

GateResearch·14h ago

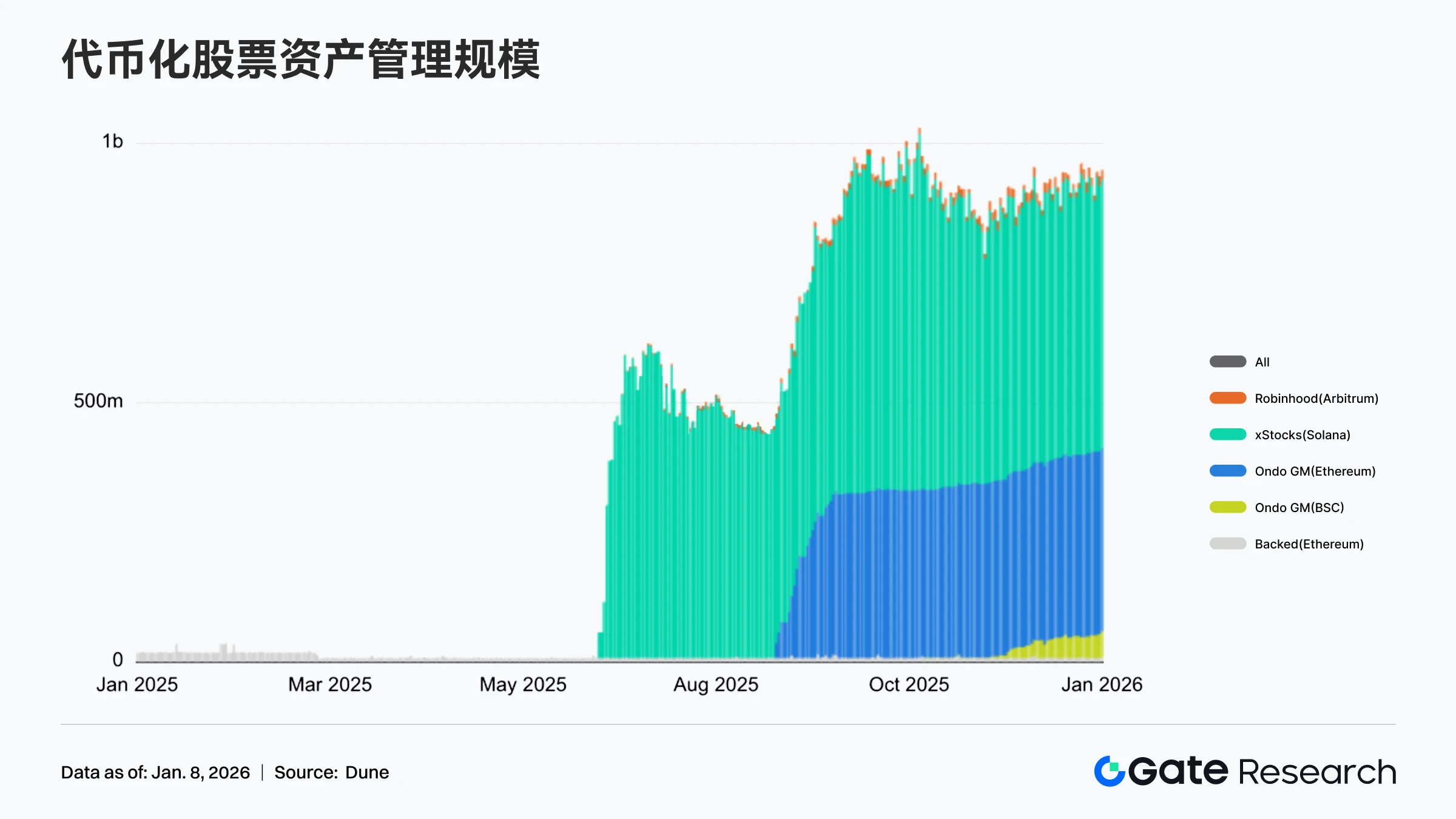

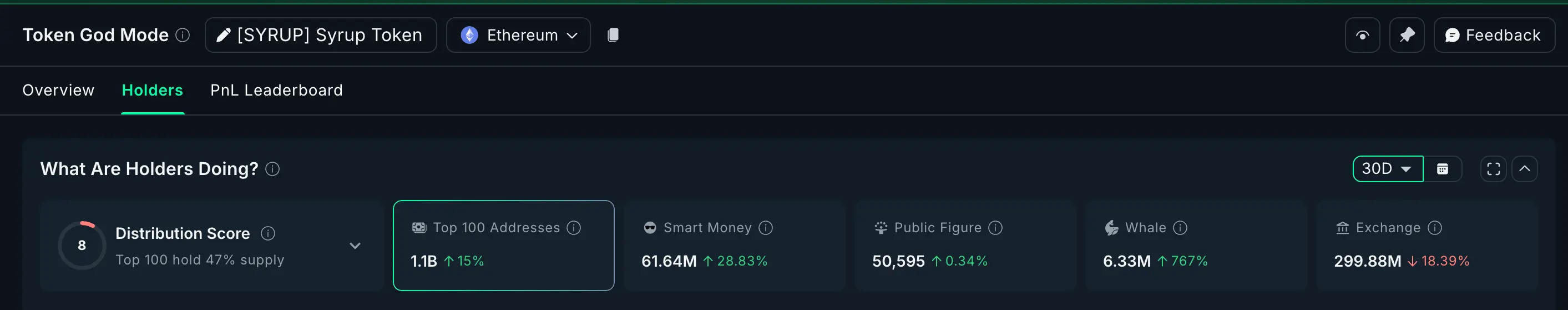

Gate Research Institute: Tokenized Stock AUM Surpasses $1 Billion | Nike Liquidates NFT Business Assets

Summary

BTC and ETH maintain oscillation and recovery, with the trend yet to be confirmed. Funds are shifting preference towards low-volatility and mid-to-long-term narrative assets.

Aave Horizon RWA market net deposits have surpassed $600 million, with institutional funds continuously entering.

Tokenized stock asset management scale has exceeded $1 billion, with on-chain securities accelerating expansion.

Nike sold RTFKT, completing a phased liquidation of its Web3 business attempt.

Polymarket introduces real estate prediction trading, accelerating coverage of real economic variables.

CONX, APT, and STRK will unlock approximately $25.23 million, $21.26 million, and $11.10 million worth of tokens respectively over the next 7 days.

Market Analysis

Market Commentary

BTC Market — After a spike and pullback on the 1-hour chart, BTC entered a consolidation phase, with the price

GateResearch·16h ago

2026 Central Bank Work Conference: Block the "side doors" for virtual currencies, open the "main doors" for digital RMB, and bring RWA into the compliant track

Written by: Liang Yu

Edited by: Zhao Yidan

The 2026 People's Bank of China Work Conference has concluded, with the deployment of "strengthening virtual currency regulation" and "steady development of digital RMB" clearly placed within the same policy framework. This is not merely a technical route choice but a profound declaration of a new financial development paradigm. It clearly indicates that the innovative trajectory of China's financial technology is being reshaped, and all explorations attempting to connect real assets with the digital world must navigate within this newly defined domain.

According to Yicai on January 6, this conference set the tone for the year's work, emphasizing strict implementation of "penetrative regulation of payment institutions" and "strengthening virtual currency regulation, continuously cracking down on related illegal activities." Meanwhile, in terms of financial services, "steady development of digital RMB" has been listed as a routine key task. This combination of tightening and stabilizing,

TechubNews·18h ago

Santiment ranks the top 10 RWA projects based on Developer activity over the past 30 days

