# BitcoinDropsBelow$65K

9.32K

MrFlower_

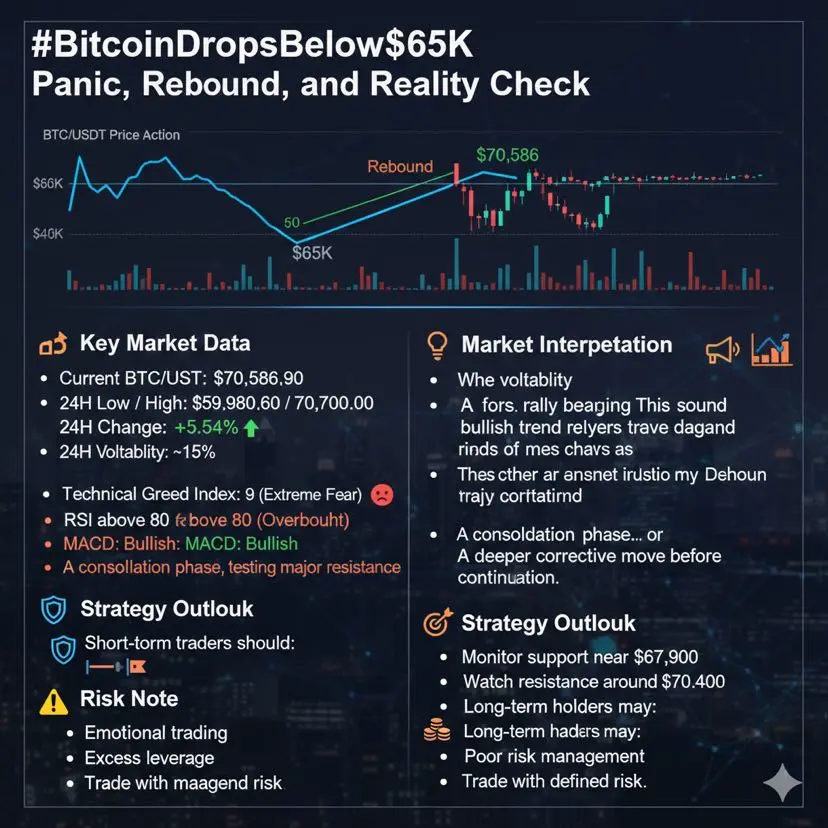

#BitcoinDropsBelow$65K Panic, Rebound, and Reality Check

Bitcoin’s recent dip below $65,000 triggered extreme fear across the market.

However, the sharp rebound that followed tells a deeper story.

BTC has now recovered near $70,586, accompanied by strong intraday volatility — a clear sign of aggressive positioning on both sides.

📈 Key Market Data

Current BTC/USDT: $70,586.90

24H Low / High: $59,980.60 / $70,700.00

24H Change: +5.54%

24H Volatility: ~15%

Fear & Greed Index: 9 (Extreme Fear)

Technical Signals:

RSI above 80 (Overbought)

MACD: Bullish

Price testing major resistance

💡 Market Inte

Bitcoin’s recent dip below $65,000 triggered extreme fear across the market.

However, the sharp rebound that followed tells a deeper story.

BTC has now recovered near $70,586, accompanied by strong intraday volatility — a clear sign of aggressive positioning on both sides.

📈 Key Market Data

Current BTC/USDT: $70,586.90

24H Low / High: $59,980.60 / $70,700.00

24H Change: +5.54%

24H Volatility: ~15%

Fear & Greed Index: 9 (Extreme Fear)

Technical Signals:

RSI above 80 (Overbought)

