Trade

Trading Type

Spot

Trade crypto freely

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Alpha

Points

Get promising tokens in streamlined on-chain trading

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More12.48K Popularity

9.25K Popularity

37.35K Popularity

91.2K Popularity

2.65K Popularity

Pin

Bitcoin drops to $88,000, major altcoins also weaken together

Source: DecenterKorea Original Title: Bitcoin at $88,000… Major Altcoins Also Downtrend [Decenter Market] Original Link:

Market Overview

Bitcoin(BTC) has fallen to the $88,000 level. The decline is influenced by cautious investor sentiment ahead of major macroeconomic events.

As of the 15th, at 8 a.m. according to global cryptocurrency market data, BTC was trading at $82,417.18, down 1.41% from 24 hours earlier. Major altcoins also showed a similar weakness:

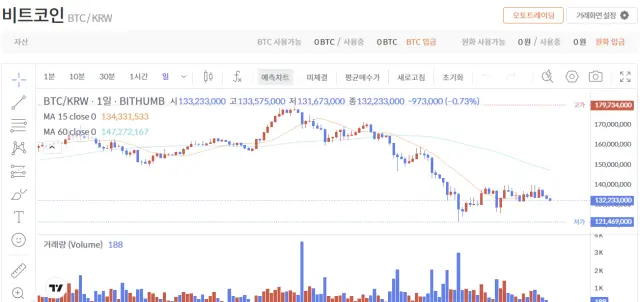

The domestic market is showing a similar trend. At the same time, BTC on domestic exchanges declined 0.64% from the previous day to 133,223,000 KRW. ETH is trading at 4,607,000 KRW, down 0.19%, and XRP has slightly increased by 0.03% to 2,983 KRW.

Reasons for Weakness

Market analysts suggest that position adjustments are ongoing ahead of the scheduled major macroeconomic indicators this week. In the U.S., November employment data will be released on the 16th, and the November Consumer Price Index(CPI) is scheduled for the 18th. Depending on the results, expectations regarding the baseline interest rate may be readjusted, which could impact the cryptocurrency market.

Overseas central bank policies are also considered variables. Ahead of the Bank of Japan(BOJ) monetary policy meeting, discussions about possible rate hikes are underway, raising concerns about a reduction in yen carry trades. Yen carry trades involve borrowing Japanese yen at ultra-low interest rates and investing in higher-yield assets such as dollars, stocks, or cryptocurrencies. If Japan raises interest rates, borrowing costs and exchange losses could increase, leading to a potential withdrawal of carry trade funds. This could increase overall volatility in global risk assets.

Market Sentiment

Cryptocurrency investment sentiment remains in an ‘extreme fear’ state. The fear and greed index from a data analytics firm indicates a level of 21 points, reflecting considerable investor apprehension.