Search results for "SWAP"

Hackers Can't Break In, So They Just Storm Your Home With Guns! Offline Violent Robbery Cases Surge Among Small Cryptocurrency Investors

As cryptocurrency prices rise and blockchain transactions become irreversible once transferred, a new form of crime is emerging worldwide. Criminals are no longer just hacking accounts online; they are directly targeting investors themselves through home invasions, gun threats, and even kidnapping, forcing victims to unlock their phones and wallets to complete transfers on the spot. Statistics show that since 2020, over 215 physical cryptocurrency attack cases have been recorded globally, with the number of cases in 2025 nearly doubling that of the previous year. Victims are no longer limited to high-level crypto insiders or those flaunting wealth; instead, an increasing number of ordinary-looking, small to medium-sized investors with modest assets but holding certain crypto holdings are being targeted.

From remote hackers to offline violence, small investors are more easily targeted

An example is Julia (, a retired woman investor from Florida, who used a pseudonym. In 2021, she was targeted in a SIM card swap attack, and within just a few minutes...

ChainNewsAbmedia·01-06 08:14

Noya.ai Research Report: The Revolution of Prediction Market Agents under the AI×DeFi Narrative

Author: 0xjacobzhao

In our previous Crypto AI series reports, we consistently emphasized the following point: the most practically valuable scenarios in the current crypto space are mainly focused on stablecoin payments and DeFi, while Agents are the key interface between AI industry and users. Therefore, in the trend of integrating Crypto and AI, the two most valuable paths are: in the short term, AgentFi based on existing mature DeFi protocols (such as lending, liquidity mining, and other basic strategies, as well as advanced strategies like Swap, Pendle PT, and funding rate arbitrage), and in the medium to long term, Agents centered around stablecoin settlement and relying on protocols like ACP/AP2/x402/ERC-8004.

DEFI-4,72%

PANews·01-06 03:18

Maduro is sanctioned, and Venezuela's legendary "60 billion in Bitcoin" has the US swallowed?

With the dramatic change in Venezuela's political situation, Maduro was detained by the US military, and the shadow reserves of Bitcoin worth up to $60 billion have become a mystery. These crypto assets accumulated through gold swaps and oil transactions—who actually controls them? Who holds the key private keys? This article is based on "Maduro's 'Lightning Strike' by the United States: Where Will Venezuela's 'Legendary $60 Billion Bitcoin' Go?" by Ye Huiwen from Wall Street Insights, reorganized by律動.

(Previous summary: Data: Predictive market 'spoils' Maduro's fall with $10 million in advance)

(Background supplement: US lawmakers propose legislation to ban government officials from insider trading in prediction markets! Polymarket suspected of leaks in Maduro arrest plan)

Table of Contents

Digital Assets of the Shadow Financial Empire

Gold Swap and Crypto Channels

The Role of Key Figure Alex Saab

Crude Oil

動區BlockTempo·01-04 07:40

Silver leasing rates surge 39%! Banks refuse to lend, shocking Wall Street

In December 2025, an abnormal signal appeared in the global silver market: the interbank leasing rate skyrocketed from 0.5% to 39%, the 1-year forward swap rate dropped to -7.09%, and buyers were willing to pay a 7% premium for immediate delivery. LBMA data shows that while nominal inventories amount to tens of thousands of tons, freely tradable inventories are only about 6,600 tons. Banks are refusing to lend silver, revealing a deadly crack between paper commitments and physical supply.

MarketWhisper·2025-12-29 03:32

Aave Founder Denies Claims of Using AAVE Token Purchase to Influence Failed Governance Vote

Aave founder denies claims that a large AAVE token purchase aimed to influence a governance vote that failed.

Aave DAO members questioned transparency after fee revenue from CoW Swap moved to a wallet linked to Aave Labs.

Governance tensions increased after the community rejected the

AAVE-3,93%

CryptoNewsLand·2025-12-27 10:21

Koposie acquires Inkora for 33 trillion KRW... shaking up the North American AI market

Information technology service company Coforge(Coforge) has acquired Encora(Encora) with a scale of approximately 3.38 trillion Korean won, accelerating its entry into the next-generation AI technology market.

Coforge plans to leverage this acquisition to capitalize on Encora's AI and technological capabilities headquartered in New Jersey, USA. In particular, Encora's enterprise application development, AI-based data processing, and user interface design capabilities are regarded as core assets. Coforge has raised a bridge loan of $550 million (about 7.9 trillion Korean won) to restructure Encora's existing debt and plans to complete the transaction through an equity swap.

