Search results for "USDT"

Gate Research Institute: Cryptocurrency Market Fluctuations and Consolidation | Aave Horizon RWA Market Net Deposits Surpass $600 Million

Cryptocurrency Asset Overview

BTC (-2.13% | Current Price 90,887 USDT)

BTC entered a consolidation phase after a sharp rise and pullback on the 1-hour chart. The price found support around $91,000, with a short-term attempt to recover towards MA5 and MA10, but overall it remains trading around MA30.

GateResearch·15h ago

Market Cap Surge and Breakout Above $1 Confirms Trend Reversal For VIRTUAL

VIRTUAL/USDT breaks a prolonged descending channel, confirming a shift from distribution toward bullish market structure.

Market capitalization expands sharply, reflecting sustained inflows and growing participation

CryptoFrontNews·20h ago

TRON sets a record for USDT transactions with a trading volume of up to $7.9 trillion in 2025

In 2025, TRON Network processed $7.9 trillion in USDT transactions, solidifying its role as a leading digital dollar payment infrastructure. With over 356 million accounts and 12 billion transactions, it holds 42% of global USDT supply. Key growth was driven by Proposal 104, which reduced energy costs by over 50%.

TRX-0,98%

TapChiBitcoin·21h ago

Gate Residual Coin Treasure USDT Financial Management Limited-Time Additional Investment | Register to Receive Higher Interest, Newcomers Can Enjoy Up to 100% Annualized Return

USDT Wealth Management Benefits Limited Time Offer

Gate YuBiBao is launching a limited-time USDT wealth management promotion during the specified period. Complete the registration to participate in multiple bonus rewards. The event includes interest rate airdrops, exclusive high-yield plans for new users, and USDT fixed-term investment combined with physical rewards, allowing users to unlock additional benefits while managing their assets.

Event Duration and Eligibility

Event Duration: January 6, 2026, 16:00 to January 20, 2026, 16:00 (UTC+8)

Participation Requirements: Must complete event registration before participating in any activities

Event Details

Event 1 | Complete registration to receive a USDT interest rate coupon

Users who register during the event period will receive a 2% annualized USDT interest rate coupon. The number of coupons for this promotion is

GateLearn·21h ago

ADA Falling Wedge Breakout Signals Cardano Price Recovery After Long Decline

ADA/USDT breaks a multi-month descending channel, confirming a structural shift supported by expanding bullish candles.

Higher-timeframe charts show controlled compression, aligning with long-term accumulation rather than renewed distribution.

Market

ADA-1,14%

CryptoFrontNews·22h ago

Altcoin Market Roadmap: TOTAL2 Still 55% Below Cycle Highs as Investors Eye 5 High-Conviction Tokens

TOTAL2 is at the level of 55% of the cycle peaks, underlining the consolidation of the market.

USDT and USDC have remained very liquid and stable in their adoption in networks.

BNB, XRP, and BCH have quantifiable fundamentals, which makes them high-conviction tokens.

The

CryptoNewsLand·22h ago

MANTRA Supports $USDC and $USDT Bridging Via Hyperlane

MANTRA Chain has introduced a straightforward method for converting EVM-based assets like $USDC and $USDT through the Hyperlane Nexus Bridge, enhancing cross-chain interoperability. Users can easily follow a video guide for seamless asset bridging with minimal fees.

BlockChainReporter·01-07 17:14

YouTube Rival Rumble Debuts Bitcoin, Tether Wallet for Crypto Creator Tips

In brief

Rumble launched Rumble Wallet, a non-custodial crypto wallet built with help from Tether and MoonPay.

The wallet will support Tether's dollar-backed and gold-backed tokens, USDT and XAUT, as well as Bitcoin.

Shares of RUM have dipped slightly on the day and are down more

Decrypt·01-07 16:06

Rumble and Tether Launches Crypto Wallet for Digital Creators - Coinspeaker

Key Notes

Rumble Wallet lets creators receive Bitcoin, USDT, and Tether Gold tips directly on the platform.

Users keep control of funds while sending crypto without banks or intermediaries.