Developer activity is a key indicator of long-term blockchain growth. Santiment ranked RWA-focused crypto projects based on 30-day development activity, highlighting the strongest ecosystems. Top projects like Hedera and Chainlink showcase commitment to infrastructure and RWA applications for finance.

TapChiBitcoin·20h ago

Solana Stablecoin Market Hits New High Amid RWA Growth

Stablecoins on Solana Experience Significant 24-Hour Growth, Reflecting Broader DeFi Trends

The market capitalization of stablecoins operating on the Solana blockchain experienced a notable increase of approximately $900 million within a single day, reaching a total of $15.3 billion. This rapid

CryptoBreaking·23h ago

Aave’s Horizon RWAs Surge Amid China’s Regulatory Crackdown

Aave’s Horizon RWAs surge past $800M, doubling since October, driven by growing institutional adoption and tokenized finance.

Canton blockchain’s $382B RWA share sparks debate, highlighting concentration risks and misleading market metrics.

China warns against RWA tokenization, citing

AAVE-1,04%

CryptoFrontNews·01-07 16:51

How the Market Collapse Devastated Our Finances and What to Do Next

NFT and RWA Conferences in Paris Canceled Amid Market Turmoil

The organizers of the upcoming non-fungible token (NFT) and real-world asset (RWA) conferences in Paris have abruptly canceled the events just a month before they were scheduled to take place, citing adverse market conditions. The

CryptoBreaking·01-06 23:55

Milestone moment! Hong Kong Hongrui Group teams up with Korea's BuySell Standards to build a new blue ocean for Asian RWA digital finance

Milestone moment! HongRui Group of Hong Kong teams up with Korea's BuySell Standards to build a new blue ocean for Asian RWA digital finance. The digital financial cooperation between China and Korea has achieved a historic breakthrough!

1. Background of the Era: The Summit Between Leaders Charts a New Blueprint for Cooperation

Recently, during the Korean President's visit to China, the 2026 China-Korea Economic and Trade Investment Cooperation Exchange Conference was grandly held in Beijing. This high-level exchange was jointly organized by relevant government departments of both countries and attracted over 500 fintech leaders, regulatory agency representatives, and industry giants from China, Korea, and ASEAN. The event focused on exploring the path to asset digitization in the Web3.0 era and promoting bilateral investment and trade cooperation to a new level.

