#Web3FebruaryFocus

Web3 Infrastructure Expansion

February is seeing major updates in blockchain infrastructure, including:

Layer 1 improvements: Ethereum, Solana, Avalanche, and other chains are rolling out upgrades for scalability, lower fees, and faster finality. These updates aim to improve dApp usability and mass adoption.

Cross-chain bridges & interoperability: Enhanced tools for asset transfers across chains are gaining traction, allowing smoother movement of tokens and NFTs across ecosystems.

Decentralized storage & compute: Platforms like Arweave, Filecoin, and Sia are expanding storage networks, which is key for hosting decentralized apps without reliance on centralized servers.

Impact: Improved infrastructure sets the stage for higher dApp usage, reduced congestion, and stronger developer interest.

DeFi & Financial Innovation

Web3’s financial layer continues to evolve rapidly:

New DeFi protocols: February highlights include new lending, staking, and automated market-making platforms aiming to offer higher yields with risk management.

Stablecoin adoption: USD-pegged stablecoins and cross-chain stablecoins are facilitating faster, cheaper transactions for traders and institutions.

Institutional integration: Banks and hedge funds are increasingly exploring tokenized assets, DeFi participation, and on-chain liquidity pools.

Impact: DeFi remains the financial backbone of Web3, attracting both retail and institutional capital.

NFTs & Metaverse Momentum

NFTs continue to dominate Web3 conversations:

Digital collectibles & art: February features high-profile NFT drops, auctions, and partnerships, often tied to gaming and metaverse projects.

Gaming & play-to-earn: Platforms are pushing NFTs as in-game assets, skins, and rewards, integrating economic incentives for users.

Virtual real estate & metaverse experiences: Metaverse platforms are expanding land sales, virtual events, and cross-platform interoperability.

Impact: NFTs remain cultural and economic drivers, bridging communities with digital ownership.

DAO Governance & Community Development

Decentralized Autonomous Organizations (DAOs) are increasingly central to project governance:

Protocol governance votes: Many projects are holding votes on protocol upgrades, treasury management, and tokenomics adjustments.

Community-driven initiatives: DAOs are funding new projects, grants, and educational campaigns to expand ecosystem participation.

Tokenized incentives: Members are rewarded for participation, voting, and proposal contributions, aligning economic incentives with governance.

Impact: DAOs are shaping the future of decentralized governance and encouraging more active participation.

Regulation & Compliance Updates

Web3 is entering a regulatory spotlight:

Jurisdiction-specific policies: Countries are issuing new guidelines on crypto trading, DeFi participation, NFT ownership, and DAO structures.

Compliance frameworks: Projects are increasingly integrating KYC/AML protocols to appeal to institutional investors.

Impact on innovation: Regulatory clarity helps reduce risk, attract capital, and legitimize the Web3 ecosystem.

Impact: Compliance is essential for long-term adoption and institutional trust.

Developer Tools & Ecosystem Growth

Web3 development tools are evolving fast:

Low-code/no-code platforms: Enable non-technical users to deploy dApps and smart contracts.

SDKs & APIs: Simplify interaction with blockchain networks for apps, wallets, and marketplaces.

Hackathons & developer grants: Encourage new projects, experimentation, and ecosystem growth.

Impact: Easier onboarding for developers leads to faster innovation and more usable products.

Market & Investment Trends

The market is actively responding to Web3 developments:

Token performance: Many governance and utility tokens see high volatility due to announcements, new protocol launches, or NFT sales.

Investor focus: February shows increased institutional exploration, including ETFs, staking products, and custody services.

Liquidity trends: Active liquidity pools and cross-chain solutions improve capital efficiency across the ecosystem.

Impact: The combination of product development and financial infrastructure is driving both short-term trading activity and long-term investment interest.