MoonPay enables easy crypto-to-fiat conversions with Apple Pay, PayPal, and credit cards.

Rumble has

Coinspeaker·01-07 15:26

Qianhai patrol officer receives 18,000 Tether coins and is accused of espionage, selling secrets at a low price, sentenced to 7 years in August

Qianhai Coast Guard member received 18,500 USDT to leak secrets to China; Kaohsiung High Branch Court sentences him to 7 years and 8 months in August.

(Background summary: Tether trading leads to death! A 25-year-old crypto trader was robbed of hundreds of thousands and died after a "flying tackle" to block the car; 7 villains face consequences)

(Additional background: Tether Golden Empire: Tether's "Borderless Central Bank" ambitions and cracks)

On the 6th, Kaohsiung High Branch Court sentenced a national security leak case: Coast Guard officer Li from the Southern Mobile Coast Guard Team was sentenced to 7 years and 8 months for providing maritime defense deployment information to Chinese intelligence personnel, under the National Security Law. He did not accept traditional cash bribes but used Tether USDT for settlement.

18,522 USDT as spy remuneration

According to court investigations, Li was in debt due to investment losses and was targeted at the end of 2022 by a Chinese intelligence agent named Tony. The other party made a clear offer

動區BlockTempo·01-07 08:30

U.S. Treasury bonds are about to surpass $40 trillion. Why might Bitcoin become the biggest winner?

By the end of 2025, the total US federal government debt has approached $38.4 trillion, equivalent to about $28.5 thousand per American household, and is rushing towards the $40 trillion mark at a rate of $5 billion to $7 billion per day. Behind this massive figure is an astonishing interest expense of over $1.2 trillion annually.

Traditionally, the ever-expanding national debt has been viewed as a pressure on the long-term value of the dollar, reinforcing Bitcoin's narrative as "digital gold" and an inflation hedge. However, a disruptive turn is occurring in this debt story: mainstream stablecoin issuers, led by USDT and USDC, are transforming from external observers to significant internal buyers of the US debt market by holding large amounts of short-term US Treasuries. This role reversal has created an unprecedented deep linkage between the cryptocurrency market and the "vessels" of the US financial system—the Treasury market and global dollar liquidity—causing Bitcoin's future to be simultaneously influenced by "hard currency" faith and short-term liquidity tides.

MarketWhisper·01-07 07:45

Gate Research Institute: Market remains under pressure with continued volatility | Polygon PoS transaction fee burn hits a new all-time high

Cryptocurrency Asset Overview

BTC (-0.21% | Current Price 92,505 USDT)

BTC has entered a consolidation phase after a short-term pullback from recent highs. The price has retreated to around $92,500, and the short-term upward momentum has paused. The moving average structure shows divergence, with MA5 crossing below MA10, and the price has broken below the short-term moving average support. However, the medium-term MA30 remains upward, indicating that the overall bullish structure has not been broken. The MACD is below the zero line, with the green histogram narrowing but not yet turning red. The bearish momentum is easing slightly, but a reversal signal is still insufficient. Overall, BTC is in a short-term correction and recovery phase after a high-level pullback. If it can regain the $93,500–$94,000 range, the upward trend may continue; otherwise, if it remains under pressure below the moving averages, attention should be paid to the support levels around $91,800–$92,000.

GateResearch·01-07 07:11

Gate Research Institute: Market sentiment shows marginal improvement | Polygon PoS transaction fee burn hits a new all-time high

Cryptocurrency Market Overview

BTC (-0.21% | Current Price 92,505 USDT): BTC has entered a consolidation phase after a recent pullback from its highs over the past day. The price has retreated to around $92,500, and the short-term upward momentum has paused. The moving average structure shows divergence, with MA5 crossing below MA10, and the price has broken below the short-term moving average support. However, the mid-term MA30 remains upward, indicating that the overall bullish structure has not been broken. The MACD is below the zero line, with the green bars narrowing but not yet turning red. The bearish momentum is easing slightly, but a reversal signal is still insufficient. Overall, BTC is in a short-term correction and recovery phase after a high-level pullback. If it can regain the $93,500–$94,000 range, the upward trend may continue; conversely, if it remains under pressure below the moving averages, attention should be paid to the support levels around $91,800–$92,000.