Just as this important diplomatic achievement was realized, the China-Korea Digital Finance and Industry Innovation Summit was held simultaneously as a key sub-forum of the exchange, providing a precise matchmaking platform for enterprises from both countries to deepen cooperation.

And in this high

TechubNews·01-06 14:39

Bitcoin RWA tokenization faces sweeping China ban

China labels RWA tokenization illegal, targeting onshore and Hong Kong Web3 service chains.

Summary

Seven top Chinese finance associations classify RWA tokenization with crypto and stablecoins as illegal, calling it high-risk and fraudulent.

Notice extends liability to overseas projects with m

Cryptonews·01-06 08:54

Global RWA is trapped by the "securities" shackles. Why does the optimal compliant solution appear in Dubai?

Currently, one of the hottest tracks in the global fintech field is undoubtedly the tokenization of real-world assets. Traditional capital giants and crypto-native institutions are entering the market one after another, depicting a grand blueprint to bring trillions of dollars worth of physical assets onto the blockchain. However, beneath this vision, a fundamental regulatory shackles has always been difficult to break free from: in the vast majority of jurisdictions, RWA with yield attributes, once exposed to the public market, are quickly incorporated into the strict framework of traditional securities law, resulting in their liquidity nature being confined.

While financial centers like Hong Kong and Singapore are cautiously exploring within the existing securities regulatory framework, Dubai in the Middle East has quietly completed a key paradigm shift. Here, they are not entangled in the classic dilemma of whether RWA qualifies as securities, but instead have chosen to create a new category—“asset-referenced virtual assets”—and have built a comprehensive compliance system covering issuance, sales, and trading. This means that a dedicated

TechubNews·01-06 07:35

From a peak of 270 billion to a flash crash, DeFi ventures into the deep waters of financial infrastructure

Author: Jae, PANews

In 2025, the DeFi (Decentralized Finance) market experienced a thrilling roller coaster ride. At the beginning of the year, driven by explosive Layer 2 performance and institutional capital inflows, TVL (Total Value Locked) skyrocketed from $182.3 billion to a historic peak of $277.6 billion, making a trillion-dollar ecosystem seem within reach.

However, in the fourth quarter, an unexpected 10/11 flash crash poured cold water on the market, causing TVL to sharply shrink to $189.3 billion, erasing the year's gains to a negligible 3.86%. This intense volatility revealed the true fabric behind the glamorous narrative of DeFi: on one side, deep evolution in sectors like staking, lending, and RWA; on the other, the fragility and governance fractures caused by leverage accumulation.

This has been a crucible of ice and fire. The market witnessed Lido's dominance in the staking sector.

DEFI7,15%

PANews·01-06 02:41

Policy Reversal! China's Seven Major Financial Associations classify RWA as "high-risk" illegal activity

In early January 2026, according to reports from Wu Shuo Blockchain and other sources, seven major core financial industry associations, including the Asset Management Association of China, the China Internet Finance Association, and the China Banking Association, jointly issued a clear regulatory signal. They reclassified the tokenization of real-world assets (RWA) as a "high-risk" business model and listed it alongside stablecoins, "air coins," and cryptocurrency mining as illegal financial activities.

This move marks a fundamental shift in China's regulatory attitude towards RWA, transitioning from a previously possible "new technology" observation window to a clear stance on risk containment and business prohibition. Analysts point out that this policy aims to completely exclude RWA from the legitimate financial system. Meanwhile, the United States is advancing its stablecoin framework under the GENUIS Act, highlighting an increasing divergence in the paths of digital asset regulation and currency digitalization between China and the US, which will have a profound impact on the development of related global sectors.

MarketWhisper·01-06 01:46

China Financial Association makes a sudden U-turn! RWA new technology reclassified as "high-risk assets"

The China Financial Association policy has suddenly changed direction. Seven major industry associations jointly issued a notice, reclassifying RWA (Real-World Asset Tokenization) from a "new technology" requiring regulatory clarification to a "high-risk" business model, placing it alongside stablecoins, air coins, and cryptocurrency mining as illegal activities. This marks a fundamental shift in the attitude of Chinese regulators towards RWA, and related enterprises face regulatory crackdown risks.

RWA-2,25%

MarketWhisper·01-06 00:55

How the Market Collapse Devastated Our Finances and What to Do Next

NFT and RWA Conferences in Paris Canceled Amid Market Turmoil

The organizers of the upcoming non-fungible token (NFT) and real-world asset (RWA) conferences in Paris have abruptly canceled the events just a month before they were scheduled to take place, citing adverse market conditions. The

CryptoBreaking·01-05 23:50

China classifies RWA as illegal financial activities

Chinese financial associations have declared the tokenization of real-world assets (RWA) as illegal financial activity. This includes unauthorized fundraising and trading not approved by regulatory authorities, posing serious legal risks for participants both domestically and internationally, highlighting China's strict stance on unregulated blockchain financial products.