Encora's advantage lies in its ability to provide global enterprises with technology that optimizes large language models(LLM) based on internal data, or transform them into automated agents integrated into enterprise applications. The company processes unstructured data through its proprietary platform "AIVA" and has achieved

TechubNews·2025-12-27 00:18

VeChain Introduces New SDK Version With Wallet Modal and Token Swap

_VeChain launches VeChain Kit v2, delivering a redesigned interface, token swaps, and developer tools to simplify decentralized application building._

VeChain has officially launched VeChain Kit v2, a new software development kit for frontend dApps. The release marks a significant ecosystem

VET-5,09%

LiveBTCNews·2025-12-25 16:31

THORChain Launches Native Cross-Chain Swap Interface in Public Beta

George Town, Cayman Islands, December 23rd, 2025, Chainwire

First-of-its-kind DEX eliminates wrapped tokens and centralized exchanges, enabling direct native asset swaps across multiple blockchains

THORChain announced today the public beta launch of swap.thorchain.org, a dedicated DeFi swap in

CryptoDaily·2025-12-25 06:55

Changee.com Strengthens Its Position as a Leading Non-Custodial Crypto Exchange

Changee.com offers a non-custodial cryptocurrency exchange platform that allows users to swiftly and securely swap over 200 altcoins without registration, prioritizing privacy and user control. With competitive rates and positive user feedback, it aims to enhance the digital finance experience through continuous innovation.

ICOHOIDER·2025-12-24 11:25

THORChain Launches Native Cross-Chain Swap Interface in Public Beta

George Town, Cayman Islands, December 23rd, 2025, Chainwire

First-of-its-kind DEX eliminates wrapped tokens and centralized exchanges, enabling direct native asset swaps across multiple blockchains

THORChain announced today the public beta launch of swap.thorchain.org, a dedicated DeFi swap

BlockChainReporter·2025-12-23 15:34

THORChain Launches Native Cross-Chain Swap Interface in Public Beta

George Town, Cayman Islands, December 23rd, 2025, Chainwire

First-of-its-kind DEX eliminates wrapped tokens and centralized exchanges, enabling direct native asset swaps across multiple blockchains

THORChain announced today the public beta launch of swap.thorchain.org, a dedicated DeFi swap in

CryptoDaily·2025-12-23 15:32

What’s Driving the 10% Drop in AAVE Price?