MACD: Bullish

Price testing major resistance

💡 Market Inte

BTC8,1%

- Reward

- 6

- 8

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

#BitcoinDropsBelow$65K

#BitcoinDropsBelow$65K 🚨

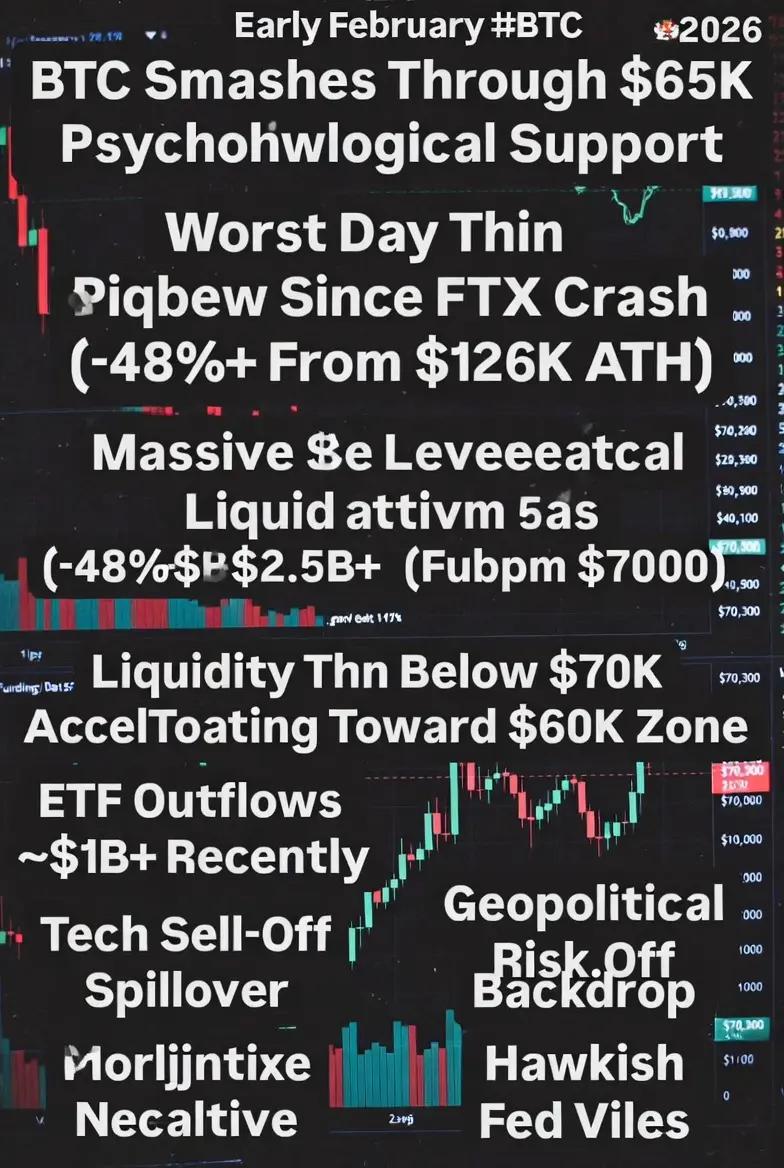

BTC just smashed through $65,000 psychological support — down ~12-15% in a single brutal day, worst since FTX crash.

From $126K ATH → -48%+ wipeout in months

.

Current price: ~$70,300 (rebounding hard +10-11% today)

Why the drop happened:

Massive leverage flush: $1B–$2.5B+ liquidations (mostly longs) cascading lower.

Funding rates flipped deeply negative → shorts piling in, longs getting nuked.

Volume exploding on the way down → panic selling + weak hands capitulating.

Liquidity thin below $70K → once broken, price accelerated fast toward $60K

#BitcoinDropsBelow$65K 🚨

BTC just smashed through $65,000 psychological support — down ~12-15% in a single brutal day, worst since FTX crash.

From $126K ATH → -48%+ wipeout in months

.

Current price: ~$70,300 (rebounding hard +10-11% today)

Why the drop happened:

Massive leverage flush: $1B–$2.5B+ liquidations (mostly longs) cascading lower.

Funding rates flipped deeply negative → shorts piling in, longs getting nuked.

Volume exploding on the way down → panic selling + weak hands capitulating.

Liquidity thin below $70K → once broken, price accelerated fast toward $60K

BTC8,1%

- Reward

- 7

- 12

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#BitcoinDropsBelow$65K Bitcoin slips below $65,000, a level many assumed would hold. This isn’t just a price dip—it’s a stress test for the entire crypto ecosystem. Traders and investors must now separate noise from real signals.

Market dynamics at play:

Institutional positioning: Large BTC wallets are moving funds toward exchanges, signaling potential sell-side pressure. This isn’t retail panic—it’s calculated repositioning by whales and institutions.

Technical structure: Short-term support around $64,500 is under threat. If breached, rapid liquidations could accelerate, dragging ETH and top

Market dynamics at play:

Institutional positioning: Large BTC wallets are moving funds toward exchanges, signaling potential sell-side pressure. This isn’t retail panic—it’s calculated repositioning by whales and institutions.