RWA-2,25%

TapChiBitcoin·01-05 13:44

Funding Weekly Report | Four public funding events, RWA fixed income market Haven completed seed round financing with a valuation of $30 million, with participation from Candaq and others

Last week, there were a total of 4 investment and financing events in the global blockchain industry, with a total scale of over $42.6 million. DeFi platform Haven raised $30 million, AIAV, which combines AI and Web3, raised $4 million, and SocialGood Inc. received $5.63 million. MMA announced the completion of a $3 million private placement, planning to build a Web3 platform.

PANews·01-05 03:02

HSL Protocol Joins Forces With M3 DAO to Expand Perpetual DEX, RWA Platform Effectiveness Through...

M3 DAO, a decentralized network that focuses on empowering people to capitalize on Web3 ecosystems, today announced a strategic partnership with HSL Protocol, a decentralized perpetual network that enables people to trade cryptocurrencies using leverage through perpetual futures as well as manage an

BlockChainReporter·01-04 16:23

Best Crypto to Buy Now: DeepSnitch AI, Solana & Stellar Lead As RWA Sector Explodes Heading Into ...

As 2026 is here, Solana’s institutional momentum is skyrocketing, with real-world asset (RWA) tokenization emerging as the next crypto narrative expected to achieve 100x growth. According to recent reports, institutional players are pouring resources into blockchain infrastructure that bridges

BlockChainReporter·01-04 13:23

The demise of Oil Coin: "One who issued a Memecoin arrested the issuer of RWA Coin"

Writing by: Xiao Bing | Deep Tide TechFlow

On January 3, 2026, the US military launched a "large-scale" attack on Venezuela, and President Maduro was swiftly arrested and transferred.

Someone commented, "The one who issued a Memecoin has been arrested, while the issuer of RWA Token remains free."

Indeed, this is the case.

On February 20, 2018, Venezuelan President Maduro announced the issuance of the world's first sovereign-backed digital currency, Petro, during a televised speech.

At that time, Venezuela was in the midst of its most severe economic crisis in history, with inflation soaring to nearly 1,000,000% (you read that right), and the national currency, the Bolivar, was depreciating like worthless paper. US sanctions further worsened the situation for this South American oil-rich country.

Maduro hoped that this digital currency could be the last straw to save the nation.

PANews·01-04 12:39

Solana RWA market capitalization soars by 325%, aiming for the billion-dollar mark, ETF attracts $765 million in funds to help SOL target $140

At the beginning of 2026, Solana delivered an impressive performance in the Real World Assets (RWA) sector. Data shows that its on-chain RWA total value soared to $873.3 million in January, a 325% increase compared to a year ago, firmly ranking third in the global blockchain RWA ecosystem. Meanwhile, the spot Solana ETF approved and launched in mid-December 2025 has attracted a net inflow of over $765 million.

The strong fundamental growth and continuous influx of institutional funds resonate, driving SOL prices to consolidate above key technical levels. Analysts are generally optimistic about its potential to reach $140 or even higher in the first quarter of 2026. This marks Solana's transformation from a high-performance public chain to an institutional-grade infrastructure that integrates traditional financial assets with crypto liquidity.

MarketWhisper·01-04 06:37

Hong Kong leads the world: Starting January 1, 2026, aligning with Basel standards, banks' crypto assets will face the strictest capital constraints!

Written by: Liang Yu

Edited by: Zhao Yidan

On January 1, 2026, Hong Kong's financial system will officially adopt a globally recognized "Risk Benchmark." Caixin.com reported on December 29 that the Hong Kong Monetary Authority has confirmed that starting from that date, Hong Kong will fully implement crypto asset regulatory capital requirements based on the latest standards of the Basel Committee on Banking Supervision (BCBS). This move not only makes Hong Kong the first major financial center in Asia to align with this international regulatory framework but also signifies that its prudent regulation of crypto assets has moved from localized pilot programs to comprehensive and systematic international integration.

According to the new regulations, the scope of "crypto assets" as defined by the Basel framework is broad, covering various digital assets that rely on cryptography and distributed ledger technology. This means that mainstream cryptocurrencies such as Bitcoin and Ethereum, as well as innovative forms like stablecoins and real-world asset tokens (RWA), are all included under a unified

TechubNews·01-04 06:30

2025 Review: From MiCA Cleaning Stablecoins, AI Breaking KYC to the Year of RWA, the Complete History of the Birth of a New Crypto Order

Author: trustin

Part One: Timeline Review — Establishing Order

January: MiCA Fully Enters into Force, European Market Completes "Quality Upgrade"

【Event】The EU's Markets in Crypto-Assets Regulation (MiCA) for electronic money tokens (EMT) and asset-referenced tokens (ART) officially comes into effect. The European Banking Authority (EBA) has delisted more than 15 unlicensed algorithmic stablecoins and offshore USD stablecoins.