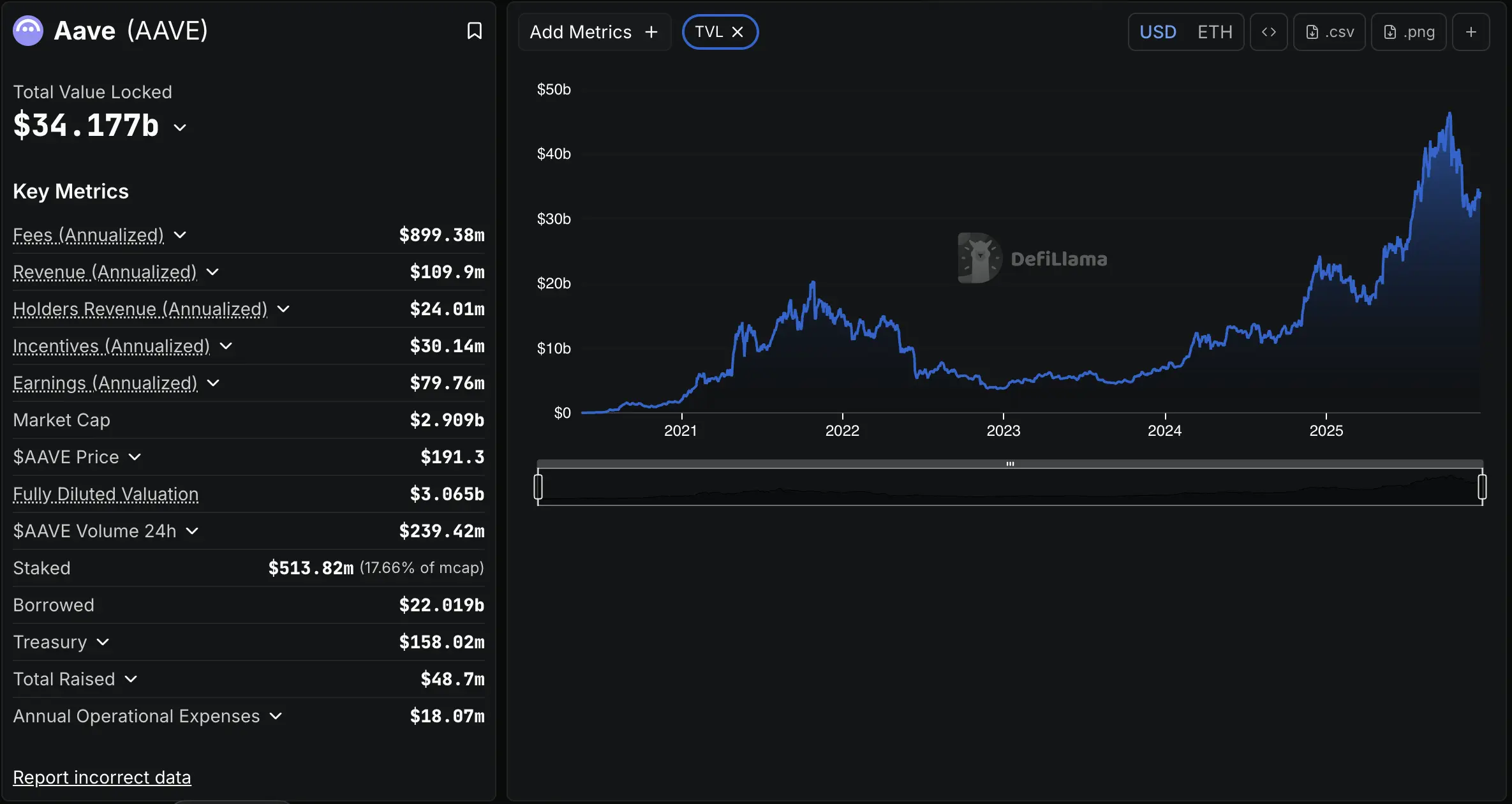

AAVE has plunged more than 10% in the past 24 hours amid renewed governance controversy, with accusations that Aave Labs secretly redirected significant swap fee revenue away from the Aave DAO treasury.

CryptopulseElite·2025-12-23 09:45

Aave DAO clashes with Aave Labs over CoW Swap fees and control of protocol IP

Aave Labs and the Aave DAO battle over CoW Swap fee flows, with delegates pushing to move all Aave IP, brand and frontend assets under direct tokenholder control.

Summary

CoW Swap fees on the Aave frontend flowed to an Aave Labs wallet, prompting accusations of "stealth privatization" and an

Cryptonews·2025-12-23 09:18

MetaMask’s native Bitcoin push deepens multichain pivot with Linea rewards twist

MetaMask has integrated native Bitcoin support, allowing users to buy, transfer, and swap BTC with EVM and Solana assets. This multichain expansion aligns with Consensys's IPO plans and includes rewards for users engaging with Bitcoin.

Cryptonews·2025-12-23 08:00

Latest Aave community controversy: free asset swap becomes charged, DAO demands the recovery of revenue control.

The Decentralized Finance (DeFi) lending platform Aave is facing strong Rebound from the community. The controversy arises from Aave's recent introduction of a 0.15% to 0.25% fee on the originally free asset swap function in the official front-end interface, and this revenue does not flow into the DAO treasury but is retained by the development company Aave Labs.

This move has sparked widespread discussion in the community about whether "decentralized governance is being undermined," and has focused the entire Decentralized Finance community on a core question: who truly controls the value and revenue of the protocol?

From Free to Paid: Major Changes to Aave's Frontend Swap Functionality

In the past, Aave users could perform free asset swaps through its official front end (such as app.aave.com), such as swapping between USDC and DAI or ETH, only bearing the basic DEX slippage and

ChainNewsAbmedia·2025-12-22 09:04

Ethereum is no longer a dark forest: How real-time blocks reshape execution fairness.

Author: Kevin Lepsoe Source: X, @lepsoe Translator: Shan Ouba, Golden Finance

When you finish reading this paragraph, a typical Ethereum user may have completed a payment, a token swap, an NFT purchase, a transaction, or registered a decentralized domain name... The key words are "or" and "may."

At the same time, users utilizing Ethereum real-time nodes can complete all of the following operations:

A payment,

A token swap,

An NFT purchase,

A transaction,

A decentralized domain registration,

and more than 200 other operations...

All operations are completed in order, the results are fully determined, and are implemented directly on the Ethereum mainnet without relying on L2.

How is all of this possible?

12 seconds, which can be called the dark age of the financial sector.

A few years ago, Ethereum

ETH-3,49%

金色财经_·2025-12-22 08:43

Aave Labs Under Scrutiny as Alleged $10M Losses Spark Outrage

Revenue Dispute: Delegates claim CowSwap integration redirected swap fees away from the Aave DAO.

Governance Backlash: Tokenholders warn alleged revenue losses could exceed $10 million annually.