Technical structure: Short-term support around $64,500 is under threat. If breached, rapid liquidations could accelerate, dragging ETH and top

- Reward

- like

- Comment

- Repost

- Share

📊 #BitcoinDropsBelow$65K

Bitcoin recently dipped below $65,000, triggering extreme fear across the market. However, price rebounded sharply, and BTC is now trading near $70,586 with strong intraday volatility.

📈 Key Data

Current BTC/USDT price: $70,586.90

24h Low / High: $59,980.60 / $70,700.00

24h Change: +5.54%

24h Volatility: ~15%

Fear & Greed Index: 9 (Extreme Fear)

Technical Signals: RSI above 80 (overbought), MACD bullish, price testing major resistance

💡 Market Interpretation

This was an exceptionally volatile session for Bitcoin. The drop below $65K appears driven by panic selling

Bitcoin recently dipped below $65,000, triggering extreme fear across the market. However, price rebounded sharply, and BTC is now trading near $70,586 with strong intraday volatility.

📈 Key Data

Current BTC/USDT price: $70,586.90

24h Low / High: $59,980.60 / $70,700.00

24h Change: +5.54%

24h Volatility: ~15%

Fear & Greed Index: 9 (Extreme Fear)

Technical Signals: RSI above 80 (overbought), MACD bullish, price testing major resistance

💡 Market Interpretation

This was an exceptionally volatile session for Bitcoin. The drop below $65K appears driven by panic selling

BTC8,1%

- Reward

- 4

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#BitcoinDropsBelow$65K

Bitcoin dropping below the $65,000 psychological level has triggered fear across the market — but price alone never tells the full story. Context matters more than headlines.

📉 Why $65K Was Important

$65K acted as a psychological + technical support

Heavy retail positioning was clustered around this level

It marked a previous consolidation zone during the last impulse leg

When such levels break, the move is often liquidity-driven, not purely trend-driven.

🧠 Market Structure Reality Check

The break below $65K occurred with accelerated momentum, suggesting stop-loss and

Bitcoin dropping below the $65,000 psychological level has triggered fear across the market — but price alone never tells the full story. Context matters more than headlines.

📉 Why $65K Was Important

$65K acted as a psychological + technical support

Heavy retail positioning was clustered around this level

It marked a previous consolidation zone during the last impulse leg

When such levels break, the move is often liquidity-driven, not purely trend-driven.

🧠 Market Structure Reality Check

The break below $65K occurred with accelerated momentum, suggesting stop-loss and

BTC8,1%

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#BitcoinDropsBelow$65K

An In-Depth, Structural Perspective on the Current Market Phase

Bitcoin breaking below the $65,000 mark is more than a mere technical milestone—it reflects a deeper shift in market psychology, liquidity dynamics, and risk positioning. For years, levels like $65K have acted as both a psychological and structural anchor for traders and institutional participants. When such anchors fail, it is not just price that reacts; sentiment, positioning, and capital flow begin to recalibrate in tandem. Understanding this move requires looking beyond the headline and analyzing the u

An In-Depth, Structural Perspective on the Current Market Phase

Bitcoin breaking below the $65,000 mark is more than a mere technical milestone—it reflects a deeper shift in market psychology, liquidity dynamics, and risk positioning. For years, levels like $65K have acted as both a psychological and structural anchor for traders and institutional participants. When such anchors fail, it is not just price that reacts; sentiment, positioning, and capital flow begin to recalibrate in tandem. Understanding this move requires looking beyond the headline and analyzing the u

BTC8,1%

- Reward

- 3

- 4

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#BitcoinDropsBelow$65K

Bitcoin Drops Below 65K Market Update

Bitcoin has recently dropped below the 65K level, triggering strong reactions across the crypto market. This move has attracted attention because it represents a major drawdown from the previous market peak and signals a shift in short term market conditions. The decline has raised important questions about trend strength, risk sentiment, and what traders should expect next.

Bitcoin Price Action and Market Sentiment

Bitcoin falling below 65K marks a significant correction from its all time high above 126K reached in October 2025. Th

Bitcoin Drops Below 65K Market Update

Bitcoin has recently dropped below the 65K level, triggering strong reactions across the crypto market. This move has attracted attention because it represents a major drawdown from the previous market peak and signals a shift in short term market conditions. The decline has raised important questions about trend strength, risk sentiment, and what traders should expect next.