【In-Depth Analysis】This is the world's first major economy to complete a "clean-up" of the stablecoin market. The historical mission of algorithmic stablecoins in compliant markets has essentially ended. The market logic has shifted from "efficiency first" to "solvency first." This has also forced global exchanges to upgrade their token listing review mechanisms—without real-time proof of reserves (PoR) and clear legal entities, these assets will lose

PANews·01-04 01:34

Solana’s Tokenized RWA Market Reaches $873M High as Institutional Interest Accelerates - Coinedict

Solana is starting 2026 with growing momentum in one of crypto’s most closely watched sectors: tokenized real-world assets (RWAs). Data shows that the total value of RWAs issued on the Solana blockchain climbed to a new all-time high of $873 million in December, reflecting a sharp increase in

Coinedict·01-03 13:09

Avalanche Marks 2025 As Breakout Year for Onchain Growth

Avalanche achieved record growth in 2025, with over 400 million transactions and 32 million smart contracts on its C-Chain. The ecosystem attracted 810,000 daily users and saw nearly $1 trillion in trading volume. RWA value peaked at $2.9 billion, emphasizing its strong economic model.

AVAX-0,92%

BlockChainReporter·01-03 11:06

NFT Market Matures in 2025: Utility, Gaming, and RWA Drive Growth

In 2025, the NFT market matured beyond its speculative bubble, shifting toward functional utility and sustainable growth. Market leaders included Cryptopunks, Courtyard, Dmarket and Pudgy Penguins.

The 2025 NFT Landscape: From Hype to Utility

In 2025, the non-fungible token ( NFT) market

Coinpedia·01-03 03:35

BTCC Wraps 2025 With 11 Million Users, $53.1B in RWA Futures, and Industry Recognition

VILNIUS, Lithuania – January 2, 2026 — BTCC, the longest-operating cryptocurrency exchange globally, has released its Q4 2025 performance report, highlighting a year of notable growth despite industry-wide challenges. The platform ended 2025 with more than 11 million registered users and saw

BlockChainReporter·01-02 15:06

RWA.xyz: Solana tokenized RWA market cap has increased by nearly 10% in the past month to $873.3 million

According to Cointelegraph, tokenized real-world assets (RWA) on Solana have grown nearly 10% in the past month, reaching a record $873.3 million, with the number of holders increasing by over 18.4% to 126,236. Most RWAs are backed by U.S. Treasury bonds, and newly launched tokenized stocks have also shown growth.

TechubNews·01-02 06:54

CEO BlackRock: RWA will usher in a simpler and more seamless investment era

Larry Fink, CEO of BlackRock, emphasizes a structural shift in global finance with $4.1 trillion in digital wallets, primarily in stablecoins. He believes asset tokenization can reduce investment friction, making it more efficient and accessible through mobile applications.

RWA-2,25%

TapChiBitcoin·01-02 03:54

Snowball Money and CheersLand Set to Bring Transparent Human-Readable OnChain Identity

Snowball Money, a platform that transforms wallet addresses into simple, recognizable identities, has declared its strategic partnership with CheersLand, a leading player in the decentralized physical infrastructure network (DePIN) and real-world asset (RWA) sectors. The hidden aim behind this partn

BlockChainReporter·01-01 07:03

3 real-world asset tokens (RWA) to watch in 2026

Real-world assets (Real-world assets – RWA) had a booming year in 2025, raising a big question for the coming year: Can this growth momentum be sustained as the market enters a more challenging phase, or is it just

TapChiBitcoin·01-01 06:04

Crypto’s Next Phase: Coinbase Sees RWA & Stablecoins Dominating

Nick from Coin Bureau has unpacked Coinbase Institutional’s new “2026 Crypto Market Outlook” — and the most striking takeaway is not about Bitcoin or Ethereum. It’s the claim that tokenized real‑world assets (RWAs), especially equities and Treasuries, are on track to sit alongside BTC, ETH,

RWA-2,25%

DailyCoin·01-01 01:44

USDT negative premium, holding stablecoins still losing money, how should we interpret this?

Under the RMB appreciation channel, USDT exhibits negative premiums, and investors do not need to panic excessively. It is recommended to maintain an appropriate proportion of stablecoin assets, which can be hedged through on-chain exchange rate strategies, such as allocating to Euro stablecoins or gold RWA, to moderately avoid exchange rate losses. This article is based on an article by @Web3Mario, organized, compiled, and written by Foresight News.

(Previous context: USDT exits the market, EURC fills the gap, Euro stablecoins surge over 170% against the trend)

(Additional background: Chinese crypto circles panic selling USDT "at a 1.5% negative premium against RMB," bear market, regulatory flight?)

Table of Contents

Why does the RMB enter an appreciation channel, and why does USDT show a negative premium

Should we convert USD stablecoins back to RMB

How to hedge exchange rate losses through on-chain strategies, gold, and euro stablecoins

動區BlockTempo·2025-12-31 15:10

What Assets Truly Deserve to Be On-Chain? The Overlooked Trillion-Dollar Opportunity

The RWA (Real World Asset) narrative has been hot for years, with endless claims that "everything can be tokenized"—real estate, art, fine wine, carbon credits, and more. It all sounds revolutionary, but most of these ideas are fundamentally misguided.