GateResearch·01-07 06:44

Trump eyes Maduro's 660,000 Bitcoins! Worth more than 60 billion in oil

Maduro claims to hold 660,000 Bitcoins worth $60 billion. Venezuela sold 73 tons of gold in 2018 to exchange for 400,000 BTC, then used oil to exchange for USDT and transferred to BTC. Venezuela's annual oil production value is only $20 billion, taking three years to earn $60 billion. Directly taking over Bitcoin would immediately credit the account, killing four birds with one stone for Trump: eliminate Maduro, take control of oil, and replenish strategic reserves.

BTC0,04%

MarketWhisper·01-07 05:20

[Crypto Capital Inflows and Outflows] BTC inflow of $100 million · outflow of $400 million

In the cryptocurrency market, the conversion between USDT and USDC on both the inflow and outflow sides is expanding synchronously, with a clear trend of reallocation centered around BTC.

According to CryptoMeter data from the 7th, the total euro (EUR) funds inflow on that day was $22.5 million. Among them, $9.9 million flowed directly into BTC, $6.5 million into USDC, with some funds also moving through stablecoin pathways.

Turkish Lira (TRY) funds amounted to $14.9 million, with $11 million flowing into USDT. South Korean Won (KRW) funds totaled $13.5 million, confirming the existence of stablecoin-mediated flows.

Brazilian Real (BRL) funds reached $6.9 million, and Japanese Yen (JPY) funds were $1.2 million, with relatively limited inflow.

USDT funds totaled $462.8 million, of which $415.6 million

TechubNews·01-07 04:34

Market Cap Surge and Breakout Above $1 Confirms Trend Reversal For VIRTUAL

VIRTUAL/USDT breaks a prolonged descending channel, confirming a shift from distribution toward bullish market structure.

Market capitalization expands sharply, reflecting sustained inflows and growing participation

CryptoFrontNews·01-07 02:51

Gate 2026 New Year VIP Feedback Program: USDT Gacha Task System Officially Launched

The 2026 VIP Super Friday event will be held from January 2 to January 8. VIP users can earn USDT gacha rewards by completing multiple tasks, with a maximum of 888 USDT available to draw. The event features a 100% winning system with limited quantities, encouraging users to deposit funds and trade.

GateLearn·01-07 02:32

Gate Yubi Bao USDT Financial Management Limited-Time Offer: Up to 100% annualized return, complete tasks to receive a whole box of Feitian Maotai.

Gate YuBiBao will launch the USDT financial management activity in January 2026. After registration, users can receive interest rate coupons and physical rewards, including new users enjoying up to 100% annualized return. The event runs from January 6 to 20. Under risk warnings, users are encouraged to participate rationally.

GateLearn·01-07 01:33

Gate Daily (January 7): The US transfers over 225 million USDT; MSCI list decision temporarily does not exclude MicroStrategy

Bitcoin (BTC) initially declined then rebounded, currently around $92,770 as of January 7. The US government moved out over 225 million USDT, raising concerns. MSCI has decided not to remove MicroStrategy and digital asset funds from the index list for now. According to Bloomberg, the chat platform Discord has secretly submitted an IPO application to the U.S. Securities and Exchange Commission.

MarketWhisper·01-07 01:18

ADA Falling Wedge Breakout Signals Cardano Price Recovery After Long Decline

ADA/USDT breaks a multi-month descending channel, confirming a structural shift supported by expanding bullish candles.

Higher-timeframe charts show controlled compression, aligning with long-term accumulation rather than renewed distribution.

Market

ADA-1,14%

CryptoFrontNews·01-07 01:06

The US government moves over 225 million USDT related to "pig butchering" scams

Data from Arkham Intelligence shows that cryptocurrency wallets allegedly linked to the US Government have moved over 225 million USD USDT. This amount is believed to be assets seized in "pig butchering" (fattening then slaughtering) scams, an increasingly common form of fraud in the field.