Bitcoin Price Action and Market Sentiment

Bitcoin falling below 65K marks a significant correction from its all time high above 126K reached in October 2025. Th

BTC8,1%

- Reward

- 5

- 5

- Repost

- Share

HighAmbition :

:

hop on boardView More

#BitcoinDropsBelow$65K In early February 2026, the global crypto market is facing renewed volatility as Bitcoin (BTC) the world’s largest cryptocurrency has fallen below the critical $65,000 level, triggering widespread discussion about market direction, investor confidence, and structural stability. This breakdown follows months of declining momentum after Bitcoin reached record highs above $120,000 in late 2025, marking a decisive shift from bullish expansion to corrective consolidation.

Recent trading sessions have seen Bitcoin slide into the $63,000–$64,000 range, levels not seen since lat

Recent trading sessions have seen Bitcoin slide into the $63,000–$64,000 range, levels not seen since lat

BTC8,1%

- Reward

- 2

- Comment

- Repost

- Share

#BitcoinDropsBelow$65K BitcoinDropsBelow65KPanicReboundAndRealityCheck

Bitcoin’s recent dip below 65000 triggered extreme fear across the market however the sharp rebound that followed tells a deeper story BTC has now recovered near 70586 accompanied by strong intraday volatility a clear sign of aggressive positioning on both sides

📈KeyMarketData current BTCUSDT 70586.90 24H low high 59980.60 70700.00 24H change +5.54 percent 24H volatility approximately 15 percent Fear and Greed Index 9 extreme fear technical signals RSI above 80 indicating overbought conditions MACD remains bullish price is

Bitcoin’s recent dip below 65000 triggered extreme fear across the market however the sharp rebound that followed tells a deeper story BTC has now recovered near 70586 accompanied by strong intraday volatility a clear sign of aggressive positioning on both sides

📈KeyMarketData current BTCUSDT 70586.90 24H low high 59980.60 70700.00 24H change +5.54 percent 24H volatility approximately 15 percent Fear and Greed Index 9 extreme fear technical signals RSI above 80 indicating overbought conditions MACD remains bullish price is

