Post content & earn content mining yield

placeholder

十一

【$CRV Signal】Short Position Price drops with stable open interest, beware of main players distributing

$CRV Price drops but open interest remains stable. Combined with persistent negative Taker buy volume and order book sell-side accumulation, this is not simply a long squeeze but more likely an orderly distribution by the main players before a key resistance.

🎯 Direction: Short

Market logic: Price retraced from the high of 0.264, but open interest stayed steady, with no sudden drop caused by a squeeze. The key indicator is the continuous negative Taker buy volume, and the 4H K-line buy/sel

View Original$CRV Price drops but open interest remains stable. Combined with persistent negative Taker buy volume and order book sell-side accumulation, this is not simply a long squeeze but more likely an orderly distribution by the main players before a key resistance.

🎯 Direction: Short

Market logic: Price retraced from the high of 0.264, but open interest stayed steady, with no sudden drop caused by a squeeze. The key indicator is the continuous negative Taker buy volume, and the 4H K-line buy/sel

- Reward

- like

- Comment

- Repost

- Share

Good morning! A new day begins, set out with the glow of FDOG, let go of distractions, stay true to your beliefs, grow together ecologically, and coexist in value. May every family member on the FDOG track harvest their own stars and seas✨☀️

View Original

- Reward

- like

- Comment

- Repost

- Share

How can I sleep when this trader turned $0.79 into $860K

- Reward

- 1

- 1

- Repost

- Share

CryptoLoverArtist :

:

wow. that's gambling. lols星星之火

星星之火

Created By@gatefunuser_936d

Listing Progress

100.00%

MC:

$2.16K

Create My Token

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4009?ref=VGDEVLFACA&ref_type=132

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Ape In 🚀View More

#CMEGroupPlansCMEToken #CMEGroupPlansCMEToken

CME Group’s exploration of a proprietary digital token marks a pivotal moment in the convergence of traditional finance and blockchain technology. As one of the largest regulated derivatives exchanges in the world, CME’s interest in tokenization signals a shift in how global financial infrastructure thinks about the movement of capital, the handling of collateral, the settlement of trades, and the operational realities of markets that increasingly operate around the clock. What initially may seem like a technical experiment actually reflects broade

CME Group’s exploration of a proprietary digital token marks a pivotal moment in the convergence of traditional finance and blockchain technology. As one of the largest regulated derivatives exchanges in the world, CME’s interest in tokenization signals a shift in how global financial infrastructure thinks about the movement of capital, the handling of collateral, the settlement of trades, and the operational realities of markets that increasingly operate around the clock. What initially may seem like a technical experiment actually reflects broade

- Reward

- 3

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Stay strong and HODL💎View More