TapChiBitcoin·01-07 00:42

Stablecoin Market Tops $317 Billion As USDT Tightens Its Grip in Early 2026

At the beginning of 2026, the global stablecoin market has passed a big mark and the total market capitalization increased to $317.94 billion. The most recent snapshot on January 6, 2026, emphasizes the ongoing connection of liquidity in the digital asset space by stablecoins. Since volatility has b

BlockChainReporter·01-06 23:03

Canza Finance Reaches $131M USDT on Aptos Platform, Introduces AI-powered Payment Protocol in Africa

On January 6, 2026, Canza Finance, a frontrunner in the Fintech space in Africa, announced that across more than $131 million cumulative dollars transacted using the Aptos Blockchain. This report indicates a 300% increase from the previous quarter in transaction activity. In addition to the report,

BlockChainReporter·01-06 21:04

MANTRA Launches MANTRA USD Stablecoin for Tokenized RWAs

MANTRA has launched MANTRA USD, a purpose-built stablecoin in collaboration with M0, aiming to challenge existing leaders, $USDC and $USDT. With a focus on equitable value distribution and community benefits, it represents a pivotal shift in stablecoin economics and promises innovative reward sharing in the evolving ecosystem.

BlockChainReporter·01-06 09:33

Gate Research Institute: Solana ETF Achieves Largest Single-Day Net Inflow | Giza's AI Agent Asset Management Scale Exceeds $40 Million

Cryptocurrency Market Overview

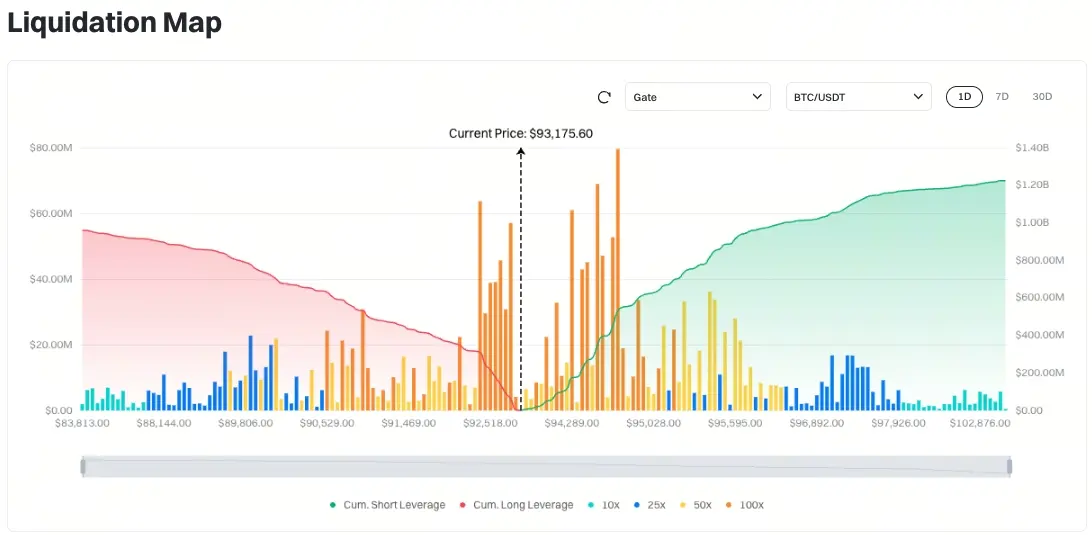

BTC (+1.17% | Current price 93,921 USDT): The daily chart shows that Bitcoin has broken above the medium- to long-term downtrend channel. The MACD green bars continue to rise, and the RSI is moving higher, releasing a somewhat positive technical signal, indicating that the price still has room for further upward movement. Currently, BTC is testing the resistance at around $93,400, a level that coincides closely with a previous high-volume trading zone. If this resistance is broken effectively, it could open the way to test the $100,000 mark. The liquidation heatmap indicates that recent major liquidation clusters are concentrated below the current price, especially in the $85,000–87,000 range, suggesting that leveraged long positions are relatively concentrated. In contrast, liquidity above is more dispersed, implying that before the market continues to rise, some time is still needed for momentum to build. The recent slow upward movement has already cleared some short

GateResearch·01-06 08:05

Tether’s $13 Billion Profit Strategy: Why the Stablecoin Issuer Is Investing Billions in AI in 2026

Tether, the issuer of the world’s largest stablecoin USDT, generated an estimated \$13 billion in profit in 2024, largely driven by interest income from U.S. Treasury holdings.

