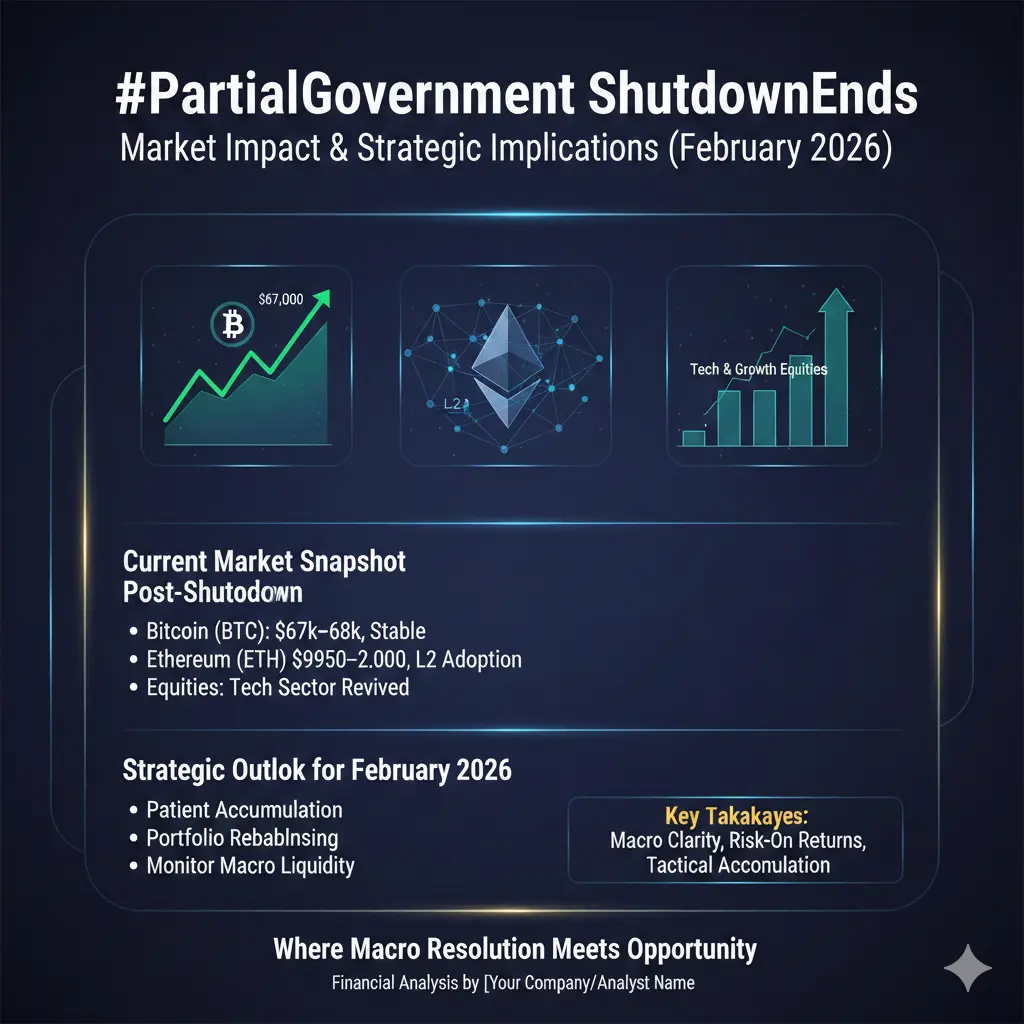

#PartialGovernmentShutdownEnds

The partial US gov shutdown drama is DONE. Trump signed the $1.2T funding bill on Feb 3 after a tense 4-day standoff (House squeaked it through 217-214). Most agencies funded thru September 2026, federal workers get back pay, DHS on a tight 2-week extension till Feb 13. Political uncertainty eased overnight — and crypto reacted like it always does: risk-off panic reversed into a sharp relief bounce.

During the shutdown peak:

Bitcoin plunged hard (briefly dipping toward $60k lows earlier this week, wiping out post-election gains and triggering $2.6B+ in liquidations)

Total crypto market cap tanked toward $2.3T at worst

90%+ of top coins bled red, fear & greed index screamed "extreme fear"

Thin liquidity + macro fears (Fed uncertainty, tech sell-off spillover) amplified the drop

Fast-forward to today (Feb 8, 2026):

BTC reclaimed $71,000+ (currently trading ~$71,000–$71,400 after climbing from weekend lows; up ~3–10% in recent sessions depending on the snapshot)

ETH sitting around $2,080–$2,100 (modest rebound, market cap ~$250B+)

Altcoins mixed but following: SOL, XRP, etc., showing green days amid volume spikes ($90B–$100B+ daily across majors)

Prediction markets now price in consolidation: heavy bets on BTC $70k–$72k range today, with $75k February targets at 64% odds

Why the rebound?