BTC8,1%

- Reward

- like

- Comment

- Repost

- Share

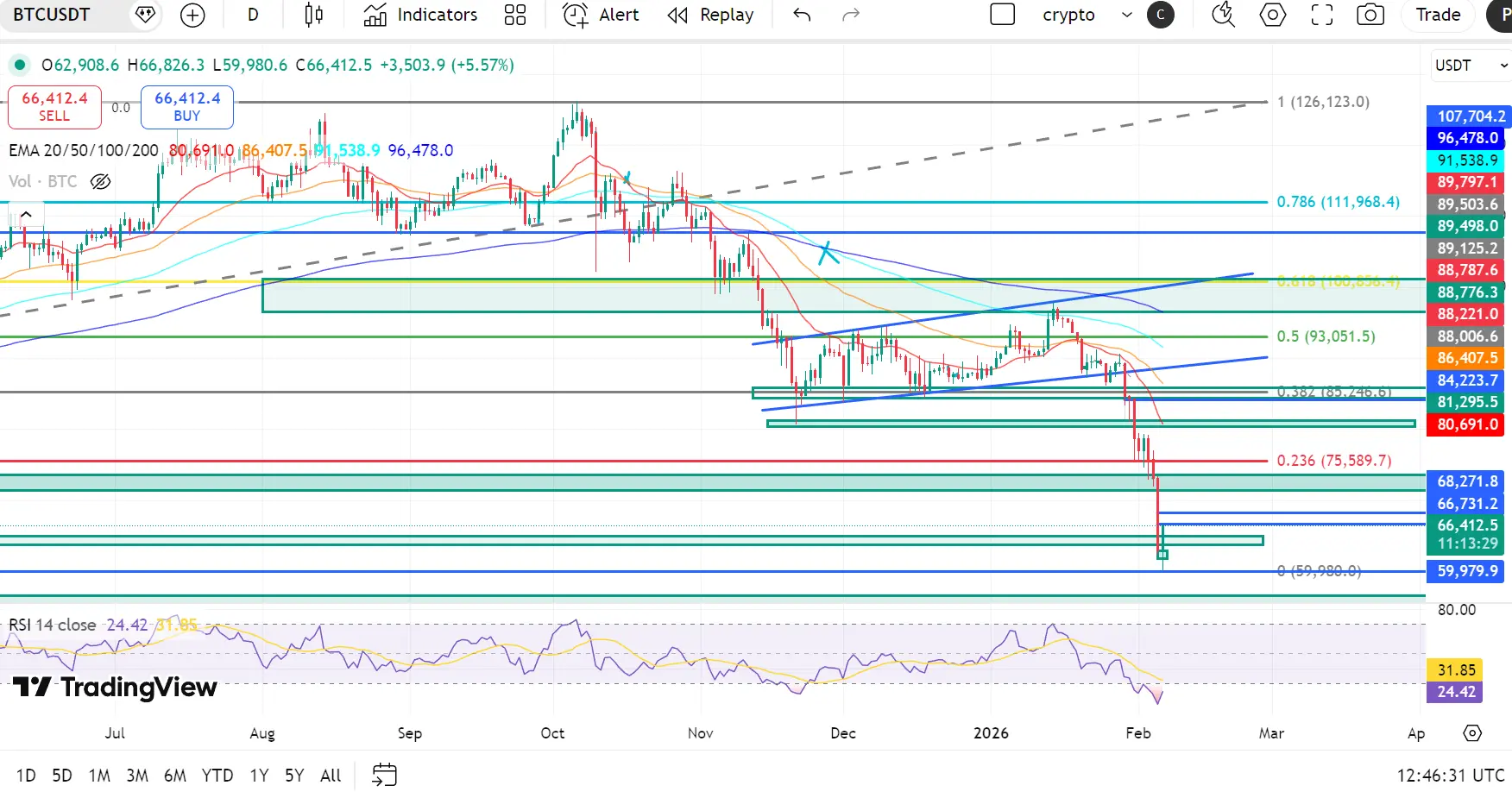

BTC Technical Outlook: Macro Breakdown, Entering Deep Corrective Phase

Bitcoin has been rejected from the $112K–$126K macro supply zone (0.786–1 Fib) and remains in a broader corrective structure following the cycle distribution top. Price continues to respect a descending corrective channel, producing lower highs and weak recovery attempts.

Recent price action shows BTC losing the $81K–$85K support cluster (0.382 Fib) and flushing aggressively into the $60K–$66K macro demand base, where buyers are now attempting to slow downside momentum. However, overall structure remains bearish.

EMA Struct

Bitcoin has been rejected from the $112K–$126K macro supply zone (0.786–1 Fib) and remains in a broader corrective structure following the cycle distribution top. Price continues to respect a descending corrective channel, producing lower highs and weak recovery attempts.

Recent price action shows BTC losing the $81K–$85K support cluster (0.382 Fib) and flushing aggressively into the $60K–$66K macro demand base, where buyers are now attempting to slow downside momentum. However, overall structure remains bearish.

EMA Struct

BTC8,1%

- Reward

- 3

- 5

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊Watching Closely 🔍️Happy New Year! View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

119.77K Popularity

23.05K Popularity

389.38K Popularity

9.32K Popularity

7.61K Popularity

6.9K Popularity

5.84K Popularity

6.45K Popularity

4.22K Popularity

3.23K Popularity

15.1K Popularity

9.19K Popularity

21.9K Popularity

29.64K Popularity

24.51K Popularity

News

View MoreTwo Major Ethereum Bulls Share Same CEX Deposit Address Despite Heavy Losses

7 m

Data: In the past 24 hours, the entire network has liquidated $649 million, with long positions liquidated at $179 million and short positions at $470 million.

16 m

Market Report: Overview of the top 5 cryptocurrencies with the biggest declines on February 7, 2026, with Hyperliquid experiencing the largest drop.

17 m

Vitalik comments, "ENS v2 will be fully deployed on Ethereum L1": a wise decision. This move will enhance security, decentralization, and user experience by integrating ENS directly into the main Ethereum network, reducing reliance on third-party layers and increasing trustworthiness. It marks a significant step forward in the development of decentralized identity and naming systems on Ethereum.

24 m

Trader Eugene: Successfully bottomed out yesterday, feeling there's still hope for the market ahead

25 m

Pin