CryptopulseElite·01-06 07:57

Zama Mainnet Goes Live on Ethereum, Bringing $0.13 Confidential Transactions to Public Blockchains

Zama officially launched its mainnet on Ethereum, marking a major breakthrough for blockchain privacy. The launch enabled the first fully confidential stablecoin transaction on Ethereum Layer 1 using encrypted USDT (cUSDT), completed at a gas cost of just $0.13.

CryptopulseElite·01-06 07:09

Tether does not promote USDT, instead invests in SQRIL! Cross-border QR payment infrastructure layout exposed

Stablecoin giant Tether invests in Southeast Asia cross-border payment startup SQRIL, but without any wallet products or USDT flow-through. SQRIL focuses on creating an API-based payment exchange layer that allows banking apps in different countries to directly scan and pay for other countries' QR codes. Users pay in their local currency, and merchants receive the local currency instantly. Currently, it supports the Philippines, Vietnam, and Indonesia, and the entire process does not involve cryptocurrencies.

MarketWhisper·01-06 03:10

Venezuela Survival Record! 10% of food bought with USDT, mining paradise becomes a restricted area

Walking in downtown Caracas, store clerks directly point to the USDT payment code, and Bolivars are almost useless. By the end of 2025, 10% of food and 40% of trading will be in cryptocurrencies. In 2023, the PDVSA corruption scandal erupted, with $20 billion stolen by officials through USDT. The government shut down all national mines citing the power grid, and tens of thousands of devices were confiscated, turning the mining paradise into a forbidden zone.

MarketWhisper·01-05 09:29

Not selling wallets or promoting USDT! Tether is simply investing in SQRIL. What makes this QR payment platform special?

Tether invests in SQRIL, betting on the cross-border QR payment infrastructure, not pushing USDT, with a long-term strategy and regulatory considerations for building banking infrastructure.

Not developing consumer-end products, Tether invests in the "underlying infrastructure" of payments

-------------------------

Stablecoin issuer Tether recently invested in Southeast Asia's cross-border payment startup SQRIL, drawing market attention. However, contrary to external expectations, this investment is not accompanied by any wallet products, $USDT traffic diversion, or consumer applications. Instead, Tether chooses to bet on a set of payment infrastructure that is "almost invisible to users."

Image source: SQRIL Stablecoin issuer Tether recently invested in Southeast Asia's cross-border payment startup SQRIL

SQRIL focuses on building

CryptoCity·01-05 08:00

Gate Research Institute: Year-End Effect Drives Recovery | Solana to Receive Major Update

Cryptocurrency Asset Overview

BTC (+1.85% | Current Price 92,898.3 USDT)

BTC has completed a high-level platform -> volume breakout -> accelerated rally in the past 24 hours, forming a bullish trend structure. On the macro level, recent fluctuations in US bond yields have stabilized, and the market's pessimistic expectations for rate cuts have been temporarily digested. Overall, risk assets are in a recovery window. Technically, short-term moving averages (MA5, MA10) have turned steep again and are forming a stable bullish alignment with MA30. In the short term, BTC is expected to maintain strong oscillations within the 92,000–93,500 USD range. If it tests support at 91,500 USD without breaking below, the upward target may further point to the 94,000–94,500 USD region.

ETH (+1.2% | Current Price 3,184.56 USDT)

ETH

GateResearch·01-05 07:34

Gate Research Institute: Global Rally in Cryptocurrency Recovery | Solana Meme Sector Revival

Cryptocurrency Market Overview

BTC (+1.85% | Current price 92,898.3 USDT): BTC has completed a volume breakout after consolidating at a high level over the past 24 hours and has entered a phase of accelerated upward trend. On the macro level, recent fluctuations in US bond yields have stabilized, and the market's pessimistic expectations for rate cuts have been partially digested. Overall, risk assets are in a recovery window. Technically, short-term moving averages (MA5, MA10) have turned sharply upward again and are forming a stable bullish alignment with MA30. From a short-term structure perspective, the upward target may further point to the 94,000–94,500 USD range.