CryptopulseElite·2025-12-31 09:29

COTI Unveils Private RWA Infrastructure As Tokenized Assets Cross $300B

COTI Foundation has launched the first private real-world asset (RWA) infrastructure, empowering compliance and privacy in blockchain transactions. This innovation positions COTI to capture a significant share of the projected $30T RWA market by 2030.

COTI-1,54%

BlockChainReporter·2025-12-30 17:04

Tokenized Gold Fuels RWA Boom As On-chain TVL Leaps From $1B to $4B

Tokenized gold has quietly become one of the year’s biggest success stories in decentralized finance, emerging as a primary engine behind the rapid expansion of real-world assets on blockchains. DefiLlama called attention to the trend on X, noting that “Tokenized Gold has been a major driver of

DEFI7,15%

BlockChainReporter·2025-12-30 16:05

2025 Global Crypto Regulatory Map: The Beginning of the Integration Era, a Year of "Convergence" between Crypto and TradFi

Author: imToken

Objectively speaking, for Crypto/Web3, 2025 will definitely be the most transformative year in the past decade.

If the past ten years have been the "wild growth" of the crypto industry on the fringes of mainstream finance, then 2025 marks the first year of this species' official "legalization evolution":

From stablecoins to RWA, from policy U-turns in Washington to regulatory frameworks in Hong Kong and the EU, the global regulatory logic is undergoing an epic paradigm shift.

1. United States: Crypto Enters a Period of Institutional Recognition

For a considerable period, US regulation of the crypto industry has resembled a tug-of-war lacking consensus.

Among them, the US Securities and Exchange Commission (SEC) under Gary Gensler has been particularly active, frequently using enforcement actions to define the legal boundaries of crypto assets, filing lawsuits,

PANews·2025-12-30 12:11

New Year's Day is approaching, and the crypto market continues to consolidate. What potential "catalysts" could exist in the market in 2026?

Article by: Glendon, Techub News

After briefly climbing above $90,000 yesterday, Bitcoin fell below $87,000 again today, with a intraday decline of 3.76%. Meanwhile, the crypto market has once again experienced a broad decline. According to SoSoValue data, no major sector in the market was spared, with 24-hour declines generally exceeding 3%. Among them, SocialFi, Layer2, AI, RWA, and NFT sectors were hit hardest, each dropping more than 5%.

In terms of institutional investment, CoinShares' latest data shows that digital asset investment products saw a net outflow of approximately $446 million last week, bringing the total outflow since October 10 to $3.2 billion. Additionally, last week, Bitcoin spot

TechubNews·2025-12-30 09:19

BlackRock’s BUIDL Pays $100M in On-Chain Dividends, Cementing RWA Momentum

BlackRock's tokenized money market fund, BUIDL, has distributed $100 million in dividends, marking it as the largest tokenized U.S. Treasury offering. Launched in March 2024 on Ethereum, it demonstrates the potential for real-world asset implementation on blockchains, gaining significant investor attention and signaling institutional confidence in regulated financial products.

Coinfomania·2025-12-30 09:09

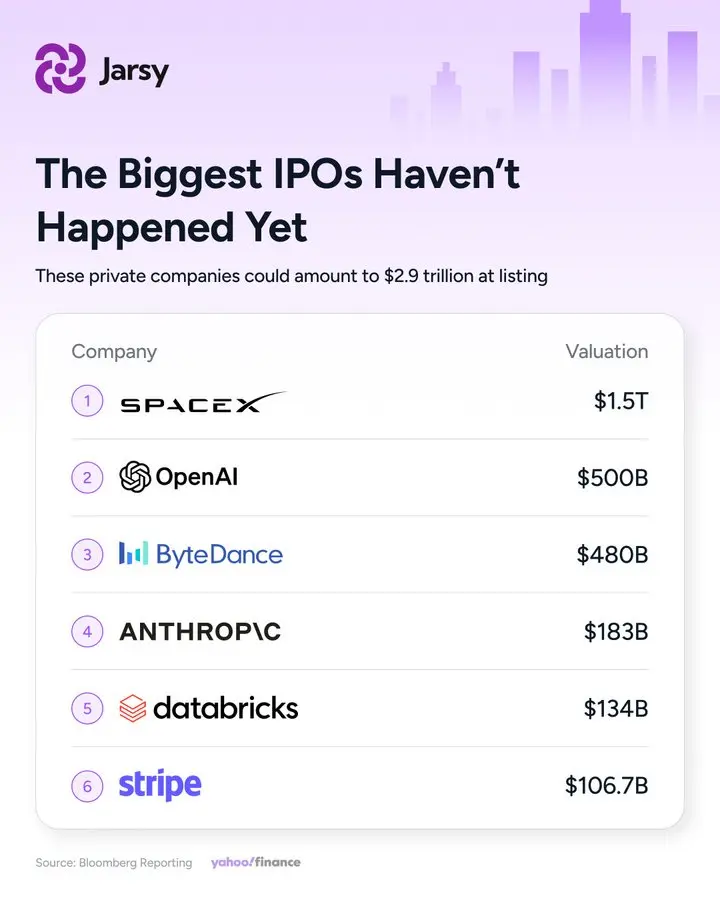

Tokenized stocks welcome the moment of stablecoins: the market value exceeds $1.2 billion, and the amount of RWA lock-up jumps to the fifth largest in DeFi