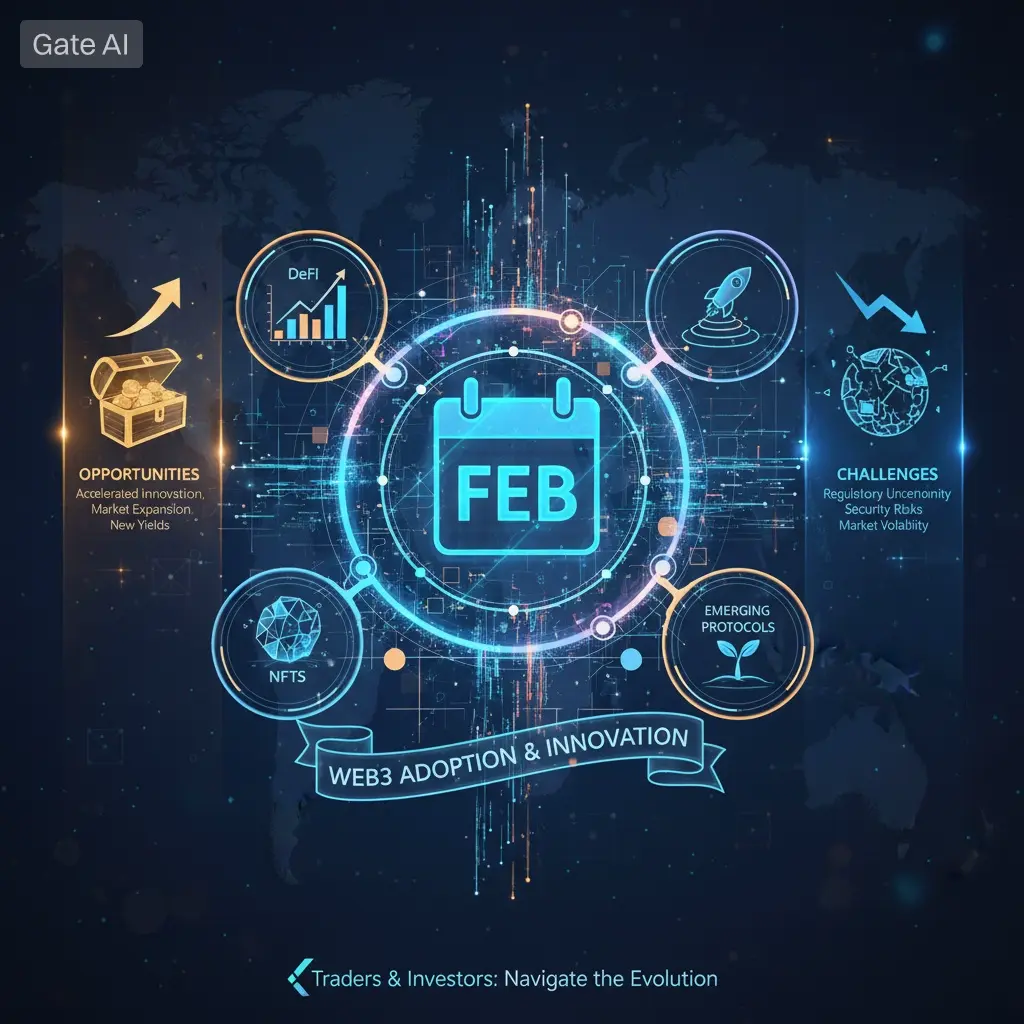

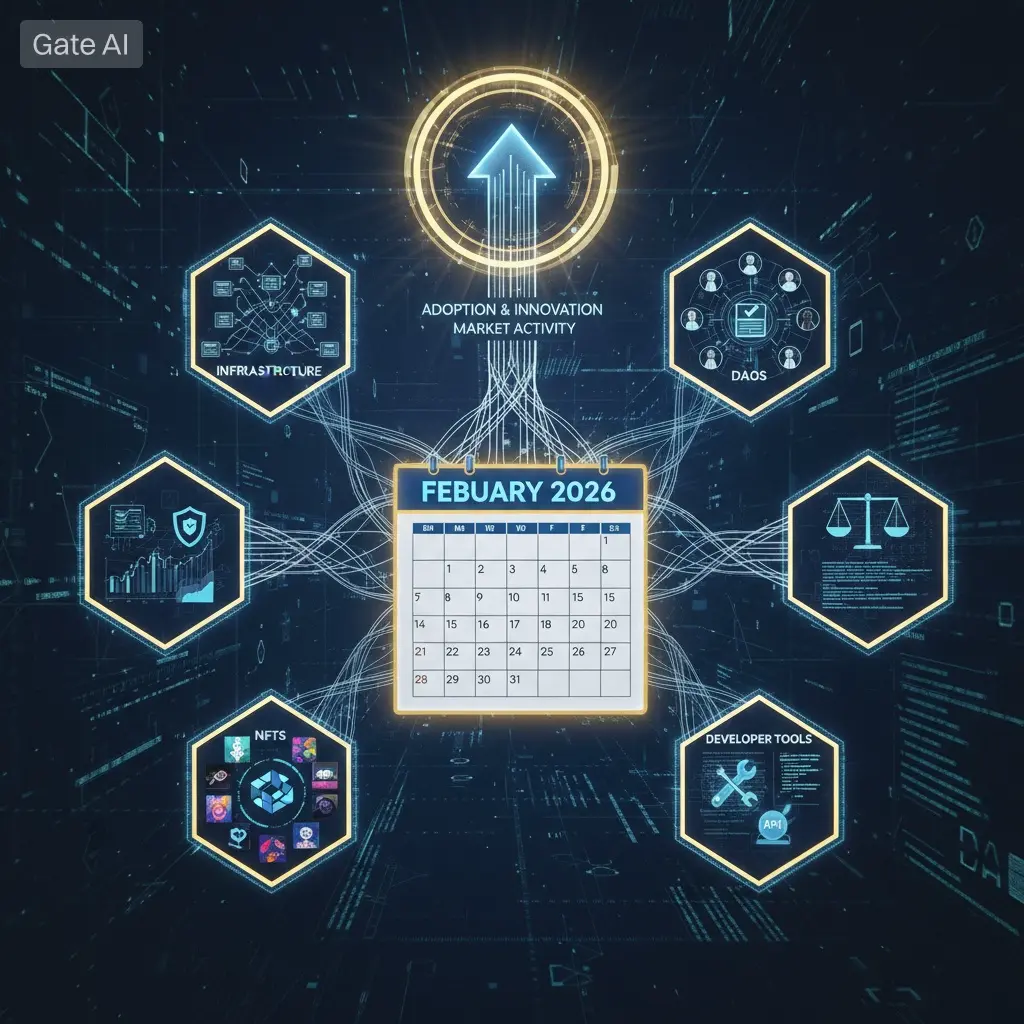

February 2026 is shaping up as a pivotal month for Web3, where infrastructure, DeFi, NFTs, DAOs, regulation, and developer tools all converge:

Web3 adoption is accelerating

Risk management and compliance are maturing

NFT and metaverse sectors continue to drive cultural engagement

Market activity reflects both opportunity and volatility

Web3 Infrastructure Expansion

February is seeing major updates in blockchain infrastructure, including:

Layer 1 improvements: Ethereum, Solana, Avalanche, and other chains are rolling out upgrades for scalability, lower fees, and faster finality. These updates aim to improve dApp usability and mass adoption.

Cross-chain bridges & interoperability: Enhanced tools for asset transfers across chains are gaining traction, allowing smoother movement of tokens and NFTs across ecosystems.

Decentralized storage & compute: Platforms like Arweave, Filecoin, and Sia are expanding storage networks, which is key for hosting decentralized apps without reliance on centralized servers.

Impact: Improved infrastructure sets the stage for higher dApp usage, reduced congestion, and stronger developer interest.

DeFi & Financial Innovation

Web3’s financial layer continues to evolve rapidly:

New DeFi protocols: February highlights include new lending, staking, and automated market-making platforms aiming to offer higher yields with risk management.

Stablecoin adoption: USD-pegged stablecoins and cross-chain stablecoins are facilitating faster, cheaper transactions for traders and institutions.

Institutional integration: Banks and hedge funds are increasingly exploring tokenized assets, DeFi participation, and on-chain liquidity pools.

Impact: DeFi remains the financial backbone of Web3, attracting both retail and institutional capital.

NFTs & Metaverse Momentum

NFTs continue to dominate Web3 conversations:

Digital collectibles & art: February features high-profile NFT drops, auctions, and partnerships, often tied to gaming and metaverse projects.

Gaming & play-to-earn: Platforms are pushing NFTs as in-game assets, skins, and rewards, integrating economic incentives for users.

Virtual real estate & metaverse experiences: Metaverse platforms are expanding land sales, virtual events, and cross-platform interoperability.

Impact: NFTs remain cultural and economic drivers, bridging communities with digital ownership.

DAO Governance & Community Development