ETH (+1.2% | Current price 3,184.56 USDT): ETH continued its upward trend over the past 24 hours, following BTC's volume-driven rise after consolidating at a high level. The price once approached 3,200 USD.

GateResearch·01-05 07:15

600 Billion USD Bitcoin Shadow Reserves Surface? Venezuela's Geopolitical Changes May Trigger a Global BTC Market Supply Tsunami

In January 2026, as Venezuelan President Nicolás Maduro was taken under control by US-led operations, the country's long-rumored massive Bitcoin "shadow reserves" surfaced. According to intelligence reports, Venezuela may have accumulated between 600,000 and 660,000 Bitcoins, worth approximately $60 billion to $67 billion, through gold swaps, oil USDT settlements, and confiscation of domestic mining machines, accounting for nearly 3% of the current total Bitcoin circulation.

This scale makes it comparable to top institutional holders like BlackRock and MicroStrategy. The ultimate fate of these assets—whether they will be frozen by the US, incorporated into strategic reserves, or forced to be sold—will be the most critical variable influencing the global Bitcoin supply-demand structure and market sentiment in 2026, potentially triggering an unprecedented long-term supply shock.

BTC0,04%

MarketWhisper·01-05 03:22

2026 New Year Opening|Gate VIP Super Friday Limited Time Launch, USDT New Year Red Envelope Daily

The 2026 New Year VIP Exclusive Feedback Event will be held from January 2 to 8. VIP users can earn USDT gacha by completing tasks, with a maximum of 888 USDT available to win. The event includes recharge, financial management, and trading tasks. The number of gacha draws is limited, and participants must complete identity verification and registration.

GateLearn·01-05 02:04

USDT negative premium, holding stablecoins still losing money, how should we respond?

Author: @Web3Mario

Summary: Hello everyone, long time no see. Sorry for the delay in updates; I have been working on designing and developing an AI product for the past three months. Honestly, changing direction is not easy. Any innovation must be built on a clear understanding of the industry boundaries before making incremental improvements beyond those boundaries. Therefore, I needed to acquire a lot of foundational knowledge in AI. Now that the product is preliminarily completed, I have more time to discuss macroeconomic environments and Web3 observations with everyone. Today, I want to talk about an interesting topic: USDT negative premium and the ongoing strengthening of the RMB. How should we view this, and how can we respond? Overall, I believe everyone doesn't need to panic too much. When building your investment portfolio, it's still wise to maintain a certain proportion of stablecoin assets. However, you can also use on-chain exchange rate hedging to appropriately avoid some foreign exchange losses.

Why is the RMB entering an appreciation phase?

PANews·01-04 01:34

USDT Dominance Shows Signs of Topping as Capital Rotation Toward Risk Assets Emerges

_USDT dominance moved above 6.5% before stalling, suggesting stablecoin inflows may be slowing as traders reassess crypto risk exposure._

Stablecoin metrics are drawing attention as market participants track shifts in crypto liquidity and risk appetite across networks today.

Recent data sugges

BTC0,04%

LiveBTCNews·01-03 14:45

Canza Finance launches a continent-scale autonomous AI protocol (CAPP) for Africa

Canza Finance announces that its native USDT's cumulative trading volume has surpassed $131 million, demonstrating a huge demand for efficient cross-border financial services. Despite the high costs and delays associated with traditional payment systems, Canza has launched the world's first autonomous payment protocol CAPP, aimed at reducing costs, increasing settlement speed, and connecting multiple mobile payment systems to promote the development of Africa's digital economy.

APT-2,98%

PANews·01-02 01:13

[Midnight News Brief] Justin Sun makes a large purchase of LIT tokens... holding 5.32% of the circulating supply, etc.