Tokenized stock market capitalization surpasses $1.2 billion, with RWA locked-up volume soaring to become the fifth largest in DeFi. Institutional giants are actively deploying compliant on-chain trading, and the market is experiencing an explosive period similar to the early days of stablecoins.

Tokenized stock market cap exceeds $1.2 billion, growth trajectory similar to early stablecoins

--------------------------

This year, besides stablecoins, tokenized stocks in the real-world asset (RWA) sector are also rapidly growing, experiencing a burst similar to the early days of stablecoins.

According to Token Terminal statistics, the total market cap of tokenized stocks has risen to $1.2 billion, with significant capital inflows in September and December.

Token Terminal points out that the current stage of tokenized stocks is comparable to stablecoins in 2020, when stable

CryptoCity·2025-12-30 08:25

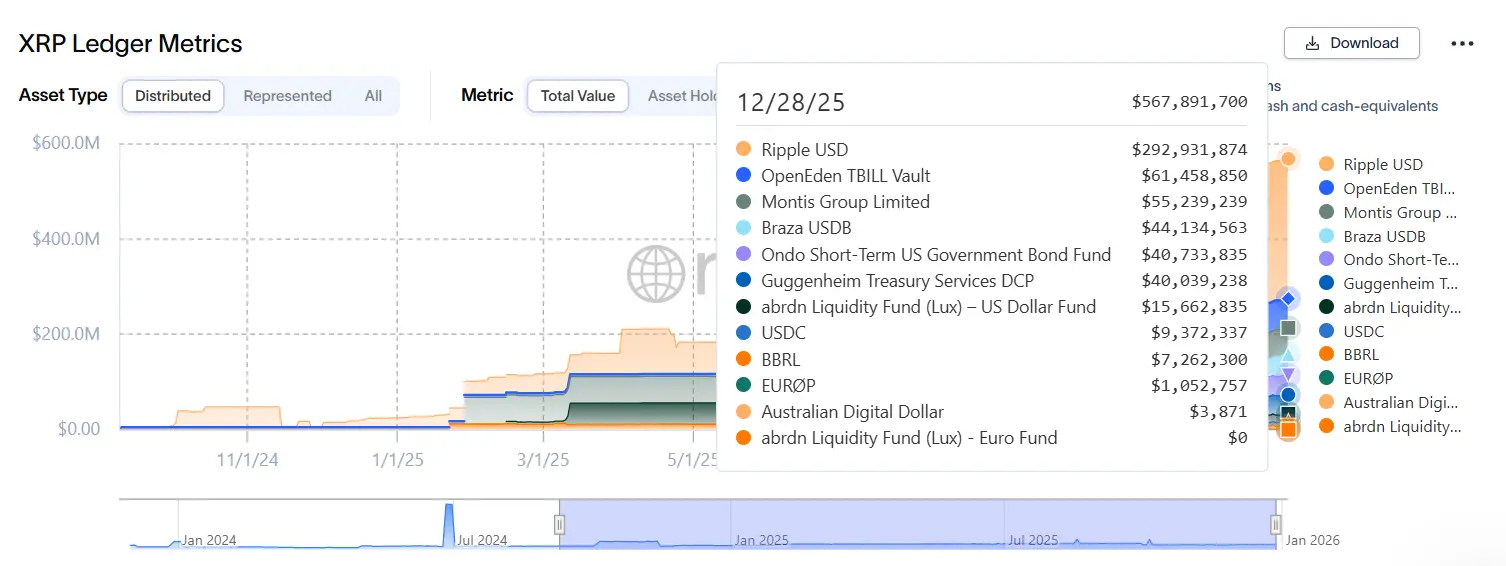

Tokenized RWA Value on XRP Has Grown 2200% in 2025

On-chain data shows that the value of tokenized RWA on the XRP Ledger (XRPL) has increased by an impressive 2,200% in 2025 alone.