Decentralized Autonomous Organizations (DAOs) are increasingly central to project governance:

Protocol governance votes: Many projects are holding votes on protocol upgrades, treasury management, and tokenomics adjustments.

Community-driven initiatives: DAOs are funding new projects, grants, and educational campaigns to expand ecosystem participation.

Tokenized incentives: Members are rewarded for participation, voting, and proposal contributions, aligning economic incentives with governance.

Impact: DAOs are shaping the future of decentralized governance and encouraging more active participation.

Regulation & Compliance Updates

Web3 is entering a regulatory spotlight:

Jurisdiction-specific policies: Countries are issuing new guidelines on crypto trading, DeFi participation, NFT ownership, and DAO structures.

Compliance frameworks: Projects are increasingly integrating KYC/AML protocols to appeal to institutional investors.

Impact on innovation: Regulatory clarity helps reduce risk, attract capital, and legitimize the Web3 ecosystem.

Impact: Compliance is essential for long-term adoption and institutional trust.

Developer Tools & Ecosystem Growth

Web3 development tools are evolving fast:

Low-code/no-code platforms: Enable non-technical users to deploy dApps and smart contracts.

SDKs & APIs: Simplify interaction with blockchain networks for apps, wallets, and marketplaces.

Hackathons & developer grants: Encourage new projects, experimentation, and ecosystem growth.

Impact: Easier onboarding for developers leads to faster innovation and more usable products.

Market & Investment Trends

The market is actively responding to Web3 developments:

Token performance: Many governance and utility tokens see high volatility due to announcements, new protocol launches, or NFT sales.

Investor focus: February shows increased institutional exploration, including ETFs, staking products, and custody services.

Liquidity trends: Active liquidity pools and cross-chain solutions improve capital efficiency across the ecosystem.

Impact: The combination of product development and financial infrastructure is driving both short-term trading activity and long-term investment interest.

February 2026 is shaping up as a pivotal month for Web3, where infrastructure, DeFi, NFTs, DAOs, regulation, and developer tools all converge:

Web3 adoption is accelerating

Risk management and compliance are maturing

NFT and metaverse sectors continue to drive cultural engagement

Market activity reflects both opportunity and volatility