HTX address transferred $400 million USDT to Aave, Sun Yuchen used $33 million to purchase LIT. In December last year, a hacker attack resulted in a loss of $76 million, a 60% decrease. Novus CEO stated that cryptocurrencies will accelerate integration into mainstream finance. MicroStrategy's stock price has declined for six consecutive months, and analysts say DOGE could drop another 30%. Binance Alpha added AIAV.

LIT-1%

TechubNews·01-01 15:45

HTX touts 38 months of fully backed PoR reserves

HTX has maintained a 100% reserve ratio for core assets over the past 38 months, with USDT user balances increasing significantly. The exchange expanded its PoR scope and emphasizes a "100% Redemption" policy for users.

Cryptonews·01-01 09:48

Tether Bolsters Bitcoin Reserves with Significant Q4 Accumulation

In a strategic move reinforcing its position as a dominant institutional force, Tether—the issuer behind the $140 billion USDT stablecoin—has

BTC0,04%

CoinsProbe·01-01 06:36

Stablecoins Poised for $4 Trillion Surge by 2030: Citibank

Stablecoin supply grew over 50% in 2025, moving from speculative assets to practical tools for payments and commerce.

USDT leads 60.75% of the market, while bank tokens may surpass stablecoins by 2030, enhancing traditional finance.

Crypto innovations are reimagining finance, improving

CODEX5,42%

CryptoFrontNews·2025-12-31 22:11

USDT negative premium, holding stablecoins still losing money, how should we interpret this?

Under the RMB appreciation channel, USDT exhibits negative premiums, and investors do not need to panic excessively. It is recommended to maintain an appropriate proportion of stablecoin assets, which can be hedged through on-chain exchange rate strategies, such as allocating to Euro stablecoins or gold RWA, to moderately avoid exchange rate losses. This article is based on an article by @Web3Mario, organized, compiled, and written by Foresight News.

(Previous context: USDT exits the market, EURC fills the gap, Euro stablecoins surge over 170% against the trend)

(Additional background: Chinese crypto circles panic selling USDT "at a 1.5% negative premium against RMB," bear market, regulatory flight?)

Table of Contents

Why does the RMB enter an appreciation channel, and why does USDT show a negative premium

Should we convert USD stablecoins back to RMB

How to hedge exchange rate losses through on-chain strategies, gold, and euro stablecoins

動區BlockTempo·2025-12-31 15:10

Trip.com Stablecoin Payment Test: The Technological Revolution and Personal Opportunities Behind the 18% Savings

At the beginning of 2024, the world’s leading online travel platform Trip.com quietly added support for USDT and USDC to its payment options. Even more surprisingly, real-world testing shows that paying for tickets with stablecoins is 18% cheaper than traditional payment methods. This is not only a significant milestone for cryptocurrencies entering mainstream consumer scenarios but also reveals the efficiency gap between traditional financial systems and blockchain technology. This article will analyze the full picture behind this phenomenon from three dimensions: technological implementation, business logic, and personal application.

Technical Architecture: Enterprise-level Payment Solution with Multi-Chain Integration

Trip.com’s crypto payments are not self-developed but are implemented through Singapore-licensed payment institution Triple-A. This choice reflects the core considerations of enterprise-level applications: compliance first and risk isolation. Triple-A holds a payment license issued by the Monetary Authority of Singapore (MAS).

TechubNews·2025-12-31 10:08

Gate Research Institute: Cryptocurrency Market Experiences Gentle Recovery | Tokenized Stock Asset Scale Reaches New High

Crypto Asset Panorama

BTC (+0.02% | Current Price: 88,660 USDT)

BTC has shown weak oscillation within a range over the past day, with prices fluctuating around $88,000–$89,000, and overall volatility remains limited. Short-term moving averages MA5 and MA10 have repeatedly converged and crossed with MA30, indicating that the market direction is still unclear, and the short-term trend leans towards sideways consolidation. Although the MACD briefly turned red, the momentum was limited, with green and red bars alternating frequently and hovering around the zero line, suggesting cautious sentiment between bulls and bears. Structurally, a confirmed breakout above the $89,500–$90,000 range with increased volume could validate a continued short-term rebound; if prices fall back and break below the $88,000 support level, attention should be paid to the risk of testing the support zone near $87,000.

