#BitcoinGoldBattle

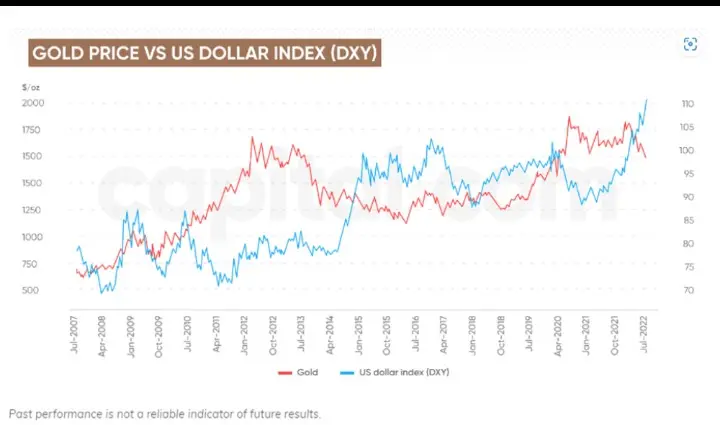

Gold and silver are currently experiencing significant upward momentum amid a weakening U.S. dollar, while Bitcoin has cooled off after recent leverage-induced corrections. As of today, spot gold is trading around $4,381/oz, silver is near $55/oz, and Bitcoin is hovering around $34,500. These price levels highlight the contrasting dynamics of traditional versus digital inflation hedges and offer an opportunity to evaluate portfolio positioning in the context of macroeconomic uncertainty, monetary policy, and market sentiment.

Gold has long been the benchmark for a safe-have

Gold and silver are currently experiencing significant upward momentum amid a weakening U.S. dollar, while Bitcoin has cooled off after recent leverage-induced corrections. As of today, spot gold is trading around $4,381/oz, silver is near $55/oz, and Bitcoin is hovering around $34,500. These price levels highlight the contrasting dynamics of traditional versus digital inflation hedges and offer an opportunity to evaluate portfolio positioning in the context of macroeconomic uncertainty, monetary policy, and market sentiment.

Gold has long been the benchmark for a safe-have

BTC-2,37%