Labs Defense: Aave Labs cites long-term innovation and DAO value creation to counter

AAVE-3,93%

CryptoNewsLand·2025-12-20 08:41

In-depth Analysis of Aave Internal Conflict: The Power Struggle Between Protocol and Frontend

Author: Chloe, ChainCatcher

Recently, the controversy between Aave DAO and Aave Labs has been exposed. The former is responsible for governance protocols, while the latter develops Aave products.

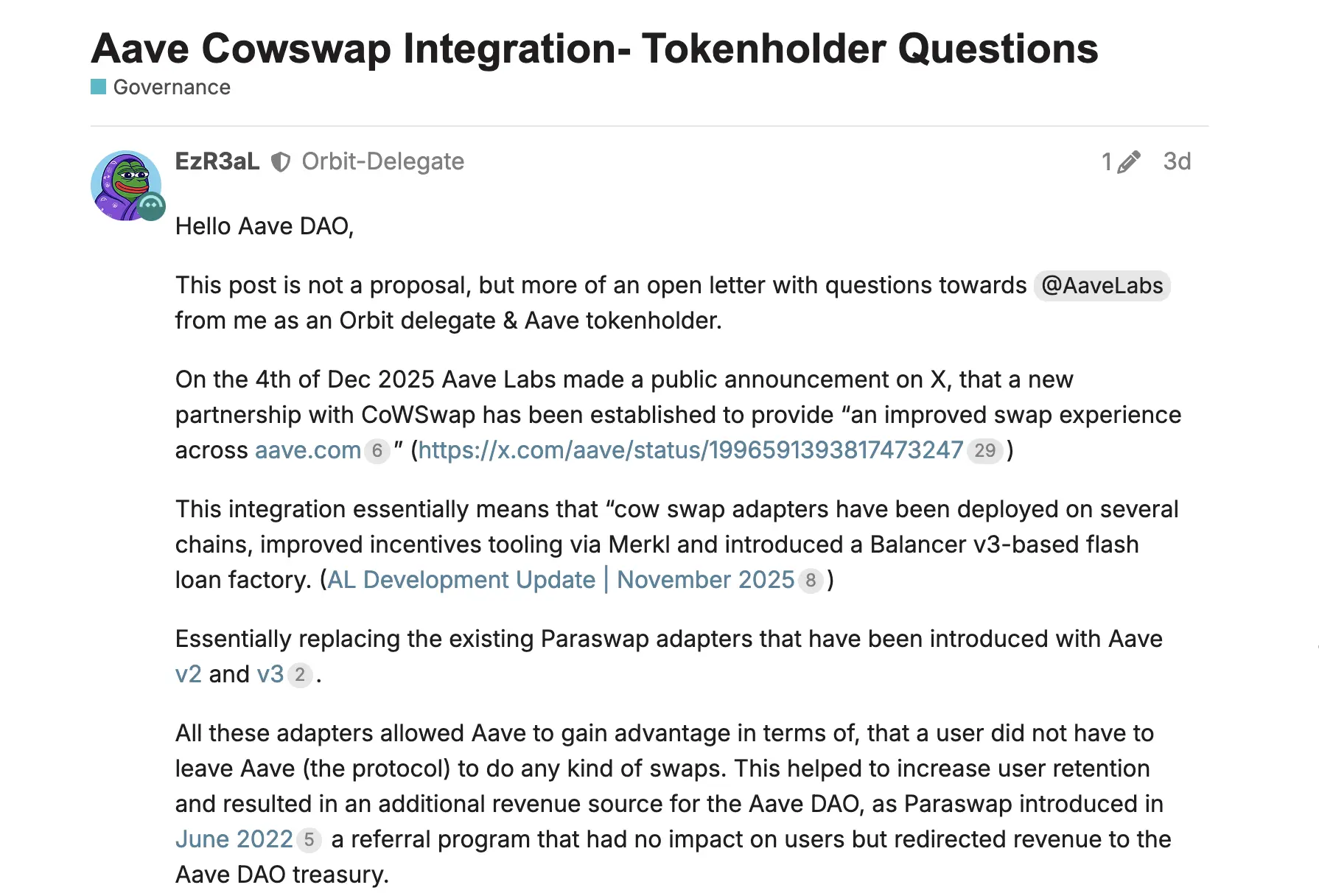

The focus of this dispute is the fee issue arising from the recent announcement of deep integration with CoW Swap. An Aave DAO member using the pseudonym EzR3aL pointed out that Aave Labs recently integrated CoW Swap services, originally intended to optimize user trading paths, but on-chain data shows that the fees generated from this integration no longer flow into the DAO, but directly into Labs' private address. At the current rate, approximately $10 million will flow out of the DAO treasury in one year.

EzR3aL raised concerns to the community: why was there no prior consultation with the DAO regarding the fees?