GateResearch·2025-12-31 07:36

Cryptocurrency Exchange for Forex Conviction: 6 Years! 245 Million Illegal Transactions Fully Exposed

The Intermediate People's Court of Leshan City, Sichuan Province, concluded a case involving the use of virtual currency to conduct illegal foreign exchange transactions, with a involved amount of 245 million yuan. The main offender, Wan Mouyuan, was sentenced to 6 years in prison and fined 740,000 yuan. His wife, Chen Mouwen, received a sentence of 2 years and 6 months. Upstream supplier Huang Mouyuan was sentenced to 5 years and 6 months. The court's first ruling recognized that using virtual currencies such as USDT as a medium to realize the exchange rate conversion between RMB and foreign currencies constitutes a disguised form of foreign exchange trading, and should be prosecuted as illegal business operations.

MarketWhisper·2025-12-31 07:04

Gate Research Institute: Ethereum Staking Demand Rebounds | Tokenized Stock Asset Scale Reaches New High

Cryptocurrency Market Overview

BTC (+0.02% | Current Price 88,660 USDT): Bitcoin has shown weak sideways consolidation over the past day, with prices fluctuating around $88,000–$89,000, and overall volatility remains limited. Short-term moving averages MA5 and MA10 have repeatedly converged and crossed with MA30, indicating that the market direction is still uncertain, and the short-term trend leans towards sideways consolidation. Although the MACD briefly turned positive, the momentum was limited, with frequent alternation of green and red bars, and it repeatedly hovered around the zero line, suggesting cautious sentiment among bulls and bears. Structurally, a confirmed breakout above the $89,500–$90,000 range with increased volume could validate a short-term rebound continuation; however, if prices fall back and break below the $88,000 support level, attention should be paid to the risk of testing the support zone around $87,000.

ETH (+0.02%)

GateResearch·2025-12-31 03:58

ETH Treasury Expands to $1.8B Using USDT Loans for 2026 Bull Run

_Trend Research builds $1.83B ETH treasury using $958M in USDT loans, positioning early for Ethereum’s expected 2026 bull run._

Hong Kong-based investment firm Trend Research holds one of the largest institutional Ethereum treasuries, valued at about $1.83 billion

The firm has been acquiring ET

ETH-1,36%

LiveBTCNews·2025-12-30 09:45

Bitunix Exchange Celebrates Its Fourth Anniversary with the "Ultra 4ward" 4 Million USDT Reward Campaign

To celebrate its fourth anniversary, cryptocurrency exchange Bitunix has launched the grand event "Ultra 4ward," offering a total prize pool of up to 4 million USDT, including major prizes such as Tesla cars and gold.

(Background: Bitunix established the "Bitunix Care Fund," a user security assurance fund, with an initial scale of 30 million USD)

(Additional background: Will Bitcoin surge to 170,000 USD within three months? Analysts: A new bull market may arrive by 2026)

Table of Contents

Ultra Security and Transparency

Ultra Liquidity and Trading Experience

Ultra Practical and User-Friendly Products

Ultra Growing Global Community

Gratitude and Moving Forward

Fourth Anniversary Celebration: 4 Million

UOS-5,39%

動區BlockTempo·2025-12-30 09:40

What is a cold wallet and which one to choose?

A cold wallet is an offline cryptocurrency storage that protects private keys from hacking. There are hardware (Ledger, Trezor, Tangem), software, and paper options costing $50-$200. The article reviews the top 6 brands for secure storage of Bitcoin, USDT, and other assets.

MarketWhisper·2025-12-30 07:31

Coixa Public Beta Launch! Pi Network DeFi Exchange Achieves Mobile Breakthrough

Coixa launches a public beta on Pi Network, marking the transformation of the Pi ecosystem into an application-oriented blockchain. This mobile-first DEX supports PI token trading, swapping, and liquidity pools, with the PI/USDT trading pair TVL reaching a significant level. Community leaders support early builders, driving Pi from a mining network to a practical feature platform.

PI0,02%

MarketWhisper·2025-12-30 06:51

Load More