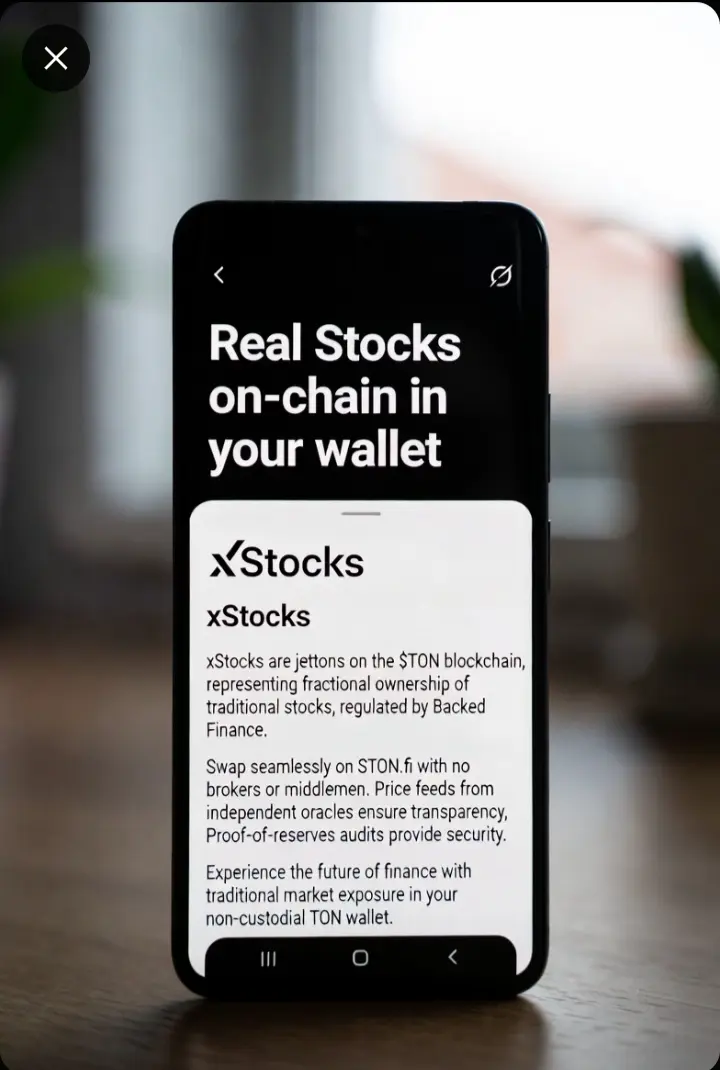

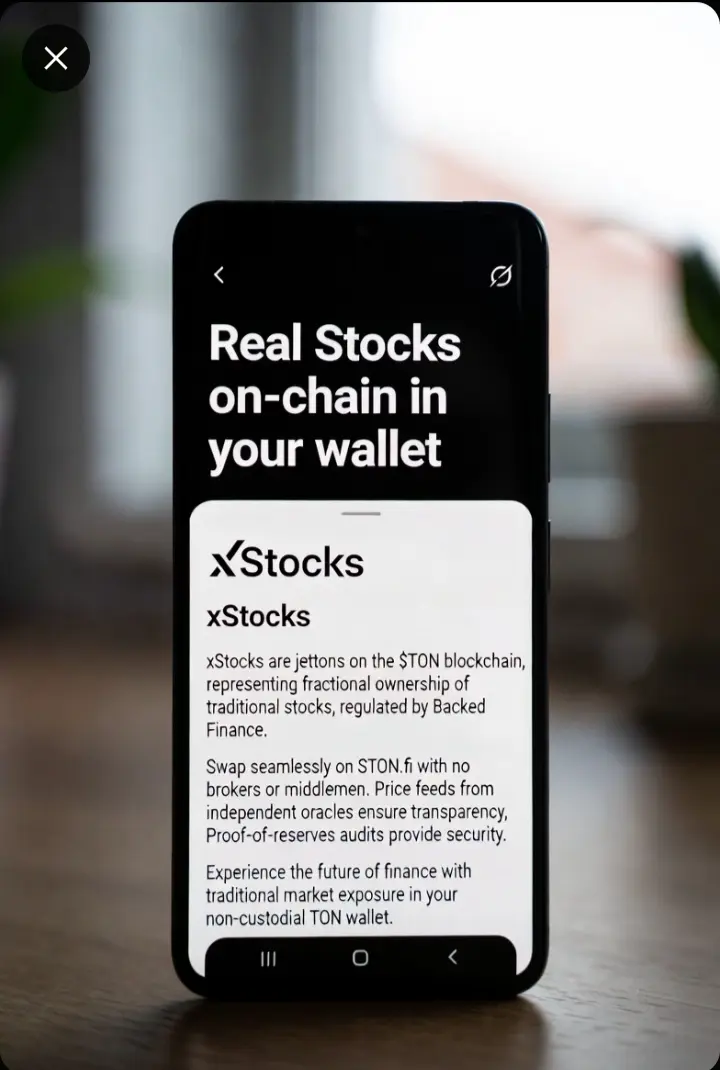

Real Stocks → On‑Chain in Your Wallet: How xStocks Actually Work 💥

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

TON0,64%

- Reward

- 1

- Comment

- Repost

- Share

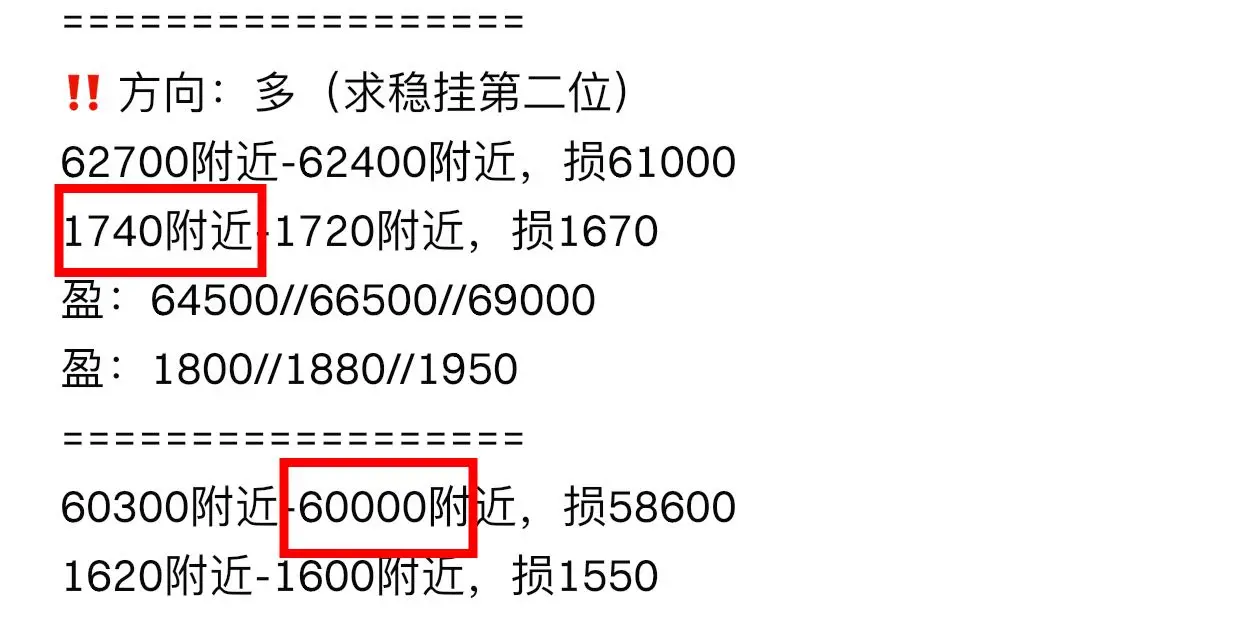

‼️Second order⬇️

‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

View Original‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Real Stocks → On‑Chain in Your Wallet: How xStocks Actually Work 💥

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

TON0,64%

- Reward

- like

- Comment

- Repost

- Share

US stock profit-taking series, students copy homework and achieve a passive income life!

Strategy: Smart Win World Strategy Robot "ZYTX GKDD V9"

Use Trading View Smart Win World indicator strategy to create "Signal Robot" and "Composite Indicator" robots, quickly become a quantitative expert in one day, and achieve a free life in one month.

#带着Gate去旅行

#GateTravel旅行分享官

#智赢天下TradingView指标

#智赢天下TradingView策略机器人

View OriginalStrategy: Smart Win World Strategy Robot "ZYTX GKDD V9"

Use Trading View Smart Win World indicator strategy to create "Signal Robot" and "Composite Indicator" robots, quickly become a quantitative expert in one day, and achieve a free life in one month.

#带着Gate去旅行

#GateTravel旅行分享官

#智赢天下TradingView指标

#智赢天下TradingView策略机器人

- Reward

- 7

- 5

- Repost

- Share

TheCounterattackOfThePonytail. :

:

Is it time to buy the dip? Are the bottom-fishing opportunities here?

Now is the moment to consider whether it's the right time to purchase assets at their lowest prices, potentially maximizing gains as the market recovers.

View More

Whales are still buying: BitMine-linked addresses scoop up another 20,000 ETH, worth over $40 million

- Reward

- like

- Comment

- Repost

- Share

WAW

织网

Created By@IfYouDon'tAcceptIt,JustFight;

Subscription Progress

0.00%

MC:

$0

Create My Token

Today marks my 599th day of posting updates without a single break. Every post is prepared with care, not rushed. [微笑] If you think I am a serious person, you can follow me, and I hope the daily content can help you. The world is vast, and I am small. Follow me so you don’t have to look hard. [微笑][微笑]

1. The market never wrong; only people are.

2. Making money is never about buying and selling, but about waiting.

3. Big money is not in volatility, but in trends.

4. Don’t argue with the market; you must follow the market.

5. I never make money by thinking; I make money by sitting still.

6. In a

View Original1. The market never wrong; only people are.