金色财经_·2025-12-17 13:49

What Is Blocto Wallet? Flow Ecosystem Mainstay Announces Shutdown Amid 99% FLOW Price Crash

Blocto—the leading multi-chain smart wallet and key infrastructure provider in the Flow ecosystem—announced it will cease operations for its core wallet, swap, and cross-chain bridge services effective December 18, 2025, at 7 PM PST.

FLOW-0,62%

CryptopulseElite·2025-12-17 06:52

Mark Cuban-supported Blocto Wallet is about to shut down. What do over 2 million users need to do?

Flow ecosystem's well-known cross-chain smart wallet Blocto officially announced on December 17 that it will terminate its wallet, Swap, and cross-chain bridge services at 7 PM PST on December 18. This project, which has served over 2 million users and is a core builder of the Flow blockchain ecosystem, has faced continuous severe losses due to the native token FLOW's price plummeting from nearly $40 in 2021 to below $0.3, making it unsustainable to maintain. This event not only involves a cumulative loss of over $5.5 million but also exposes the severe survival challenges faced by Web3 infrastructure projects that overly rely on a single ecosystem and token economy in the deep bear market.

FLOW-0,62%

MarketWhisper·2025-12-17 01:56

DEX users keep full custody as smart contracts replace exchange middlemen

Decentralized exchanges let users trade crypto from non-custodial wallets via smart contracts and liquidity pools, cutting out centralized intermediaries and custodial risk.

Summary

DEXs are non-custodial trading platforms where users swap tokens directly via smart contracts instead of centrali

Cryptonews·2025-12-16 14:36

Data shows that whales are increasingly favoring Ethereum over Bitcoin

According to recent data, large investors (whales) in the cryptocurrency market are accumulating Ethereum (ETH) more strongly than Bitcoin (BTC). Trading activity recorded on Lookonchain shows that a whale swapped 502.8 BTC to acquire 14,500 ETH, and continued to swap 1,969 BTC for

TapChiBitcoin·2025-12-15 11:06

Bridgers Brings XRP and RLUSD to 50+ Chains via One-Click Swaps

Bridgers has rolled out one-click cross-chain swaps for XRP, RLUSD and other XRPL-based assets. The upgrade connects Ripple assets to more than 50 blockchains and over 600 tokens. For users, the pitch is simple: swap once, move anywhere. No complex steps and no chain-hopping stress. The platform

XRP-4,5%

Coinfomania·2025-12-15 06:44

Aave Governance Crisis! Laboratory Embezzles $10 Million in Fees, Igniting Community Outrage

Aave Decentralized Autonomous Organization (DAO) and Aave Labs have erupted into a heated conflict over fee distribution issues related to CoW Swap integration. DAO members revealed that the fees generated from using CoW Swap for crypto asset exchanges are flowing into private addresses controlled by Aave Labs, rather than the Aave DAO treasury. This has resulted in a weekly loss of approximately $200,000 worth of Ethereum, amounting to an annual loss of up to $10 million.

MarketWhisper·2025-12-15 03:04

Firestorm erupts in Aave governance forum over CoW Swap fees

A dispute has arisen between Aave DAO and Aave Labs over the routing of integration fees from CoW Swap, with concerns about the lack of consultation and revenue distribution. Aave Labs claims development rights, while DAO members demand fees returned to the treasury.

Cointelegraph·2025-12-14 18:15

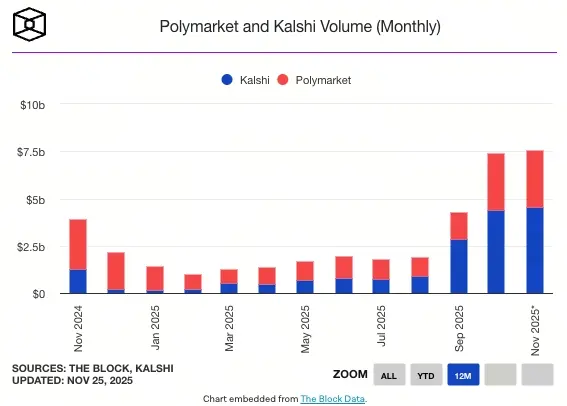

Bitnomial receives CFTC approval to launch prediction markets in the US

Bitnomial Clearinghouse LLC has been approved by the U.S. Commodity Futures Trading Commission (CFTC) to clear fully collateralized swap contracts. This decision allows the parent company Bitnomial to deploy the prediction market while providing clearing services for platforms.

BTC-2,08%

TapChiBitcoin·2025-12-13 01:29

Debate over Aave DAO revenue after CoW Swap integration

Aave is facing a heated debate over revenue distribution after concerns arose about fees from the new CoW Swap interface not going to the Aave DAO treasury. Marc Zeller emphasizes potential revenue loss, while founder Stani Kulechov defends Aave Labs' right to earn from their developments.