Shutdown resolution removed immediate tail risk — No more "gov frozen, SEC/CFTC half-offline" fears slowing ETF flows or regulatory news.

Buy-the-dip institutions stepped in — Spot BTC ETFs saw inflows on the weakness; whales accumulated during the fear.

Classic crypto resilience — Risk assets hate uncertainty, but love clarity. Even brief stability = FOMO trigger.

Technical bounce — BTC held key support near $60k–$65k zone; reclaiming $71k flips momentum short-term.

But don't get too euphoric — this cycle's brutal:

BTC still down ~40–50% from late-2025 ATH (~$126k peak)

Heavy ETF outflows earlier in the year, deleveraging waves, QT fears lingering

Looming DHS funding cliff (Feb 13) could spark round 2 of shutdown drama — prediction markets already betting $50k+ volume on renewed risk by mid-Feb

Broader macro: Fed chair signals, potential rate path uncertainty, AI/tech rotation dragging correlated assets

Sentiment: Extreme fear flipped to neutral/greed, but not full bull yet

Analyst takes right now:

Bulls eye $75k–$80k+ if $71k–$73k holds as support (weekly close above could ignite next leg)

Bears warn dead-cat bounce — $54k–$60k retest possible if macro worsens or DHS implodes

Mid-term: Trump pro-crypto policies (still in play) + potential institutional return could fuel recovery to $90k+ by mid-2026, but liquidity stress tests keep volatility sky-high

Bottom line: Shutdown end was a massive catalyst for relief, but crypto remains a high-beta beast. Politics still moves markets — even 4-day blips cause billion-dollar swings.

The partial US gov shutdown drama is DONE. Trump signed the $1.2T funding bill on Feb 3 after a tense 4-day standoff (House squeaked it through 217-214). Most agencies funded thru September 2026, federal workers get back pay, DHS on a tight 2-week extension till Feb 13. Political uncertainty eased overnight — and crypto reacted like it always does: risk-off panic reversed into a sharp relief bounce.

During the shutdown peak:

Bitcoin plunged hard (briefly dipping toward $60k lows earlier this week, wiping out post-election gains and triggering $2.6B+ in liquidations)

Total crypto market cap tanked toward $2.3T at worst

90%+ of top coins bled red, fear & greed index screamed "extreme fear"

Thin liquidity + macro fears (Fed uncertainty, tech sell-off spillover) amplified the drop

Fast-forward to today (Feb 8, 2026):

BTC reclaimed $71,000+ (currently trading ~$71,000–$71,400 after climbing from weekend lows; up ~3–10% in recent sessions depending on the snapshot)

ETH sitting around $2,080–$2,100 (modest rebound, market cap ~$250B+)

Altcoins mixed but following: SOL, XRP, etc., showing green days amid volume spikes ($90B–$100B+ daily across majors)

Prediction markets now price in consolidation: heavy bets on BTC $70k–$72k range today, with $75k February targets at 64% odds

Why the rebound?

Shutdown resolution removed immediate tail risk — No more "gov frozen, SEC/CFTC half-offline" fears slowing ETF flows or regulatory news.

Buy-the-dip institutions stepped in — Spot BTC ETFs saw inflows on the weakness; whales accumulated during the fear.

Classic crypto resilience — Risk assets hate uncertainty, but love clarity. Even brief stability = FOMO trigger.

Technical bounce — BTC held key support near $60k–$65k zone; reclaiming $71k flips momentum short-term.

But don't get too euphoric — this cycle's brutal:

BTC still down ~40–50% from late-2025 ATH (~$126k peak)

Heavy ETF outflows earlier in the year, deleveraging waves, QT fears lingering

Looming DHS funding cliff (Feb 13) could spark round 2 of shutdown drama — prediction markets already betting $50k+ volume on renewed risk by mid-Feb

Broader macro: Fed chair signals, potential rate path uncertainty, AI/tech rotation dragging correlated assets

Sentiment: Extreme fear flipped to neutral/greed, but not full bull yet

Analyst takes right now:

Bulls eye $75k–$80k+ if $71k–$73k holds as support (weekly close above could ignite next leg)

Bears warn dead-cat bounce — $54k–$60k retest possible if macro worsens or DHS implodes

Mid-term: Trump pro-crypto policies (still in play) + potential institutional return could fuel recovery to $90k+ by mid-2026, but liquidity stress tests keep volatility sky-high

Bottom line: Shutdown end was a massive catalyst for relief, but crypto remains a high-beta beast. Politics still moves markets — even 4-day blips cause billion-dollar swings.