2. Making money is never about buying and selling, but about waiting.

3. Big money is not in volatility, but in trends.

4. Don’t argue with the market; you must follow the market.

5. I never make money by thinking; I make money by sitting still.

6. In a

- Reward

- 3

- 4

- Repost

- Share

DragonLookingUp :

:

66666666666666666666View More

#交易机器人 I am using the SOLUSDT contract grid bot on Gate, with a total return since creation of +71.37%

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

🌈 #GateLiveStreamingInspiration - Feb.8

Today's Topic Recommendations:

🔹 Whales are still buying: BitMine-linked addresses scoop up another 20,000 #ETH, worth over $40 million

🔹 Exclusive insight from Bitwise’s Chief Advisor: This sell-off was driven by “paper capital”, while long-term capital has not exited the market

🔹 New cross-chain breakthrough: SushiSwap officially integrates Solana, enabling seamless swaps between SOL and EVM assets

🔹 A macro storm is approaching: Nonfarm payrolls, #CPI, Middle East negotiations, and Japan’s election set the stage for a critical week of bull–bear

Today's Topic Recommendations:

🔹 Whales are still buying: BitMine-linked addresses scoop up another 20,000 #ETH, worth over $40 million

🔹 Exclusive insight from Bitwise’s Chief Advisor: This sell-off was driven by “paper capital”, while long-term capital has not exited the market

🔹 New cross-chain breakthrough: SushiSwap officially integrates Solana, enabling seamless swaps between SOL and EVM assets

🔹 A macro storm is approaching: Nonfarm payrolls, #CPI, Middle East negotiations, and Japan’s election set the stage for a critical week of bull–bear

- Reward

- 1

- 2

- Repost

- Share

Erikid54 :

:

Buy To Earn 💎View More

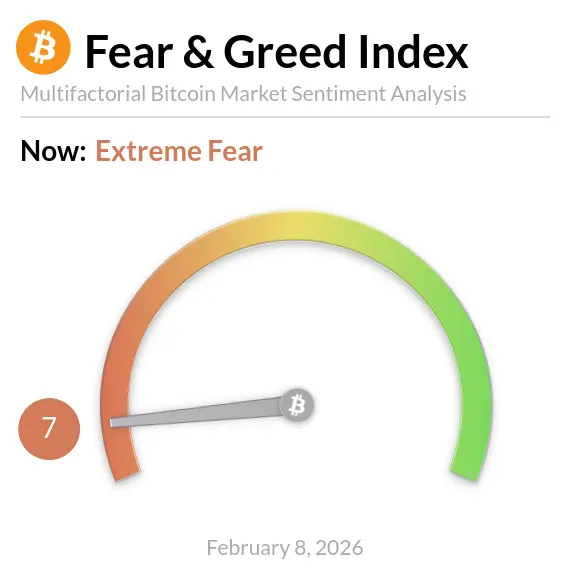

#BitcoinDropsBelow$65K #BitcoinDropsBelow$65K

Bitcoin has slipped below the key psychological level of sixty-five thousand dollars, triggering a wave of reactions across markets, newsfeeds, trading desks, and investor portfolios. This move has drawn attention not only because of the price level itself but because of what it represents in the broader context of market sentiment, macro uncertainty, and the evolving narrative around digital assets.

The decline reflects a complex interplay of supply and demand dynamics, wider risk appetite shifts, and the psychological impact of breaking an import

Bitcoin has slipped below the key psychological level of sixty-five thousand dollars, triggering a wave of reactions across markets, newsfeeds, trading desks, and investor portfolios. This move has drawn attention not only because of the price level itself but because of what it represents in the broader context of market sentiment, macro uncertainty, and the evolving narrative around digital assets.

The decline reflects a complex interplay of supply and demand dynamics, wider risk appetite shifts, and the psychological impact of breaking an import

- Reward

- 1

- 2

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

- Reward

- like

- Comment

- Repost

- Share

On February 8th, Bitcoin market analysis from a higher timeframe perspective. The Bitcoin short positions are not yet complete; the final decline, which is the third wave, is still pending. From a time cycle perspective, multiple higher-level timeframes indicate that the bearish trend needs adjustment, so do not be fooled by a temporary rebound. Blindly buying low. The winter of Bitcoin has arrived, and the oscillation cycle will require several years of adjustment. However, this kind of adjustment also sets the stage for future major market movements. So, you must understand that your princip

BTC-1,47%

- Reward

- 2

- 2

- Repost

- Share

GateUser-e177c72e :

:

Is there still no divergence in the larger cycle?View More

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More145.5K Popularity

34.01K Popularity

392.72K Popularity

14.69K Popularity

13.6K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.48KHolders:20.01%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.46KHolders:10.00%

News

View MoreMarket Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

12 m

Browser cache issues cause abnormal display of Arweave network block data.

19 m

Illinois proposes bill to establish state-level Bitcoin reserve

38 m

Multiple traditional financial assets experience price fluctuations, with gold, silver, and crude oil strengthening.

1 h

South African Reserve Bank Governor warns that the growth in stablecoin usage could impact monetary unity

1 h

Pin