TapChiBitcoin·2025-12-13 00:19

Coinbase expands support for Solana and integrates DEX trading directly within the app

Coinbase protocol expert Andrew announced that Coinbase is expanding native integration with the Solana ecosystem. The platform has launched a Solana-based DEX trading feature directly within the Coinbase app, allowing users to swap native Solana tokens directly. Users can pay with

SOL-2,27%

TapChiBitcoin·2025-12-11 10:09

Ueda and the male hawk signal! The countdown to the Bank of Japan's interest rate hike has changed dramatically in the yen exchange rate

The overnight swap market shows that traders are predicting an 88% probability of a rate hike by the Bank of Japan in December. Bank of Japan Governor Kazuo Ueda said that Japan is getting closer to achieving 2% inflation on a sustainable basis, which is interpreted by the market as a key signal of interest rate hikes. If the Bank of Japan raises borrowing costs to 0.75%, it will hit the highest level in 29 years since 1995. After Kazuo Ueda's comments were broadcast, the yen strengthened in response, rising above the 156 mark against the US dollar at one point.

MarketWhisper·2025-12-10 06:48

Xgram.io Launches Direct Bitcoin to Monero Swaps

Xgram.io has launched a Bitcoin-to-Monero swap feature, allowing users to easily convert BTC to XMR. This streamlined process enhances privacy and simplifies asset management, catering to growing user demand for quick and low-cost transactions.

CryptoNewsLand·2025-12-08 20:03

Bringing the forex market on-chain is far more complex than simply swapping stablecoins—it's a trillion-dollar market that is widely misunderstood.

Author | Spinach Spinach Talks Web3

Link: Statement: This article is a reprint. Readers can find more information through the original link. If the author has any objections to the form of reprinting, please contact us and we will make modifications according to the author's requirements. The reprint is for information sharing only and does not constitute any investment advice, nor does it represent the views and positions of WuTalk.

In 2024, while participating in a Monetary Authority of Singapore (MAS) pilot project, I started to frequently engage with the field of foreign exchange due to involvement in the on-chain swap between the Singapore dollar stablecoin and African CBDC, and began to discuss with many people. At that time, the feedback from many was almost identical: Forex is one of the largest financial markets in the world—even taking just a small share would be enough to make a profit. My thinking was straightforward: since stablecoins can circulate globally, then moving the forex exchange scenario onto the chain using AMM would have huge potential, right? However, after trying many...

WuSaidBlockchainW·2025-12-07 05:37

iAero Protocol Launches Token Sweeper, Distributes 5% of LIQ Supply to Stakers

Press Release

Sheridan, Wyoming, USA, December 4th, 2025, Chainwire

iAero Protocol Launches Token Sweeper Application, Announces LIQ Distribution Campaign.

Base-native liquid staking protocol introduces multi-token batch swap tool and six-month staker rewards program.

iAero Protocol, a liquid s

BitcoinInsider·2025-12-04 21:13

iAero Protocol Launches Token Sweeper, Distributes 5% of LIQ Supply to Stakers

Sheridan, Wyoming, USA, December 4th, 2025, Chainwire

iAero Protocol Launches Token Sweeper Application, Announces LIQ Distribution Campaign.

Base-native liquid staking protocol introduces multi-token batch swap tool and six-month staker rewards program.

iAero Protocol, a liquid staking protocol

CryptoFrontNews·2025-12-04 19:45

How a Changelly User Recovered $4.3M From a Frozen Swap

More than $4.3 million in frozen digital assets on the Changelly platform has been successfully recovered after months of uncertainty, marking a significant development for victims of blocked crypto swaps.

BitcoincomNews·2025-12-03 05:17

Is a rate hike in December likely in Japan? Bank of Japan Governor Kazuo Ueda hints at taking action.

The Governor of the Bank of Japan, Kazuo Ueda, has issued the clearest hint yet that the central bank's board may raise the benchmark interest rate this month. He pointed out that any rate increase would only be an adjustment to the degree of easing, and the authorities will decide whether to take action based on the actual situation.

Central Bank Governor Kazuo Ueda hinted that Japan is likely to raise interest rates in December.

According to a report by Bloomberg, on Monday in Nagoya, Bank of Japan Governor Kazuo Ueda delivered a speech to local business leaders, stating that the Bank of Japan "will weigh the pros and cons of raising policy interest rates by examining domestic and foreign economies, inflation, and financial markets, and will make decisions at its discretion."