The real-world asset tokenization theme, championed by BlackRock CEO Larry Fink and the SEC Chair Paul Atkins, dominated discussions across multiple crypto communities t

TheCryptoBasic·2025-12-30 07:03

Gate Research Institute: Bitcoin Fails to Hold the $90,000 Level | RWA Sector TVL Surpasses DEX

Cryptocurrency Market Overview

BTC (-0.37% | Current Price 87,393 USDT): Bitcoin remains in a narrow range between $86,000 and $90,000, having been repeatedly rejected near $90,000 since mid-December. Recent price movements resemble a consolidation phase after volatility contraction rather than a trend continuation, with both bulls and bears temporarily reaching a stage of balance. Once the price effectively breaks through the critical resistance zone of $90,000–$92,000, upward momentum is expected to re-ignite. From an on-chain perspective, Bitcoin is gradually transitioning from the previous aggressive selling phase to a stabilization phase. Currently, a large number of spot buy orders, mainly from whales, are clustered around the current price level, forming a stark contrast to earlier pullbacks dominated by retail traders and a noticeable absence of large participants. The sustained involvement of spot whales typically indicates longer-term position building, especially common in low-volatility environments.

GateResearch·2025-12-30 06:39

Cantor Fitzgerald 警告寒冬來襲!機構卻砸 500 億押注 RWA

Cantor Fitzgerald warns that Bitcoin has entered a long-term downturn, having been above the high point for 85 days, and may test MicroStrategy's cost basis at $75,000. However, institutional adoption rates are surging against the trend, with RWA tokenization value increasing to $18.5 billion this year and expected to break $50 billion by 2026. DEX expansion and the CLARITY bill provide regulatory clarity, and the market is now dominated by institutions rather than retail investors, marking the industry’s move into an institutionalized phase.

MarketWhisper·2025-12-30 05:43

DeFi landscape changes: RWA surpasses DEX with $17 billion TVL, entering the top-tier track

According to the latest data from DefiLlama, the total value locked (TVL) in Real World Asset (RWA) protocols has surpassed $17 billion, successfully overtaking decentralized exchanges (DEX) by the end of 2025, ranking as the fifth largest category in DeFi ecosystem TVL, just behind lending, liquidity staking, cross-chain bridges, and re-staking sectors. This milestone achievement signifies that the driving force behind DeFi's development is shifting from pure on-chain financial experiments to the large-scale absorption of traditional yield assets and safe-haven assets. The core driver of this wave is not speculation, but rather institutional asset-liability management needs in a "higher and longer" interest rate environment, as well as macro allocation demands stimulated by the rise of gold and silver. This silent transformation indicates that the integration of the crypto economy with the trillion-dollar traditional financial market has entered a phase of substantial acceleration.

MarketWhisper·2025-12-30 04:01

The crypto winter may reappear in 2026, but Cantor Fitzgerald foresees a new era of institutional growth and on-chain transformation

Renowned financial institution Cantor Fitzgerald pointed out in its latest year-end report that the cryptocurrency market may be entering the early stages of a new "crypto winter," which could echo Bitcoin's approximately four-year cycle. However, unlike previous adjustments, this cycle is expected to be less chaotic, more institution-led, and increasingly defined by decentralized finance, real-world asset tokenization, and clearer regulations. The report data shows that the total on-chain RWA value has surged to $18.5 billion this year and is expected to surpass $50 billion by 2026. Although Bitcoin prices may face pressure, the market infrastructure and participants are undergoing profound structural changes, laying the foundation for a more sustainable growth in the next cycle.

MarketWhisper·2025-12-30 01:24

The People's Bank of China makes a major announcement! New Digital RMB framework to be launched on New Year's Day 2026

On December 29, the People's Bank of China announced that the new digital yuan framework will be launched on January 1, 2026, emphasizing central bank regulation, the liability nature of commercial banks, account-based systems, and compatibility with distributed ledger technology. On the same day, the Hong Kong Monetary Authority implemented Basel's new crypto asset regulations, including Bitcoin, Ethereum, RWA, and stablecoins into bank capital regulation.

MarketWhisper·2025-12-29 07:00

Toto Finance Brings Real-World Assets On-Chain With RWA Tokenization

Toto Finance aims to bridge traditional finance and Web3 by integrating real-world assets (RWAs) on the blockchain. By combining tokenization with legal compliance and custody, it enhances transparency and connects finance with the physical economy.

BlockChainReporter·2025-12-29 06:05

Crypto Venture Capital Shift: Public Chains and AI Cool Down, Predictions, Payments, and RWA Become New Hotspots

The cryptocurrency venture capital market is undergoing changes, with the boom in public chain financing cooling down, and investors shifting their focus to application projects with real users and revenue. Emerging sectors such as prediction markets, payment systems, and real-world assets (RWA) are rising, attracting significant capital. By 2025, financing performance in fields like payments and RWA is expected to be impressive, while DeFi remains steady but relatively cautious. Investment trends indicate that consumer-end products and genuine application scenarios are gaining more attention.

PANews·2025-12-28 23:34

Developing Economies to Lead RWA Tokenization Boom in 2026: Crypto Expert

Emerging Markets Drive Growth in Tokenized Real-World Assets

The market for tokenized real-world assets (RWA) is projected to experience substantial growth through 2026, fueled primarily by the adoption of blockchain-based asset management in emerging economies. Jesse Knutson, Head of

CryptoBreaking·2025-12-28 19:45

Load More