According to the overnight swap index, traders believe that the likelihood of the Central Bank raising interest rates at the policy meeting ending on December 19 is about 64%. If a rate hike occurs by January at the latest, this percentage will rise to 90%. In contrast, two weeks ago, the market's expectation for a rate hike in December was only 30%.

The Japanese yen is appreciating, the two-year public

ChainNewsAbmedia·2025-12-01 04:54

THORChain: The Decentralization Liquidity Revolution of the 2025 cross-chain trading platform

[BTC](https://www.gate.com/post/topic/BTC) [ETH](https://www.gate.com/post/topic/ETH) [去中心化](https://www.gate.com/post/topic/%E5%8E%BB%E4%B8%AD%E5%BF%83%E5%8C%96) In the world of Crypto Assets, cross-chain trading platforms are becoming key to facilitating the free flow of assets between different Blockchains. Through decentralized Liquidity protocols, THORChain breaks traditional limitations, achieving efficient cross-chain asset swap within its ecosystem. This not only enhances the application efficiency of crypto cross-chain bridges but also signifies a new era of Decentralization Exchange technology, restoring confidence for more users in controlling their assets.

幣圈動態·2025-11-29 16:03

Hidden Fee Scam in Plain Sight: How Crypto Copilot Quietly Drained Solana Traders

Security researchers disclosed that Crypto Copilot, a Chrome extension, has been consistently skimming SOL from users trying to swap on Raydium. Instead of directly draining wallets, the extension attaches a hidden transfer instruction to legitimate transactions, siphoning at least 0.0013 SOL

SOL-2,27%

CryptoBreaking·2025-11-28 08:14

Malware Chrome Extension Secretly Siphoned Fees From Solana Traders for Months

In brief

Chrome extension Crypto Copilot secretly adds a hidden SOL transfer to every Raydium swap, siphoning fees to an attacker's wallet.

Security platform Socket found the extension uses obfuscated code and a misspelled, inactive backend domain to mask its activity.

On-chain theft remains

Decrypt·2025-11-27 20:03

Houdini Pay targets freelancers with privacy-focused crypto payment tool

Centralized instant exchange aggregator Houdini Swap has rolled out a private payment service allowing users to receive payments in their preferred asset without revealing their onchain address.

According to an announcement shared with Cointelegraph, Houdini Pay allows users to generate shareable p

Cointelegraph·2025-11-27 14:43

Binance Alpha 2.0 has completed the contract swap for Alt.town (TOWN)

According to Mars Finance news on November 27, the official announcement states that Binance Alpha 2.0 has completed the contract swap for Alt . town (TOWN). The swap of the new and old tokens has been conducted at a ratio of 1:1. The deposit service for the new TOWN tokens has been opened. Binance Alpha 2.0 has opened trading for Alt . town (TOWN) on November 27, 2025, at 14:00 (UTC+8).

TOWN-0,95%

MarsBitNews·2025-11-27 07:10

South Korean giant Naver partners with Dunamu to invest $7 billion in AI and Blockchain, the next day Upbit suffered an attack resulting in a loss of $36.7 million.

South Korean tech giant Naver has completed a merger with Dunamu, the parent company of the local cryptocurrency exchange Upbit, through a share swap, and announced an investment of 10 trillion won (approximately 7 billion USD) over the next five years to build next-generation AI and Blockchain financial infrastructure. This strategic partnership will integrate Naver's AI technology, Naver Financial's Payment Network, and Dunamu's digital asset trading ecosystem, while both parties plan to launch a won-pegged stablecoin. However, the day after the merger announcement, the Upbit exchange suffered a hacker attack targeting Solana network assets, resulting in a loss of approximately 36.7 million USD. The platform has frozen some assets and promised to fully compensate users for their losses, raising deep scrutiny over the exchange's security system.

MarketWhisper·2025-11-27 05:59

Oracle's credit risk skyrockets, Morgan Stanley: AI cash burn pressure may reach new highs again.

Morgan Stanley (Morgan Stanley)'s latest analysis indicates that Oracle (Oracle)'s recent credit default swap (CDS) costs continue to rise, noting that Oracle's five-year CDS increased to 1.25% annually on 11/25, reaching a nearly three-year high. At the same time, it warns that unless Oracle clarifies its funding plans to the market soon, CDS could exceed 1.5% in the short term and approach the record of 1.98% seen during the 2008 financial crisis next year. However, Oracle

ChainNewsAbmedia·2025-11-27 03:08

Naver Financial to acquire Upbit operator Dunamu in a $10.3B stock-swap deal

Naver Financial will acquire Dunamu in a $10.3B stock-swap deal.

The merger now awaits shareholder votes and key regulatory approvals.

If successful, Upbit’s operator will become a wholly owned Naver subsidiary in 2026.

Naver Financial has set the stage for one of South Korea’s largest fintech a

BitcoinInsider·2025-11-26 15:06

NAVER officially announced that it will acquire 100% of Dunamu's shares through a share exchange.

NAVER announced the acquisition of the operator Dunamu of the crypto assets exchange Upbit through a stock swap, which will become a wholly-owned subsidiary upon completion of the transaction. This move aims to gain momentum for the rise of digital assets while maintaining the operation of existing businesses and exploring structural reorganization to enhance efficiency and shareholder value.

DeepFlowTech·2025-11-26 08:01

Robinhood targets the prediction market, derivative exchange to launch in 2026.

Robinhood and Susquehanna International Group have formed a joint venture to launch a new derivation exchange to expand its prediction market products. The new exchange will begin operations in 2026, acquiring the MIAXdx derivation clearinghouse and swap trading execution platform from Miami International Holdings.

MarketWhisper·2025-11-26 06:26

Which targets are Wall Street short positions focused on? Goldman Sachs reveals the shorting undercurrents amid the AI wave.

The short-selling levels in the US stock market have risen to a five-year high, but funds are not recklessly challenging AI giants; instead, they are targeting the 'pseudo-beneficiaries' that have been boosted by the AI concept but lack core competitiveness. The utilities zone and weak AI stocks have become the new focus. This article is sourced from a piece by Jin10 Data, organized, translated, and written by Shen Chao. (Background: Arthur Hayes: Bitcoin is about to bottom out, but don't rush to go all in! 'Money printing market' needs to wait for the US stock market to collapse again.) (Background information: The correlation between Bitcoin and the US stock market has soared to a three-year high, '2025 gains fully pulled back', can Halving and DAT save the crypto market?) Data shows that the short-selling levels in the US stock market have risen to a five-year high, but funds are not hastily challenging AI giants; instead, they are taking a detour to find those 'pseudo-beneficiaries' that have been uplifted by the AI concept but lack core competitiveness. The current sentiment in the US stock market is slightly tense, Oracle credit default swap ( CDS.

動區BlockTempo·2025-11-25 13:01

Which targets are Wall Street shorts eyeing? Goldman Sachs reveals the shorting undercurrents amid the AI wave.

Source: Jin10

The current sentiment in the US stock market is somewhat tense, with a surge in Oracle's credit default swap (CDS) trading volume, and even AI industry insiders admit that there are some "signs of a bubble" in the market. Against this backdrop, discussions about when, where, and how to short are increasing.

Goldman's latest hedge fund positioning report contains many interesting details. The report shows that the so-called "smart money" is not yet ready to heavily short AI giants, but some of the funds have already begun to focus on the weaker companies in this wave.

First of all, after experiencing such a strong upward trend, the median short-selling ratio of S&P 500 constituent stocks remains unexpectedly high. It is equivalent to 2.4% by market capitalization, placing it in the 99th percentile of short-selling levels over the past five years, and significantly higher than the long-term average since 1995.

As early as May, short selling

DeepFlowTech·2025-11-25 09:31

A summary of the movements of smart money: Which stocks are American hedge funds currently shorting?

Original Author: Caixin

Reprint: White55, Mars Finance

With the recent turbulence in the U.S. stock market and a surge in Oracle CDS (credit default swap) trading, even insiders in the AI field have begun to acknowledge that there is some bubble in the market. This has made it a focal point for many investors to focus on how, when, and where hedge funds and other active institutions are shorting the market.

Fortunately, the latest hedge fund positioning report released by Goldman Sachs contains a lot of valuable information worth digging into. The core finding from the Goldman Sachs report is that the so-called "smart money" is not yet ready to massively short the AI giants, but some institutions have already begun to target relatively weaker companies in this field...

Short positions in US stocks are at a high level in recent years.

Let's first take a look at the overall market situation. Despite experiencing a strong rally this year, the median short ratio of the S&P 500 index constituents is still remarkably high. Currently,

MarsBitNews·2025-11-25 08:23

The largest compliance encryption giant in Asia! Naver and Upbit's parent company will merge on the 27th and go public in the United States.

The largest exchange in Korea, Upbit's parent company Dunamu, will achieve a comprehensive equity swap with Naver's subsidiary Naver Financial, creating a financial group that combines payment, social interaction, and encryption trading, with a valuation exceeding $34.5 billion, and plans to list on the NASDAQ in the United States. Upbit's profitability is significantly higher than that of Naver Financial, and after the merger, actual decision-making power will be held by Naver, which may reshape the landscape of the Asian crypto market.

ChainNewsAbmedia·2025-11-25 04:14

Load More